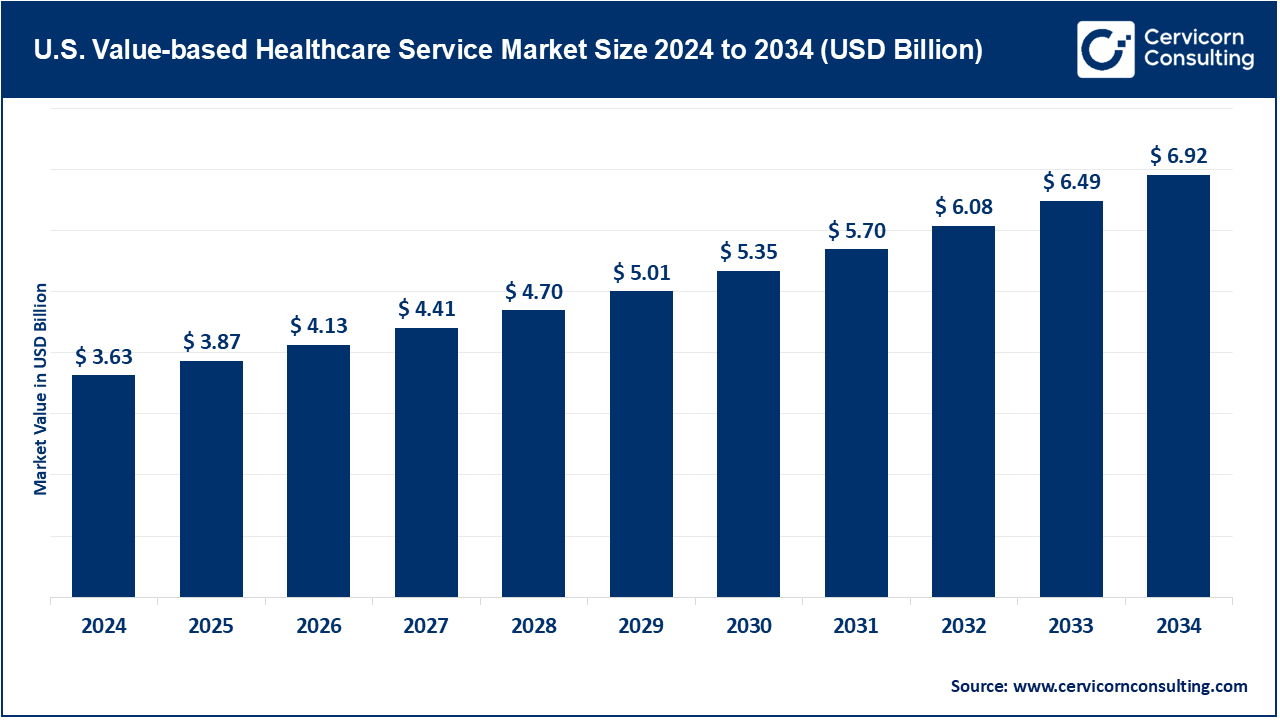

The U.S. value-based healthcare service market was valued at approximately USD 3.63 trillion in 2024 and is projected to climb to roughly USD 6.92 trillion by 2034, translating into a compound annual growth rate of 6.66% across the period from 2025 to 2034.

Nearly one in two Americans now lives with a chronic illness, from diabetes to heart failure, so the healthcare system urgently needs models that prevent complications, manage these conditions over years, and catch problems early-same objectives that guide value-based programs like Accountable Care Organizations, bundled-payer contracts, and patient-centered medical homes. Federal programs such as MACRA, the Medicare Shared Savings Program and a set of pilot projects under ACMI have sped up the shift by tying provider income to quality measures instead of volume, offering financial rewards when patients fare better. Evidence of that pay-for-performance approach comes from 2021, when MSSP ACOs alone saved Medicare roughly 1.9 billion dollars, a figure that speaks to both efficiency and patient care. The advancement of technology is essential for the growth of value-based care. The pandemic brought 63 times increase in telehealth visits which helped in chronic disease management, in retaining patients, and decreasing avoidable hospital stays by 25%. Now, there is real-time interoperability on the cloud which enables the collaboration of multiple provider teams to manage entire populations of over a million patients. In medical education, Stanford Medicine employs 360° cameras to capture recording clinical simulations which allows for remote participatory lessons for medical students around the globe.

The US healthcare scene is steadily moving away from the old get-paid-per-visit model and toward a value-based system that rewards real patient results. In this new setup, doctors and hospitals work together, use data smartly, and try to lift patient health while trimming costs at the same time.

Major programs leading the charge are Accountable Care Organizations (ACOs), bundled-payment arrangements, and patient-centred medical homes, each spelling out clear goals and shared rewards. That push has gained extra muscle from rising rates of chronic illness, friendly new government rules, and the rapid growth of apps, telehealth, and other digital tools. Public and private insurers now nudge providers with risk-sharing deals, weaving value-based care deeper into the nation’s health-care makeover.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 3.87 Billion |

| Expected Market Size in 2034 | USD 6.92 Billion |

| Projected CAGR 2025 to 2034 | 6.66% |

| Key Segments | Component, Model Type, Payer Category, Deployment Mode, Application, End User |

| Key Companies | UnitedHealth Group (Optum), CVS Health (Aetna & Oak Street Health), Cigna, Anthem (Elevance Health), Humana, Kaiser Permanente, Evolent Health, Lumeris, Health Care Service Corporation (HCSC), Cerner Corporation (Oracle Health), Epic Systems Corporation, Health Catalyst, Innovaccer, IBM Watson Health, Allscripts Healthcare Solutions |

Accountable Care Organizations: Accountable Care Organizations (ACOs) stand out as a cornerstone of value-based care across the American health system. An ACO is essentially a voluntary alliance of physicians, hospitals, and ancillary providers who agree to share patient data and treatment plans in order to streamline, safe, and cost-effective care for Medicare beneficiaries. By reducing redundant tests and intercepting errors before they escalate, ACOs aim to spare patients unneeded interventions and curtail overall spending. Providers who meet predetermined quality metrics and demonstrate savings subsequently divide the surplus revenue, creating a compelling financial incentive. As an illustration, the Medicare Shared Savings Program (MSSP) managed to save Medicare 4.3 billion dollars in 2022 which drives the point that ACOs can create a great deal of value through care coordination and managed spending. 84% of its 482 ACOs achieved savings, and 63% of participants earned shared savings.

Patient-Centered Medical Homes: Patient-Centered Medical Homes (PCMHs) shift the spotlight squarely onto primary-care teams and the continuity of care they cultivate over time. Grounded in a holistic, multidisciplinary philosophy, the PCMH model organizes resources around each individual, especially those managing complex, persistent diseases. By fostering regular outreach, coordinated referrals, and symptom-specific education, PCMHs tend to lift patient satisfaction, curb avoidable hospital readmissions, and improve clinical control for conditions like diabetes and heart failure.

Bundled Payment Models: In Bundled Payment Models, the payer issues one fixed fee that covers every procedure, follow-up visit, and rehabilitation session linked to a single clinical episode—think hip replacement or cardiac bypass surgery.

Others: The Others category catalogues an array of newer experiments, from global capitation and shared-savings arrangements to mixed-value contracts that blend features of the foundational models.

Providers: Hospitals, clinics, and integrated health systems constitute the core constituency of value-based care programs. Charged with delivering consistent, high-quality treatment, these entities must also keep overall spending within fixed budgets. Rising demands for better clinical results, paired with public scrutiny of wasteful procedures, push them to deploy sophisticated electronic health records, centralized care coordinators and population-health dashboards. Because this segment commands the largest slice of the market, observers forecast steady, if cautious, expansion as providers pivot away from traditional fee-for-service reimbursement.

Payers: Insurers, including commercial plans and federal programs like Medicare and Medicaid, fill the twin roles of architect and underwriter for value-focused payment models. They establish incentives such as bundled episodes, gain-sharing pools and capitated risk contracts that financially reward caregivers who deliver quality at lower cost. Equally, payers channel resources into advanced data analytics that track clinical outcomes, measure patient compliance and project savings. By doing so, they set uniform benchmarks, ease inter-provider comparability and steadily push the entire system toward more collaborative, outcome-driven practice. For instance, in Maryland’s global budget model—a blend of fee-for-service and capitation where a per-hospital, yearly budget is set for a defined population—Medicare has restrained over 1.4 billion dollars in spending over five years by curtailing avoidable procedures and readmissions.

Patients: Value-based care relies on the assumption that patients will act on the incentives built into the model, and evidence suggests they are doing just that. Consumer-friendly technologies, clearer health records, and dedicated care teams now place patients in the center of the decision-making process, allowing them to shape weekly goals and long-term plans.

Chronic Care: Chronic care dominates the healthcare technology market by volume, largely because illnesses such as diabetes, heart failure, hypertension, and chronic obstructive pulmonary disease (COPD) are spreading at an alarming rate. Together, these conditions consume a large share of hospital budgets and require intricate, continuous management rather than episodic treatment. Value-based reimbursement fits chronic care perfectly, since it rewards regular monitoring, seamless care coordination, and active patient participation. By using real-time data and tailored plans, clinicians are financially motivated to head off complications, minimize revisits, and secure durable health gains for patients.

Acute Care: Acute care, in contrast, addresses severe or time-sensitive problems that demand immediate medical attention, including emergency surgery, traumatic injuries, or serious infections. Under value-oriented pay models, acute episodes are now judged not only on clinical success but also on their overall cost and the speed with which patients return to normal activity. Bundled payments are widely applied in this space, especially for predictable surgical paths such as knee replacements or cardiac stenting, since they urge hospitals and surgeons to keep expenditures in check for the entire episode, from pre-admission testing through rehabilitation. Likewise, Medicare’s BPCI initiative for Bundled Payments for Care Improvement lowered payments for episodes of care like knee replacements. Payments for these episode aggregates dropped by 444 dollars per episode, primarily due to reduction in post-acute care and readmissions.

Preventive Care: Preventive care has moved to the forefront of modern medicine, emphasizing early detection and intervention to stop minor health issues from evolving into serious diseases. Core elements include routine screenings, up-to-date vaccines, annual physical exams, and personalized guidance on nutrition and exercise.

Market Segmentation

By Component

By Model Type

By Payer Category

By Deployment Mode

By Application

By End User

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Value-based Healthcare Service

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Model Type Overview

2.2.2 By Component Overview

2.2.3 By Payer Category Overview

2.2.4 By Deployment Mode Overview

2.2.5 By Application Overview

2.2.6 By End User Overview

2.3 Competitive Overview

Chapter 3. U.S. Impact Analysis

3.1 Russia-Ukraine Conflict: U.S. Market Implications

3.2 Regulatory and Policy Changes Impacting U.S. Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Focus on Patient Outcomes and Cost Containment

4.1.1.2 Government and Payer Incentives for Value-Based Models

4.1.2 Market Restraints

4.1.2.1 Complexity in Implementation and Transition

4.1.2.2 Data Integration and Interoperability Challenges

4.1.3 Market Challenges

4.1.3.1 Misalignment of Incentives Across Stakeholders

4.1.3.2 Limited Access to Real-Time, High-Quality Data

4.1.4 Market Opportunities

4.1.4.1 Expansion of Personalized and Preventive Care

4.1.4.2 Leveraging Technology for Care Coordination and Efficiency

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 U.S. Value-based Healthcare Service Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Value-based Healthcare Service Market, By Model Type

6.1 U.S. Value-based Healthcare Service Market Snapshot, By Model Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Accountable Care Organizations (ACOs)

6.1.1.2 Patient-Centered Medical Homes (PCMH)

6.1.1.3 Bundled Payments

6.1.1.4 Others

Chapter 7. Value-based Healthcare Service Market, By Component

7.1 U.S. Value-based Healthcare Service Market Snapshot, By Component

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Software

7.1.1.2 Services

7.1.1.3 Platforms

Chapter 8. Value-based Healthcare Service Market, By Payer Category

8.1 U.S. Value-based Healthcare Service Market Snapshot, By Payer Category

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Medicare and Medicare Advantage

8.1.1.2 Medicaid

8.1.1.3 Commercial

Chapter 9. Value-based Healthcare Service Market, By Deployment Mode

9.1 U.S. Value-based Healthcare Service Market Snapshot, By Deployment Mode

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 On-premise

9.1.1.2 Cloud-based

Chapter 10. Value-based Healthcare Service Market, By Application

10.1 U.S. Value-based Healthcare Service Market Snapshot, By Application

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Chronic Care

10.1.1.2 Acute Care

10.1.1.3 Preventive Care

Chapter 11. Value-based Healthcare Service Market, By End-User

11.1 U.S. Value-based Healthcare Service Market Snapshot, By End-User

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Hospitals & Providers

11.1.1.2 Payers & Insurance Companies

11.1.1.3 Patients

Chapter 12. Value-based Healthcare Service Market, By U.S.

12.1 Overview

12.2 U.S.

12.3 U.S. Value-based Healthcare Service Market Revenue, 2022-2034 ($Billion)

12.4 Market Size and Forecast

12.5 U.S. Market Segmental Analysis

Chapter 13. Competitive Landscape

13.1 Competitor Strategic Analysis

13.1.1 Top Player Positioning/Market Share Analysis

13.1.2 Top Winning Strategies, By Company, 2022-2024

13.1.3 Competitive Analysis By Revenue, 2022-2024

13.2 Recent Developments by the Market Contributors (2024)

Chapter 14. Company Profiles

14.1 Optum

14.1.1 Company Snapshot

14.1.2 Company and Business Overview

14.1.3 Financial KPIs

14.1.4 Product/Service Portfolio

14.1.5 Strategic Growth

14.1.6 U.S. Footprints

14.1.7 Recent Development

14.1.8 SWOT Analysis

14.2 CVS Health (Aetna & Oak Street Health)

14.3 Cigna

14.4 Anthem (Elevance Health)

14.5 Humana

14.6 Kaiser Permanente

14.7 Evolent Health

14.8 Lumeris

14.9 Health Care Service Corporation (HCSC)

14.10 Cerner Corporation (Oracle Health)

14.11 Epic Systems Corporation

14.12 Health Catalyst

14.13 Innovaccer

14.14 IBM Watson Health

14.15 Allscripts Healthcare Solutions