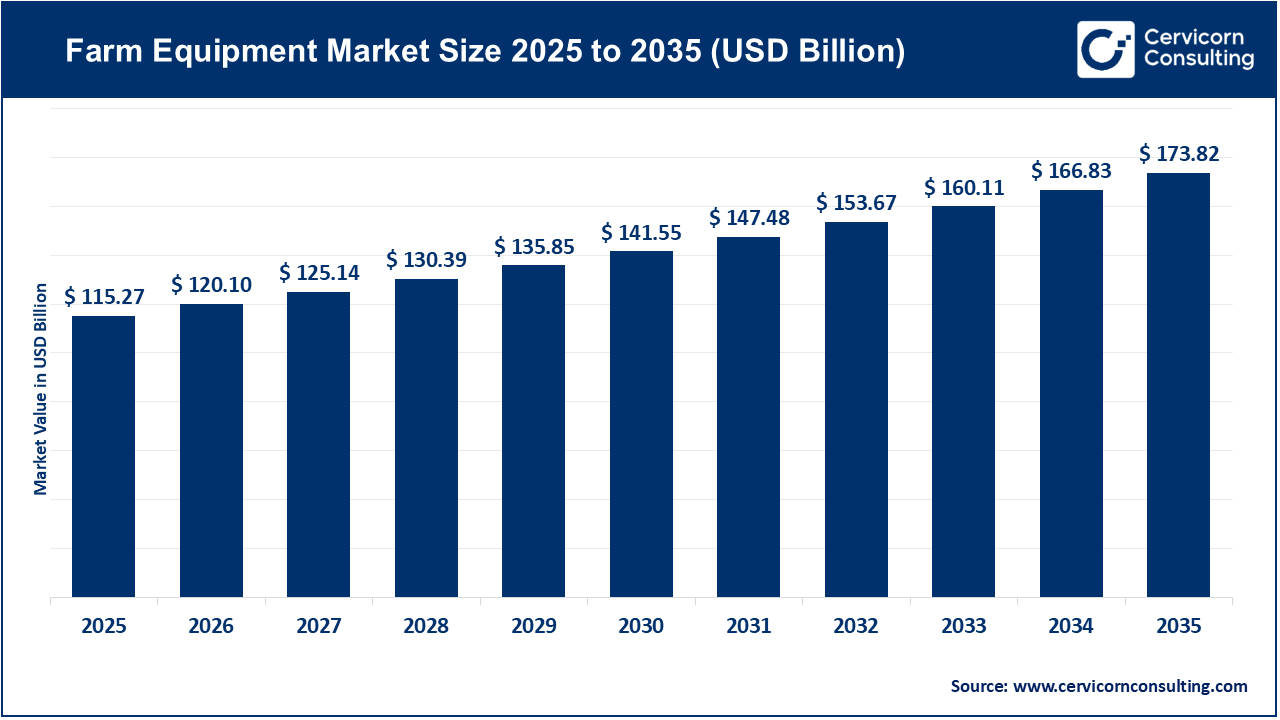

The global farm equipment market size reached at USD 115.27 billion in 2025 and is expected to be worth around USD 173.82 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.2% over the forecast period 2026 to 2035. The farm equipment market is expanding, driven by increased global demand for food and commercial farming expansion in many regions. The growing global population places additional pressure on agricultural production and, as a result, many farmers are willing to utilize increasingly sophisticated and expensive modern mechanized tools to boost production. Labor shortages in rural areas are accelerating the transition to the mechanized farm equipment market. The adoption of GPS guidance, smart irrigation, and AI-assisted tractors improve the efficiency of farming operations and crop production. The adoption of new machines decreases input waste and increases profits for the more efficient farmer.

Government subsidies and programs for countrified financing strongly support the adoption of mechanization in the farm equipment market, especially in developing economies. The increased adoption of sustainable farming practices, is also increasing demand for energy-efficient and low-emission farm equipment. The growing popularity of custom hiring services are also reducing barriers to entry for small rural farmers to access costly equipment, thereby opening up the market for wide adoption. As a result of these factors, including continued urbanization and farmland consolidation, the farm equipment market is expected to experience positive growth in the long run.

Evolution of Farm Equipment Toward Green Technology

Agricultural machinery has come a long way, from hand tools and horse or animal power, to steam and diesel-powered machines during the industrial revolution. The introduction of farm tractors, mechanical-ploughs and harvesters improved productivity and reduced the need for labour on larger farms. Hydraulics, automation and precision-farming tech then ushered in a new era in agriculture. The advent of GPS-enabled and smart sensor equipment has resulted in better soil, crop, and water usage monitoring capabilities. This is whether farmers are utilizing traditional mechanical farming methods, or adopting more data-driven, technology supported farming capabilities.

For the last decade or so, firms have begun to develop farm equipment with green technology to help minimize environmental harms and support more sustainable farming approaches and practices. Currently, farm machinery companies are focused on electric tractors, solar powered irrigation systems, and low emissions engines to help farmers minimize their carbon footprint. Biofuel-driven machinery and more energy-efficient electronics allow farmers to operate more ecologically sustainable operations globally. Additionally, artificial intelligence and the Internet of Things (IoT) provides farms with input utilization betterment to help maximize ecological sustainability, while minimizing chemical fertilizers and water waste. This technology mirrors global change for sustainable food production and to broaden the adoption of more environmentally responsible practices.

1. Launch of new autonomous tractors by major OEMs

John Deere launched second-generation autonomous tractors called John Deere's autonomous tractors in early 2025 using AI, vision systems and autonomy kits. This represents an important milestone for the farm equipment market because it allows the mechanisation of farms at scale where human labour is in short supply, allowing larger farms to extend their operating hours and produce higher efficiencies with less reliance on human oversight.

2. Electrification of agricultural machinery

LOVOL is releasing the E1000 electric tractor in November 2025 at AGRITECHNICA 2025. A combination of zero-emission power and smart technology, the electric tractor is another example of how the electrification trend of agricultural machinery will support and drive the farm equipment market, while responding to sustainable interest from farmers, reducing operating costs and meeting new environmental regulations.

3. Widespread adoption of precision and autonomous farm machinery

The autonomous farm equipment market was valued at USD 70 billion in 2025 and is projected to continue to expand at more than 8% CAGR through 2035. This aligns with the agronomic trend towards stimulating farm equipment sales and demand for higher value, technologically advanced machines that offer improved yield and resource use and cause further replacement of traditional farm equipment.

4. Government-backed mechanisation and green technology initiatives in emerging markets

Demonstrations of e-tractors and electric tillers in 2025 by CSIR in India showed government backing for electric farm equipment amongst small and marginal farms without detrimental labor forces. Demonstration with government backing will expand access for smaller farmers to utilize mechanized and green equipment to reach a larger penetration in overall farm equipment.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 120.10 Billion |

| Estimated Market Size in 2035 | USD 173.82 Billion |

| Expected CAGR 2026 to 2035 | 4.20% |

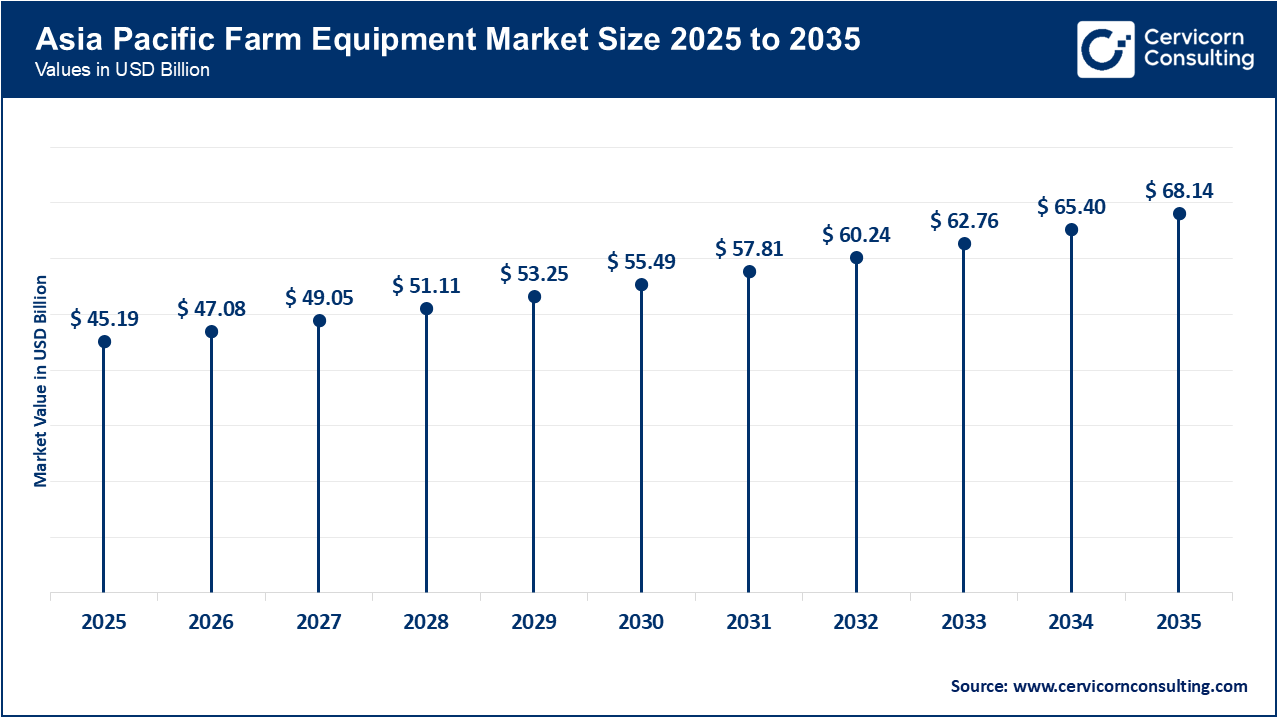

| Dominant Region | Asia-Pacific |

| Key Segments | Equipment, Power Source, Automation, End Users, Region |

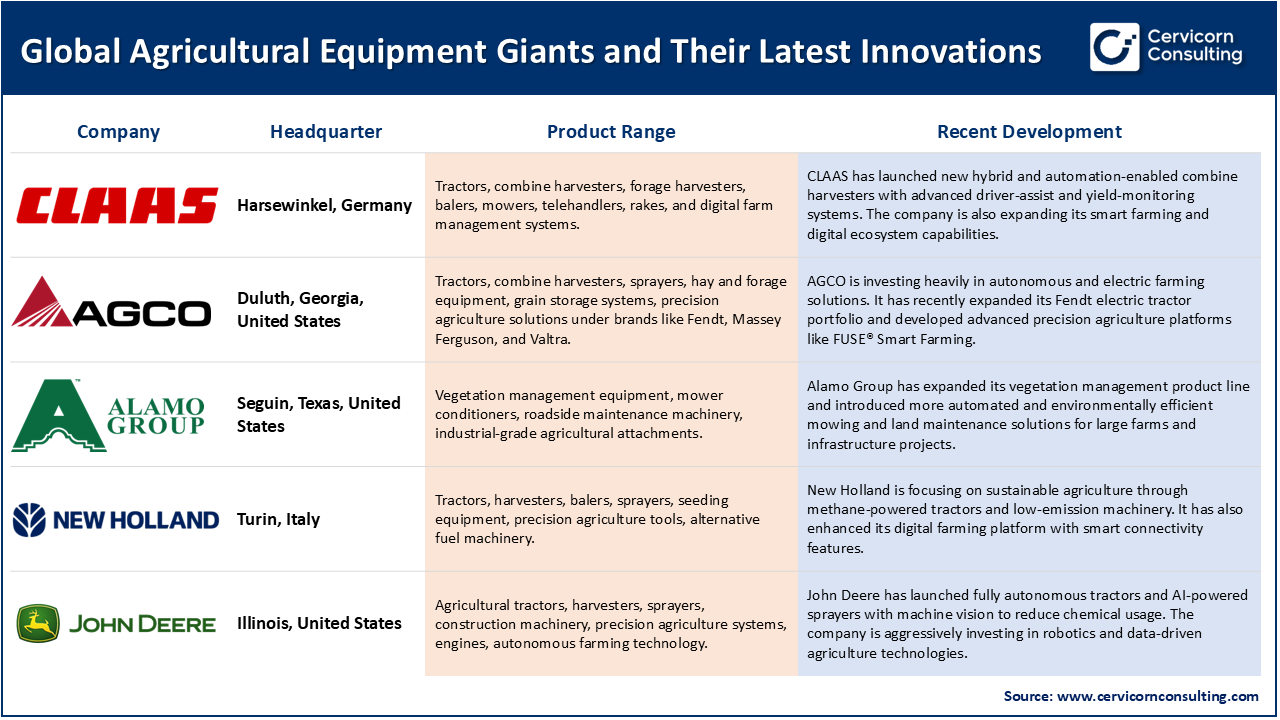

| Key Companies | Deere & Company (John Deere), CNH Industrial, AGCO Corporation, Kubota Corporation, CLAAS Group, Mahindra & Mahindra Ltd., Yanmar Holdings Co., Ltd., Toyo Corporation (Iseki & Co., Ltd.), Alamo Group Inc., SDF Group (SAME Deutz-Fahr), Minsk Tractor Works (MTZ), JCB Agriculture, Lovol Heavy Industry, Changfa Group, YTO Group Corporation |

The farm equipment market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America farm equipment market size reached at USD 34 billion in 2025 and is expected to surpass around USD 51.28 billion by 2035. The North America is propelled by increasing automation, precision-farming technologies, and chronic labor shortages. Farmers in the U.S., Mexico and Canada are acquiring smart tractors, GIS mapping, autonomous implements, and sensor-based systems to improve productivity. Government subsidies, and beneficial tax policies also help support purchases of large equipment. The move toward big-acre commercial farming also sustains demand for high-horsepower equipment. In addition, as older equipment fleets reach the end of their service lives, replacement demand helps stabilize and grow the market.

Recent Developments:

The Asia-Pacific farm equipment market size estimated at USD 45.19 billion in 2025 and is projected to reach around USD 68.14 billion by 2035. The Asia-Pacific region market growth is fueled by the immediate necessity to mechanise production with declining rural workforces and increasing agricultural wages, particularly in India, China, and Southeast Asia. Governments in these markets are offering financial incentives for equipment procurement, and smallholder farming is slowly adopting modern equipment. Rising rural incomes and croppable intensification are also partly driving serial adoption of tractors and harvesting machinery. Hence the Asia-Pacific region provides scope for both scaling opportunities and rapid growth.

Recent Developments:

The Europe farm equipment market size reached at USD 24.32 billion in 2025 and is forecasted to hit around USD 36.68 billion by 2035. The European market for farm equipment is being propelled by a movement towards sustainability, emission-reduction, and the digitalisation of farming. Farmers and equipment manufacturers are adopting low-emission, sensor-rich machinery, electric tractors, and precision systems in compliance with regulatory burden and labour shortages. With the consolidation of farms and rising labour costs, the trend is towards larger and smarter machinery, moving the European market past horsepower to "smart farming."

Recent Developments:

Farm Equipment Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia-Pacific | 39.2% |

| North America | 29.5% |

| Europe | 21.1% |

| LAMEA | 10.2% |

The LAMEA farm equipment market size valued at USD 11.76 billion in 2025 and is anticipated to reach around USD 17.73 billion by 2035. The LAMEA is influenced by increasing food need, urbanisation, and government infrastructure spending in agriculture. In Latin America, rising population and export-oriented farming models are driving the need for modern machinery. In the Middle East and Africa, additional traction is given to irrigation, land-development and machinery for arid areas. Governments are working with an increasing number of subsidies and partnerships, facilitating mechanisation in underserved areas. Overall, the region shows opportunities growing quickly, but from a lower base.

Recent Developments:

The farm equipment market is segmented into equipment, power source, application, and region.

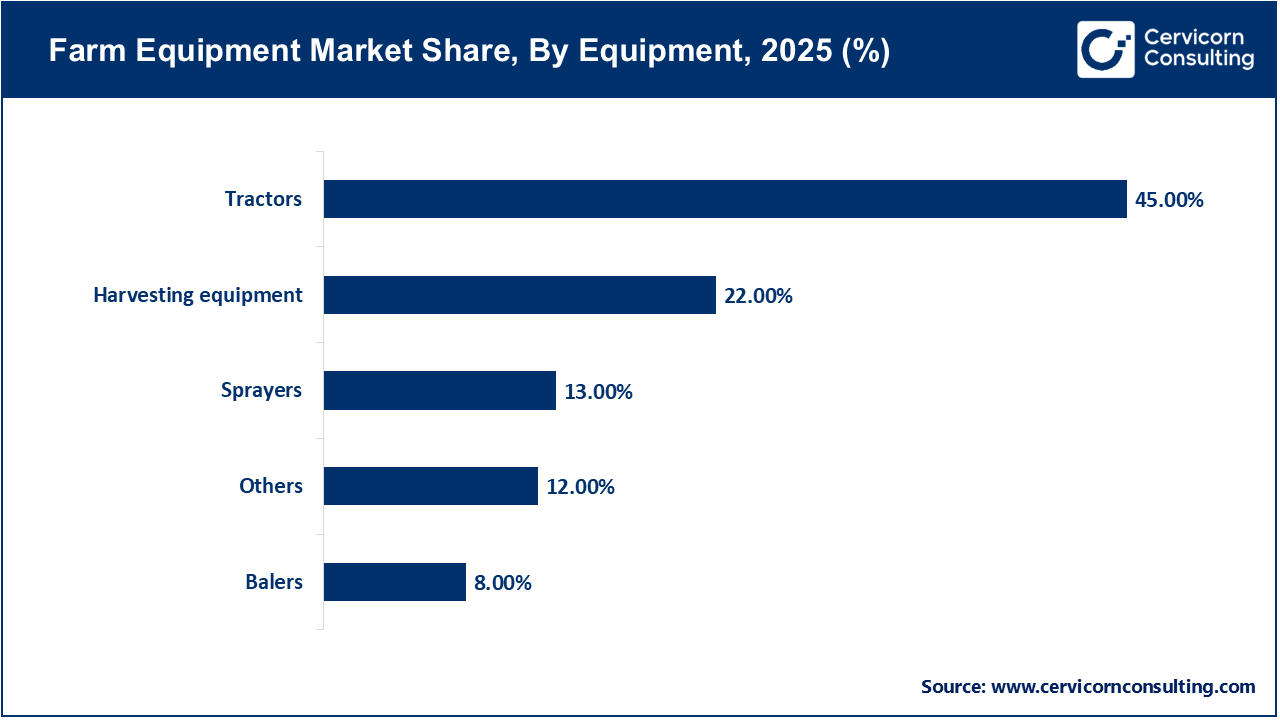

Tractors are the leading segment in the farm equipment market because they are utilized in nearly all aspects of the farming operation. Tractors are used for plowing, sowing, moving or hauling, spraying, and for providing power to various attachments. The multi-functional capabilities of tractors also reduce the need to have multiple different machines for each task. Strong demand from both small and large farm producers further supports the segment dominance of tractors in the agricultural market. The growth of tractors in developing economies has also been aided by government subsidies often coupled with easy financing. Continuous improvement in engine efficiency, and comfort and convenience features, also adds to the leadership of tractors in the farm equipment market.

Harvesting equipment represents the fastest growing segment of the farm equipment market due to increased labor shortages and the need for faster harvesting of crops. Farmers prefer combining harvesters due to combining the labor associated with harvest and minimization of crop loss. Larger farm size also adds to the demand for harvesting equipment with farmers developing multi-cropping systems to improve harvest and farm income. Harvesters have also added automation capabilities, precision features, and the ability to manipulate specific yield factors to the harvesting equipment market to improve efficiency and produce higher yields. The growth of larger scale commercial farming and contract farming management models has also contributed to the gaining segment of harvesting equipment.

Tractor-powered equipment leads the market as tractors are central to agricultural mechanization worldwide. Most basic and advanced agriculture implements operate using tractor power, through use of the PTO and hydrualic system. High existing tractor penetration within major agricultural economies provides definite strength to this already strong segment. Farmers typically prefer tractor-powered machinery due to their reliability and availability of service and support. This segment of equipment also benefits from the continued development of more reliable, durable and powerful tractors. Tractor-powered farm implements have, and continue to be, a stable segment with high demand, especially in North America and Europe.

Farm Equipment Market Share, By Power Source, 2025 (%)

| Power Source | Revenue Share, 2025 (%) |

| Tractor-Powered | 52% |

| Mechanical | 32% |

| Electric & Battery-Powered | 16% |

Electric and battery-powered equipment is the fastest growing segment since farmers are placing greater emphasis on sustainable farming practices. Farmers have responded to the rising costs of fuel and changing emissions regulations by seeking out electric power options. Advances in battery technology have increased operating times and improved performance of electric machines. Government incentives have demonstrated support for adoption of low-emission agricultural machinery and implement. Furthermore, manufacturers have initiated programs to market newly designed electric tractors and small farm machines in order to meet this growing demand. Changes in sustainability from both the consumer and manufacturer side have resulted in the rapid growth of this segment of agriculture machinery.

The cultivation and soil preparation segments continue to dominate the industry because all farming operations start with land preparation. The use of equipment (e.g. ploughs, cultivators, tillers, and harrows) for cultivation occurs repeatedly within each cropping cycle. This means that there will always be a continuous demand for soil preparation machines in every geography. The greater the number of uses, the higher the demand for replacement or maintenance of equipment. The growth of mechanized agriculture in Asia and Africa has helped facilitate growth in this application segment. This application segment remains a foundation, driving overall equipment sales.

Farm Equipment Market Share, By Distribution Channel, 2025 (%)

| Distribution Channel | Revenue Share, 2025 (%) |

| Cultivation & Soil Preparation | 36% |

| Harvesting | 24% |

| Planting & Seeding | 18% |

| Livestock | 12% |

| Others | 10% |

The harvesting application segment continues to be the fastest growing application segment of farm equipment because of the demand for fast, efficient harvesting of crops. Harvesting windows are getting shorter and the weather is unpredictable, requiring rapid operations in the field. Mechanized harvesting of crops helps reduce the reliance on seasonal labor, and mitigates losses associated with post-harvest management. Additionally, rising wages in rural agrarian communities mean that machines have become similarly cost-effective. The adoption of smart harvesting technologies is having a marked stimulus effect on demand for harvesting machinery. Altogether, it is expected that this application segment will continue to see sustained growth.

Recent Technologies

Autonomous and Automated Agriculture Equipment

John Deere has rolled out autonomy-ready tractors and an Autonomy Precision Upgrade which enables existing machinery to operate with limited human intervention. This technology is propelling the farm equipment industry as it provides enhanced efficiency, reduces the need for labor, and allows high-volume producers to retrofit aging fleets rather than invest in a new equipment.

Electric & Driver Optional Tractors

Monarch Tractor launched the MK-V, a fully electric, optionally autonomous tractor with cloud-based connectedness and AI fleet management software. This advancement is pushing the farm equipment market toward sustainability and lower operating costs of the equipment investment, making sustainable equipment a legitimate option for farms of the future.

3. Solar-Powered Robot for Seeding and Weeding

FarmDroid's FD20 is a fully automated state-of-the-art, solar-powered autonomous robot that uses high-accuracy RTK GPS and solar-power productively without the need to recharge. This technology is driving the agricultural equipment market by allowing fully autonomous (self-propelled) field operations that reduces task reliance on human labor and chemical usage with alternative approaches to seeding and weeding, particularly for specialty crop and sustainable crop producers.

By Equipment

By Power Source

By Automation

By End Users

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Farm Equipment

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Equipment Overview

2.2.2 By Power Source Overview

2.2.3 By Automation Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising demand for food production

4.1.1.2 Government support and subsidies

4.1.2 Market Restraints

4.1.2.1 High cost of advanced equipment

4.1.2.2 Lack of technical knowledge

4.1.3 Market Challenges

4.1.3.1 Dependence on weather and climate conditions

4.1.3.2 Supply chain disruptions and raw material costs

4.1.4 Market Opportunities

4.1.4.1 Growth in precision agriculture

4.1.4.2 Rising demand for electric and green machinery

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Farm Equipment Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Farm Equipment Market, By Equipment

6.1 Global Farm Equipment Market Snapshot, By Equipment

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Tractors

6.1.1.2 Harvesting equipment

6.1.1.3 Sprayers

6.1.1.4 Balers

6.1.1.5 Others

Chapter 7. Farm Equipment Market, By Power Source

7.1 Global Farm Equipment Market Snapshot, By Power Source

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Mechanical

7.1.1.2 Tractor-powered

7.1.1.3 Electric & battery-powered

Chapter 8. Farm Equipment Market, By Automation

8.1 Global Farm Equipment Market Snapshot, By Automation

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Manual

8.1.1.2 Semi-Automatic

8.1.1.3 Automatic

Chapter 9. Farm Equipment Market, By End-User

9.1 Global Farm Equipment Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Individual Farmers

9.1.1.2 Commercial Farm

Chapter 10. Farm Equipment Market, By Application

10.1 Global Farm Equipment Market Snapshot, By Application

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Cultivation and soil preparation

10.1.1.2 Planting and seeding

10.1.1.3 Harvesting

10.1.1.4 Livestock

10.1.1.5 Others

Chapter 11. Farm Equipment Market, By Region

11.1 Overview

11.2 Farm Equipment Market Revenue Share, By Region 2024 (%)

11.3 Global Farm Equipment Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Farm Equipment Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Farm Equipment Market, By Country

11.5.4 UK

11.5.4.1 UK Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Farm Equipment Market, By Country

11.6.4 China

11.6.4.1 China Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Farm Equipment Market, By Country

11.7.4 GCC

11.7.4.1 GCC Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Farm Equipment Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Deere & Company (John Deere)

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 CNH Industrial

13.3 AGCO Corporation

13.4 Kubota Corporation

13.5 CLAAS Group

13.6 Mahindra & Mahindra Ltd.

13.7 Yanmar Holdings Co., Ltd.

13.8 Toyo Corporation (Iseki & Co., Ltd.)

13.9 Alamo Group Inc.

13.10 SDF Group (SAME Deutz-Fahr)

13.11 Minsk Tractor Works (MTZ)

13.12 JCB Agriculture

13.13 Lovol Heavy Industry

13.14 Changfa Group

13.15 YTO Group Corporation