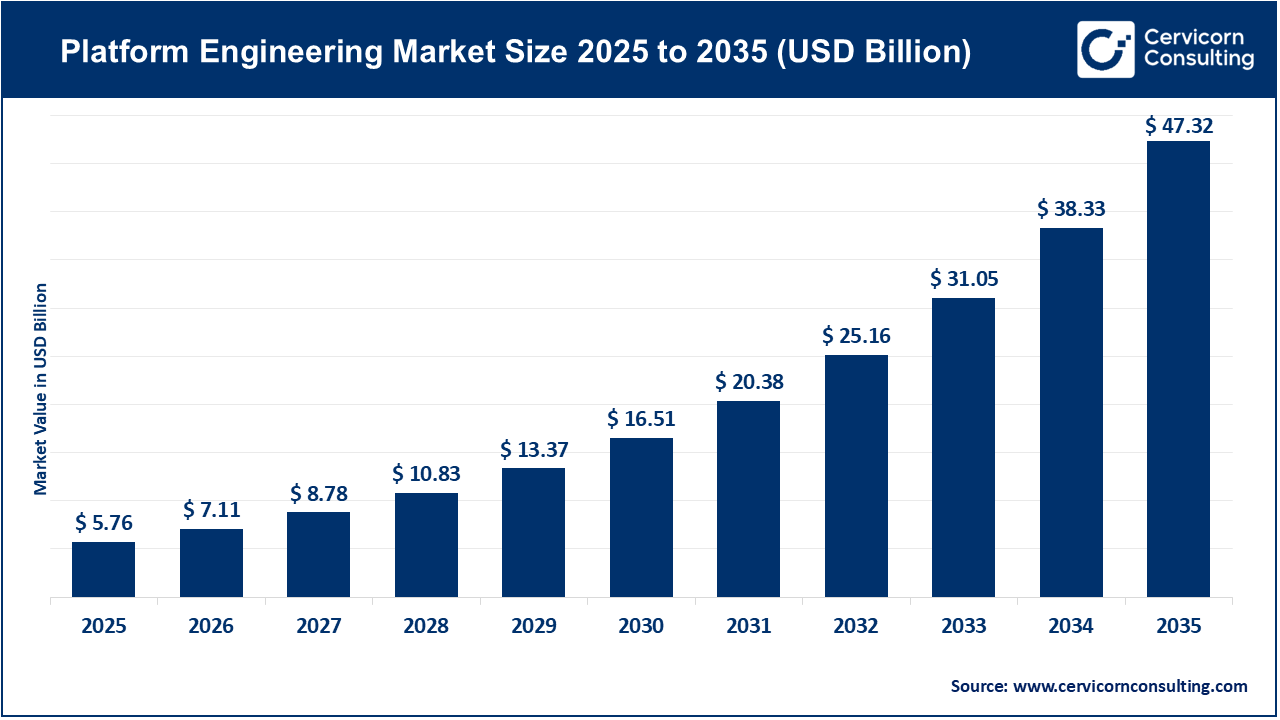

The global platform engineering market size was valued at USD 5.76 billion in 2025 and is expected to be worth around USD 47.32 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 23.4% over the forecast period from 2026 to 2035. The growing popularity of the platform engineering market is driven by several factors, including the need for faster, more reliable software delivery and the aim to enhance developer productivity through improved developer experiences. As more organizations adopt cloud computing, DevOps, and automation tools, the need to provide scalable, secure systems will continue to drive the platform engineering market. Emerging technologies such as microservices, edge computing, and the rollout of 5G are also increasing demand for platform engineering solutions that support ongoing digital transformation.

In addition to improving delivery speed and productivity, another key growth driver for the platform engineering market is cost reduction and increased innovation through greater efficiency. Organizations use platform engineering to reduce the time required to create and implement new software systems and to streamline workflows. This enables them to identify new features, deliver those features to customers more rapidly, and respond quickly to changing market conditions. Consequently, the adoption of AI-driven products and services in the engineering workflow is automating repetitive and tedious aspects of product development, further enhancing team productivity.

Emerging Technologies Driving Expansion of the Platform Engineering Market

| Company | Recent Development | Relation to Platform Engineering Market |

| Amazon Web Services (AWS) | Announced new infrastructure offerings at AWS re:Invent 2025, including more powerful CPUs and advanced cloud/AI capabilities. | Enhances cloud platforms that support scalable, high-performance engineering platforms. |

| Amazon (parent of AWS) | Restructured its AI division to accelerate innovation in AI models, custom silicon, and compute technologies. | Signals deeper integration of AI into engineering platforms for automation and smart operations. |

| Microsoft | Highlighted over 1,000 real-life AI transformation examples showing broad adoption of cloud and AI infrastructure. | Shows how platform engineering is enhanced by AI workloads and cloud modernization. |

| Anthropic | Secured major funding rounds and cloud partnership with Google to increase AI compute capacity and integrate with scalable platforms. | Reflects how partnerships and compute scale support advanced platform features. |

| Databricks | Entered partnerships with Anthropic, Google, and OpenAI and launched new tools like Agent Bricks and Lakebase, boosting data and AI platform capabilities. | Strengthens platform engineering by enabling AI agent automation and data services within platforms. |

| Cast AI | Raised USD 108 Mn in funding and expanded Kubernetes automation features to optimize cloud workloads. | Enhances platform engineering by improving resource automation and cloud cost management. |

1. AWS and Major Tech Firms Expand Cloud and AI Infrastructure

In 2025, Amazon Web Services (AWS) and other leading technology companies, such as Microsoft and Google, confirmed investment commitments for expanding their cloud and artificial intelligence (AI) infrastructure capabilities. As a result of these investments, the cloud and AI infrastructure will support the platform engineering market with greater speed, more powerful computing resources, and more sophisticated cloud solutions. As cloud infrastructure gets better at handling AI tasks, it allows more companies to use platform engineering strategies that require scalable, flexible, and secure cloud systems. Consequently, this advanced cloud infrastructure provides more organizations with the ability to create advanced internal developer platforms (IDPs) and cloud-native applications, which helps drive growth in the platform engineering market.

2. EU Sovereign Tech Fund Proposal to Support Open-Source Infrastructure

In 2025, the EU-STF was introduced to provide long-standing financial support for open-source software and critical digital infrastructure in Europe. This government program is a way to support the foundational technologies that all of the tools and frameworks used for building platforms rely upon. Providing a long-term investment in open-source projects allows the EU-STF to provide confidence to organizations to use these foundations for building automated solutions, orchestrating complex processes, and creating development pipelines. Increased confidence in the use of strong, well-supported open technologies will ultimately lead to increased adoption and innovation within the platform engineering ecosystem.

3. Ahmedabad Blockchain-Based Civic Service Platform Launch

The AMC (Ahmedabad Municipal Corporation), a municipality located in Ahmedabad, Gujarat, India recently implemented a digital civic services platform that runs on blockchain technology. Blockchain and other emerging technologies are being developed to provide public sector service delivery. Additionally, the AMC's platform service demonstrates how platform engineering has created a robust architecture that supports the development of secure, reliable, and efficient public service platforms. The increasing adoption of these types of platforms by governments will create growing demand for platforms and expertise, expanding the platform engineering sector into additional verticals such as e-governance and public services.

4. Kyndryl’s USD 2.25 Bn Investment in India for AI and Modern Tech Infrastructure

Kyndryl has announced a USD 2.25 billion investment in India to increase the number of AI initiatives, upgrade enterprise technology infrastructure, and create future-ready talent and innovation labs. This is a major commitment to increasing local digital capacity and demand for all types of platform engineering services in connection with AI, automation and the integration of cloud technologies. As a result, as more enterprises and public institutions in India continue to adopt modern platforms as a result of the expansion of the aforementioned types of infrastructures, the demand for platform engineering in India creates new career opportunities for many more people and requires new services, tools and skilled professionals who can design, build and manage the resulting new platforms.

The platform engineering market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

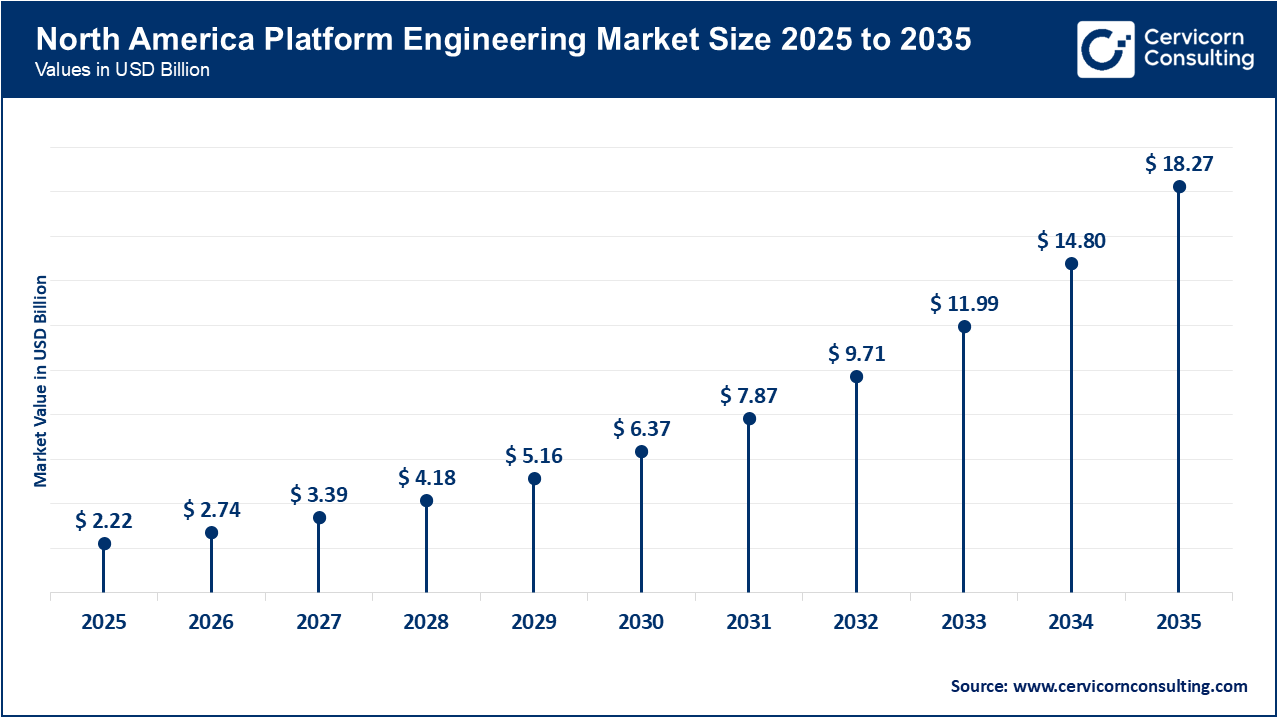

The North America platform engineering market size was reached at USD 2.22 billion in 2025 and is forecasted to grow around USD 18.27 billion by 2035. North America leads platform adoption bece major cloud and AI infrastructure investments create a rich foundation for platform engineering. Large cloud providers continually release faster compute, AI services, and automated tooling that make internal developer platforms more capable and easier to adopt. These improvements reduce time to market for software and enable teams to run agentic automation, observability, and security at scale. Strong partner ecosystems and enterprise demand for AI-ready platforms push vendors and integrators to build platform engineering offerings that exploit the region’s advanced cloud footprint.

Recent Developments:

The Asia-Pacific platform engineering market size was reached at USD 1.39 billion in 2025 and is predicted to hit around USD 11.40 billion by 2035. Asia-Pacific growth is powered by large corporate investments and fast adoption of digital public services. Multinationals and regional IT firms are funding data centers, AI labs, and talent programs. At the same time, governments and cities deploy blockchain, e-governance, and DPI projects that require robust platform engineering to run at scale. This twin push private capital and public digital projects accelerates demand for platform design, implementation, and optimization services across APAC. The result is rapid scaling of platforms that support real-time and citizen-facing workloads.

Recent Developments:

The Europe platform engineering market size was estimated at USD 1.58 billion in 2025 and is projected to surpass around USD 12.97 billion by 2035. Europe market is driven by public funding and digital-sovereignty efforts that strengthen open source and critical infrastructure. Governments and agencies are moving to secure and fund core open components so enterprises can rely on maintained, auditable stacks for large-scale platforms. This reduces vendor lock-in risks and encourages home-grown and partner ecosystems to deliver compliant platform engineering services across sectors. The policy focus on resilience and sovereignty also spurs companies to embed security and observability into platform roadmaps for public and private customers.

Recent Developments:

Platform Engineering Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 38.6% |

| Europe | 27.4% |

| Asia-Pacific | 24.1% |

| LAMEA (Latin America, Middle East & Africa) | 9.9% |

The LAMEA platform engineering market was valued at USD 0.57 billion in 2025 and is anticipated to reach around USD 4.68 billion by 2035. In LAMEA, platform engineering demand is rising from digital government strategies and national digital agendas that modernize public services. Countries across Latin America, the Middle East, and Africa pursue national digital plans and digital public infrastructure to improve service delivery and economic participation. These initiatives create opportunities for local system integrators and global vendors to deliver secure, scalable platforms. Public sector modernization, together with private sector digital growth, stimulates investment in platforms that can handle identity, payments, and regulatory needs across diverse markets.

Recent Developments:

The platform engineering market is segmented into deployment model, organization size, service, end-user, and region.

Cloud-based deployment dominates the platform engineering market because organizations increasingly rely on cloud infrastructure to support modern application development. Cloud platforms enable scalability, flexibility, and faster deployment cycles, which align well with DevOps and agile practices. Enterprises prefer cloud-based platform engineering solutions because they simplify infrastructure management and support automation, monitoring, and security from a single platform. The availability of managed services from major cloud providers further reduces operational complexity. As businesses adopt microservices, containers, and distributed systems, cloud-based platforms become essential for handling growing workloads efficiently and reliably.

Platform Engineering Market Share, By Deployment Model, 2025 (%)

| Deployment Model | Revenue Share, 2025 (%) |

| Cloud-based | 72.8% |

| On-premises | 27.2% |

Cloud-based deployment is also the fastest-growing segment in the market due to rapid digital transformation across industries. Companies are shifting from on-premises systems to cloud-native architectures to reduce costs and improve agility. Small and medium enterprises are increasingly adopting cloud platforms because they avoid heavy upfront infrastructure investment. The growth of hybrid and multi-cloud strategies further accelerates demand for cloud-based platform engineering. These platforms allow organizations to scale quickly, integrate new technologies, and respond faster to market changes, driving strong growth momentum.

Large enterprises dominate the platform engineering market because they operate complex IT environments with multiple development teams and applications. These organizations require standardized platforms to improve developer productivity, ensure security, and maintain operational consistency. Platform engineering helps large enterprises manage cloud infrastructure, automate workflows, and support continuous integration and deployment. With higher budgets and access to skilled professionals, large enterprises can invest in custom internal developer platforms. Their focus on long-term digital transformation and large-scale modernization projects keeps them as the leading contributors to market revenue.

Platform Engineering Market Share, By Organization Size, 2025 (%)

| Organization Size | Revenue Share, 2025 (%) |

| Large Enterprises | 64.5% |

| Small & Medium Enterprises (SMEs) | 35.5% |

Small and medium enterprises are the fastest-growing segment in the market as cloud-based and managed solutions become more accessible. SMEs adopt platform engineering to accelerate product development and reduce operational overhead. These platforms help smaller teams automate infrastructure management and focus more on innovation. The availability of subscription-based pricing and open-source tools lowers entry barriers. As SMEs compete in digital-first markets, they increasingly rely on platform engineering to scale operations quickly and deliver reliable applications, driving rapid growth in this segment.

Development and implementation services dominate the market because organizations need customized platforms tailored to their workflows. This segment includes building internal developer platforms, configuring cloud infrastructure, and integrating automation tools. Companies invest heavily in this phase to establish a strong foundation for software delivery. As more businesses modernize legacy systems and adopt cloud-native technologies, demand for development and implementation services remains high. These services play a critical role in enabling faster deployments, improved reliability, and better developer experiences.

Platform Engineering Market Share, By Service, 2025 (%)

| Service | Revenue Share, 2025 (%) |

| Design & Architecture | 14.6% |

| Development & Implementation | 32.8% |

| Integration & Migration | 18.9% |

| Support & Maintenance | 16.7% |

| Optimization & Performance Tuning | 11.4% |

| Others | 5.6% |

Optimization and performance tuning is the fastest-growing service segment in the market as organizations focus on efficiency and cost control. Once platforms are deployed, companies seek to improve performance, reduce cloud spending, and enhance system reliability. This includes workload optimization, resource management, and continuous monitoring. The rise of AI-driven analytics and automation tools further supports this growth. As platforms scale and support advanced applications, ongoing optimization becomes essential, driving increased demand for these specialized services.

IT and telecommunications dominate the platform engineering market because they rely heavily on digital platforms and continuous service delivery. These sectors manage large-scale networks, cloud services, and software products that require high availability and performance. Platform engineering enables automation, rapid deployment, and efficient infrastructure management. Telecom operators also need platforms to support emerging technologies like 5G and edge computing. Their early adoption of DevOps and cloud-native models makes IT and telecommunications the largest end-user segment in the market.

Platform Engineering Market Share, By End-User, 2025 (%)

| End-User | Revenue Share, 2025 (%) |

| IT & Telecommunications | 29.7% |

| Banking, Financial Services & Insurance (BFSI) | 18.6% |

| Retail & E-Commerce | 14.3% |

| Healthcare | 11.8% |

| Manufacturing & Industrial | 13.1% |

| Government & Public Sector | 9.4% |

| Others | 3.1% |

The government and public sector segment is the fastest-growing in the market due to rising investments in digital governance. Governments are launching platforms for citizen services, healthcare systems, taxation, and smart city projects. These initiatives require secure, scalable, and reliable platforms. Platform engineering helps public institutions modernize legacy systems and improve service delivery. Increased focus on transparency, data security, and efficiency is accelerating adoption, making the public sector a key growth driver in the market.

By Deployment Model

By Organization Size

By Service

By End-User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Platform Engineering

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Deployment Model Overview

2.2.2 By Organization Size Overview

2.2.3 By Service Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing demand for faster software delivery

4.1.1.2 Rising adoption of cloud and DevOps practices

4.1.2 Market Restraints

4.1.2.1 High initial implementation cost

4.1.2.2 Shortage of skilled platform engineers

4.1.3 Market Challenges

4.1.3.1 Expansion into government and public sector projects

4.1.3.2 Integration of AI and automation

4.1.4 Market Opportunities

4.1.4.1 Managing complex and distributed systems

4.1.4.2 Security and compliance risks

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Platform Engineering Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Platform Engineering Market, By Deployment Model

6.1 Global Platform Engineering Market Snapshot, By Deployment Model

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Cloud-based

6.1.1.2 On-premises

Chapter 7. Platform Engineering Market, By Organization Size

7.1 Global Platform Engineering Market Snapshot, By Organization Size

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Large Enterprises

7.1.1.2 Small & Medium Enterprises (SMEs)

Chapter 8. Platform Engineering Market, By Service

8.1 Global Platform Engineering Market Snapshot, By Service

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Design & Architecture

8.1.1.2 Development & Implementation

8.1.1.3 Integration & Migration

8.1.1.4 Support & Maintenance

8.1.1.5 Optimization & Performance Tuning

8.1.1.6 Others

Chapter 9. Platform Engineering Market, By End-User

9.1 Global Platform Engineering Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 IT & Telecommunications

9.1.1.2 Banking, Financial Services & Insurance (BFSI)

9.1.1.3 Retail & E-Commerce

9.1.1.4 Healthcare

9.1.1.5 Manufacturing & Industrial

9.1.1.6 Government & Public Sector

9.1.1.7 Others

Chapter 10. Platform Engineering Market, By Region

10.1 Overview

10.2 Platform Engineering Market Revenue Share, By Region 2024 (%)

10.3 Global Platform Engineering Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Platform Engineering Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Platform Engineering Market, By Country

10.5.4 UK

10.5.4.1 UK Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Platform Engineering Market, By Country

10.6.4 China

10.6.4.1 China Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Platform Engineering Market, By Country

10.7.4 GCC

10.7.4.1 GCC Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Platform Engineering Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Amazon Web Services, Inc.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Google LLC

12.3 Microsoft Corporation

12.4 IBM Corporation

12.5 Cisco Systems, Inc.

12.6 Oracle Corporation

12.7 Salesforce, Inc.

12.8 SAP SE

12.9 ServiceNow, Inc.

12.10 Accenture

12.11 Cognizant

12.12 Tata Consultancy Services (TCS)

12.13 XenonStack

12.14 Thoughtworks