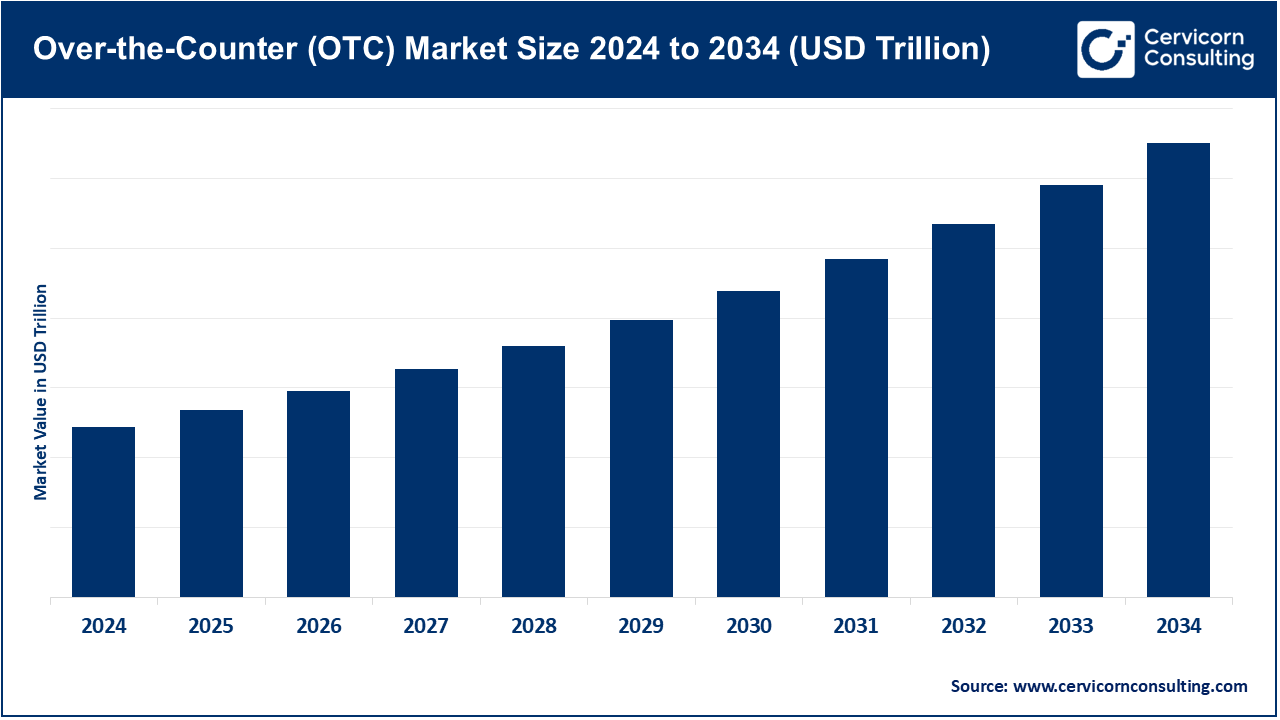

The global over-the-counter (OTC) market is expected to grow steadily at a CAGR of 7.3% from 2025 to 2034, with notional outstanding volumes projected to surpass USD 750–800 trillion by the end of 2025. This growth is driven by increasing demand for hedging instruments such as interest rate swaps, foreign exchange forwards, and credit default swaps, particularly as businesses and investors navigate volatile macroeconomic conditions, fluctuating interest rates, and currency risks. Regulatory reforms such as Dodd-Frank and EMIR have increased transparency and centralized clearing for many OTC derivatives, which has improved confidence and liquidity in the market, encouraging broader participation by institutional investors. The expansion of electronic trading platforms and swap execution facilities (SEFs) has also enhanced efficiency and reduced operational friction, further fueling market activity.

Key growth drivers include globalization of trade and finance, the rising complexity of risk management needs among corporates, and the increased use of derivatives for portfolio diversification. Emerging markets are becoming more significant contributors as financial institutions and corporations in Asia-Pacific and Latin America expand their use of OTC derivatives for hedging currency, interest rate, and commodity exposures. In addition, technological advancements such as algorithmic trading, real-time data analytics, and blockchain-based settlement solutions are expected to enhance market accessibility and reduce counterparty risk, supporting long-term growth of the OTC market.

What is the Over-the-Counter (OTC) Market?

The over-the-counter (OTC) market is a decentralized market where financial instruments such as stocks, bonds, currencies, and derivatives are traded directly between two parties rather than through a centralized exchange. Unlike exchange-traded markets, the OTC market operates through a network of dealers, brokers, and electronic platforms, allowing participants to negotiate terms such as price, quantity, and settlement directly. This market plays a crucial role in global finance by providing liquidity for instruments that are not listed on formal exchanges and by facilitating customized transactions that meet the specific needs of institutions, corporations, and investors.

The main benefits of the OTC market include flexibility, customization, and access to a wide range of instruments. OTC contracts can be tailored to match the exact requirements of the counterparties in terms of maturity, notional amount, and risk exposure—something that is often not possible with standardized exchange-traded products. It also allows companies to hedge specific risks, such as interest rate or currency fluctuations, more precisely. Additionally, OTC markets typically offer greater liquidity for certain securities (like bonds) and open investment opportunities for instruments that may not qualify for listing on major exchanges, thus supporting broader capital formation and risk management.

1. Continued Growth in Notional Outstanding

2. Shift Towards Centralized Clearing

3. Regulatory Enhancements and Oversight

4. Technological Advancements and Automation

Report Scope

| Area of Focus | Details |

| OTC Market CAGR (2025 to 2034) | 7.3% |

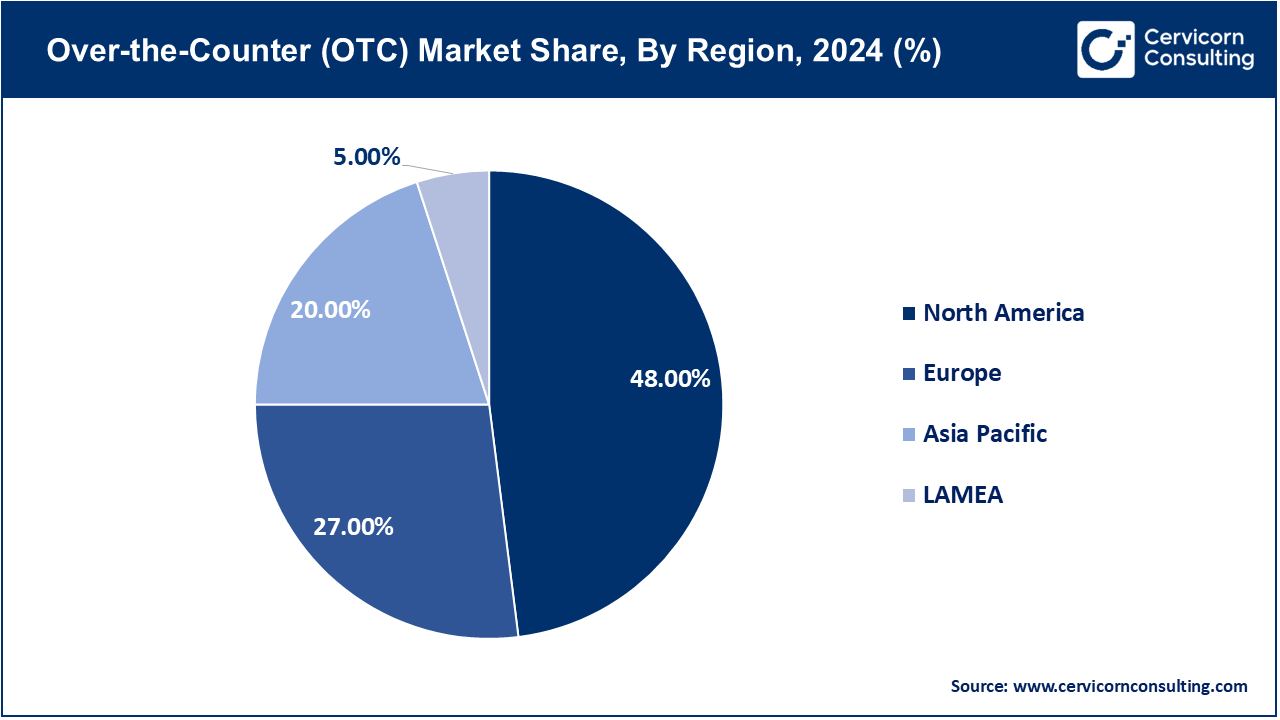

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Instrument Type, Market Structure, Participant Type, Region |

| Key Companies | J.P. Morgan, Goldman Sachs, Citigroup, Bank of America, Morgan Stanley, Deutsche Bank AG, UBS Group AG, Barclays PLC, HSBC Holdings PLC, BNP Paribas S.A., Société Générale S.A., Wells Fargo & Company, Royal Bank of Canada, Mizuho Financial Group, Nomura Holdings, Inc. |

The OTC market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

North America continues to lead in OTC derivatives trading, with the U.S. accounting for a significant portion of global activity. In 2024, the region saw notable advancements in market infrastructure and product offerings. For instance, the launch of the FMX Futures Exchange in September 2024 introduced a competitive alternative to established players like CME Group. FMX offers a combined platform for futures, repos, and foreign exchange trades, leveraging advanced trading technology to attract market participants. This move underscores the region's commitment to enhancing market efficiency and providing diverse trading options.

The APAC region is experiencing rapid growth in OTC derivatives trading, driven by regulatory reforms and increasing market participation. In 2024, Japan's derivatives market was set for expansion, with Tokyo and Singapore emerging as top locations for derivatives trading over the next three to five years. This trend reflects the region's evolving financial landscape and the growing sophistication of its markets. Additionally, mandatory reporting of OTC derivatives transactions, introduced as part of G20 reforms, has been a key focus in countries like Japan, Australia, Singapore, and Hong Kong, aiming to enhance transparency and reduce systemic risks.

Europe's OTC market is undergoing significant changes, characterized by market consolidation and evolving regulatory challenges. In 2024, the European Energy Exchange (EEX) experienced a substantial increase in trading volumes, driven by new members and a shift from OTC trading to the exchange. This transition reflects the industry's response to heightened volatility in energy markets and the need for more transparent and efficient trading platforms. However, the European Banking Authority (EBA) highlighted the dominance of non-EU banks, particularly U.S. institutions, in key segments of the European derivatives market, raising concerns about financial autonomy and the need for strategic adjustments.

The LAMEA region is witnessing gradual growth in OTC derivatives trading, with emerging markets playing a pivotal role in this expansion. In 2024, the region's financial markets experienced increased activity, driven by rising demand for hedging instruments and greater integration into the global financial system. Strategic developments, such as the establishment of new trading platforms and the implementation of regulatory reforms, are contributing to the maturation of OTC markets in countries across Latin America, the Middle East, and Africa. These efforts aim to enhance market transparency, attract foreign investment, and foster economic stability in the region.

The OTC market is segmented into capacity, application, chemistry, end-user, and region.

Derivatives: OTC derivatives, including interest rate swaps, FX forwards, and credit default swaps, dominate the OTC market in terms of notional outstanding. Interest rate derivatives alone account for the largest share of global OTC exposure, reflecting their critical role in hedging against interest rate and currency risks.

Commodities: Commodity derivatives, particularly energy and metal contracts, are the fastest-growing segment. Increasing volatility in oil, gas, and precious metals, along with rising demand for hedging commodity price risk in emerging markets, has driven rapid expansion in OTC commodity trading.

Dealer Market: The dealer market remains the largest structure in OTC trading. Market makers provide continuous bid/ask quotes and liquidity for a wide variety of instruments, enabling efficient execution of large or customized trades between institutional participants.

Direct Negotiation: Bilateral, directly negotiated OTC contracts are growing quickly, especially in emerging markets and bespoke derivatives. This segment benefits from flexibility, allowing participants to tailor contract terms such as maturity, notional size, and settlement method according to specific risk-management needs.

Institutional Investors: Institutional investors, including hedge funds, pension funds, and insurance companies, dominate OTC markets due to their high trading volumes and large-scale risk-management requirements. They are key drivers of liquidity and market depth.

Corporates/Banks: Corporates and banks are the fastest-growing segment in OTC participation, increasingly using derivatives to hedge operational and financial risks. Rising globalization, cross-border trade, and currency exposure are pushing more corporates to adopt OTC instruments for risk mitigation.

The OTC market is predominantly controlled by a few large financial institutions, with U.S. banks holding a significant share in key segments. As of December 2023, U.S. banks accounted for nearly 28% of the European derivatives market, contributing to a total non-EU market share of 33.73% in that sector. This dominance is particularly evident in interest rate derivatives, commodity trading fees, and investment services. These institutions leverage their extensive global networks, advanced trading platforms, and comprehensive product offerings to maintain their competitive edge.

The competitive dynamics in the OTC market are also influenced by technological advancements and evolving regulatory frameworks. Market participants are increasingly adopting electronic trading platforms, algorithmic trading, and blockchain technology to enhance efficiency, reduce costs, and improve transparency. For instance, the launch of the FMX Futures Exchange in September 2024 introduced a combined platform for futures, repos, and foreign exchange trades, leveraging advanced trading technology to attract market participants. Additionally, regulatory bodies are implementing reforms to address emerging risks and ensure the resilience of the financial system, influencing market strategies and operations.

Market Segmentation

By Instrument Type

By Market Structure

By Participant Type

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Over-the-Counter (OTC)

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Instrument Type Overview

2.2.2 By Market Structure Overview

2.2.3 By Participant Type Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Demand for Hedging and Risk Management

4.1.1.2 Technological Advancements

4.1.2 Market Restraints

4.1.2.1 High Counterparty Risk

4.1.2.2 Regulatory Compliance Costs

4.1.3 Market Challenges

4.1.3.1 Market Complexity and Transparency Issues

4.1.3.2 Volatility and Systemic Risk

4.1.4 Market Opportunities

4.1.4.1 Expansion in Emerging Markets

4.1.4.2 Innovation in Product Offerings

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Over-the-Counter (OTC) Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Over-the-Counter (OTC) Market, By Instrument Type

6.1 Global Over-the-Counter (OTC) Market Snapshot, By Instrument Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Equities (OTC Stocks)

6.1.1.2 Fixed Income

6.1.1.3 Derivatives

6.1.1.4 Foreign Exchange (FX)

6.1.1.5 Commodities

6.1.1.6 Others

Chapter 7. Over-the-Counter (OTC) Market, By Market Structure

7.1 Global Over-the-Counter (OTC) Market Snapshot, By Market Structure

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Dealer Market

7.1.1.2 Brokered Market

7.1.1.3 Direct Negotiation

Chapter 8. Over-the-Counter (OTC) Market, By Participant Type

8.1 Global Over-the-Counter (OTC) Market Snapshot, By Participant Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Institutional Investors

8.1.1.2 Retail Investors

8.1.1.3 Market Makers/Dealers

8.1.1.4 Corporates/Banks

Chapter 9. Over-the-Counter (OTC) Market, By Region

9.1 Overview

9.2 Over-the-Counter (OTC) Market Revenue Share, By Region 2024 (%)

9.3 Global Over-the-Counter (OTC) Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Over-the-Counter (OTC) Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Over-the-Counter (OTC) Market, By Country

9.5.4 UK

9.5.4.1 UK Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Over-the-Counter (OTC) Market, By Country

9.6.4 China

9.6.4.1 China Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Over-the-Counter (OTC) Market, By Country

9.7.4 GCC

9.7.4.1 GCC Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Over-the-Counter (OTC) Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 J.P. Morgan

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Goldman Sachs

11.3 Citigroup

11.4 Bank of America

11.5 Morgan Stanley

11.6 Deutsche Bank AG

11.7 UBS Group AG

11.8 Barclays PLC

11.9 HSBC Holdings PLC

11.10 BNP Paribas S.A.

11.11 Société Générale S.A.

11.12 Wells Fargo & Company

11.13 Royal Bank of Canada

11.14 Mizuho Financial Group

11.15 Nomura Holdings, Inc.