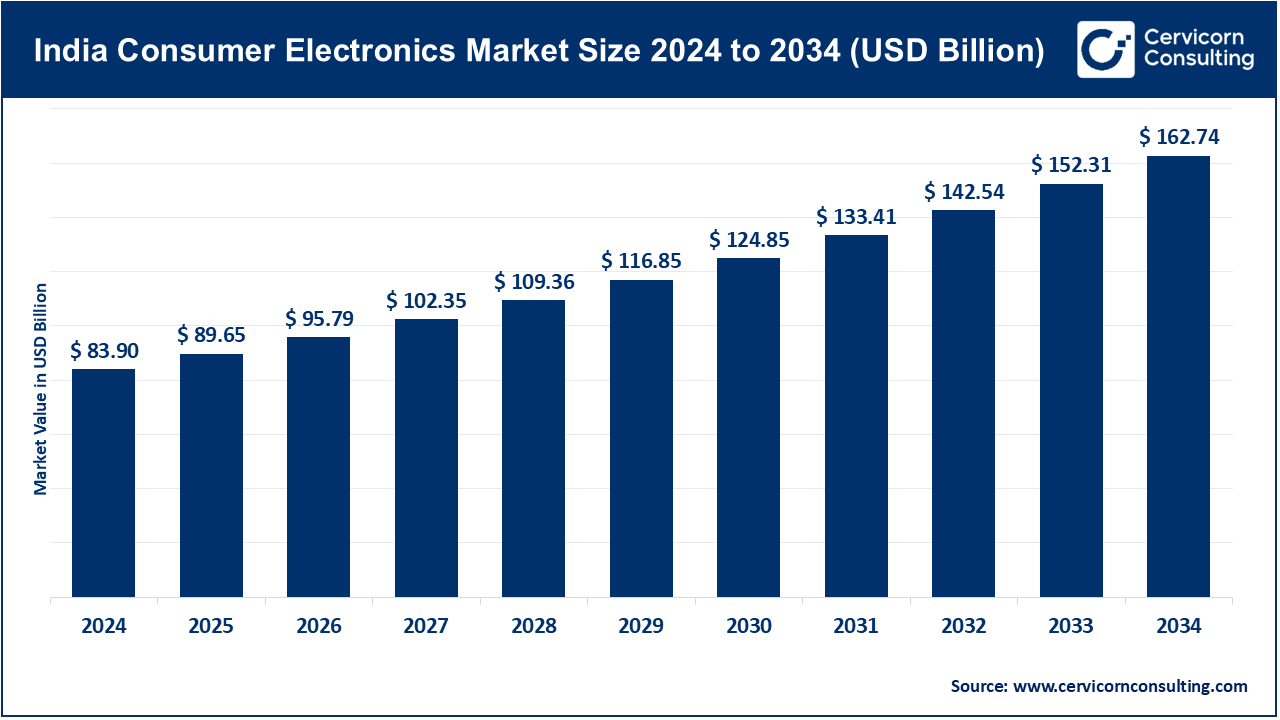

The India consumer electronics market size was valued at USD 83.90 billion in 2024 and is anticipated to reach around USD 162.74 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.85% over the forecast period from 2025 to 2034. The India consumer electronics market is emerging as one of the fastest growing in the world owing to higher levels of income, increasing population living in urban areas, and growing use of the internet. With a population exceeding 1.4 billion, India is one of the largest markets in the world as close to 65% of the population is in the working age demographic, increasing the demand for smartphones, laptops and household appliances. Internet usage, which already surpassed 850 million users, is complemented by the launch of 5G, which is accelerating the use of intelligent devices and smart products. These “Digital India” and “Make in India” policies by the government are further localizing production, which is decreasing the reliance on foreign products and increasing the availability of such products to the middle class. Also, increasing demand for ecofriendly devices is expanding the market. The strong growth of e-commerce which has captured a large portion of the consumer electronics sales further provides greater convenience to the users making India one of the fastest growing markets in the world.

The India consumer electronics market includes smartphones, televisions, audio systems, wearable gadgets, and other appliances. The latter is of great global significance as it includes everything used in households, which diversifies the market further. The factors that sustained and grew the market, such as increased urbanization, rising incomes, and greater digital adoption, suggest that the market still has a lot of potential.

Smartphones: Smartphones dominates the market with almost 40% share. This is attributed to the increased use of 4G and 5G networks, as well as the popularity of economic data packages and demand for multifunctional phones. Samsung, Xiaomi, and Vivo are increasing their market share by selling over 200 million units annually, expanding their sphere of influence to urban and semi-urban regions.

Televisions: Smart televisions have grown in popularity and hold the second largest share of the market. They as a product account for 20% of the television market. Furthermore, sales in metro cities have increased by more than 15% on a yearly basis supporting the rising subscription of streaming services and growing home entertainment.

Wearables: Wearables, including Smartwatches and fitness bands are also helping the wearables market expand as they are integrated with phones and IoT devices. The market has grown approximately 18% over the past three years as it is popular among health-conscious individuals.

Home Appliances: Refrigerators, air conditioners, and washing machines are classified as home appliances. They make up around 25% of the market. The remaining 15% share of the market is captured by personal care electronics and audio devices, which exhibit a steady growth trend driven by increased disposable incomes and lifestyle spending.

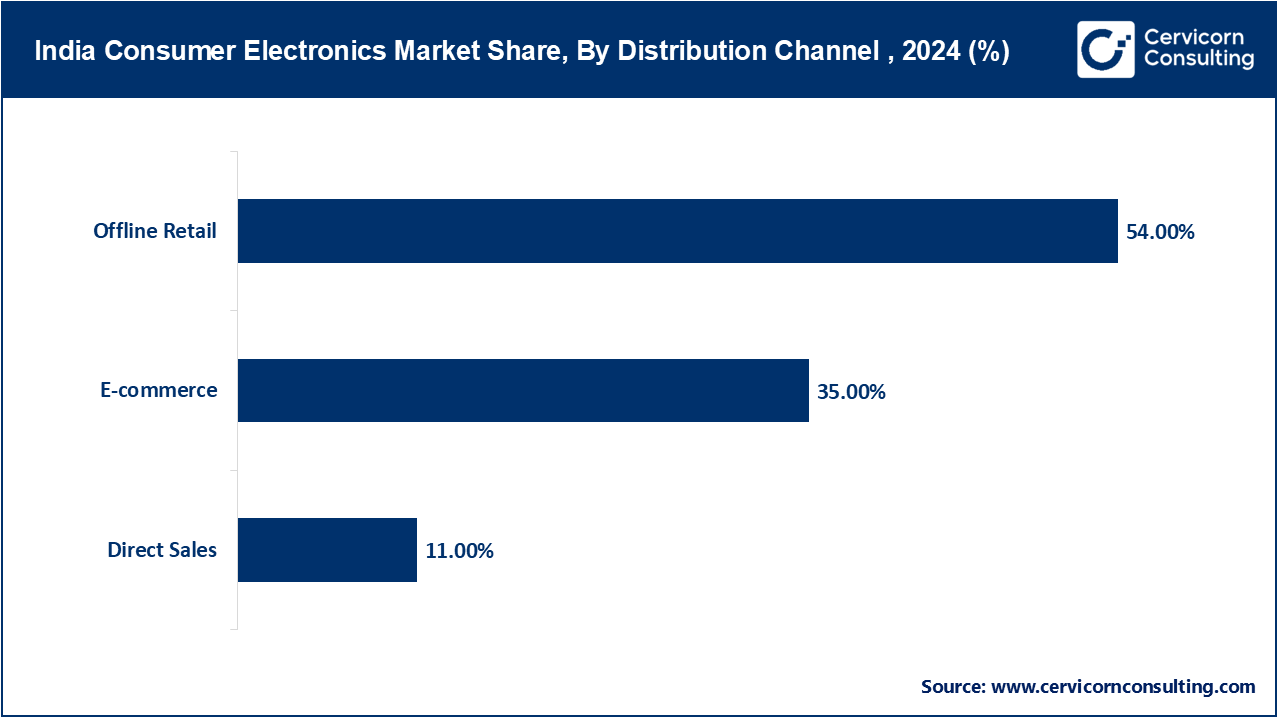

Offline Retail: Retail—comprising specialist electronics outlets, hyper-store formats, and multi-brand showrooms—retains leadership, capturing close to 55% of overall value. Key players—Croma, Reliance Digital, and Vijay Sales—are particularly influential in tier-one and metropolitan areas, where the advantages of tactile evaluation and immediate ownership remain compelling. Growth in this channel, however, has moderated to 8% annually as intensified digital competition and evolving consumer behavioural.

E-commerce Platforms: online marketplaces—Amazon, Flipkart, and Tata Cliq—have established themselves as the fastest-growing tier, commanding approximately thirty-five percent and posting a compound annual growth rate of 20-22% over the preceding three fiscal years. Growth is principally propelled by the convenience of home delivery, targeted promotional pricing, and the widespread assimilation of digital payment solutions, particularly pronounced in tier-two and tier-three urban clusters.

Direct Sales: Direct sales account for the remaining 10% of the market. Brands such as Apple and Samsung exploit these avenues to deepen brand equity, to distribute differentiated product assortments, and to ensure a heightened standard of post-sale service. Hybrid retail approaches that merge offline and online channels, including popular “click-and-collect” models, continue to gather momentum among both merchants and consumers.

Urban: Urban consumers, whose numbers approximate 60% of overall transactions, propel the segment through elevated discretionary spending, digitally fluent routines, and a propensity to pioneer operational novelties. Urban annual smartphone volumes, by themselves, are already breaching the 100 million-device thresholds. The twin thrust of deepening e-commerce and expanding organized retail further enhances consumer visibility of both premium and mid-priced consumer electronics.

Tier-1/2/3 Cities: Around 25% of the share of semi-urban customers in the market is also making them an important target for spending, particularly in budget smartphones, LED TVs, and home appliances. The growth in internet access, the availability of smartphones, and the advent of purchasing through digital wallets, EMIs, and similar financing options have made these regions easier to access and are recording a sales growth of upwards of 12-15% in these regions.

Rural Consumers: Consumers in rural areas of the country have the potential to be an important target market, as they currently only account for 15% of the market share. Government digital programs, rural electrification initiatives, and enhanced mobile connectivity are driving the sales of budget smartphones, basic home appliances, and basic audio devices. There are however no doubt considerable challenges associated such as low access to retailers, low brand perception, and high sensitivity towards prices. Xiaomi, Samsung, and LG are expanding their distribution networks to include these regions, frequently integrating offline retail and e-commerce to penetrate more remote markets.

Market Segmentation

By Product Type

By Distribution Channel

By End-User

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Consumer Electronics

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Type Overview

2.2.2 By Distribution Channel Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3. India Impact Analysis

3.1 COVID 19 Impact on India Consumer Electronics Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: India Market Implications

3.3 Regulatory and Policy Changes Impacting India Market

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing Penetration of Smartphones and Connected Devices

4.1.1.2 Surge in Online Shopping Driving Electronics Sales Growth

4.1.1.3 Government’s ‘Make in India’ Push Strengthening Local Manufacturing

4.1.1.4 Increasing Electrification & Infrastructure Development in Rural India

4.1.2 Market Restraints

4.1.2.1 Heavy Dependence on Imports for Critical Components

4.1.2.2 Supply Chain Disruptions Impacting Product Availability and Lead Times

4.1.2.3 Intense Competition Driving Aggressive Pricing and Low Profitability

4.1.3 Market Opportunity

4.1.3.1 Explosive Growth Potential in Tier 2 and Tier 3 Cities

4.1.3.2 Growing Acceptance of Premium and Luxury Electronics Segments

4.1.3.3 Digital Payments and EMI Financing Driving Higher Consumer Spending

4.1.4 Market Challenges

4.1.4.1 Rising Labor and Logistics Costs Impacting Overall Profitability

4.1.4.2 Increasing Consumer Expectations for Fast Delivery and Hassle-Free Service

4.1.4.3 Growing Return Rates in E-Commerce Impacting Profit Margins

4.2 Market Trends

4.2.1 Strong Growth in Wearables and Audio Accessories Driven by Digital Lifestyles

4.2.2 Accelerated Adoption of Smart TVs and OTT-Optimized Entertainment Devices

4.2.3 Increasing Influence of E-Commerce and D2C Brands on Consumer Buying Behavior

4.2.4 Premiumization Trend Driven by Urban Upgraders and Affluent Consumers

Chapter 5. Premium Insights and Analysis

5.1 India Consumer Electronics Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. India Consumer Electronics Market, By Product Type

6.1 India Consumer Electronics Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.2 Smartphones

6.1.3 TVs

6.1.4 Wearables

6.1.5 Home Appliances

6.1.6 Audio Devices

6.1.7 Others

Chapter 7. India Consumer Electronics Market, By Distribution Channel

7.1 India Consumer Electronics Market Snapshot, By Distribution Channel

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.2 Offline

7.1.2.1 Large Format Retail (Reliance Digital, Croma, Vijay Sales, etc.)

7.1.2.2 Exclusive Brand Outlets (Samsung, Apple, LG stores)

7.1.2.3 Multi-brand Retail Stores

7.1.2.4 Local Distributors and Dealers

7.1.3 Online

7.1.3.1 E-commerce Marketplaces (Amazon, Flipkart)

7.1.3.2 D2C Brand Websites

7.1.3.3 Quick-Commerce Platforms (Blinkit, Zepto, etc for small appliances)

Chapter 8. India Consumer Electronics Market, By End User

8.1 India Consumer Electronics Market Snapshot, By End User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

8.1.2 Commercial

8.1.2.1 Offices

8.1.2.2 Restaurants & Hotels

8.1.2.3 Educational Institutions

8.1.2.4 Retail Stores

8.1.2.5 Healthcare Facilities

8.1.3 Household

Chapter 9. India Consumer Electronics Market, By Region/City Tier

9.1 Overview

9.2 India Consumer Electronics Market Revenue Share, By Region/City Tier 2023 (%)

9.2.1 Market Size and Forecast

9.3 Metro Cities (Delhi, Mumbai, Bengaluru, Chennai, etc.)

9.3.1 Indian Metro Cities Consumer Electronics Market Revenue, 2021-2033 ($Billion)

9.3.2 Indian Metro Cities Consumer Electronics Market Revenue, 2021-2033 ($Billion), By Product Type

9.3.3 Indian Metro Cities Consumer Electronics Market Revenue, 2021-2033 ($Billion), By Distribution Channel

9.3.4 Indian Metro Cities Consumer Electronics Market Revenue, 2021-2033 ($Billion), By End User

9.4 Tier 1 Cities

9.4.1 Indian Tier 1 Cities Consumer Electronics Market Revenue, 2021-2033 ($Billion)

9.4.2 Indian Tier 1 Cities Consumer Electronics Market Revenue, 2021-2033 ($Billion), By Product Type

9.4.3 Indian Tier 1 Cities Consumer Electronics Market Revenue, 2021-2033 ($Billion), By Distribution Channel

9.4.4 Indian Tier 1 Cities Consumer Electronics Market Revenue, 2021-2033 ($Billion), By End User

9.5 Tier 2 & Tier 3 Cities

9.5.1 Indian Tier 2 & Tier 3 Cities Consumer Electronics Market Revenue, 2021-2033 ($Billion)

9.5.2 Indian Tier 2 & Tier 3 Cities Consumer Electronics Market Revenue, 2021-2033 ($Billion), By Product Type

9.5.3 Indian Tier 2 & Tier 3 Cities Consumer Electronics Market Revenue, 2021-2033 ($Billion), By Distribution Channel

9.5.4 Indian Tier 2 & Tier 3 Cities Consumer Electronics Market Revenue, 2021-2033 ($Billion), By End User

9.6 Rural Area

9.6.1 Indian Rural Area Consumer Electronics Market Revenue, 2021-2033 ($Billion)

9.6.2 Indian Rural Area Consumer Electronics Market Revenue, 2021-2033 ($Billion), By Product Type

9.6.3 Indian Rural Area Consumer Electronics Market Revenue, 2021-2033 ($Billion), By Distribution Channel

9.6.4 Indian Rural Area Consumer Electronics Market Revenue, 2021-2033 ($Billion), By End User

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2021-2023

10.1.3 Competitive Analysis By Revenue, 2021-2023

10.2 Recent Developments by the Market Contributors (2023)

Chapter 11. Company Profiles

11.1 Samsung Electronics India

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Xiaomi India

11.3 LG Electronics India

11.4 Sony India

11.5 Vivo India

11.6 Realme India

11.7 Panasonic

11.8 Apple

11.9 Philips

11.10 OnePlus India