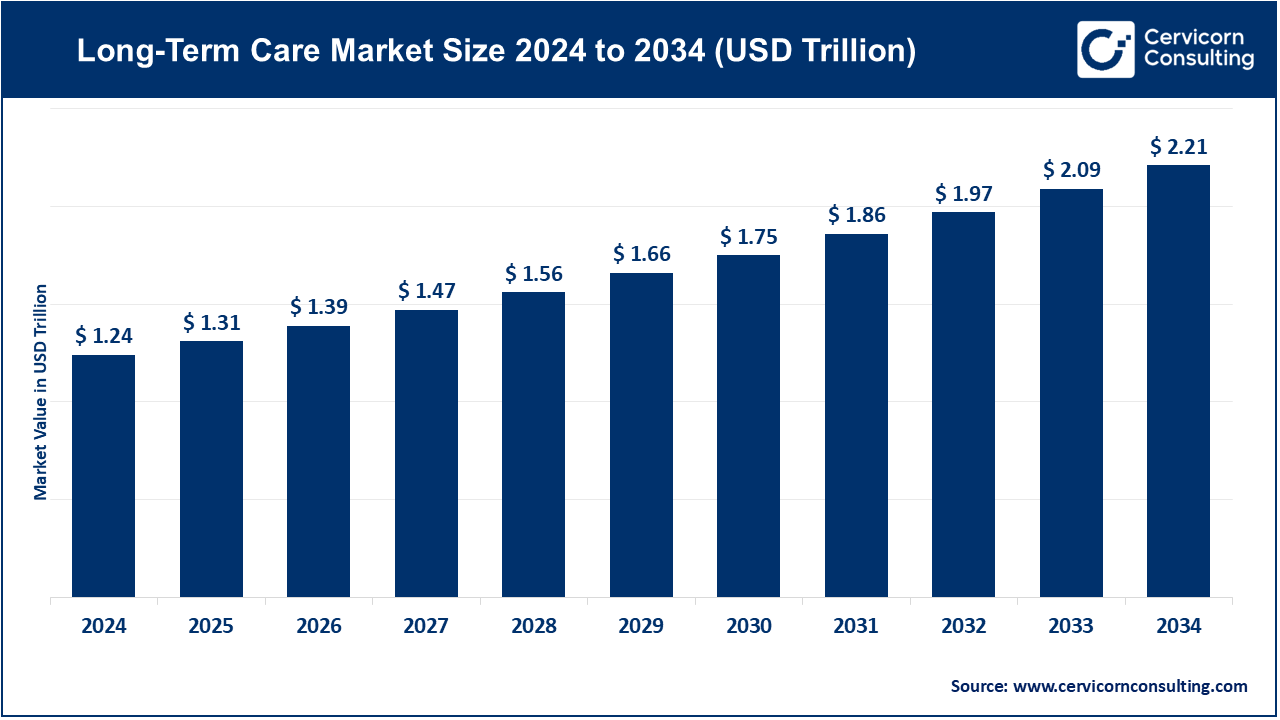

The global long-term care market size was accounted for USD 1.24 trillion in 2024 and is expected to be worth around USD 2.21 trillion by 2034, growing at a compound annual growth rate (CAGR) of 6.2% over the forecast period 2025 to 2034. The accelerating demand for cost-effective and efficient healthcare solutions redounds from the increase chronic diseases and the aging population around the world. This rapid LTC market growth has led to increased adoption of cutting-edge diagnostic and monitoring technologies aimed at improving LTC patient care. Streamlining multiple diagnostic functions into compact and high-throughput systems not only reduces sample volume and reagent consumption but also cuts cost and operational expenses. Furthermore, LTC structures highly value prompt and accurate testing as swift and precise testing saves time and can be the difference between life and death in chronic disease management.

The system's portability and adaptability are now able to provide LTC services in home and community settings, making point of care testing reachable. This flexibility is also revolutionizing the field of testing in and around traditional clinical settings and centers. Finally, the advanced systems in monitoring and diagnostic provide a greater ability in helping with customized healthcare and treatments by permitting the testing and monitoring to be done outside the clinical setting and close to the patient. LTC advanced systems and integration with personalized treatment approaches contribute to greater accessibility and customized healthcare, all associated with enhanced efficiency and cost patient care, setting advanced systems the core catalysts for improving next generation long term care.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 1.31 Trillion |

| Expected Market Size in 2034 | USD 2.21 Trillion |

| Projected CAGR 2025 to 2034 | 6.20% |

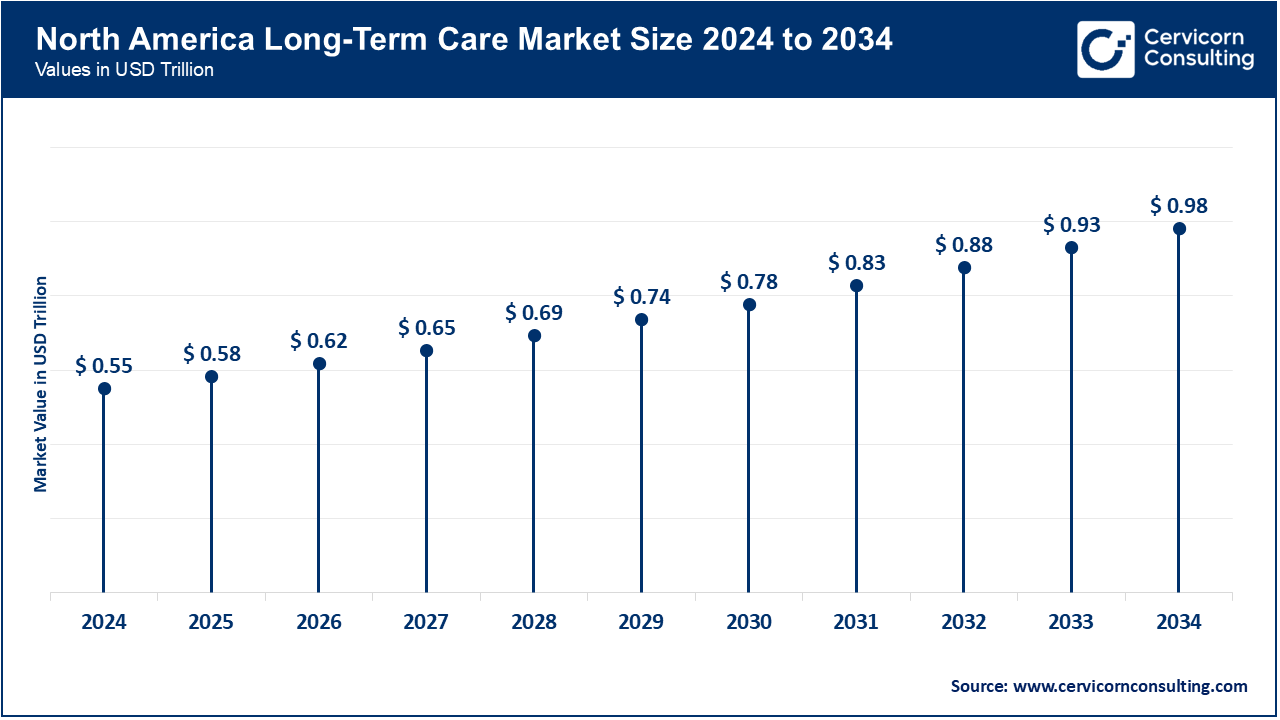

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Service, Application, Payer, Age Group, Gender, Region |

| Key Companies | Amedisys Inc., Brookdale Senior Living, Sunrise Carlisle LP, Home Instead Senior Care Inc., Atria Senior Living Group, Senior Care Centers of America, Extendicare Inc., Diversicare Healthcare Services Inc., Kindred Healthcare Inc., Capital Senior Living |

The long-term care market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

The adoption of Llong-term care services is still predominantly bigger in North America due to increasing population of the elderly, well-developed healthcare facilities and government subsidies. In March 2025, a number of the states in the U.S. broadened Medicaid-funded home healthcare services, which enable elderly to access skilled nursing and therapy in their homes. The use of digital monitoring systems and telehealth platforms in nursing homes and assisted living facilities is steadily growing in the United States and Canada as a way of improving patient care, lowering hospital readmissions, and increasing staff efficiency.

Europe has been working on the quality of LTC by complying with regulations, integrating digitally, and using advanced care models. A number of assisted living facilities in Germany and France added wearable health monitors and artificial intelligence-powered care planners in June 2025, to improve monitoring of patient health and chronic conditions. The U.K., Netherlands, and Italy are developing community-based programmes and home healthcare services to decrease the need to rely on institutional care and offer more patient-centred services.

The growth of LTC services is booming in Asia-Pacific because of the growing numbers of aging populations, governmental funding, and investments by the private sector. In July 2025, Japan, South Korea, and India introduced telehealth-enabled home care programs, enabling elderly people living in rural parts to receive remote access to skilled nursing services, physical therapy services, and chronic disease monitoring. The Chinese LTC facilities are also integrating technology-based solutions to care such as remote monitoring, digital health records, and AI-assisted therapy programs to enhance the efficiency of their operations and patient outcomes.

LAMEA is slowly implementing LTC services in hospitals, nursing homes, and community based programs. In August of 2025, Brazil and South Africa widened home care and community-based services of elderly people to the poorly served masses. UAE and Saudi Arabia have made investments in assisted living centers and hospice care programs to keep up with the rising demand of eldercare services in the Middle East, and rural Africa efforts target mobile healthcare units and telemedicine to make services more accessible.

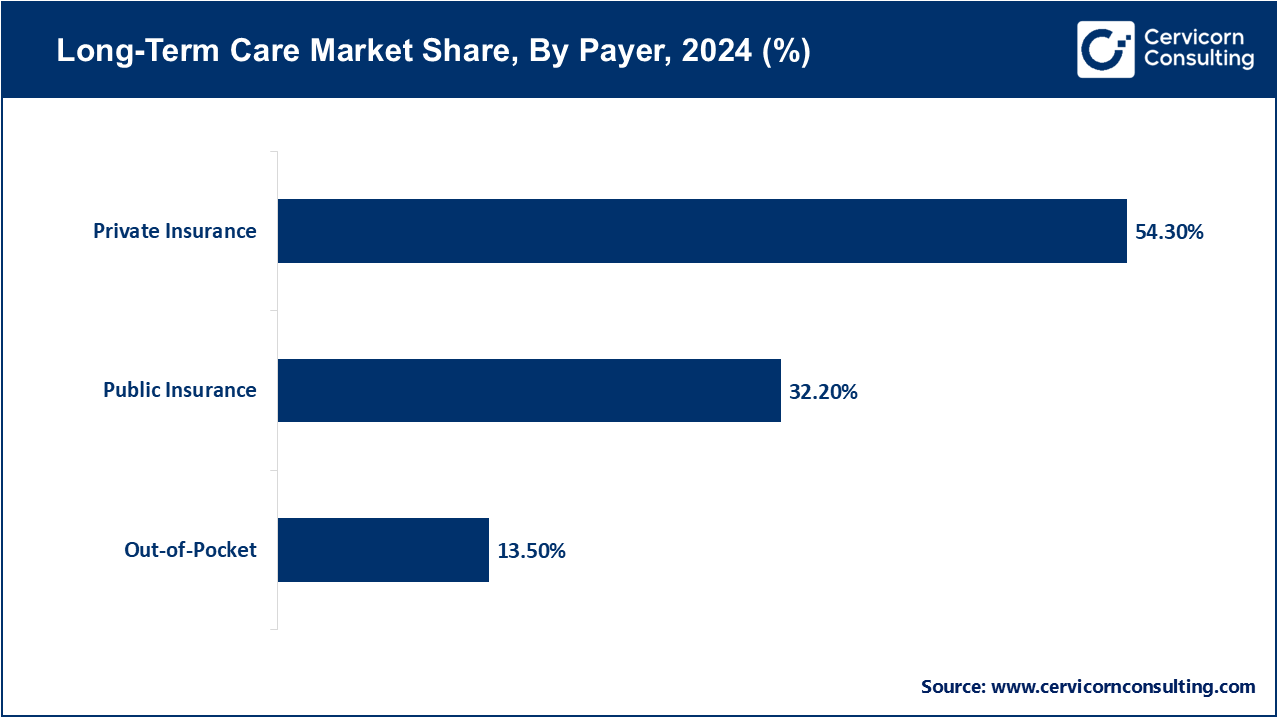

Public Insurance: In developed markets, Medicare and Medicaid are cornerstones for government-funded programs and for value-based reimbursement. In the U.S., the March 2025 expansion of government funding for Medicaid specifically for elderly care developed service and infrastructure for home healthcare access.

Private Insurance: In the U.S. and other developed markets, Employer Sponsored and Individual Long-Term Care insurance plans are gaining traction. In July 2025, Private Insurance marketed hybrid products for home care, assisted living and nursing home care, making these services more mid and middle class affordable.

Out-of-Pocket: Direct payments are more substantial in countries with limited insurance. In July 2025, between 30 and 40 percent of Long-Term Care in India was paid for with Direct Out-Of-Pocket expenditure, generating demand for home healthcare services that are affordable.

Nursing Care: Nursing Care provides proficient and skilled support 24/7 for people suffering from chronic illness, rehabilitation, post-surgical care, and complex medical situations. In March 2025, multiple LTC facilities in the US upgraded their Nursing Care with digital facilities for real-time monitoring and tracking of vital signs, consolidation of NMC's medication adherence logs, and automatic readmission alerts. This resulted in drastic improvement of patient outcomes and reduction of readmission rates.

Home Healthcare Services: Home healthcare encompasses both medical and non-medical support to patients in their home. This includes hands-on nursing, physiotherapy and occupational therapy, and daily living assistance. In May 2025, home healthcare services provided patients with remote monitoring, increasing the reimbursement limit for home healthcare services provided by the US Center for Medicare & Medicaid services increased in-line reimbursement of telehealth and remote monitoring services, allowing a greater population of elderly patients quality care from home.

Long-Term Care Market Share, By Service, 2024 (%)

| Service | Revenue Share, 2024 (%) |

| Nursing Care | 41.70% |

| Home Healthcare | 21.40% |

| Assisted Living Facilities | 16.80% |

| Hospice Care | 9.20% |

| Community-Based | 7.40% |

| Others | 3.50% |

Assisted Living Facilities: Assisted living provides personal care, medication, and basic medical assistance while allowing them their social activities and independence. In June 2025, assisted living facilities in Europe recorded a 12-15% increase in enrollments after new technology integrations which comprised of digital care tracking and wearable health monitors.

Hospice Care: Palliative and end-of-life care that focuses on the comfort of the patient, symptom management, and emotional support are provided in hospice services. In July 2025, multiple hospices in the US incorporated AI powered systems for real time symptom tracking and care plan adjustments aimed at improving the management of pain for patients at a terminal phase of their illness.

Community-Based Services: Services run by and for a community can again include adult day care, meal delivery, transportation, and social interaction activities. In August 2025, Canada introduced telehealth-enabled monitoring programs for remote seniors, minimizing hospital visits and care reactively.

Others: Respite care for family caregivers, rehabilitation centers for post-acute care, and specialized programs for dementia, Parkinson’s, and other chronic conditions are other services. With demand for tailored and patient-centered care growing, these services and programs are expanding.

Hospital: Hospitals' LTC services emphasize post-acute care, management of chronic illnesses, and transitional care. In April 2025, U.S. hospitals indicated an increase in LTC bed-usage for elderly patients recovering from complex surgeries and severe illnesses further demonstrating the role of LTC in hospitals.

Nursing Home: Nursing homes deliver 24-hour care for residents and for patients with various levels of chronic illnesses and/or functional disabilities. In May 2025, Europe experienced an increase in the occupancy of nursing homes and the increase was attributed to an increase in the aging and chronic disease burden of the population, demonstrating the need for skilled nursing care infrastructure.

Clinic: Clinics provide outpatient LTC services which encompasses routine LTC, monitoring chronic diseases and preventive care. In June 2025, some clinics in the Asia-Pacific region began offering home-visit services integrated with digital monitoring to ensure continuity of care for elderly patients.

Long-Term Care Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Hospital | 18.40% |

| Nursing Home | 27.10% |

| Clinic | 9.80% |

| Home Care | 39.50% |

| Others | 5.20% |

Home Care: Home care encompasses a wide range of services delivered to patients in their residences includes nursing care, physical therapy, assistance with personal hygiene, activities of daily living and other daily living support. In July 2025, U.S. telehealth services expanded remote LTC monitoring to the extent that nurses were able to track and assess various health metrics to provide timely interventions.

Other: The innovative long-term care initiatives are specialized rehabilitation units, day care and memory care programs, and various innovative long-term care activities which are increasingly focusing on the complex social and functional needs of the older population in emerging markets.

65 years to 74 years: early elderly aged who demand preventive health care, wellness maintenance and minimal support with day to day chores.

75-84 Years: Middle aged population is becoming more and more reliant on assisted living, home healthcare services and specialized nursing services as a result of chronic illnesses.

85+ Years: Old population with high dependency on full-time nursing services, hospice services, and community-based assistance. The care provision to this group is leading to innovation in monitoring, mobility aids, and integration of telehealth.

Male: a little less percentage of LTC users because of a low life expectancy. The men in this category usually need care of post-surgery or chronic illnesses in hospitals or nursing centers.

Long-Term Care Market Share, By Gender, 2024 (%)

| Gender | Revenue Share, 2024 (%) |

| Male | 47.90% |

| Female | 52.10% |

Female: Greater LTC user percentage as there is a longer life expectancy and greater number of chronic conditions. Assisted living, home care and community-based services segments are dominated by women.

Market Segmentation

By Service

By Application

By Payer

By Age Group

By Gender

By Region