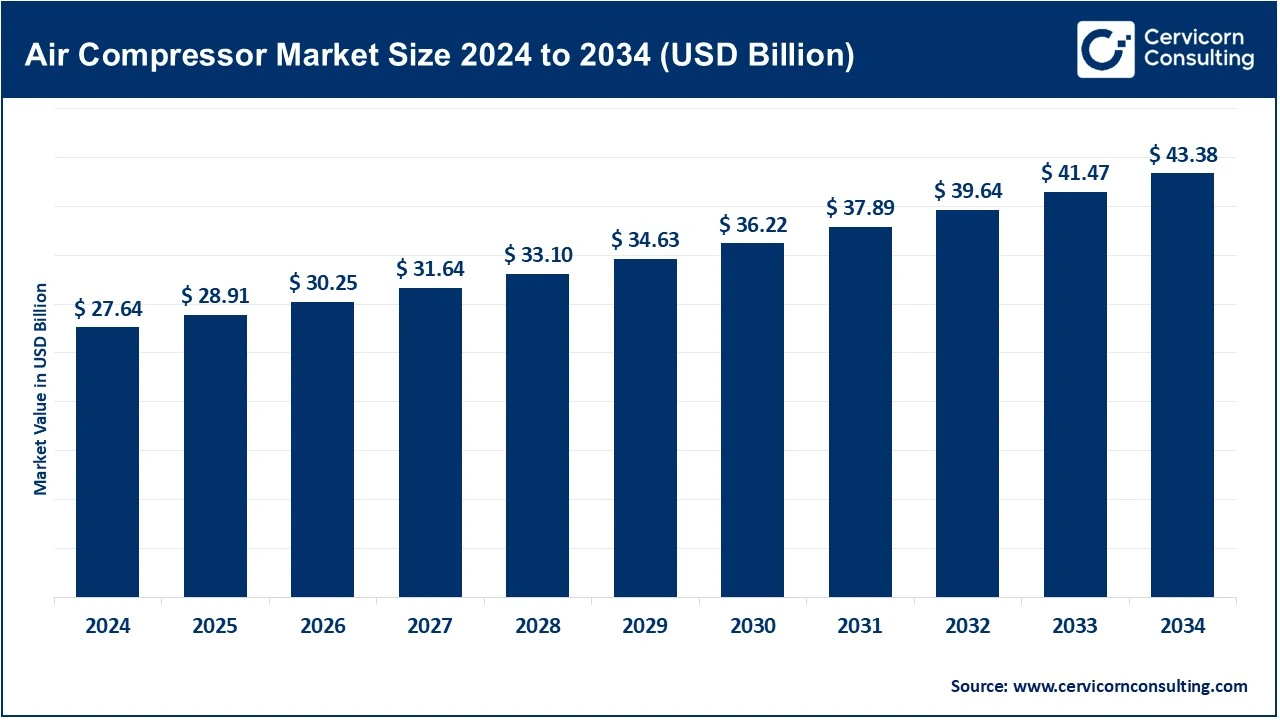

The global air compressor market size was accounted for USD 27.64 billion in 2025 and is expected to be worth around USD 43.38 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.6% over the forecast period 2026 to 2035. The air compressor market is expanding quickly as a result of the growing demand for compressed air among industries due to the need for increased production. The growth is also due to more industrial activity around the world and more building construction in all fields. Air compressors are needed in factories and production facilities as well as for big construction projects. Furthermore, as companies continue to explore ways to save on energy costs and implement environmentally friendly policies, the demand for energy-efficient and intelligent compressors will continue to grow. The introduction of automation and digital technology is enabling greater efficiency and effectiveness of air compressors within today's modern-day industrial environment.

The growth of the air compressor market is also supported by increased activity in specific end-user markets, including automotive, oil and gas, and food processing, in addition to the healthcare industry. In addition, there is a significant increase in the number of electric vehicles being produced, as well as significant investment in infrastructure in the Asia Pacific region, which will further lead to increasing demand for air compressors within the industry. As customers continue to favour longer-lasting and more efficient models (i.e., rotary and variable-speed compressors), companies will continue to develop innovative products for them.

Advancements in IoT and Smart Technologies Driving the Air Compressor Market

The air compression equipment industry has become increasingly impacted by recent technological advances in the Internet of Things (IoT) and artificial intelligence, allowing manufacturers to create intelligent connected compressors out of their traditional compressor line-ups. By integrating these technologies into their compressors, manufacturers have created a platform to collect, communicate and analyse data from multiple sensors, providing real-time information such as pressure, temperature and energy usage from a compressor. With access to this type of data, companies have greater visibility of their equipment health, knowledge about when to perform preventive maintenance prior to equipment failures, and the ability to improve operational efficiencies through increased energy savings. These new features improve compressor productivity, reliability and control, especially in automated manufacturing and Industry 4.0 environments, where uptime and cost savings are critically important.One of the best examples of how these new technologies are being introduced to the air compressor equipment industry is with ELGi’s Air~Alert solution. Air~Alert is an Internet-based solution designed specifically to provide a 24/7 remote monitoring capability of an air compressor’s machine performance. This valuable resource allows plant managers to monitor the health of their compressors, schedule preventative maintenance at optimal times, and minimize unplanned downtime through the use of alerts generated from real-time performance data collected from connected devices.

1. Launch of Kompress.ai AI Platform

Lantronix Inc. partnered with Vodafone IoT in late 2025 to introduce Kompress.ai. This AI-based subscription service for intelligent industrial air compressors is designed to use big data to optimize compressor functions through predictive analysis and other advanced technologies. This is a major step forward in the development of "smart" compressed air systems that take advantage of real-time analytic information to offer enhanced efficiency and predict future maintenance needs. Also, as more organizations begin implementing systems using Artificial Intelligence and Machine Learning, the demand for connected air compressors continues to increase as more companies become digitally transformed and continue to seek ways to maximize operational performance.

2. TEWATT Stage V Dual-Mode Air Compressor Introduction

In March 2025, TEWATT launched its Dual-Mode Air Compressor in Stage V format which meets EU emissions regulations and provides wide operational pressure ranges for demanding applications such as drilling and oil and gas projects. This effort is a major advancement in the air compressor industry by bringing equipment in line with stringent emissions and sustainability requirements set forth by the EU, thereby urging manufacturers, and ultimately users, to use clean and compliant technologies to reduce emissions and expand their usage in regions that have specified environmentally compliant air compressors.

3. ELGi Energy-Efficient Tech and Partnerships

During 2025, ELGi is developing new technologies, such as the Demand=Match and STABILISOR Systems, as well as creating strategic partnerships (including Hitachi’s distributor in India) to pursue the expansion of advanced compressors. As a result, this leads to an increase in energy efficiency and decreases in operating costs, thus making this equipment more appealing to industrial customers focusing on sustainability and cost savings. Ultimately, the air compressor market will benefit from increased adoption of energy-efficient and reliable systems, especially in rapidly growing Asia Pacific-based industries.

4. Atlas Copco’s Oil-Free Compressor Leadership Push

In March 2025, Atlas Copco enhanced the quality of their zero-oil air compressor line by promoting the Class Zero compressor range which provides some of the purest forms of compressed air. This promotion focused heavily on those applications within the air compressor industry that require "contaminant-free" compressed air. Some of the most important areas of application using zero oil air compressors include pharmaceutical manufacturing, food & beverage production, and electronic component manufacture. The combination of increased focus towards cleaner compressors as well as the increased need for more efficient technology, plus increasing regulatory requirements regarding air purity, results in tremendous opportunities for upgrading and deploying more technology.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 28.91 Billion |

| Estimated Market Size in 2035 | USD 43.38 Billion |

| Projected CAGR 2026 to 2035 | 4.60% |

| Dominant Region | Asia-Pacific |

| Key Segments | Type, Product, Lubrication, Application, Region |

| Key Companies | Atlas Copco AB, Bauer Compressors Inc., Doosan Corporation, ELGi Equipments Limited, Hitachi Ltd., Ingersoll Rand Inc., Rolair Systems, Suzler Ltd., Kaeser Kompressoren SE, Kaishan Compressors, Mitsubishi Heavy Industries Ltd., Siemens AG |

The air compressor market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America air compressor market size was valued at USD 7.02 billion in 2025 and is expected to reach around USD 11.02 billion by 2035. The North America is growing strongly and steadily as a result of increased industrial automation, large investments in infrastructure, and increased implementation of advanced manufacturing technologies like Industry 4.0, which has created a demand for more efficient compressed air systems in factories and other facilities throughout North America. Within North America, the United States is the major driver of air compressor market growth because of an increased emphasis on automation, energy efficiency and modernization in the manufacturing and oil & gas industries. Additionally, the North America air compressor market benefits greatly from the presence of many of the major compressor manufacturers in the region who provide a broad array of portable and stationary air compressors throughout North America.

Recent Developments:

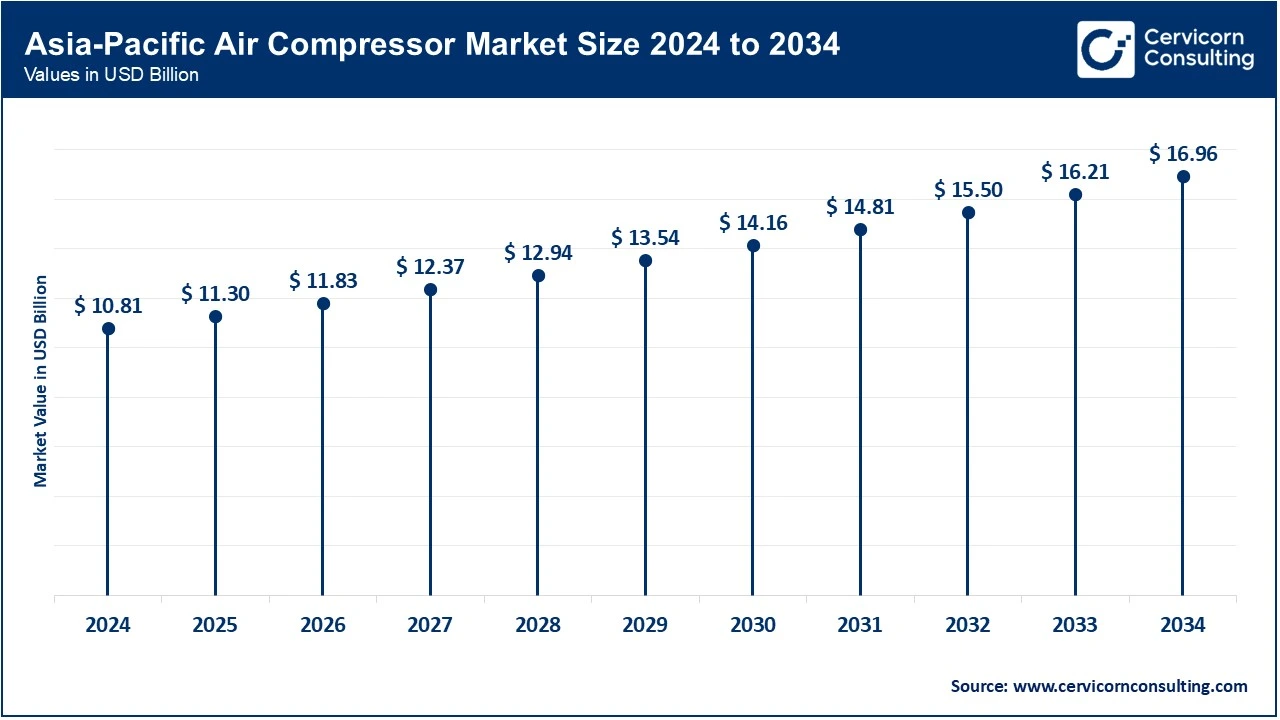

The Asia-Pacific air compressor market size was estimated at USD 10.81 billion in 2025 and is projected to surpass around USD 16.96 billion by 2035. The Asia-Pacific region is leading the market and currently has the largest percentage of total worldwide sales. The region has an increasingly large amount of sales as a result of the rapid industrialization of the area, creating expanding natural resource manufacturing bases in countries such as China and India, as well as increasing levels of investment in infrastructure development throughout the area. The area's focus on energy-efficient production processes and the implementation of advanced production technologies also contributes to the growth in the demand for air compressors in multiple industries, including electronic components, automotive parts, beverage products, and construction products. By providing a manufacturing environment that allows companies to obtain lower-cost supplies while receiving government assistance, these regions create a favorable environment for attracting foreign investors and developing local manufacturing operations.

Recent Developments:

The Europe air compressor market size was reached at USD 6.08 billion in 2025 and is forecasted to hit around USD 9.54 billion by 2035. The European market is an advanced and established marketplace, with numerous strong manufacturing companies and strict regulations in energy use and CO2 emissions. There is continued demand for energy-efficient and low-emission compressors across the automotive, chemicals, and industrial automation marketplace from major European countries such as Germany, the United Kingdom, and France. To maintain their current position in the marketplace, European manufacturers are focusing their research and development efforts on new technologies, including oil-free compressors, and adhering to stricter EU energy standards. The European region continues to grow as a major contributor to the global growth of the air compressor industry.

Recent Developments

Air Compressor Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia-Pacific | 39.10% |

| North America | 25.40% |

| Europe | 22% |

| LAMEA | 13.50% |

The LAMEA air compressor market was valued at USD 3.73 billion in 2025 and is anticipated to reach around USD 5.86 billion by 2035. The air compressor industry will continue to expand steadily in the LAMEA region as more industries invest in the production of goods and services through industrialization of the O&G, energy, and manufacturing sectors. In the Middle East, due to the abundance of oil reserves, which requires extensive use of compressors for transporting and processing gases, there is a stronger correlation between the Middle East and the compressor industry compared to Africa or Latin America. In addition, Latin America and Africa are investing significantly in infrastructure, and the availability of adequate energy sources will lead to increased demand for highly efficient air compressors across multiple uses.

Recent Developments:

The air compressor market is segmented into type, product, lubrication, application, and region.

The stationary air compressor market is represented by the largest segment of the air compressor industry. Stationary air compressors are larger in size than portable air compressors, which allows them to continuously provide compressed air, and they are used extensively in a variety of industries. Industrial settings and manufacturing facilities frequently use stationary air compressors, as they require high capacity, reliability, and strength. The ability of stationary air compressors to supply large quantities of compressed air for large pneumatic systems in factories and production plants is why they are considered the global leader in the air compressor industry.

Air Compressor Market Share, By Type, 2025 (%)

| Type Segment | Revenue Share, 2025 (%) |

| Stationary | 71.50% |

| Portable | 28.50% |

The portable segment of the air compressor industry is considered the fastest-growing segment of the industry because portable air compressors provide maximum flexibility and mobility in their use. Portable air compressors are compact and can be transported to any job site or location of use. Many contractors and industrial workers consider portable air compressors to be beneficial for construction, repair, and small workshops due to their portability. Portable air compressors are available in both gas-powered and electric models, making them appealing to new and developing users who are not accustomed to using air compressors.

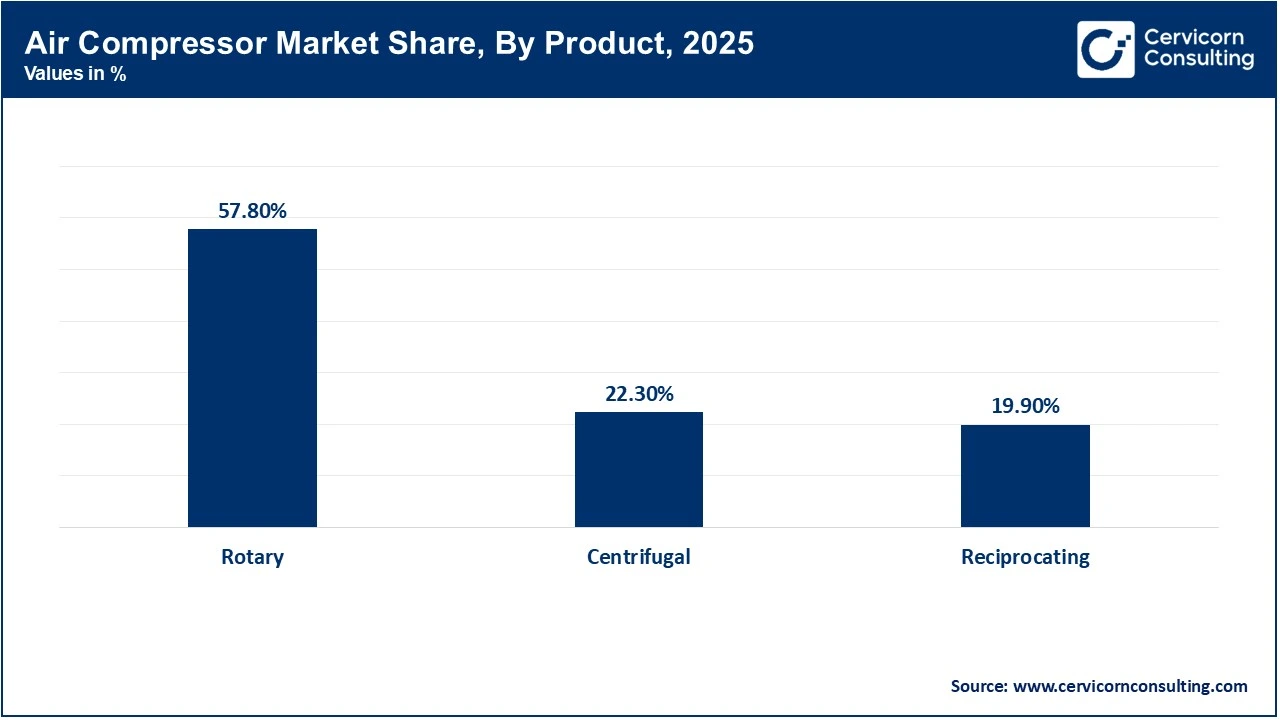

The market is currently dominated by rotary air compressors, which provide continuous and dependable compressed air flows with high energy efficiency levels. These types of air compressors are used in manufacturing, commercial vehicle production, and the chemical sectors where an uninterrupted air supply is critical. With their small footprint, low noise levels, and low maintenance requirements, they can operate continuously throughout the day. Therefore, as increased focus on industrial automation continues, rotary air compressors will remain the market leader.

Centrifugal compressors are growing more rapidly than rotary compressors, particularly in larger-scale industrial applications. Centrifugal air compressors are excellent for large-scale industrial operations including Electric Power Generation Facilities, Petrochemical Manufacturing Facilities, and Steel Mills. Many centrifugal air compressors operate without oil and generate a higher volume of airflow while creating less noise than other forms of air compressor. As the demand for clean air and large amounts of compressed air increases, centrifugal air compressor sales will continue to grow rapidly.

The oil-filled segment currently dominates the air compressor market due to its widespread application in heavy industries. They have a number of advantages including better cooling, greater durability, and more efficient continuous operation. Oil-filled compressors are most commonly used by manufacturing, construction and mining industries where air purity is not as important as performance and durability. Additionally, oil-filled compressors typically have a lower initial price point than oil-free compressors, which also accounts for the high level of demand for these products.

Air Compressor Market Share, By Lubrication, 2025 (%)

| Lubrication Segment | Revenue Share, 2025 (%) |

| Oil Filled | 64.70% |

| Oil Free | 35.30% |

Oil-free compressors are the fastest growing segment of the air compressor market because of the need for compliance with strict air quality and safety standards. Food & beverage, pharmaceutical, medical and electronic companies all require absolutely pure and contaminant-free air. The growing pressure from regulators and a desire to improve the quality of their products has resulted in many companies deciding to invest in oil-free compressors. Additionally, improved technological developments have allowed for improved efficiency and reliability in oil-free compressor systems.

Manufacturing is the largest segment, and it uses compressed air for many of its pneumatic tools, automation systems, and assembly lines. Manufacturing companies are increasingly using compressed air because of its capability to enhance production, reduce inefficiencies, and improve the overall productivity of their operations. The continued growth of the automotive, metal processing and general manufacturing industries will continue to drive the strong demand for air compressors in Manufacturing segments.

Air Compressor Market Share, By Application, 2025 (%)

| Application Segment | Revenue Share, 2025 (%) |

| Manufacturing | 29.6% |

| Oil and Gas | 17.8% |

| Energy | 11.4% |

| Food & Beverages | 9.3% |

| Electronics | 8.7% |

| Healthcare | 7.5% |

| Home Appliances | 6.1% |

| Others | 9.6% |

As Electronics and Healthcare are fastest growing application segments for air compressors, electronics manufacturers utilize high purity air in the process of chip fabrication and precision assembly. Similarly, healthcare uses compressors as part of the operation of medical devices and laboratory equipment. The growing demand in both semiconductor manufacturing and the production of medical devices and cleanroom environments is creating a major increase in the demand for air compressors in both Electronics and Healthcare. Supporting this trend is the continued long-term growth potential for advanced and oil-free air compressor technologies in the market.

Recent Developments by Major Companies

Atlas Copco AB

Bauer Compressors Inc.

Doosan Corporation

Market Segmentation

By Type

By Product

By Lubrication

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Air Compressor

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Product Overview

2.2.3 By Application Overview

2.2.4 By Lubrication Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing Industrial and Manufacturing Activities

4.1.1.2 Demand for Energy-Efficient Equipment

4.1.2 Market Restraints

4.1.2.1 High Initial Investment Cost

4.1.2.2 Regular Maintenance Requirements

4.1.3 Market Challenges

4.1.3.1 Fluctuating Energy Prices

4.1.3.2 Environmental and Emission Regulations

4.1.4 Market Opportunities

4.1.4.1 Integration of IoT and Smart Technologies

4.1.4.2 Infrastructure Growth in Emerging Economies

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Air Compressor Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Air Compressor Market, By Type

6.1 Global Air Compressor Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Stationery

6.1.1.2 Portable

Chapter 7. Air Compressor Market, By Product

7.1 Global Air Compressor Market Snapshot, By Product

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Rotary

7.1.1.2 Centrifugal

7.1.1.3 Reciprocating

Chapter 8. Air Compressor Market, By Application

8.1 Global Air Compressor Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Electronics

8.1.1.2 Manufacturing

8.1.1.3 Oil and Gas

8.1.1.4 Healthcare

8.1.1.5 Food & Beverages

8.1.1.6 Home Appliances

8.1.1.7 Energy

8.1.1.8 Others

Chapter 9. Air Compressor Market, By Lubrication

9.1 Global Air Compressor Market Snapshot, By Lubrication

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Oil free

9.1.1.2 Oil filled

Chapter 10. Air Compressor Market, By Region

10.1 Overview

10.2 Air Compressor Market Revenue Share, By Region 2024 (%)

10.3 Global Air Compressor Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Air Compressor Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Air Compressor Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Air Compressor Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Air Compressor Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Air Compressor Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Air Compressor Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Air Compressor Market, By Country

10.5.4 UK

10.5.4.1 UK Air Compressor Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Air Compressor Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Air Compressor Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Air Compressor Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Air Compressor Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Air Compressor Market, By Country

10.6.4 China

10.6.4.1 China Air Compressor Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Air Compressor Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Air Compressor Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Air Compressor Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Air Compressor Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Air Compressor Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Air Compressor Market, By Country

10.7.4 GCC

10.7.4.1 GCC Air Compressor Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Air Compressor Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Air Compressor Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Air Compressor Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Atlas Copco AB

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Bauer Compressors Inc.

12.3 Doosan Corporation

12.4 ELGi Equipments Limited

12.5 Hitachi Ltd.

12.6 Rolair Systems

12.7 Suzler Ltd.

12.8 Kaeser Kompressoren SE

12.9 Kaishan Compressors

12.10 Mitsubishi Heavy Industries Ltd.

12.11 Siemens AG