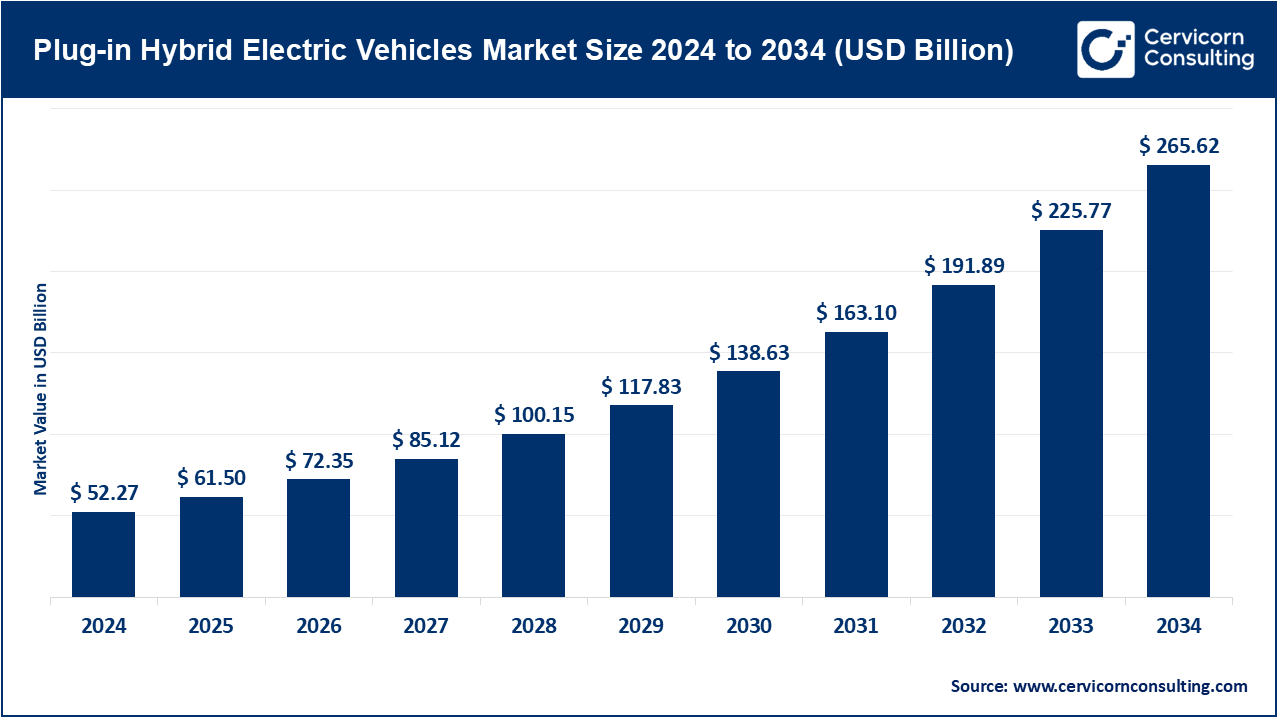

The global plug-in hybrid electric vehicles market size was valued at USD 52.27 billion in 2024 and is anticipated to reach around USD 265.62 billion by 2034, growing at a compound annual growth rate (CAGR) of 17.65% over the forecast period from 2025 to 2034. The plug-in hybrid electric vehicles (PHEVs) are growing in popularity because of the need for cleaner, more fuel-efficient modes of transportation, tougher emission regulations, and government subsidies. From user experience to performance, automotive manufacturers are focusing on improved range and distributed investments in advanced batteries, strongly efficient powertrains, and modern, connected vehicle systems. Enhanced market growth is supported by the building of charging infrastructures and growing consumer sensitivity to sustainable practices.

Operational efficiency, cost-effectiveness, and consumer convenience are driven by the digital technologies of AI-based energy management, predictive maintenance, and vehicle-to-grid integration. Ongoing investments in R&D, the pivot to electrified mobility, and strategic partnerships between manufacturers and tech firms provide considerable momentum for the market growth of PHEVs in the coming years.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 61.50 Billion |

| Estimated Market Size in 2034 | USD 265.62 Billion |

| Projected CAGR 2025 to 2034 | 17.65% |

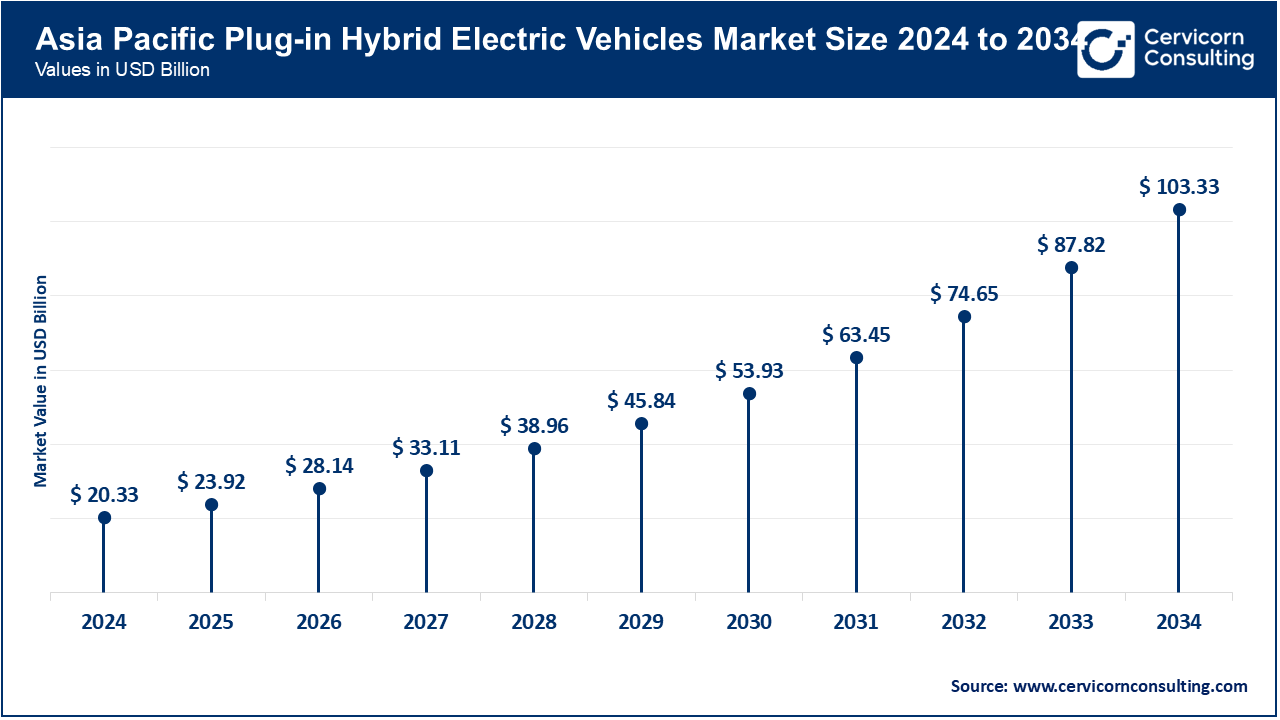

| Dominant Region | Asia-Pacific |

| Key Segments | Vehicle Type, Propulsion, Battery Capacity, Charging Mode, Region |

| Key Companies | BYD Company Ltd., Tesla, Inc., BMW Group, Mercedes-Benz Group AG, Ford Motor Company, General Motors, Volkswagen Group, Toyota Motor Corporation, Kia Corporation, Chrysler (Stellantis Group) |

The PHEV market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

The Asia-Pacific is one of the fastest-growing in the world. PHEV adoption is led by Japan, China, South Korea, and India. China has the largest PHEV market in the region and offers the most aggressive government incentives, expanding EV charging infrastructure, and development of public-private partnerships. Japan is focused on urban mobility and fleet electrification, while South Korea targets smart city integration and next-generation batteries. India is currently building PHEV infrastructure and urban EV policies. In Southeast Asia, Thailand, Indonesia, and Vietnam are improving their transportation and energy systems to support electric mobility.

North America hit notable growth, due to the advanced automotive market, high consumer adoption of electrified vehicles, R&D investments, and government incentives on electrified mobility and emission reduction, along with the expansion of DC fast charging networks. Mid 2023, over 60% of hybrid and plug PHEVs vehicles are sold in the US with Stellantis, Ford, and Tesla all expanding into the PHEV market. Canada is also seeing the electrification of fleets in the logistics industry. Increased urban sustainability, along with consumer awareness and strong support of urban sprawl, bolstered of sustainability programs, are driving the rapid adoption of PHEV in North America.

Europe is the second largest PHEV market. Strict emission regulations, abundant charging infrastructure, and government regulated subsidies all fuel the expansion of the PHEV market. Germany, UK, and France are providing incentives, tax benefits, and urban low emission zones to promote the electrification of private and fleet vehicles. The PHEV Luxology market is expanding with new releases by major German automotive manufacturers to meet the needs of the market with new PHEV models, including sedans, SUVS, and luxury vehicles. The European focus on smart city plans and the integration of new sustainable development fuels and renewable energy also drives the mobility market.

PHEVs Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 22.40% |

| Europe | 31.50% |

| Asia-Pacific | 38.90% |

| LAMEA | 7.20% |

The LAMEA is emerging region, driven by urbanization, compensation, and government initiatives promoting clean transportation. Sub-Saharan Africa, specifically Brazil, South Africa, and the UAE, are early adopters. Regional collaborations with global automakers and technology providers are increasing access to advanced hybrid vehicles. Investments in charging infrastructure and public-private partnerships are expected to accelerate adoption, making LAMEA a key growth region for PHEVs post-2026.

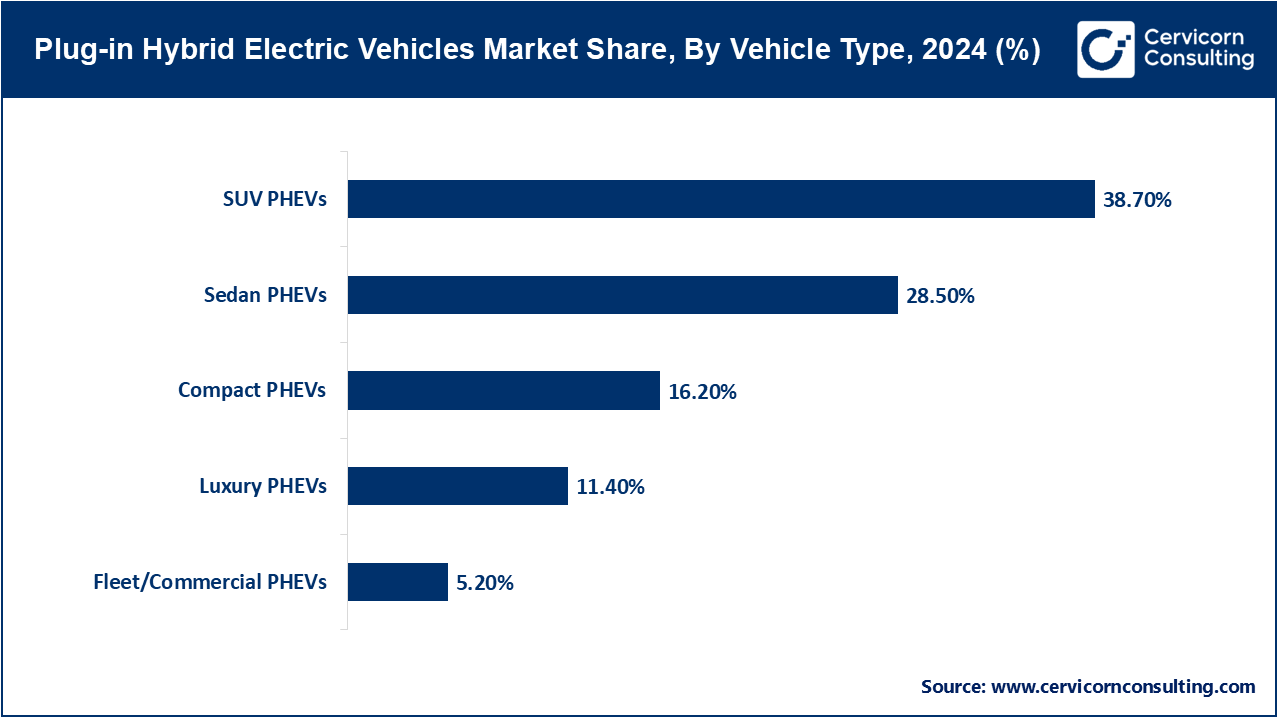

Compact PHEVs: Designed mainly for city commuters, compact plug-in hybrid vehicles help tackle urban traffic congestion and provide affordable city travel. In Europe and Asia, compact PHEVs have also become more common due to congestion and limited parking. These vehicles are enhanced to be more energy-efficient and to have improved electric-only driving ranges. Toyota, Honda, and BYD are among the manufacturers that improved efficiency by also building the batteries to be more lightweight to provide better electric-only ranges. PHEVs are purchased by urban cost-sensitive customers and first-time EV buyers. These buyers are looking for cost-effective electronics to help with their travel while also being environmentally friendly.

Sedan PHEVs: With the most balanced performance, comfort, and efficiency, sedan PHEVs are most fitting for corporate fleets and private users. Targeting commuters with longer travel distances, BMW, Hyundai, and Kia PHEVs released by mid-2025 with a range of 60-100 km. Many users smart energy management systems that enable users to optimize the energy in the battery, schedule predictive maintenance, and make home charging work with PHEV charging. These vehicles are also popular in Europe and North America due to government policies and emission regulations.

SUV PHEVs: The PHEV market is seeing growth in the SUV segment. This is because many consumers prefer larger, more versatile vehicles. The Mitsubishi Outlander PHEV, Volvo XC60 Recharge, Ford Escape PHEV combine excellent electric ranges with off-road and cargo capabilities. More families, fleet operators, and urban commuters opt for SUV PHEVs, balancing practicality needs and sustainability goals. The segment is also growing due to people looking for eco-conscious options to traditional gas-guzzling SUVs.

Luxury PHEVs: For luxury PHEVs the market consists of Audi, Porsche, and Mercedes-Benz. Audi, Porsche, and Mercedes-Benz integrate luxury features, such as high-performance drivetrains, advanced infotainment systems, and extravagant interiors. They offer electric ranges above 100 km and sophisticated hybrid management systems. Luxury PHEVs focus on high-income earners who want to eco-friendly while maintaining high drivability standards, and advanced tech and style. They have systems for predictive charging, vehicle-to-grid systems, and AI energy optimization.

Fleet/Commercial PHEVs: Adoption of PHEVs in commercial and fleet operations is increasing rapidly due to their ability to reduce fuel costs and emissions. Ride-hailing services, corporate fleets, and logistics companies are implementing PHEVs to comply with sustainability targets and reduce operational expenditure. Manufacturers like Ford and Hyundai are developing fleet-specific PHEVs with enhanced durability, simplified maintenance, and telematics-enabled performance tracking to support corporate mobility solutions.

Parallel Hybrid: In a parallel PHEV, the wheels can be driven by either the combustion engine, the electric motor, or by both together. This setup allows the system to use energy efficiently in both the city and highway conditions. Toyota and Honda have implemented this technology in compact and sedan PHEVs and achieved a good balance between fuel economy and performance. Because of simpler mechanical design and lower maintenance costs, parallel hybrids have a good presence in cost-sensitive markets.

Series Hybrid: In a series configuration, the combustion engine has the sole function of generating electricity for the electric motor, which in turn, drives the wheels. This allows for a smoother and quieter drive which is ideal for city use in compact cars and sedans. This is seen in BMW’s i-series and the Mitsubishi Outlander PHEV, who chose this configuration to maximize electric driving efficiency and reduce city commute emissions.

PHEVs Market Share, By Powertrain, 2024 (%)

| Powertrain | Revenue Share, 2024 (%) |

| Parallel Hybrid | 30.60% |

| Series Hybrid | 21.30% |

| Series-Parallel Hybrid | 48.10% |

Series-Parallel Hybrid: Series-parallel hybrids have the benefits of both series and parallel systems. This allows the engine and electric motor to either drive the vehicle or function as a generator when the situation calls for it. This is seen in Hyundai, Kia, and Ford who use series-parallel hybrids in their SUVs and mid-size sedans. This configuration permits flexible energy management and improves adaptability within urban and long-distance travel.

Up to 10 kWh: Used for short-distance urban commutes, these small-capacity batteries are found in compact and entry-level sedan PHEV models. They provide an electric-only range of 30–50 km, which is enough for daily city driving. Keeping the battery capacity low helps in keeping the vehicle lightweight, and cost-competitive, which encourages adoption of these vehicles among first-time buyers and urban commuters.

10–20 kWh: Mid-range battery capacities found in SUVs and sedans provide an extended electric-only range of 50–100 km which supports daily commutes, intercity travel, and short leisure trips. Enhanced battery management systems which optimize the charging and discharging cycles of the battery help in improving battery longevity and the performance of the vehicle. A practical balance of cost, efficiency, and range is the reason most models in North America and Europe leverage 10-20 kWh batteries.

PHEVs Market Share, By Battery Capacity, 2024 (%)

| Battery Capacity | Revenue Share, 2024 (%) |

| Up to 10 kWh | 23.70% |

| 10–20 kWh | 58.50% |

| Above 20 kWh | 17.80% |

Above 20 kWh: These high-capacity batteries are used in luxury PHEVs and high performance SUVs as well as fleet vehicles. They provide over 100 km of electric-only driving which is perfect for long trips as well as reducing gasoline dependency. Advanced and AI assisted battery thermal management systems perform energy optimization which guarantees the battery’s longevity and safety. Examples of these vehicles are Porsche Cayenne E-Hybrid and Mercedes-Benz GLE PHEV.

AC Charging: Alternating current charging is the norm for home and work charging stations. Nearly all PHEVs include on-board chargers enabling convenient AC charging along with overnight and daytime charging at work. Most automakers include companion apps that allow charging status and energy usage monitoring as well as scheduling for optimized charging. Urban commuters who predominantly drive electric-only will appreciate the overnight AC setup and efficient charging options app.

DC Fast Charging: By 2025, fully deployed DC fast charging infrastructure will be available across Europe, North America, and parts of Asia. DC fast charging enables quick battery power replenishment and significantly reduces long-trip downtime. To maximize fleet vehicle uptime, PHEVs compatible with DC fast charging will enhance practicality for intercity travel and logistical use.

PHEVs Market Share, By Charging Mode, 2024 (%)

| Charging Mode | Revenue Share, 2024 (%) |

| AC Charging | 50.30% |

| DC Fast Charging | 39.20% |

| Wireless / Inductive Charging | 10.50% |

Wireless / Inductive Charging: Inductive charging systems serve as convenient alternatives for urban and commercial use. Automakers like BMW, Hyundai, and Nissan are launching pilot programs with wireless charging stations across Europe and Asia. Vehicles equipped with inductive charging will be able to automatically recharge their batteries at public spaces and designated parking spots, making it easier and quicker for city residents to adopt an EV.

Market Segmentation

By Vehicle Type

By Propulsion/Powertrain

By Battery Capacity

By Charging Mode

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Plug-in Hybrid Electric Vehicles

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Vehicle Type Overview

2.2.2 By Propulsion/Powertrain Overview

2.2.3 By Battery Capacity Overview

2.2.4 By Charging Mode Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Incentives from the Government and Initiatives on Sustainability

4.1.1.2 Demand from Consumers for PHEV Flexible Functionality

4.1.2 Market Restraints

4.1.2.1 Costs of Plug-In Hybrid Electric Vehicles (PHEV) are High

4.1.2.2 Unavailability of Charging PHEV

4.1.3 Market Challenges

4.1.3.1 Battery Technology and Lifecycle Management

4.1.3.2 Integration with Existing Automotive Ecosystems

4.1.4 Market Opportunities

4.1.4.1 Advanced Analytics and Connectivity

4.1.4.2 Emerging Market Growth

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Plug-in Hybrid Electric Vehicles Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Plug-in Hybrid Electric Vehicles Market, By Vehicle Type

6.1 Global Plug-in Hybrid Electric Vehicles Market Snapshot, By Vehicle Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Compact PHEVs

6.1.1.2 Sedan PHEVs

6.1.1.3 SUV PHEVs

6.1.1.4 Luxury PHEVs

6.1.1.5 Fleet/Commercial PHEVs

Chapter 7 Plug-in Hybrid Electric Vehicles Market, By Propulsion/Powertrain

7.1 Global Plug-in Hybrid Electric Vehicles Market Snapshot, By Propulsion/Powertrain

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Parallel Hybrid

7.1.1.2 Series Hybrid

7.1.1.3 Series-Parallel Hybrid

Chapter 8 Plug-in Hybrid Electric Vehicles Market, By Battery Capacity

8.1 Global Plug-in Hybrid Electric Vehicles Market Snapshot, By Battery Capacity

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Up to 10 kWh

8.1.1.2 10–20 kWh

8.1.1.3 Above 20 kWh

Chapter 9 Plug-in Hybrid Electric Vehicles Market, By Charging Mode

9.1 Global Plug-in Hybrid Electric Vehicles Market Snapshot, By Charging Mode

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 AC Charging

9.1.1.2 DC Fast Charging

9.1.1.3 Wireless / Inductive Charging

Chapter 10 Plug-in Hybrid Electric Vehicles Market, By Region

10.1 Overview

10.2 Plug-in Hybrid Electric Vehicles Market Revenue Share, By Region 2024 (%)

10.3 Global Plug-in Hybrid Electric Vehicles Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Plug-in Hybrid Electric Vehicles Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Plug-in Hybrid Electric Vehicles Market, By Country

10.5.4 UK

10.5.4.1 UK Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Plug-in Hybrid Electric Vehicles Market, By Country

10.6.4 China

10.6.4.1 China Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Plug-in Hybrid Electric Vehicles Market, By Country

10.7.4 GCC

10.7.4.1 GCC Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Plug-in Hybrid Electric Vehicles Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12 Company Profiles

12.1 BYD Company Ltd.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Tesla, Inc.

12.3 BMW Group

12.4 Mercedes-Benz Group AG

12.5 Ford Motor Company

12.6 General Motors

12.7 Volkswagen Group

12.8 Toyota Motor Corporation

12.9 Kia Corporation

12.10 Chrysler (Stellantis Group)