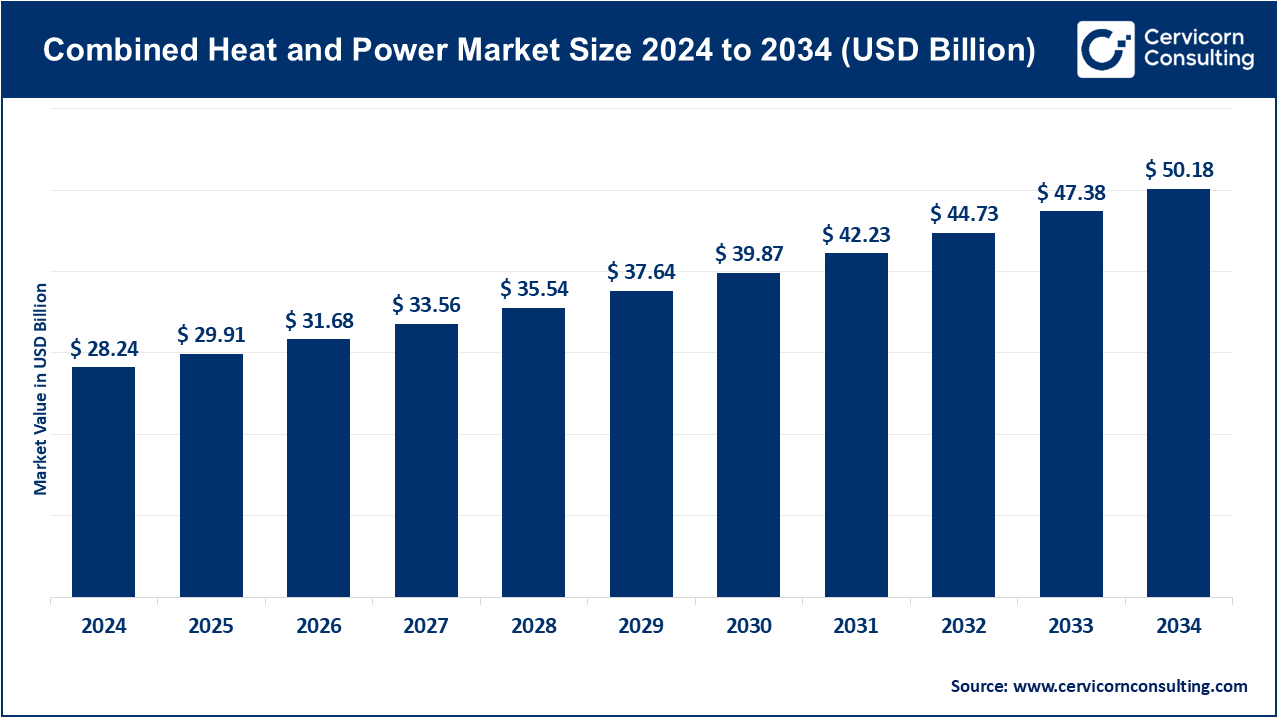

The global combined heat and power market size was estimated at USD 28.24 billion in 2024 and is expected to surpass around USD 50.18 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.92% over the forecast period from 2025 to 2034. The combined heat and power market is driven by high industrialization, urbanization, as well as the increasing demands in efficient and dependable energy initiatives in industries like manufacturing, chemicals and commercial infrastructures. The use of automation and AI-controlled systems, as well as digital twins, is improving operational efficiency, performance optimization, and carbon emissions are reduced significantly. CHP is being championed as an essential component of the global energy transition as governments all over the world support the shift to cleaner energy sources using incentives, renewable energy targets and waste-to-energy and low-carbon projects.

Meanwhile, industry coordination through the combination of IoT-driven monitoring systems and smart grid connectivity is assisting industries to realize real time energy control, enabled maintenance as well as fuel optimization. The major players are spending on hybrid CHP systems and renewable-integrated solutions in order to meet the tougher environmental conservation regulations and sustainability objectives. As a result, the combined heat and power market is transforming into a digital and low-carbon innovativeness-led ecosystem which is becoming one of the pillars of the contemporary energy infrastructure aimed at efficiency, resilience and sustainability.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 29.91 Billion |

| Estimated Market Size in 2034 | USD 50.18 Billion |

| Projected CAGR | 5.92% |

| Domiant Region | Asia-Pacific |

| Key Segments | Technology, Fuel Type, Capacity, Application, Region |

| Key Companies | 2G Energy Inc., General Electric Company, Aegis Energy Services Inc., Caterpillar Inc., Curtis Engine & Equipment Co. Inc., Yanmar America Corp, Siemens Energy AG, Bosch Thermotechnology GmbH, Viessmann Werke Group GmbH & Co. KG, Mitsubishi Heavy Industries Ltd. |

The combined heat and power market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

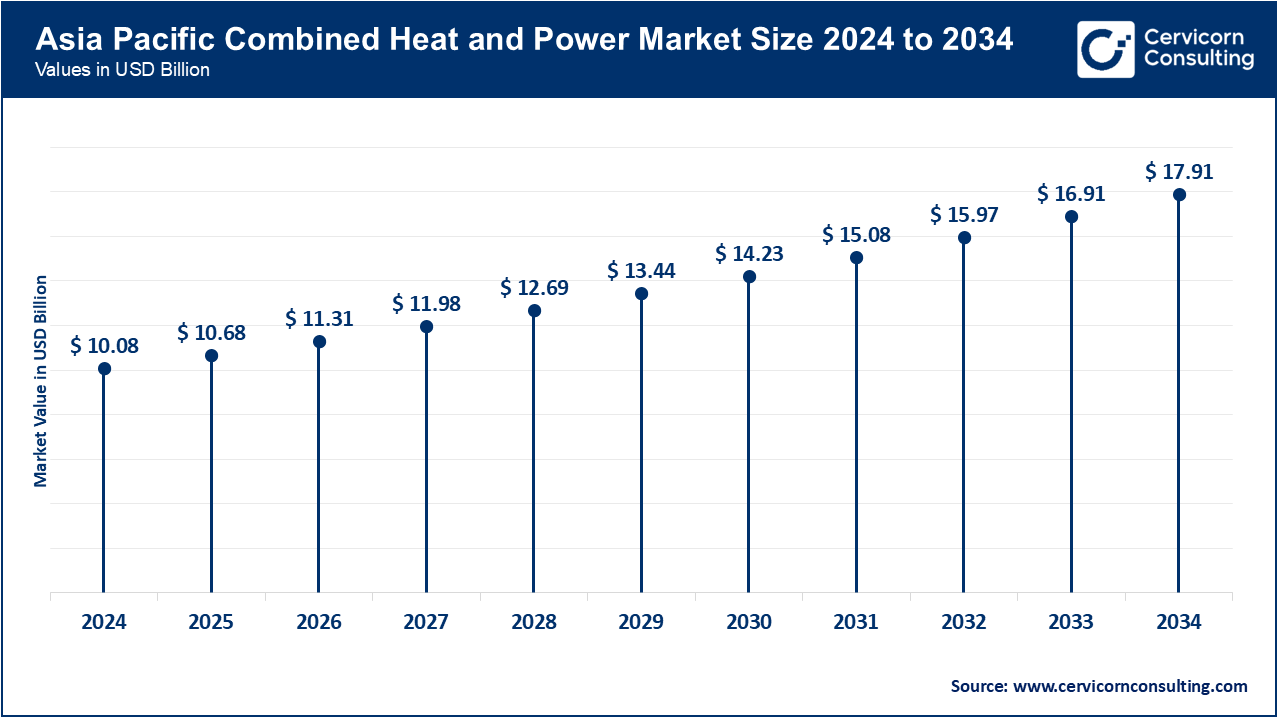

The Asia-Pacific region is the fastest-growing CHP market because of rapid urbanization, industrialization, and infrastructure development. China, India, Japan, and South Korea are the largest producers and consumers, and together account for most of the world's CHP capacity. China is focusing on large district energy and industrial CHP projects. Japan and South Korea are focusing on energy-efficient commercial and industrial CHP systems. Strong demand is coming from India in the smart city programs, railways, and renewable energy projects. Countries in Southeast Asia, such as Vietnam, Thailand, and Indonesia, are also making investments in conventional and renewable CHP. The vast amount of raw materials and labor in the region, along with rising investments in green energy infrastructure, give the region great potential for growth.

North America’s robust industrial structure, technology use, and orderly manufacturing systems make it a global leader for CHP. Large-scale industrial infrastructures, district energy systems, and modern CHP plants offering stable production and distribution are found in the U.S. and Canada. Sustainable energy projects, for example, fuel cell CHP, waste heat recovery, and hybrid gas turbine systems, receive strong venture capital attention. Powerful digital monitoring systems, AI-based energy regulation, and predictive maintenance enhance efficiency and reduce emissions. Government incentives and policies supporting the growth of low-carbon technology are also very positive for the market. The strategic partnerships formed between industrial users, utilities, and technology providers are a testimony to North America’s renewed respect for the potential in CHP.

Various countries in Europe have adopted highly favorable regulations and policies around market construction of CHP frameworks and systems. Germany, the U.K., France, and Italy have also taken the lead in the development of hydrogen-based CHP systems, as well as carbon footprint-reducing biomass and electric microturbine systems. In industrial and commercial installations, the emphasis on energy efficiency have centered around energy conservation, lifecycle efficiency, and low-emission technologies. Strategic partnerships for the integration of digital reliability and optimization systems with non-CHP renewable energy systems aids with the fuel conservation and renewable energy blending. Robust investments continue to drive market and eco-innovation in Europe as fuel cells and reciprocating engine CHP systems become enhanced. Europe is also the world’s most advanced in eco-CHP and eco energy solution systems.

Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 25.30% |

| Europe | 29.90% |

| Asia-Pacific | 35.70% |

| LAMEA | 9.10% |

The primary drivers of Industrialization, urbanization, and construction of new infrastructure make LAMEA a likely candidate for CHP technology. Brazil, Mexico, and Argentina have active commercial and industrial projects alongside energy projects, making them frontrunners in Latin America. Countries like the UAE and Saudi Arabia in the Middle East have made investments in sustainable energy like fuel cell CHP and waste heat recovery. In Africa, the Southern, East and West regions have localized CHP projects. International collaborations, modernization of the energy infrastructure, and the introduction of affordable CHP technology have made localized industrial commercial energy plants, and distributed energy resources in LAMEA regions possible. The LAMEA region has CHPs deployment development goals, and gap in infrastructure and the regulations on the books and in practice make the region the most likely region for development in the use of CHP technology.

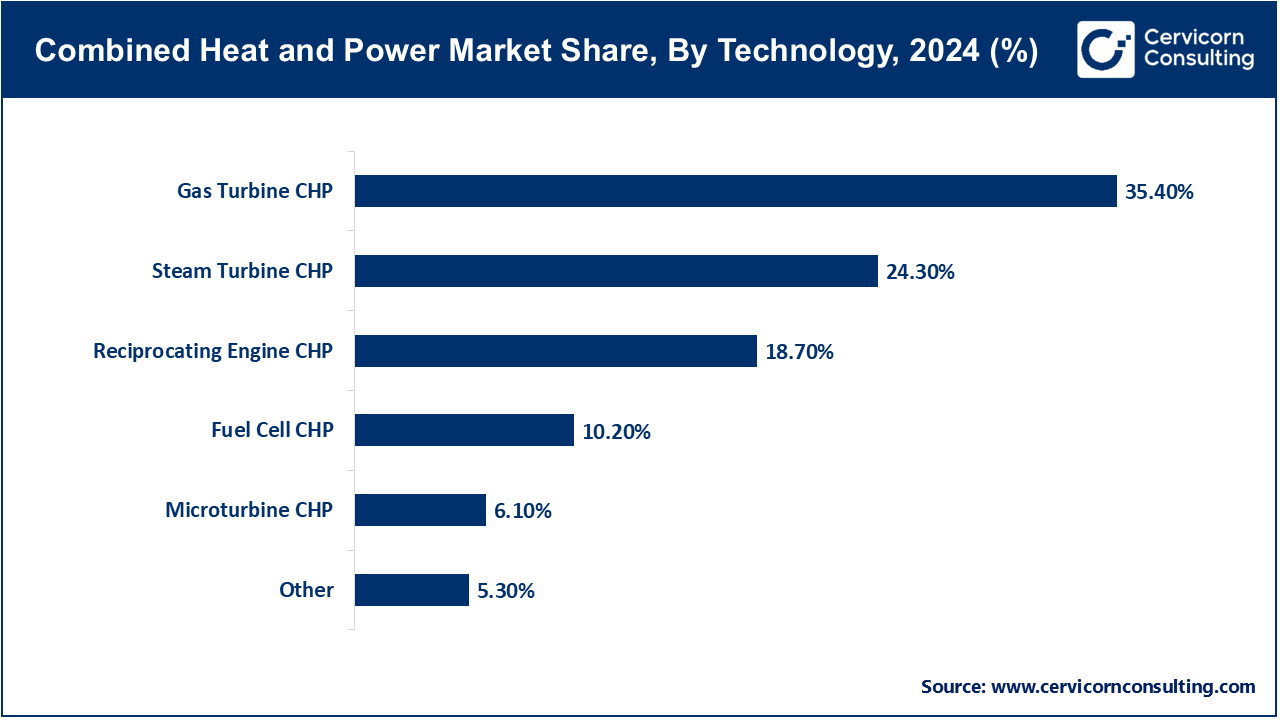

Gas turbine Combined: This systems use natural gas and other fuels to power gas turbines, which are then connected to generators to produce electricity and capture exhaust for heating. These systems are growing in use in industrial plants power electricity and have moderate power heat requirements. Gas turbines are efficient, have quick start-up times, and are appropriate for large applications. Innovations such as AI-based energy management systems aimed at optimizing performance and minimizing emissions are becoming common. The gas turbine CHP systems are being coupled to renewable biofuels for more eco-friendly gas turbine CHP systems. Gas turbines are an excellent option for uninterrupted power to industrial plants.

Steam turbine CHP: This systems generate electricity and heat for industrial use with the steam produced in boilers. These systems are mainly used in the chemical, paper, and food processing industries which have high process steam requirements. Steam turbines are flexible with the fuels they can use and have high-capacity electricity generation. There is a growing trend to change steam turbines to use low-carbon fuels and improved thermal efficiency. These systems are used extensively in industrial energy.

Reciprocating Engine CHP: Reciprocating Engine CHP systems utilize large internal combustion engines to drive generators while recovering waste heat for heating or other process applications. This system is frequently used for decentralized power generation in commercial buildings and small industries, and works best in situations where variable electricity demand is present. The system is also low-cost, high efficiency at part-load and flexible in operation. Innovative technology integration, such as hybridization with battery storage and IoT-enabled predictive maintenance, have system adaptability and flexibility as a key factor for Reciprocating Engine CHP systems. This explains the popularity of Reciprocating Engine CHP systems for medium-scale energy projects.

Fuel Cell CHP: Fuel Cell Combined Heat and Power (CHP) Systems utilize electrochemical processed to convert chemical energy to electricity while simultaneously producing heat as a byproduct. Fuel Cell CHP Systems are increasingly being used in the residential, commercial, and institutional sectors due to their high efficiency and low emissions. Hydrogen-fueled fuel cells offer a means of further decarbonizing energy supply, and innovations in solid oxide as well as proton-exchange membrane fuel cells have made them more reliable. This technology operates quietly, with no immediate emissions, and is therefore suitable for use in areas with stringent environmental regulations. The expected growth of fuel cell CHP systems as an emerging technology is directly correlated to the adoption of global green hydrogen infrastructure.

Microturbine CHP. Microturbine CHP installs small-scale turbines that simultaneously produce electricity and capture waste heat. It is favored for distributed generation in small industrial and commercial applications. Their compactness, ease in maintenance, and compatibility with biogas and other fuels make Microturbines a good option. Their integration with renewable biogas and energy storage systems further enhances flexibility. They capture waste heat which can be used for space heating or hot water, improving overall efficiency. LTE-M and NBIoT connectivity can be used for automated optimal operational monitoring, fault prediction, and fault diagnostics. They are especially popular in urban and off-grid energy projects, driven by distributed generation and remote IoT power systems.

Natural Gas: Due to its dominance by methane-rich composition, natural gas is the most common fuel for CHP systems. It is used because of its availability, lower emissions compared to coal, and efficiency in electricity and heat generation. The major consumers of natural gas are industries, commercial buildings, and district heating networks. The focus of technological innovation to gas has been the integration of renewables as a way to reduce carbon gas emissions. Gas-based CHP systems have predictable carbon emissions and are able to respond quickly to gas and heating demand which allows natural gas to be used in regions with natural gas infrastructure. This ability helps CHP systems to expand globally.

Biomass: Biomass fuel sources for steam or engine-driven CHP consist of wood chips, agricultural residues, and energy crops. In renewable energy and circular economy initiatives, biomass's appeal is growing. Biomass, if sustainably sourced, is not only carbon-neutral but also adaptable to steam turbines and reciprocating engines. Innovations include automated feeding systems and densified biomass pellets. Biomass CHP reduces reliance on fossil fuels and meets the energy needs of rural communities. Biomass CHP adoption is encouraged by government incentives.

Market Share, By Fuel Type, 2024 (%)

| Fuel Type | Revenue Share, 2024 (%) |

| Natural Gas | 56% |

| Biomass | 14% |

| Coal | 11% |

| Biogas | 9% |

| Waste Heat Recovery | 6% |

| Others | 4% |

Coal: Traditionally, coal-fired CHP is used in large industrial plants and district heating projects. Due to environmental regulations and high carbon emissions, the use of coal is declining. As a transition strategy, co-firing with biomass or natural gas is used to reduce pollution. Some industries still use coal because of high heat output and reliability, but advanced emission control technologies are in place to meet sustainability goals. The coal-based CHP market is gradually shifting to low-carbon alternatives.

Biogas: The production of biogas combined heat and power (CHP) systems utilizes methane gas produced during anaerobic digestion of organic waste. The technology is gaining prevalence in the agricultural sector, waste management, and decentralized energy. Biogas is renewable, reduces emissions from landfills, and is contributive to energy circularity. The technology used for biogas CHP systems is mainly microturbines and reciprocating engines. The use of IoT to track and monitor systems aids in optimization, performance, and reduction of downtime. Biogas CHP systems are developed in line with the global increase in waste-to-energy technology.

Waste Heat Recovery: Waste heat recovery systems generate power and thermal energy from residual heat of industrial processes or from exhaust gases. This technology improves energy efficiency and lowers emissions by reducing fuel demand. The steel, cement, and chemical industries are the main sector adopters of this technology. The integration of energy recovery systems with steel production from electric arc furnaces (EAF) or high-temperature processes optimizes energy use. Predictive maintenance within smart energy management systems improves the reliability of the system. Waste heat recovery systems are used more in both new and retrofitted industrial plants.

Industrial: Industrial CHP is used in manufacturing, steel, chemical, paper, and food processing plants. These sectors demand large, continuous electricity and process heat. CHP reduces energy costs, improves reliability, and supports sustainability targets. AI optimization and predictive maintenance in CHPs focus on efficiency. Industrial CHPs are recapturing and utilizing waste heat. The level of waste heat integration improves the energy efficiency of the entire country.

Commercial: Commercial CHP provides electricity, heating, and cooling to office buildings, shopping centers, hospitals, and hotels. Expansion of this market is seen primarily in the developed world due to the reliability of energy and the demand for green building certifications. Utility cost savings, energy reliability, and security are major business drivers for investing in CHP. Along with renewables, commercial systems significantly enhance the sustainability of the businesses. Active monitoring and predictive analytics focus on renewables, and sustainability drive commercial CHP systems. Commercial building CHP adoption is rapidly expanding in urban areas of the world.

Market Share, By Capacity, 2024 (%)

| Capacity | Revenue Share, 2024 (%) |

| Industrial | 45.70% |

| Commercial | 27.60% |

| Residential | 14.50% |

| Institutional | 12.20% |

Residential: Residential CHP serves apartment complexes or individual homes, providing electricity and hot water or space heating. These systems reduce electricity bills and ensure backup heating during grid outages. Micro-CHP units are compact and suitable for urban areas with high energy costs. Integration with solar PV or energy storage enhances efficiency. IoT monitoring allows homeowners to track performance and maintenance needs. The residential CHP market is growing in Europe and Asia due to energy efficiency incentives.

Institutional: Institutional CHP is installed in universities, hospitals, government facilities, and research centers. It provides stable electricity and heating while lowering operational costs and emissions. The systems are designed for resilience and energy reliability. Advanced monitoring ensures optimal performance and reduces downtime. Hydrogen-ready and low-emission fuels are being explored for institutional CHP. Institutions increasingly prioritize CHP for sustainability and net-zero commitments.

Market Segmentation

By Technology

By Fuel Type

By Capacity

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Combined Heat and Power

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Fuel Type Overview

2.2.3 By Application Overview

2.2.4 By Capacity Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Industrial and Commercial Energy

4.1.1.2 Switch to Low-carbon and renewable energy

4.1.2 Market Restraints

4.1.2.1 Expensive Capitals and Operation Costs

4.1.2.2 Regulatory and Compliance Pressures

4.1.3 Market Challenges

4.1.3.1 Supply Chain Vulnerabilities

4.1.3.2 Technological Complexity and Skills Gap

4.1.4 Market Opportunities

4.1.4.1 Combination with Renewable and Hydrogen-Based Energy

4.1.4.2 Expansion in Emerging Markets

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Combined Heat and Power Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Combined Heat and Power Market, By Technology

6.1 Global Combined Heat and Power Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Gas Turbine CHP

6.1.1.2 Steam Turbine CHP

6.1.1.3 Reciprocating Engine CHP

6.1.1.4 Fuel Cell CHP

6.1.1.5 Microturbine CHP

6.1.1.6 Others

Chapter 7. Combined Heat and Power Market, By Fuel Type

7.1 Global Combined Heat and Power Market Snapshot, By Fuel Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Natural Gas

7.1.1.2 Biomass

7.1.1.3 Coal

7.1.1.4 Biogas

7.1.1.5 Nuclear

7.1.1.6 Diesel

7.1.1.7 Waste Heat Recovery

7.1.1.8 Others

Chapter 8. Combined Heat and Power Market, By Application

8.1 Global Combined Heat and Power Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Industrial

8.1.1.2 Commercial

8.1.1.3 Residential

8.1.1.4 Institutional

Chapter 9. Combined Heat and Power Market, By Capacity

9.1 Global Combined Heat and Power Market Snapshot, By Capacity

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Up to 10 MW

9.1.1.2 11-150 MW

9.1.1.3 151-300 MW

9.1.1.4 Above 300 MW

Chapter 10. Combined Heat and Power Market, By Region

10.1 Overview

10.2 Combined Heat and Power Market Revenue Share, By Region 2024 (%)

10.3 Global Combined Heat and Power Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Combined Heat and Power Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Combined Heat and Power Market, By Country

10.5.4 UK

10.5.4.1 UK Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Combined Heat and Power Market, By Country

10.6.4 China

10.6.4.1 China Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Combined Heat and Power Market, By Country

10.7.4 GCC

10.7.4.1 GCC Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Combined Heat and Power Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 2G Energy Inc.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 General Electric Company

12.3 Aegis Energy Services Inc.

12.4 Caterpillar Inc.

12.5 Curtis Engine & Equipment Co. Inc.

12.6 Yanmar America Corp

12.7 Siemens Energy AG

12.8 Bosch Thermotechnology GmbH

12.9 Viessmann Werke Group GmbH & Co. KG

12.10 Mitsubishi Heavy Industries Ltd.