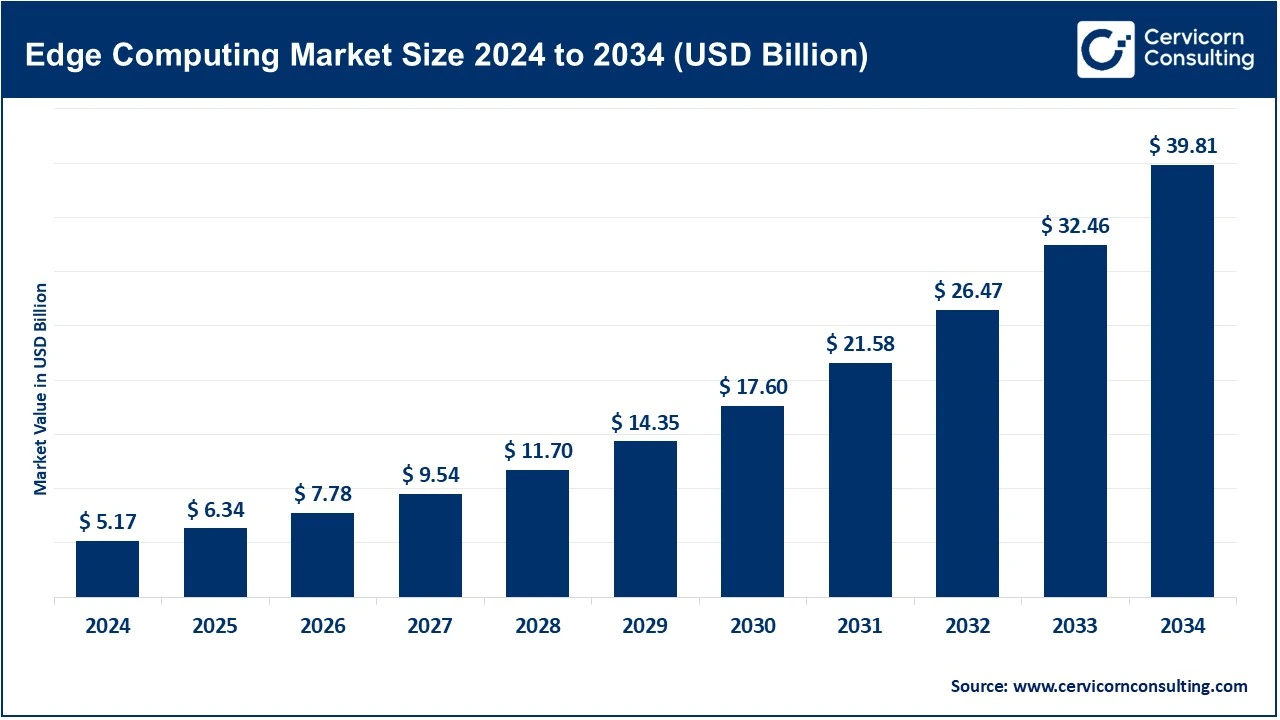

The global edge computing market size reached at USD 167.82 billion in 2025 and is expected to be worth around USD 867.41 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 17.9% over the forecast period 2026 to 2035. The edge computing market is growing rapidly because companies need faster and more efficient ways to process huge amounts of data. More devices connected through IoT generate massive data that cannot always be sent to distant cloud servers, so businesses are placing computing closer to where the data is created. This reduces network congestion, lowers latency, and enables real-time decision-making, which is critical for applications like industrial automation, autonomous vehicles, and smart cities. The rollout of 5G networks and the rising use of AI at the edge also boost demand for edge solutions, making the edge computing market essential for processing data with speed and reliability.

Recent developments are further strengthening this growth. Many technology companies are launching new edge AI processors, partnerships, and specialized infrastructure to support edge innovation. For example, global firms are expanding edge AI licensing and chip designs to accelerate on-device intelligence, while regional initiatives are producing local edge processors to support national tech ecosystems. Cloud providers and telcos are also investing in distributed edge nodes and services to meet the rising need for hybrid cloud and low-latency applications. These advancements help drive the edge computing market forward by enabling more industries to adopt edge solutions for real-world use cases.

Growth in Connected Devices Driving Demand for Low-Latency Edge Processing

The rapid growth in connected devices such as IoT sensors, smart machines, wearables, and autonomous systems is creating large volumes of data at the network edge. Sending all this data to centralized cloud data centers causes delays, bandwidth strain, and higher costs. Many applications like industrial automation, smart grids, connected vehicles, and real-time video analytics need instant responses. This makes low-latency processing near the data source essential. Edge computing allows data to be processed locally, close to where it is generated, which improves speed, reliability, and security. As the number of connected devices continues to rise, the need for fast, local data processing increases, strongly driving the growth of the edge computing market.

Moreover, the steady rise in both IoT and non-IoT active device connections worldwide is strongly driving the edge computing market. As billions of devices generate continuous data, processing everything in centralized clouds becomes inefficient and slow. This growth increases the need for low-latency, real-time data processing closer to the source, which edge computing enables. As a result, industries are investing more in edge infrastructure to handle higher data volumes, improve performance, and support applications such as smart cities, industrial automation, and connected healthcare.

1. Toyota & NTT’s USD 3.3 Bn AI Mobility Platform Initiative

Toyota Motor Corporation and Nippon Telegraph and Telephone (NTT) announced a joint investment of about USD 3.3 billion to build a distributed Mobility AI Platform that combines AI, communication, and edge computing capabilities to process data locally for real-time mobility applications such as autonomous driving and traffic safety. This initiative highlights how edge computing infrastructure is becoming foundational for advanced AI systems that require low-latency data processing near vehicles and traffic networks. By integrating edge computing into automotive and mobility ecosystems, this development accelerates real-world adoption of edge technologies in critical industries, encouraging other players to invest in edge-enabled platforms for intelligent transport systems.

2. Accenture’s Strategic Investment in CLIKA for Edge AI

Accenture Ventures invested in CLIKA, a startup focusing on high-performance AI compression tools that make it easier to run AI models on edge devices. This partnership aims to simplify deployment of compact AI models across a broad range of edge endpoints, such as IoT sensors, robotics, and autonomous vehicles. By reducing the complexity of running AI at the edge, this milestone helps enterprises scale intelligent edge computing solutions faster and more cost-effectively. The development strengthens the ecosystem of software tools supporting edge computing and drives broader enterprise adoption by solving key deployment challenges.

3. Expansion of Distributed Edge Data Centers Globally

Although not tied to a single company announcement, investment trends in edge data center construction represent a major milestone for the edge computing market. Data centers built closer to users reduce latency and improve performance for edge workloads, enabling real-time processing for applications like streaming, IoT, and industrial automation. This shift toward decentralized computing infrastructure supports market growth by making edge solutions more accessible, scalable, and efficient across industries worldwide.

4. Japan’s Government-Backed “Society 5.0” Initiative Integrating Edge Tech

Japan’s “Society 5.0” national initiative, backed by significant public investment in AI and smart infrastructure, promotes the integration of edge computing across sectors including logistics and healthcare. This government-led push encourages development of next-generation smart systems that rely on local data processing for speed and reliability. Public initiatives like this not only boost domestic edge computing adoption but also set benchmarks for other countries to follow, driving innovation and investment in edge technologies at both national and industry levels.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 197.78 Billion |

| Expected Market Size in 2035 | USD 867.41 Billion |

| Projected CAGR 2026 to 2035 | 17.90% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Component, Application, Organization Size, Deployment Mode, Vertical, Region |

| Key Companies | Amazon Web Services (AWS), Microsoft Corporation, Cisco Systems Inc., IBM Corporation, Hewlett Packard Enterprise (HPE), Dell Technologies, Google LLC, Intel Corporation, NVIDIA Corporation, Huawei Technologies, Siemens AG, Schneider Electric, Nokia Corporation, Juniper Networks, Advantech Co., Ltd. |

The edge computing market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

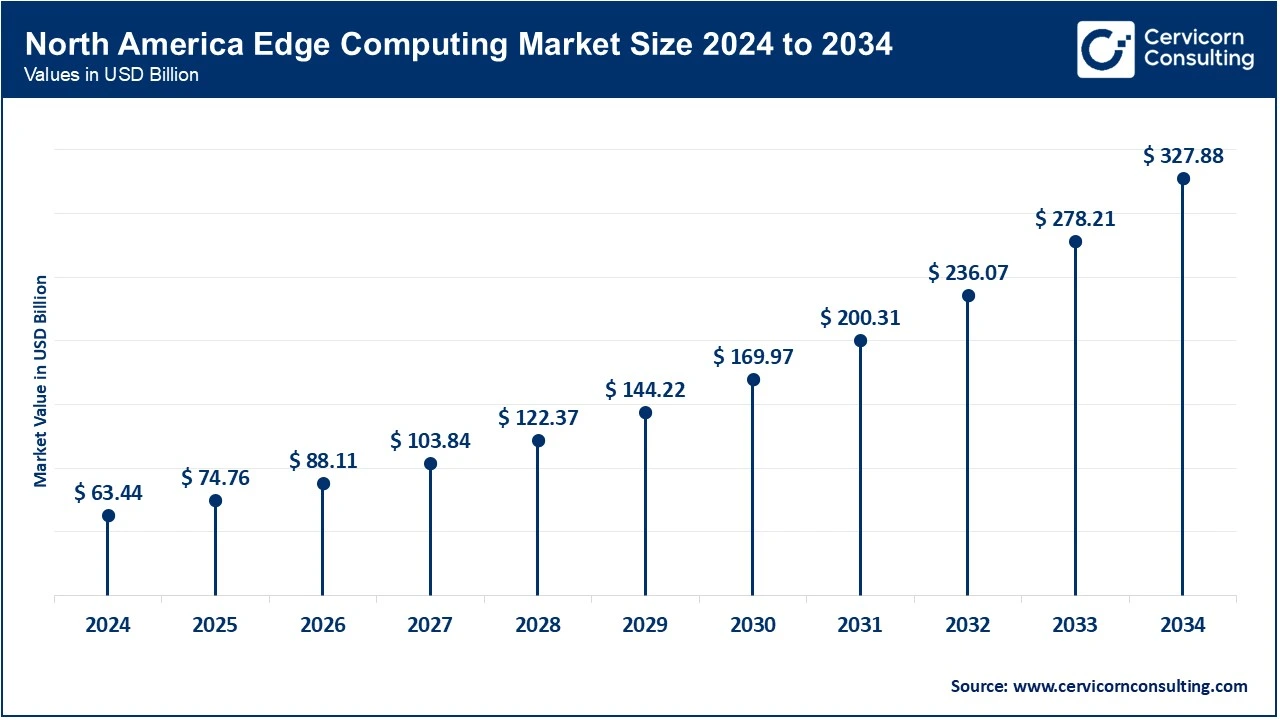

The North America edge computing market size was valued at USD 63.44 billion in 2025 and is expected to be worth around USD 327.88 billion by 2035. North America leads the market because the region has advanced digital infrastructure, early adoption of 5G, and heavy investment by major tech companies. The widespread deployment of 5G networks improves low-latency performance, which boosts edge use in sectors such as manufacturing, healthcare, and retail. Large data center ecosystems and strong cloud penetration also support edge deployment across industries, helping enterprises process data close to where it’s generated and improving operational efficiency. North America’s established technology ecosystem keeps it at the forefront of edge computing innovation.

Recent Developments:

Asia-Pacific (APAC) Edge Computing Market: Smart Cities & 5G Expansion Fuel Fast Growth

The Asia-Pacific edge computing market size was estimated at USD 40.44 billion in 2025 and is forecasted to surpass around USD 209.05 billion by 2035. The Asia-Pacific region is the fastest-growing market thanks to rapid adoption of 5G networks, smart city projects, and a dense ecosystem of connected devices. Countries like China, India, Japan, and South Korea are investing heavily in digital infrastructure, Industry 4.0, and low-latency processing capabilities. Rising industrial IoT adoption and government support for digital transformation further accelerate market growth. As more enterprises deploy edge solutions for real-time data analytics and automation, Asia-Pacific continues to expand its edge computing footprint.

Recent Developments:

The Europe edge computing market size was accounted for USD 43.47 billion in 2025 and is projected to hit around USD 224.66 billion by 2035. Europe market is growing as industries adopt IoT and digital transformation initiatives. Strong IT infrastructure across countries and investment in network modernization supports the deployment of edge solutions. European governments and businesses are focusing on data sovereignty and innovation in sectors like automotive, smart cities, and manufacturing. These factors drive edge computing adoption to enable real-time processing, localized data handling, and improved service delivery across industrial and public sectors.

Recent Developments:

Edge Computing Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 37.8% |

| Europe | 25.9% |

| Asia-Pacific | 24.1% |

| LAMEA | 12.2% |

The LAMEA edge computing market was valued at USD 20.47 billion in 2025 and is anticipated to reach around USD 105.82 billion by 2035. LAMEA are emerging markets as cloud infrastructure investments expand, especially in data centers and connectivity services. Increasing digital adoption in sectors like e-commerce, telecommunications, and public services creates demand for edge solutions to support low-latency processing. Investments by global cloud providers in LAMEA boost local capacity and help organizations adopt edge computing for faster data analysis and service delivery, driving regional market growth.

Recent Developments:

The edge computing market is segmented into component, application, organisation size, deployment mode, vertical, and region.

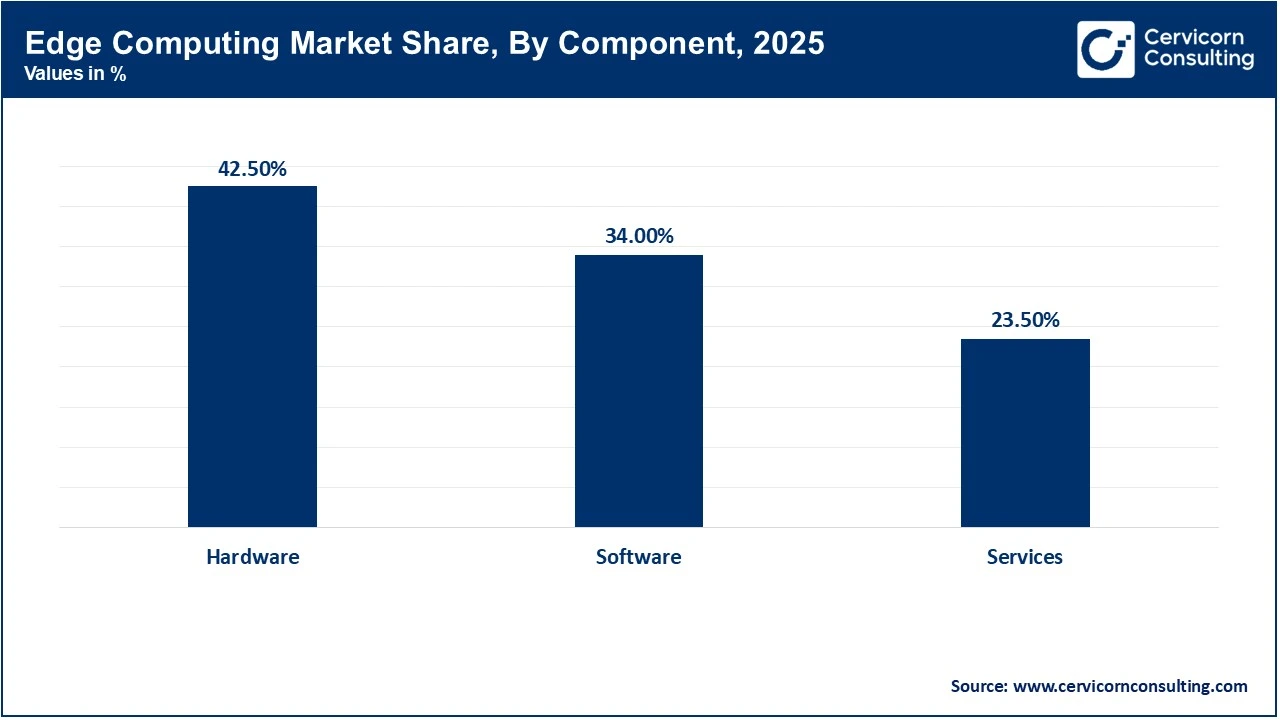

Hardware dominates the edge computing market because it forms the foundation of edge infrastructure. Devices such as edge servers, gateways, sensors, and industrial controllers are required to collect and process data near the source. Large-scale deployment of IoT devices, smart factories, and telecom edge nodes has increased demand for robust hardware. Without reliable hardware at the edge, software and services cannot function effectively, making this segment the largest contributor.

Software is the fastest-growing segment in the edge computing market as enterprises focus on data analytics, orchestration, and AI-driven decision-making. Software platforms help manage distributed edge nodes, run AI models, and integrate edge systems with cloud environments. Growing demand for edge AI, automation, and real-time analytics is accelerating software adoption. This shift from hardware-only investments to intelligent software layers drives rapid growth.

IoT and industrial IoT applications dominate the edge computing market due to their widespread use across manufacturing, utilities, smart cities, and logistics. These applications generate continuous streams of data that require local processing to reduce latency and bandwidth usage. Edge computing improves operational efficiency and system reliability in IoT environments. The large installed base of IoT devices keeps this segment in a leading position.

Edge Computing Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| IoT & IIoT Applications | 36.8% |

| Real-Time Processing & Control | 25.4% |

| Edge AI & Inference | 22.1% |

| Immersive & Interactive Experiences | 15.7% |

Edge AI and inference is the fastest-growing application segment in the edge computing market. Businesses are increasingly deploying AI models at the edge to enable real-time insights, predictive maintenance, and intelligent automation. Processing AI workloads locally improves response time and data privacy. Advancements in AI chips and lightweight models are accelerating adoption across industries.

On-premises edge computing dominates the edge computing market due to strong requirements for data control, security, and ultra-low latency. Industries such as manufacturing, healthcare, and defense prefer on-site processing to meet regulatory and operational needs. This deployment model ensures reliability even in low-connectivity environments. These advantages keep on-premises edge widely adopted.

Edge Computing Market Share, By Deployment Mode, 2025 (%)

| Deployment Mode | Revenue Share, 2025 (%) |

| On-Premises Edge Computing | 57.6% |

| Cloud-Integrated Edge | 42.4% |

Cloud-integrated edge is the fastest-growing deployment mode in the edge computing market. It combines the scalability of cloud with the speed of edge processing. Organizations use this model to manage edge nodes centrally while processing critical data locally. Growing adoption of hybrid cloud strategies and 5G networks is accelerating this segment’s growth.

Telecommunications and IT dominate the edge computing market as telecom operators deploy edge infrastructure to support 5G, content delivery, and network optimization. Edge computing helps reduce latency for applications like video streaming and real-time communication. IT companies also use edge solutions to support distributed cloud services. Heavy investment in network infrastructure keeps this vertical in the lead.

Edge Computing Market Share, By Vertical, 2025 (%)

| Vertical | Revenue Share, 2025 (%) |

| Telecommunications & IT | 24.6% |

| Manufacturing | 18.9% |

| Healthcare & Life Sciences | 12.8% |

| Retail & Consumer Goods | 11.3% |

| Transportation & Logistics | 9.4% |

| Energy & Utilities | 8.2% |

| Government & Public Sector | 7.1% |

| Media & Entertainment | 4.5% |

| Others | 3.2% |

Healthcare and life sciences are the fastest-growing verticals in the edge computing market. Edge computing enables real-time patient monitoring, medical imaging analysis, and faster clinical decision-making. It also supports data privacy by processing sensitive information locally. The rise of digital health, remote care, and smart medical devices is driving rapid growth in this segment.

Amazon Web Services (AWS)

Microsoft Corporation

Cisco Systems Inc.

Market Segmentation

By Component

By Application

By Organization Size

By Deployment Mode

By Vertical

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Edge Computing

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Component Overview

2.2.2 By Organization Size Overview

2.2.3 By Application Overview

2.2.4 By Deployment Mode Overview

2.2.5 By Vertical Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Demand for low-latency processing

4.1.1.2 Growth of IoT and connected devices

4.1.2 Market Restraints

4.1.2.1 High initial deployment cost

4.1.2.2 Complexity of edge infrastructure management

4.1.3 Market Challenges

4.1.3.1 Data security and privacy risks

4.1.3.2 Lack of standardization

4.1.4 Market Opportunities

4.1.4.1 Integration of AI at the edge

4.1.4.2 Expansion of 5G networks

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Edge Computing Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Edge Computing Market, By Component

6.1 Global Edge Computing Market Snapshot, By Component

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Software

6.1.1.2 Hardware

6.1.1.3 Services

Chapter 7. Edge Computing Market, By Organization Size

7.1 Global Edge Computing Market Snapshot, By Organization Size

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Large Enterprises

7.1.1.2 Small & Medium-sized Enterprises (SMEs)

Chapter 8. Edge Computing Market, By Application

8.1 Global Edge Computing Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Real-Time Processing & Control

8.1.1.2 Edge AI & Inference

8.1.1.3 Immersive & Interactive Experiences

8.1.1.4 IoT & IIoT Applications

Chapter 9. Edge Computing Market, By Deployment Mode

9.1 Global Edge Computing Market Snapshot, By Deployment Mode

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 On-Premises Edge Computing

9.1.1.2 Cloud-Integrated Edge

Chapter 10. Edge Computing Market, By Vertical

10.1 Global Edge Computing Market Snapshot, By Vertical

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Telecommunications & IT

10.1.1.2 Manufacturing

10.1.1.3 Healthcare & Life Sciences

10.1.1.4 Retail & Consumer Goods

10.1.1.5 Transportation & Logistics

10.1.1.6 Energy & Utilities

10.1.1.7 Government & Public Sector

10.1.1.8 Media & Entertainment

10.1.1.9 Others

Chapter 11. Edge Computing Market, By Region

11.1 Overview

11.2 Edge Computing Market Revenue Share, By Region 2024 (%)

11.3 Global Edge Computing Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Edge Computing Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Edge Computing Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Edge Computing Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Edge Computing Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Edge Computing Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Edge Computing Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Edge Computing Market, By Country

11.5.4 UK

11.5.4.1 UK Edge Computing Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Edge Computing Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Edge Computing Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Edge Computing Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Edge Computing Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Edge Computing Market, By Country

11.6.4 China

11.6.4.1 China Edge Computing Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Edge Computing Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Edge Computing Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Edge Computing Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Edge Computing Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Edge Computing Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Edge Computing Market, By Country

11.7.4 GCC

11.7.4.1 GCC Edge Computing Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Edge Computing Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Edge Computing Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Edge Computing Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Amazon Web Services (AWS)

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Microsoft Corporation

13.3 Cisco Systems Inc.

13.4 IBM Corporation

13.5 Hewlett Packard Enterprise (HPE)

13.6 Dell Technologies

13.7 Google LLC

13.8 Intel Corporation

13.9 NVIDIA Corporation

13.10 Huawei Technologies

13.11 Siemens AG

13.12 Schneider Electric

13.13 Nokia Corporation

13.14 Juniper Networks

13.15 Advantech Co., Ltd.