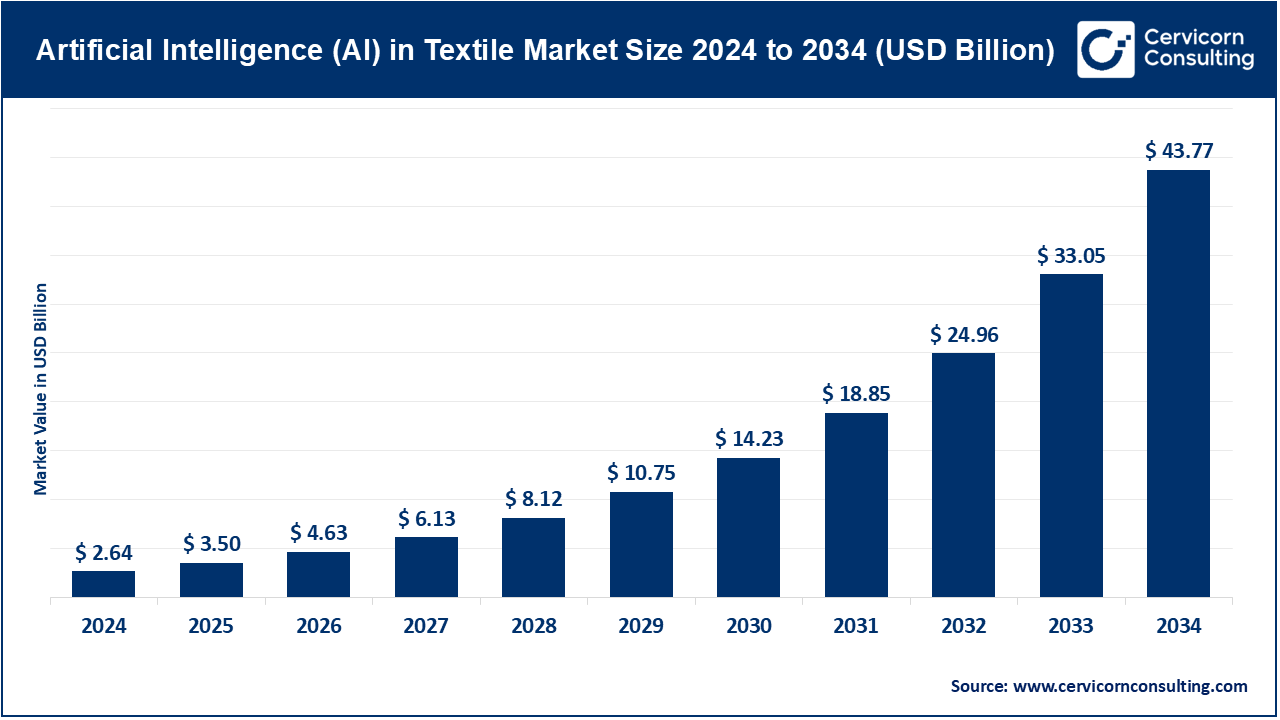

The global artificial intelligence (AI) in textile market size was valued at USD 2.64 billion in 2024 and is anticipated to reach around USD 43.77 billion by 2034, growing at a compound annual growth rate (CAGR) of 32.42% over the forecast period from 2025 to 2034.

The artificial intelligence in textile market is accelerating due to greater automation in manufacturing, intense interest in intelligent fabrics, and the imperative to streamline supply chains. Simultaneously, the sector is leveraging AI to advance sustainability by employing machine-learning algorithms that minimize water, energy, and chemical inputs while curtailing the volume of waste. By embedding digital practices throughout the value chain, AI enables fashion labels to furnish clientele with fine-grained product recommendations and to compress product lead-times. Parallel expansion of online retail platforms and a marked consumer tilt toward made-to-order garments are reinforcing the trend.

The global artificial intelligence in textiles market encompasses the deployment of cutting-edge AI technologies—particularly machine learning, computer vision, predictive analytics, and robotic automation—within the textile and apparel value chain. Typical applications range from demand forecasting, intelligent manufacturing processes, and defect detection, to inventory oversight, supply chain optimization, and tailored fashion recommendations. By facilitating instantaneous data interpretation and automated decision-making, AI empowers textile enterprises to curtail expenditures, reduce material waste, and expedite manufacturing timelines. Accelerated adoption of these capabilities is driven by broader industrial imperatives for digital transformation, which are increasingly framed by strategic goals of enhanced competitiveness and environmental sustainability.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 3.50 Billion |

| Expected Market Size in 2034 | USD 43.77 Billion |

| Projected CAGR 2025 to 2034 | 32.42% |

| Leading Region | Asia-Pacific |

| Key Segments | Component, Technology, Material, Application, End User, Region |

| Key Companies | Microsoft Corporation, IBM Corporation, Google LLC, Amazon Web Services (AWS), SAP SE, Oracle Corporation, General Vision Inc., Salesforce Inc., Adobe Inc., Huawei Technologies Co., Ltd., Nvidia Corporation, Siemens AG |

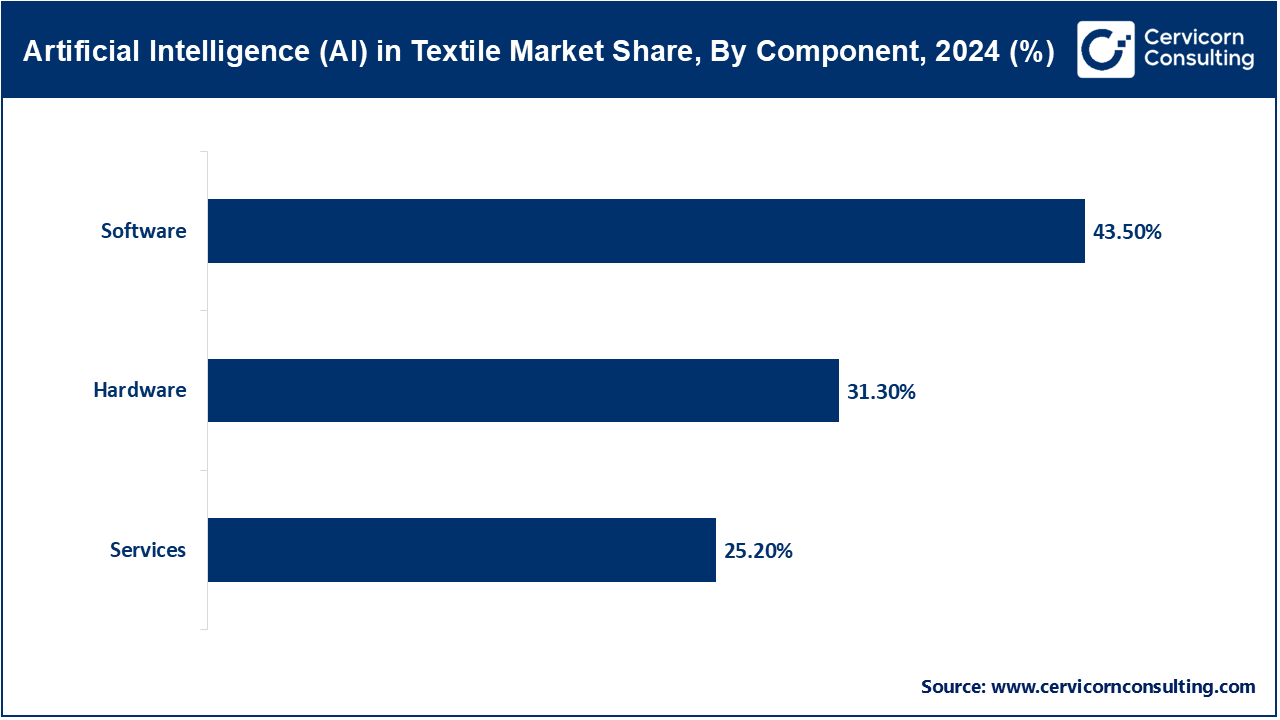

Software: Software holds the largest share, since AI tools for predicting trends, learning from data, and seeing patterns in pictures are helping mills spot problems early, guess stocking needs, and plan designs in virtual space. Take the AI quality inspection app that lets a line spot defects with 90% better accuracy—waste drops, and the bottom line gets a healthy bump.

Hardware: Hardware capabilities are maturing, evidenced by the deployment of intelligent machines, cameras, and sensors integrated with AI within production lines, which enable end-to-end observability and intelligent automation. Mills that now deploy AI-augmented sensors in spinning and weaving facilities are reporting productivity gains nearing twenty per cent; continuous monitoring reduces stoppage events and the volume of rework, yielding significant throughput improvements.

Services: Consulting systems interoperability, and on-site operational support are rising most rapidly, especially within small and medium-sized weaving mills that lack the resources to recruit in-house data scientists. These service models ease the transition to AI and ensure continued value delivery well beyond initial pilot phases. With tighter profit margins and heightened sustainability commitments, mills are prioritizing software solutions, yet the tangible value of floor-installed machines coupled with the expertise required for their upkeep is generating substantial demand, thereby energizing the sector as the foundation for the next generation of textile AI innovation.

Plastics & Polymers (PE, PET, PVC, PP, etc.): Plastics are the dominant type of materials in packaging, accounting for about 33.7%. That’s one of the reasons the focus is still on PET, especially since we see it everywhere in soda and drink bottles. These days, manufacturers are hopping on the recycled-plastic bandwagon or using simpler-material choices so their products last longer and leave a smaller footprint on the planet. That’s basically the new normal.

Glass: For wine, spirits, craft juices, and fancy food goodies, glass is the most preferrable. The material practically plays loop-the-loop in the recycling circuit: chipped cullet streams back into the furnace, where it finds its thermal trainer—furnace heat—already threaded with pre-consumed glass. Meanwhile, trials in Europe are rolling out still lines using refillable glass for juices and dairy, intended to quell the still-image of surge single-use glass.

Machine learning: The machine learning segment has dominated the market. Machine learning is the most innovative and worrisome development to happen in the world of technology. It can now perform complex tasks such as predicting shopper demand in real time. Its sensors are now predicting shopping and advertising using demand forecasting which is now “smart enough” to track unused goods.

Computer Vision: Computer technical systems that oversee the image are now incorporating these into their webcams which perceive the materials of the coffee nitro to dress it up and estimate the seams as well as the color. They are doing such tasks with an accuracy of 95%. This is excellent for color and material accuracy in garments and reduces the waste of leftover materials.

Natural language processing (NLP): Natural language processing, or NLP, has now become a standard component of e-commerce ecosystems, where chatbots and digital assistants engage shoppers, deliver tailored product suggestions, and orchestrate seamless checkout. Data indicate that these interventions can elevate conversion rates—defined as the proportion of visitors who complete a purchase—by as much as 20%, translating into significant sales growth without incremental promotional spend.

Predictive Analytics: Production forecasting and overall optimization of the supply chain has become easier due to the incorporation of Predictive analytics that now helps companies in achieving cost efficiency of up to 30% by accurately estimating demand and the resources needed to fulfill it.

Robotics and Automation: Smart factories that incorporate AI are equipped with self-operating machines revising monotonous tasks, and subsequently reducing the demand for human labor, enhancing efficiency in the processes by 20% to 25%. Automated robotics are revolutionizing the textile industry by giving rise to these smart factories.

Textile Manufacturers: AI is being adopted by fashion and clothing manufacturers to enable them track trends and innovate designs in real time. Deep consumer data, and social media, is ingested by platforms that provide brands the ability to estimate trends, reducing unsold inventory by 30%.

Fashion and Apparel Brands: Fashion and apparel enterprises are leveraging machine learning to accelerate pre-season color and silhouette forecasting as well as to iterate complex product lifecycles. Hospitality-grade platforms that aggregate social media sentiment, e-commerce interaction, and purchase-history datasets have enabled brands to curtail end-of-season markdown stock by as much as 30%, mitigating waste and aligning collections with market demand.

Artificial Intelligence (AI) in Textile Market Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Textile Manufacturers | 30% |

| Fashion & Apparel Brands | 24% |

| E-commerce & Retailers | 20% |

| Luxury Fashion Houses | 10% |

| Technical Textiles | 16% |

E-commerce and retailers: E-commerce and brick-and-mortar retailers are integrating AI-powered recommendation algorithms, conversational agents, and virtual fitting-room technologies to refine the shopping journey, yielding conversion-rate growth of up to 25% and returns-offset declines of approximately 20%.

Luxury fashion houses: Luxury fashion houses are directing resources toward AI-led personalization, employing comprehensive analytics and immersive design technologies to deliver bespoke apparel while preserving brand exclusivity and realizing cost efficiencies.

Technical Textiles: Meanwhile, technical textiles, used in industries like automotive, healthcare, and defense, are increasingly integrating AI for quality assurance and material innovation, where AI-enabled systems have been shown to reduce defect rates by more than 90%.

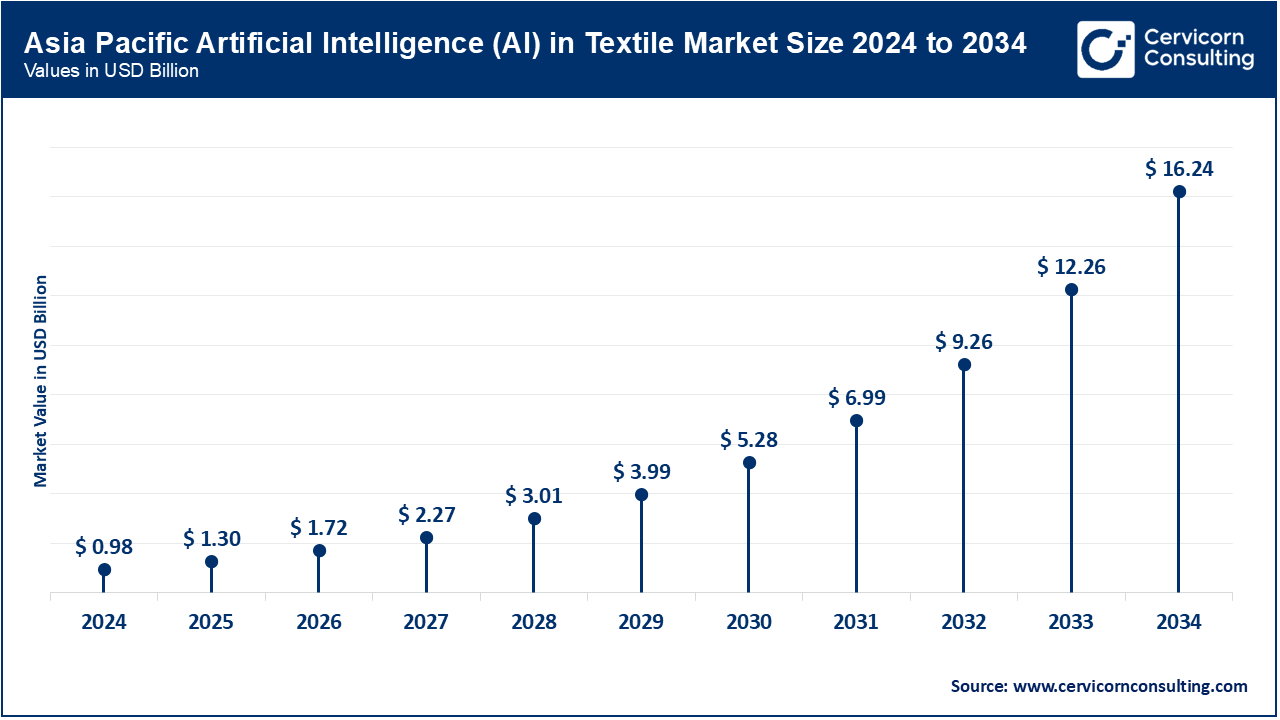

The Asia-Pacific region constitutes the most rapidly expanding geographic segment, propelled by the regional preeminence of textile production nodes, including China, India, Bangladesh, and Vietnam. Collectively, these economies are responsible for in excess of 60% of world textile outbound shipments; accordingly, producers are expediently integrating AI to boost operational efficiency, attenuate labor dependency, and comply with rigorous international sustainability benchmarks. Within China, AI-mediated fault detection platforms in woven fabric assemblies have documented quality appraisal precision exceeding 95%, thereby greatly curtailing fabric rejection. India, characterized by a broad small- and medium-sized enterprise (SME) ecosystem, is progressively adopting AI for demand foretelling and optimization of supply networks, catalyzed by the expanded scope of e-commerce. Notwithstanding this advance, pronounced impediments, including elevated capitalization outlay and a constrained technical labor pool, continue to inhibit more extensive AI deployment.

North America, in contrast, occupies the vanguard of conceptualization and deployment, underpinned by mature digital infrastructures, elevated research and development expenditure, and a pronounced consumer appetite for personalized apparel. The United States occupies a leading position in the application of artificial intelligence to e-commerce and smart manufacturing. Predominant brands exploit predictive analytics to lower inventory carrying costs by as much as 30% while simultaneously enhancing customer interaction through hyper-personalized recommendation systems.

Artificial Intelligence (AI) in Textile Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 29.40% |

| Europe | 24.80% |

| Asia-Pacific | 37.10% |

| LAMEA | 8.70% |

The Europe AI in textile market size was accounted for USD 0.65 billion in 2024 and is predicted to surpass around USD 10.85 billion by 2034.

Europe is progressing rapidly behind the United States, with Germany, Italy, and France embedding AI into both textile production and the sustainable fashion movement. Manufacturers are prioritizing greener processes; AI-driven fine-tuning of dyeing and finishing operations has brought reported reductions in water consumption approaching 20%.

Latin America has now reached an early-spectrum transitional phase and simultaneously exhibits above-average latent capacity, with Brazil and Mexico charting speedier diffusion among fashion retail and integrated digital services arenas. Multiscale analytics, now reconfigured along cognitive paradigms, support forecasting of purchasing intent fewer degrees of variance, leveraging an expanding aspirant middle-class preference for differentiated rather than generalized apparel portfolios. The Middle East and African subregions enter a subsequent penetration phase, where Gulf Cooperation Council territories, especially the UAE and Saudi Arabia, concentrate capital flows onto AI algorithms optimized for high-value textile presences and retail experiences. Parallel pockets of acceleration emerge in South Africa, where cognitive personalization within digital commerce and algorithmically optimized distribution networks constitute the primary uptake modes. Consequently, while mature North America and Western portions of Europe retain nominal leadership in environment-embedded implementations, the Asia-Pacific dense production lattice is consolidating the prescriptive architecture required for scalable incremental pattern-resilience, and simultaneously the emerging Latin and ME-African symptomatology acquires infrastructural end-state capabilities in preparatory pilot degrees.

Market Segmentation

By Component

By Technology

By Material

By Application

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Artificial Intelligence (AI) in Textile

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Component Overview

2.2.3 By Material Overview

2.2.4 By Application Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Advanced material development

4.1.1.2 Rising demand for personalization, trend forecasting, and improved customer experiences

4.1.2 Market Restraints

4.1.2.1 High cost of implementation and lack of adequate infrastructure

4.1.2.2 Shortage of skilled workforce

4.1.3 Market Challenges

4.1.3.1 Complexity of integrating AI solutions

4.1.3.2 Data security, privacy, and ethical concerns

4.1.4 Market Opportunities

4.1.4.1 Push for sustainability and eco-friendly production

4.1.4.2 The rapid expansion of e-commerce

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Artificial Intelligence (AI) in Textile Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Artificial Intelligence (AI) in Textile Market, By Technology

6.1 Global Artificial Intelligence (AI) in Textile Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Machine Learning

6.1.1.2 Computer Vision

6.1.1.3 Natural Language Processing (NLP)

6.1.1.4 Predictive Analytics

6.1.1.5 Robotics & Automation

Chapter 7. Artificial Intelligence (AI) in Textile Market, By Component

7.1 Global Artificial Intelligence (AI) in Textile Market Snapshot, By Component

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Software (AI platforms, Machine Learning Tools, Analytics Solutions)

7.1.1.2 Services (Consulting, Implementation, Support & Maintenance)

7.1.1.3 Hardware (Sensors, Cameras, AI-enabled Machines)

Chapter 8. Artificial Intelligence (AI) in Textile Market, By Material

8.1 Global Artificial Intelligence (AI) in Textile Market Snapshot, By Material

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Plastics & Polymers (PE, PET, PVC, PP, etc.)

8.1.1.2 Glass

Chapter 9. Artificial Intelligence (AI) in Textile Market, By Application

9.1 Global Artificial Intelligence (AI) in Textile Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Design & Product Development

9.1.1.2 Quality Control & Defect Detection

9.1.1.3 Production Planning & Optimization

9.1.1.4 Supply Chain & Inventory Management

9.1.1.5 Sales & Marketing (personalization, trend forecasting)

9.1.1.6 Customer Experience & Virtual Try-On

Chapter 10. Artificial Intelligence (AI) in Textile Market, By End-User

10.1 Global Artificial Intelligence (AI) in Textile Market Snapshot, By End-User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Textile Manufacturers

10.1.1.2 Fashion & Apparel Brands

10.1.1.3 E-commerce & Retailers

10.1.1.4 Luxury Fashion Houses

10.1.1.5 Technical Textiles (industrial, medical, automotive)

Chapter 11. Artificial Intelligence (AI) in Textile Market, By Region

11.1 Overview

11.2 Artificial Intelligence (AI) in Textile Market Revenue Share, By Region 2024 (%)

11.3 Global Artificial Intelligence (AI) in Textile Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Artificial Intelligence (AI) in Textile Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Artificial Intelligence (AI) in Textile Market, By Country

11.5.4 UK

11.5.4.1 UK Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Artificial Intelligence (AI) in Textile Market, By Country

11.6.4 China

11.6.4.1 China Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Artificial Intelligence (AI) in Textile Market, By Country

11.7.4 GCC

11.7.4.1 GCC Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Artificial Intelligence (AI) in Textile Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Microsoft Corporation

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 IBM Corporation

13.3 Amazon Web Services (AWS)

13.4 Google LLC

13.5 SAP SE

13.6 Oracle Corporation

13.7 General Vision Inc.

13.8 Salesforce Inc.

13.9 Adobe Inc.

13.10 Huawei Technologies Co., Ltd.

13.11 Nvidia Corporation

13.12 Siemens AG