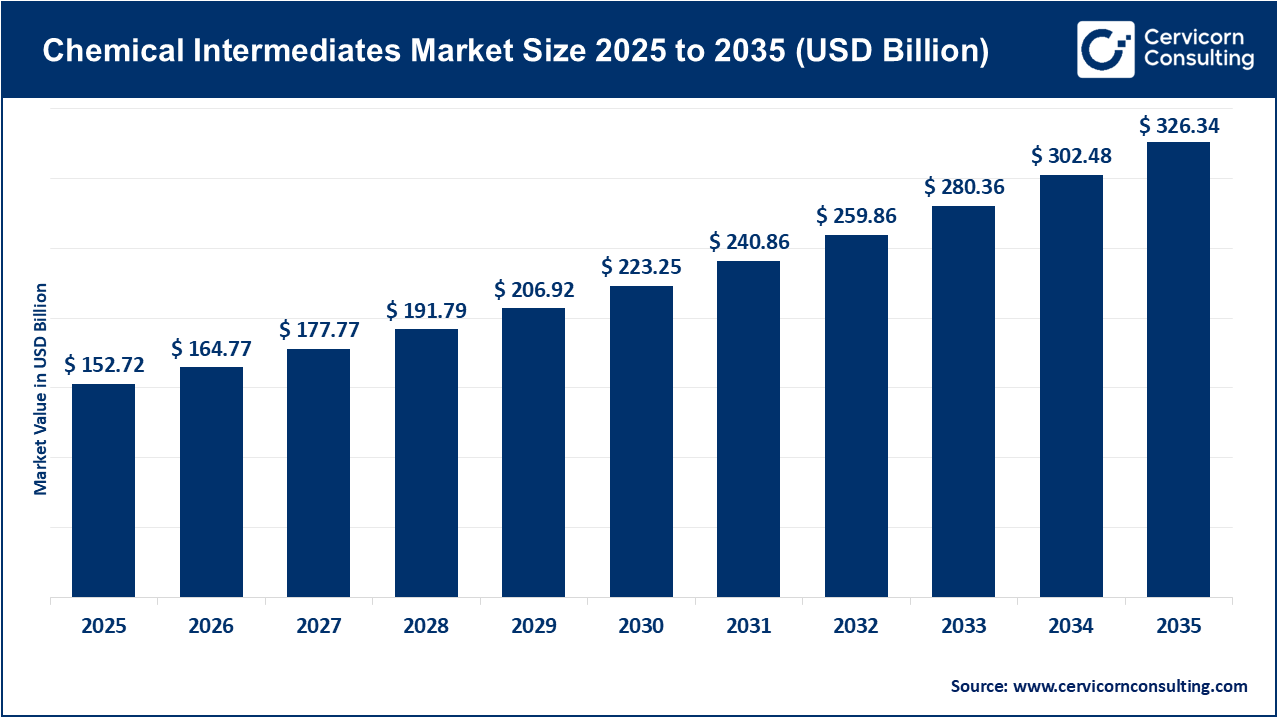

The global chemical intermediates market size was valued at USD 152.72 billion in 2025 and is expected to be worth around USD 326.34 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 7.9% over the forecast period from 2026 to 2035. The chemical intermediates market is primarily driven by the expanding demand from key downstream industries such as pharmaceuticals, agrochemicals, coatings, polymers, and personal care. Rapid industrialization in emerging economies, especially in Asia-Pacific, continues to boost consumption of intermediates used in manufacturing plastics, resins, dyes, surfactants, and active ingredients. Additionally, the rising need for high-purity and specialty intermediates in pharmaceutical and electronics applications is accelerating innovation and capacity expansion. Shifts toward continuous processing, improved catalytic technologies, and contract manufacturing models are also enhancing production efficiency and strengthening supply chains.

Growth factors include the increasing adoption of bio-based and sustainable feedstocks, supported by regulatory pressure to reduce carbon emissions and dependence on petrochemical sources. Companies are investing in green chemistry, renewable raw materials, and energy-efficient processes, creating new opportunities within specialty and fine-chemical intermediates. Moreover, ongoing R&D in high-performance materials, growing agricultural chemical demand, and rising healthcare expenditures globally are fueling long-term market growth. The combination of environmental mandates, technological advancements, and expanding end-use sectors continues to position the chemical intermediates market for steady expansion.

What are chemical intermediates?

Chemical intermediates are compounds formed at a middle stage during a chemical reaction and are used as building blocks to produce finished products such as pharmaceuticals, agrochemicals, polymers, dyes, coatings, and specialty chemicals. They are not typically sold directly to consumers but serve as essential inputs in various industrial synthesis processes, enabling manufacturers to create more complex molecules efficiently and cost-effectively. Because they determine the performance, purity, and functionality of end products, chemical intermediates play a critical role in modern manufacturing across diverse sectors.

Sustainability Initiatives Transforming the Chemical Intermediates Market

Sustainability initiatives are reshaping the chemical intermediates market as companies adopt renewable feedstocks, low-carbon technologies, and greener synthesis routes to reduce environmental impact. Manufacturers are increasingly investing in bio-based intermediates, energy-efficient catalytic processes, and waste-minimizing systems to comply with stricter global regulations. These efforts help reduce carbon footprints, strengthen supply-chain resilience, and support long-term resource efficiency across major end-use industries. Growing customer demand for sustainable chemicals is driving innovation, encouraging companies to create high-value intermediates with improved environmental performance.

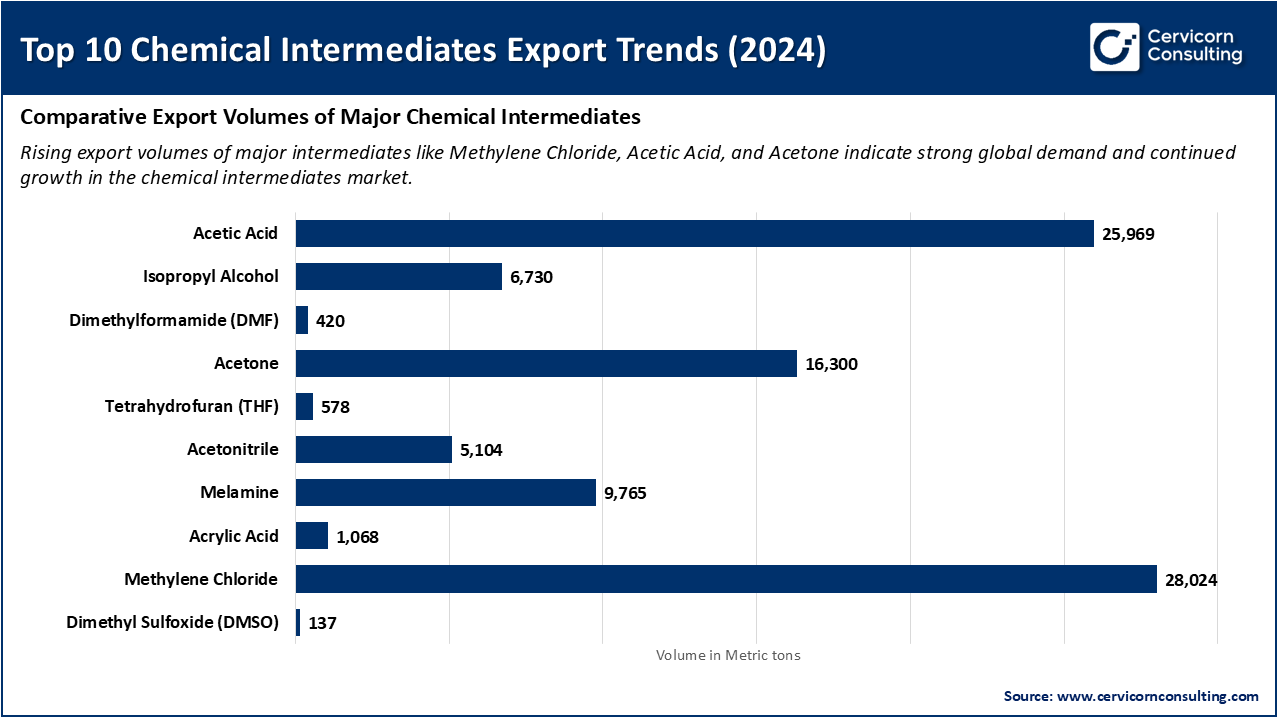

Top 10 Chemical Intermediates Export Trends in 2024

The data highlights the top chemical intermediates exported in 2024, showing that high-volume products like Methylene Chloride, Acetic Acid, and Acetone dominate global trade and reflect strong demand from industries such as pharmaceuticals, polymers, and agrochemicals. The significant export activity of these intermediates indicates expanding downstream manufacturing and rising international consumption, which together drive overall market growth.

1. BASF expands biomass-balanced intermediates portfolio (2024-2025)

In 2024 and 2025, BASF significantly broadened its biomass-balanced chemical intermediates offering, adding products such as 1,4-butanediol (BDO), tetrahydrofuran (THF), polyTHF, and DMAPA produced using renewable feedstocks instead of fossil raw materials. This milestone signals a strategic shift toward sustainable production, catering to growing demand for low-carbon chemicals. By offering certified "green" intermediates, BASF helps downstream users meet environmental targets, encouraging wider adoption of bio-based inputs and pushing the industry toward greener supply chains. This, in turn, drives growth in the chemical intermediates market especially in segments prioritizing sustainability.

2. Rise of Bio-based Intermediates in Mainstream Markets (e.g. Bio-Based Propylene Glycol growth)

The increasing demand for sustainable, eco-friendly solutions has boosted bio-based intermediates - for instance, the market for bio-based propylene glycol (a common intermediate) is projected to grow significantly over the next decade. As industries like personal care, pharmaceuticals, and plastics progressively adopt bio-derived inputs, this shift expands the addressable market for chemical intermediates beyond traditional petrochemical sources. This transition not only opens new market segments, but also encourages innovation in biorefinery and green-chemistry processes, fueling overall market growth.

3. Shift toward Circular Economy and Green-Chemistry Practices in Industry

In 2025 the chemical sector has increased adoption of circular-economy principles, waste-minimization strategies, and resource-efficient processes, responding to global environmental pressures and stricter regulations. This milestone reflects a broader transformation: chemical companies are redefining operations to reduce emissions, improve resource-use efficiency, and lower hazardous waste. As a result, demand is rising for intermediates produced via green chemistry, helping companies reduce environmental risk and regulatory exposure. This trend strengthens long-term sustainability and competitiveness, thereby expanding the market for environmentally conscious intermediates.

4. Government Policy Push - NITI Aayog Launches Roadmap to Strengthen India's Chemical Industry (2025)

In July 2025, NITI Aayog released a report titled "Chemical Industry: Powering India's Participation in Global Value Chains," outlining a plan to scale India's chemical output and boost its share in global value chains, targeting USD 1 trillion in chemical output by 2040. This policy-level milestone could drive substantial expansion of domestic demand for chemical intermediates in India including for pharmaceuticals, polymers, agrochemicals and more. Increased government support, investment and capacity expansion will likely stimulate both demand and supply side growth, making India an important growth engine for the global chemical intermediates market.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 164.77 Billion |

| Estimated Market Size in 2035 | USD 326.34 Billion |

| Projected CAGR in 2026 to 2035 | 7.9% |

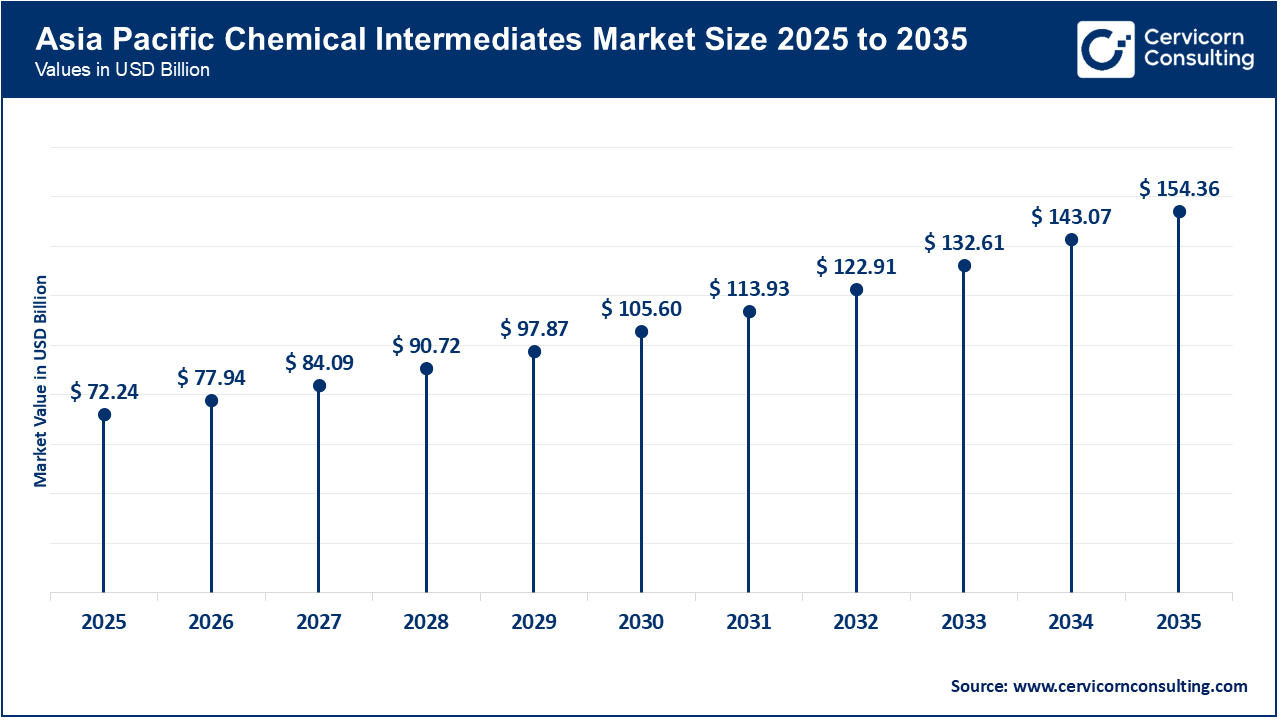

| Top-performing Region | Asia-Pacific |

| Key Segments | Source, Product Type, End Use, Region |

| Key Companies | BASF, SABIC, LyondellBasell, Dow, Arkema, Evonik Industries, Eastman Chemical Company, ExxonMobil Chemical, Nouryon, Mitsubishi Chemical, Solvay, INEOS, Covestro, Huntsman Corporation, Clariant |

The chemical intermediates market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

North America market is driven by strong demand from pharmaceuticals, specialty chemicals, and high-performance materials, supported by mature manufacturing infrastructure and continuous innovation in synthesis technologies. The United States leads the region with robust R&D investments, particularly in biotechnology and sustainable chemistry, which are expanding the adoption of bio-based intermediates. Additionally, regulatory emphasis on cleaner production has encouraged companies to upgrade facilities and shift toward low-emission processes, strengthening market competitiveness and paving the way for long-term growth.

Recent Developments:

Asia-Pacific is the fastest-growing region, fueled by rapid industrialization, strong petrochemical capacity, and rising consumption in pharmaceuticals, agrochemicals, and polymers. China, India, and Southeast Asia are major growth engines, offering competitive manufacturing costs and large-scale production hubs. Increasing foreign direct investment, government support for chemical clusters, and accelerated infrastructure development continue to strengthen regional supply chains. The increasing shift of global chemical production to Asia-Pacific further amplifies demand for diverse intermediates across several downstream sectors.

Recent Developments:

Europe remains a leading market due to its aggressive sustainability policies, circular-economy goals, and broad adoption of green chemistry practices. Strong regulatory frameworks such as REACH and carbon-reduction mandates are pushing chemical manufacturers to develop low-impact intermediates and adopt renewable feedstocks at scale. Countries like Germany, France, and the Netherlands are at the forefront, investing heavily in eco-efficient production technologies and recycling-based feedstock systems, which enhance Europe's position as a hub for environmentally advanced chemical intermediates.

Recent Developments:

Chemical Intermediates Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia-Pacific | 47.30% |

| North America | 19.20% |

| Europe | 21.40% |

| LAMEA | 12.10% |

The LAMEA region is experiencing steady growth, driven mainly by strong petrochemical expansion in the Middle East and increasing diversification into specialty chemicals in Latin America. Abundant feedstock availability, particularly in the Gulf nations, continues to attract investment in intermediate production, while Latin American countries are expanding downstream chemical capabilities to reduce import dependence. Government initiatives supporting industrial diversification and adoption of modern chemical technologies are further strengthening market prospects across the region.

Recent Developments:

The chemical intermediates market is segmented into source, product type, end use, and region.

Petrochemical-based intermediates currently dominate the market due to their widespread availability, established production infrastructure, and cost-effective large-scale synthesis routes. These intermediates form the backbone of polymer, agrochemical, and coating industries, which continue to rely heavily on fossil-derived feedstocks for consistency and performance reliability. Despite sustainability pressures, petrochemical-based intermediates maintain strong demand because alternative renewable feedstocks are still scaling and remain more expensive.

Chemical Intermediates Market Share, By Source, 2025 (%)

| Source | Revenue Share, 2025 (%) |

| Petrochemical-Based | 58.40% |

| Bio-based/Renewable | 14.70% |

| Natural Gas-Derived | 12.90% |

| Coal-Based | 7.60% |

| Recycled/Circular Feedstocks | 4.10% |

| Others | 2.30% |

Bio-based intermediates are the fastest-growing segment, driven by global sustainability initiatives, regulatory incentives, and increasing corporate commitments to reduce carbon footprints. Industries such as pharmaceuticals, personal care, and packaging are adopting renewable feedstocks to meet eco-friendly product goals, resulting in rising investment in biomass-derived chemicals and green synthesis technologies. As production efficiencies improve, bio-based intermediates are rapidly gaining traction as viable alternatives to fossil-based materials.

Acids dominate the product type segment because they serve as fundamental building blocks for a wide range of downstream chemical processes, including polymer manufacturing, resins, pharmaceuticals, and industrial solvents. Their versatility, high consumption volumes, and essential role in bulk and specialty chemical production make acids a critical and consistently demanded intermediate category. The persistent need for industrial acids across diverse sectors helps maintain their leading market share.

Chemical Intermediates Market Share, By Product Type, 2025 (%)

| Product Type | Revenue Share, 2025 (%) |

| Alcohols | 18.60% |

| Amines | 11.80% |

| Aldehydes & Ketones | 10.20% |

| Acids | 22.90% |

| Esters | 9.40% |

| Halogenated Intermediates | 8.70% |

| Specialty Chemical Intermediates | 14.10% |

| Others | 4.30% |

Specialty chemical intermediates are experiencing the fastest growth as industries seek high-performance and application-specific compounds for pharmaceuticals, electronics, advanced materials, and agrochemicals. The rising trend toward customized formulations, higher purity requirements, and value-added chemical synthesis is accelerating investments in specialty intermediates. Their superior margins, technological complexity, and increasing adoption in high-growth end-use sectors position them as the most rapidly expanding segment.

The pharmaceuticals and API segment dominates the market due to the expanding global demand for medicines, increasing chronic disease prevalence, and continuous innovation in drug development. Chemical intermediates are essential for synthesizing active pharmaceutical ingredients, making them integral to modern healthcare supply chains. The sector's stringent quality requirements and consistent production cycles ensure stable, high-volume consumption of intermediates.

Chemical Intermediates Market Share, By End Use, 2025 (%)

| End Use | Revenue Share, 2025 (%) |

| Pharmaceuticals & APIs | 27.5% |

| Agrochemicals | 18.3% |

| Polymers & Plastics | 22.1% |

| Paints, Coatings & Adhesives | 11.6% |

| Personal Care & Cosmetics | 7.9% |

| Oil & Gas / Petrochemical Processing | 8.5% |

| Textile | 2.8% |

| Others | 1.3% |

The agrochemical segment is growing at the fastest rate as global food demand rises, leading to increased use of crop protection chemicals and yield-enhancing products. Intermediates used in herbicides, pesticides, and fungicides are witnessing strong demand driven by agricultural modernization and the need to maximize output on limited farmland. Emerging markets in Asia-Pacific and Latin America are further accelerating growth, making agrochemicals a key expansion segment in the industry.

Strategic Approach to International Chemicals Management (SAICM) - Global Chemicals Governance Push

The SAICM framework, endorsed by over 175 governments globally, aims to ensure chemicals are managed in a way that minimizes harm to human health and the environment across their lifecycle.

European Green Deal & REACH / Chemicals Strategy for Sustainability - Europe's Regulatory Push

Europe's Green Deal, together with ongoing chemical safety regulation under REACH and the broader Chemicals Strategy for Sustainability, is pushing chemical manufacturers to reduce emissions, eliminate hazardous substances, and shift toward sustainable chemical products.

BioE3 Policy - India's Push for Bio-Based Chemical Production

In August 2024, the Indian government approved BioE3 Policy to stimulate bio-manufacturing, biotechnology, and bio-based chemicals as part of a broader bioeconomy strategy.

By Source

By Product Type

By End Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Chemical Intermediates

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Source Overview

2.2.2 By Product Type Overview

2.2.3 By End Use Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Demand from Pharmaceuticals and Agrochemicals

4.1.1.2 Shift Toward Sustainable and Bio-Based Chemicals

4.1.2 Market Restraints

4.1.2.1 Volatility in Petrochemical Feedstock Prices

4.1.2.2 Stringent Environmental and Safety Regulations

4.1.3 Market Challenges

4.1.3.1 Supply Chain Disruptions and Capacity Constraints

4.1.3.2 Increasing Competition and Pressure to Innovate

4.1.4 Market Opportunities

4.1.4.1 Growing Adoption of Green and Specialty Intermediates

4.1.4.2 Expansion in Emerging Markets

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Chemical Intermediates Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Chemical Intermediates Market, By Source

6.1 Global Chemical Intermediates Market Snapshot, By Source

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Petrochemical-Based

6.1.1.2 Bio-based/Renewable

6.1.1.3 Natural Gas–Derived

6.1.1.4 Coal-Based

6.1.1.5 Recycled/Circular Feedstocks

6.1.1.6 Others

Chapter 7. Chemical Intermediates Market, By Product Type

7.1 Global Chemical Intermediates Market Snapshot, By Product Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Alcohols

7.1.1.2 Amines

7.1.1.3 Aldehydes & Ketones

7.1.1.4 Acids

7.1.1.5 Esters

7.1.1.6 Halogenated Intermediates

7.1.1.7 Specialty Chemical Intermediates

7.1.1.8 Others

Chapter 8. Chemical Intermediates Market, By End Use

8.1 Global Chemical Intermediates Market Snapshot, By End Use

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Pharmaceuticals & APIs

8.1.1.2 Agrochemicals

8.1.1.3 Polymers & Plastics

8.1.1.4 Paints, Coatings & Adhesives

8.1.1.5 Personal Care & Cosmetics

8.1.1.6 Oil & Gas/Petrochemical Processing

8.1.1.7 Textile

8.1.1.8 Others

Chapter 9. Chemical Intermediates Market, By Region

9.1 Overview

9.2 Chemical Intermediates Market Revenue Share, By Region 2024 (%)

9.3 Global Chemical Intermediates Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Chemical Intermediates Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Chemical Intermediates Market, By Country

9.5.4 UK

9.5.4.1 UK Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Chemical Intermediates Market, By Country

9.6.4 China

9.6.4.1 China Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Chemical Intermediates Market, By Country

9.7.4 GCC

9.7.4.1 GCC Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Chemical Intermediates Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 BASF

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 SABIC

11.3 LyondellBasell

11.4 Dow

11.5 Arkema

11.6 Evonik Industries

11.7 Eastman Chemical Company

11.8 ExxonMobil Chemical

11.9 Nouryon

11.10 Mitsubishi Chemical

11.11 Solvay

11.12 INEOS

11.13 Covestro

11.14 Huntsman Corporation

11.15 Clariant