Whey Protein Market Size and Growth Factors 2025 to 2034

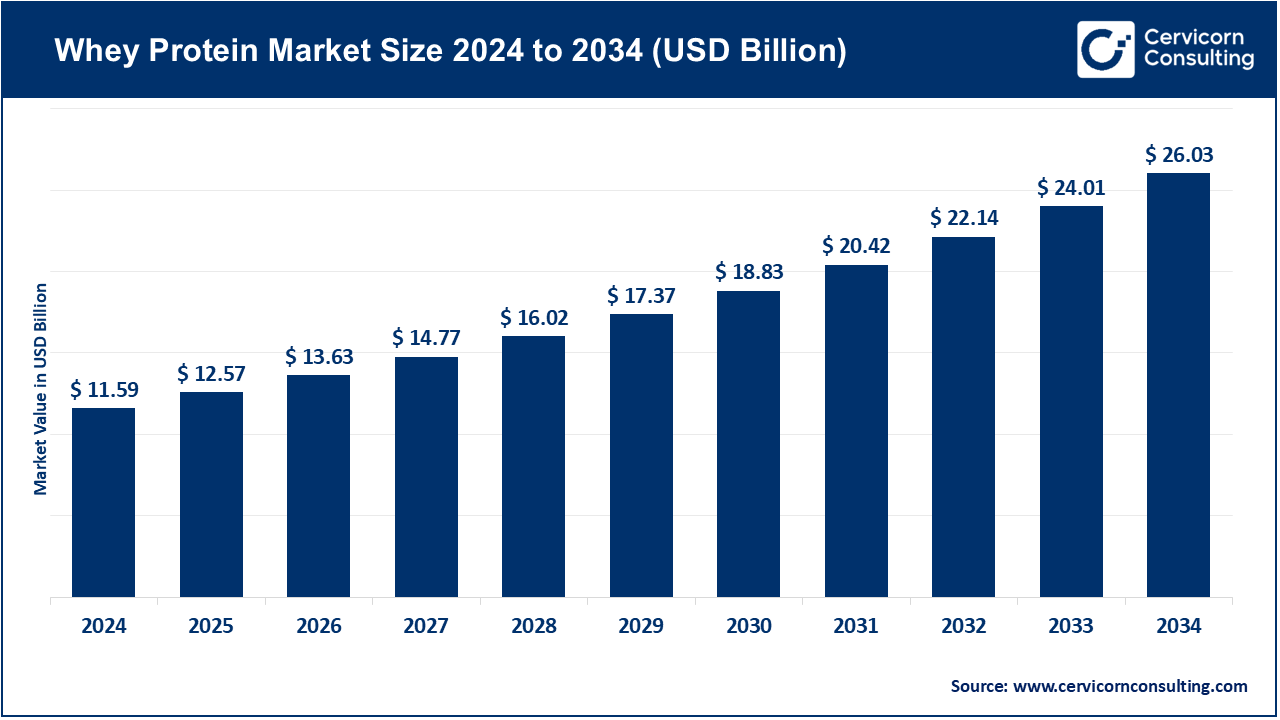

The global whey protein market size was valued at approximately USD 11.59 billion in 2024 and is projected to climb to roughly USD 26.03 billion by 2034, translating into a compound annual growth rate (CAGR) of 8.43% across the period from 2025 to 2034. The main drivers of growth include a renewed surge in fitness and bodybuilding trends across the globe, wherein more consumers are looking for effective solutions related to muscle recovery or weight management. In the United States, this can be exemplified by over 12% growth in whey protein-dependent sports nutrition just for the year 2023. Other applications, like bakery products that now comprise bars and drinks, spread the reach of whey protein much ahead of its traditional supplement application. The emergence of e-commerce platforms has increased accessibility because online sales grew by 25% globally after the pandemic. Companies such as Glanbia Nutritionals are already tapping into this trend by preparing some innovative clean-label whey protein products to join transparency and sustainability among consumers. All these factors put this ingredient right at the heart of the booming nutrition and wellness industry worldwide.

What is whey protein?

The whey protein industry belongs to the production, distribution, and sales of those products that are whey-based proteins extracted from milk in a process of cheese making. Whey protein is an excellent source of complete protein that contains significant essential amino acid content. It finds its major application in sports nutrition, dietary supplements, infant formulas, functional foods and animal feed applications. This product is highly preferred by athletes as well as fitness-conscious consumers due to its quick digestibility and muscle recovery properties. The major forms of whey protein concentrate available in the market include isolate and hydrolysate; these forms differ from one another based on their protein content as well as degree of processing. Growing consciousness across different segments about the importance of protein consumption relative to health and wellness drives demand globally.

Approximate Annual Whey Protein Production (Metric Tons), Top 5 Countries

| Countries |

Whey Protein Production (Metric Tons) |

| United States |

6,00,000 |

| Germany |

2,50,000 |

| Netherland |

2,00,000 |

| France |

1,80,000 |

| New Zealand |

1,50,000 |

Whey Protein Market Report Highlights

- The urbanization and increased fitness activities in India and China are contributing to the annual growth of over 10% in the Asia-Pacific fitness market, and making it one of the fastest growing regions.

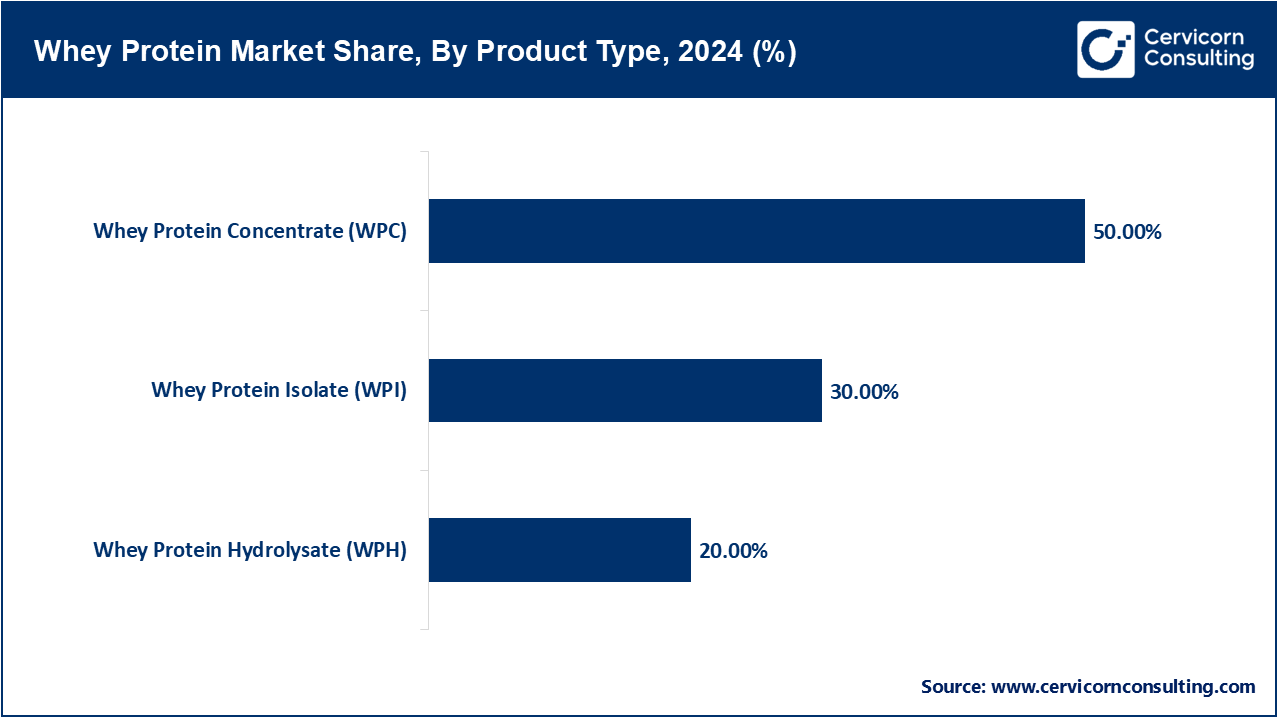

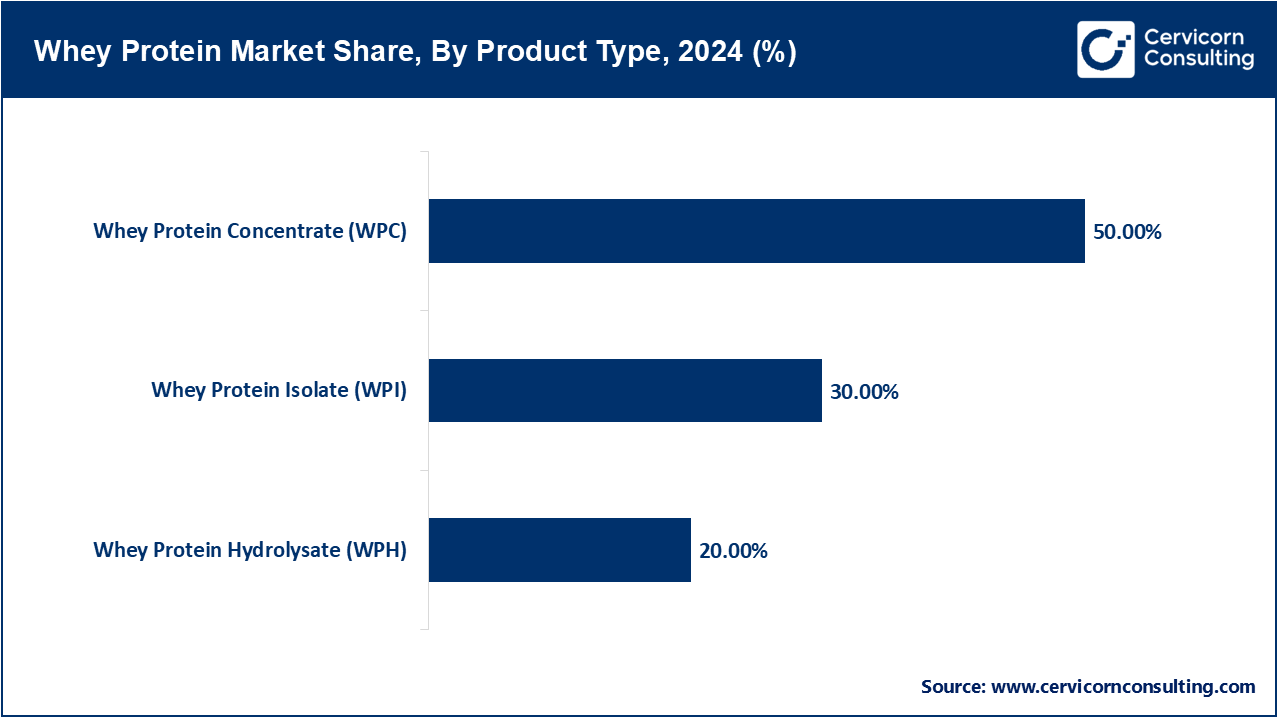

- By Product, WPC maintaining the highest product share, with WPC having over 50% market share. WPCs are preferred due to their balanced protein ratio and cost while WPIs are growing due to their high purity.

- The application segment is dominated by fitness and sport activities as they hold over 37% share of the fitness market. This is driven by rising participation in physical training and sports globally.

- Online retailers are the fastest growing segment expanding at 20% while accounting for 39% sale share with hypermarkets and supermarkets. The growth is driven by convenience and expanded product access.

Whey Protein Market Trends

- Clean-label and natural whey protein products: Consumers are now more aware and conscious of the products they purchase, especially the ingredients, resulting in an increase in the purchasing of clean-label whey protein products. Proteins are now preferred with no additives, preservatives, or even allergens, and are made with the least amount of processing. A survey conducted by Ingredion in 2023 showed more than 65% of consumers from around the globe view clean-label products as an important factor for purchasing nutritional supplements. Manufacturers are now looking to cold-processed whey proteins, and organic or non-GMO certifications to meet this demand. An example of this was Glanbia Nutritionals and their “NaturPro” range, which features cold-filtered whey protein concentrates that are minimally processed to keep the natural bioactive compounds. Such products are extremely attractive in North America and Europe, which consists of more than 70% of the global clean-label whey market share, and demand does not ignore purity or quality.

- Functional and personalized nutrition solutions: The functional uses of whey protein are increasing as multi-layered personalized nutrition expands. Apart from sports whey protein is also utilized in meal substitutes, in weight control formulation devices, supplements for cognition and in other multi-functional products. As personalized nutrition continues to grow, nutrition recommendations based on one’s genetics, lifestyle, and other personalized attributes opens up more possibilities for whey protein. When looking over the data, the global personalized nutrition market is likely to grow up to USD 17.5 billion by 2030, exhibiting a 10-12% CAGR on the condition that protein enriched formulations are at the forefront. Other industries such as Arla Foods enable the customization of the nutritional profile based on the consumer data to deliver personalized whey protein supplements tailored for muscle growth, metabolic function, and aging. Expanding to the greater Asia-Pacific region, the integration of digital health and the increasing middle-class incomes have a naturally rising demand for these nutritional products and thus has contributed to the growth of the region’s whey protein market over 10% annually.

Whey Protein Market Dynamics

Market Drivers

- Expanding applications of whey protein: Whey protein’s use spanning from exercise supplements to functional foods and beverages serves as a significant driver for growth in the sector. Its adaptability makes it possible for whey protein to be included in such items as protein bars, meal replacement shakes, baked goods, and even infant formulas. The functional foods sector is where protein enriched foods will thrive, as it is growing rapidly: from USD 140 billion in 2021, it will reach USD 275 billion in 2030, making it the fastest growing sector in the food industry, approximately 8-10% CAGR. The most dynamic is the Asia-Pacific region, specifically China and India, where augmented economic growth is leading to a growing upper-class tuned to health and nutrition. Primarily, Friesland Campina in these regions enabled consumer demand for convenient nutrition by launching whey protein-fortified dairy beverages. Moreover, there is a significant demand by e-commerce platforms for whey protein encompasses. Online sales have surged by 25% since 2020, allowing time-pressed buyers to access health products.

- Technological advancements and product innovation: New processing methods such as cold and microfiltration further increase protein purity and bioavailability while preserving important bioactive elements, allowing the native bioactive elements to meet the needs of consumers for clean-label and high-quality goods. Companies are shifting towards ultra-convenient formats of whey protein such as ready to drink shakes, flavored powders, and protein enriched snacks which fit into busy schedules. As an example, Hilmar Ingredients launched some whey protein isolates with improved taste and solubility which can greatly enhance their use in beverages and bakery goods. There is also an increasing trend of incorporating whey proteins with plant-based ingredients which diversifies foods for flexitarians and those looking for more sustainable foods. All of these are not only increase the applications of the products but also increase adoption by consumers of different ages and locations. Continuous innovations strengthen the competitive advantage of whey protein in the nutraceuticals market and are projected to support 7-9% CAGR through 2034.

Market Restraints

- Lactose intolerance and dairy allergies: Whey protein's production from milk means it has naturally occurring lactose, which is problematic for the growing demographic of lactose intolerant individuals—approximately 65% of the global population. This condition is associated with the bloating, cramps, and diarrhea and is a deterrent for many users of whey-based supplements. In addition, although less common, milk protein allergies are more serious, which limits the accessibility of whey protein products. These factors have motivated some consumers looking for non-dairy sources, affecting the sales of whey protein. For example, Glanbia Nutritionals developed lactose free whey protein isolates for the sensitive consumers in Europe. While there is a 10-20% prevalence of lactose intolerance in Europe, the segment is niche compared to the overall market. Simultaneously, the need to educate consumers and the lack of clear labeling overly complicates marketing, which slows adoption.

- The growing popularity of plant-based proteins: The plant protein market, which includes proteins derived from peas, rice, and soy, is expected to grow at a CAGR of 10%. This is driven by the increase in veganism, concern for the environment, and a shift toward more sustainable nutrition. In comparison with plant proteins, whey proteins are expected to grow at a slower rate. Internationally, the whey protein market is dominated by the traditional producers of whey protein. These critics often assume plant proteins are more sustainable and acceptable for people with dairy allergies. Nutrition brands such as Beyond Meat have started using rice and pea protein to mimic the amino acid profile of whey which finds widespread acceptance. There is still a challenge for traditional whey protein producers to keep pace with plant protein innovations which appeal to younger consumers turning vegan.

Market Challenges

- Price volatility of whey protein raw materials: Factors like feed costs, the weather, and the global supply and demand balance directly affect the dairy sector, which in turn impacts whey protein supply. As the U.S. Department of Agriculture reported, average milk prices on the farm surged over 15% in 2023. This directly resulted in whey protein concentrate prices also climbing. The resulting cost variation ultimately increases retail pricing, which in turn drives away low cost-sensitive consumers and makes supply chain planning more difficult for manufacturers.

- Environmental sustainability issues linked to dairy farming: Due to greenhouse gas emissions, water usage, and land degradation, dairy production is under close watch from consumers and environmental groups. The FAO claims that the dairy sector emits approximately 4% of the global greenhouse gases. This contributes to the increasing concern and awareness of consumers that motivates the search for more sustainable and eco-friendly protein sources. Consequently, This trend is forcing manufacturers of whey protein to adopt and communicate more sustainable practices. These actions cut carbon emissions, and “go green” to protect brand loyalty while fighting more sustainable competition. Growing concern for the environment will keep plant-based alternatives in demand. Ultimately, this will grow the market share of these plant protein alternatives while putting more whey manufacturers out of business if they don’t adapt. The trend of embracing plant-based alternatives is predicted to thrive, the eco-friendly impact will be more desirable.

Market Opportunities

- The carbon credit revenue streams: The farmers may be able to financially reap the benefits of restored soil carbon by selling it to voluntary carbon markets. This makes instant income besides crop sales. In April 2024, Indigo Ag sold 15 million worth of carbon credits that focus on regenerative agriculture to large food corporations. The participating farms were paid to have verified storage of carbon. Regenerative projects will have improved financial sustainability through such markets.

- AgriTech Alliances of Precision Regeneration: Tech startups are providing efficiency-enhancing tools such as AI irrigation control, drone mapping and microbial soil testing. These assist the farmers in perfecting regenerative activities. In September 2023 Biome Makers joined Syngenta to implement DNA soil testing to target microbe-based interventions. The cooperation enhanced production accompanied by the rejuvenation of the soil. The level of tech-enabled scaling of regenerative agriculture opens up such avenues.

Whey Protein Market Segmental Analysis

Product Type Analysis

Whey Protein Concentrate (WPC): With the Compound Whey Protein (WPC) making up the biggest portion, accounting for roughly 50-60%. Demand for WPC is based on the moderate protein level of 70-80% as this, combined with the lower relative cost of WPC, favors its use in sports nutrition, health supplements, functional food, and beverages. Its lower cost and versatile nutrition profile gained these products acceptability in the emerging markets of India and Brazil, which are eager to obtain high-quality proteins at a lower price. For example, FrieslandCampina and other such companies are producing WPC based dairy products to cater to the rising demand of protein in these countries.

Whey Protein Isolate (WPI): Whey protein isolate (WPI) has a protein concentration of over 90%, with low levels of lactose and fat. It makes up 30% of the market. Due to WPI’s low lactose content, high purity, and fast absorption rate, it is ideal for athletes and fitness enthusiasts. WPI has been expanding in North America and Europe as WPI high tuned performance and high-equality nutrition is in demand, along with a clean-label. Glanbia Nutritionals is a good example of a company that has advanced WPI products with high solubility and flavor suited for sophisticated WPI buyers. Since WPI has a lower lactose content, it is also easier to digest for those who are sensitive, which increases the demand for WPI product.

Whey Protein Hydrolysate (WPH): WPH's protein accounts for 10-15% of the market and is specifically targeted since the protein is pre-digested so it is easier to absorb and less allergenic. WPH is being used more often for infants and in medical nutrition as gentle digestion is often better. For example, Arla Foods specializes in WPH for infants and the elderly, focusing on WPH in specialized nutrition products.

Application Analysis

Sports nutrition: It is the largest and fastest growing segment, valued at over forty percent of the total whey protein market in 2024. Their awareness and participation in fitness, gym, and sports at the global level drives the requirement for whey protein, which is an essential component in muscle develop and recovery medicines. For the instance, in the US, the growth of sports nutrition market increased by over twelve percent in 2024 mainly in the millennial and Gen Z eras for use of protein for health and fitness purposes. Companies such as Optimum Nutrition and Myprotein took advantage of the trend and launched whey protein powders, ready to drink shakes, and protein bars for the athletes and fitness market.

Dietary Supplements: The dietary supplements which accounts for 25 to 30% of the market. Whey protein is largely used in general wellness supplements that target weight management, supporting immunity, and older populations. This segment is expanding as protein is in demand by consumers wanting to meet protein requirements in the easiest and effective way. Abbott Nutrition, for example, uses whey protein in meal replacements and nutritional supplements aimed at older adults and those with certain health conditions, stressing the ingredient’s importance in the preservation of muscle mass and overall health.

Whey Protein Market Revenue Share, By Application, 2024 (%)

| Application |

Revenue Share, 2024 (%) |

| Sports Nutrition |

37% |

| Dietary Supplements |

25% |

| Functional Foods & Beverages |

19% |

| Infant Nutrition |

12% |

| Animal Feed |

7% |

Functional foods and beverages: This segment represent another rapidly growing application segment, estimating at around 15 to 20% of the market. Whey protein is now added to baked goods, dairy drinks, snacks, and nutrition bars to increase protein content and provide health benefits. Protein-fortified functional foods have seen significant demand in the Asia-Pacific region due to the increase in health awareness and urban lifestyle. An example is FrieslandCampina's launch of dairy drinks enriched with whey protein in India.

Infant nutrition and animal feed: Whey protein's high-quality amino acids and digestibility means it is vital in infant formulas and makes up 5-7% of the infant nutrition market. Whey proteins are also used in animal feed to better the nutrition of livestock.

Distribution Channel Analysis

Supermarkets and hypermarkets: The dominant method of distribution remains supermarkets and hypermarkets, with the highest market share of about 39% in 2024. These driven supermarkets appeal to the general and first time customers due to the large assortment of stocked products, lower price, and easy access. Retailers like Walmart and hypermarkets like Carrefour broadened their health and wellness sections to stock whey protein products, including powders and ready-to-drink beverages, thus making the incorporation of protein into daily diets more convenient for consumers.

Online retail: With the expansion of e-commerce retailers such as Amazon and Alibaba, as well as niche shopping and health-focused online outlets, the way consumers buy products has drastically changed, allowing shoppers to obtain a wide range of items including nutrition products and receive them directly to their homes. E-commerce has become the fastest-growing distribution channel, and adds nearly 25-30% to total global whey protein sales. This channel of shopping is extremely popular among young consumers, especially those who are well-versed with the Internet and prefer easy-to-use shopping interfaces. With the online digital craze, Myprotein and Optimum Nutrition are prime examples of brands who have benefited from a direct-to-consumer selling model and have seen a surge in sales.

Specialty Stores: Health-focused gyms, workout clubs, and fitness centers have approximately 27% of market share within wellness and nutrition. They appeal to fitness buffs and athletes who like one-on-one consultations and appreciate having premade product bundles. These specialized fitness retailers build more consumer confidence by having qualified personnel who offer the products and services and give practical insights. GNC and Vitamin Shoppe are the primary retailers in North America and sell the whey protein supplements, making them popular specialized whey retailers.

Pharmacies and drug stores: This segment contribute a smaller but important segment, roughly 10-12%, serving consumers seeking nutritional supplements for medical or wellness reasons. Pharmacies provide easy access to certified and trusted whey protein products, often recommended by healthcare professionals.

Whey Protein Market Regional Analysis

Why does North America hold the largest share of the whey protein market?

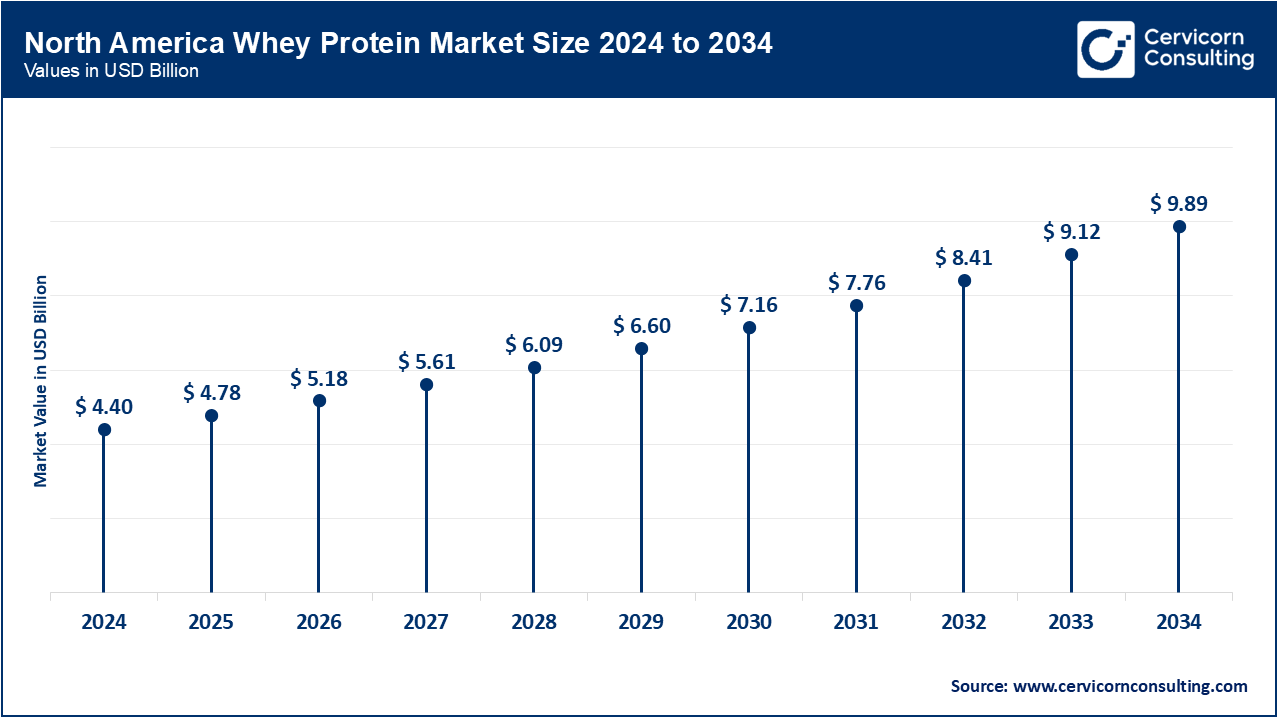

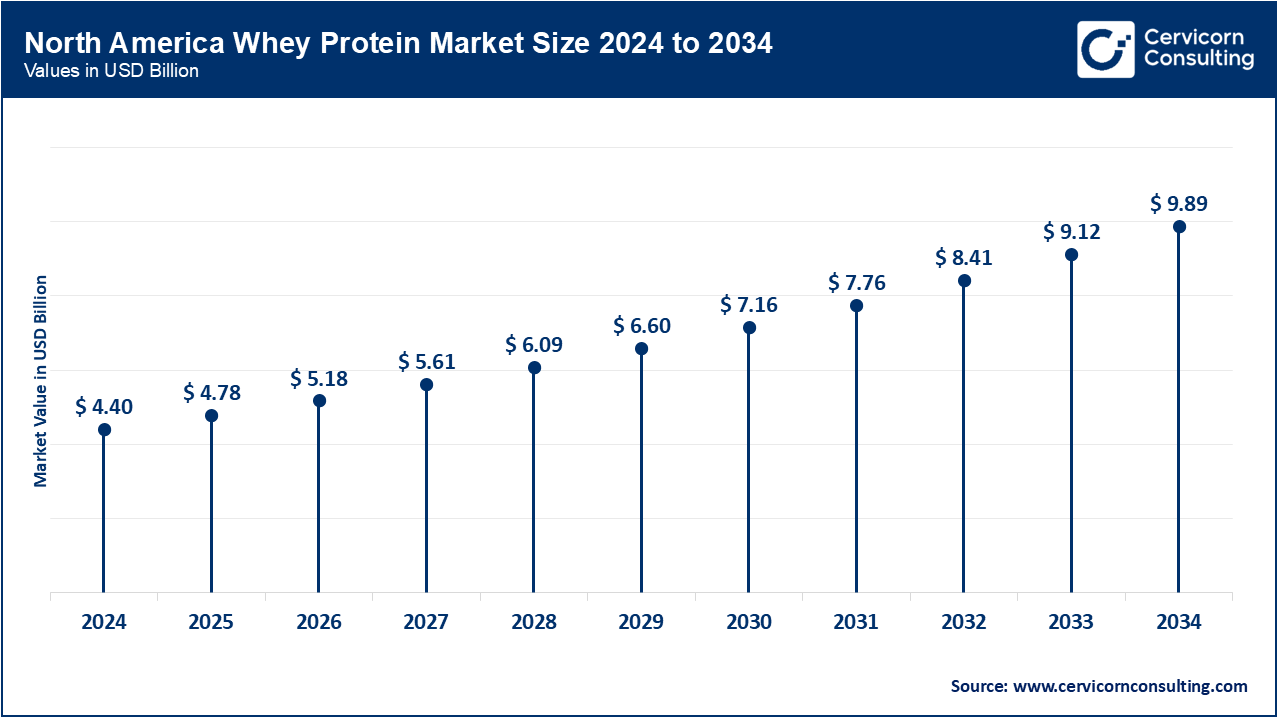

- The North America whey protein market size was valued at USD 4.40 billion in 2024 and is anticipated to reach around USD 9.89 billion by 2034.

As of now, the United States region remains the largest and most mature market for protein, accounting for approximately 35-40% of the global market share. Consumer awareness about health and fitness, the adoption of sports nutrition products, and good infrastructure are some of the key determinants for the market region. The region, however, does heavily rely on the United States, for approximately 30% of adults consuming protein supplements. Since the demand is high, it is an attended market by leading companies such as Glanbia Nutritionals and Hilmar Ingredients. They provide a wide range of whey protein products made for athletes, bodybuilders and general wellness consumers. The dependable resources these regions have strengthens the fact that they are leading the North American market.

Why does Europe hold second position in the whey protein market?

- The Europe whey protein market size was estimated at USD 3.25 billion in 2024 and is expected to surpass around USD 7.29 billion by 2034.

Europe is in second place, possessing around 25-30% of the market share with a growing focus on health and sustainable and ethically sourced products. Germany, the United Kingdom, France, and Nordic countries have a high demand for whey protein, especially in sports nutrition, functional foods, and even in medical nutrition. The European Union has stringent regulations on food safety, and labeling fostering transparency and quality which motivates branded manufacturers to provide organic and non-GMO whey protein alternatives. As an example, organic whey protein products have been introduced by Arla Foods for customers mindful of the environment.

Why has Asia-Pacific captured the fastest growth in the whey protein market?

- The Asia-Pacific whey protein market size was accounted for USD 2.78 billion in 2024 and is expected to hit USD 6.25 billion by 2034.

This region has the fastest growth in the world and now boasts over 10% annual growth. These trends are also evident in China, India, Japan, and Australia. Urbanization, disposable income, and health awareness are exploding in these countries. The whey protein market is developing as well, with China's middle class and fitness audiences increasingly consuming protein supplements, aided by e-commerce. Opportunities also exist regionally, as demonstrated by Friesland Campina’s successful introduction of whey protein-fortified dairy beverages in India. The government also promotes whey protein in nutrition which is aimed at countering lifestyle diseases.

Whey Protein Market Revenue Share, By Region, 2024 (%)

| Region |

Revenue Share, 2024 (%) |

| North America |

38% |

| Europe |

28% |

| Asia-Pacific |

24% |

| LAMEA |

10% |

LAMEA Whey Protein Trends

- The LAMEA whey protein market was valued at USD 1.16 billion in 2024 and is anticipated to reach USD 2.60 billion by 2034.

In Latin America, nations such as Brazil and Mexico are leading the market due to the expanding middle class, increasing income levels, a broadening fitness and wellness culture, and a surge in disposable income. Modern retail outlets and the rise in e-commerce are enhancing the reach of whey protein to a larger segment of the population. Brazil's sports nutrition sector, for example, grew more than 8% in 2023 due to an increase in gym usage and sports participation. In the Middle East, the United Arab Emirates (UAE) and Saudi Arabia are both witnessing increasing healthcare and fitness investments alongside government efforts to adopt better health habits. The protein supplement market's growth in the UAE is equally impressive, with over 20% growth in sales recorded in 2023.

Whey Protein Market Top Companies

Recent Developments

- August 2025: The Costco-exclusive protein drink launch by Idaho-based snack brand Genius Gourmet was a sparkling drink that featured a unique fizzy texture and mushroom extract as a preservative. With 30 grams of ultra-filtered whey protein isolate, 0 sugar, no lactose, and only 130 calories, the drink is a 12 oz can. The drink’s flavor and nutrition profile sparked a lot of attention on TikTok.

- August 2025: Myprotein has now launched a new product, "Clear Whey 'Splash of,'" the lighter version of its Clear Whey Protein Clear Whey Protein. Like its predecessor, the new product offers 20 grams of protein but now offers a refreshing, sweet, and natural tasting drink with water for under 90 calories.

Market Segmentation

By Product Type

- Whey Protein Concentrate (WPC)

- Whey Protein Isolate (WPI)

- Whey Protein Hydrolysate (WPH)

By Distribution Channel

- Supermarkets / Hypermarkets

- Specialty Stores

- Online Retail

- Pharmacies & Drug Stores

By Application

- Sports Nutrition

- Dietary Supplements

- Functional Foods & Beverages

- Infant Nutrition

- Animal Feed

By End Users

- Athletes

- Bodybuilders

- Lifestyle Users

By Region

- North America

- APAC

- Europe

- LAMEA