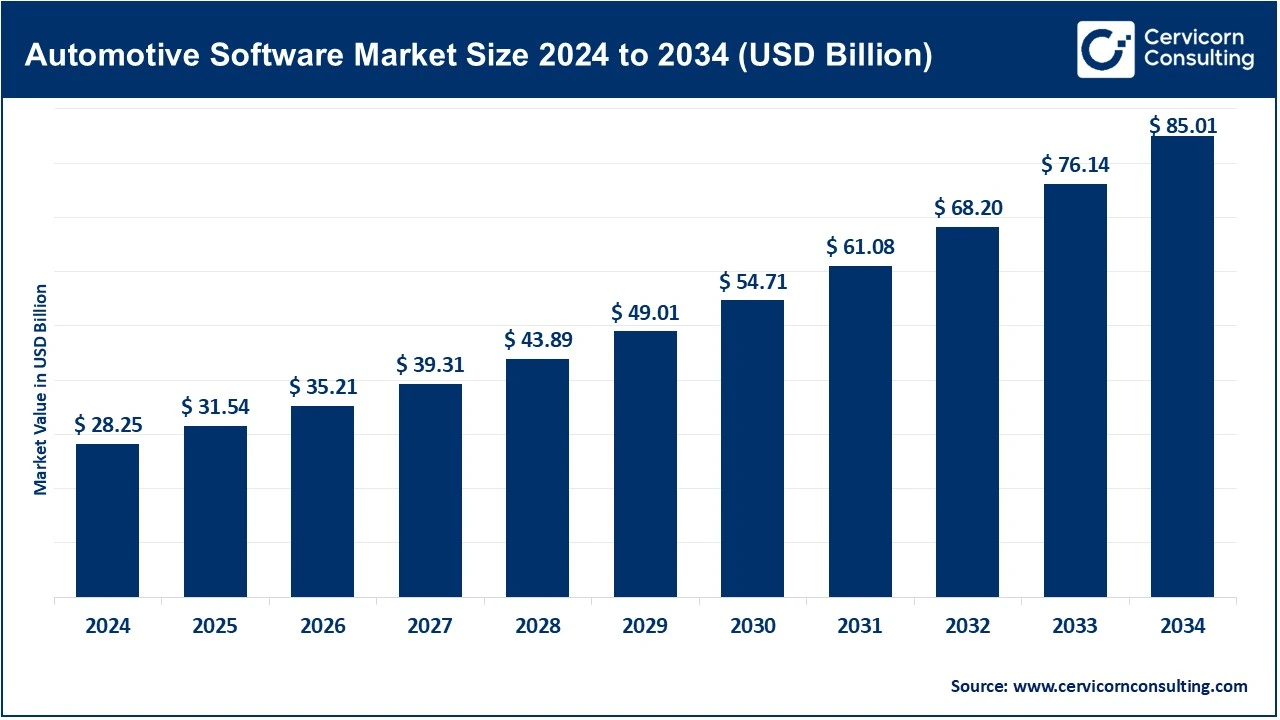

The global automotive software market size was reached at USD 28.25 billion in 2024 and is projected to surpass around USD 85.01 billion by 2034, growing at a compound annual growth rate (CAGR) of 11.65% over the forecast period from 2025 to 2034. The automotive software market is expanding rapidly across the globe. This is largely a result of the demands of industrialization, energy management, and urbanization. Some of the industries that have a stake in this growth include manufacturing, utilities, and commercial infrastructure, and there is a greater emphasis on improving operational efficiency, optimizing performance, and lowering the carbon footprint. There is the use of cutting-edge technologies such as AI automation, digital twins, and other advanced automation processes. The use of government sponsored programs focusing on the adoption of cleaner energy has made the use of automotive software solutions even more prevalent. These solutions are being used in the automotive software energy management and urbanization in automotive software to regulated energy systems.

Real time energy measurement and predictive analytics is delivered through automotive software solutions. IoT-enabled monitoring systems and smart grid–interconnected energy resources provide these capabilities. Automotive software gas meters used in commercial and industrial applications monitor fuel consumption, gas usage forecasting, and emissions monitoring. Software intelligence integration with renewable energy management provides regulatory compliance and promotes ecofriendly energy use. Automotive software is deployed more in modern energy infrastructures and is key for framework monitoring and enforcement, emissions reduction, and environmental measurement.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 31.54 Billion |

| Estimated Market Size in 2034 | USD 85.01 Billion |

| Projected CAGR 2025 to 2034 | 11.65% |

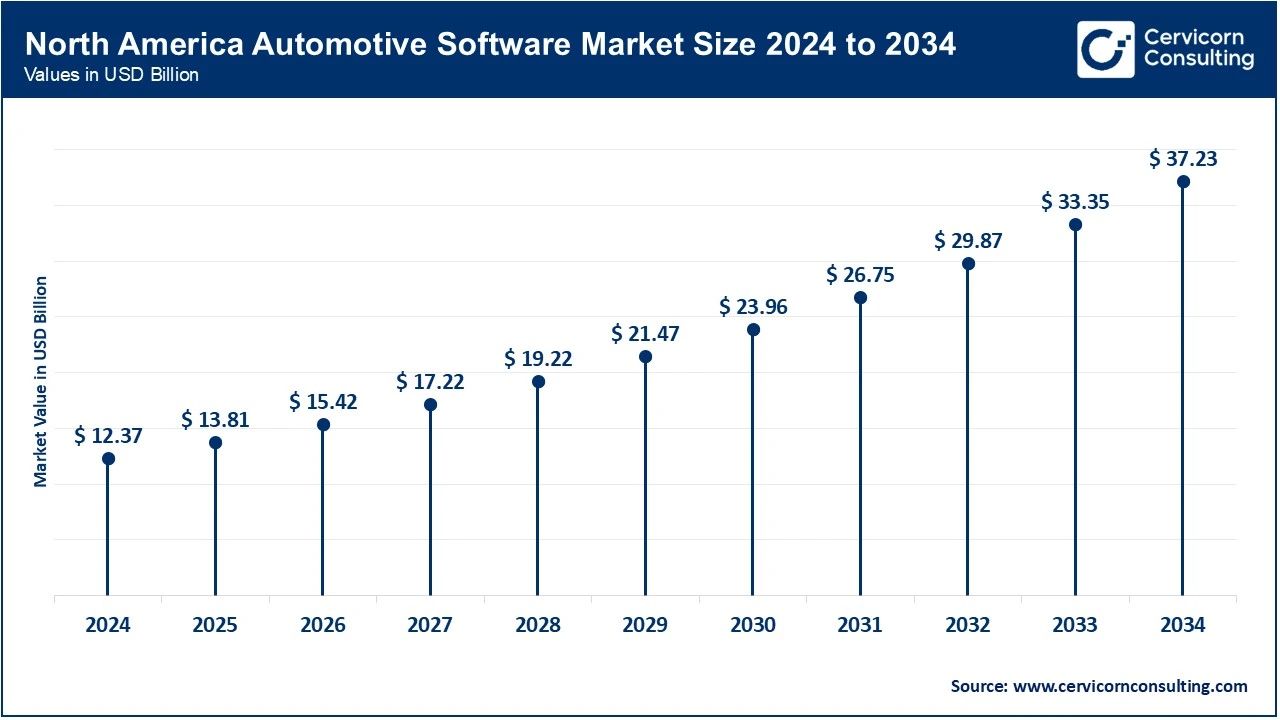

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Solution Type, Technology, Vehicle Type, Product, Propulsion Type, End-User, Deployment, Application, Region |

| Key Companies | Cox Automotive, Microsoft Corporation, SAP SE, CDK Global, Reynolds and Reynolds, Cadence Design Systems, Solera Holdings, Synopsys, PTC Inc., Luxoft, Tata Elxsi, Wayve, TomTom, N-iX |

The automotive software market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

Well-developed industrial infrastructure, use of technology and strict energy regulations are among the reasons that make North America the pioneer in market. In the U.S. and Canada, software is used to implement predictive maintenance and energy optimization and emission monitoring in large industrial plants, commercial facilities, and utility networks. The use of AI analytics, IoT-enabled monitoring, and digital twin improves operational efficiency. The government policies that promote low-carbon and renewable energy technologies also encourage expansion in the market. Close cooperation of utilities and industrial actors with suppliers of technology stimulates innovation. The area is also undertaking hydrogen-prepared and renewable-integrated energy systems.

Europe hit significant growth because of the stringent regulatory environment, and the need to be sustainable. Germany, the U.K, France, and Italy are the countries that have been at the forefront in residential, commercial and industrial deployments. The main areas of interest are energy efficiency, carbon mitigation, and integration with renewable and hydrogen-ready systems. The creation of predictive maintenance and smart energy solutions is promoted by collaborative work of technology vendors, energy companies, and research institutes. Combination of AI, IoT, fuels cells and biogas tracking enhance performance and operational efficiency. Europe remains a pioneer in the adoption of smart metering and low-carbon energy software throughout the world.

Asia-Pacific is the fastest growing market due to high rate of urbanization, industrialization and modernization of the infrastructure. Market expansion depends on China, India, Japan and South Korea that are chief contributors. China puts much emphasis on industrial and district energy projects whereas Japan and South Korea concentrate on commercial energy efficiency. Large-scale energy optimization is supported by the smart city projects, industrial parks and the renewable energy developed in India. The Southeast Asian states such as Vietnam, Thailand and Indonesia are connecting smart meters to renewable systems. Regional adoption is also enhanced by the availability of inexpensive labor, as well as, the increasing investments in solar and renewable energy.

Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 43.80% |

| Europe | 22.70% |

| Asia-Pacific | 28.10% |

| LAMEA | 5.40% |

Automotive software will be adopted in LAMEA due to industrialization, urbanization, and development of infrastructure. Brazil, Mexico, and Argentina are among the major commercial and industrial roll-outs. The UAE and Saudi Arabia in the Middle East are concerned with integrating renewables, hydrogen-blended systems, and the IoT-based solutions. The countries in Africa, localized industrial, commercial, and distributed energy projects are being implemented in the southern, eastern, and western regions. Market penetration is improved through international collaboration as well as modernization efforts. There are infrastructure gaps and regulatory challenges that have potential to grow in the long term. The area also has high potential of adopting smart metering and energy management.

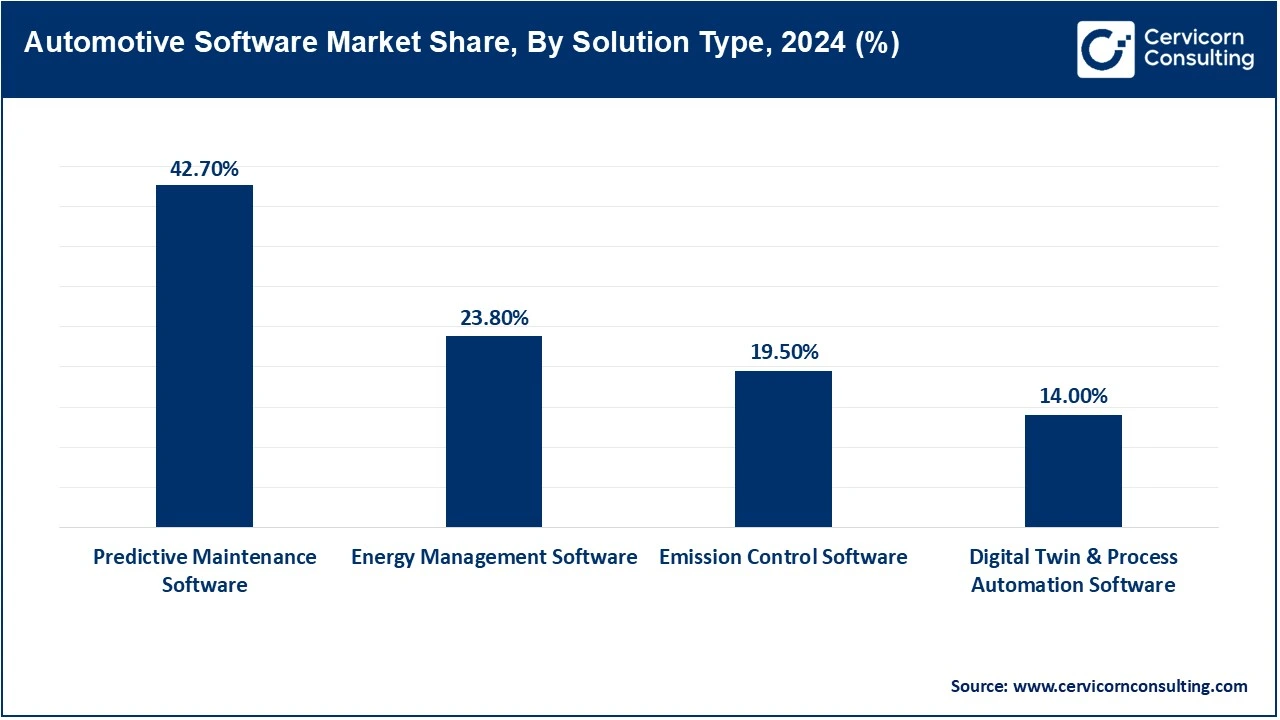

Predictive Maintenance Software: These systems keep a constant watch over vehicles and industrial procedures to foresee breakdowns and set maintenances. AI analytics assist in enhancing performance and minimizing unplanned downtime. Operational efficiency and predictive insights are attained through predictive analytics powered by IoT sensors. Along with scenario planning and simulation, digital twins further extend integration. The offered solutions are mainly adopted in logistics, smart cities, and manufacturing. They extend the lifespan of systems and equipment, resulting in reduced costs.

Energy Management Software: Software solutions monitor, evaluate, and optimize the consumption of energy in industrial and automotive systems. They connect to smart grids and other IoT devices, providing real-time integration. Predictive analytics enables energy load balancing and active control of energy during peak periods. Centralized monitoring and remote control are possible through cloud platforms. These systems assist in managing hybrid systems and renewable energy to realize carbon reduction. The main drivers are cost savings and improvements in energy efficiency.

Emission Control Software: These solutions track and analyze emissions from cars and industry. Emissions control software detects irregularities and coordinates with IoT sensors and AI. Automated and self-adjusting frameworks ensure compliance with environmental emissions standards and track policy adherence. Carbon emissions and process optimization are guided by predictive insights. With the growing adoption of hybrid systems and renewable energy, paired software is more common and advocated in developed markets with strict environmental legislation.

Digital Twin & Process Automation Software: Digital twin software in the automotive and industrial space crafts virtual systems for optimization. AI and IoT interoperability unlock predictive maintenance and operational prowess. These systems simulate processes, hazard detection, and safety enhancements. Smart grid and energy management system connectivity diligence upgrades. Manufacturing, utilities, and smart cities profoundly depend on the systems for downtime and waste elimination. Efforts in systems and processes digitalization promote sustainable practices.

IoT Enabled systems: IoT-equipped automotive software is designed with operational sensors, and industrial equipment. EIoT designed for automotive software to capture operational data in real time. Emission control systems use predictive AI models for maintenance and fault detection. Automated sensors identify and capture energy usage, emissions, and performance benchmarks for operational flows and processes. Efficiency enhancements, resources optimizations, and AI usage are solid complements. Most capture-analytical systems are in urban commercial and industrial smart infrastructures.

AI-Driven Analytics: With the help of AI, analytics software looks at extensive datasets from interconnected systems to identify patterns that assist in predicting future trends, failures, and possible points of optimization. Machine learning models recognize patterns that enhance operational and energy efficiency, while AI, in conjunction with the IoT and cloud integration, improves instantaneous decision-making. AI aids in decreasing downtime and maintenance expenditures while increasing safety in operations. Predictive insights assist in achieving energy and operational efficiency with a focus on low-carbon emissions. The use of AI analytics for operational optimization is an increasing trend in various business sectors globally.

Market Share, By Technology, 2024 (%)

| Technology | Revenue Share, 2024 (%) |

| IoT-enabled Systems | 39.50% |

| AI-driven Analytics | 24.40% |

| Cloud-based Platforms | 21.30% |

| Advanced Metering Infrastructure (AMI) | 14.80% |

Cloud-Based Platforms: Centrally cloud-based software for the automotive and industrial processes offers monitoring and management control. Real-time data offers the potential for predictive maintenance and energy optimization. Facilities and regions of various business sectors are streamlined for security, remote control, and analytical capabilities via enhanced cloud computing. The integration with IoT, AI, and digital twins is a growing trend in smart cities, industrial parks, and energy-intensive sectors to drive operational efficiency.

Advanced Metering Infrastructure (AMI): AMI is able to collect and relay data dynamically, and offers two-way communication for operational energy data collection. Predictive maintenance, IoT monitoring, and digital twins are integrated systems found in AMI in the residential, commercial, and industrial sectors that drive operational efficiency. AMI systems support renewable energy and grids that are ready for hydrogen. These systems cut downtime and enhance energy distribution. AMI systems are very effective in large energy and automotive infrastructure networks.

Manufacturing and Industrial Facilities: In industrial setups, predictive maintenance reduces downtime and improves production continuity. Incorporation of IoT and AI which reduces operational workflows and optimizes energy use is augmented by AI predictive maintenance. Integrating with smart grids promotes demand response and sustainability. Industrial energy software optimizes supply energy consumption, evaluates process efficiency, and tracks emissions. These solutions support low carbon and emissions reduction initiatives. These solutions have notable uptake in industrial centers in North America, Europe, and the Asia Pacific.

Commercial Infrastructure: IoT software energy management systems automate energy consumption and emissions management in offices, hotels, hospitals, and shopping malls. Integration with smart grids and renewable energy systems improves energy management thereby enhancing operational cost efficiency. Predictive and real-time IoT analytics for emissions and consumption facilitate green standards building compliance. Faulty energy systems costs and emissions reduction aid operational cost efficiency. Adoption is noted in the urban centers of the developed world.

Market Share, By End-User, 2024 (%)

| End-User | Revenue Share, 2024 (%) |

| Manufacturing & Industrial Facilities | 45.20% |

| Commercial Infrastructure | 23.60% |

| Utilities & Energy Companies | 17.70% |

| Smart Cities & Urban Infrastructure | 13.50% |

Utilities and Energy Companies: Utility companies implement automotive software for real-time system monitoring, load management, and billing control. Integration of smart meters and AMI systems and AI analytics for demand forecasting and energy allocation improves balances energy distribution and reduces distribution losses. IoT systems track emissions and resources thereby facilitating regulatory compliance. Adoption is noted due to modernization initiatives and government-imposed standards.

Smart Cities & Urban Infrastructure: Cities track and analyze traffic patterns, transportation systems, and even vehicles for emissions from fuel. Cities use Predictive Analytics for Energy Management, Cosumnption Planning and Emission Management. Advanced IoT and AI functionalities provide real-time decision support and help service delivery. Cities use innovative, low carbon and renewable energy technologies to provide energy and services. Emission data, urban-planning, and sustainability frameworks use Predictive Analytics to provide effective Planning Model and Framework. Europe, Asia Pacific, and North America show increased adoption of predictive analytics.

On-Premise: Local installations provide software solutions that allow direct command over data and analytics, and facilitate predictive maintenance and emission analysis. On-premise systems are mandatory for installations where data security is a concern. IoT and Industrial equipment integration boost operational maintenance. Internal IT staff is required for maintenance and upgrades. These systems are common in large industrial and manufacturing setups.

Market Share, By Deployment, 2024 (%)

| Deployment | Revenue Share, 2024 (%) |

| On-Premise | 48.70% |

| Cloud / SaaS | 51.30% |

Cloud/SaaS: Information can be retrieved, and systems can be controlled from any geographical point via Cloud access. Predictive maintenance and process optimization is instantaneous in real-time analytics. AI, IoT, and Digital Twin Technology Integration advancement Cloud and Diven services. Contracting Cloud services creates competitive advantage of reduced operational and IT infrastructure costs. Cloud SaaS widely supports multi-site operations and smart city applications. Rapid Deployment and Flexibility are the main reasons for growing adoption.

Market Segmentation

By Solution Type

By Technology

By Vehicle Type

By Application

By Product

By End-User

By Deployment

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Automotive Software

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Solution Type Overview

2.2.3 By Vehicle Type Overview

2.2.4 By Product Overview

2.2.5 By Deployment Overview

2.2.6 By Application Overview

2.2.7 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Global Demand for Energy in Industries and Businesses

4.1.1.2 Reducing Carbon in Energy

4.1.2 Market Restraints

4.1.2.1 Substantial Initial Outlay and Operation Expenses

4.1.2.2 Regulatory Pressures and Compliance

4.1.3 Market Challenges

4.1.3.1 Vulnerable Supply Chains

4.1.3.2 Technological Complexity and Lack of Skilled Workforce

4.1.4 Market Opportunities

4.1.4.1 Integration with Renewable Energy and IoT Platforms

4.1.4.2 Expansion in Emerging Markets

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Automotive Software Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Automotive Software Market, By Technology

6.1 Global Automotive Software Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 IoT-enabled Systems

6.1.1.2 AI-driven Analytics

6.1.1.3 Cloud-based Platforms

6.1.1.4 Advanced Metering Infrastructure (AMI)

Chapter 7. Automotive Software Market, By Solution Type

7.1 Global Automotive Software Market Snapshot, By Solution Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Predictive Maintenance Software

7.1.1.2 Energy Management Software

7.1.1.3 Emission Control Software

7.1.1.4 Digital Twin & Process Automation Software

7.1.1.5 Hybrid Vessels

Chapter 8. Automotive Software Market, By Product

8.1 Global Automotive Software Market Snapshot, By Product

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 OS

8.1.1.2 Middleware

8.1.1.3 Software Application

Chapter 9. Automotive Software Market, By Propulsion Type

9.1 Global Automotive Software Market Snapshot, By Propulsion Type

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 ICE

9.1.1.2 EV

Chapter 10. Automotive Software Market, By Deployment

10.1 Global Automotive Software Market Snapshot, By Deployment

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 On-Premise

10.1.1.2 Cloud / SaaS

Chapter 11. Automotive Software Market, By Deployment

11.1 Global Automotive Software Market Snapshot, By Deployment

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Passenger Vehicles

11.1.1.2 Commercial Vehicles

Chapter 12. Automotive Software Market, By Application

12.1 Global Automotive Software Market Snapshot, By Application

12.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

12.1.1.1 ADAS & Safety

12.1.1.2 Infotainment

12.1.1.3 Navigation

12.1.1.4 Autonomous Driving

12.1.1.5 Engine & Transmission

12.1.1.6 Smart Diagnostics & Predictive Maintenance

12.1.1.7 In-car Voice Assistance

12.1.1.8 Connectivity

12.1.1.9 Others

Chapter 13. Automotive Software Market, By End-User

13.1 Global Automotive Software Market Snapshot, By End-User

13.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

13.1.1.1 Manufacturing & Industrial Facilities

13.1.1.2 Commercial Infrastructure

13.1.1.3 Utilities & Energy Companies

13.1.1.4 Smart Cities & Urban Infrastructure

Chapter 14. Automotive Software Market, By Region

14.1 Overview

14.2 Automotive Software Market Revenue Share, By Region 2024 (%)

14.3 Global Automotive Software Market, By Region

14.3.1 Market Size and Forecast

14.4 North America

14.4.1 North America Automotive Software Market Revenue, 2022-2034 ($Billion)

14.4.2 Market Size and Forecast

14.4.3 North America Automotive Software Market, By Country

14.4.4 U.S.

14.4.4.1 U.S. Automotive Software Market Revenue, 2022-2034 ($Billion)

14.4.4.2 Market Size and Forecast

14.4.4.3 U.S. Market Segmental Analysis

14.4.5 Canada

14.4.5.1 Canada Automotive Software Market Revenue, 2022-2034 ($Billion)

14.4.5.2 Market Size and Forecast

14.4.5.3 Canada Market Segmental Analysis

14.4.6 Mexico

14.4.6.1 Mexico Automotive Software Market Revenue, 2022-2034 ($Billion)

14.4.6.2 Market Size and Forecast

14.4.6.3 Mexico Market Segmental Analysis

14.5 Europe

14.5.1 Europe Automotive Software Market Revenue, 2022-2034 ($Billion)

14.5.2 Market Size and Forecast

14.5.3 Europe Automotive Software Market, By Country

14.5.4 UK

14.5.4.1 UK Automotive Software Market Revenue, 2022-2034 ($Billion)

14.5.4.2 Market Size and Forecast

14.5.4.3 UKMarket Segmental Analysis

14.5.5 France

14.5.5.1 France Automotive Software Market Revenue, 2022-2034 ($Billion)

14.5.5.2 Market Size and Forecast

14.5.5.3 FranceMarket Segmental Analysis

14.5.6 Germany

14.5.6.1 Germany Automotive Software Market Revenue, 2022-2034 ($Billion)

14.5.6.2 Market Size and Forecast

14.5.6.3 GermanyMarket Segmental Analysis

14.5.7 Rest of Europe

14.5.7.1 Rest of Europe Automotive Software Market Revenue, 2022-2034 ($Billion)

14.5.7.2 Market Size and Forecast

14.5.7.3 Rest of EuropeMarket Segmental Analysis

14.6 Asia Pacific

14.6.1 Asia Pacific Automotive Software Market Revenue, 2022-2034 ($Billion)

14.6.2 Market Size and Forecast

14.6.3 Asia Pacific Automotive Software Market, By Country

14.6.4 China

14.6.4.1 China Automotive Software Market Revenue, 2022-2034 ($Billion)

14.6.4.2 Market Size and Forecast

14.6.4.3 ChinaMarket Segmental Analysis

14.6.5 Japan

14.6.5.1 Japan Automotive Software Market Revenue, 2022-2034 ($Billion)

14.6.5.2 Market Size and Forecast

14.6.5.3 JapanMarket Segmental Analysis

14.6.6 India

14.6.6.1 India Automotive Software Market Revenue, 2022-2034 ($Billion)

14.6.6.2 Market Size and Forecast

14.6.6.3 IndiaMarket Segmental Analysis

14.6.7 Australia

14.6.7.1 Australia Automotive Software Market Revenue, 2022-2034 ($Billion)

14.6.7.2 Market Size and Forecast

14.6.7.3 AustraliaMarket Segmental Analysis

14.6.8 Rest of Asia Pacific

14.6.8.1 Rest of Asia Pacific Automotive Software Market Revenue, 2022-2034 ($Billion)

14.6.8.2 Market Size and Forecast

14.6.8.3 Rest of Asia PacificMarket Segmental Analysis

14.7 LAMEA

14.7.1 LAMEA Automotive Software Market Revenue, 2022-2034 ($Billion)

14.7.2 Market Size and Forecast

14.7.3 LAMEA Automotive Software Market, By Country

14.7.4 GCC

14.7.4.1 GCC Automotive Software Market Revenue, 2022-2034 ($Billion)

14.7.4.2 Market Size and Forecast

14.7.4.3 GCCMarket Segmental Analysis

14.7.5 Africa

14.7.5.1 Africa Automotive Software Market Revenue, 2022-2034 ($Billion)

14.7.5.2 Market Size and Forecast

14.7.5.3 AfricaMarket Segmental Analysis

14.7.6 Brazil

14.7.6.1 Brazil Automotive Software Market Revenue, 2022-2034 ($Billion)

14.7.6.2 Market Size and Forecast

14.7.6.3 BrazilMarket Segmental Analysis

14.7.7 Rest of LAMEA

14.7.7.1 Rest of LAMEA Automotive Software Market Revenue, 2022-2034 ($Billion)

14.7.7.2 Market Size and Forecast

14.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 15. Competitive Landscape

15.1 Competitor Strategic Analysis

15.1.1 Top Player Positioning/Market Share Analysis

15.1.2 Top Winning Strategies, By Company, 2022-2024

15.1.3 Competitive Analysis By Revenue, 2022-2024

15.2 Recent Developments by the Market Contributors (2024)

Chapter 16. Company Profiles

16.1 Cox Automotive

16.1.1 Company Snapshot

16.1.2 Company and Business Overview

16.1.3 Financial KPIs

16.1.4 Product/Service Portfolio

16.1.5 Strategic Growth

16.1.6 Global Footprints

16.1.7 Recent Development

16.1.8 SWOT Analysis

16.2 Microsoft Corporation

16.3 SAP SE

16.4 CDK Global

16.5 Reynolds and Reynolds

16.6 Dassault Systèmes

16.7 Cadence Design Systems

16.8 Solera Holdings

16.9 Synopsys

16.10 PTC Inc.

16.11 Luxoft

16.12 Tata Elxsi

16.13 Wayve

16.14 TomTom

16.15 N-iX