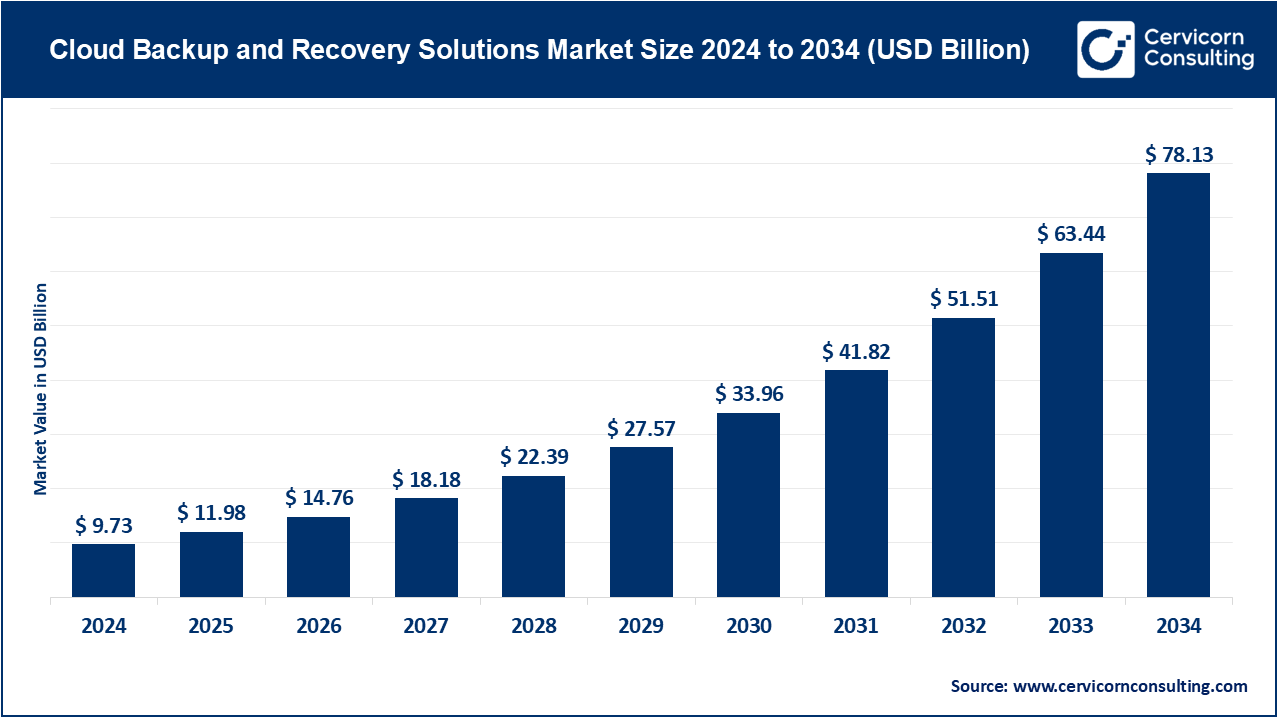

The global cloud backup and recovery solutions market size was valued at USD 9.73 billion in 2024 and is expected to be worth around USD 78.13 billion by 2034, registering a compound annual growth rate (CAGR) of 23.16% over the forecast period from 2025 to 2034.

Cloud backup and recovery solutions market offers services that enable enterprises to replicate, store and secure its applications that are set via cloud set-up. Cloud backup and recovery solutions work as a safeguard for data loss, that can cause by either hardware failures or cyberattacks.

Key driver for the market can be observed with the rising regulatory compliance that supports industry-specific mandates such as GDPR, APRA and others. With the rising remote work culture, ensuring availability of data across distributed networks has become significant, this requirement also acts as a trend for the market’s expansion. Tier 1 vendors in the cloud backup and recovery solutions market comprise of AWS, Microsoft and Google.

”According to the Veeam Data Protection Trends Report 2024, 88% of enterprises were either likely or almost certain to use a Backup-as-a-service or Disaster-as-a-service for at least some of their production servers.”

This stat ties a significance with cloud-native, policy-driven and service-based potential. Here are few emerging technologies that refer to the latest trends in the market:

Cervicorn Consulting helps organizations benchmark adoption maturity, assess ROI from quantum-safe and blockchain-based backup models, and identify high-growth investment corridors. Talk to our analyst today.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 11.98 Billion |

| Estimated Market Size in 2034 | USD 78.13 Billion |

| Projected CAGR 2025 to 2034 | 23.16% |

| Dominant Region | North America |

| Growing Region | Asia-Pacific |

| Key Segments | Component, Deployment Mode, Service Type, End-use Industry, Region |

| Key Comapnies | Veeam Software, Dell Technologies, Commvault, Rubrik, Veritas Technologies, IBM Corporation, Microsoft Corporation, AWS, Datto, Inc., Zerto Ltd., Oracle Corporation |

This potential in the cloud backup and recovery solutions market refers to expansion of end users with the rise of regulatory compliances. Along BFSI and healthcare; government sector, retail industry, IT & telecom and energy sectors are observed to offer a strong potential to the market’s expansion. Vertical growth or end-user expansion holds opportunity due to rising investors as well as services providers.

A survey shows that retailers invest in cloud backup to support omnichannel operations and protect POS data. Sectors such as IT & telecom and government sector need data sovereignty and disaster recovery. These industries generate and carry massive data and need latency optimization across distributed infrastructure.

Market Restraint

IT Resources Limitations

Integrating and implementing or maintaining cloud backup and disaster recovery solutions often required expertise across cloud architecture, cybersecurity compliance and data management. Many organizations lack skilled IT professionals where a dependency can be created. Cybersecurity Workforce Study (2024) revealed that, the global industry is facing an approximate shortage of 4 million cybersecurity professionals which directly impacts areas like data protection and recovery. While this factors acts as a restraint for cloud backup and disaster recovery solutions market, increasing managed service providers and simplified skill development may create strategic angle for investors and industry players.

Did You Know?

According to O’Reily’s Cloud Adoption Report, about two-third of respondents currently operate in a public cloud and 45% use a private cloud. Whereas RightScale (after a survey of 800 organizations) stated that more than 94% of organizations with over 1,000 employees have significant portion of their workloads in the cloud.

Supportive Case Study

Global leader in next-gen digital solutions, Infosys surveyed approximately 2500 enterprises across multiple countries in order to look at how implementation or integration of cloud systems deeply correlates with business profit. In result, Infosys stated that enterprises effectively using cloud (60% of its total workloads) could generate up to $414 billion in annual profits globally.

What are Strategic Recommendations for Investors in Cloud Computing Industry?

At Cervicorn Consulting, our boardroom experts believe that companies integrating AI at the data center layer represent high-value opportunities. Our experts have also decoded how AI is transforming data infrastructure that can empower investors to secure sustainable growth in this evolving market. In the upcoming years, demand for Backup-as-a-service will continue to rise. Vendors shifting towards offering AI-driven automated services, immutable storage will stand strong in the industry.

Get boardroom-level insights from our experts on AI reshaping industries, read more about AI data center market here.

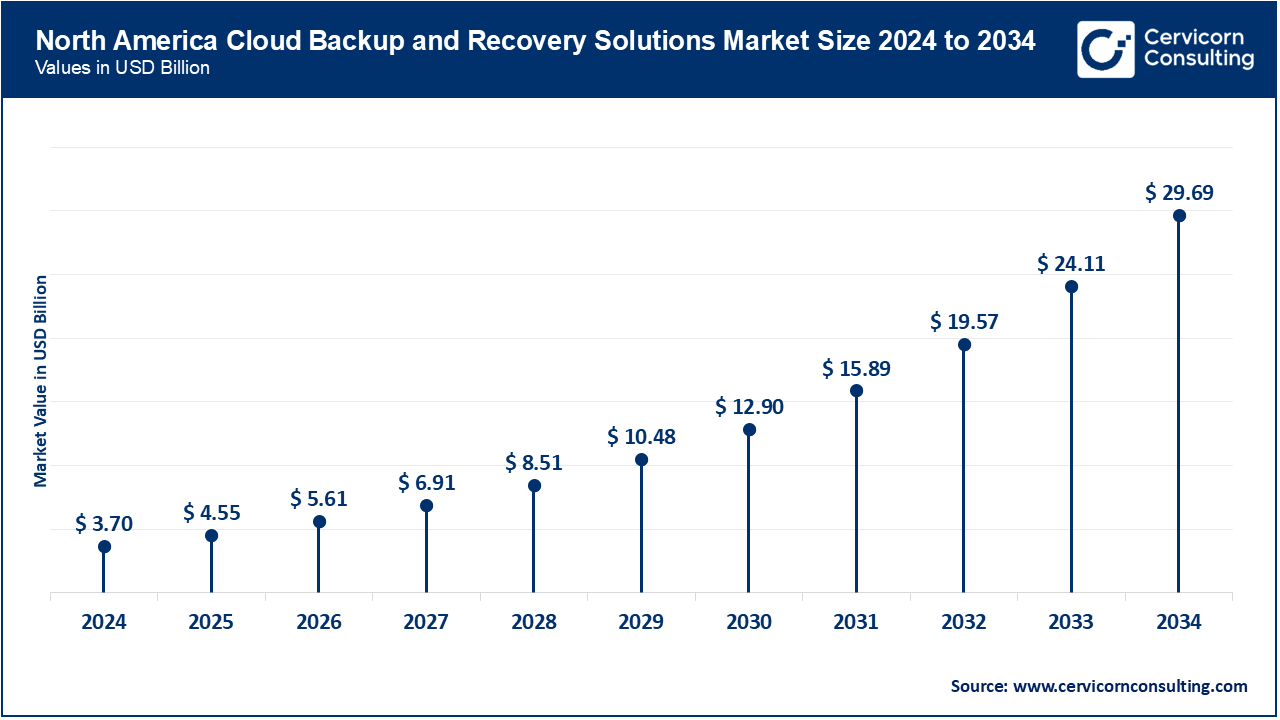

North America with its ability to invest in next-gen tech solutions held the largest share of the cloud backup and disaster recovery solutions market in 2024; the region is observed to stand strong with the upcoming integrations in the sector. The region’s market is driven by the presence of major providers such as AWS, Azure and Google Cloud. Additionally, strong infrastructure, significant investments and faster adoption to distributed networks create a strong potential for North America to grow.

Asia-Pacific is witnessing growth in cloud backup, data recovery, and cloud storage solutions, propelled by a coming together of a range of factors. To begin with, the deluge of data from IoT, mobile, video streaming, remote working, and digitization mandates is compelling organizations to reconsider data storage and protection. Second, regional governments are driving cloud-first, data sovereignty, and digital infrastructure policies, which are resulting in higher spending on cloud platforms and backup/recovery infrastructures. Third, organizations are investing bigger portions of their IT budgets on cloud backup and recovery as business continuity, cyber resilience, and regulation move to the top of the agenda.

Behaviorally, there is considerable evidence that most APAC organizations anticipate both the amount of data being stored in the cloud and their budgets for public cloud storage / backup to grow.

Solution Insights: In 2024, the solutions segment dominated the market owing to the requirement of business continuity during any mishap. Solutions in this sector often comprise of immutable storage offerings, A-drive threat detection and integration of the same. For instance, Commvault and Veeam recently expanded their enterprise-grade platforms that integrate backup and workload management.

Cloud Backup and Recovery Solutions Market Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Solutions | 60% |

| Services | 40% |

Services Insights: Moreover, the services segment is observed to grow at the fastest rate during the forecast period as growing organizations, especially small-scale organizations look for managed services to reduce IT burdens internally. Major player IBM’s managed backup services highlighted that enterprises outsource backup management to focus on cost optimization.

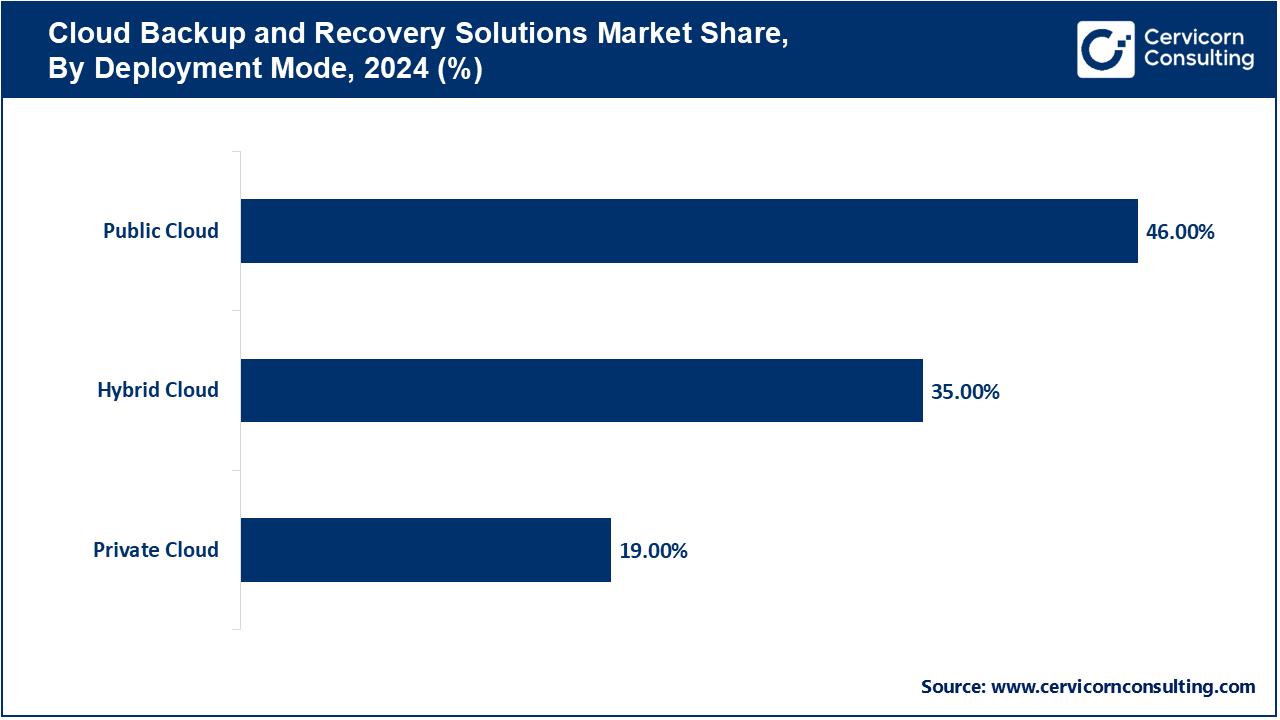

Public Cloud Insights: In 2024, the public cloud segment held the largest share in the market due to its scalability, lower upfront cost, and the ability to support diverse workloads. Enterprises migrating from on-premises infrastructure find public cloud solutions from providers like AWS Backup or Microsoft Azure Backup more efficient.

Hybrid Cloud insights: Observed to be the fastest growing segment in the cloud backup and recovery solutions market, the segment is known for combining the power of scalability of public clouds with the control of private infrastructure. This model is crucial for BFSI and healthcare sectors where compliance demands local storage but workloads need benefits from cloud systems.

Incremental Backup Insights: Incremental backup segment held the significant share of the market in 2024 that is known for its ability to minimize storage and bandwidth by only saving changed or updated data, this ability makes it widely utilized and preferred service type; especially by industries that carry fluctuating data volume such as BFSI and IT & telecom.

Cloud Backup and Recovery Solutions Market Share, By Service Type, 2024 (%)

| Service Type | Revenue Share, 2024 (%) |

| Full Backup | 26% |

| Incremental Backup | 53% |

| Differential Backup | 21% |

Differential Backup Insights: Expected to be the fastest growing segment during the forecast period, differential backups carry a balance between legal audits and baseline creation. The segment’s expansion is observed due to its balance between efficiency and recovery speed. Media firms and real-time data users adopt it to minimize restore windows without running full backups.

BFSI Insights: The BFSI segment leads the market. These enterprises handle structured data and rely heavily on database backups to maintain integrity. Such industry verticals expect zero-downtime systems and compliance-driven data protection, thereby stands as a major segment in the industry. For instance, major financial firms have adopted VMware Cloud Disaster Recovery to meet GDPR and Basel III standards while securing millions of transactions daily.

Healthcare Insights: The healthcare sector is experiencing rapid digital transformation, making it one of the fastest-growing verticals in cloud backup and recovery. The proliferation of electronic health records (EHRs), telemedicine platforms, and AI-driven diagnostics has resulted in an unprecedented surge in sensitive data that must be stored securely, accessed quickly, and remain compliant with strict regulations.

With 88% of enterprises moving toward BaaS or DRaaS, our data-backed insights and competitive analyses empower you to invest where the next wave of enterprise demand emerges. Engage with our team to explore market sizing, pricing models, and competitive intelligence today.

Market Segmentation

By Component

By Deployment Mode

By Service Type

By End-use Industry

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Cloud Backup and Recovery Solutions

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Component Overview

2.2.2 By Deployment Mode Overview

2.2.3 By Service Type Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.2 Market Restraints

4.1.3 Market Challenges

4.1.4 Market Opportunities

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Cloud Backup and Recovery Solutions Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Cloud Backup and Recovery Solutions Market, By Component

6.1 Global Cloud Backup and Recovery Solutions Market Snapshot, By Component

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Solutions

6.1.1.2 Services

Chapter 7. Cloud Backup and Recovery Solutions Market, By Deployment Mode

7.1 Global Cloud Backup and Recovery Solutions Market Snapshot, By Deployment Mode

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Public Cloud

7.1.1.2 Hybrid Cloud

7.1.1.3 Private Cloud

Chapter 8. Cloud Backup and Recovery Solutions Market, By Service Type

8.1 Global Cloud Backup and Recovery Solutions Market Snapshot, By Service Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Full Backup

8.1.1.2 Incremental Backup

8.1.1.3 Differential Backup

Chapter 9. Cloud Backup and Recovery Solutions Market, By End-use Industry

9.1 Global Cloud Backup and Recovery Solutions Market Snapshot, By End-use Industry

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 BFSI

9.1.1.2 Healthcare

9.1.1.3 IT & Telecom

9.1.1.4 IT & Telecom

9.1.1.5 Government

9.1.1.6 Manufacturing

9.1.1.7 Others

Chapter 10. Cloud Backup and Recovery Solutions Market, By Region

10.1 Overview

10.2 Cloud Backup and Recovery Solutions Market Revenue Share, By Region 2024 (%)

10.3 Global Cloud Backup and Recovery Solutions Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Cloud Backup and Recovery Solutions Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Cloud Backup and Recovery Solutions Market, By Country

10.5.4 UK

10.5.4.1 UK Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Cloud Backup and Recovery Solutions Market, By Country

10.6.4 China

10.6.4.1 China Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Cloud Backup and Recovery Solutions Market, By Country

10.7.4 GCC

10.7.4.1 GCC Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Cloud Backup and Recovery Solutions Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 IBM Corporation

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Microsoft Corporation

12.3 Amazon Web Services, Inc. (AWS)

12.4 Dell Technologies Inc.

12.5 Veeam Software

12.6 Commvault Systems, Inc.

12.7 Acronis International GmbH

12.8 Veritas Technologies LLC

12.9 Barracuda Networks, Inc.

12.10 Druva Inc.

12.11 Cohesity, Inc.

12.12 Rubrik, Inc.

12.13 Datto, Inc.

12.14 Zerto Ltd.

12.15 Oracle Corporation