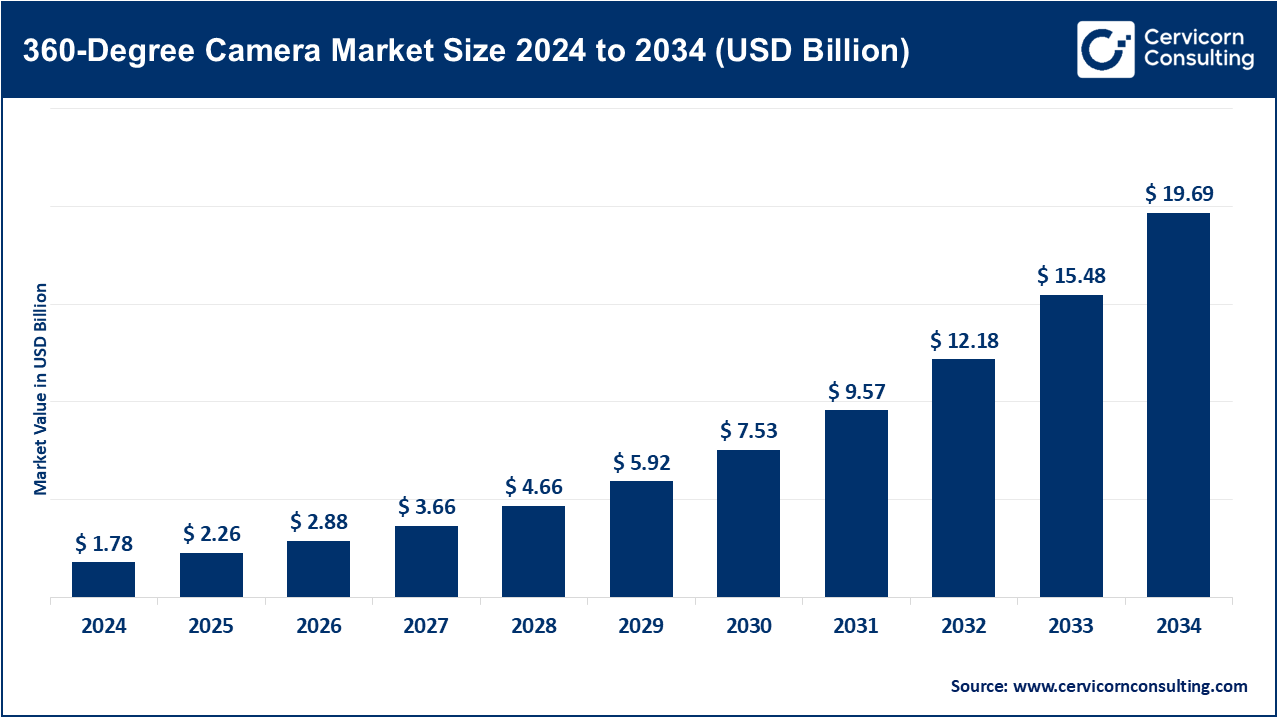

The global 360-degree camera market size was valued at USD 1.78 billion in 2024 and is anticipated to reach around USD 19.69 billion by 2034, growing at a compound annual growth rate (CAGR) of 27.17% over the forecast period from 2025 to 2034.

The introduction of virtual reality (VR) and augmented reality (AR) technology has immensely shaped the desire for more VR and AR immersive content. The production of VR headsets and AR devices requires a large amount of 360-degree content for full immersion, thus driving supply and demand. The current generation of 360-degree cameras is integral to the production of realistic training simulations, responsive virtual environments, and hyper-realistic promotional content. During 2024, the media and entertainment industry contributed more than 40% of total global revenue in this segment, a growth propelled by demand for immersive video, interactive gaming, and broadcast-quality live events. Meanwhile, consumer interest—stimulated by travel vlogging and social-media trends—resulted in an 18% year-over-year increase in unit shipments.

What is 360-degree camera?

A 360-degree camera is a device which has several lenses mounted on it and is capable of capturing the entire spherical view of the surrounding environment both horizontally and vertically. It enables the recording and streaming of content in an immersive format, captured in surroundings which can later be interacted with or viewed in virtual reality space. The 360-degree camera market is rapidly emerging with the development of the consumer electronics industry, increasing use of VR/AR technologies, and growing application in automotive safety systems. The media and entertainment industry, security and surveillance, real estate, tourism, and automotive sectors have all started to adopt these cameras. Their use from advanced driver-assistance systems (ADAS) and in public security is driven by the ability to eliminate blind spots and the growing need for public security.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 2.26 Billion |

| Expected Market Size in 2034 | USD 19.69 Billion |

| Projected CAGR 2025 to 2034 | 27.17% |

| Key Region | North America |

| Quickest Growing Area | Asia-Pacific |

| Key Segments | Type, Component, Resolution, Lens, Power Source, Distribution Channel, Camera Type, Application, Region |

| Key Companies | GoPro, Inc., Samsung Electronics Co., Ltd., Ricoh Company, Ltd., Insta360 (Shenzhen Arashi Vision Co., Ltd.), LG Electronics Inc., Nikon Corporation, Garmin Ltd., 360fly, Inc., Panono GmbH, Sony Corporation, Xiaomi Corporation, Bubl Technology Inc. |

Wired: Wired 360-degree cameras continue to hold bandwidth in the security, automotive, and indoor commercial sectors, with more than 55% of their use recorded in these areas because of steady energy and network access. In the automotive sector, fixed 360-degree systems facilitate automated parking, driver assistance, and blind-spot monitoring, which are now incorporated into 70% of high-end vehicles. A case in point, the Nissan Around View Monitor employs a fixed multi-camera system to enable a real-time 360-degree view for enhanced safety and maneuvering of the vehicle.

360-Degree Camera Market Revenue Share, By Type, 2024 (%)

| Type | Revenue Share, 2024 (%) |

| Wired | 39% |

| Wireless | 61% |

Wireless: The 360-degree camera’s applications spanning both consumer and industrial sectors have resulted in the wireless sector holding a record of more than 48% of shipments by 2024. The use of mobile phone connections, portability, and battery operation of the devices ensures seamless utilization. With the ability to access the internet via Wi-Fi, Bluetooth, and 4G or 5G, real-time streaming is possible. This functionality is utilized by 65% of social media influencers and VR studio operators. Recent improvements in edge computing and cloud storage have enabled real-time transmission of 8K camera footage with a reduction in latency of 40%. For instance, Insta360 ONE RS is praised for its modular design, real-time wireless streaming, and cloud backup, appealing to both amateurs and professionals.

Hardware: Camera lenses, image sensors, housing, battery, and mounting gear all fall under this category. Reductions in size for drones, helmets, and body worn devices are being made. In addition enhancements are also being made in miniaturization, synchronization of multi-lens, and image stabilization. Improvements in hardware also make enhancements in low-light performance, dynamic range, and field of view. Companies are also making advancements in increasing the range of protection which includes resistance to water, dust, and impacts which in turn makes it usable for military, and sports grade applications. However, the budget for devices is high which retails for high resolution (8K+), thermal, and infra-red vision cameras.

360-Degree Camera Market Revenue Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Hardware | 68% |

| Software | 32% |

Software: In the 360° camera ecosystem, software is of paramount importance. Applications for editing, stitching, and streaming have increased in value by 40% and, in 2024, will constitute more than a third of the value-added services. Features such as smart object tracking and scene detection powered by AI and machine learning, as well as autonomous recording capabilities, can reduce the time for editing by as much as 65%. Over 70% of enterprise clients utilize remote post-production updates for firmware updates, image smoothing, and interactive content enhancement. VR post-production remote workstations, virtual reality workstations, and collaborative editing software permit real-time multi-user workflows from different geographic locations. Integration with YouTube VR, Meta Horizon, and Matterport allows for publishing to millions. Matterport also allows cloud editing, which is used by real estate agents to edit and publish virtual tours to listings, thereby streamlining post-production work.

HD: The entry level tier is occupied by the versatile HD 360-degree cameras which are useful for casual users, educational institutions, and even virtual meetings. Priced competitively, they provide basic panoramic features and will drive widespread adoption. HD works for social media or indoors, but fails to provide adequate detail for outdoor security camera applications or serious professional-grade work.

360-Degree Camera Market Revenue Share, By Resolution, 2024 (%)

| Resolution | Revenue Share, 2024 (%) |

| HD | 38% |

| 4K and Above | 62% |

4k and Above: This segment is booming due to its appeal in cinematography, real estate, and industrial monitoring. With the advent of 4K, 6K, and even 8K resolution cameras, lifelike detail viewed through immersive VR and AR devices is becoming commonplace. High-end creators favor these segments for promotional material, tourism advertising, and broadcast-grade content. However, highly detailed outputs result in massive file sizes, demanding sophisticated systems for storing, editing, and playing back the video footage. Still, growing cloud capabilities and more efficient file compression techniques will increase adoption of these systems across industries.

Automotive: 360-degree cameras are some of the most rapidly advancing automotive technologies; they are now standard in over 70% of luxury and electric vehicles. Integrated into advanced driver assistance systems (ADAS), they utilize multiple wide-angle lenses to create bird’s-eye views that enhance parking aids, lane-change assistance systems, as well as collision avoidance systems. These systems mitigate factors that lead to driver error and assist in semi-autonomous driving functions by performing real-time mapping of the environment. For Instance, BMW's Surround View utilizes four 360° cameras to provide a stitched image overhead for advanced maneuvering assistance.

Media & Entertainment: The media & entertainment segment accounted for a highest revenue share in market. In film, gaming, sports, and live events, 360-degree cameras are creating new paradigms of content creation. Immersive storytelling is being powered by AR and VR platforms using this technology. Broadcasters and filmmakers can now position viewers in the heart of action which dramatically improves audience engagement. Social media ecosystem builders like Facebook and YouTube are promoting immersive 360-degree formats, which, in turn, is accelerating camera adoption for vlogs, documentaries, and virtual tours.

Security & Surveillance: The adoption of 360-degree cameras in public areas, offices, and smart cities enables for panoramic coverage which enhances blind spot reduction as well as AI-based threat detection and behavioral analysis. Governments are increasingly investing along with enterprises into smart surveillance systems that utilize 360-degree technology for better emergency response and public safety. This is also driven by higher urbanization and crime rates along with legal requirements for security solutions with greater coverage.

Others: 360-degree cameras are used in real estate for immersive property views, as well as in tourism, education, and healthcare sectors for remote inspections, virtual tours, and training. Hotels and museums offer virtual visits while educational institutions foster interactive learning experiences. Industries conduct equipment training, safety simulations, and remote diagnostics using such cameras. The wide-ranging applicability across domains has rendered this segment commercially diverse and rapidly evolving.

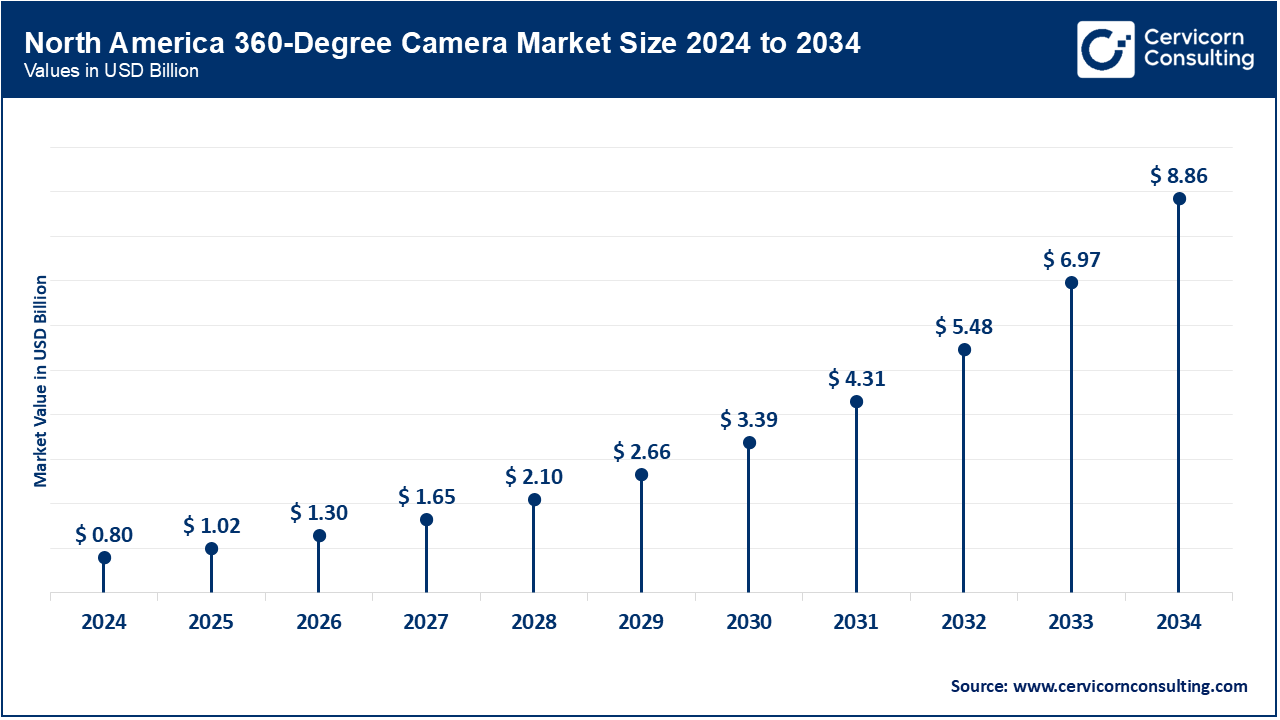

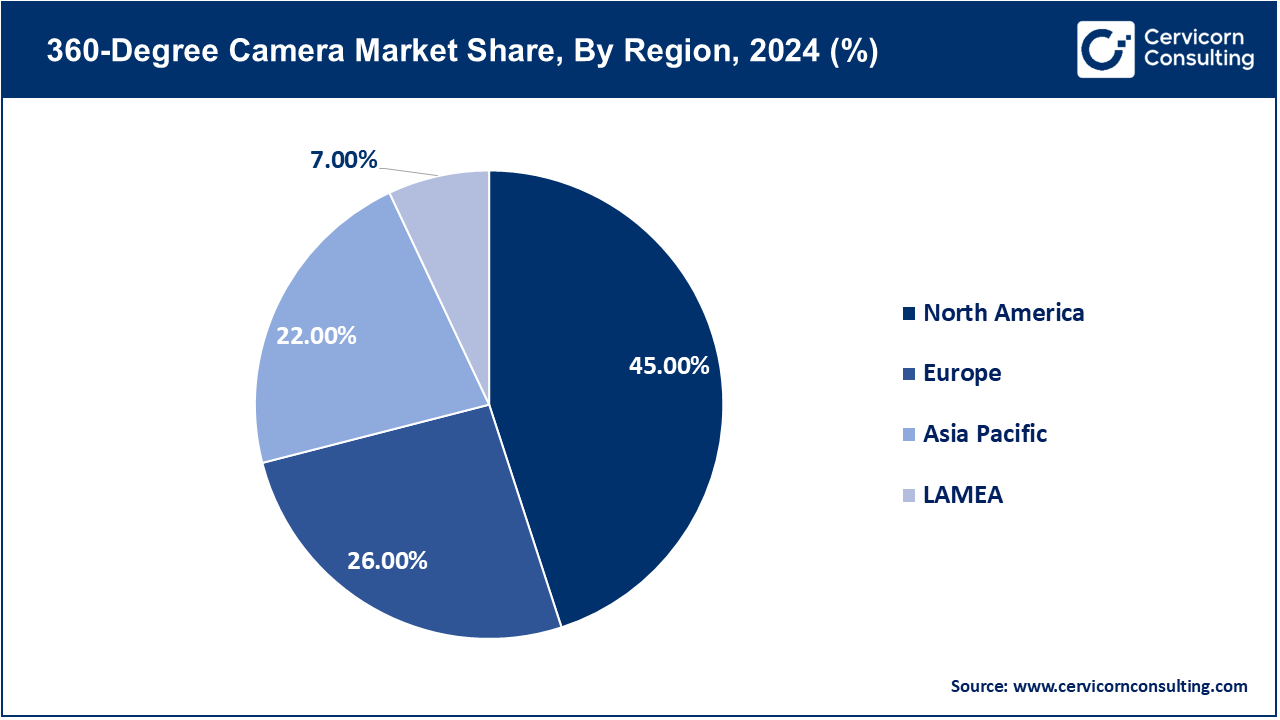

The North America region is set to dominate the market. The region is a fully matured and innovation-based hub for for 360-degree cameras. The impact of immersive technologies in entertainment, automotive, and surveillance industry has driven demand across consumer and commercial segments. Countries such as the US stand industry leaders of VR/AR market because of the technology conglomerates Meta (Facebook), Google, and Apple guaranteeing substantial investments in immersive ecosystems. The media and entertainment industry has adopted the uses of 360 dramatically, implementing them for sports broadcasting, sma/com events, samar velour. Facebook and YouTube 360° video streaming service offering encouragement for creators and influencers to immersive format adoption presently available in North America. There is more than 85% penetration of smartphones in this region, with average internet speeds above 150 Mbps allowing seamless viewing and sharing of 360° content. The leading heart among industries driving the market has been automotive because companies such as Tesla, GM, and Ford include multi-lens surround camera systems integrated into their vehicles as part of ADAS applications for driver and pedestrian safety. More than 65% of new high-end cars that will be bought in this region come with a facility related to having cameras all around the car. Ford’s Co-Pilot360, for instance, capitalizes on a topology of distributed cameras to refine parking assist and low-speed collision-avoidance algorithms.

The Asia-Pacific region is expected to witness strong growth over the forecast period. Greater household spending power, accelerated digital integration, and a robust local manufacturing base are the primary growth drivers. China, Japan, South Korea, and India stand at the forefront of both production and consumption, with Chinese factories accounting for over 60% of global output, a result of sophisticated electronics and sensor ecosystems. For example, Xiaomi’s Mi Sphere Camera offers high-resolution capture at a budget price, catering to both hobbyists and small enterprises in the region. These trends are especially popular among the youth. From the perspective of emerging opportunities, India stands out due to the expanding smartphone penetration, growing media sector, and heightened digitization in education, tourism, and real estate sectors. The investment in accessible 360-degree cameras is transforming content creation and allowing small businesses, educators, and realtors to produce interactive content without high production expenses.

Europe has a notable share in the global market, due to the emerging automotive innovation, security infrastructure, media, and industrial automation. Germany, UK, France, and Italy are the pillars of this expansion because of strict compliance with legislation, sophisticated manufacturing systems, and increased public imaging technology interest. The region is also well known for luxury and high-tech automotive brands like BMW, Mercedes, Audi, and Volvo, which have started the integration of 360-degree camera systems for parking assist, blind spot monitoring, and autonomous cruise control into new models. Europe remains active in the media and entertainment industry having a well-developed film industry as well as broadcasting and tourism which increasingly adopts videos with immersive angles.

Countries such as Brazil, Mexico, and Argentina are witnessing the advanced application of technology in public safety, education, and virtual real estate. Investments from the Government in urban security systems have resulted in using sophisticated 360-degree surveillance cameras in public transportation, parks, and other areas which experience high levels of crime and violence. Media companies and influencers from Brazil and Mexico are also adopting 360-degree formats for events like concerts and sports to increase viewer engagement online. In the Middle East, especially in UAE and Saudi Arabia, 360-degree cameras are extensively used in construction, smart city development, and retail surveillance. They are also investing heavily to boost tourism and luxury retail coupled with infrastructure growth. For example, Dubai and Riyadh are using 360-degree video technology in malls and airports and luxury real estate showrooms to deepen the immersion of shoppers and travelers. Africa is in the early stages of 360° camera adoption, with activity concentrated in South Africa, Kenya, and Nigeria. NGOs and international partners support projects in education, journalism, and wildlife conservation, where 360° footage is used for immersive storytelling and remote learning. In the current year, more than 40 percent of 360° deployment initiatives across the region have secured financing via competitive grants or philanthropic donations. A noteworthy case, Africam, leverages a network of distributed 360° cameras to stream live footage of African wildlife reserves, thereby granting geographically distributed audiences synchronous access to vulnerable ecosystems and the behavioral rhythms of species therein.

Market Segmentation

By Type

By Component

By Resolution

By Lens

By Power source

By Distribution Channel

By Camera Type

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of 360-Degree Camera

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Component Overview

2.2.2 By Type Overview

2.2.3 By Resolution Overview

2.2.4 By Lens Overview

2.2.5 By Power Source Overview

2.2.6 By Distribution Channel Overview

2.2.7 By Camera Type Overview

2.2.8 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Enterprise Adoption in Training and Simulation

4.1.1.2 Wearable and Miniature 360-Degree Cameras

4.1.2 Market Restraints

4.1.2.1 High Cost

4.1.2.2 Large Data Storage and Bandwidth Requirements

4.1.3 Market Challenges

4.1.3.1 Technical Complexity and Lack of Standardization

4.1.3.2 Privacy and Data Security Concerns

4.1.4 Market Opportunities

4.1.4.1 Expansion in Virtual Tourism and Real Estate Visualisation

4.1.4.2 Integration in Healthcare and Remote Education

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global 360-Degree Camera Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. 360-Degree Camera Market, By Type

6.1 Global 360-Degree Camera Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Wired

6.1.1.2 Wireless

Chapter 7. 360-Degree Camera Market, By Component

7.1 Global 360-Degree Camera Market Snapshot, By Component

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Hardware

7.1.1.2 Software

Chapter 8. 360-Degree Camera Market, By Resolution

8.1 Global 360-Degree Camera Market Snapshot, By Resolution

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 HD

8.1.1.2 4K and Above

Chapter 9. 360-Degree Camera Market, By Lens

9.1 Global 360-Degree Camera Market Snapshot, By Lens

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Single

9.1.1.2 Multiple

9.1.1.3 Dual

Chapter 10. 360-Degree Camera Market, By Power source

10.1 Global 360-Degree Camera Market Snapshot, By Power source

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Electric

10.1.1.2 Battery Operated

Chapter 11. 360-Degree Camera Market, By Distribution Channel

11.1 Global 360-Degree Camera Market Snapshot, By Distribution Channel

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Direct Sales

11.1.1.2 Indirect Sales

Chapter 12. 360-Degree Camera Market, By Camera Type

12.1 Global 360-Degree Camera Market Snapshot, By Camera Type

12.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

12.1.1.1 Single

12.1.1.2 Professional

Chapter 13. 360-Degree Camera Market, By Application

13.1 Global 360-Degree Camera Market Snapshot, By Application

13.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

13.1.1.1 Automotive

13.1.1.2 Media & Entertainment

13.1.1.3 Consumer

13.1.1.4 Travel & Tourism

13.1.1.5 Commercial

13.1.1.6 Military & Defense

13.1.1.7 Healthcare

13.1.1.8 Others

Chapter 14. 360-Degree Camera Market, By Region

14.1 Overview

14.2 360-Degree Camera Market Revenue Share, By Region 2024 (%)

14.3 Global 360-Degree Camera Market, By Region

14.3.1 Market Size and Forecast

14.4 North America

14.4.1 North America 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.4.2 Market Size and Forecast

14.4.3 North America 360-Degree Camera Market, By Country

14.4.4 U.S.

14.4.4.1 U.S. 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.4.4.2 Market Size and Forecast

14.4.4.3 U.S. Market Segmental Analysis

14.4.5 Canada

14.4.5.1 Canada 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.4.5.2 Market Size and Forecast

14.4.5.3 Canada Market Segmental Analysis

14.4.6 Mexico

14.4.6.1 Mexico 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.4.6.2 Market Size and Forecast

14.4.6.3 Mexico Market Segmental Analysis

14.5 Europe

14.5.1 Europe 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.5.2 Market Size and Forecast

14.5.3 Europe 360-Degree Camera Market, By Country

14.5.4 UK

14.5.4.1 UK 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.5.4.2 Market Size and Forecast

14.5.4.3 UKMarket Segmental Analysis

14.5.5 France

14.5.5.1 France 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.5.5.2 Market Size and Forecast

14.5.5.3 FranceMarket Segmental Analysis

14.5.6 Germany

14.5.6.1 Germany 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.5.6.2 Market Size and Forecast

14.5.6.3 GermanyMarket Segmental Analysis

14.5.7 Rest of Europe

14.5.7.1 Rest of Europe 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.5.7.2 Market Size and Forecast

14.5.7.3 Rest of EuropeMarket Segmental Analysis

14.6 Asia Pacific

14.6.1 Asia Pacific 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.6.2 Market Size and Forecast

14.6.3 Asia Pacific 360-Degree Camera Market, By Country

14.6.4 China

14.6.4.1 China 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.6.4.2 Market Size and Forecast

14.6.4.3 ChinaMarket Segmental Analysis

14.6.5 Japan

14.6.5.1 Japan 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.6.5.2 Market Size and Forecast

14.6.5.3 JapanMarket Segmental Analysis

14.6.6 India

14.6.6.1 India 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.6.6.2 Market Size and Forecast

14.6.6.3 IndiaMarket Segmental Analysis

14.6.7 Australia

14.6.7.1 Australia 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.6.7.2 Market Size and Forecast

14.6.7.3 AustraliaMarket Segmental Analysis

14.6.8 Rest of Asia Pacific

14.6.8.1 Rest of Asia Pacific 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.6.8.2 Market Size and Forecast

14.6.8.3 Rest of Asia PacificMarket Segmental Analysis

14.7 LAMEA

14.7.1 LAMEA 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.7.2 Market Size and Forecast

14.7.3 LAMEA 360-Degree Camera Market, By Country

14.7.4 GCC

14.7.4.1 GCC 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.7.4.2 Market Size and Forecast

14.7.4.3 GCCMarket Segmental Analysis

14.7.5 Africa

14.7.5.1 Africa 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.7.5.2 Market Size and Forecast

14.7.5.3 AfricaMarket Segmental Analysis

14.7.6 Brazil

14.7.6.1 Brazil 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.7.6.2 Market Size and Forecast

14.7.6.3 BrazilMarket Segmental Analysis

14.7.7 Rest of LAMEA

14.7.7.1 Rest of LAMEA 360-Degree Camera Market Revenue, 2022-2034 ($Billion)

14.7.7.2 Market Size and Forecast

14.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 15. Competitive Landscape

15.1 Competitor Strategic Analysis

15.1.1 Top Player Positioning/Market Share Analysis

15.1.2 Top Winning Strategies, By Company, 2022-2024

15.1.3 Competitive Analysis By Revenue, 2022-2024

15.2 Recent Developments by the Market Contributors (2024)

Chapter 16. Company Profiles

16.1 GoPro, Inc.

16.1.1 Company Snapshot

16.1.2 Company and Business Overview

16.1.3 Financial KPIs

16.1.4 Product/Service Portfolio

16.1.5 Strategic Growth

16.1.6 Global Footprints

16.1.7 Recent Development

16.1.8 SWOT Analysis

16.2 Samsung Electronics Co., Ltd.

16.3 Ricoh Company, Ltd.

16.4 Insta360

16.5 LG Electronics Inc.

16.6 Nikon Corporation

16.7 Garmin Ltd.

16.8 360fly, Inc.

16.9 Panono GmbH

16.10 Sony Corporation

16.11 Xiaomi Corporation

16.12 Bubl Technology Inc.