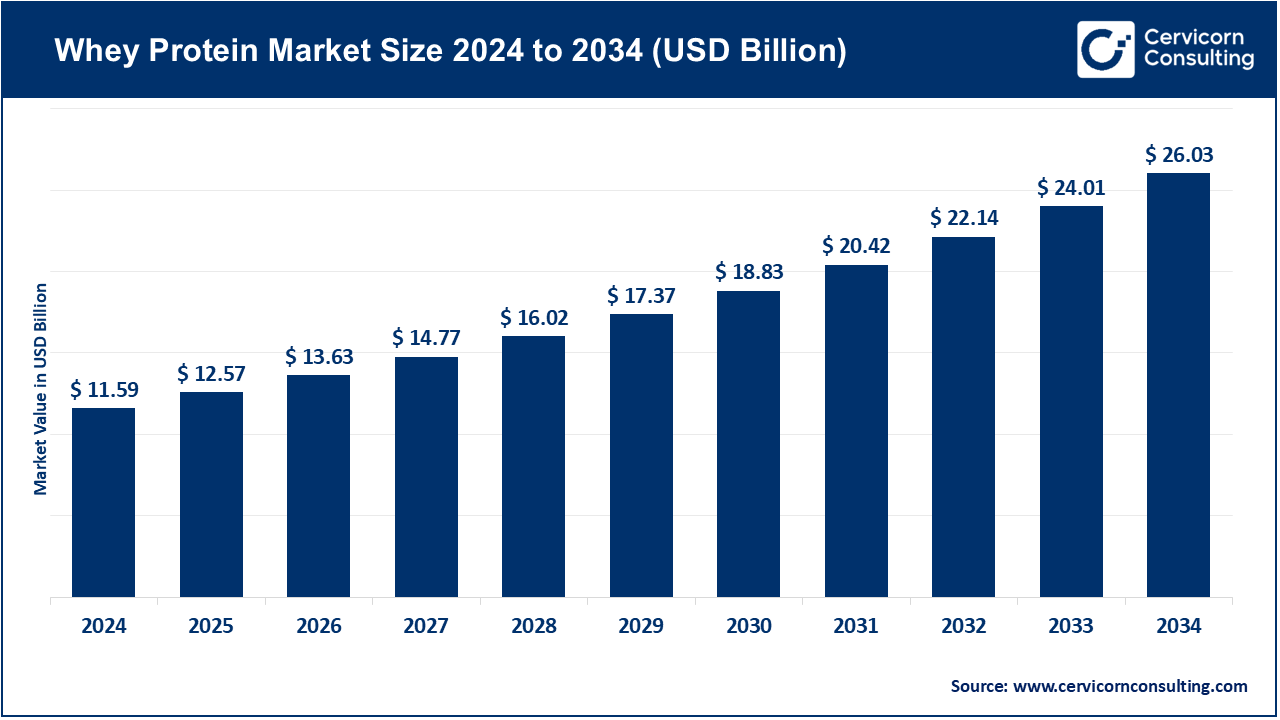

The global whey protein market size was valued at approximately USD 11.59 billion in 2024 and is projected to climb to roughly USD 26.03 billion by 2034, translating into a compound annual growth rate (CAGR) of 8.43% across the period from 2025 to 2034. The main drivers of growth include a renewed surge in fitness and bodybuilding trends across the globe, wherein more consumers are looking for effective solutions related to muscle recovery or weight management. In the United States, this can be exemplified by over 12% growth in whey protein-dependent sports nutrition just for the year 2023. Other applications, like bakery products that now comprise bars and drinks, spread the reach of whey protein much ahead of its traditional supplement application. The emergence of e-commerce platforms has increased accessibility because online sales grew by 25% globally after the pandemic. Companies such as Glanbia Nutritionals are already tapping into this trend by preparing some innovative clean-label whey protein products to join transparency and sustainability among consumers. All these factors put this ingredient right at the heart of the booming nutrition and wellness industry worldwide.

What is whey protein?

The whey protein industry belongs to the production, distribution, and sales of those products that are whey-based proteins extracted from milk in a process of cheese making. Whey protein is an excellent source of complete protein that contains significant essential amino acid content. It finds its major application in sports nutrition, dietary supplements, infant formulas, functional foods and animal feed applications. This product is highly preferred by athletes as well as fitness-conscious consumers due to its quick digestibility and muscle recovery properties. The major forms of whey protein concentrate available in the market include isolate and hydrolysate; these forms differ from one another based on their protein content as well as degree of processing. Growing consciousness across different segments about the importance of protein consumption relative to health and wellness drives demand globally.

Approximate Annual Whey Protein Production (Metric Tons), Top 5 Countries

| Countries | Whey Protein Production (Metric Tons) |

| United States | 6,00,000 |

| Germany | 2,50,000 |

| Netherland | 2,00,000 |

| France | 1,80,000 |

| New Zealand | 1,50,000 |

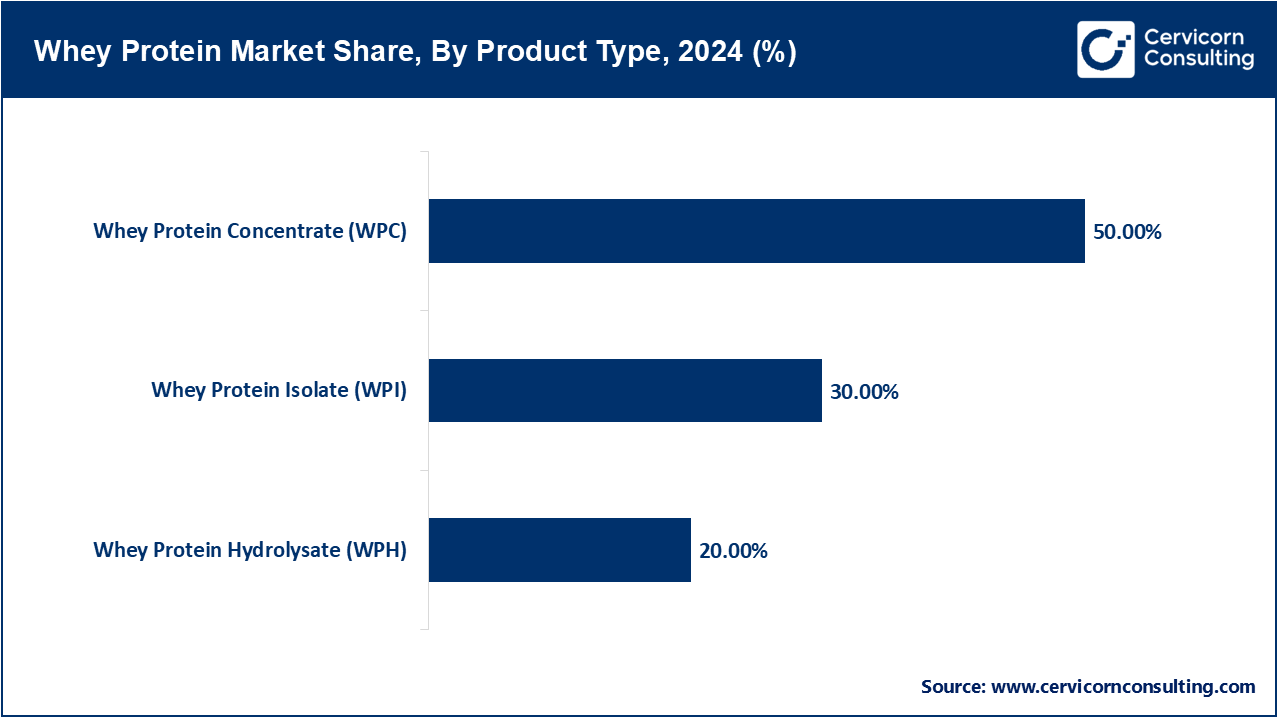

Whey Protein Concentrate (WPC): With the Compound Whey Protein (WPC) making up the biggest portion, accounting for roughly 50-60%. Demand for WPC is based on the moderate protein level of 70-80% as this, combined with the lower relative cost of WPC, favors its use in sports nutrition, health supplements, functional food, and beverages. Its lower cost and versatile nutrition profile gained these products acceptability in the emerging markets of India and Brazil, which are eager to obtain high-quality proteins at a lower price. For example, FrieslandCampina and other such companies are producing WPC based dairy products to cater to the rising demand of protein in these countries.

Whey Protein Isolate (WPI): Whey protein isolate (WPI) has a protein concentration of over 90%, with low levels of lactose and fat. It makes up 30% of the market. Due to WPI’s low lactose content, high purity, and fast absorption rate, it is ideal for athletes and fitness enthusiasts. WPI has been expanding in North America and Europe as WPI high tuned performance and high-equality nutrition is in demand, along with a clean-label. Glanbia Nutritionals is a good example of a company that has advanced WPI products with high solubility and flavor suited for sophisticated WPI buyers. Since WPI has a lower lactose content, it is also easier to digest for those who are sensitive, which increases the demand for WPI product.

Whey Protein Hydrolysate (WPH): WPH's protein accounts for 10-15% of the market and is specifically targeted since the protein is pre-digested so it is easier to absorb and less allergenic. WPH is being used more often for infants and in medical nutrition as gentle digestion is often better. For example, Arla Foods specializes in WPH for infants and the elderly, focusing on WPH in specialized nutrition products.

Sports nutrition: It is the largest and fastest growing segment, valued at over forty percent of the total whey protein market in 2024. Their awareness and participation in fitness, gym, and sports at the global level drives the requirement for whey protein, which is an essential component in muscle develop and recovery medicines. For the instance, in the US, the growth of sports nutrition market increased by over twelve percent in 2024 mainly in the millennial and Gen Z eras for use of protein for health and fitness purposes. Companies such as Optimum Nutrition and Myprotein took advantage of the trend and launched whey protein powders, ready to drink shakes, and protein bars for the athletes and fitness market.

Dietary Supplements: The dietary supplements which accounts for 25 to 30% of the market. Whey protein is largely used in general wellness supplements that target weight management, supporting immunity, and older populations. This segment is expanding as protein is in demand by consumers wanting to meet protein requirements in the easiest and effective way. Abbott Nutrition, for example, uses whey protein in meal replacements and nutritional supplements aimed at older adults and those with certain health conditions, stressing the ingredient’s importance in the preservation of muscle mass and overall health.

Whey Protein Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Sports Nutrition | 37% |

| Dietary Supplements | 25% |

| Functional Foods & Beverages | 19% |

| Infant Nutrition | 12% |

| Animal Feed | 7% |

Functional foods and beverages: This segment represent another rapidly growing application segment, estimating at around 15 to 20% of the market. Whey protein is now added to baked goods, dairy drinks, snacks, and nutrition bars to increase protein content and provide health benefits. Protein-fortified functional foods have seen significant demand in the Asia-Pacific region due to the increase in health awareness and urban lifestyle. An example is FrieslandCampina's launch of dairy drinks enriched with whey protein in India.

Infant nutrition and animal feed: Whey protein's high-quality amino acids and digestibility means it is vital in infant formulas and makes up 5-7% of the infant nutrition market. Whey proteins are also used in animal feed to better the nutrition of livestock.

Supermarkets and hypermarkets: The dominant method of distribution remains supermarkets and hypermarkets, with the highest market share of about 39% in 2024. These driven supermarkets appeal to the general and first time customers due to the large assortment of stocked products, lower price, and easy access. Retailers like Walmart and hypermarkets like Carrefour broadened their health and wellness sections to stock whey protein products, including powders and ready-to-drink beverages, thus making the incorporation of protein into daily diets more convenient for consumers.

Online retail: With the expansion of e-commerce retailers such as Amazon and Alibaba, as well as niche shopping and health-focused online outlets, the way consumers buy products has drastically changed, allowing shoppers to obtain a wide range of items including nutrition products and receive them directly to their homes. E-commerce has become the fastest-growing distribution channel, and adds nearly 25-30% to total global whey protein sales. This channel of shopping is extremely popular among young consumers, especially those who are well-versed with the Internet and prefer easy-to-use shopping interfaces. With the online digital craze, Myprotein and Optimum Nutrition are prime examples of brands who have benefited from a direct-to-consumer selling model and have seen a surge in sales.

Specialty Stores: Health-focused gyms, workout clubs, and fitness centers have approximately 27% of market share within wellness and nutrition. They appeal to fitness buffs and athletes who like one-on-one consultations and appreciate having premade product bundles. These specialized fitness retailers build more consumer confidence by having qualified personnel who offer the products and services and give practical insights. GNC and Vitamin Shoppe are the primary retailers in North America and sell the whey protein supplements, making them popular specialized whey retailers.

Pharmacies and drug stores: This segment contribute a smaller but important segment, roughly 10-12%, serving consumers seeking nutritional supplements for medical or wellness reasons. Pharmacies provide easy access to certified and trusted whey protein products, often recommended by healthcare professionals.

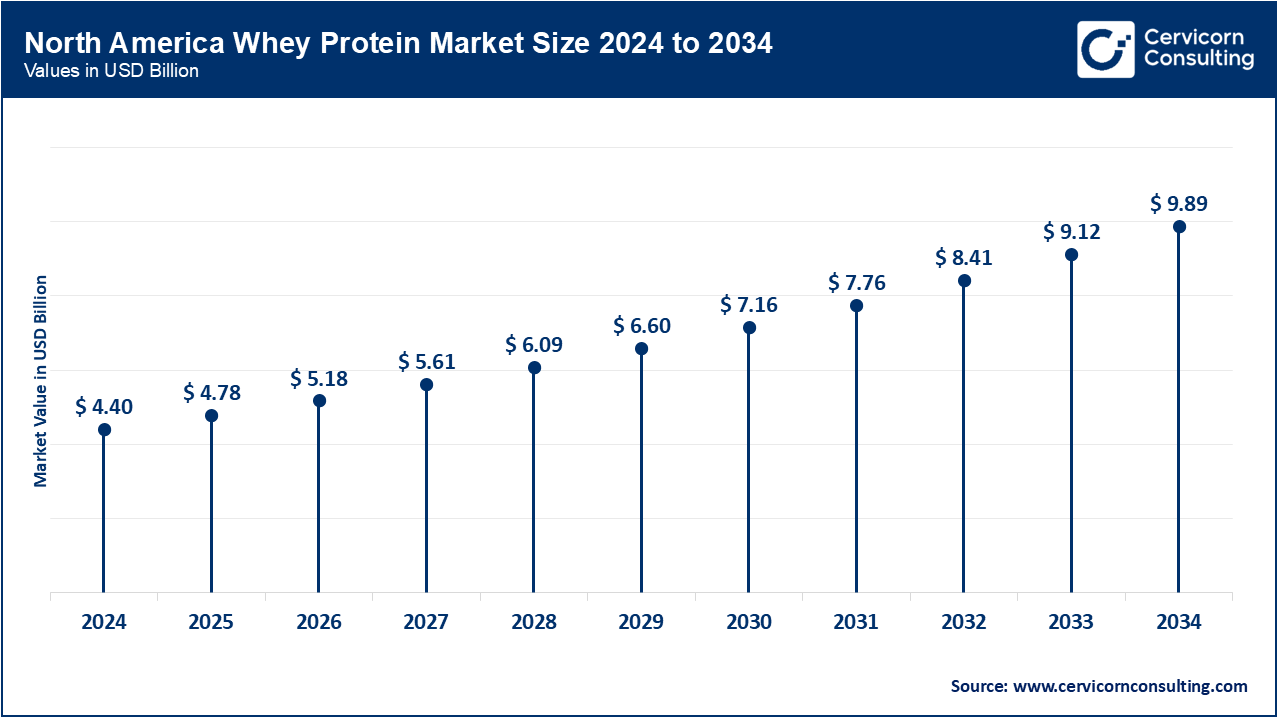

As of now, the United States region remains the largest and most mature market for protein, accounting for approximately 35-40% of the global market share. Consumer awareness about health and fitness, the adoption of sports nutrition products, and good infrastructure are some of the key determinants for the market region. The region, however, does heavily rely on the United States, for approximately 30% of adults consuming protein supplements. Since the demand is high, it is an attended market by leading companies such as Glanbia Nutritionals and Hilmar Ingredients. They provide a wide range of whey protein products made for athletes, bodybuilders and general wellness consumers. The dependable resources these regions have strengthens the fact that they are leading the North American market.

Europe is in second place, possessing around 25-30% of the market share with a growing focus on health and sustainable and ethically sourced products. Germany, the United Kingdom, France, and Nordic countries have a high demand for whey protein, especially in sports nutrition, functional foods, and even in medical nutrition. The European Union has stringent regulations on food safety, and labeling fostering transparency and quality which motivates branded manufacturers to provide organic and non-GMO whey protein alternatives. As an example, organic whey protein products have been introduced by Arla Foods for customers mindful of the environment.

This region has the fastest growth in the world and now boasts over 10% annual growth. These trends are also evident in China, India, Japan, and Australia. Urbanization, disposable income, and health awareness are exploding in these countries. The whey protein market is developing as well, with China's middle class and fitness audiences increasingly consuming protein supplements, aided by e-commerce. Opportunities also exist regionally, as demonstrated by Friesland Campina’s successful introduction of whey protein-fortified dairy beverages in India. The government also promotes whey protein in nutrition which is aimed at countering lifestyle diseases.

Whey Protein Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 38% |

| Europe | 28% |

| Asia-Pacific | 24% |

| LAMEA | 10% |

In Latin America, nations such as Brazil and Mexico are leading the market due to the expanding middle class, increasing income levels, a broadening fitness and wellness culture, and a surge in disposable income. Modern retail outlets and the rise in e-commerce are enhancing the reach of whey protein to a larger segment of the population. Brazil's sports nutrition sector, for example, grew more than 8% in 2023 due to an increase in gym usage and sports participation. In the Middle East, the United Arab Emirates (UAE) and Saudi Arabia are both witnessing increasing healthcare and fitness investments alongside government efforts to adopt better health habits. The protein supplement market's growth in the UAE is equally impressive, with over 20% growth in sales recorded in 2023.

Market Segmentation

By Product Type

By Distribution Channel

By Application

By End Users

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Whey Protein

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Type Overview

2.2.2 By Distribution Channel Overview

2.2.3 By Application Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Expanding applications of whey protein

4.1.1.2 Technological advancements and product innovation

4.1.2 Market Restraints

4.1.2.1 Lactose intolerance and dairy allergies

4.1.2.2 The growing popularity of plant-based proteins

4.1.3 Market Challenges

4.1.3.1 Price volatility of whey protein raw materials

4.1.3.2 Environmental sustainability issues linked to dairy farming

4.1.4 Market Opportunities

4.1.4.1 The growing trend of personalized nutrition

4.1.4.2 Emerging markets potential for whey protein growth

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Whey Protein Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Whey Protein Market, By Product Type

6.1 Global Whey Protein Market Snapshot, By Product Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Whey Protein Concentrate (WPC)

6.1.1.2 Whey Protein Isolate (WPI)

6.1.1.3 Whey Protein Hydrolysate (WPH)

Chapter 7. Whey Protein Market, By Distribution Channel

7.1 Global Whey Protein Market Snapshot, By Distribution Channel

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Supermarkets / Hypermarkets

7.1.1.2 Specialty Stores

7.1.1.3 Online Retail

7.1.1.4 Pharmacies & Drug Stores

Chapter 8. Whey Protein Market, By Application

8.1 Global Whey Protein Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Sports Nutrition

8.1.1.2 Dietary Supplements

8.1.1.3 Functional Foods & Beverages

8.1.1.4 Infant Nutrition

8.1.1.5 Animal Feed

Chapter 9. Whey Protein Market, By End-User

9.1 Global Whey Protein Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Athletes

9.1.1.2 Bodybuilders

9.1.1.3 Lifestyle Users

Chapter 10. Whey Protein Market, By Region

10.1 Overview

10.2 Whey Protein Market Revenue Share, By Region 2024 (%)

10.3 Global Whey Protein Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Whey Protein Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Whey Protein Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Whey Protein Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Whey Protein Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Whey Protein Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Whey Protein Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Whey Protein Market, By Country

10.5.4 UK

10.5.4.1 UK Whey Protein Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Whey Protein Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Whey Protein Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Whey Protein Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Whey Protein Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Whey Protein Market, By Country

10.6.4 China

10.6.4.1 China Whey Protein Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Whey Protein Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Whey Protein Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Whey Protein Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Whey Protein Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Whey Protein Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Whey Protein Market, By Country

10.7.4 GCC

10.7.4.1 GCC Whey Protein Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Whey Protein Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Whey Protein Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Whey Protein Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Glanbia Nutritionals

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Arla Foods

12.3 FrieslandCampina

12.4 Hilmar Ingredients

12.5 Fonterra Co-operative Group

12.6 Dairy Farmers of America

12.7 Murray Goulburn Co-operative

12.8 Synlait Milk Limited

12.9 Agropur Inc.

12.10 Saputo Inc.

12.11 Kerry Group

12.12 Lactalis Group