AI in Textile Market Size and Growth Factors 2025 to 2034

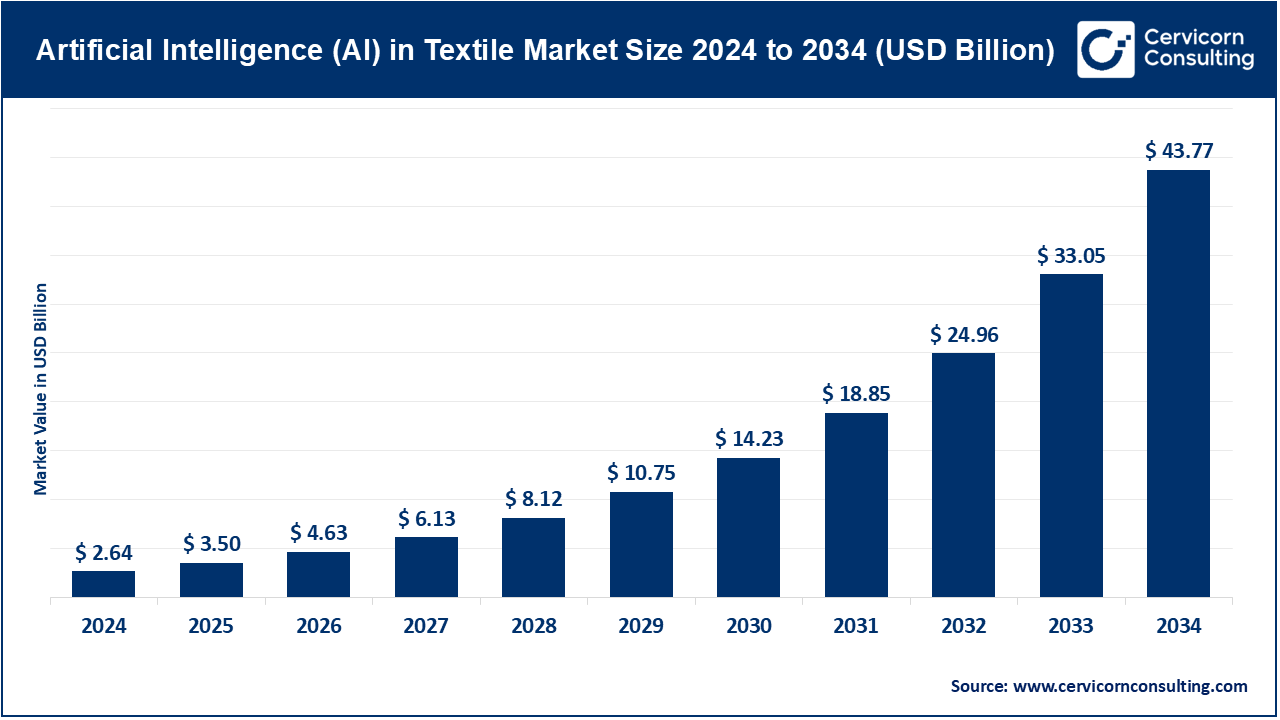

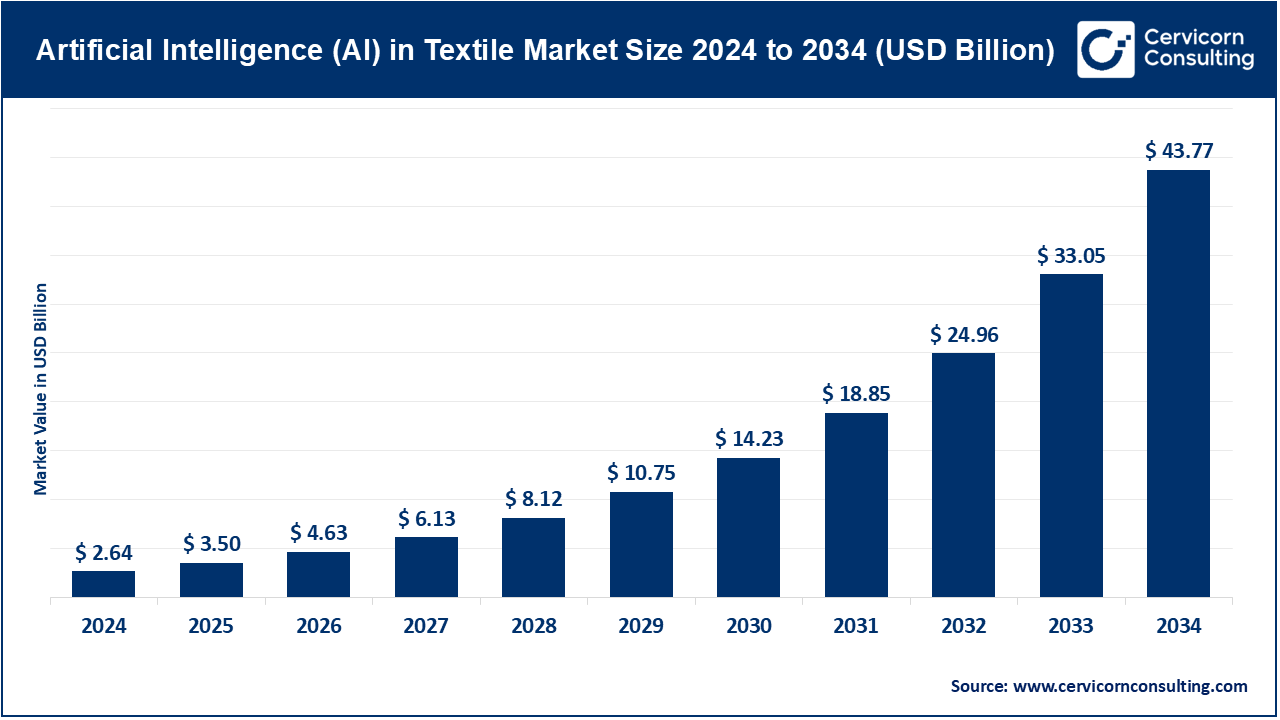

The global artificial intelligence (AI) in textile market size was valued at USD 2.64 billion in 2024 and is anticipated to reach around USD 43.77 billion by 2034, growing at a compound annual growth rate (CAGR) of 32.42% over the forecast period from 2025 to 2034.

The artificial intelligence in textile market is accelerating due to greater automation in manufacturing, intense interest in intelligent fabrics, and the imperative to streamline supply chains. Simultaneously, the sector is leveraging AI to advance sustainability by employing machine-learning algorithms that minimize water, energy, and chemical inputs while curtailing the volume of waste. By embedding digital practices throughout the value chain, AI enables fashion labels to furnish clientele with fine-grained product recommendations and to compress product lead-times. Parallel expansion of online retail platforms and a marked consumer tilt toward made-to-order garments are reinforcing the trend.

The global artificial intelligence in textiles market encompasses the deployment of cutting-edge AI technologies—particularly machine learning, computer vision, predictive analytics, and robotic automation—within the textile and apparel value chain. Typical applications range from demand forecasting, intelligent manufacturing processes, and defect detection, to inventory oversight, supply chain optimization, and tailored fashion recommendations. By facilitating instantaneous data interpretation and automated decision-making, AI empowers textile enterprises to curtail expenditures, reduce material waste, and expedite manufacturing timelines. Accelerated adoption of these capabilities is driven by broader industrial imperatives for digital transformation, which are increasingly framed by strategic goals of enhanced competitiveness and environmental sustainability.

AI in Textile Market Report Highlights

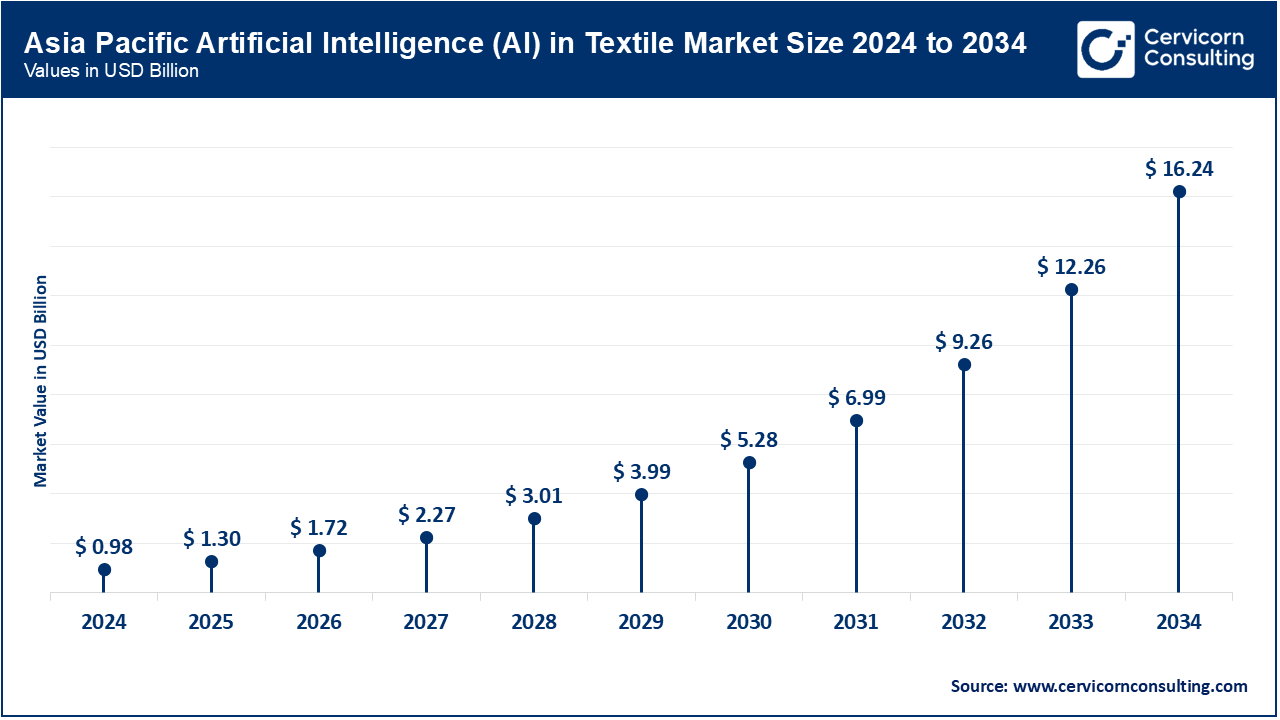

- By region, the Asia-Pacific region is expanding most rapidly, propelled by extensive textile manufacturing clusters in China, India, Bangladesh, and Vietnam that together account for upwards of 60% of worldwide textile exports, while North America and Europe continue to outpace in the integration of cutting-edge technologies.

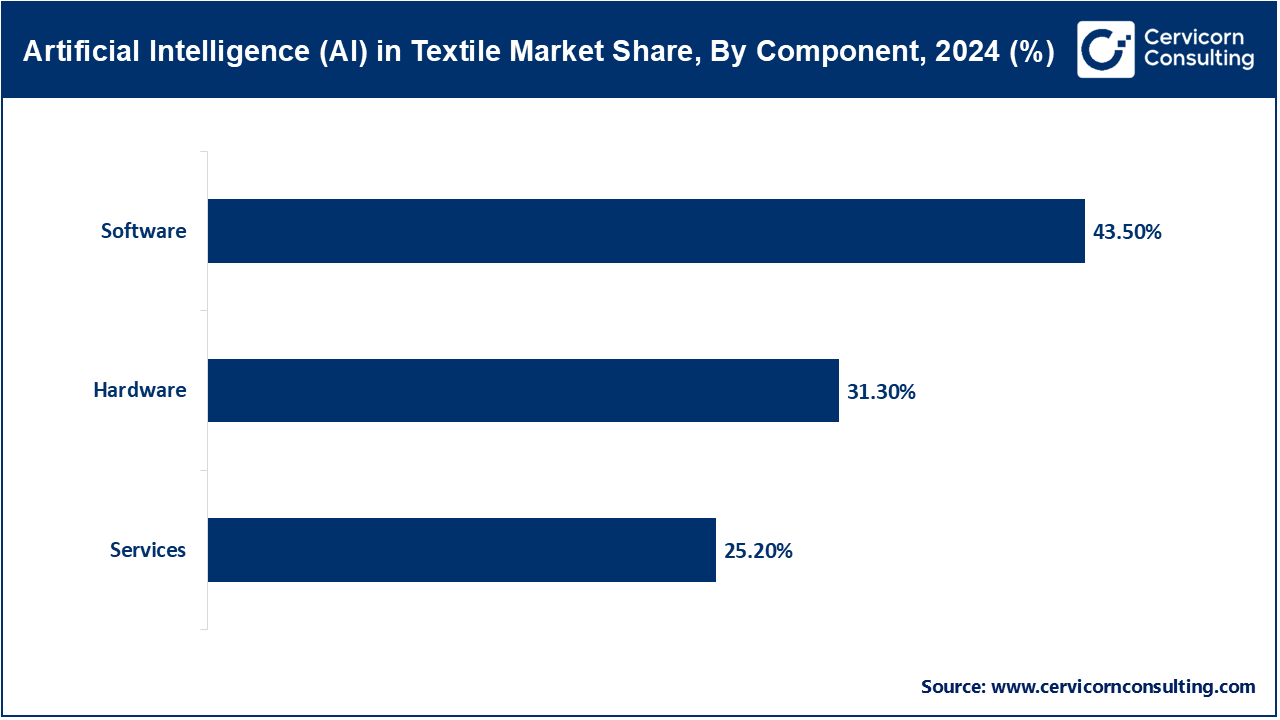

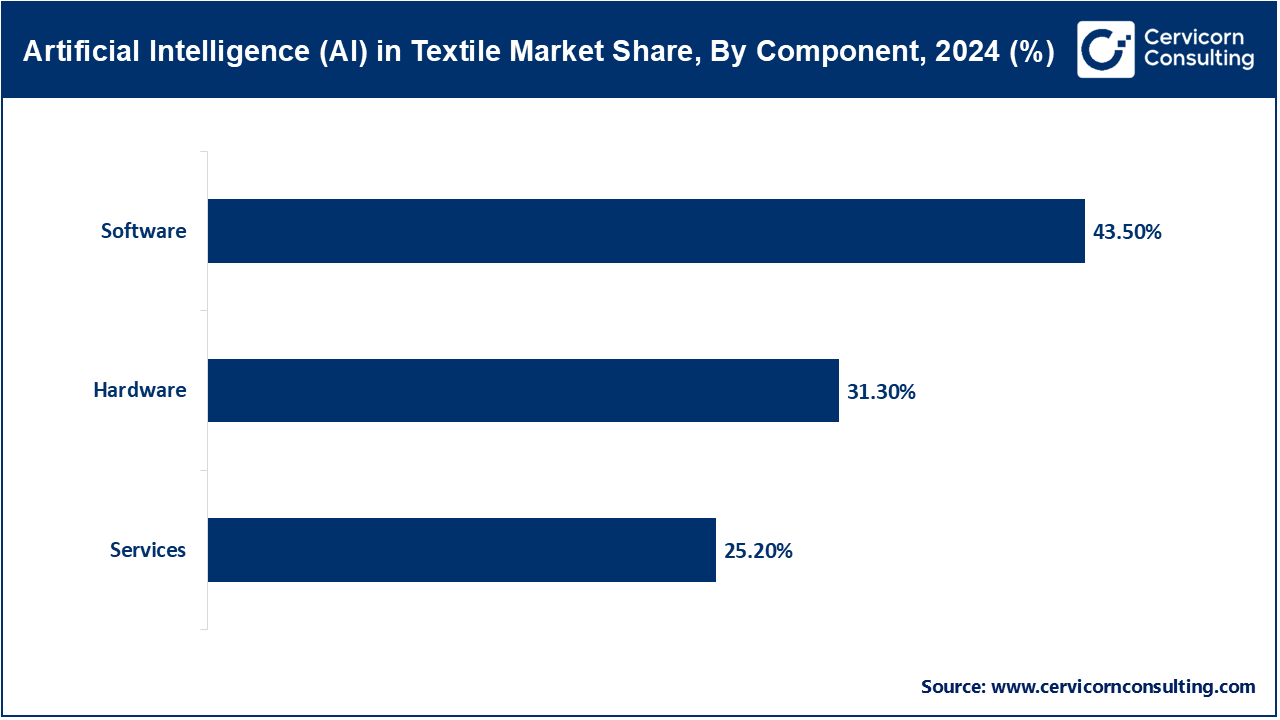

- Software dominates the market with around 43.5% of the market share. AI-based platforms employing predictive analytics, machine learning, and computer vision for tasks like defect detection, supply-demand forecasting, and virtual garment design are now commonplace.

- By technology, computer vision coupled with machine learning is expanding the most rapidly, achieving over 95% precision in spotting fabric flaws and enhancing demand forecasting by as much as 50%.

- E-commerce and fashion houses hold the largest share of demand, using AI-driven recommendation algorithms and virtual fitting solutions. This has led to nearly a 25% increase in online sales and cut product returns by close to 20%.

AI in Textile Market Trends

- Growing adoption of AI-powered automation and smart manufacturing systems: A defining trend of the global AI in textile market is the escalating use of AI-enhanced automation and intelligent manufacturing systems to elevate productivity and lower operating costs. Manufacturers are deploying AI-supported robotics, automated quality inspections, and predictive maintenance mechanisms to refine workflows and curtail unplanned outages. For example, contemporary AI defect detection platforms now identify minute anomalies in textile substrates with precision levels surpassing 95%, thus dramatically decreasing scrap and sharpening quality assurance. Surge in uptake of the technology correlates with the necessity of shortening production lead times imposed by fast fashion cycles and the simultaneous demand for eco-efficient operations. An industry survey projects that the deployment of AI automation in textile production will yield declines in manufacturing expenditures in the range of 15 to 20%, accompanied by efficiency gains of nearly 25%, establishing the technology as a decisive competitive weapon.

- The integration of AI into fashion design: The surge in rapidly evolving consumer expectations has compelled textile firms to harness AI algorithms for granular examination of social media sentiment, transaction history, and seasonal buying behaviour, thereby generating more precise forecasts and curtailing the accumulation of unsold stock. Region-specific predictive modelling in fashion merchandising has reported reductions in holding costs of up to 30 per cent, in tandem with improvements in sell-through performance approaching 40 per cent. Complementing these gains, AI-enhanced design ecosystems are synthesising novel prints, spatial textures, and bio-compatible fabric replacements, thereby enabling retailers to respond to an expanding base of environmentally conscious shoppers. Concurrently, AI-curated recommendation frameworks are reshaping digital sales environments by enhancing consumer interaction and delivering conversion uplifts of up to 25%.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 3.50 Billion |

| Expected Market Size in 2034 |

USD 43.77 Billion |

| Projected CAGR 2025 to 2034 |

32.42% |

| Leading Region |

Asia-Pacific |

| Key Segments |

Component, Technology, Material, Application, End User, Region |

| Key Companies |

Microsoft Corporation, IBM Corporation, Google LLC, Amazon Web Services (AWS), SAP SE, Oracle Corporation, General Vision Inc., Salesforce Inc., Adobe Inc., Huawei Technologies Co., Ltd., Nvidia Corporation, Siemens AG |

AI in Textile Market Dynamics

Market Drivers

- Advanced material development: AI-driven design tools enable brands to explore novel fabric patterns, textures, and silhouettes without producing physical samples, thereby shortening the time from design inception to commercial availability by approximately 30%. For instance, machine-learning-enhanced material science software can forecast fabric behavior under a spectrum of environmental and mechanical stresses, guiding manufacturers toward textiles precisely calibrated to rigorous industrial specifications. This capacity to expedite innovation and to construct intelligently engineered textiles is propelling the accelerated integration of AI, thereby affirming the technology's status as a vital enabler for both the mainstream fashion sector and for specialized engineered textile markets.

- Rising demand for personalization, trend forecasting, and improved customer experiences: Another significant driver is the escalating need for personalized experiences, predictive modeling, and enhanced consumer interaction within the apparel and textile domain. The dual pressures of fast fashion logistics and explosive e-commerce demand have prompted firms to deploy artificial intelligence in the systematic examination of vast and multichannel datasets, including transaction histories of 30%, clickstream analytics, and social media impressions. By amplifying the velocity and granularity of 50% data analysis, organizations can outsource some of the pattern-recognition burdens to algorithms, yielding near-term, high-resolution foreknowledge of style trajectories, strategic stock replenishment, and hyper-relevant product promotion. Beyond merchandising, AI-assisted experimentation in digital textile simulation permits the lightweight exploration of alternative materials and micro-patterns, satisfying an amplifying consumer insistence on sustainable and distinctive apparel. Cumulatively, these interlocking mechanisms are steering the textile ecosystem toward a paradigm marked by rigorous data stewardship, consumer centrism, and an accelerated commitment to ecological integrity.

Market Restraints

- High cost of implementation and lack of adequate infrastructure: The elevated financial barrier associated with integrating artificial intelligence (AI) into textile manufacturing constitutes a principal constraint to expanded deployment. Implementing capabilities such as automated defect inspection, anticipatory asset upkeep, and demand prediction necessitates capital outlay for bespoke hardware, enterprise-grade software, and personnel with advanced quantitative and programming competencies. Empirical observations indicate that the upfront cost of AI-enhanced textile machinery can surpass that of conventional alternatives by 25 to 30%, presenting a pronounced deterrent in cost-sensitive marketplaces throughout South Asia and sub-Saharan Africa. Peripheral to these capital considerations, the absence of reliable, high-bandwidth telecommunications and cohesive data governance frameworks in established textile corridors obstruct the continuous data flow required for effective AI operations, stalling the anticipated gains in latency-sensitive monitoring and predictive modelling functions. Compounding these economic and infrastructural barriers is a pervasive dearth of technically literate personnel, coupled with a notable cultural hesitance toward elevated management by data.

- Shortage of skilled workforce: Contemporary artificial-intelligence applications in textiles demand proficiency in machine learning, data analytics, and automated workflow design; however, the sector remains predominantly reliant upon manual processes and still possesses only thin penetration by this talent pool. Notably, while AI-based quality inspection modules promise defect-detection enhancements exceeding 90%, many production lines execute these applications at sub-optimal levels simply because the requisite specialist training and operational leadership are unavailable. Parallel to this technical hurdle, a pervasive apprehensiveness among the workforce regarding potential displacement by automated procedures fosters a climate of scepticism toward expediting adoption. Compounding these dynamics, enterprises confronted by stringent data-privacy legislation when implementing customer-analytic algorithms—especially in the pervasive domain of digital retail—curtail the hoped-for granularity of AI-facilitated personalization. The confluence of these technical, cultural, and regulatory impediments appreciably retards AI integration, especially within emerging-market textiles characterised by lower managed labour cost and narrower upfront capital.

Market Opportunities

- Push for sustainability and eco-friendly production: AI is mobile to help drive this shift by using every resource with laser focus, powering recycling, and creating greener fabrics the market can’t live without. Take design, for example. AI design tools whip up virtual prototypes, meaning brands can skip countless physical samples and cut down fabric waste by up to 30%. Or look at smart factories: AI fine-tunes dyeing and finishing, the steps that crank out about 20% of the water pollution in global textile production, shrinking water and chemical use while saving banks of cash. Some companies are going next level with AI in material science, mixing recycled fibers and plant alternatives into new fabrics that bang with the sustainable fashion trend. So while green is the trending talk, using AI in manufacturing is a shortcut to save money and outsmart the competition at the same time.

- The rapid expansion of e-commerce: AI-powered analytics and recommendation systems are game-changers for retailers, helping them spot which way consumer trends are headed, keeping shoppers more engaged, and nudging sales conversions up. Just look at personalized, AI-influenced shopping hints: they’ve been known to lift online sales by 25% or more. On the inventory side, smart forecasting slashes leftover stock by almost 40%. Then there are virtual fitting rooms that blend AI and augmented reality, letting people “try on” clothes from their couch and cutting returns by 20%. AI is also speeding up direct-to-consumer setups, letting brands quickly respond to what customers say, create fresh designs, and ship them in record time. These tech advances make customers happier and create fresh ways to earn money, proving that jumping on AI now is a savvy move for growth in the textile world.

Market Challenges

- Complexity of integrating AI solutions: Textile manufacturers looking to deploy artificial intelligence face a daunting obstacle: systems designed for autonomous aircraft do not simply interface with the thirty-year-old equipment most suppliers possess. Countless production lines—especially in growing economies—continue to operate legacy looms, stationary dye tanks, and labor-intensive stamping and counting stations. When mill owners attempt to install AI-powered cameras for defect inspection or thermal sensors to prevent over-heating motor failures, the retrofit often demands a laborious overhaul. Piecing in new wiring, rigid brackets, and support brackets routinely elevates material and installation costs by 20-25%, compelling the entire retrofit expenditure to double or more. Consequently, the small- and medium-sized suppliers—responsible for sustain-ing over eighty percent of the global sector—continue to defer these investments, delaying entire container loads of T-shirts and denim. Compounding the problem, whatever manufacturing data is captured travels between stations in marginally implemented codes or is transcribed onto paper.

- Data security, privacy, and ethical concerns: An increasing number of consumer brands are leveraging advanced analytics to discern preferences, track navigation patterns, and deliver bespoke product suggestions, resulting in an unprecedented accumulation of personally identifiable information. This accumulation constitutes a pronounced vulnerability should adversarial actors access the repository, should the data be repurposed without consent, or should the enterprise lapse in compliance with statutes such as the European Union's General Data Protection Regulation. Transparency in data steward practices—such as its geographic storage location, access controls, and retention policies—remains elusive. Moreover, the environmental architecture is sustained by distributed cloud infrastructure, the throughput of which is necessary not only to orchestrate logistics and generate product availability, but also to furnish a continuous digital storefront. Reports indicate that cyber-assaults targeting the structural layer of the textile manufacturing ecosystem have increased by an estimated forty per cent over the most recent biennium. Finally, when a machine-learning model autonomously establishes the retail value of a sneaker or predicts the leading seasonal hue, the derivation of that determination often resides within opaque, proprietary technology, rendering external confirmation of the underlying rationale exceedingly difficult.

AI in Textile Market Segmental Analysis

Component Type Analysis

Software: Software holds the largest share, since AI tools for predicting trends, learning from data, and seeing patterns in pictures are helping mills spot problems early, guess stocking needs, and plan designs in virtual space. Take the AI quality inspection app that lets a line spot defects with 90% better accuracy—waste drops, and the bottom line gets a healthy bump.

Hardware: Hardware capabilities are maturing, evidenced by the deployment of intelligent machines, cameras, and sensors integrated with AI within production lines, which enable end-to-end observability and intelligent automation. Mills that now deploy AI-augmented sensors in spinning and weaving facilities are reporting productivity gains nearing twenty per cent; continuous monitoring reduces stoppage events and the volume of rework, yielding significant throughput improvements.

Services: Consulting systems interoperability, and on-site operational support are rising most rapidly, especially within small and medium-sized weaving mills that lack the resources to recruit in-house data scientists. These service models ease the transition to AI and ensure continued value delivery well beyond initial pilot phases. With tighter profit margins and heightened sustainability commitments, mills are prioritizing software solutions, yet the tangible value of floor-installed machines coupled with the expertise required for their upkeep is generating substantial demand, thereby energizing the sector as the foundation for the next generation of textile AI innovation.

Material Analysis

Plastics & Polymers (PE, PET, PVC, PP, etc.): Plastics are the dominant type of materials in packaging, accounting for about 33.7%. That’s one of the reasons the focus is still on PET, especially since we see it everywhere in soda and drink bottles. These days, manufacturers are hopping on the recycled-plastic bandwagon or using simpler-material choices so their products last longer and leave a smaller footprint on the planet. That’s basically the new normal.

Glass: For wine, spirits, craft juices, and fancy food goodies, glass is the most preferrable. The material practically plays loop-the-loop in the recycling circuit: chipped cullet streams back into the furnace, where it finds its thermal trainer—furnace heat—already threaded with pre-consumed glass. Meanwhile, trials in Europe are rolling out still lines using refillable glass for juices and dairy, intended to quell the still-image of surge single-use glass.

Technology Analysis

Machine learning: The machine learning segment has dominated the market. Machine learning is the most innovative and worrisome development to happen in the world of technology. It can now perform complex tasks such as predicting shopper demand in real time. Its sensors are now predicting shopping and advertising using demand forecasting which is now “smart enough” to track unused goods.

Computer Vision: Computer technical systems that oversee the image are now incorporating these into their webcams which perceive the materials of the coffee nitro to dress it up and estimate the seams as well as the color. They are doing such tasks with an accuracy of 95%. This is excellent for color and material accuracy in garments and reduces the waste of leftover materials.

Natural language processing (NLP): Natural language processing, or NLP, has now become a standard component of e-commerce ecosystems, where chatbots and digital assistants engage shoppers, deliver tailored product suggestions, and orchestrate seamless checkout. Data indicate that these interventions can elevate conversion rates—defined as the proportion of visitors who complete a purchase—by as much as 20%, translating into significant sales growth without incremental promotional spend.

Predictive Analytics: Production forecasting and overall optimization of the supply chain has become easier due to the incorporation of Predictive analytics that now helps companies in achieving cost efficiency of up to 30% by accurately estimating demand and the resources needed to fulfill it.

Robotics and Automation: Smart factories that incorporate AI are equipped with self-operating machines revising monotonous tasks, and subsequently reducing the demand for human labor, enhancing efficiency in the processes by 20% to 25%. Automated robotics are revolutionizing the textile industry by giving rise to these smart factories.

End User Analysis

Textile Manufacturers: AI is being adopted by fashion and clothing manufacturers to enable them track trends and innovate designs in real time. Deep consumer data, and social media, is ingested by platforms that provide brands the ability to estimate trends, reducing unsold inventory by 30%.

Fashion and Apparel Brands: Fashion and apparel enterprises are leveraging machine learning to accelerate pre-season color and silhouette forecasting as well as to iterate complex product lifecycles. Hospitality-grade platforms that aggregate social media sentiment, e-commerce interaction, and purchase-history datasets have enabled brands to curtail end-of-season markdown stock by as much as 30%, mitigating waste and aligning collections with market demand.

Artificial Intelligence (AI) in Textile Market Share, By End User, 2024 (%)

| End User |

Revenue Share, 2024 (%) |

| Textile Manufacturers |

30% |

| Fashion & Apparel Brands |

24% |

| E-commerce & Retailers |

20% |

| Luxury Fashion Houses |

10% |

| Technical Textiles |

16% |

E-commerce and retailers: E-commerce and brick-and-mortar retailers are integrating AI-powered recommendation algorithms, conversational agents, and virtual fitting-room technologies to refine the shopping journey, yielding conversion-rate growth of up to 25% and returns-offset declines of approximately 20%.

Luxury fashion houses: Luxury fashion houses are directing resources toward AI-led personalization, employing comprehensive analytics and immersive design technologies to deliver bespoke apparel while preserving brand exclusivity and realizing cost efficiencies.

Technical Textiles: Meanwhile, technical textiles, used in industries like automotive, healthcare, and defense, are increasingly integrating AI for quality assurance and material innovation, where AI-enabled systems have been shown to reduce defect rates by more than 90%.

AI in Textile Market Regional Analysis

Why is Asia-Pacific rapidly expanding in the AI in textile market?

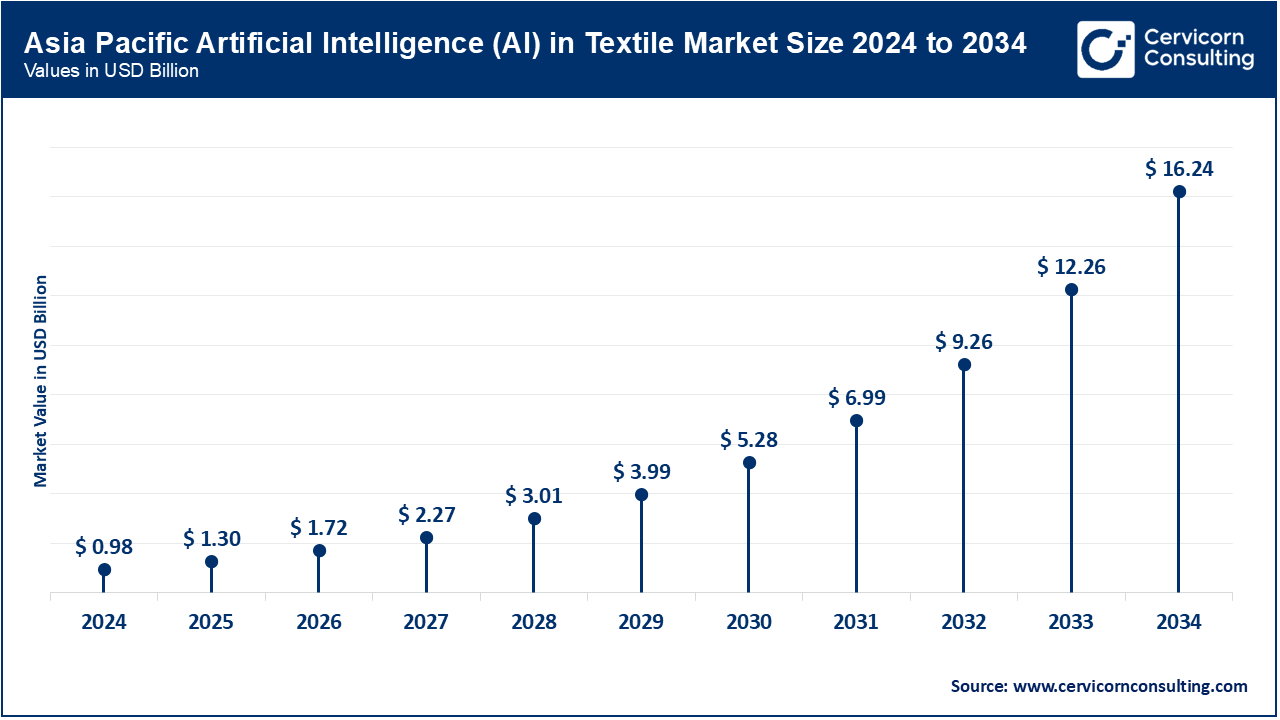

- The Asia-Pacific AI in textile market size was valued at USD 0.98 billion in 2024 and is expected to hit around USD 16.24 billion by 2034.

The Asia-Pacific region constitutes the most rapidly expanding geographic segment, propelled by the regional preeminence of textile production nodes, including China, India, Bangladesh, and Vietnam. Collectively, these economies are responsible for in excess of 60% of world textile outbound shipments; accordingly, producers are expediently integrating AI to boost operational efficiency, attenuate labor dependency, and comply with rigorous international sustainability benchmarks. Within China, AI-mediated fault detection platforms in woven fabric assemblies have documented quality appraisal precision exceeding 95%, thereby greatly curtailing fabric rejection. India, characterized by a broad small- and medium-sized enterprise (SME) ecosystem, is progressively adopting AI for demand foretelling and optimization of supply networks, catalyzed by the expanded scope of e-commerce. Notwithstanding this advance, pronounced impediments, including elevated capitalization outlay and a constrained technical labor pool, continue to inhibit more extensive AI deployment.

What are the driving factors of North America AI in textile market?

- The North America AI in textile market size was estimated at USD 0.78 billion in 2024 and is forecasted to grow USD 12.87 billion by 2034.

North America, in contrast, occupies the vanguard of conceptualization and deployment, underpinned by mature digital infrastructures, elevated research and development expenditure, and a pronounced consumer appetite for personalized apparel. The United States occupies a leading position in the application of artificial intelligence to e-commerce and smart manufacturing. Predominant brands exploit predictive analytics to lower inventory carrying costs by as much as 30% while simultaneously enhancing customer interaction through hyper-personalized recommendation systems.

Artificial Intelligence (AI) in Textile Market Share, By Region, 2024 (%)

| Region |

Revenue Share, 2024 (%) |

| North America |

29.40% |

| Europe |

24.80% |

| Asia-Pacific |

37.10% |

| LAMEA |

8.70% |

Europe is progressing rapidly in the AI in textile market

The Europe AI in textile market size was accounted for USD 0.65 billion in 2024 and is predicted to surpass around USD 10.85 billion by 2034.

Europe is progressing rapidly behind the United States, with Germany, Italy, and France embedding AI into both textile production and the sustainable fashion movement. Manufacturers are prioritizing greener processes; AI-driven fine-tuning of dyeing and finishing operations has brought reported reductions in water consumption approaching 20%.

LAMEA Market Trends

- The LAMEA AI in textile market was valued at USD 0.23 billion in 2024 and is anticipated to reach around USD 3.81 billion by 2034.

Latin America has now reached an early-spectrum transitional phase and simultaneously exhibits above-average latent capacity, with Brazil and Mexico charting speedier diffusion among fashion retail and integrated digital services arenas. Multiscale analytics, now reconfigured along cognitive paradigms, support forecasting of purchasing intent fewer degrees of variance, leveraging an expanding aspirant middle-class preference for differentiated rather than generalized apparel portfolios. The Middle East and African subregions enter a subsequent penetration phase, where Gulf Cooperation Council territories, especially the UAE and Saudi Arabia, concentrate capital flows onto AI algorithms optimized for high-value textile presences and retail experiences. Parallel pockets of acceleration emerge in South Africa, where cognitive personalization within digital commerce and algorithmically optimized distribution networks constitute the primary uptake modes. Consequently, while mature North America and Western portions of Europe retain nominal leadership in environment-embedded implementations, the Asia-Pacific dense production lattice is consolidating the prescriptive architecture required for scalable incremental pattern-resilience, and simultaneously the emerging Latin and ME-African symptomatology acquires infrastructural end-state capabilities in preparatory pilot degrees.

AI in Textile Market Top Companies

- Microsoft Corporation

- IBM Corporation

- Google LLC

- Amazon Web Services (AWS)

- SAP SE

- Oracle Corporation

- General Vision Inc.

- Salesforce Inc.

- Adobe Inc.

- Huawei Technologies Co., Ltd.

- Nvidia Corporation

- Siemens AG

Recent Developments

- June 2025: Senstile Presents "Digital Material Fingerprints": at an academic technosemposium under the theme Advancing Digitisation of Fibre Systems via Causal AI, Senstile exhibited the emergent appellation Digital Material Fingerprints, whose analytic corpus is premised upon an autonomic “textile Material DNA.” Coded within a multidimensional vector synthesis, the architecture sequentially records and parameterizes tactile resistance, microscopic structure, colimetric identity, spectral chromatic response, and an integrated fiber-chemical cartography. Ensuing subsystems, equipped with recursive logic cores, extend analytic granularity beyond classical captured point range, thereby calibrating recursive forecasting fidelity for subsequent design-lifecycle decision tiers.

- April 2025: The Computer Fashion Design Association (CFDA) and eBay jointly designated Refiberd the recipient of the Circular Fashion Innovator of the Year award, granting the enterprise $300,000 in project finance. Refiberd, an emergent firm focusing on artificial-intelligence-driven textile valorization, advanced its portfolio with a hyperspectral scanning mechanism. The system precisely discriminates among multilayer material assemblies inherent in post-consumer garments—marking a critical step toward the industrialization of closed-loop textile recycling.

Market Segmentation

By Component

- Software

- AI platforms

- Machine Learning Tools

- Analytics Solutions

- Services

- Consulting

- Implementation

- Support & Maintenance

- Hardware

- Sensors

- Cameras

- AI-enabled Machines

By Technology

- Machine Learning

- Computer Vision

- Natural Language Processing (NLP)

- Predictive Analytics

- Robotics & Automation

By Material

- Plastics & Polymers (PE, PET, PVC, PP, etc.)

- Glass

By Application

- Design & Product Development

- Quality Control & Defect Detection

- Production Planning & Optimization

- Supply Chain & Inventory Management

- Sales & Marketing (personalization, trend forecasting)

- Customer Experience & Virtual Try-On

By End User

- Textile Manufacturers

- Fashion & Apparel Brands

- E-commerce & Retailers

- Luxury Fashion Houses

- Technical Textiles (industrial, medical, automotive)

By Region

- North America

- APAC

- Europe

- LAMEA