India Consumer Electronics Market Size and Growth Factors 2025 to 2034

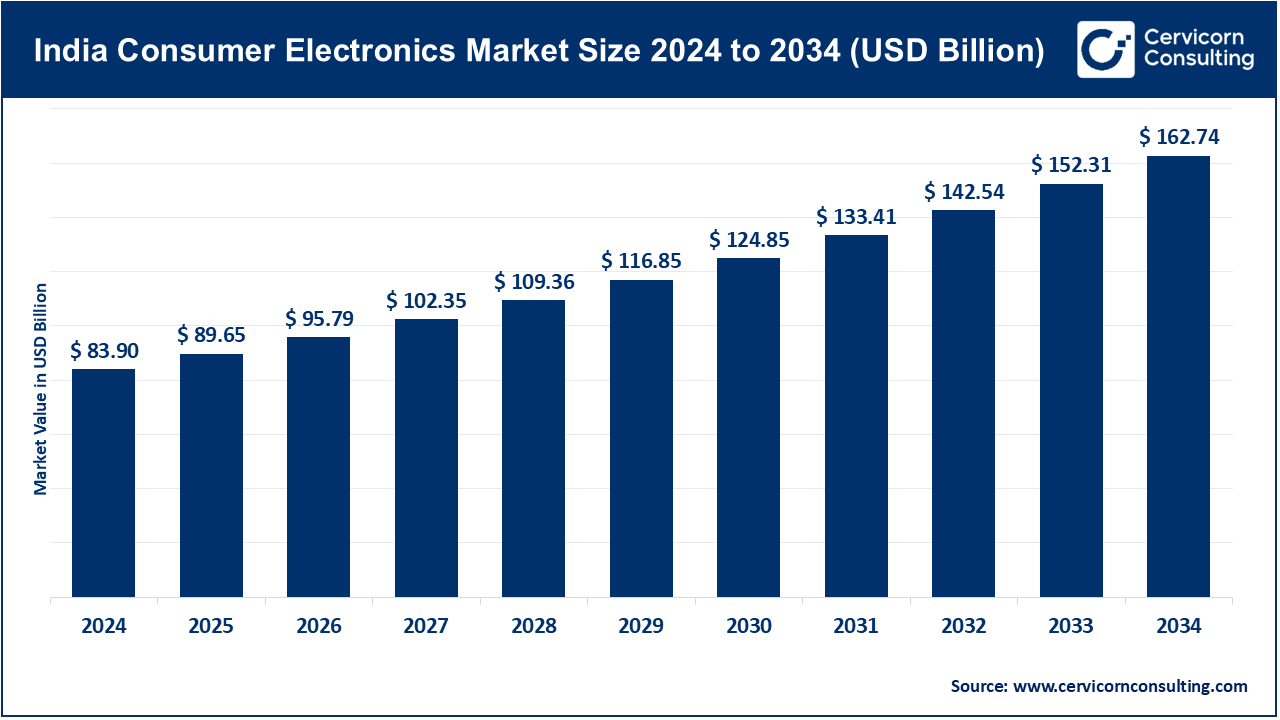

The India consumer electronics market size was valued at USD 83.90 billion in 2024 and is anticipated to reach around USD 162.74 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.85% over the forecast period from 2025 to 2034. The India consumer electronics market is emerging as one of the fastest growing in the world owing to higher levels of income, increasing population living in urban areas, and growing use of the internet. With a population exceeding 1.4 billion, India is one of the largest markets in the world as close to 65% of the population is in the working age demographic, increasing the demand for smartphones, laptops and household appliances. Internet usage, which already surpassed 850 million users, is complemented by the launch of 5G, which is accelerating the use of intelligent devices and smart products. These “Digital India” and “Make in India” policies by the government are further localizing production, which is decreasing the reliance on foreign products and increasing the availability of such products to the middle class. Also, increasing demand for ecofriendly devices is expanding the market. The strong growth of e-commerce which has captured a large portion of the consumer electronics sales further provides greater convenience to the users making India one of the fastest growing markets in the world.

The India consumer electronics market includes smartphones, televisions, audio systems, wearable gadgets, and other appliances. The latter is of great global significance as it includes everything used in households, which diversifies the market further. The factors that sustained and grew the market, such as increased urbanization, rising incomes, and greater digital adoption, suggest that the market still has a lot of potential.

India Consumer Electronics Market Report Highlights

- The Indian consumer electronics landscape is expanding vigorously, propelled by enhanced disposable income levels, accelerated urban growth, and pervasive penetration of intelligent devices.

- Smartphones, flat-screen televisions, portable computers, and wearables represent the around 41%, whilst the segment for smart home apparatus is progressively attracting digitally literate consumers.

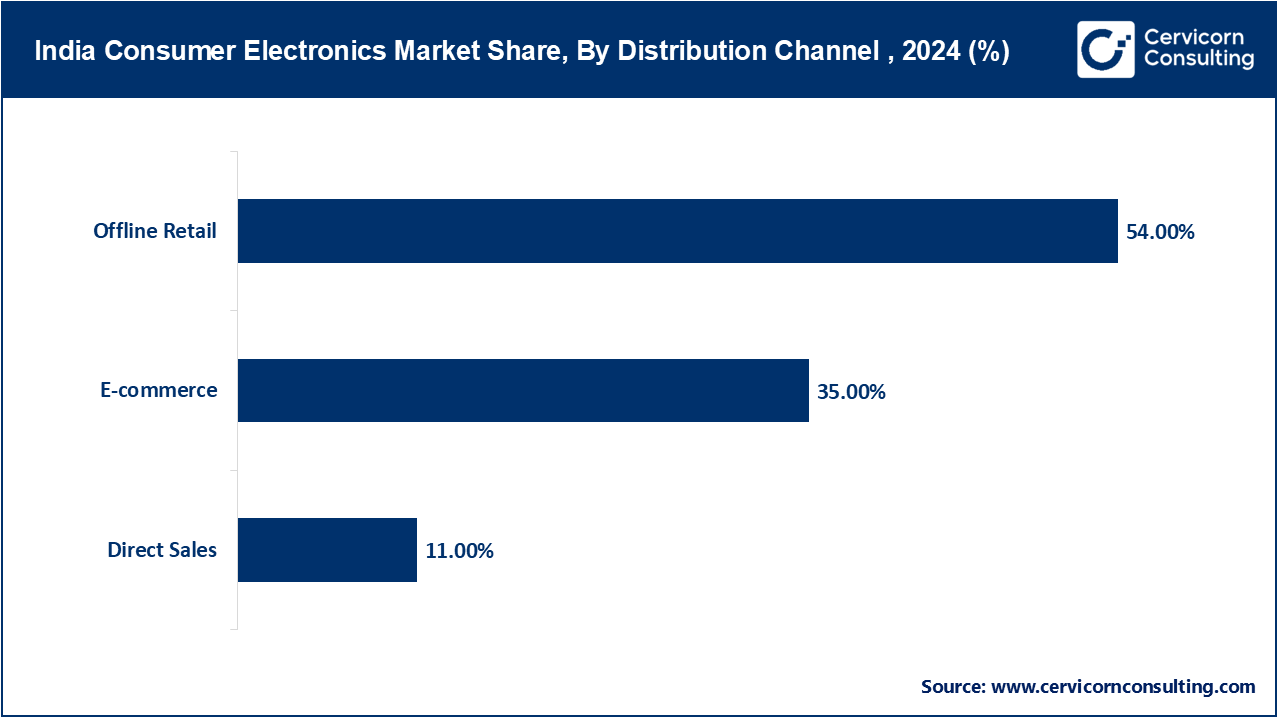

- Digital distribution avenues are proliferating, now commanding a considerable proportion of 45% market share, owing to convenience and significant promotional inducements.

- Advancements in internet reach, alongside rising digital proficiency, continue to stimulate procurement of interconnected gadgets, Internet of Things appliances, and visual entertainment hardware.

India Consumer Electronics Market Trends

- Technological adoption and changing lifestyle preferences: The introduction of new technologies, such as smart gadgets, e-commerce, and artificial intelligence, are transforming product offerings and improving accessibility. Businesses from India and abroad are now competing for a share in the electronic market. This makes the country one of the world’s fastest-growing and most dynamic consumer electronics markets. The consumer electronics market in India is going through a transformative phase due to the adoption of new technologies and lifestyle changes. The most notable is the increasing number of smart and connected consumer electronics. The Indian market is witnessing a sharp rise in the adoption of smart devices like smartphones, with more than 60% of the population possessing a smartphone and over 900 million internet users. The market is also witnessing growth in smart devices such as smart TVs, wearables, as well as home automation products, with the smart TV segment growing at an annual double-digit growth rate. There is also an increase in the purchasing of home security systems, voice-activated assistants, and smart kitchen appliances among urban households, showcasing the growing preference for technology.

- Rising demand for sustainable and energy-efficient electronics: There is substantial traction gained with LED lighting, inverter-based air conditioners, and energy-efficient refrigerators, with the energy-efficient appliance market increasing by over 15% annually. Also, the need for better management of electronic waste coupled with regulations is pushing manufacturers to come up with eco-friendly products that have recyclable parts. This is reinforced by government-sponsored campaigns, like the Bureau of Energy Efficiency's labeling program, that influence consumer buying behavior in urban and semi-urban areas. All these trends paint the picture of a deep-seated change in the Indian consumer electronics market toward smart and connected, and sustainable products—driven by a young, tech-savvy, and eco-friendly population that accelerates innovation, adoption, and substantial market expansion in a wide variety of segments.

India Consumer Electronics Market Dynamics

Market Drivers

- Rising disposable incomes and rapid urbanization: Growth in the India consumer electronics market is being spurred by the emergence of new technologies and increasing urban household spending. Higher average spending continues to expand the market for consumer electronic appliances such as smartphones, home televisions, and wearable devices. To give an example, the last few years have witnessed a sharp growth in the number of users averaging over 850 million mobile subscribers in 2025. Also, coming to the AI arms race in household devices, people have started embracing smart home appliances like washing machines, AI refrigerators, and VC cleaners.

- Digital transformation and technological penetration: Another important factor is the accelerated digitalization and penetration of technology in the country. Online sales report electronics as one of the fast-growing product categories, with some exceeding 25% growth year on year. Moreover, the accelerating impact of social media alongside digital testimonials is influencing buying behavior, especially with the youth eager to blend technology with every aspect of their life. The country is quickly becoming one of the largest markets for consumer electronics as the available income, alongside the growing digital economy, are both facilitating a culture of early and frequent adoption. This trend is also drawing domestic producers and overseas corporations trying to establish a presence in India’s rapidly evolving consumer electronics landscape. This increasing momentum, affordability and technological accessibility combined, significantly expands the market.

Market Restraints

- High dependency on imports: One of the key issues is the heavy reliance of electronics manufacturers on imports from China, South Korea, and Vietnam. Domestic producers are at the mercy of global supply chain perturbations and currency exchange rates. To illustrate, any spike in import duties and cryogenic shipping can increase pricing for consumer electronics, making sophisticated electronics less economical for the average Joe. In India, over 70% of the demand for consumer electronics are imports in 2024, stunting the growth of domestic players as they are unable to compete with global brands on quality and variety.

- Intense price sensitivity among Indian consumers: Interest is noted in smart TVs, automation devices, wearables, and home automation products, but a big chunk of the population still focuses on the pricing of the product instead of its features. For example, urban metros are quick to adopt smart home devices and premium mobile phones, but on the contrary, semi urban and rural areas depend on basic mobile phones, low-cost appliances, and LED TVs. This results in the market where high-value products are unlikely to achieve significant penetration, despite the availability of technology. In addition, the shrinking market and increasing technological evolution, high expectations for after-sales service, and demand for low-cost products further discourage smaller players from scaling their operations. Potential buyers of electronics sometimes hesitate to purchase devices that might get out-of-date within a short period of time. Taken together, import dependency, price sensitivity, and rapid technological advancement form a complex challenge for the Indian consumer electronics industry, as they curb the industry’s growth potential and frustrate both local companies and foreign manufacturers in achieving steady growth in market share.

Market Opportunities

- Smart home and IoT segment: The smart-home and IoT vertical gains a comparatively robust avenue for expansion, as modular offerings—smart televisions, digital assistants, and home-control frameworks—gain traction among digitally fluent metropolitan households. The ecosystem of over 900 million mobile users, coupled with broadband accessibility extending to 60% of the census, constitutes a latent reservoir for connected-product penetration. The recent proliferation of remote-working options, for example, has accelerated the uptake of laptops, video cameras, and peripheral accessories, validating the market for companies deploying cohesive smart-home trajectories.

- Local manufacturing initiatives: Heightened consumer literacy and upward aspirational trends in peri-urban and rural demographics are increasingly converting demand for competitively priced smartphones, wireless audio solutions, and energy-efficient home appliances. Public policy initiatives, notably the ‘Make in India’ blueprint, fortify domestic fabrication capabilities and supply-chain rationalization, empowering manufacturers to price to value without eroding unit economics. Concurrently, the meteoric rise of e-commerce marketplaces provides a logistics and distribution backbone for housing electronics, empowering brands to access non-urban and small-tier jurisdictions that remained opaque only a few fiscal cycles ago.

Market Challenges

- Fragmented retail ecosystem and uneven penetration of organized retail channels: The lack of balance not only restricts the market’s scope, but also raises the likelihood of counterfeit and low-quality goods undermining market integrity and trust. In addition, rapid advances in technology and shifts in consumer behavior increase the burden on manufacturers to continuously evolve. Take, for instance, the surging demand for smart home devices, AI-enabled appliances, and 5G-compatible electronics. These shifts demand significant investments in research and development, as well as a skilled workforce, which tends to be a financial burden for smaller industry players. In addition, the lower tier consumer financing options pose a significant challenge, which in turn, despite the large tech-savvy population, slows the adoption rate.

- Rising cost and volatility of raw materials and components: Global supply chain disruption, currency changes, and geopolitical tension always carry the risk of sharp increases in production costs. Take the 2022 to 2023 period for example, during which a number of laptop and smartphone manufacturers were hit with component shortages, which in part, led to slow product releases and a subsequent 10-15% price hike for end consumers. One of the other major challenges includes the lack of digital infrastructure in tier 2 and tier 3 cities. This lack of infrastructure makes digital access increasingly difficult and thus, access to markets limited. Although urban consumers tend to sprint towards the latest tech, such as smart TVs, AI home appliances, and wearables, their rural and semi-urban counterparts depend on brick and mortar stores which offer limited selection and brands. Additionally, small to medium-sized manufacturers carry the hefty burden of having to constantly spend on skilled personnel, after-sales support, and research and development to keep up with competitors due to rapid technological advancements.

India Consumer Electronics Market Segmental Analysis

Product Type Analysis

Smartphones: Smartphones dominates the market with almost 40% share. This is attributed to the increased use of 4G and 5G networks, as well as the popularity of economic data packages and demand for multifunctional phones. Samsung, Xiaomi, and Vivo are increasing their market share by selling over 200 million units annually, expanding their sphere of influence to urban and semi-urban regions.

Televisions: Smart televisions have grown in popularity and hold the second largest share of the market. They as a product account for 20% of the television market. Furthermore, sales in metro cities have increased by more than 15% on a yearly basis supporting the rising subscription of streaming services and growing home entertainment.

Wearables: Wearables, including Smartwatches and fitness bands are also helping the wearables market expand as they are integrated with phones and IoT devices. The market has grown approximately 18% over the past three years as it is popular among health-conscious individuals.

Home Appliances: Refrigerators, air conditioners, and washing machines are classified as home appliances. They make up around 25% of the market. The remaining 15% share of the market is captured by personal care electronics and audio devices, which exhibit a steady growth trend driven by increased disposable incomes and lifestyle spending.

Distribution Channel Analysis

Offline Retail: Retail—comprising specialist electronics outlets, hyper-store formats, and multi-brand showrooms—retains leadership, capturing close to 55% of overall value. Key players—Croma, Reliance Digital, and Vijay Sales—are particularly influential in tier-one and metropolitan areas, where the advantages of tactile evaluation and immediate ownership remain compelling. Growth in this channel, however, has moderated to 8% annually as intensified digital competition and evolving consumer behavioural.

E-commerce Platforms: online marketplaces—Amazon, Flipkart, and Tata Cliq—have established themselves as the fastest-growing tier, commanding approximately thirty-five percent and posting a compound annual growth rate of 20-22% over the preceding three fiscal years. Growth is principally propelled by the convenience of home delivery, targeted promotional pricing, and the widespread assimilation of digital payment solutions, particularly pronounced in tier-two and tier-three urban clusters.

Direct Sales: Direct sales account for the remaining 10% of the market. Brands such as Apple and Samsung exploit these avenues to deepen brand equity, to distribute differentiated product assortments, and to ensure a heightened standard of post-sale service. Hybrid retail approaches that merge offline and online channels, including popular “click-and-collect” models, continue to gather momentum among both merchants and consumers.

End User Analysis

Urban: Urban consumers, whose numbers approximate 60% of overall transactions, propel the segment through elevated discretionary spending, digitally fluent routines, and a propensity to pioneer operational novelties. Urban annual smartphone volumes, by themselves, are already breaching the 100 million-device thresholds. The twin thrust of deepening e-commerce and expanding organized retail further enhances consumer visibility of both premium and mid-priced consumer electronics.

Tier-1/2/3 Cities: Around 25% of the share of semi-urban customers in the market is also making them an important target for spending, particularly in budget smartphones, LED TVs, and home appliances. The growth in internet access, the availability of smartphones, and the advent of purchasing through digital wallets, EMIs, and similar financing options have made these regions easier to access and are recording a sales growth of upwards of 12-15% in these regions.

Rural Consumers: Consumers in rural areas of the country have the potential to be an important target market, as they currently only account for 15% of the market share. Government digital programs, rural electrification initiatives, and enhanced mobile connectivity are driving the sales of budget smartphones, basic home appliances, and basic audio devices. There are however no doubt considerable challenges associated such as low access to retailers, low brand perception, and high sensitivity towards prices. Xiaomi, Samsung, and LG are expanding their distribution networks to include these regions, frequently integrating offline retail and e-commerce to penetrate more remote markets.

India Consumer Electronics Market Top Companies

- Samsung Electronics India

- Xiaomi India

- LG Electronics India

- Sony India

- Vivo India

- Realme India

- Panasonic India

- Apple India

- OnePlus India

- Philips India

Recent Developments

- August 2025: Apple communicated its intention to fulfil the entire iPhone 17 production requirement for the U.S. market within India, a course of action entailing the augmentation of manufacturing facilities at five Indian sites, including two newly inaugurated locations.

- August 2025: Singapore-headquartered appliance innovator Rotimatic publicly unveiled Rotimatic Next, a fully integrated, AI-enhanced roti-making appliance engineered for the Indian household. Leveraging precision robotics, the device can produce hot, fully-cooked rotis in fewer than 120 seconds. The company has strategically relocated production to the Bangalore-Mysore corridor, thereby optimising logistics for both domestic and export fulfilment.

Market Segmentation

By Product Type

- Smartphones

- TVs

- Wearables

- Home Appliances

- Audio Devices

- Others

By Distribution Channel

- Offline

- Large Format Retail (Reliance Digital, Croma, Vijay Sales, etc.)

- Exclusive Brand Outlets (Samsung, Apple, LG stores)

- Multi-brand Retail Stores

- Local Distributors and Dealers

- Online

- E-commerce Marketplaces (Amazon, Flipkart)

- D2C Brand Websites

- Quick-Commerce Platforms (Blinkit, Zepto, etc for small appliances)

By End-User

- Commercial

- Offices

- Restaurants & Hotels

- Educational Institutions

- Retail Stores

- Healthcare Facilities

- Household