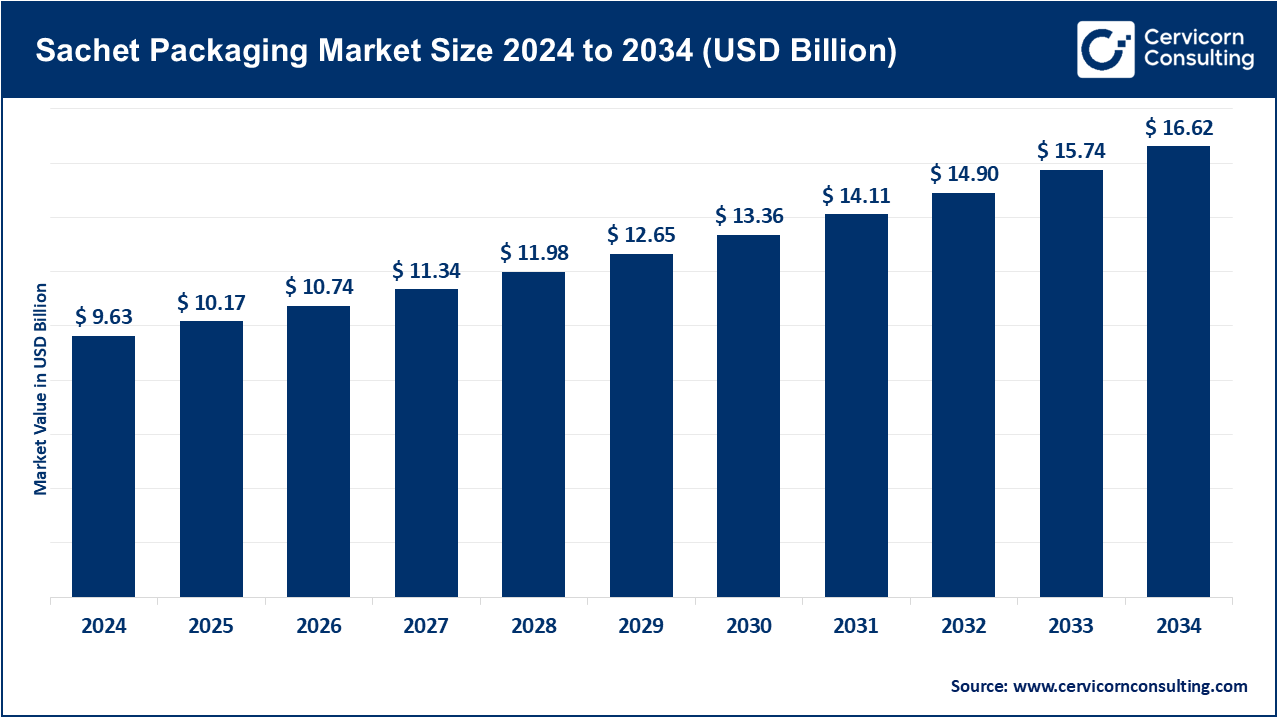

The global sachet packaging market size recorded USD 10.17 billion in 2024 and is anticipated to be worth around USD 16.62 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.61% over the forecast period from 2025 to 2034. The global sachet packaging market is experiencing sustained growth due to increased need within the food and beverage sector, personal care, and pharmaceuticals for inexpensive single-use packs. Increased demand for ready-to-use products in developing countries, cost-efficient manufacturing, and easy-to-carry portable packaging all add to the market growth. Sustainability trends on the other hand are positively impacting the use of sachets that can be recycled or composted. Unilever, for instance, filled eco-friendly sachets in Southeast Asia to curb the rampant plastic pollution while Procter and Gamble had launched waterless shampoo sachets for the rural part of India. These are some ways in which companies are using sachet packaging to expand their market penetration while being environmentally responsible which will in turn create demand for sachets across markets.

The sachet packaging market is defined as the sector that manufactures and trades miniature, flexible, sealed containers which are made of plastic, paper or aluminium foil, and designed to hold single servings or dosages of food, beverages, personal care products, pharmaceuticals, and household items. These quantities are generally offered between 1ml and 100ml (or grams), and are especially valued in price-sensitive and rural markets for their low cost, convenience, and portability. They are aimed at broadening the reach of brands with little product wastage, and thus are widely marketed for samples, single servings, and promotional uses.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 10.17 Billion |

| Expected Market Size in 2034 | USD 16.62 Billion |

| Projected CAGR 2025 to 2034 | 5.61% |

| Leading Region | Asia-Pacific |

| Key Segments | Packaging Material, Material, Product Type, End User, Region |

| Key Companies | Amcor plc, Constantia Flexibles, Huhtamaki Oyj, Mondi Group, Sonoco Products Company, Sealed Air Corporation, ProAmpac, Uflex Ltd., Glenroy, Inc., Pouch Direct, Clondalkin Group, Swiss Pack Pvt. Ltd. |

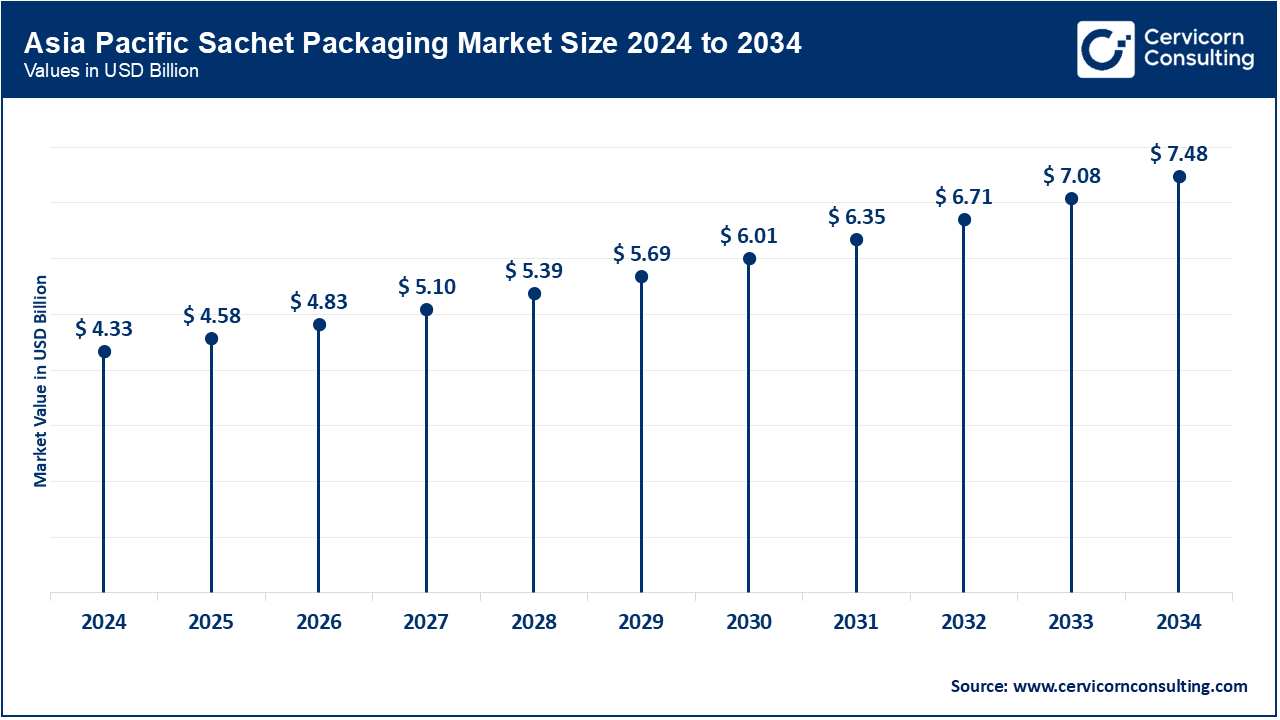

Asia-Pacific remains the leader, holding almost 45% of the market share. Besides an increase in FMCG consumption, the region also has a large rural population coupled with reliable distribution networks. Economically, nations such as India, Indonesia, and the Philippines are leading in sachet sales. For instance, Hindustan Unilever sells over a billion shampoo sachets in India and Nestlé Indonesia’s single-serve coffee sachets are a common sight in bookstores and other retail shops. Other countries are also seeking to remedy the rural retail outlet problem. On the downside, India and Vietnam’s single-use plastic regulations are hindering the sachet market, forcing manufacturers to find biodegradable alternatives.

With 18% of the market share in 2024, the region is also seeing new retail products such as nutraceuticals, cosmetics, as well as market offerings due to the growing e-commerce industry. or instance, Sephora Skincare and Makeup sachets are included in online orders, converting orders to full size purchases. In the food industry, Nescafé and protein supplement brands use single-serve sachets for easy consumption on the go. While there is an increase in sustainability regulations, especially in states like California and New York, brands are turning to recyclable or compostable sachets to align with consumer pods. Brands are trying to meet consumer expectations. There is a shift in trends where brands use high-quality printing and materials to reinforce their positioning as a premium brand.

In 2024, Europe held approximately 20% of the total market share. European consumers are more environment conscious and work towards sustainable packaging. EU regulations related to single use plastics are forcing brands to use recyclable and paper sachets. This includes L’Oréal with their skincare paper sachets and Nestlé with their recyclable coffee sachets in the UK and Germany. Use of sustainable materials and eco-friendly packaging is in demand and adopted, often regardless of the price. However, slow product launches due to higher production and stricter compliance costs are an issue. These costs, alongside Europe’s leading R&D sector makes them a hub for sustainable jet innovation, setting global trends.

Sachet Packaging Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 27% |

| Europe | 20% |

| Asia-Pacific | 45% |

| LAMEA | 8% |

Growth is attributed to lower priced personal care and food products in higher population countries such as Nigeria, Egypt, and South Africa. Unilever's Sunlight detergent sachets sell quite well in Nigeria, as do Nestle's Maggi seasoning sachets in many western African countries. Both brands' sachets are affordable, which along with low-priced recycling facilities, drives massive waste of sachets. It seems that urban dwellers are slowly becoming more attentive to sustainability issues, but rural regions are still heavily focused on low prices. It will still take a number of years until greater adoption of sachets made of paper is realized, despite many brands starting small-scale trials of paper sachets.

Multi-layer Laminates: Multi-layer laminates dominate the sachet packaging industry, holding a market share of nearly seventy two percent. These laminates are made of a combination of plastics, aluminum, and even paper which gives them a high barrier against moisture, oxygen and even UV light. For products which have a longer need for storage, such as instant coffee, dairy powders and even certain cosmetics, these laminates are a must. An example is Hindustan Unilever who uses sachets of instant shampoo and detergent for one time use, which is made of multi-layer laminates. The versatility of these laminates makes them easy to customize in terms of thickness, printing, and barrier properties.

Sachet Packaging Market Share, By Packaging Material, 2024 (%)

| Packaging Material | Revenue Share, 2024 (%) |

| Single-layer Film | 28% |

| Multi-layer Laminates | 72% |

Single-layer film: These films are easier and cheaper forms of packaging and are used for short shelf life products like sugar and spices, as well as sample sachets. Single-layer films represent about 28% of the global market, as they are inexpensive to manufacture, lightweight, and in some instances, recyclable. Nestlé, for example, employs single-layer PE films for their sachets of cocoa powder and instant beverages. Single-layer films do not possess as advanced barrier properties like those found in multi-layer laminates, which is why they continue to be in high demand within cost-sensitive and high-volume sectors. These products are favored for their low price, and the simplicity of mass production makes them ideal for low-cost daily purchases.

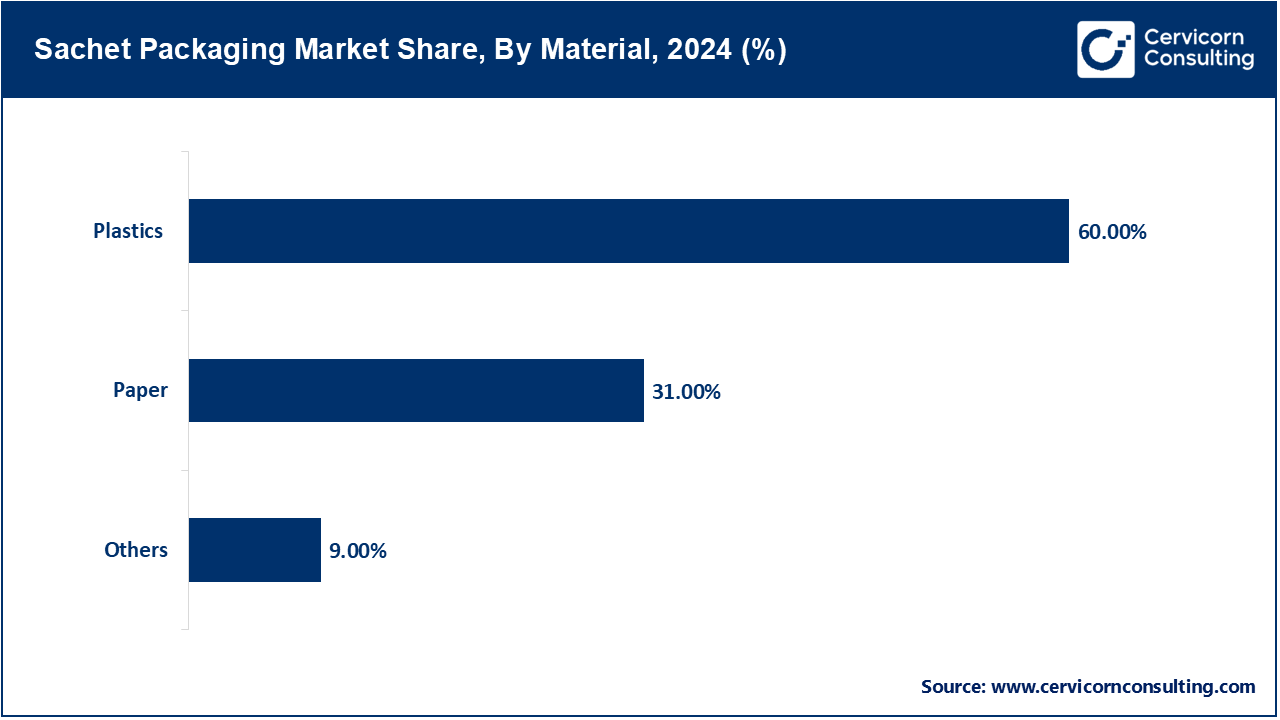

Plastics & Polymers (PE, PET, PVC, PP, etc.): Due to availability, low price, light weight, and durability, plastic continues to be the leading material used in sachet packaging. For example, Nestle and Unilever are leading fast-moving consumer goods (FMCG) companies that utilize PE and PP sachets for instant coffee, shampoo, and sauce. These plastic sachets are mass distributed due to the moisture and chemical resistance which offers a longer shelf life practically. Even with environmental concerns, the sachet packaging market continues to be dominated plastic materials, constituting 60% of the market. Alternatives, like biodegradable materials, make up roughly 10% and are not adaptable for larger scale operations.

Paper: The paper-based sachets are gaining popularity in ecologically driven markets due to sustainability movements and regulations aimed at reducing plastic waste. Eliminating dry consumables like sugar, tea, and snack powders which are sachet packed globally to about 18%, these are paper sachets. To cater to environmentally conscious consumers, multinational companies like Mondelez and Amul have started using paper sachets to package sugar and spices in some regions. Though paper sachets are biodegradable and recyclable, their protective barriers are weaker than plastic and laminates which makes paper sachets suitable to biodegradable consumables with shorter shelf lives. Market adoption is expected to rise at a steady paceamid increasing regulations, consumer demand, and the propensity to use environmentally safe packaging materials.

Others: Instant coffee, powdered milk, and some pharmaceuticals are products to which moisture, light, and oxygen are sensitive. For these products, aluminum foil sachets are preferred. They account for almost 12% of the global sachet market because of elaborate barrier protection. Biodegradable sachets represent the fastest growing market with 10% global share.

Food and beverage: The food and beverage sectors lead the market share using sachets with approximately 40% share due to convenience provided in portion controlled servings. single-serve coffee sachets manufactured by Nescafé and Amul’s sugar sachets provide easy access to instant foods. Increased disposable income and the consumption of food on-the-go are key drivers.

Personal Care & Cosmetic: Accounting for 30% of the market, sachets for personal care items cover shampoos, conditioners, creams, lotions, and facial cleansers. They serve to budget-conscious customers as well as allow new product sampling through trial sizes. Single-use sachets of shampoo and facial creams are offered by P&G and L’Oreal in India, Indonesia, and the Philippines. The sachets are sold due to increase personal hygiene in urban areas and rising disposable incomes in developing countries.

Others: About 15% of the global pharmaceutical market is sachets and is used for oral doses of liquids, powdered medicines, and nutritional supplements. Unit-dose sachet packaging is advantageous for accuracy in dosage, hygiene, and compliance. Household products such as detergents, dishwashing liquids, and cleaners are about 10% of the market in sachets. Single use sachets are common in rural and low income areas.

Food & Beverages: The food & beverages industry constitutes approximately 42% of the global demand for sachets. Single-serve products such as instant coffee, ketchup, sugar, and various condiments control the market. Companies like Nestlé, Amul, and Heinz deploy sachets to meet the needs of their on-the-go consumers. The industry continues to expand with increasing urbanization, convenience-driven lifestyles, and deeper retail penetration in the Asia-Pacific and Latin America regions. To maintain the product multi-layer laminates and plastics are best suited. The reduction of food waste and increased accessibility in the low-income segment provided by portion-controlled sachets allows this application to dominate on a global scale.

Personal Care: Personal care accounts for approximately 28% of sachets demand. Affordability and product trial opportunities drive demand for shampoo, lotion, and face cream single use sachets. L’Oreal, P&G, and Dove have been noted to use sachets to market to the emerging low-income consumers. Increased hygiene vigilance, travel-friendly packaging, and online retailing have supported growth. While plastics remain the dominant package, biodegradable options are being explored in more environmentally aware areas. India, Southeast Asia, and Africa are the leading markets for this segment as sachets provide affordable access to personal care items.

Pharmaceuticals: The pharmaceutical sachet market is estimated to have a 14% share in this segment. Pediatric syrups, oral rehydration salts, and powdered medicines are dosed correctly and hygienically when packed into unit doses.

Others: Bayer and Syngenta use single-dose sachets for pesticides and fertilizers for small-scale farmers, illustrating other sachet users. Additionally, other industries such as agrochemicals, lubricants, and specialty chemicals account for approximately 5% of the sachet market. Other industries also benefit from single-dose sachets as they enhance safety, precision, and wastage.

Market Segmentation

By Packaging Material

By Material

By Product Type

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Sachet Packaging

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Packaging Material Overview

2.2.2 By Material Overview

2.2.3 By Product Type Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Demand for Affordable, Single-Serve Packaging

4.1.1.2 Expanding FMCG Distribution Networks in Emerging Markets

4.1.2 Market Restraints

4.1.2.1 Environmental Concerns and Plastic Waste Regulations

4.1.2.2 Limited Recyclability and Waste Management Infrastructure

4.1.3 Market Opportunities

4.1.3.1 Expansion into Eco-Friendly and Biodegradable Sachets

4.1.3.2 Growth in E-commerce and Sample Distribution Models

4.1.4 Market Challenges

4.1.4.1 Balancing Cost Efficiency with Sustainability Goals

4.1.4.2 Counterfeit Products and Brand Dilution Risks

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Sachet Packaging Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Sachet Packaging Market, By Packaging Material

6.1 Global Sachet Packaging Market Snapshot, By Packaging Material

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Single-layer Film

6.1.1.2 Multi-layer Laminates

Chapter 7. Sachet Packaging Market, By Material

7.1 Global Sachet Packaging Market Snapshot, By Material

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Plastics

7.1.1.2 Paper

7.1.1.3 Others (Aluminum Foil, Biodegradable/Compostable Materials)

Chapter 8. Sachet Packaging Market, By Product Type

8.1 Global Sachet Packaging Market Snapshot, By Product Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Shampoo & Conditioner Sachets

8.1.1.2 Food & Beverage Sachets (sauces, coffee, sugar, dairy products)

8.1.1.3 Pharmaceutical Sachets (powders, oral liquids)

8.1.1.4 Others

Chapter 9. Sachet Packaging Market, By End-User

9.1 Global Sachet Packaging Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Food & Beverages

9.1.1.2 Personal Care & Cosmetics

9.1.1.3 Pharmaceuticals

9.1.1.4 Others

Chapter 10. Sachet Packaging Market, By Region

10.1 Overview

10.2 Sachet Packaging Market Revenue Share, By Region 2024 (%)

10.3 Global Sachet Packaging Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Sachet Packaging Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Sachet Packaging Market, By Country

10.5.4 UK

10.5.4.1 UK Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Sachet Packaging Market, By Country

10.6.4 China

10.6.4.1 China Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Sachet Packaging Market, By Country

10.7.4 GCC

10.7.4.1 GCC Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Sachet Packaging Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Amcor plc

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Constantia Flexibles

12.3 Huhtamaki Oyj

12.4 Mondi Group

12.5 Sonoco Products Company

12.6 Sealed Air Corporation

12.7 ProAmpac

12.8 Uflex Ltd.

12.9 Glenroy, Inc.

12.10 Pouch Direct

12.11 Clondalkin Group

12.12 Swiss Pack Pvt. Ltd.