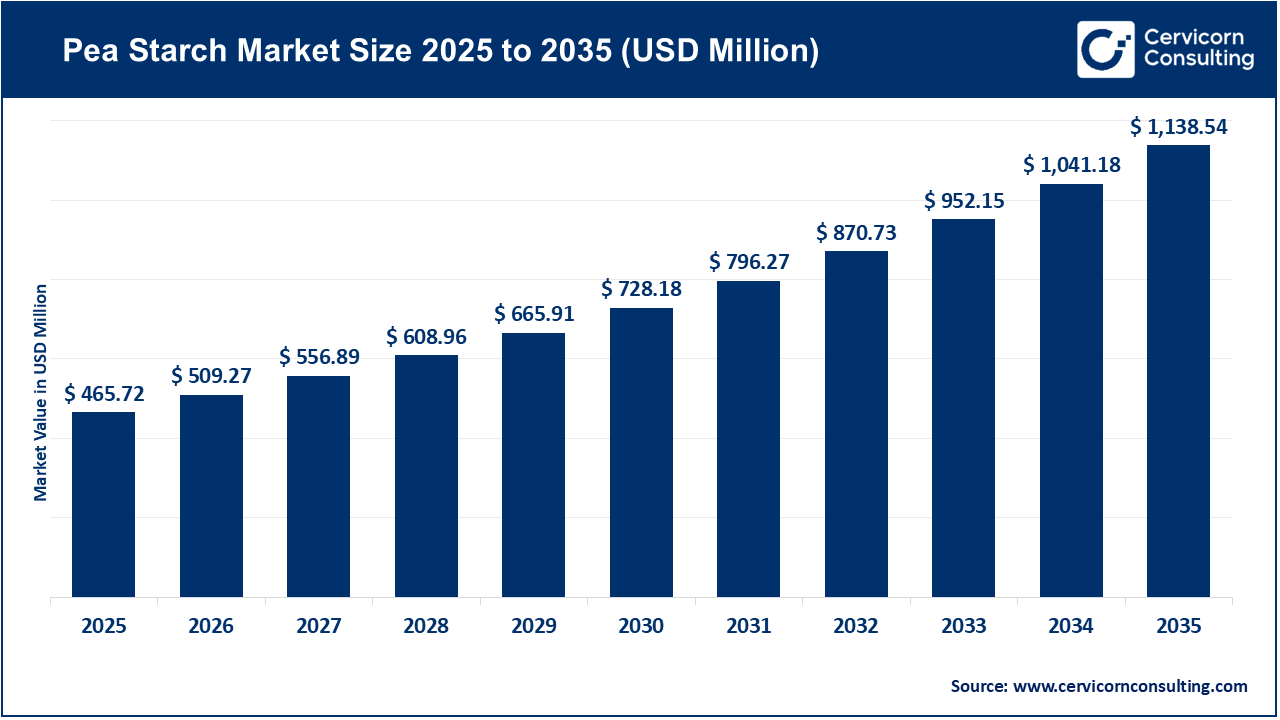

The global pea starch market size was valued at USD 465.72 million in 2025 and is expected to be worth around USD 1,138.54 million by 2035, exhibiting at a compound annual growth rate (CAGR) of 9.4% over the forecast period 2026 to 2035. The pea starch market is continuing to expand due to the increasing consumer demand for plant-based and clean-label products. Pea starch provides a natural source of thickening, binding, and gelling agents for food manufacturers of snack food, baked goods, dairy alternatives, and prepackaged meals. Pea starch is non-GMO, gluten-free, and does not contain any known allergens, making it attractive to consumers with dietary restrictions. All of these trends create consistent growth in the food and beverage sector.

Another contributor to the expansion of the pea starch market comes from increased consumption of animal feed, pet food, and other industrial uses. When added to feed products made from animal by-products, pea starch improves the quality of the product by improving the texture, stability, and digestibility of the feed product. Within all of these industries, pea starch has become a common ingredient in items such as films, adhesives and biodegradable materials. Farmers are growing more peas while advancements in processing technologies are reducing costs and increasing supply. Collectively, these factors are driving the expansion of the pea starch market.

Rising Demand in Animal and Pet Food

Recently, premium pet food companies have been increasingly substituting wheat and corn binders with a pea-based ingredient due to the growing popularity of grain-free and allergen friendly products. Many of the new products that will hit the market during 2024 utilize pea starch as a significant component in their formulations, improving both the texture and the digestibility of the final product.

In addition, the animal feed industry has embraced pea starch as a functional ingredient, incorporating it into some of their commercial livestock diets. The use of pea starch in the formulation of animal feed will help improve the durability of the pellets produced, as well as provide a source of slow-release energy to livestock.

All these recent developments demonstrate a concerted effort on the part of both the pet food and animal feed industries to transition toward cleaner, more functional ingredients, which bodes well for the ongoing growth of the pea starch market.

1. Launch of next-gen “label-friendly” pea starch by a major ingredient producer

Recently, Roquette has launched AMYSTA™ L 123, a thermally-soluble plant-based starch that assists food manufacturers in decreasing their ingredient lists, enhancing clean label credentials, and simplifying on-pack communication.

This type of product innovation has an immediate effect on the demand for pea starch, making it easier for food companies to replace traditional starches (such as high fructose corn syrup, sorghum, rice, etc.) with cleaner and simpler ingredients. As more and more food manufacturers begin to use these AMYSTA™ product types, it increases the overall penetration of pea starches into the broader food processing industry and subsequently increases the market size of pea starch.

2. Surge in new food & beverage product launches containing pea starch (2019–2024)

North America saw over 206 new food and beverage products released from 2019 to 2023 that included pea starch as an ingredient. However, just in January 2024 alone there have been 7 new product launches containing pea starch as an ingredient. Since many products have begun to be developed using pea starch as a primary ingredient, more brands will begin to create and develop more products using the ingredient. As brands continue to develop and produce new products, it will lead to an increase of volume in regards to pea starch. Therefore, increasing the volume of production for all products containing pea starch thus increases the availability and capacity of the entire supply chain for pea starch.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 509.27 Million |

| Estimated Market Size in 2035 | USD 1,138.54 Million |

| Projected CAGR in 2026 to 2035 | 9.35% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Product Type, Grade, Application, Region |

| Key Companies | Ingredion Incorporated, Roquette Frères, Cosucra Groupe Warcoing, Groupe Emsland, PURIS Foods, AGT Food and Ingredients, Yantai Shuangta Food Co., Ltd., Vestkorn Milling AS, Axiom Foods, Cargill Inc., The Scoular Company, Meelunie B.V. |

The pea starch market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

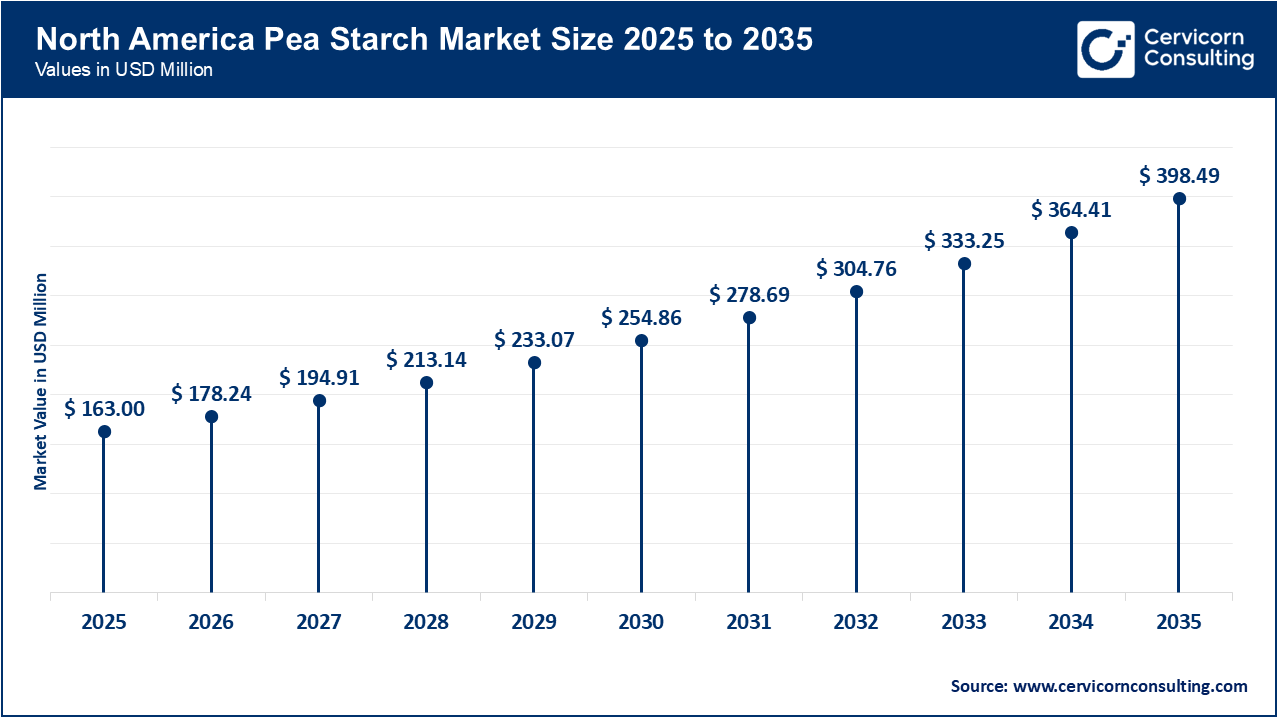

The North America pea starch market size was valued at USD 163 million in 2025 and is expected to surpass around USD 398.49 million by 2035. North America leads the market due to the widespread adoption of plant-based and gluten-free foods and cooking supplies. Many of these food products are also labeled as "clean" due to their simple, recognizable ingredients. North America is home to some of the most innovative food processing companies, as well as established supply chains and a growing awareness among consumers about the benefits of using non-GMO and allergen-free ingredients. The pet-humanization trend has resulted in increased demand for pea starch in premium and grain-free pet food recipes, which has contributed to the growth of the North American market for pea starch. Significant investments in pulse processing infrastructure and the increased acreage dedicated to growing peas will ensure that there is a stable supply of raw materials available to support the growth of the North American pea starch market.

Recent Developments:

The Asia-Pacific pea starch market size was estimated at USD 116.43 million in 2025 and is forecasted to grow around USD 284.64 million by 2035. Asia-Pacific is a rapidly growing region with enormous potential for pea starch growth as disposable incomes rise, urbanisation picks up speed, and packaged and convenience food consumption continues rising. Consumers are also adopting allergen-free, plant-based, and non-GMO ingredients; all of these developments contribute to increased demand for pea starch in this region as more consumers become educated about them. With an increase in investment in food manufacturing facilities, manufacturers are investing in the production of pet food in China and Southeast Asia, and more starch processing facilities are being established throughout this area, making it easier for consumers to access and utilize pea starch. The increasing use of pea starch in industrial applications like adhesives, paper strengthening, and fermentation is further encouraging growth in this part of the world.

Recent Developments:

The Europe pea starch market size accounted for USD 144.37 million in 2025 and is projected to hit around USD 352.95 million by 2035. The European market is large due to increased consumer demand for organic, minimally processed, and sustainable products. Due to the stringent clean label regulations in Europe, many manufacturers are opting to use natural sources of starch from peas instead of using synthetic or modified starches. Large ingredient suppliers and strong regulations on plant-based materials are also in place in Europe, so these companies often develop new formulations that include pea starch. Pea starch is commonly used in the bakery, dairy alternative, meat substitute, sauce, and biodegradable products. Also, the initiatives around sustainability, especially in relation to reducing plastic and utilizing bio-based raw materials, have created additional market opportunities for pea starch as a functional starch.

Recent Developments:

Pea Starch Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 35% |

| Europe | 31% |

| Asia-Pacific | 25% |

| LAMEA | 9% |

The LAMEA pea starch market size was valued at USD 41.91 million in 2025 and is anticipated to reach around USD 102.47 million by 2035. Pea starch is an emerging market in Latin America, the Middle East and Africa, with the food manufacturing industry growing as more people search for inexpensive, clean-label food products, and are interested in plant-based and allergen-free food products. The animal feed and pet food industries have increased the amount of pea starch used in their products because the functional properties of pea starch help improve pellet durability and digestibility. Western dietary trends are slowly making their way to these countries and increased reliance on alternative starch sources require them to do so. The growth of trade links and continual investment from global ingredient manufacturers will create a solid long-term presence in these emerging markets.

Recent Developments:

The pea starch market is segmented into product type, grade, application, and region.

The native pea starch is leading product segment, as it supports the demand for minimally processed, clean-label products. For food manufacturers, native pea starch is the preferred choice for a natural thickening agent and binding agent when producing baked goods, snack products, non dairy products, and ready-to-eat meals. This contributes to its large usage rate among all types of pea starches. In addition, the gluten-free and allergen-friendly characteristics of native pea starch make it an affordable option that allows for greater involvement from both food and animal feed industries.

Pea Starch Market Share, By Product Type, 2025 (%)

| Product Type | Revenue Share, 2025 (%) |

| Native Pea Starch | 83% |

| Modified Pea Starch | 17% |

Modified pea starch is the fastest-growing segment, as manufacturers require improved stability of modified pea starches in applications of heating (high temperature), shearing (high physical force), and processing using acidic solutions. Modified pea starch is also superior to native pea starch in formulation compatibility due to its nature being a highly functional ingredient in applications such as sauces, instant foods, candy, and non-consumer oriented (industrial) products. As more manufacturers seek plant-based functional ingredients to replace chemically based, modified starches, the overall growth of modified pea starches will continue to experience rapid growth in the near future.

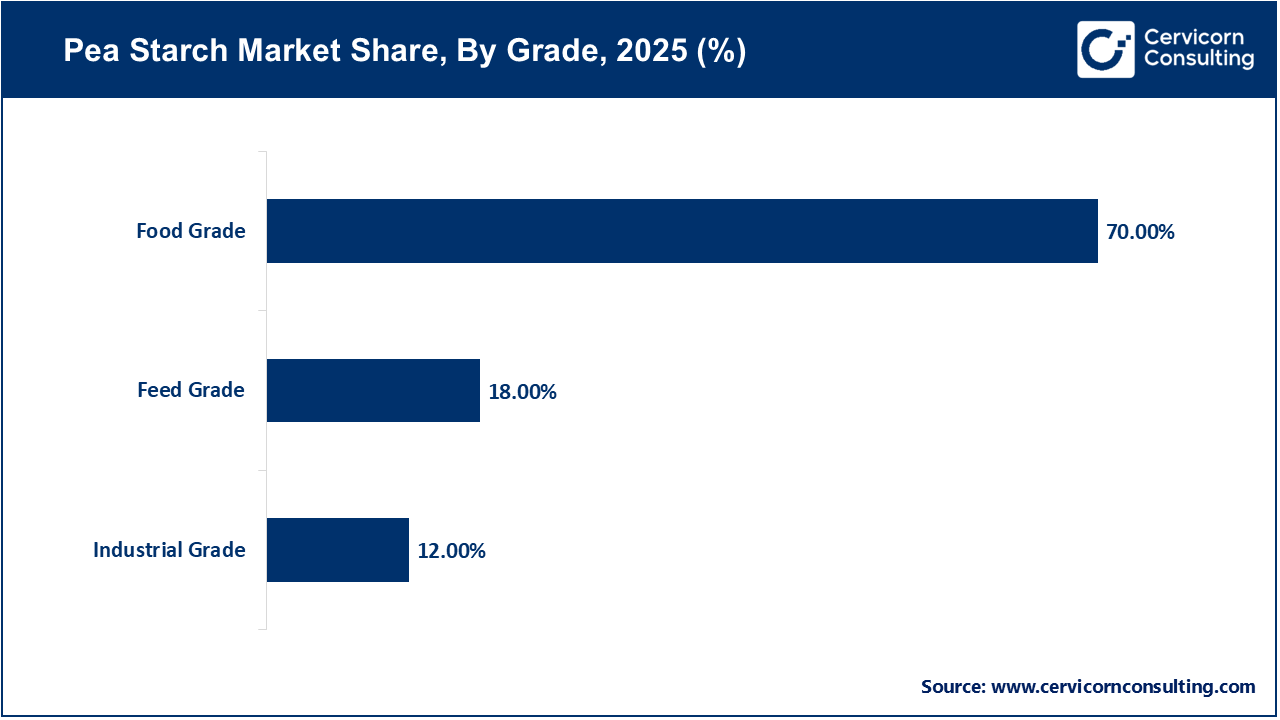

The food-grade segment is largest segment, which is primarily used by the food and beverage industry as thickeners, gelling agents, and to enhance the texture of the end product. Food-grade pea starch plays a critical role as part of the increasing trend towards clean and simple labels for processed foods. As consumers continue to demand healthier options, food-grade pea starch will continue to be the most dominant segment in the pea starch market.

Industrial-grade pea starch is experiencing huge growth and expansion. Many manufacturers are currently utilising industrial-grade pea starch as an alternative source for petroleum-based materials. There is a rising demand for eco-friendly products and manufacturers are actively looking to incorporate the use of industrial-grade pea starch into their supply chains. This transition to using biodegradable materials will be supported by governments around the world through a number of proposed sustainability policies.

The food and beverages segment is the largest segment. This is because food & beverage manufacturers are the largest users of pea starch to produce their processed foods, bakery items, snacks, noodles, confectionery and dairy alternatives. Pea starch has a clean-label product formulation, which is an important factor for consumers looking for 'natural' products to buy. In addition, pea starch's natural functional properties make it an excellent ingredient to improve the texture, binding and stability of foods produced in this segment. The demand from consumers for plant-based and gluten-free food products will continue to drive this segment's growth.

Pea Starch Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Food & Beverages | 49% |

| Animal Feed & Pet Food | 29% |

| Industrial Applications | 12% |

| Pharmaceuticals | 6% |

| Personal Care & Cosmetics | 4% |

The animal feed and pet food segment has experienced the highest rate of growth due to the increasing popularity and expanding market for premium and grain-free pet food products. Pea starch provides binding properties, digestibility, and energy-release profile as a source of energy for pets, and it is being used more frequently in the formulation of modern pet foods. The rapid growth of pet humanization and the increasing demand for pet foods with natural ingredients is driving the continued growth of this market segment.

By Product Type

By Grade

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Pea Starch

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Type Overview

2.2.2 By Grade Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing Demand for Clean-Label and Plant-Based Ingredients

4.1.1.2 Rising Use in Pet Food and Animal Feed

4.1.2 Market Restraints

4.1.2.1 Price Volatility of Pea Raw Materials

4.1.2.2 Limited Availability and Processing Capacity

4.1.3 Market Challenges

4.1.3.1 Competition from Established Starches Like Corn, Potato, and Tapioca

4.1.3.2 Functional Limitations in Certain Processing Conditions

4.1.4 Market Opportunities

4.1.4.1 Expansion in Biodegradable Packaging and Industrial Applications

4.1.4.2 Growing Demand for Gluten-Free and Allergen-Free Foods

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Pea Starch Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Pea Starch Market, By Product Type

6.1 Global Pea Starch Market Snapshot, By Product Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Native Pea Starch

6.1.1.2 Modified Pea Starch

Chapter 7. Pea Starch Market, By Grade

7.1 Global Pea Starch Market Snapshot, By Grade

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Food Grade

7.1.1.2 Feed Grade

7.1.1.3 Industrial Grade

Chapter 8. Pea Starch Market, By Application

8.1 Global Pea Starch Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Food & Beverages

8.1.1.2 Animal Feed & Pet Food

8.1.1.3 Industrial Applications

8.1.1.4 Pharmaceuticals

8.1.1.5 Personal Care & Cosmetics

Chapter 9. Pea Starch Market, By Region

9.1 Overview

9.2 Pea Starch Market Revenue Share, By Region 2024 (%)

9.3 Global Pea Starch Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Pea Starch Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Pea Starch Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Pea Starch Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Pea Starch Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Pea Starch Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Pea Starch Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Pea Starch Market, By Country

9.5.4 UK

9.5.4.1 UK Pea Starch Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Pea Starch Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Pea Starch Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Pea Starch Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Pea Starch Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Pea Starch Market, By Country

9.6.4 China

9.6.4.1 China Pea Starch Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Pea Starch Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Pea Starch Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Pea Starch Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Pea Starch Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Pea Starch Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Pea Starch Market, By Country

9.7.4 GCC

9.7.4.1 GCC Pea Starch Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Pea Starch Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Pea Starch Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Pea Starch Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Ingredion Incorporated

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Roquette Frères

11.3 Cosucra Groupe Warcoing

11.4 Groupe Emsland

11.5 PURIS Foods

11.6 AGT Food and Ingredients

11.7 Yantai Shuangta Food Co., Ltd.

11.8 Vestkorn Milling AS

11.9 Axiom Foods

11.10 Cargill Inc.

11.11 The Scoular Company

11.12 Meelunie B.V.