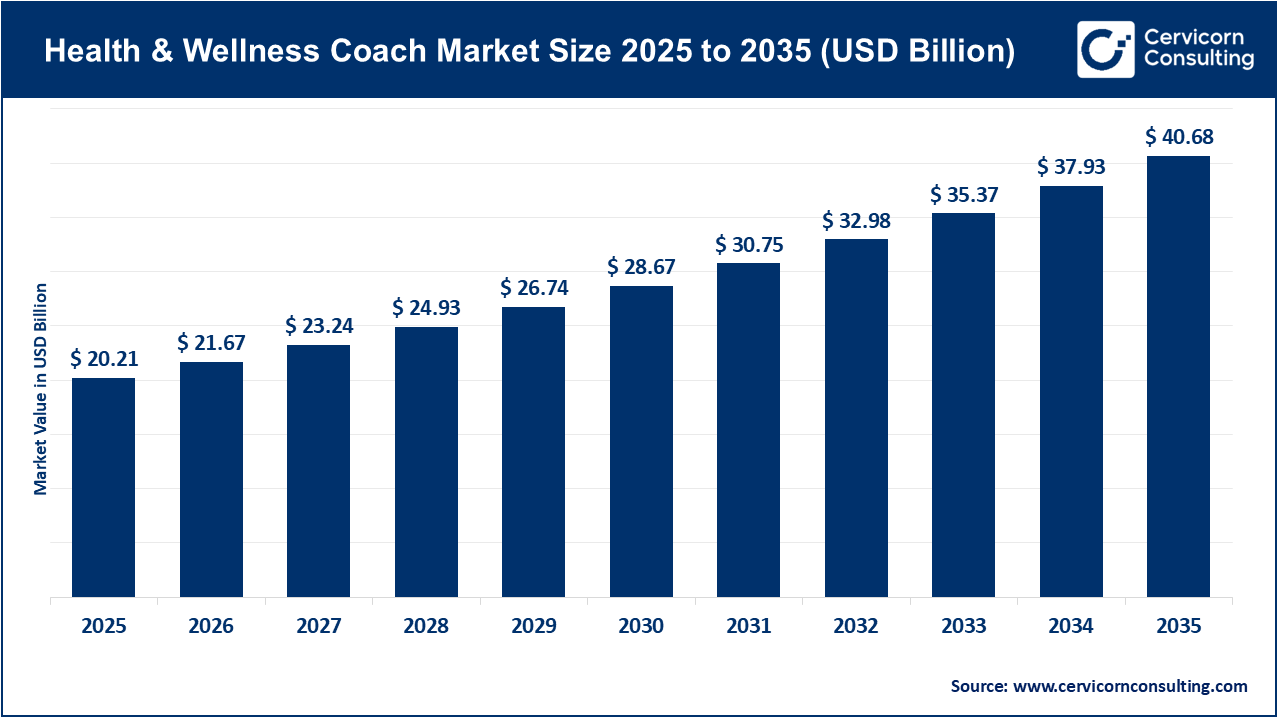

The global health and wellness coach market size reached at USD 20.21 billion in 2025 and is expected to be worth around USD 40.68 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 7.25% over the forecast period 2026 to 2035. The health and wellness coach market is experiencing growth as more people are focusing on their well-being, both physical and mental. Busy lifestyles, stress, and chronic disease are all causing individuals to seek help from professionals to maintain good health, fitness, and mental health. Individuals and corporations are employing wellness programs to improve wellness, productivity, and quality of life. It is now easier and cheaper for individuals to find a coach with the increased digital platforms and mobile apps available. This trend has also contributed to the increases in the health and wellness coach markets as individuals join online sessions to discuss fitness, nutrition, or stress relief.

Another primary driver of this market growth has been the global shift towards preventive healthcare. Individuals are now trained to not wait until they are sick to become concerned about their wellness, but rather choose appropriate lifestyle changes to maintain good health. Governments and healthcare providers have also transferred into wellness programs due to the rising costs of the medical system. Increased knowledge of mental health, along with a more informed population, and certified coaches, all contribute to increased trust in the market. These forces will tra nslate to experience strong demand in the industry while continuing to grow in all areas.

What is Health & Wellness Coach?

A Health & Wellness Coach is a trained professional who guides people to improve their overall well-being through lifestyle and behavioral changes. Health and wellness coaches can help clients in areas such as nutrition, exercise, stress management, sleep and mental health. Rather than treating an illness or disease, coaches focus on helping clients develop healthy behaviors that include motivation, goal-setting, and accountability. A health and wellness coach typically works with individuals or groups to develop a personalized plan that promotes sustainable physical, emotional, and mental health.

Inclusivity Accelerating the Health & Wellness Coach Market

As the focus on inclusion continues to grow, the health and wellness coaching industry is rapidly expanding through the establishment of wellness for all people regardless of background, gender, ethnicity, or ability. Modern consumers are more receptive to wellness programs that reflect their identity and specific needs. When coaching programs include various groups of members, clients begin to feel valued and supported, and are more likely to attend and remain loyal to the program. For example, one company saw a 38% increase in attendance to its wellness programs after implementing the delivery of wellness education in a variety of languages and culturally relevant articles. Studies show that 61% of LGBTQ+ employees feel that access to inclusive mental health support is important to their well-being.

Popular brands like Noom, Headspace, and BetterUp have begun to expand the inclusivity of their platforms. Noom, for instance, is implementing diverse coaching populations, individualized pathways to wellness, and gender-neutral wellness approaches, thus, creating engagement for a wider audience to establish and support their programs. This level of inclusivity and affiliation towards a range of groups increases consumers' trust and builds a client group that represents a range of demographics, both geographically and chronologically. This inclusivity will drive innovation, marketing, and sustainable wellness coaching industry growth as cultural awareness and education about equality and diversity continues to improve.

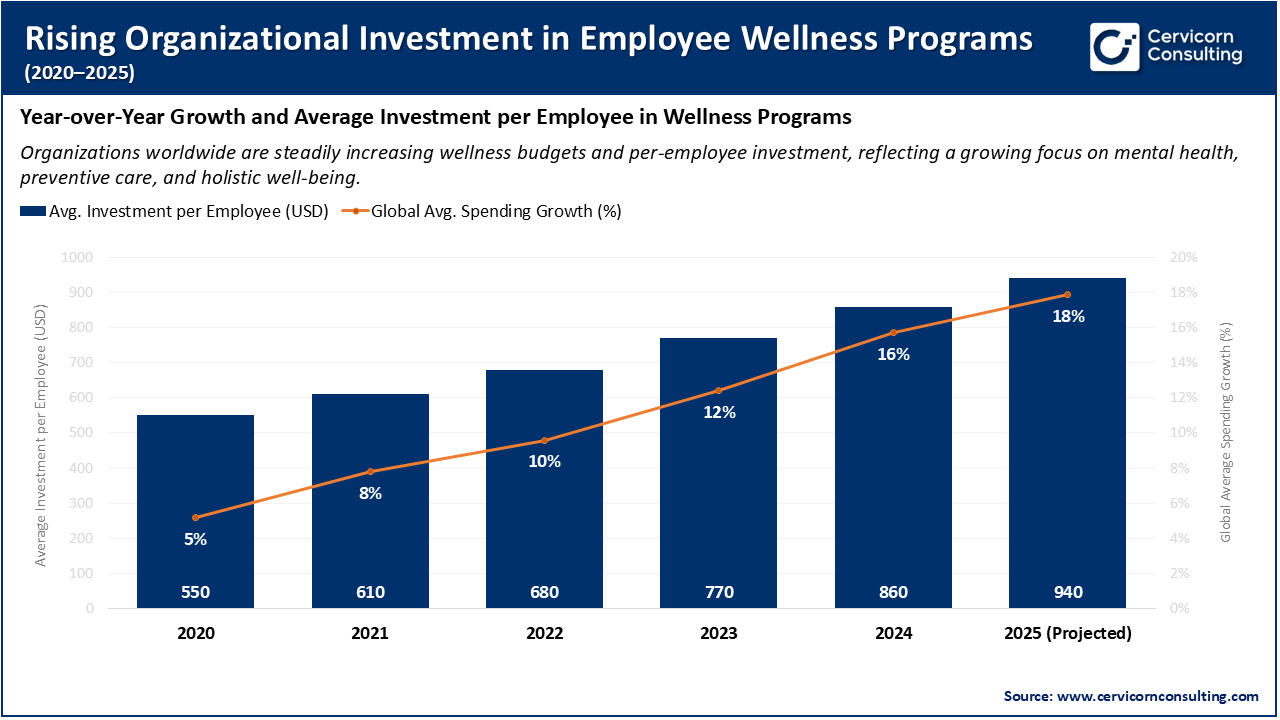

The continuous increase in the share allocated by organizations for employee wellbeing from 5% in 2020 to 18% in 2025 is a key emergence in the growth of the health and wellness coach market. More companies are focusing their investments in mental health, fitness, and wellbeing, which will lead to increases in the demand for certified coaches and digital wellness membership platforms. Higher investment leads to more innovation, corporate partnerships, and access, which solidifies wellness coaching as a critical business strategy and accelerates the long-term development of the wellness coaching market.

Rise of Virtual and Hybrid Coaching Models

Integration of AI and Automated Coaching Tools

Growth of Corporate Wellness and Employee Health Programs

Surge in Investment and Startup Innovation

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 21.67 Billion |

| Expected Market Size in 2035 | USD 40.68 Billion |

| Projected CAGR 2026 to 2035 | 7.25% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Type of Coaching, Mode of Delivery, End-user, Region |

| Key Companies | BetterUp, International Academy for Professional Development Ltd, ADVANCED WELLNESS SYSTEMS, LLC, TotalWellness, Choose Health by Sargent and Associates, Concentra, Inc., Dr. Lana Wellness, Wellhub (formerly Gympass), ESI Employee Assistance Group, Weljii, WellSteps.com, LLC, Wellness Coaches USA, LLC |

The health & wellness coach market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America health and wellness coach market size reached at USD 9.05 billion in 2025 and is expanding to USD 18.22 billion by 2035. North America is the dominant region because of its cultural emphasis on preventative healthcare, increasing awareness of mental health, and willingness to adopt new technology. North America has a mature infrastructure that supports both professional coaches and healthcare systems or digital wellness platforms. Consumers are continually looking for coaching solutions for lifestyle diseases, nutrition improvement, emotional balance. Corporate wellness programs are common, with many companies in the U.S. adding wellness benefits to their offerings to promote employee retention. The embrace of mobile technologies and wearables propels even more customised coaching offerings that are based on data, in addition to promoting continuous innovation and engagement.

Recent Developments:

The Europe health and wellness coach market size reached at USD 5.58 billion in 2025 and is forecasted to hit around USD 11.23 billion by 2035. The Europe is witnessing a steady increase in demand as governments and healthcare stakeholders prioritize care that prevents illness and promotes mental health. In countries such as the U.K., Germany and the Netherlands, the incorporation of coaching within the health care system is improving credibility and hence adoption of coaches. Additionally, with European employers recognizing the advantages of healthy employees, both corporate and community wellness programs continue to expand. Designed regulatory systems, along with professional training programs in Europe, provide a viable structure for better service quality and thus, increased trust and success in wellness coaching.

Recent Developments:

The Asia-Pacific health and wellness coach market size estimated at USD 3.94 billion in 2025 and is projected to surpass around USD 7.93 billion by 2035. The Asia-Pacific is fastest-growing region, driven by increasing urbanization, higher disposable incomes, and growing health awareness among younger populations. Rapid digital developments across the region coupled with the smartphone phenomenon create a market for online coaching platforms and wellness apps. Many consumers are seeking accessible, rich alternatives for managing lifestyle related stresses, obesity, or diseases. Local government initiatives for preventative health care have contributed to the increasing uptake of wellness initiatives. Countries like India, China, Japan, and Australia are quickly advancing by combining their traditional health practices, i.e. yoga, with developing digital wellness programs.

Recent Developments:

Health & Wellness Coach Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 44.8% |

| Europe | 27.6% |

| Asia-Pacific | 19.5% |

| LAMEA | 8.1% |

The LAMEA health and wellness coach market size reached at USD 1.64 billion in 2025 and is anticipated to reach around USD 3.30 billion by 2035. The LAMEA region is an emerging but promising area in the market. Growing awareness of chronic disease prevention, increasing smartphone adoption, and more funding into healthcare are driving this growth. The Latin America region (notably Brazil and Mexico) is experiencing rapid growth in corporate wellness programs in response to a growing awareness in the workplace health sector. Middle East and Africa are seeing wellness initiatives being driven by government health authorities by participating health awareness campaigns and developing programs for employee health, thus further stimulating the market. While there are still barriers to infrastructure, and price points, this gives scope for new and innovative low-cost digital health solutions.

Recent Developments:

The health & wellness coach market is segmented into product, application, end-use industry, and region.

The personal health coaching is leading segment in health and wellness coach industry because it offers personal support that works with each person’s unique lifestyle and health objectives. Clients prefer a one-on-one approach to assist them with weight management, nutrition, fitness, and developing healthier habits over time. Personal health coaches offer regular check-ins, tailored plans, and emotional support which build stronger trust and better outcomes. Companies like Noom and BetterUp have made personal health coaching more accessible and open to mobile users so that a certified coach is only a couple clicks away. This will continue to be the leading sector in the industry as people seek out personalized health solutions in all circumstances over general wellness programs.

Health & Wellness Coach Market Share, By Type of Coaching, 2025 (%)

| Type of Coaching | Revenue Share, 2025 (%) |

| Personal Health Coaching | 32.4% |

| Corporate Wellness Coaching | 21.7% |

| Fitness Coaching | 18.6% |

| Nutrition Coaching | 14.3% |

| Mental Wellness Coaching | 13.0% |

Mental wellness coaching is the most rapidly growing segment as awareness of mental health issues increases globally. Stress, pressure, anxiety, and burnout have led to people seeking support from teachers, counselors, even behavioral specialists and therapist that can provide systematic support that is sometimes not available through traditional therapy treatment. Mental wellness coaches teach clients how to improved resilience, mindfulness, and work-life balance using simple and consistent techniques. Major platforms, such as Headspace and Calm, have introduced features and applications which focus on mental wellness. Employers are also expanding wellness benefits to include mental health support, which is seeing major growth. As the stigma around mental health continues to decrease, the demand for certified mental wellness coaches continues to grow at a rapid pace.

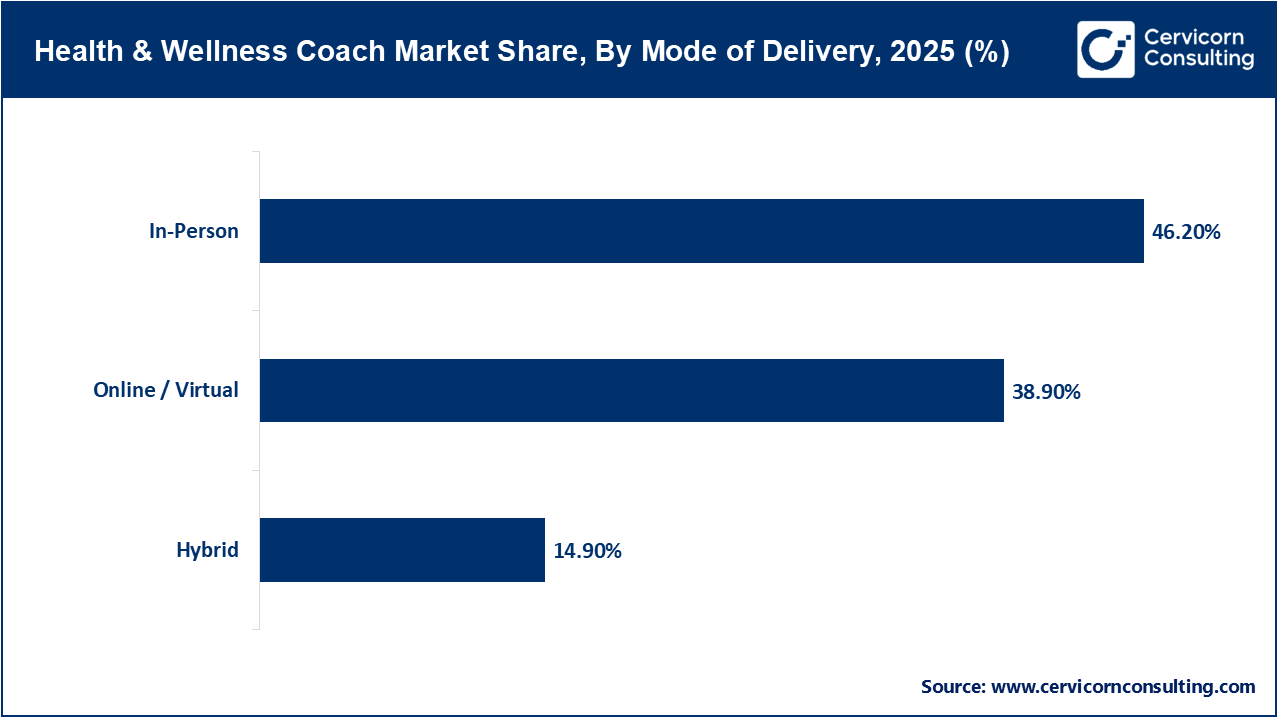

In-person coaching segment remains the dominant mode because it provides a stronger human connection and immediate interaction. Clients often feel more comfortable participating in activities such as fitness training, yoga, and nutrition counseling when the coach can observe and give real-time feedback. Coaching in-person typically offers better accountability and motivation than coaching online. Although online platforms are increasing in usage, clients who value personal interaction and accountability prefer in person. All around the world, high-end wellness centers, gyms, and private health studios continue to use a coaching model that relies heavily on in-person coaching. In-person coaching creates a premium and customized experience for the client.

Online and virtual coaching is the fastest-growing mode in the health and wellness coach market as technology transforms the wellness experience. When coaching is done online using Zoom, a wellness app, or mobile phones, coaching is as accessible as the internet. Time is saved, travel costs are lessened, and the global population can be coached online. Companies like Wellhub, MyFitnessPal, and BetterUp have expanded their virtual coaching programs in fitness, nutrition, and mental wellness, respectively. Online sessions can benefit busy professionals, remote professionals, or corporate teams. The proliferation of digital health tools will likely increase global online coaching. The global online coaching market will continue to increase, especially with the potential for artificial intelligence integration.

Individual consumers are dominating segment in market, as achieving individual health and wellness is now the primary focus of individuals around the world today. As a result, individuals are exercising their purchasing power to better their overall quality of life through fitness, nutrition, and lifestyle coaching, and recognising illness prevention. Digital delivery provides convenience or access to certified coaches by providing them with platforms to monitor progress and provide plans tailored to individuals. Demand is to some extent driven by Millennials and Gen Z, who increasingly seek technology based, flexible options for wellness. As they further prioritize self-improvement and more preventive approaches to healthcare, the evidence suggests demand will remain individuals.

Health & Wellness Coach Market Share, By End-User, 2025 (%)

| End-User | Revenue Share, 2025 (%) |

| Individuals | 52.7% |

| Corporates / Organizations | 33.8% |

| Healthcare Providers / Insurers | 13.5% |

The corporate and organizational is the rapidly growing segment of market due to the recognition by corporations of the value of happy and healthy employees. Corporations are investing significantly in comprehensive wellness programs that incorporate health coaching, mindfulness, and nutrition in an effort to reduce absenteeism and improve productivity at work. Global companies, such as Wellhub (previously branded as Gympass), BetterUp, and Virgin Pulse, are partnering with corporations to scale coaching solutions across the workplace. Many employers are providing mental health and lifestyle coaching for employees as part of their employee benefits. The growth of the corporate and organizational sector is significant since the enhancements to workflow and workplace culture lead to consistent demand for wellness coaches. This area has been one of the most dynamic growth areas in the industry.

Industry Leaders’ Perspectives on Health & Wellness Coach Market Growth:

Alexi Robichaux – CEO & Co-Founder of BetterUp

Cesar Carvalho – CEO & Co-Founder of Wellhub

Market Segmentation

By Type of Coaching

By Mode of Delivery

By End-user

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Health and Wellness Coach

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type of Coaching Overview

2.2.2 By Mode of Delivery Overview

2.2.3 By End-user Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing Awareness of Preventive Health and Lifestyle Diseases

4.1.1.2 Increasing Corporate Focus on Employee Well-being

4.1.2 Market Restraints

4.1.2.1 Lack of Standardized Certification and Regulation

4.1.2.2 High Service Costs and Limited Accessibility

4.1.3 Market Challenges

4.1.3.1 Maintaining Client Engagement and Long-Term Results

4.1.3.2 Data Privacy and Ethical Concerns in Digital Coaching

4.1.4 Market Opportunities

4.1.4.1 Integration of Technology and AI-Based Coaching Tools

4.1.4.2 Expansion into Emerging Markets and Rural Areas

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Health and Wellness Coach Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Health and Wellness Coach Market, By Type of Coaching

6.1 Global Health and Wellness Coach Market Snapshot, By Type of Coaching

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Personal Health Coaching

6.1.1.2 Corporate Wellness Coaching

6.1.1.3 Fitness Coaching

6.1.1.4 Nutrition Coaching

6.1.1.5 Mental Wellness Coaching

Chapter 7. Health and Wellness Coach Market, By Mode of Delivery

7.1 Global Health and Wellness Coach Market Snapshot, By Mode of Delivery

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 In-Person

7.1.1.2 Online / Virtual

7.1.1.3 Hybrid

Chapter 8. Health and Wellness Coach Market, By End-user

8.1 Global Health and Wellness Coach Market Snapshot, By End-user

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Individuals

8.1.1.2 Corporates / Organizations

8.1.1.3 Healthcare Providers / Insurers

Chapter 9. Health and Wellness Coach Market, By Region

9.1 Overview

9.2 Health and Wellness Coach Market Revenue Share, By Region 2024 (%)

9.3 Global Health and Wellness Coach Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Health and Wellness Coach Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Health and Wellness Coach Market, By Country

9.5.4 UK

9.5.4.1 UK Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Health and Wellness Coach Market, By Country

9.6.4 China

9.6.4.1 China Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Health and Wellness Coach Market, By Country

9.7.4 GCC

9.7.4.1 GCC Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Health and Wellness Coach Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 BetterUp

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 International Academy for Professional Development Ltd

11.3 ADVANCED WELLNESS SYSTEMS, LLC

11.4 TotalWellness

11.5 Choose Health by Sargent and Associates

11.6 Concentra, Inc.

11.7 Dr. Lana Wellness

11.8 Wellhub (formerly Gympass)

11.9 ESI Employee Assistance Group

11.10 Weljii

11.11 WellSteps.com, LLC

11.12 Wellness Coaches USA, LLC