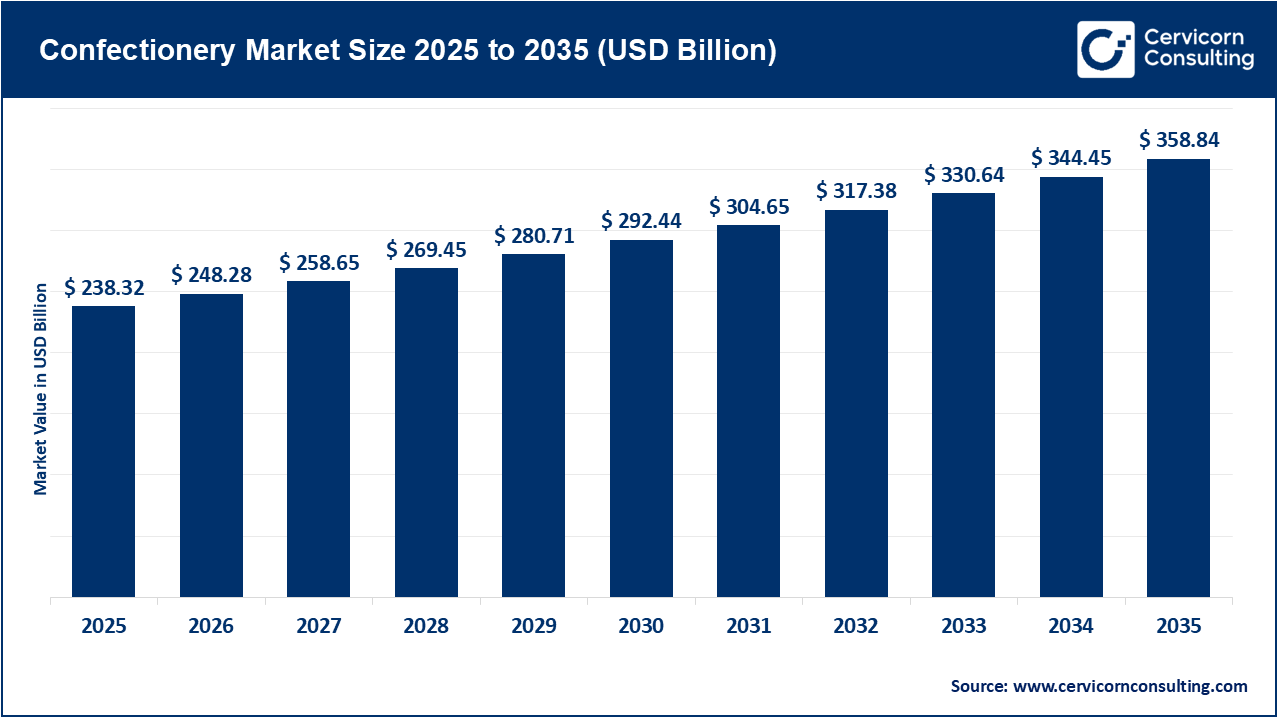

The global confectionery market size was valued at USD 238.32 billion in 2025 and is expected to be worth around USD 358.84 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.2% over the forecast period 2026 to 2035. The confectionery market is expanding steadily due to evolving consumer preferences, product innovation, and premiumization. An increase in the demand for indulgent products and expanding gifting culture during holidays and seasonal celebrations continues to propel market growth. Companies are focusing on product innovation by launching new flavors, healthier ingredients, and sustainable packaging in response to health-conscious and environmentally-minded consumers. Moreover, e-commerce and digital marketing have made candy easier to find, which has helped the industry grow and sell more around the world.

Additionally, key drivers of the confectionery market are changing lifestyles, an increase in disposable incomes, and the growing impact of Western snacking habits in developing parts of the world. The trend towards clean, organic, and sugar-free confectionery is also contributing to challenges to brands, as consumers exhibit an increased focus on health and wellness. Advancements in packaging technology and customisation further add to shelf appeal and consumer engagement. All of these factors continue to push growth throughout the market, while also fostering ideas and innovation across all categories - from chocolate and sugar confectionery to gum and specialty sweets.

What is confectionery?

Confectionery refers to food products that are sweet products made of sugar, chocolate or another sweetener and eaten for enjoyment or as a treat at the end of a meal. The function of confectionery is to provide pleasure and indulgence, replacing other potential meals that could be eaten as part of a more nutritional diet. Confectionery items may utilize ingredients such as cocoa, fruits, nuts, dairy, and flavoring agents. Confectionery can fit into a variety of forms, textures and flavors that differ by cultural preference or production processes.

Types of Confectionery:

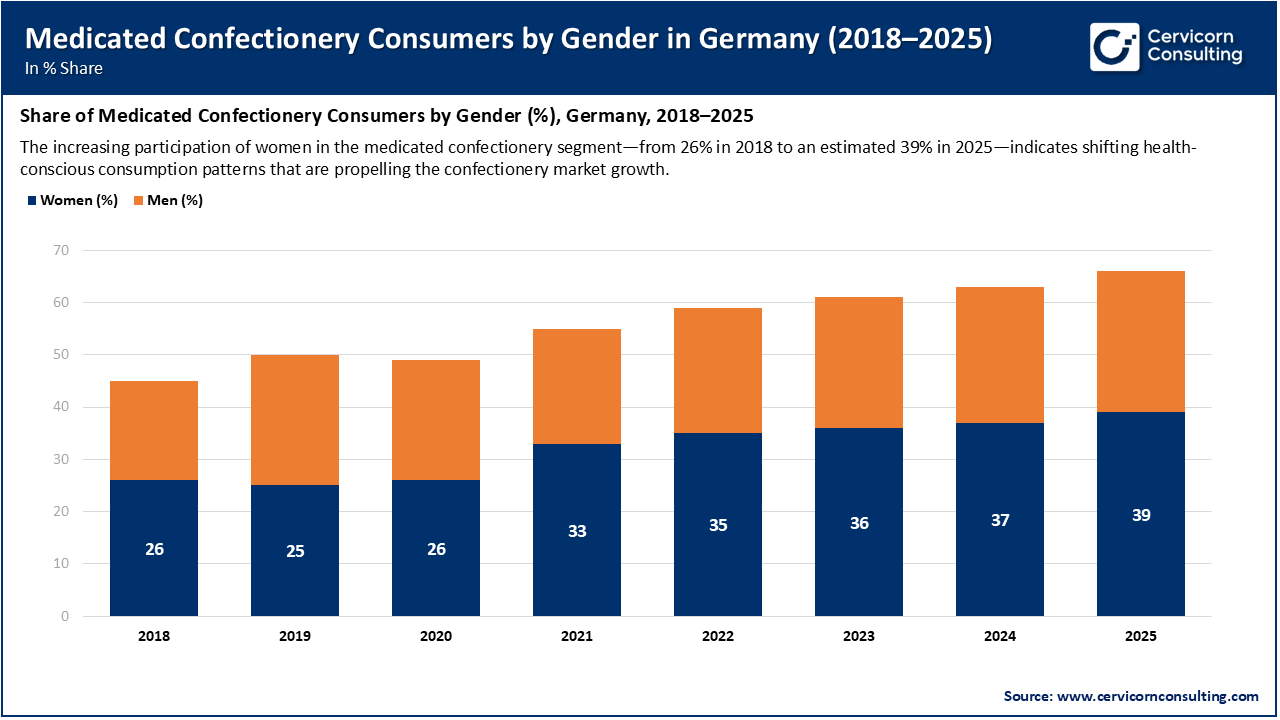

The increasing popularity of medicated confectionery is notably influencing the growth of the confectionery market as consumers appreciation products that provide taste and functional health benefits. For example, lozenges, gummy bears with vitamins, and herbal candies all serve as delivery mechanisms for therapeutic ingredients (vitamins, probiotics, and extracts) in a tasty, easy consumable form. The increase in demand is due to an increase in the focus on wellness, immunity, and preventive health, specifically popularized among younger health-conscious consumers. Manufacturers are leveraging this opportunity by combining traditional confectionery appeal with medicinal and nutraceutical properties, leading to market expansion in the functional and health-centric snacking space.

The chart shows a steady increase in the number of consumers, particularly among women, in the medicated confectionery category. Women increase steadily from 26% in 2018 to 39% in 2025, while men also show a less significant increase. Steady growth is indicative of a broader consumer shift towards functional and wellness-based confectionery products such as vitamin lozenges, herbal candies, and throat-soothing sweets. This increase in women, allowed to be more health-conscious and brand loyal consumers, is a major factor accelerating the broader confectionery market. It demonstrates medicated confectionery consumption being more than a niche but hits into an element of everyday snacking behavior in Germany, whereby indulgence meets the preventive health benefits, further fueling confectionery market growth.

Rising Demand for Premium and Functional Products

Expanding Online and Convenience Retail Channels

Growing Health Concerns Over Sugar Consumption

Fluctuating Raw Material Prices

Innovation in Plant-Based and Clean-Label Products

Rising Demand in Emerging Economies

Intense Market Competition and Brand Saturation

Sustainability and Ethical Sourcing Pressure

The confectionery market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

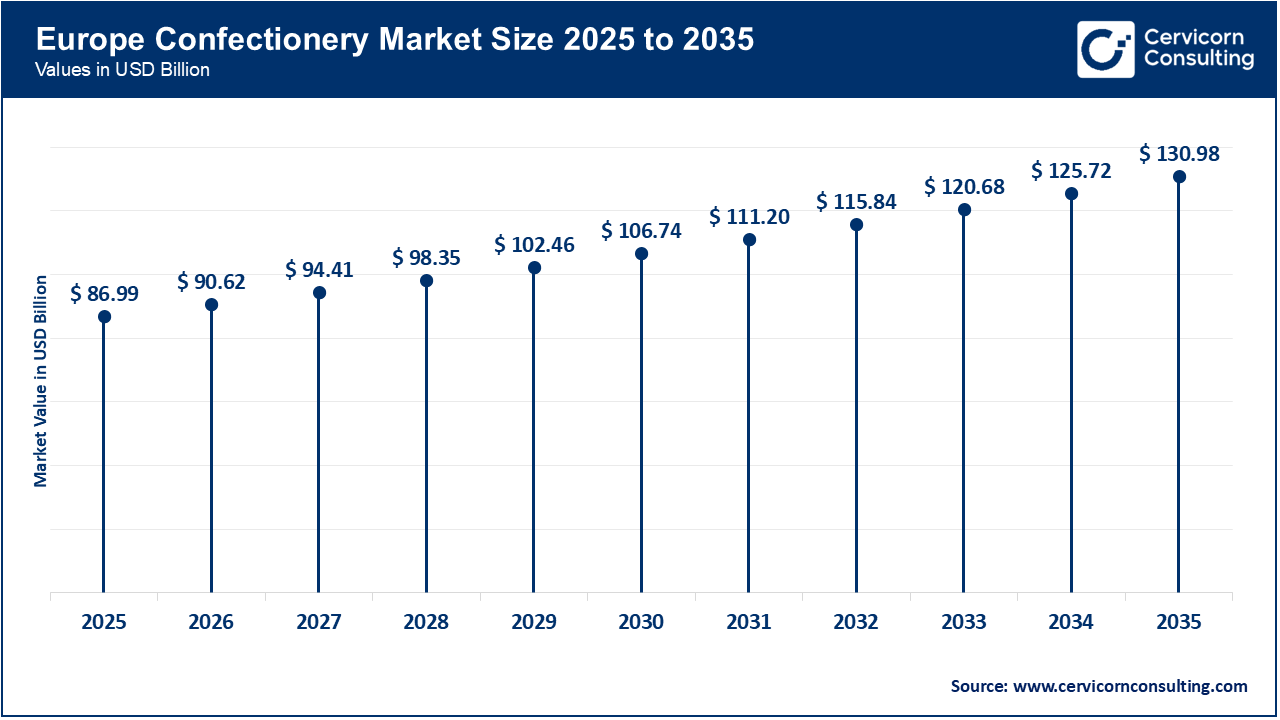

Europe is a leading region due to its long history of premium chocolate production and the artisanal craft of chocolate. Countries such as Switzerland, Belgium, Germany, and the U.K. have dominant shares of product innovations, research, and all-time export value. There are patterns emerging in Europe around clean-label confectionary, organic forms, and lower sugar formats. This has been a result of an EU-driven health focus, changing dietary behavior, as well as developing trade markets, which will continue over time. Sustainability is an area of focus, indicated by the investment by brands into fair-trade cocoa sourcing, recyclable packaging, and carbon-neutral manufacturing processes. In addition, vegan and plant-based forms of confectionary are increasing throughout most of Western Europe as the region moves towards a more sustainable offering and links to global wellness trends.

Recent Developments:

North America is one of the most mature and important region, with strong brand presence, product innovation, and premiumization already underway. Consumers are buying more dark chocolate, sugar-free confectionery, and functional confectionery containing vitamins, collagen, or plant-based ingredients in the U.S. and Canada. Seasonal sales around Halloween, Christmas, or Valentine's keep consumers interested in confectionery. Sustainability and ethical sourcing are also gaining traction as consumers want to know where cocoa and ingredients originate. North American manufacturers are focusing on digital marketing and e-commerce to bolster extensibility and consumer engagement while adding direct-to-consumer capabilities.

Recent Developments:

The APAC is the fastest growing region driven by rapid urbanization, disposable incomes that are rising, and westernization of snacking. Consumers in China, India, Japan and Korea are testing their comfort levels with flavour profiles of traditional tastes, and or styles of ingredient such as matcha, mango, and sesame, which have been fused into modern confectionery styles. Younger demographics and increased gifting culture during holidays like Diwali, Lunar New Year, and Valentine's Day support even higher sales growth as new gifting occasions emerge. Portfolio innovation continues to respond to the growing demand for sugar-free, organic, and vegan options among health-focused millennial consumers. Local brands are gaining traction with culturally inspired flavors while multinational brands are establishing bases to fulfill cost efficiency and local tastes.

Recent Developments:

Confectionery Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Europe | 36.50% |

| North America | 28.80% |

| Asia-Pacific (APAC) | 23.70% |

| LAMEA | 11% |

The LAMEA region is projected to emerge as a growth frontier due to levels of growing urbanization and improved retail infrastructure impacting social convergence. So much of this development is based around Latin America with countries like Brazil and Mexico playing key roles creating strong local confectionery traditions as well as having an expanding middle class. The Middle East is seeing demand for premium gifting chocolates or haram products in the Gulf, particularly the UAE and Saudi Arabia. The African confectionary market is being influenced by investments into productive local capacity and access to affordable brands, however the market can experience a limitation with raw materials and imports. There still exists a large quality confectionary opportunity acting as value addition, particularly around localized supply chains or e-commerce enabled channels.

Recent Developments:

The confectionery market is segmented into product type, age group, distribution channel, and region.

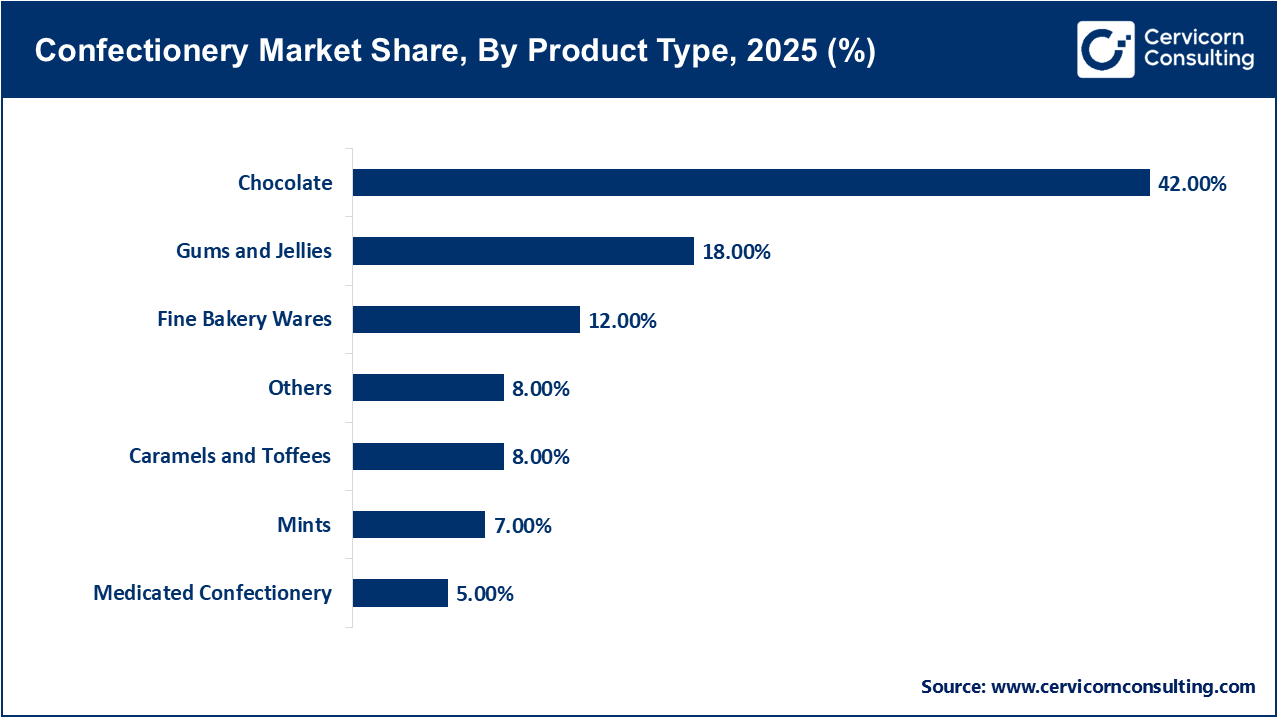

Chocolate segment is dominating in the confectionery market due to its widespread popularity, premiumization, and continuous innovations in flavor and texture. The segment can easily appeal to all consumers from kids to adults and all occasions from everyday indulgences to gifting. Global brands utilize sustainability as a reputable cocoa source, artisanal quality, and luxury packaging to enhance brand affinity. The addition of functional and dark flavors with moderate sugar levels has also established chocolate as the dominant player in the dessert category.

Medicated confectionery is the largest emerging segment, mainly driven by growing interest in wellness-focused sweets. Products such as throat lozenges, vitamin-infused gummies, and herbal candies are generating interest among health-conscious consumers who want functional benefits from eating sweets. Growing demand for immunity-boosting products, sugar-free products, and plant-based products is also boosting the growth of this emerging segment.

Children segment leads the market with have the highest consumption of confectionery due to their desire for sweet, colorful, and fun formats. This continues to drive turnover of confectionery products, particularly chocolates, jellies and toffees. Brands aimed at children continue to appeal to them using character-based packaging, limited editions and interactive marketing campaigns to maintain some level of sales volume. Regardless of parents being concerned about sugar consumption, children continue to be the most engaged consumer demographic to confectionery categories worldwide.

Confectionery Market Share, By Age Group, 2025 (%)

| Age Group | Revenue Share, 2025 (%) |

| Children | 48% |

| Adult | 45% |

| Geriatric | 7% |

The adult segment of the confectionery market is growing rapidly due to changing lifestyles and incomes as consumers indulge more in the premium and functional confectionery segment. Consumers have also focused on premium, artisanal, low-sugar, or dark chocolate products and, medicated confectionery that supports their wellness into their lifestyles to reduce stress. A shift has started away from traditional sugary treats, toward premium flavor experiences and health-based alternatives. This has fostered opportunities in marketplace growth for adult confectionery and growing premium brand presence.

Supermarkets and hypermarkets are the most preferred point of distribution channel within the confectionery segment and for good reason. They usually have great product differentiation, shelf appeal, price promotions, and provide a huge assortment. Consumers enjoy the ease, and convenience of doing one-stop shopping where confectionery products are impulse purchases at checkout. Supermarkets and hypermarkets also provide a crucial part of the company's distribution partnerships for both local and global brands, providing key retailers to ensure ongoing visibility and market share.

Confectionery Market Share, By Distribution Channel, 2025 (%)

| Distribution Channel | Revenue Share, 2025 (%) |

| Supermarkets and Hypermarkets | 47% |

| Convenience Stores | 18% |

| Online Stores | 22% |

| Others | 13% |

Online stores are the fastest growing distribution channel, fueled by digital transformation, lifestyle shifts in home delivery, direct-to-consumer (D2C) strategies, and as e-commerce becomes increasingly popular. Brands can reach more consumers, offer personalization, and bundle gifting or subscription boxes through e-commerce distribution. Social media marketing and influencer awareness has also provided visibility in engagement in online retail, showing potential as a key driver of future growth in the confectionery market.

Industry Leaders’ Perspectives: Voices Shaping the Future of Confectionery (2025):

1. Supply-Chain Integrity & Sustainability

Francesco Tramontin, Vice-President for EU Institutional Relations at Ferrero Group states “Sustainability is not a standalone program anymore. Sustainability is a core focus for the confectionery industry.” He explains in an exclusive interview at the World Confectionery Conference 2025 that future competitiveness will be defined based on compliance with regulations such as the EU Deforestation Regulation (EUDR). He noted that in the case of EUDR, while the implementation was delayed by 1 year, companies are still on the hook and need to prepare now if there is demand and/or compliance expected by regulators. His thinking is that brands that focus on traceability and ethically sourced cocoa, and those that focus on transparency around products will position themselves for the future and gain consumer trust. Brands that do not will be faced with reputational risks as well as the risks of compliance.

2. Innovation Meets Consumer-Centric Values

As discussed at the Sweets & Snacks Expo 2025, consumers appear to be shifting from “indulging” in confectionery to “permission to indulge,” balancing flavours, textures and experience with health claims, ingredients and purpose. One practitioner suggested that consumers are less likely to accept products that are made up of “just sugar and flavour”, engage with brands that introduce new formulations with less sugar, plant based ingredients, functional claims or ethical sourcing. This means that slower supply chain issues or delayed product innovations will not suffice, the future winners will be fast players, who are imaginative with formulations and respect consumer centric values.

Market Segmentation

By Product Type

By Age Group

By Distribution Channel

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Confectionery

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Age Group Overview

2.2.3 By Distribution Channel Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Demand for Premium and Functional Products

4.1.1.2 Expanding Online and Convenience Retail Channels

4.1.2 Market Restraints

4.1.2.1 Growing Health Concerns Over Sugar Consumption

4.1.2.2 Fluctuating Raw Material Prices

4.1.3 Market Challenges

4.1.3.1 Intense Market Competition and Brand Saturation

4.1.3.2 Sustainability and Ethical Sourcing Pressure

4.1.4 Market Opportunities

4.1.4.1 Innovation in Plant-Based and Clean-Label Products

4.1.4.2 Rising Demand in Emerging Economies

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Confectionery Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Confectionery Market, By Product Type

6.1 Global Confectionery Market Snapshot, By Product Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Chocolate

6.1.1.2 Mints

6.1.1.3 Gums and Jellies

6.1.1.4 Caramels and Toffees

6.1.1.5 Fine Bakery Wares

6.1.1.6 Medicated Confectionery

6.1.1.7 Others

Chapter 7. Confectionery Market, By Age Group

7.1 Global Confectionery Market Snapshot, By Age Group

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Children

7.1.1.2 Adult

7.1.1.3 Geriatric

Chapter 8. Confectionery Market, By Distribution Channel

8.1 Global Confectionery Market Snapshot, By Distribution Channel

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Supermarkets and Hypermarkets

8.1.1.2 Convenience Stores

8.1.1.3 Online Stores

8.1.1.4 Others

Chapter 9. Confectionery Market, By Region

9.1 Overview

9.2 Confectionery Market Revenue Share, By Region 2024 (%)

9.3 Global Confectionery Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Confectionery Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Confectionery Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Confectionery Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Confectionery Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Confectionery Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Confectionery Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Confectionery Market, By Country

9.5.4 UK

9.5.4.1 UK Confectionery Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Confectionery Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Confectionery Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Confectionery Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Confectionery Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Confectionery Market, By Country

9.6.4 China

9.6.4.1 China Confectionery Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Confectionery Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Confectionery Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Confectionery Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Confectionery Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Confectionery Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Confectionery Market, By Country

9.7.4 GCC

9.7.4.1 GCC Confectionery Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Confectionery Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Confectionery Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Confectionery Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 The Hershey Company

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Mondelez International, Inc.

11.3 Nestlé S.A.

11.4 Ezaki Glico Co., Ltd.

11.5 Meiji Co., Ltd.

11.6 Mars Incorporated

11.7 Ferrero Group

11.8 Pladis

11.9 Chocoladefabriken Lindt & Sprüngli AG

11.10 Perfetti Van Melle

11.11 Haribo GmbH & Co. K.G.