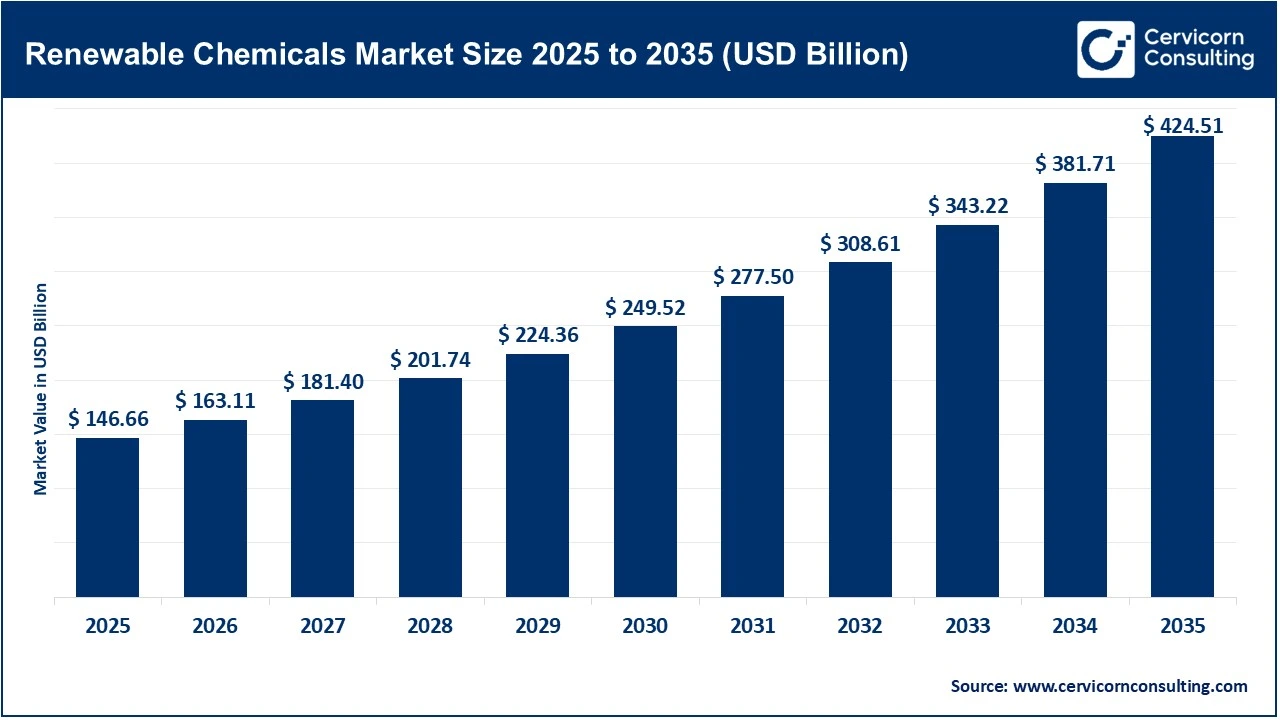

The global renewable chemicals market size was estimated at USD 146.66 billion in 2025 and is expected to be worth around USD 424.51 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 11.2% over the forecast period from 2026 to 2035. The renewable chemicals market continues to grow as an increasing number of consumers and professional users consider sustainability and renewable resources to be more important than fossil-derived chemicals. The renewable chemical market is developing. Manufacturers are motivated to implement renewable chemicals into their products, including packaging, cleaning products, pharmaceuticals, and automotive materials, by increasing awareness of global climate change, reducing COâ‚‚ emissions, and maintaining a safe environment for future generations. The shift towards renewable chemicals is also aided by government support, stricter environmental regulations and incentives to promote green manufacturing have sped up the pace of transitioning to renewable chemicals. Improvements in digital supply chains and global access to bio-based products also contribute to the steady growth of the renewable chemicals market.

Recent developments are influencing the future growth of the renewable chemicals market, particularly through continued investment in green chemistry, biotechnology, and advanced processing technologies. Companies are growing their bio refinery capacity, as well as working together to develop ways to make the process more efficient and cost-effective. Companies are also increasing their corporate sustainability commitments, and growing interest and demand for biodegradable products has created tremendous momentum for this market growth across Asia, the Pacific, and North America. In addition to these developments, global shifts in feedstock availability and global production strategies will continue to influence pricing trends, which will impact the long-term adoption of renewable chemicals.

Rising Adoption of Eco-Friendly Chemicals Driving Market Growth

The increasing trend toward adopting eco-friendly chemicals has been a driving force in the growth of the renewable chemicals market, with industry and consumer demand moving toward environmentally sound and sustainable manufacturing. A wide variety of manufacturers, including those in the packaging, cleaning products, pharmaceuticals, and automotive industries, have begun substituting fossil-based chemicals with bio-based and biodegradable products to minimize greenhouse gas emissions and comply with increasingly rigid environmental regulations. Corporate ESG commitments and bans on the use of hazardous chemicals within the product development process, along with the increasing consumer preference toward purchasing green products, have all contributed to the acceleration of this transition. Furthermore, the increasing demand for renewable chemicals has stimulated growth opportunities, resulting in additional investments in green chemistry, biorefineries, and sustainable production processes, creating further momentum for growth within the market.

Major Recent Investments in Renewable Chemicals (2024-2025)

| Initiative | Investment | Purpose |

| UPM - Leuna Biorefinery (Germany) | EUR 1.275 billion | New advanced biochemicals production facility (220,000 tpa) |

| Godavari Biorefineries Ltd (India) | INR 130 crore (USD 16 Mn) | New corn/grain ethanol distillery to enhance renewable chemicals feedstock |

| Sironix Renewables (USA) | USD 3.5 million funding | Scaling up sustainable bio-chemical ingredient production |

| DOE - U.S. Renewable Chemicals & Fuels R&D | Up to USD 23 million | Grants for biomass & renewable chemicals technology R&D |

| Varo Energy (Europe) | USD 600 million planned | Major Sustainable Aviation Fuel (SAF) facility in Rotterdam (renewable fuels/chemicals link) |

1. BASF Expands Bio-Based and Low-Carbon Chemical Production in Europe

BASF has recently developed a wide range of bio-based products and mass-balanced certified chemicals for use throughout all of Europe. The European Union Green Deal Agreement and various carbon reduction mandates facilitated these efforts. The growth of these products is occurring due to increasing pressures on companies to be more environmentally friendly and to strict government regulations. Companies from the packaging, automotive, and industrial sectors are now looking for more sustainable alternatives to fossil fuels. Furthermore, with help from government support and rules, BASF has managed to reduce the risks of switching to renewable chemicals, which has allowed it to produce more of these chemicals across the continent and boost Europe's role in sustainable chemical production.

2. U.S. Government-Backed Expansion of Bio-Refineries by ADM and Cargill

Archer-Daniels-Midland (ADM) and Cargill have increased their U.S. biorefinery and bio-based processes with assistance from federal and state bio-based economy programs. This growth is attributable to United States government programs, including support from the U.S. Department of Energy and incentives provided by the federal and state governments for renewable fuels and biobased (bio-based) manufacturing. The investments increase the amount of renewable feedstocks and intermediates, reduce production costs, and accelerate the adoption of renewable chemical products for new uses such as industrial, cleaning, and packaging products.

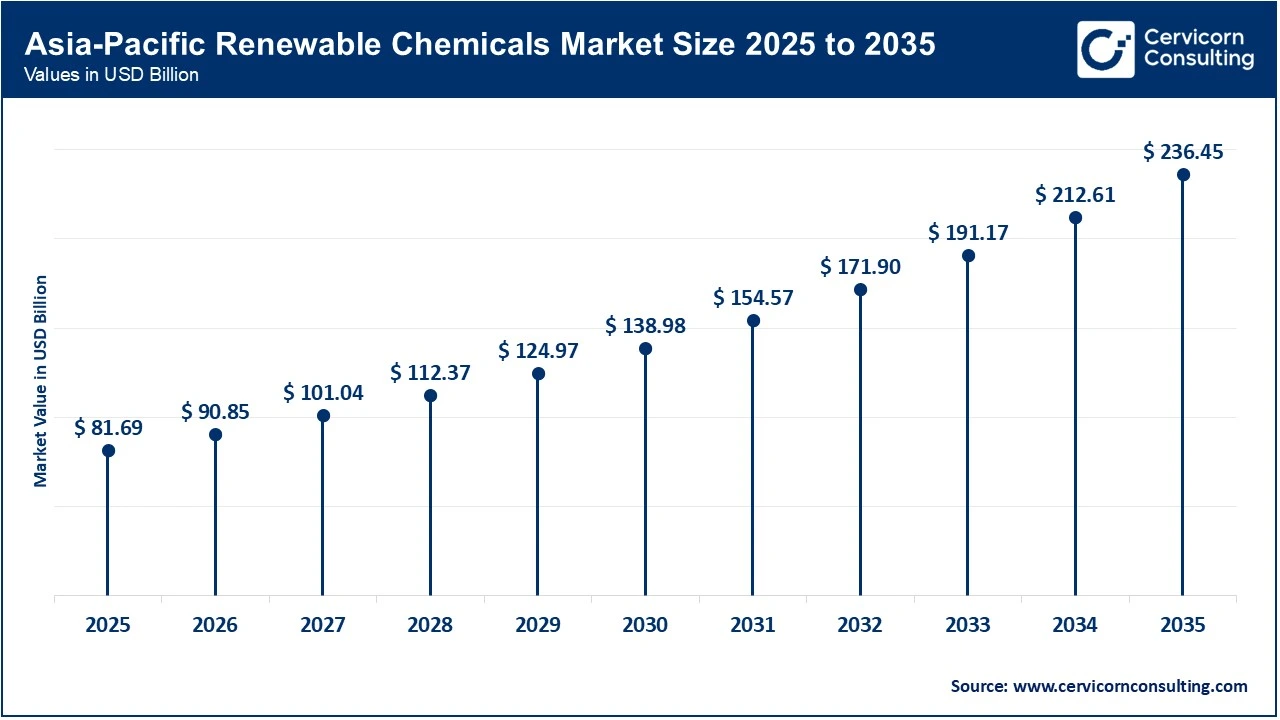

3. Asia-Pacific Bio-Refinery Investments Supported by National Sustainability Targets

The major players, like Mitsubishi Chemical Group, and many local producers are now making significant investments in large-scale biorefinery development throughout Japan, China, and Southeast Asian countries. These investments will support the government's efforts to achieve carbon neutrality and decarbonization in industry. The government has set ambitious goals for creating renewable materials from biomass using resource-efficient technologies and has created strong policies to support this sector and create demand for sustainably sourced materials. Therefore, the Asia-Pacific is continuing to increase its ability to manufacture and export renewable chemicals more than any other region.

4. Braskem Advances Bio-Based Polymer Innovation Under Latin American Bioeconomy Programs

The Brazilian government has implemented the National Plan for Bio-Economy and Sustainability to support the use of bio-based polymers throughout Brazil. The plan encourages producers to use renewable feedstocks like sugarcane while providing financial incentives and renewable sources of energy. These efforts have led to the widespread use of bio-based polyethylene in packaging and consumer products, mainly because of increasing government rules aimed at cutting down plastic waste and COâ‚‚ emissions. Thus, the global market for renewable chemicals now views renewable polymers as one of the primary areas of growth.

The renewable chemicals market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The Asia-Pacific renewable chemicals market size was valued at USD 81.69 billion in 2025 and is expected to grow around USD 236.45 billion by 2035. The Asia-Pacific region leads the market due to the area's rapid industrial growth, extensive supply of renewable raw materials, and substantial governmental backing for sustainable manufacturing. The countries of China, India, and Japan are making significant investments in biorefineries and utilizing green chemistry to decrease their reliance upon petrochemicals used in the manufacture of consumer goods. The growth of the market is being propelled by the increasing production capacity of chemical plants and facilities, the low price of labor, and the expansion of various sectors such as packaging, transportation, and consumer products. Furthermore, with more stringent regulations regarding environmental issues and national goals for carbon neutrality, the growth in this market has increased significantly.

Recent Developments:

The North America renewable chemicals market size was estimated at USD 27.28 billion in 2025 and is forecasted to surpass around USD 78.96 billion by 2035. North America is the fastest-growing region due to higher levels of research and development (R&D), robust policy structures, and implementation of sustainable practices within various sectors of its economy. The U.S. and Canada are also taking advantage of various government-assisted programs that promote the use of bio-based manufacturing and provide grants for the research and development of green chemistry products. Demand for renewable chemical intermediates is being driven by the pharmaceutical, cleaning products, and automobile manufacturing sectors. In addition, the establishment of the supply chain and the ability of many manufacturers to implement new production technologies reinforce the region's ability to grow.

Recent Developments:

The Europe renewable chemicals market size was reached at USD 22.29 billion in 2025 and is projected to hit around USD 64.53 billion by 2035. Europe's renewable chemicals market is significantly shaped by stringent regulatory policies regarding the environment and a strong commitment to fostering a sustainable economy. As the European Union advances its policies to reduce carbon emissions, enhance plastic recycling, and encourage the use of sustainable raw materials, numerous industries are actively seeking renewable chemical alternatives to petroleum-based products. Initiatives funded by the government, coupled with emerging public-private partnerships, have resulted in increased investment, which, in turn, has increased innovation and facilitated market entry for biochemical technologies.

Recent Developments

Renewable chemicals market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia-Pacific | 55.7% |

| North America | 18.6% |

| Europe | 15.2% |

| LAMEA | 10.5% |

The LAMEA renewable chemicals market was valued at USD 15.40 billion in 2025 and is anticipated to reach around USD 44.57 billion by 2035. The LAMEA region is experiencing steady growth driven by the availability of many renewable raw material sources, such as sugar, biomass, and agricultural waste, in Latin America, and more policies focusing on sustainable development, economic diversification, and a circular economy in countries in the Middle East and Africa. Further support for the growth of this regional market comes from increased demand for products made from renewable chemicals in packaging, cleaning products, and various types of industrial use across various levels of industrial development.

Recent Developments:

The renewable chemicals market is segmented into type, feedstocks, application, and region.

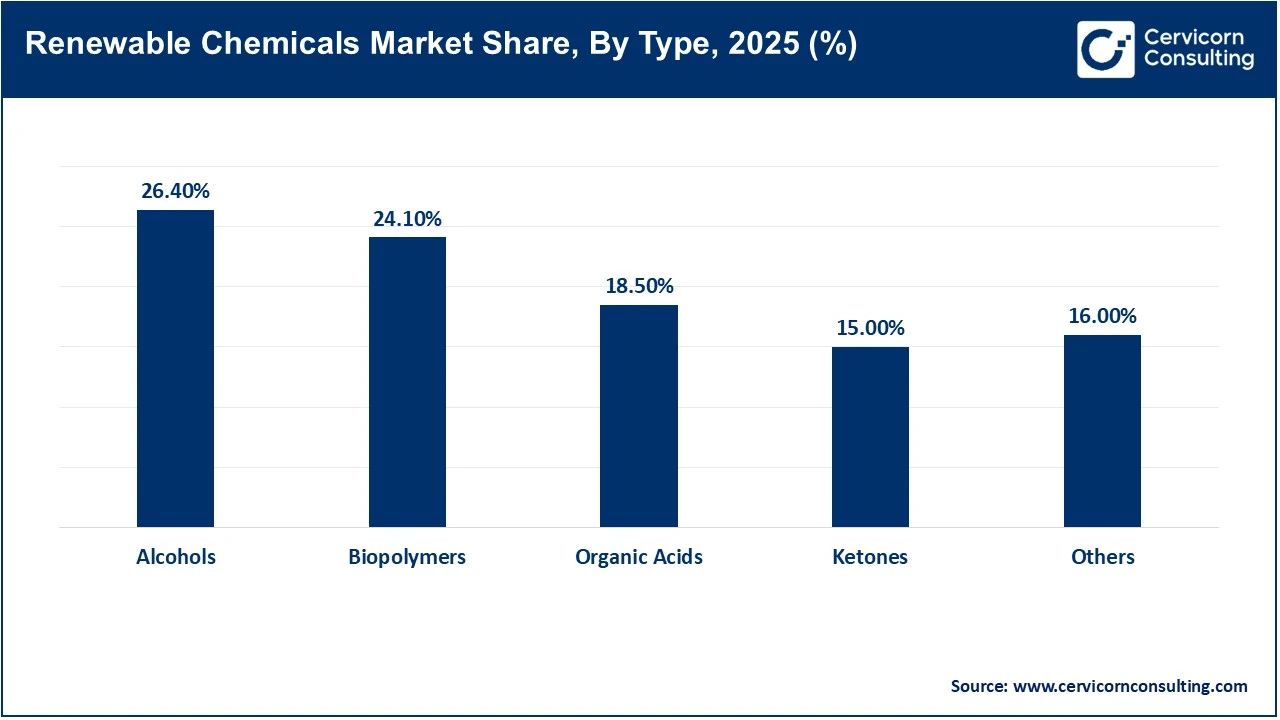

The alcohols are the dominant type within the market because they are used so frequently as fuel, solvents, and chemical intermediates. Bio-ethanol and bio-methanol have also been widely accepted for petrochemical substitution, as well as being used in pharmaceutical manufacturing and industrial processing, largely due to blending mandates and emissions reduction targets. The fusion of established production technology, large-scale capability to produce these products, and high-volume demand from the transportation and industrial sectors contributes to the current leading position of alcohol in the market.

Biopolymers are the fastest-growing type, supported by increased demand for sustainable and biodegradable materials. The application of biopolymers in packaging, consumer products, and automotive interiors will continue to drive growth through their increased use. Changes in government regulation regarding single-use plastics and corporate social responsibility will continue to motivate manufacturers to convert from oil-based polymer products to bio-based alternatives. Ongoing research and development to improve material performance while maintaining competitive pricing will continue to drive rapid growth in this segment.

Biomass dominated the renewable chemicals market because of its availability, low cost, and compatibility with existing biorefineries. The three main sources of biomass used to produce renewable chemicals in volume are agricultural crop residues, forestry products, and other materials generated from human activity. Additionally, many governments are backing initiatives supporting the value-added use of waste as well as circular economy models that use biomass in place of fossil fuels. These efforts will allow biomass to be used more widely and consistently throughout the world.

Renewable chemicals market Share, By Feedstocks, 2025 (%)

| Feedstocks | Revenue Share, 2025 (%) |

| Biomass | 35.3% |

| Corn | 19.2% |

| Sugarcane | 15.1% |

| Algae | 18.4% |

| Others | 12.0% |

Algae is the fastest-growing segment due to the high potential for yield and low competition with food sources. Algae offer numerous advantages, such as their rapid growth and efficient sequestration of carbon dioxide. Increased funding for advanced systems developed to cultivate algae and ongoing research and development supported by various governments will continue to accelerate algae commercialization. As the cost to produce algae continues to decline, algae is rapidly becoming an acceptable option for future mass production of renewable chemicals.

Petrochemical applications dominate the market, as the use of renewable chemicals replaces fossil-based intermediates in the manufacturing process. The high consumption volumes, integration of these renewable chemicals into existing chemical value chains, and regulatory pressure to reduce emission levels have contributed to the growth of petrochemical production. Renewable alcohols, organic acids, and bio-based intermediates are commonly adopted to enhance sustainability without compromising on performance and therefore continue to represent the largest application segment of petrochemicals.

Renewable chemicals market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Petrochemical | 57.6% |

| Packaging Products | 15.3% |

| Cleaning & Detergent Products | 9.3% |

| Pharmaceutical | 7.9% |

| Automotive | 5.8% |

| Others | 4.1% |

Packaging products represent the fastest-growing application, due to the increasing interest in using more biodegradable, recyclable, and environmentally friendly packaging materials. As a result of stricter regulations placed on plastic waste and the increasing focus of consumers on sustainable products, the move to sustainable packaging is now occurring at a tremendous speed within the food and beverage industries, as well as in a variety of consumer goods categories. Therefore, this segment within the renewable chemicals market will continue to be one of the major drivers of growth for this industry.

BASF SE

Dow Inc.

Braskem S.A.

By Type

By Feedstocks

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Renewable Chemicals

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Feedstocks Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Focus on Sustainability and Low-Carbon Manufacturing

4.1.1.2 Strong Government Support and Regulatory Push

4.1.2 Market Restraints

4.1.2.1 High Production Costs and Limited Cost Competitiveness

4.1.2.2 Feedstock Availability and Supply Chain Uncertainty

4.1.3 Market Opportunities

4.1.3.1 Advancements in Green Chemistry and Biotechnology

4.1.3.2 Expanding Demand from Emerging Economies

4.1.4 Market Challenges

4.1.4.1 Scaling Production from Pilot to Commercial Level

4.1.4.2 Competition from Established Petrochemical Alternatives

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Renewable Chemicals Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Renewable Chemicals Market, By Type

6.1 Global Renewable Chemicals Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Alcohols

6.1.1.2 Biopolymers

6.1.1.3 Organic Acids

6.1.1.4 Ketones

6.1.1.5 Others

Chapter 7. Renewable Chemicals Market, By Feedstocks

7.1 Global Renewable Chemicals Market Snapshot, By Feedstocks

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Biomass

7.1.1.2 Corn

7.1.1.3 Sugarcane

7.1.1.4 Algae

7.1.1.5 Others

Chapter 8. Renewable Chemicals Market, By Application

8.1 Global Renewable Chemicals Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Petrochemical

8.1.1.2 Packaging Products

8.1.1.3 Cleaning & Detergent products

8.1.1.4 Pharmaceutical

8.1.1.5 Automotive

8.1.1.6 Others

Chapter 9. Renewable Chemicals Market, By Region

9.1 Overview

9.2 Renewable Chemicals Market Revenue Share, By Region 2024 (%)

9.3 Global Renewable Chemicals Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Renewable Chemicals Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Renewable Chemicals Market, By Country

9.5.4 UK

9.5.4.1 UK Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Renewable Chemicals Market, By Country

9.6.4 China

9.6.4.1 China Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Renewable Chemicals Market, By Country

9.7.4 GCC

9.7.4.1 GCC Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Renewable Chemicals Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 BASF SE

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Dow Inc.

11.3 Archer-Daniels-Midland Company (ADM)

11.4 Braskem S.A.

11.5 Cargill, Incorporated

11.6 DuPont de Nemours, Inc.

11.7 Evonik Industries AG

11.8 Corbion N.V.

11.9 Novozymes A/S

11.10 NatureWorks LLC

11.11 BioAmber Inc.

11.12 Amyris, Inc.

11.13 DSM-Firmenich

11.14 Mitsubishi Chemical Group

11.15 TotalEnergies SE