The global digital twin market size was valued at USD 32.58 billion in 2025 and is expected to be worth around USD 493.52 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 31.2% over the forecast period from 2026 to 2035. The digital twin market is primarily driven by the rapid adoption of Industry 4.0, IoT-enabled assets, and the growing need for real-time operational visibility. Organizations across manufacturing, energy, automotive, and aerospace sectors are increasingly deploying sensors and connected devices, generating large volumes of data that digital twins can transform into actionable insights. This enables predictive maintenance, reduces downtime, improves asset performance, and lowers operational costs. Additionally, the rising complexity of industrial systems and supply chains is pushing enterprises to adopt simulation-based decision-making tools, where digital twins play a critical role in testing scenarios, optimizing designs, and minimizing risk before physical implementation.

Market growth is further accelerated by advancements in Artificial Intelligence (AI), machine learning, edge analytics and cloud computing, which enhance the accuracy, scalability, and affordability of digital twin solutions. Cloud-based deployment models are lowering entry barriers for small and mid-sized enterprises, while integration with AR/VR is expanding use cases in training and remote operations. Increasing investments in smart cities, renewable energy infrastructure, and healthcare digitization, along with strong support for digital transformation initiatives across both private and public sectors, are also contributing to sustained market expansion.

How the Rapid Growth of Industrial IoT Platforms Is Driving the Digital Twin Market

The rapid expansion of Industrial IoT (IIoT) platforms is a key catalyst for the digital twin market because it vastly increases the volume and granularity of real-world data that digital twins can use to mirror physical assets and systems. As the number of connected IoT devices continues to surge reaching about 18.5 billion in 2024 with an expected 14% growth to over 21 billion by the end of 2025 this growing network of sensors and smart equipment supplies continuous streams of operational data that fuel digital twin simulations and analytics. This proliferation of IIoT endpoints makes it possible to monitor performance, detect anomalies, and optimize processes in real time, solidifying digital twins as essential tools for enterprises looking to improve visibility and control over complex industrial environments.

Furthermore, industrial enterprises are increasingly planning or already adopting IoT-powered digital twin solutions, with estimates suggesting up to 75% of industrial companies will embrace digital twins backed by IoT data by 2025. This indicates a clear recognition of how IoT infrastructure enables enhanced decision-making, predictive maintenance, and operational efficiency improvements. The synergy between IIoT and digital twins not only accelerates digital transformation goals but also promotes scalable, data-driven innovation across sectors like manufacturing, energy, and smart infrastructure.

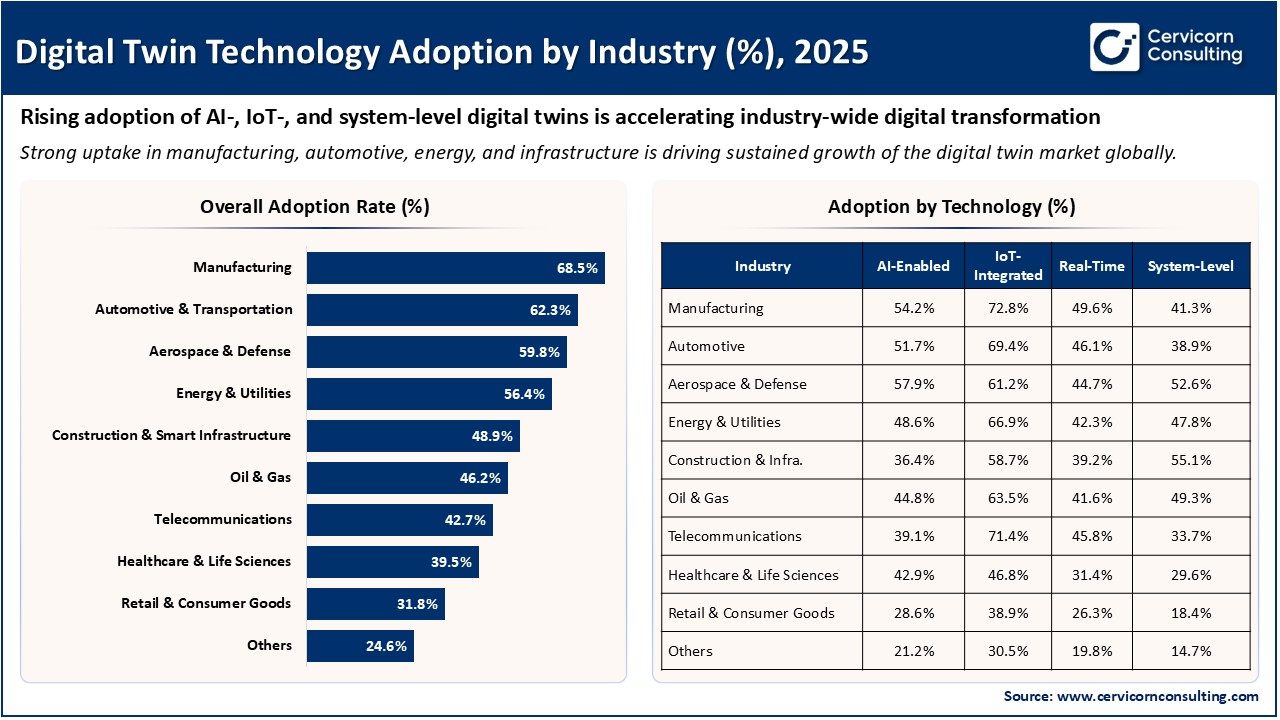

Digital Twin Technology Adoption by Industry (2025)

The image highlights strong digital twin adoption across asset-intensive industries, led by manufacturing (68.5%), automotive & transportation (62.3%), and aerospace & defense (59.8%), reflecting their early embrace of Industry 4.0 and simulation-driven operations. IoT-integrated digital twins show the highest penetration across most sectors, underscoring the importance of real-time data connectivity as a foundation for digital twin deployments. Meanwhile, system-level and AI-enabled twins are gaining traction in construction, energy, and aerospace, indicating a shift toward more complex, end-to-end digital models that are driving sustained market growth.

1. Global Rollout of Borealis’ AI-Powered Borstar Digital Twin Program

Borealis recently announced the global rollout of its Borstar Digital Twin program, integrating AI, real-time optimization, and advanced analytics across its polyethylene and polypropylene production sites worldwide. This milestone signals how established industrial manufacturers are leveraging digital twins not just for pilot projects but for full-scale operational deployment, setting a precedent for others in heavy industry to follow. Such expansive implementation enhances throughput, minimizes system inefficiencies, and accelerates digital transformation across complex manufacturing environments, underpinning broader industry confidence in digital twin utility.

2. Schneider Electric, AVEVA & ETAP Joining the OpenUSD Alliance

Tech giants Schneider Electric, AVEVA, and ETAP recently joined the OpenUSD alliance to develop interoperable, standardized 3D digital twin assets using USD (Universal Scene Description) frameworks. This collaboration with NVIDIA, Pixar, Adobe, and Autodesk boosts compatibility and cross-platform simulation capabilities, enabling complex industrial twins to share richer data across ecosystems. With adoption of GD&T-style standards and 3D assets simplification, industry players can now reduce development time and cost for next-generation digital twin applications. This push toward standardization helps overcome data silos and accelerates market growth by simplifying integration across tools and industries.

3. Expansion of Digital Twin Consortium Testbeds and Industry Collaboration

The Digital Twin Consortium has expanded its innovation efforts with multiple testbeds, new members, and strategic partnerships throughout 2025. These initiatives bring in semiconductor leaders (e.g., AMD), spatial intelligence partners, academic institutions, and global industry groups collectively fostering shared R&D frameworks for next-generation twin systems. By creating open test environments and advancing common methodologies, the consortium lowers barriers to entry and helps enterprises of all sizes validate use cases, driving faster adoption across sectors such as manufacturing, aerospace, and smart infrastructure.

4. Strategic Partnerships Driving Digital Twin Adoption in the Built Environment

In November 2025, Nemetschek Group and Hexagon announced a strategic partnership aimed at accelerating digital twin deployment in building and construction sectors. This move, complemented by venture capital investment trends and rising proptech VC activity, showcases how digital twin technology is moving beyond traditional industrial lines into real estate, infrastructure, and smart buildings. The increased adoption of digital twins for lifecycle planning, BIM integration, and real-time facility management reflects a diversification of use cases that elevates demand across new markets, reinforcing digital twin value as a strategic enterprise tool.

The digital twin market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America digital twin market size was valued at USD 11.60 billion in 2025 and is predicted to surge around USD 175.69 billion by 2035. North America leads adoption of digital twin technologies thanks to deep enterprise IT/OT integration, strong cloud & GPU infrastructure, and major tech and industrial incumbents driving commercial deployments. Large manufacturers, energy firms, and defense contractors increasingly combine AI, simulation, and real-time operational data to build production-scale twins that shorten development cycles and cut downtime. Recent product launches that unify simulation and live data (and partnerships with AI/GPU vendors) are accelerating enterprise pilots into full rollouts, pushing North America to the forefront of industrial metaverse and large-scale digital twin commercialization.

Recent Developments:

The Asia-Pacific digital twin market size was estimated at USD 10.56 billion in 2025 and is forecasted to grow around USD 159.90 billion by 2035. Asia-Pacific is rapidly expanding digital twin use across smart cities, manufacturing, and construction thanks to strong government digitization programs, high automation uptake, and local industrial champions. Regional vendors and conglomerates are combining IoT, AI, and metaverse-style platforms to deliver real-time twin solutions for construction sites, power plants, and factory floors. The result is fast commercialization of operational twins and broad public-sector interest in city/energy twins, making APAC one of the fastest evolving regions for production-grade twin deployments.

Recent Developments:

The Europe digital twin market size was reached at USD 8.73 billion in 2025 and is projected to attain around USD 132.26 billion by 2035. Europe’s digital twin adoption is driven by strong engineering OEMs, utilities, and a regulatory push for interoperability and sustainability. European software and industrial automation vendors emphasize standards, 3D/visualization frameworks, and asset lifecycle management, enabling cross-vendor integration across manufacturing and energy. The region is notable for coalition building around open standards and simulation-ready 3D assets, which reduces vendor lock-in and speeds enterprise implementations critical for pan-EU projects and multi-site deployments. This focus on standards and enterprise platforms strengthens Europe’s position as a center for scalable, interoperable digital twin solutions.

Recent Developments:

Digital Twin Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 35.6% |

| Asia-Pacific | 32.4% |

| Europe | 26.8% |

| LAMEA (Latin America, Middle East & Africa) | 5.2% |

The LAMEA digital twin market was valued at USD 1.69 billion in 2025 and is anticipated to reach around USD 25.66 billion by 2035. LAMEA shows fast strategic adoption in energy, oil & gas, and infrastructure, where governments and NOCs invest in digital twins for asset reliability, planning, and sustainability goals. Gulf nations in particular are deploying enterprise digital twin platforms to support energy transition and large projects, while major oil & gas players use twins for subsurface imaging, predictive maintenance, and simulation-driven engineering. These country-level initiatives plus regional industry expos are turning pilots into operational programs and creating demand for global and local solution providers.

Recent Developments:

The digital twin market is segmented into type, technology, application, end-use industry, and region.

Product digital twins dominate the market due to their widespread adoption in manufacturing, automotive, and electronics industries. These twins are heavily used during product design, prototyping, testing, and lifecycle management, allowing companies to reduce physical testing costs and accelerate time to market. Their relatively lower complexity and faster return on investment compared to system-level twins have driven early and sustained adoption. As organizations increasingly focus on improving product quality, customization, and innovation speed, product digital twins continue to command the largest share.

System digital twins are the fastest-growing segment as enterprises move toward holistic, end-to-end digitalization. These twins model entire systems such as factories, power grids, transportation networks, or smart cities, enabling advanced scenario planning and real-time optimization. Growth is fueled by rising investments in smart infrastructure, large-scale automation, and integrated operations management. Although complex to deploy, system digital twins offer higher long-term value by improving cross-functional decision-making, resilience, and sustainability, driving rapid adoption among large enterprises and governments.

IoT and IIoT dominate the digital twin technology landscape because they form the foundational data layer required for real-time synchronization between physical assets and virtual models. Sensors, connected machines, and industrial networks continuously feed operational data into digital twins, enabling monitoring, diagnostics, and performance optimization. The maturity of IoT ecosystems, declining sensor costs, and widespread industrial connectivity have made IIoT the most widely deployed technology, ensuring its leading position across manufacturing, energy, and transportation sectors.

Digital Twin Market Share, By Technology, 2025 (%)

| Technology | Revenue Share, 2025 (%) |

| IoT & Industrial IoT (IIoT) | 41.8% |

| Artificial Intelligence & ML | 28.4% |

| AR & VR | 12.3% |

| Blockchain | 4.1% |

| Others | 13.4% |

Artificial intelligence and machine learning represent the fastest-growing technology segment due to their ability to significantly enhance digital twin intelligence and autonomy. AI-driven models improve predictive accuracy, automate anomaly detection, and enable self-optimizing systems. As enterprises seek advanced insights rather than basic visualization, AI integration is becoming critical for predictive maintenance, demand forecasting, and scenario simulation. Rapid advances in algorithms, increased computing power, and growing availability of industrial data are accelerating AI adoption within digital twin platforms.

Predictive maintenance is the dominant application segment as organizations prioritize asset reliability, cost reduction, and operational continuity. Digital twins allow continuous monitoring of equipment health and enable early detection of failures before breakdowns occur. This application is particularly valuable in asset-intensive industries such as manufacturing, energy, oil & gas, and transportation, where unplanned downtime is costly. The clear financial benefits and measurable ROI of predictive maintenance have made it one of the earliest and most widely adopted digital twin use cases.

Digital Twin Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Predictive Maintenance | 26.3% |

| Real-time Monitoring & Simulation | 21.7% |

| Product Design & Development | 18.2% |

| Asset Performance Management | 13.9% |

| Operations Optimization | 10.6% |

| Supply Chain Management | 5.8% |

| Others | 3.5% |

Real-time monitoring and simulation is the fastest-growing application segment, driven by the need for instant operational visibility and rapid decision-making. Enterprises increasingly rely on live digital replicas to simulate operational scenarios, assess risks, and optimize processes dynamically. This application is gaining traction in smart factories, logistics networks, and urban infrastructure management. The growth of edge computing and high-speed connectivity further supports real-time capabilities, enabling organizations to respond faster to disruptions and continuously optimize performance.

Manufacturing remains the dominant end-use industry for digital twins due to early adoption of automation, robotics, and smart factory concepts. Digital twins are widely used to optimize production lines, improve product quality, reduce waste, and enhance equipment utilization. Manufacturers benefit from digital twins across the entire value chain, from product design to after-sales service. The sector’s strong focus on efficiency, cost control, and operational excellence has consistently driven high investment in digital twin technologies.

Digital Twin Market Share, By End-Use Industry, 2025 (%)

| End-Use Industry | Revenue Share, 2025 (%) |

| Manufacturing | 30.1% |

| Energy & Utilities | 18.2% |

| Automotive & Transportation | 14.6% |

| Aerospace & Defense | 11.2% |

| Construction & Smart Infrastructure | 9.1% |

| Healthcare & Life Sciences | 6.4% |

| Oil & Gas | 5.1% |

| Retail & Consumer Goods | 2.8% |

| Telecommunications | 1.8% |

| Others | 0.7% |

Construction and smart infrastructure represent the fastest-growing end-use segment as digital twins expand beyond traditional industrial applications. Governments and private developers are increasingly using digital twins for building lifecycle management, urban planning, traffic simulation, and energy optimization. The integration of digital twins with BIM, IoT sensors, and sustainability initiatives is accelerating adoption. As cities invest in smart infrastructure and resilient urban systems, digital twins are becoming essential tools for long-term planning, monitoring, and optimization.

By Type

By Technology

By Application

By End-Use Industry

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Digital Twin

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Type Overview

2.2.3 By Application Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing Adoption of Industry 4.0 and Smart Manufacturing

4.1.1.2 Increasing Need for Predictive Maintenance and Asset Optimization

4.1.2 Market Restraints

4.1.2.1 High Implementation and Integration Costs

4.1.2.2 Data Security and Privacy Concerns

4.1.3 Market Challenges

4.1.3.1 Lack of Standardization and Interoperability

4.1.3.2 Shortage of Skilled Workforce

4.1.4 Market Opportunities

4.1.4.1 Expansion into Smart Cities and Infrastructure Management

4.1.4.2 Integration with AI, AR/VR, and Advanced Analytics

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Digital Twin Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Digital Twin Market, By Technology

6.1 Global Digital Twin Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Artificial Intelligence and Machine Learning

6.1.1.2 IoT and Industrial IoT (IIoT)

6.1.1.3 Augmented Reality (AR) and Virtual Reality (VR)

6.1.1.4 Blockchain

6.1.1.5 Others

Chapter 7. Digital Twin Market, By Type

7.1 Global Digital Twin Market Snapshot, By Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Product Digital Twin

7.1.1.2 Process Digital Twin

7.1.1.3 System Digital Twin

Chapter 8. Digital Twin Market, By End User

8.1 Global Digital Twin Market Snapshot, By End User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Manufacturing

8.1.1.2 Automotive & Transportation

8.1.1.3 Aerospace & Defense

8.1.1.4 Energy & Utilities

8.1.1.5 Healthcare & Life Sciences

8.1.1.6 Construction & Smart Infrastructure

8.1.1.7 Oil & Gas

8.1.1.8 Retail & Consumer Goods

8.1.1.9 Telecommunications

8.1.1.10 Others

Chapter 9. Digital Twin Market, By Application

9.1 Global Digital Twin Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Product Design & Development

9.1.1.2 Predictive Maintenance

9.1.1.3 Asset Performance Management

9.1.1.4 Operations Optimization

9.1.1.5 Supply Chain Management

9.1.1.6 Real-time Monitoring & Simulation

9.1.1.7 Others

Chapter 10. Digital Twin Market, By Region

10.1 Overview

10.2 Digital Twin Market Revenue Share, By Region 2024 (%)

10.3 Global Digital Twin Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Digital Twin Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Digital Twin Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Digital Twin Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Digital Twin Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Digital Twin Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Digital Twin Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Digital Twin Market, By Country

10.5.4 UK

10.5.4.1 UK Digital Twin Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Digital Twin Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Digital Twin Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Digital Twin Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Digital Twin Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Digital Twin Market, By Country

10.6.4 China

10.6.4.1 China Digital Twin Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Digital Twin Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Digital Twin Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Digital Twin Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Digital Twin Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Digital Twin Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Digital Twin Market, By Country

10.7.4 GCC

10.7.4.1 GCC Digital Twin Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Digital Twin Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Digital Twin Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Digital Twin Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Siemens

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Microsoft

12.3 IBM

12.4 General Electric (GE)

12.5 Oracle

12.6 PTC

12.7 Dassault Systèmes

12.8 ANSYS

12.9 Cisco

12.10 Bentley Systems

12.11 ABB

12.12 AVEVA Group