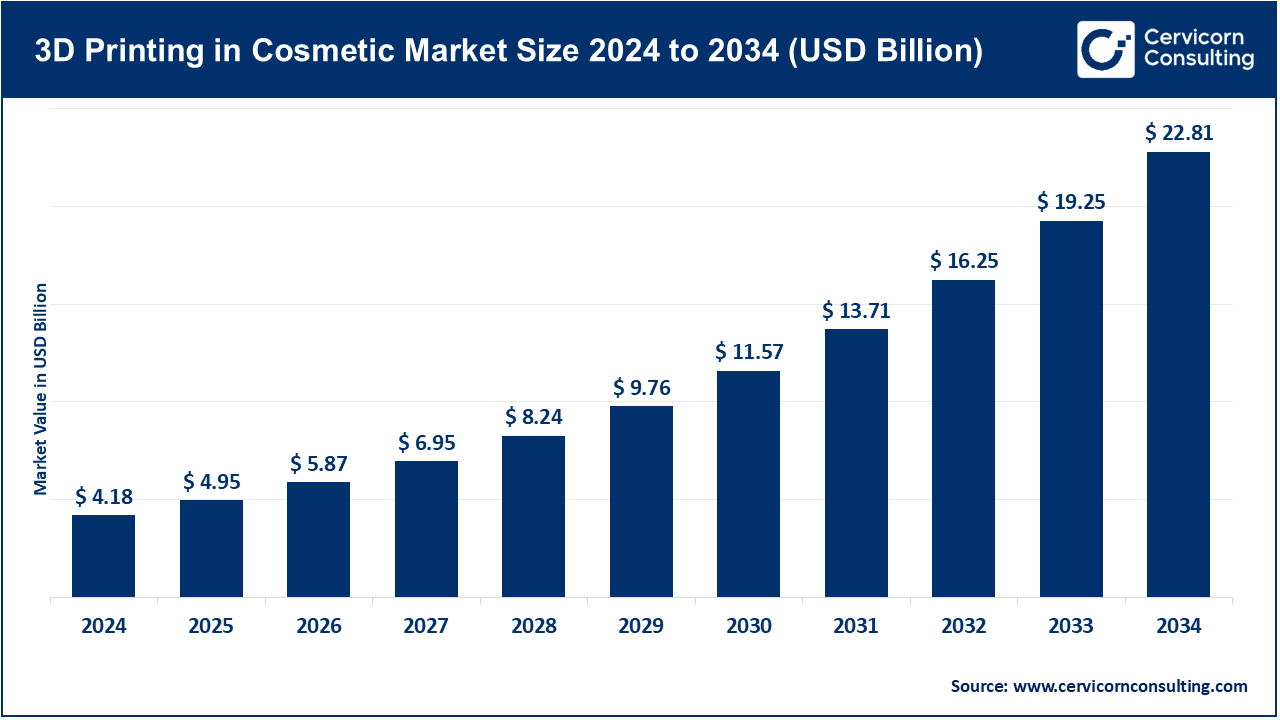

The global 3D printing in cosmetic market size was valued at USD 4.18 billion in 2024 and is anticipated to reach around USD 22.81 billion by 2034, growing at a compound annual growth rate (CAGR) of 18.5% over the forecast period from 2025 to 2034. Rapid growth is being observed in the 3D printing in cosmetic market owing to various transformations in the sector in terms of personalization, sustainable production, and experimental development of new products, in the beauty and personal care sector. As consumers insist on custom-made solutions, ethical business, and green-friendly production, cosmetic brands are inclined towards 3D printing to speed up the process of product design, decrease wastes, and enable customer interaction. Applied in luxury skincare through to mass-market cosmetics, this new technology is transforming the very conceptualization of products, their testing, and delivery.

3D printing in cosmetics using additive manufacturing technologies to create a 3D printing in cosmetics products and packaging and beyond to support cosmetic products and even skin models printed via hydrogel printing 3D printing in cosmetics can generate revolutionary results, one example would be the bioprint of skin models 3D Printing in Cosmetics has the ability to transform the entire cosmetic industry by using stereolithography (SLA), selective laser sintering (SLS), and material jetting technology to design, prototype, and print cosmetic products and their packaging as well It provides very targeted formulations of skincare products, custom-done makeup products and props new approaches to packaging, and makes the production highly specific and affordable, and the environmental effects lower. Growing pressure to ban animal testing, ESG pledges, and consumer pressure to adopt clean beauty products is already increasing the pace of its use, making 3D printing a foundation technology for the future of the global beauty biosphere.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 4.95 Billion |

| Expected Market Size in 2034 | USD 22.81 Billion |

| Projected Market CAGR 2025 to 2034 | 18.5% |

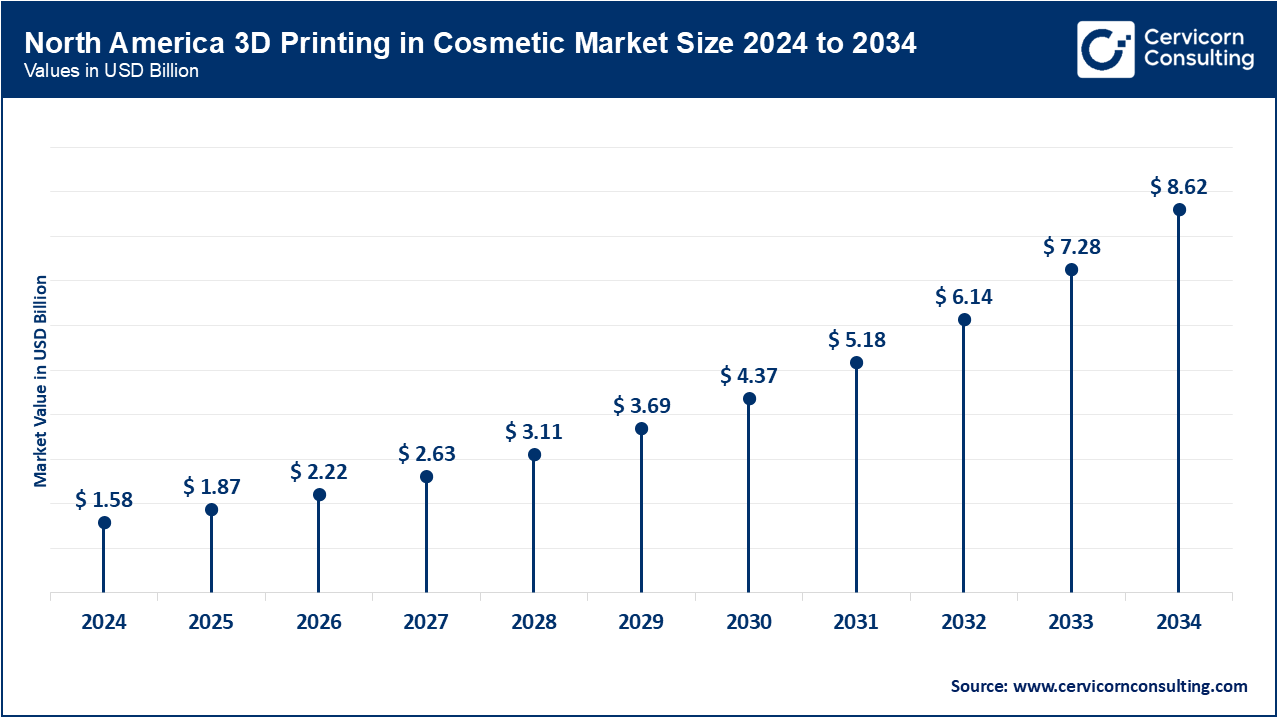

| Prominent Region | North America |

| Fastest Expanding Region | Asia-Pacific |

| Key Segments | Technology, Application, Material, End-Use, Distribution Channel, Region |

| Key Companies | LOreal, Neutrogena, Mink Beauty (Luxe), Chanel (via Erpro 3D Factory), Shiseido, Estee Lauder, Unilever, Dior, BASF (with Natural Machines), JALA Group, Organovo, 3D Systems, Materialise, Formlabs, Stratasys |

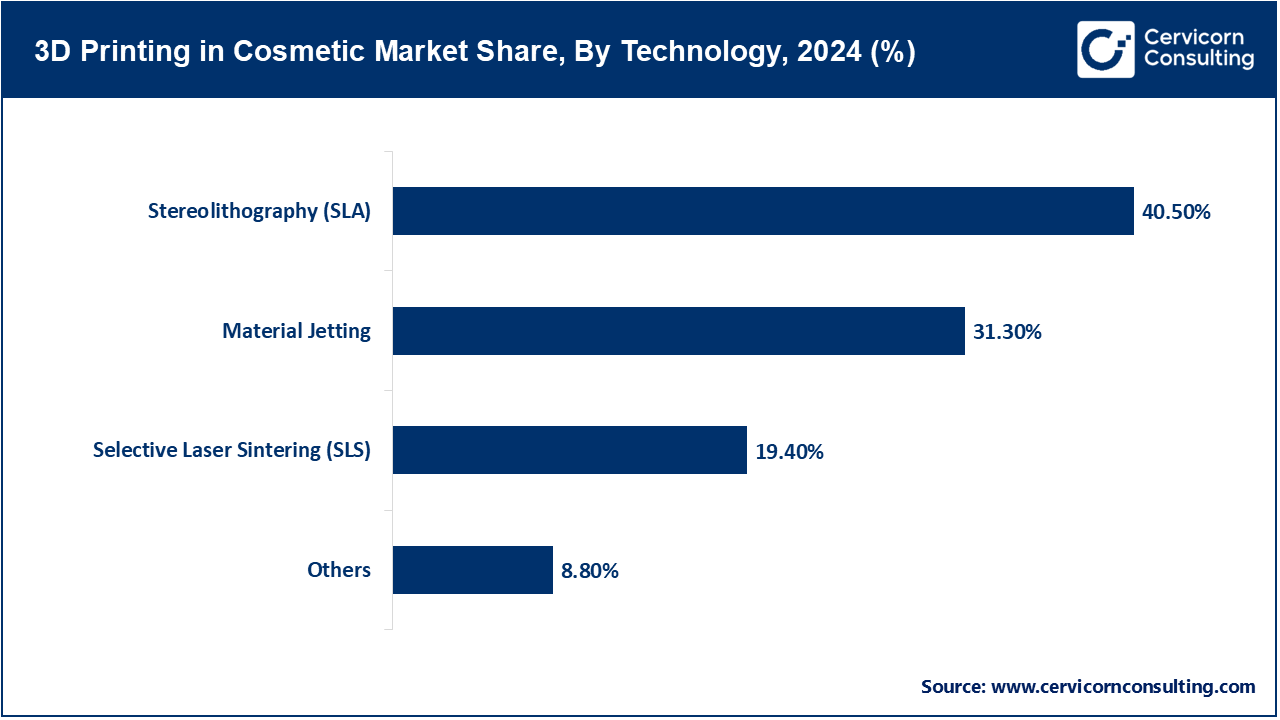

Stereolithography (SLA): It is a 3D printing technology involving the use of laser to harden liquid resin to create finished plastic using cosmetic prototypes and molds. It is highly utilized in packaging of skin care products and applicator. In June 2023, L Or o r e l embraced SLA printers to produce precision applicator tips of foundation packaging to give substantial time reduction in development. The scenario has shown how SLA aided in speeding up the design validation in advance of mass production.

SLS (Selective Laser Sintering): This uses a high-powered laser that melts powder materials into 3D structures applicable to durable packaging and appliers components. It is advantageous because it is flexible on complex geometries without molds. Procter and Gamble have innovated the use of SLS to make stronger, more sustainable refillable deodorant cases in September 2024; this makes circular packaging solutions possible. This application cutting down traditional molds reliance and customization. This gave us the durability and also sustainability which is in line with the eco-friendly consumerism trends.

Material Jetting: This is in cosmetics printing and it uses layers of a liquid material that is cured using a UV light source to result in even, multi materials type of cosmetics. It has the capability of producing vivid color, which is suitable in lipsticks and makeup prototypes. In February 2024 Chanel used material jetting to produce realistic samples of lipstick in various colours to test on consumers. This aided on the suppression of wastes since there was no need of the physical production on a large-scale during testing periods. The procedure gave texture and aesthetic correctness to prototypes.

Others (Multi Jet Fusion, FDM, DLP): Examples of this include Multi Jet Fusion (MJF), Fused Deposition Modeling (FDM), and Digital Light Processing (DLP) which are used as cosmetic applications in rapid prototyping and functional testing. They are cost effective and scalable to different use cases. In April 2023, Estee Lauder used MJF to speed up the creation of packages of new skincare serums with a 40 percent decrease in the length of prototyping cycles. Through this application, rapid cycling of packaging model was possible prior to production of final tooling. The approaches offer flexible solutions to achieving a balance between cost, speed, and those material requirements.

Prototyping: The prototyping segment has dominated the market. The initial step associated with product development is prototyping, and it is here where 3D printing is used to design the models of cosmetic packaging and applicators. It enables form, fit and functioning to be tested before production. Shiseido experimented with 200+ different mascara brush iterations in weeks in March 2024 by using 3D printing. This slashed designers cycles radically against conventional tooling.

Packaging Design: 3D Packaging design can help brands experiment with revolutionary shapes, refillable packaging, and more sustainable solutions. The strategy reduces waste to a minimum since it does not produce molds on a large scale. In July 2023, LVMH used 3D printing on luxury perfume bottles and tried out the avant-garde design with Dior. This enabled the brand to know how consumers would react before finally producing the glass.

Customized Skincare: Printable skincare entails customizing devices or containers to skin type and dosage of the skin products. This puts consumer control of personalization at their disposal. With the release of Skin360 3D-printed masks, Neutrogena changed the consumer care skin regime in October 2024, offering them masks generated by facial scans. These masks were produced on the biocompatible materials that allow contacts with the skin.

Color Cosmetics (Make up, Lipsticks, Foundations): In color cosmetics, 3D printing generates a prototype version of lipsticks, foundations, and blushes whose surfaces have become so realistic in terms of color and texture. It aids consumer testing and innovation at retail. In May 2023, Yves Saint Laurent trialed 3D-printed moulds of lipstick that could be customized over-the-counter to the exact shade. The customers were allowed to select favorite colors that were printed in a few minutes to test.

Bio printing (Skin Models, Tissues): Bioprinting in cosmeceuticals seeks to use skin models and tissues to test products on safety and efficacy without animal testing. It mixes cells with biomaterials in order to mimic the nature of real tissue. Bio printed skin model In August 2024, BASF and CTIBiotech announced anti-aging product testing using bio printed human skin models. This greatly minimized the use of animal trials that were controversial. It enabled accelerated cycles of R&D that are ethically acceptable. Bioprinting is taking up importance in regulatory compliance as well as innovation in the area of cosmetic testing.

Polymers: The polymers segment was prominent leader in the market. Polymers represent the most popular material in 3D-printed packaging of cosmetics because of their low weight, price, and sturdiness. They are pre-eminent in applicators and refillable cases. Unilever has designed shampoo bottle caps that have much less virgin plastic content than before using polymer-based printing used to design them in January 2024. The project was set up to improve the circular economy activities in packaging.

Resins: SLA printing mainly uses resin to print prototypes of high detail useful in the cosmetic industry. They have a preference on smoother surfaces and sharpness. Lancome utilized resin-based SLA printing in March 2023 to prototype quasi-intricate perfume bottle tops that had fragile engravings. Compared to luxury branding requirements, quality of detail accuracy was paired with lower cost of heavy tooling. With resin printing came a possibility to test out numerous artistic versions of a print prior to manufacturing.

Waxes: This printing to make molds and trials in creating details of designing. They are particular in mock-ups of luxury packages. In September 2023, Guerlain used wax 3D printing to create custom lipstick packaging on limited edition releases. The wax models allowed the prototype to be visualized accurately with final casting in metal. This enhanced seasonal offerings in terms of creativity. Wax printing also guarantees that aesthetics of the brand are preserved and minimises initial risk design.

Biocompatible Materials: This is key in healthcare and bio printing where direct skincare or tissue simulation process is involved. They provide functionality and safety in customised skincare masks, or applicators. Neutrogena masks Skin360 were produced in December 2024, and had a biocompatible material approved by FDA, which ensures they can be used every day without harm to health. This trend put forward material innovation as boasting a main ingredient towards regulatory approval. It connected individualization and consumer safety.

Others (Metals, Hybrids): Other substances such as metal and mixed composites are used in premium cosmetic container or machineries. They are long-lasting and luxurious. In April, Estee Lauder tested metal-polymer 3D hybrid in luxury jars of creams. The combination gave strength and light handling on handling to attract consumers. The solution facilitated quality branding and less labour crafting.

Skincare Brands: The skincare brands segment has captured highest revenue share in the market. Another way 3D printing is used by skincare brands is in the production of tailored applicators, refill packaging and product testing. This aids in satisfying the growing interest in personalisation. Another first in the world of consumer skincare was in October 2024 when Neutrogena launched Skin360 personalized masks. It also placed the brand in the lead as a skin wellness innovator. The greatest advantage of the consumer-focused applications of 3D printing is likely to have its positive effect on skincare brands. The methodology connects R & D and the personalization of consumers.

Paint & Color Cosmetics Businesses: Companies that deal with makeup use 3D printing in making molds, packaging samples, and testing shades to be used by customers. This enables fast innovation cycles within the competitive arena. In May 2023, Yves Saint Laurent launched store-level 3D printing of personalised lipstick in real time to offer a real-time customisation of shade. This example created a shopping tradition in consumer activity. It also reduced wastage and incorporated luxury value. The cosmetic industries therefore promote the personalization of 3D printing.

Luxury Brands: The beauty luxury brands are centered on beauty and exclusivity, whereby they use the technology of 3D printing to develop the high end package design. They tend to mix new technologies with the old craftsmanship. Istead, Dior did a test run of 3D printed prototypes of avant-garde perfume bottles in July 2023 prior to mass production. This formed special shapes that were in accordance with luxury identity. 3D printing facilitated rapid iterations yet retained exclusivity. It is a packaging invention creativity utilizer by luxury brands.

Personal Care Producers: Manufacturers of personal care apply 3D printing to packaging innovation and research and development. They underline cost economies in conjunction with better products. In January 2024 Unilever also used 3D printing to test sustainable packaging with prototype caps on bottles of shampoo. The relocation facilitated greater speed of package innovation. It displayed the diversity of the use of additive manufacturing beyond luxury brands. Printing in personal care manufacturers is employed to make the interface relevant to scale and sustainability.

Online Platforms: The online platforms segment has garnered highest revenue share in the market. E-commerce is facilitated by online sites where 3D-printed customized cosmetics are sold. They are also used to reach an international market with personalized services. In February 2024, Neutrogena introduced 3D-printed Skin360 masks into distribution utilizing online ordering, in which facial scans could be uploaded specifically to manufacture. This relationship between digital data and physical printed goods reintroduced e-commerce personalization. It demonstrated the way in which the Internet can transform the way consumers interact. The Internet mediums, therefore, lead to the embrace of mass customization.

Offline Retail (Flagship Stores, Beauty Retail Stores): Offline retail embraces 3D printing in experiential shopping whereby, customers are empowered to design products in the store. It connects the customization with elegant experiences. Starting in May 2023, Yves Saint Laurent customers can print the lipsticks of their choice at stores in Paris and Tokyo. This better involvement by combining the technology with retail influential presence. The relocation increased the number of customers and minimized the number of products that could not be sold. The offline retailers are still a platform of experiencing adoption of the 3D printing.

Direct-to-Consumer (D2C): D2C plays enable cosmetic brands to fulfill 3D-printed personalized goods directly to the end-users without the interference of any intermediaries. This enhances profit and customer relations. L'Oreal In October 2024, L'Oreal conducted an experiment with D2C subscription boxes of 3 -printed skincare applicators that matched skin types. Customers would have the option of subscribing and getting personalized tools to them at the comfort of their homes. The project enabled stronger brand-consumer relations as well as lower retail reliance. The D2C models are emerging as essential to a market focused on personalization.

Special Cosmetic Labs: R&D and innovation focus within specialty cosmetic labs have been found through the use of 3D printing to test new ways of providing packaging and products. They collaborate closely with brands to bring up speed in trials. In August 2023, the cosmetic laboratory of BASF partnered with startups to design 3D printed models of skin tissues to ensure safer testing of the products. This fast tracked the permission of new formulations. Specialty labs are agents of scale innovation. They are major facilitators of cosmetic R&D environments.

The 3D printing in cosmetic market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

The North-America is growing at a high pace and is able to persevere with clear R&D expenditures and customer bases of personalization. U.S. has been leading in pre-packaged beauty treatment products, where biocompatible substances which are primarily used in cosmetic products use are under FDA controlled use. In June 2023, Neutrogena launched its Skin360 skincare-customized face masks 3D-printed in the United States, based on facial scan data. The country of Canada is also making some investments in sustainable packaging prototypes by means of polymer-based 3D printing. Brands are being driven to use environmentally-friendly 3D-printed designs by the increasing importance of ESG and sustainability. Such a tech innovation fits with the North American dominance in the use of beauty tech.

The European 3D Printing in Cosmetic Company is pushed by luxury brands, strong sustainability laws and consumer demand of exclusivity. France, Germany, and Italy are leading the technology in relation to packaging which involves 3D printing. Usage LVMH tested 3D-printing high-fashion perfume bottles in July 2023 to use with Dior, an example of how the technology can be used as both creative and environmentally friendly. Cosmetic companies are being driven by the Green Deal proposed by the European Union toward refillable, recyclable 3D-printed packaging. Additive manufacturing is used in Germany to manufacture biocompatible cosmetic applicators by startups. This has led to 3D printing making a standard practice in the luxury and skincare industries with a globally harmonized EU-wide environment.

The rapidly expanding 3D printing market in Asia-Pacific is fuelled by the factors such as urbanization, growth in disposable incomes, and the desire to have personalized beauty. China, Japan and South Korea are big frontiers of innovations, with brands trying to experiment with both skincare and makeup. Shiseido trialed 3D-printed mascara brush prototypes in Japan in October 2024, and within weeks it was able to test more than 200 variations. Material jetting is another Chinese beauty-tech experiment, in smart lipstick molds. South Korea is mixing K-beauty novelty with 3D-printed packaging to launch products at best pace. The area has turned into an international center of personalization as well as cost-effective manufacturing.

3D Printing in Cosmetic Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 37.80% |

| Europe | 26.20% |

| Asia-Pacific | 30.40% |

| LAMEA | 5.60% |

LAMEA is the latest emerging market; it is growing slowly but steadily owing to sustainability, emphasis on luxury, and international partnerships. In April 2024, Natura &Co Brazil started trialling of 3D printed eco-packaging to decrease its carbon footprint. Mexico is supporting the startups that integrate digital scanning with custom cosmetics. The goal of the Vision 2030 Yemen strategy saw Saudi Arabia present 3D-printed perfume bottle models in the Middle East. South Africa is experimenting the cosmetic bioprinting with universities on skincare testing. In general, the area uses international collaborations to develop niche cosmetic and packaging innovations.

Market Segmentation

By Technology

By Application

By Material

By End-Use

By Distribution Channel

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of 3D Printing in Cosmetic

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Material Overview

2.2.3 By Distribution Channel Overview

2.2.4 By Application Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Sustainable Practices Imperative Driver

4.1.1.2 Acceleration of R&D via rapid prototyping

4.1.2 Market Restraints

4.1.2.1 Post-Processing Requirement

4.1.2.2 Health issues towards emissions

4.1.3 Market Challenges

4.1.3.1 Scaling Prototypes to Commercial Output

4.1.3.2 Regulatory Compliance Standards

4.1.4 Market Opportunities

4.1.4.1 Home Beauty printers

4.1.4.2 Partnership with Luxury Brands

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global 3D Printing in Cosmetic Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. 3D Printing in Cosmetic Market, By Technology

6.1 Global 3D Printing in Cosmetic Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Stereolithography (SLA)

6.1.1.2 Selective Laser Sintering (SLS)

6.1.1.3 Material Jetting

6.1.1.4 Others

Chapter 7. 3D Printing in Cosmetic Market, By Material

7.1 Global 3D Printing in Cosmetic Market Snapshot, By Material

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Polymers

7.1.1.2 Resins

7.1.1.3 Waxes

7.1.1.4 Biocompatible Materials

7.1.1.5 Others

Chapter 8. 3D Printing in Cosmetic Market, By Distribution Channel

8.1 Global 3D Printing in Cosmetic Market Snapshot, By Distribution Channel

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Online Platforms

8.1.1.2 Offline Retail (Flagship Stores, Beauty Retail Chains)

8.1.1.3 Direct-to-Consumer (D2C)

8.1.1.4 Specialty Cosmetic Labs

Chapter 9. 3D Printing in Cosmetic Market, By Application

9.1 Global 3D Printing in Cosmetic Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Prototyping

9.1.1.2 Packaging Design

9.1.1.3 Customized Skincare

9.1.1.4 Color Cosmetics (Makeup, Lipsticks, Foundations)

9.1.1.5 Bioprinting (Skin Models, Tissues)

Chapter 10. 3D Printing in Cosmetic Market, By End-User

10.1 Global 3D Printing in Cosmetic Market Snapshot, By End-User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Skincare Brands

10.1.1.2 Makeup & Color Cosmetics Companies

10.1.1.3 Luxury Beauty Brands

10.1.1.4 Personal Care Manufacturers

Chapter 11. 3D Printing in Cosmetic Market, By Region

11.1 Overview

11.2 3D Printing in Cosmetic Market Revenue Share, By Region 2024 (%)

11.3 Global 3D Printing in Cosmetic Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America 3D Printing in Cosmetic Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe 3D Printing in Cosmetic Market, By Country

11.5.4 UK

11.5.4.1 UK 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific 3D Printing in Cosmetic Market, By Country

11.6.4 China

11.6.4.1 China 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA 3D Printing in Cosmetic Market, By Country

11.7.4 GCC

11.7.4.1 GCC 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA 3D Printing in Cosmetic Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 L’Oréal

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Neutrogena

13.3 Mink Beauty (Luxe)

13.4 Chanel (via Erpro 3D Factory)

13.5 Shiseido

13.6 Estee Lauder

13.7 Unilever

13.8 Dior

13.9 BASF (with Natural Machines)

13.10 JALA Group

13.11 Organovo

13.12 3D Systems

13.13 Materialise

13.14 Formlabs

13.15 Stratasys