The global liquid packaging market size was valued at USD 420.67 billion in 2024 and is expected to be worth around USD 692.10 billion by 2034, expanding at a compound annual growth rate (CAGR) of 5.1% over the forecast period from 2025 to 2034.

Growth is being powered by several converging trends, most critically the public’s appetite for convenient, portable ready-to-drink products. This demand has prompted rapid development of flexible pouches, spouted formats, and bag-in-box systems. At the same time, e-commerce’s swift rise is reshaping packaging, with brands selecting leak-proof, impact-resistant designs that will survive the rigors of transit and still look good on the shelf. According to industry data, rigid plastics now comprise about 35% of market volume, glass holds near 20%, and flexible pouches claim 15%. This data shows a slow but steady migration toward lighter, more portable solutions. Consumption of ready-to-drink items has quickened the uptake of spouted pouches and bag-in-box varieties; the boom in online sales is raising the bar for formats that stay sealed and intact during shipping. Sustainability is a growing demand from both shoppers and policymakers; accordingly, companies are transitioning to recyclable, compostable, and mono-material substrates. Market frontrunners like Tetra Pak and SIG are rolling out paper-based cartons with reduced polyethylene and aluminum layers, thus simplifying the recycling stream and decreasing environmental impact. These innovations are not only meeting regulatory and consumer expectations—they are also altering the competitive landscape itself.

Liquid packaging includes the materials and processes employed to handle, protect, and transport liquids while safeguarding their quality and shelf life. It prevents leakage, spoilage, and contamination while also ensuring ease in access and handling. Products in liquid form can be packaged in rigid containers such as plastic and glass bottles and metal cans, or in flexible packaging such as pouches, cartons, and bag-in-box systems. It is mostly used in the food and beverages, pharmaceutical, chemical, and personal care industries. Liquid packaging is using sustainable materials and advanced barrier technologies and innovative designs to respond to environmental regulations and changing consumer needs.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 442.14 Billion |

| Estimated Market Size in 2034 | USD 692.10 Billion |

| Projected CAGR 2025 to 2034 | 5.10% |

| Leading Region | Asia-Pacific |

| Key Segments | Packaging Type, Material, Technology, End User, Region |

| Key Companies | Tetra Pak International S.A., SIG Combibloc Group Ltd., Elopak ASA, Smurfit Kappa Group, Amcor plc, Mondi Group, Sealed Air Corporation, Bemis Company, Inc., International Paper Company, Berry Global Inc., Huhtamäki Oyj, DS Smith plc |

The Asia-Pacific region is leading due to urbanization, expanding middle-class incomes, and the ever-growing consumption of packaged drinks, dairy products, and sauces. China and India are emerging as the fastest growing consumer markets. There is increasing consumption of aseptic pouches, PET bottles, and bag-in-box systems containing affordable, long-shelf-life products. For example, India’s Amul manufactures milk pouches using high-speed VFFS machines, and Suntory is a Japanese beverage manufacturer that uses lightweight PET to reduce carbon emissions.

The North America in 2024 is forecasted to be around 23% of the global demand and is driven by higher consumption of packaged beverages, dairy, and liquid personal care products. The U.S. is leading the market because of the extensive use of aseptic cartons, PET bottles, as well as lightweight flexible pouches. The market is also changing due to sustainability initiatives. For example, Coca-Cola North America is increasing rPET in their beverage bottles and Tetra Pak is expanding their paper-based packaging. The market is also growing steadily due to the matured consumption of value-added plant based beverages, ready-to-drink coffee, and pharmaceutical liquids.

The European market will take up about 27% of the total global market value in 2024, attributed to the integration of recyclable and bio-based packaging which companies have undertaken as a result of enforceable sustainability policies by the EU. Germany, France, and the U.K lead in the adoption of tethered caps, mono-material pouches, and paper-based cartons. Danone increases the recyclability maximized by his labels on dairy products using clear PET labels while SIG Combibloc partners his cartons with retailers in recycling collaborations. The organic and premium product consumption is increasing which uses aseptic cartons and glass bottles. European markets are innovative in liquid packaging emphasizing reduction of carbon emissions plus lightweighting and circular economy approaches.

In 2024, Latin America will contribute with 10% of global share, with Brazil and Mexico leading in the consumption of dairy, fruit juices and even household cleaning liquids. The region’s economic development and urbanization are driving higher consumption of these markets and also lower-cost flexible liquid packaging. As an example, in Mexico, Grupo Lala uses aseptic cartons for shelf-stable milk distribution and Brazilian juice exporters PET bottles for Brazilian juice exports. Other regions of Latin America still face some challenges such as recycling infrastructure gaps and fluctuating prices for raw materials. On the bright side, these regions are also putting in place EPR regulations which will promote better collection and recycling. The Middle East and Africa are projected to account for around 4-5% of global demand in 2024, driven by the increasing consumption of bottled water, edible oils, and pharmaceutical liquids. Gulf countries exhibit significant consumption of premium PET bottles for bottled water products such as Masafi, while dairy producers in Africa depend on inexpensive HDPE bottles and pouches.

Rigid: Rigid packaging captured highest revenue share in 2024, showcasing the convenience and protection it offers. PET plastic bottles are used widely for beverages and waters owing to their lightweight characteristics and clarity. Glass bottles are not as common, but they are used for premium and alcoholic beverages because they are chemically inert and have aesthetic appeal. They possess significant market share, and are gaining traction, as illustrated by the 64% of market share for beer cans recaptured in 2023. These overturning trends show market adaptability.

Liquid Packaging Market Share, By Packaging Type, 2024 (%)

| Packaging Type | Revenue Share, 2024 (%) |

| Rigid | 64.80% |

| Flexible | 35.20% |

Flexible: The segments of flexible packaging such as spouted pouches, stand-up pouches, aseptic cartons, and bag-in-box are currently at a smaller share, but are expected to grow rapidly at a CAGR of roughly 5.8% from 2025 to 2034. These segments are lightweight, inexpensive, and suit e-commerce and on-the-go needs. In the packaging of syrups, edible oils, and wine, bag-in-box is extremely popular because of its puncture resistance and bulk dispensing ease.

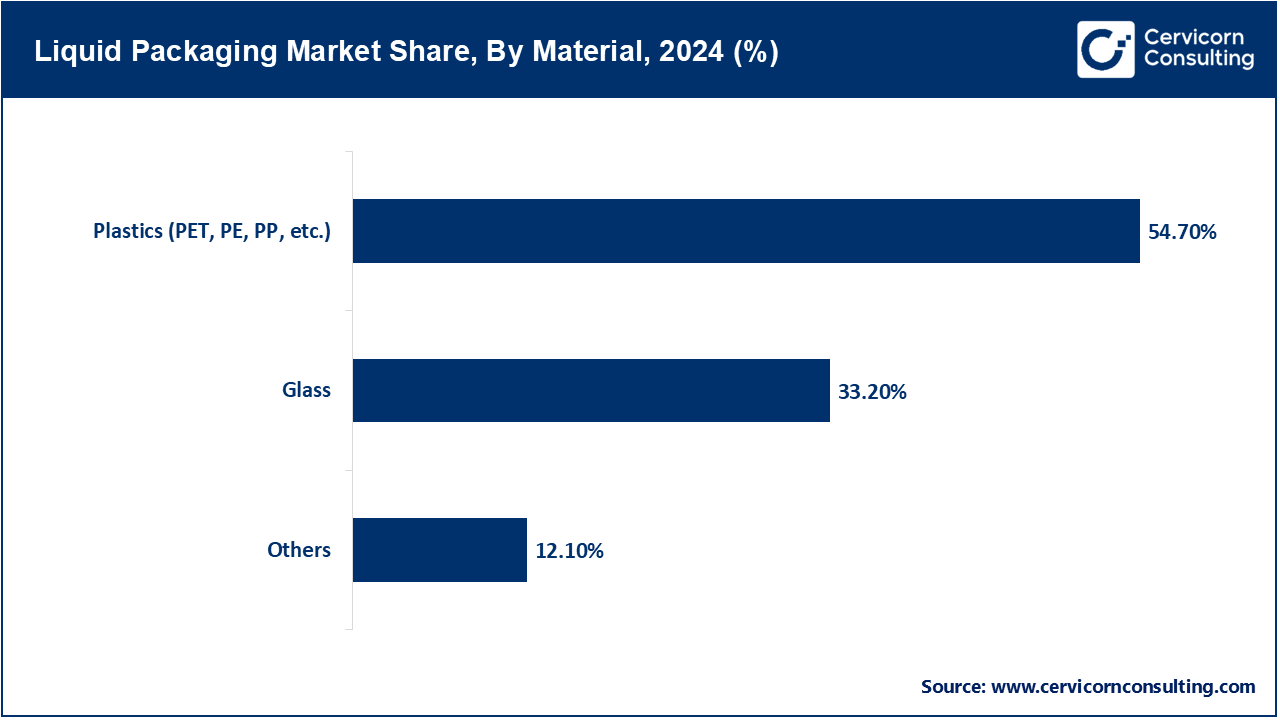

Plastics & Polymers (PE, PET, PVC, PP, etc.): Plastics are the largest segment of the material with a market share of almost 54.70%, so PET is important as well due to its widespread use in beverage containers. The shift by manufacturers to either recycled plastics or mono-material alternatives to improve a product's lifespan while cutting down on the environmental impact is increasingly common.

Glass: Wine, spirits, craft juices, and premium food items still use glass as packaging where brand image, neutrality, and quality signal matter. With glass packaging, carbonation and flavor are preserved due to glass’s excellent chemical inertness and barriers to oxygen and water vapor. In addition, glass packaging supports closed-loop circularity where used glass shards, or cullet, as well as the furnaces and furnaces, have high recycled content. For example, leading distillers invested in etched and decorated glass to improve brand equity and in Europe, retable glass for juices and dairy is being tested to reduce single use glass waste. Although glass is still heavier than other packaging options, shelf impact decaline, lightweight flint glass, and increased cullet rates are improving emissions per bottle.

Others: Aluminum and steel cans are the preferred selection for packaging beer and energy drinks due to the quick turn-around time for filling. These also functional drinks and RTDs. These drinks also benefit from a host of other packaging and beverage-based benefits. The EU, UK, and EEA have a strong circularity since they recorded an estimated 76% of aluminum beverage can recycling in 2021, which continued to improve in 2022. Aluminum cans provide other benefits too. They have high cube and rapid chilling efficiency which is an added plus for to-go consumption. These are also used to capture demand in convenience occasions. Global beverage captains are switching from glass to aluminum and new nitro coffee RTDs prefer cans for pressure resistance and quality retention.

Aseptic Packaging: Aseptic cartons allow storage of milk and juices at room temperature, sharply cutting down cold storage expenses. The carton packaging market reached an approximate $24 billion in 2024 and is projected to expand until 2030 fueled by dairy substitutes and school milk sales. Tetra Pak and SIG sustain market leadership by reducing aluminum content in cartons and switching to biobased PE made from sugarcane, enhancing renewables and reducing carbon footprint. Quick serve and foodservice broaden usage via portion packs. With recycling infrastructure improving in key markets, fiber recovery from cartons is increasing, which benefits retailer sustainability scorecards on corporate responsibility and compliance with national packaging waste laws.

Liquid Packaging Market Share, By Technology, 2024 (%)

| Technology | Revenue Share, 2024 (%) |

| Aseptic Packaging | 77.10% |

| Blow Molding | 16.50% |

| Others | 6.40% |

Blow Molding: Blow molding continues to be the dominant technology for manufacturing hollow plastic liquid containers such as PET bottles for beverages and HDPE for dairy, household, and personal care items. The blow molded plastics market reached an estimated 84 to 86 billion dollars in 2024, with packaging alone constituting over 35%. The sector is characterized with high production speeds, flexibility in design, and lightweighting. Stretch blow molding is SBM is standard for carbonated drinks and water, necks, and clarity. Global beverage companies employ two-stage SBM for rPET water bottles to improve recycled-content integration and dairy producers use extrusion blow molding for opaque HDPE jugs with handles.

Others: Form-fill-seal technology combines the forming, filling, and sealing of a package into a single, fully automated operation. It is most commonly used with pouches for dairy products, sachets for juices, liquid condiments, and single-serve beverages.

Food & Beverages: the liquid packaging for food and beverages is the most significant end-use segment. The segment includes dairy items, juices, sauces, soups, cooking oils, and alcoholic and non-alcoholic beverages. The need for preserving the shelf life of the products drives the use of aseptic cartons, PET bottles, and pouches. As an illustration, Coca-Cola utilizes lightweight PET bottles with tethered caps for compliance with European Union sustainability guidelines, and Nestlé uses aseptic cartons for plant-based beverages to minimize refrigeration requirements.

Pharmaceuticals: By the year 2024, the pharmaceutical sector is projected to contribute almost 8–10% to the liquid packaging market, which includes products like syrups, medicinal liquids, oral suspensions, and even some diagnostic reagents. Safety, tamper-evidence, and precise dosing are extremely critical. While blow-molded (HDPE) bottles and glass vials remain the dominant packaging materials, lighter PET bottles are capturing market share for over-the-counter products. For example, calibrated PET syrup bottles with child-resistant caps are used by Pfizer for cough syrups. Moreover, IV saline solutions packaged in aseptic bag-in-box or flexible pouches are used in the IV saline market.

Others: Personal care liquids such as shampoos, conditioners, lotions, and liquid soaps account for about 7% of market share in 2024. Packaging must balance aesthetics, ergonomics, and shelf impact, while supporting product protection. The chemicals segment—including household cleaners, industrial lubricants, agrochemicals, and automotive fluids—accounts for roughly 6–8% of liquid packaging demand in 2024. HDPE jerry cans, PET bottles, and laminated pouches are common, selected for chemical resistance and strength. For example, Reckitt packages liquid disinfectants in HDPE with shrink-sleeve labeling for durability, while motor oil brands use blow-molded containers with molded handles for ease of pouring.

Market Segmentation

By Packaging Type

By Material

By Technology

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Liquid Packaging

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Packaging Type Overview

2.2.3 By Material Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Demand for Ready-to-Drink & Convenience Beverages

4.1.1.2 Sustainability & Eco-Friendly Packaging Innovation

4.1.2 Market Restraints

4.1.2.1 Fluctuating Raw Material Costs & Supply Pressures

4.1.2.2 Regulatory Pressures & Recycling Infrastructure Gaps

4.1.3 Market Challenges

4.1.3.1 Raw Material Cost Volatility & Supply Chain Strain

4.1.3.2 Weak Recycling Infrastructure & Regulatory Burdens

4.1.4 Market Opportunities

4.1.4.1 Surge in Asia-Pacific Demand and Expansion of E-commerce

4.1.4.2 Innovation in Smart & Sustainable Packaging Technologies

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Liquid Packaging Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Liquid Packaging Market, By Technology

6.1 Global Liquid Packaging Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Aseptic Packaging

6.1.1.2 Blow Molding

6.1.1.3 Others (Form-Fill-Seal (FFS))

Chapter 7. Liquid Packaging Market, By Packaging Type

7.1 Global Liquid Packaging Market Snapshot, By Packaging Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Rigid

7.1.1.2 Flexible

Chapter 8. Liquid Packaging Market, By Material

8.1 Global Liquid Packaging Market Snapshot, By Material

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Plastics (PET, PE, PP, etc.)

8.1.1.2 Glass

8.1.1.3 Others (Metal, Paperboard, Biodegradable & Compostable materials)

Chapter 9. Liquid Packaging Market, By End-User

9.1 Global Liquid Packaging Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Food & Beverages (dairy, juices, sauces)

9.1.1.2 Pharmaceuticals (syrups, medicinal liquids)

9.1.1.3 Personal Care (shampoos, lotions)

9.1.1.4 Chemicals (cleaners, lubricants)

Chapter 10. Liquid Packaging Market, By Region

10.1 Overview

10.2 Liquid Packaging Market Revenue Share, By Region 2024 (%)

10.3 Global Liquid Packaging Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Liquid Packaging Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Liquid Packaging Market, By Country

10.5.4 UK

10.5.4.1 UK Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Liquid Packaging Market, By Country

10.6.4 China

10.6.4.1 China Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Liquid Packaging Market, By Country

10.7.4 GCC

10.7.4.1 GCC Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Liquid Packaging Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Tetra Pak International S.A.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 SIG Combibloc Group Ltd.

12.3 Elopak ASA

12.4 Smurfit Kappa Group

12.5 Amcor plc

12.6 Mondi Group

12.7 Sealed Air Corporation

12.8 Bemis Company, Inc. (now part of Amcor)

12.9 International Paper Company

12.10 Berry Global Inc.

12.11 Huhtamäki Oyj

12.12 DS Smith plc