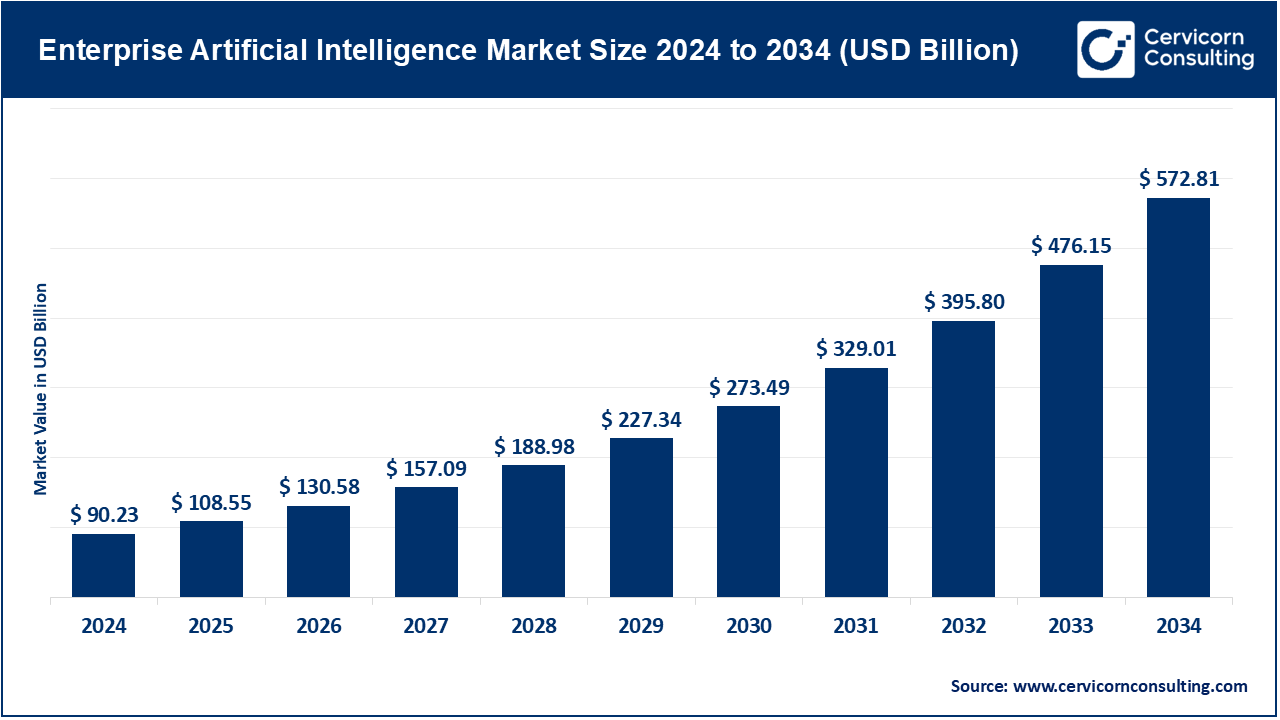

The global enterprise artificial intelligence market size was valued at USD 90.23 billion in 2024 and is expected to hit around USD 572.81 billion by 2034, growing at a compound annual growth rate (CAGR) of 20.3% over the forecast period from 2025 to 2034. The enterprise artificial intelligence market deals with the way companies embrace artificial intelligence technologies in their systems and processes, including the use of machine learning, natural language processing, computer vision, and robotic process automation. For instance, AI integration can enable companies to make better decisions, be more productive, or improve client interactions. AI liberates firms from performing routine-level tasks; in another way, it provides noteworthy insights from colossal data and optimizes processes within finance, human resources, customer service, manufacturing, and marketing departments. Given the fast exploitation of digital transformation, numerous organizations incorporate AI solutions into their cloud systems, ERP software, and CRM platforms to stay ahead of their competitors and earn flexibility.

This market is being bolstered majorly by a surge in data generation by the respective businesses and a pressing need for decision-making based on the data. Firms across various industrial domains are searching for AI to leverage big data for trend analysis, forecasting, and customized services. Growing demand exists for extra business processes to be automated to save on costs and improve in accuracy. Further advances in AI and computing power are making these solutions more scalable and accessible even for the SMEs apart from the big MNCs. Also, the rise in remote work and online services have spurred even more demand in AI-powered tools for workflow management, cybersecurity, and virtual collaboration.

The enterprise AI market is booming now as more organizations acknowledge the benefits of intelligent systems. Healthcare, finance, manufacturing, retail, and logistics industries are rapidly adopting AI to solve complex problems, create more streamlined supply chains, and improve customer experiences. The ecosystem includes various AI platforms, software tools, services, and infrastructure for enterprise use. With a focus on responsible and ethical AI deployments toward transparency and data privacy regulations, companies battle integration woes, data silos, and the scarcity of skilled resources; yet, with continued deepening on AI capabilities and digital infrastructure, the market continues to explode.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 108.55 Billion |

| Expected Market Size in 2034 | USD 572.81 Billion |

| Projected CAGR 2025 to 2034 | 20.3% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Deployment Mode, Technology, Organization Size, Application, Industry Vertical, Region |

| Key Companies | Alphabet Inc., Amazon Web Services, Inc., DataRobot, Inc., Hewlett Packard Enterprise Development LP, IBM Corporation, Intel Corporation, Microsoft Corporation, NVIDIA Corporation, Oracle Corporation, SAP SE, Wipro Limited |

Cloud-Based: The cloud-based has generated the highest revenue share. This agility, cost-effectiveness, and scalability have driven cloud adoption as the preferred deployment mode in the international enterprise AI market. With cloud-based AI solutions, companies can leverage robust computing power and AI tools with low infrastructure investment costs. As a result, these applications are deployed and updated swiftly such that the businesses remain in tune with the modern AI technology landscape. They also provide remote access and collaborative working environments across-language teams, an indispensable asset nowadays in enterprise global operations. Further specialization is provided by cloud providers like AWS, Microsoft Azure, and Google Cloud AI services, covering machine learning, NLP, and image recognition through simple APIs-a boon for even smaller firms to access top-tier AI facilities. Better data storage, security, and compliance offerings can only add to the enterprises' resolve to embrace the cloud. With hybrid cloud and multi-cloud becoming the means of choice for enterprises pursuing flexibility and innovation, the cloud-based AI route is here to stay.

Enterprise AI Market Revenue Share, By Deployment Mode, 2024 (%)

| Deployment Mode | Revenue Share, 2024 (%) |

| Cloud-Based | 56.80% |

| On-Premises | 43.20% |

On-Premises: The on-premises section serves enterprises who demand full control over their data, their infrastructure, and their AI operations at the very least. It tends to be preferred by organizations from highly regulated sectors--that is, sectors where data privacy and compliance are critical-such as finance, defence, or healthcare. On-premises deployment is more suited to custom installations: it lets one configure AI models and workflows for individual business needs. Changes in latency will also be kept to a minimum, an advantage in real-time AI arenas like manufacturing automation or fraud detection. Capital expenditures and maintenance costs tend to be higher with this model, which includes investment in hardware, software, and IT personnel. On-premises AI is slower to adopt than the cloud; nevertheless, it remains important for organizations concerned with security and internal governance. In fact, a certain subset of enterprises even considers this as an alternative for avoiding vendor lock-in or simply because their AI workloads need to be kept operational in environments lacking any significant form of reliable Internet. The segment continues to evolve with edge computing and private cloud innovations.

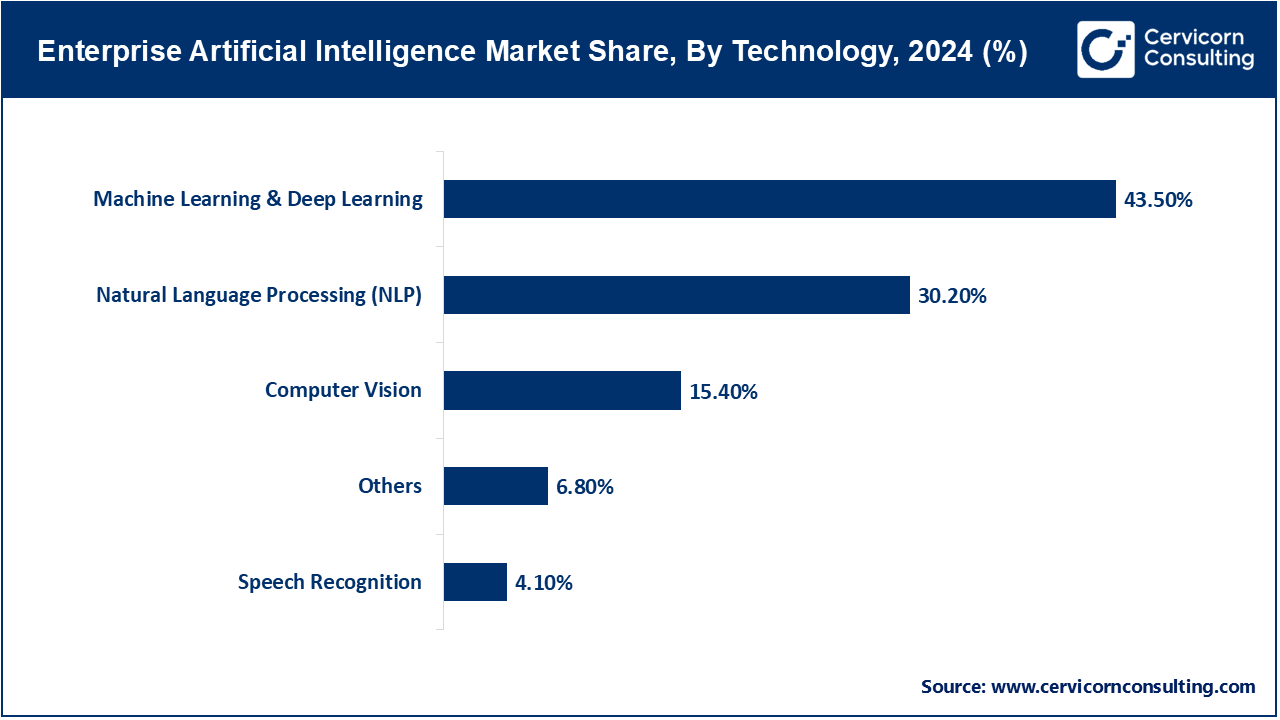

Machine Learning & Deep Learning: The machine learning & deep learning segment accounted for the largest share of revenue. ML and DL are the prevailing powers that drive and reshape enterprise AI implementations. ML provides a system with learning from data and improvement in performing a given function. DL, being a subtype of ML, uses neural networks to mimic brain-like processing to solve complicated issues. Enterprises in sectors such as healthcare, finance, and retail are utilizing ML/DL for predictive analytics, fraud detection, demand forecasting, image recognition, and decision-making without human intervention. The large datasets, enhanced computing power, and AI platforms such as the TensorFlow or Porch have markedly sped up acceptability. Convolutional- and recurrent-type neural networks-as available under the banner of DL-are mainly useful for image, speech, and natural language understanding. They also allow for intelligent automation, allowing for specific savings on operational costs while enhancing such aspects as customer experience quality. ML and DL, as AI-driven innovation approaches, represent two fundamental means for competitive advantage and digital transformation.

Natural Language Processing (NLP): The domain of NLP is shaking up enterprise AI, enabling machines to understand, interpret, and generate human language. From chatbot services to virtual assistants, from sentiment analysis to translation services and automated document processing, NLP is the key. Enterprises leverage NLP-based services to improve customer service, vacate possible communication workflows, and extract pertinent idea from text data in an unstructured form including emails, reports, and social media. A few applications of this kind of NLP lie in natural language querying of CRM, help desk, and HR platforms. This, in turn, results in ease and enhancement of user engagement. The evolved transformer-based models such as BERT and GPT have given one-shot NLP an edge in contextual understanding and hence have made the system more accurate and versatile. This means that companies are using NLP for compliance monitoring, content summarization, and multilingual assistance. Communication on the digital level has practically taken over day-to-day real-world operations, and NLP is there to come big in helping machines communicate with users in a natural and more effective manner.

Computer Vision: Computer vision technology allows machines to "see," which means analysing visual data from the world, such as images and videos. In a corporate environment, it extends to facial recognition, grading and inspection, medical imaging, retail shelf monitoring, security surveillance, and augmented reality applications. The main emphasis of Computer Vision is to enhance productivity, accuracy, and safety by automating meant-for-human visual tasks. For example, it may be used in a manufacturing setting to apprehend defects on the assembly lines, while in retail it observes shelf inventory and customer behaviour. Medicine employs it to diagnose using medical scans; the technology is fostered by deep learning and convolutional neural networks (CNNs) that particularly have a knack for identifying patterns and features in images. Such adapted technological trends have given rise to edge infrastructure and enhanced camera hardware. Also, industries are coming up with a new integration of computer vision with IoT and robotics for real-time decision-making. As visual data increasingly becomes the face of enterprise operations, computer vision will continue growing its enterprise use cases.

Speech Recognition: Speech recognition technology converts speech into text and processes voice commands so that human-computer interaction can be more natural and accessible. Within the enterprise, we find these systems commonly used for voice-activated virtual assistants, call centre automation, real-time transcription services, and voice-based data entry systems. Speech recognition is assisting customers, promoting accessibility, and creating worker productivity, especially in hands-free workplaces such as healthcare and logistics. Initially, such transcription services ensure adherence for quality checks and for legal purposes. With improved speech recognition from deep learning and massive voice datasets, as well as the natural-language-understanding system in situational response, the overall implementation has been enhanced. Thanks to AI cloud services that keep things cheap like Google Speech-to-Text and AWS Transcribe, such technology becomes the reach of all companies of all sizes. Slowly yet steadily, speech recognition is emerging as the backbone for enterprise digital transformation with voice interfaces and multilingual support.

Security and Risk Management: Security and risk management predominantly apply AI for proactive threat detection, prevention, and response. Machine learning algorithms sift through enormous volumes of data to detect anomalous patterns, potential breaches, fraud, and incidents in real time. AI systems and mechanisms for identity verification, network monitoring, and behaviour analysis have thus become indispensable in safeguarding cybersecurity measures. Risk scoring and predicative analytics through Artificial Intelligence (AI) are important elements in maintaining compliance and pre-empting fraud in financial services and banking. Besides, the regulatory reporting and threat intelligence are achieved faster and easier through AI with minimal human involvement and error. With the increasing sophistication of cyber-attacks, AI has received limelight for establishments that seek speedy, scalable, and adaptive defence. Building exposures are on the rise, and thus institutions are venturing into AI technology to secure data and risk and keep their day-to-day operations going. The paradigm shift caused by zero-trust-office-security-based model and real-time remediation have further exasperated AI penetrations into enterprise risk management.

Marketing and Advertising Management: Artificial Intelligence (AI) has been placed at a transformative seat in marketing and advertising management with the realization of hyper-personalized, data-driven campaigns. AI algorithms are used to interpret customer behaviour, preferences, and past data to segment the audiences, predict their buying patterns, and present them targeted content on any platform. Natural Language Processing and image recognition are used for sentiment analysis and brand monitoring to provide marketers with a pulse of the customer's perception in real time. It is Agile and with the integration of AI, Automated Ad Buying and Placement using Programmatic Ad Platforms optimize toward assured ROI. Moreover, AI-powered mechanisms such as chatbots and recommendation engines keep the users engaged and converted. Marketers apply predictive analytics to forecast trends and adapt their strategies. Given the stage of digital marketing and rise of omnichannel engagement, enterprises are increasingly using AI for purposes ranging from optimization of ad spends to improvements in campaign efficiencies and obtaining their strategic competitive advantage. In the presence of Artificial Intelligence, the huge power of tracking and analysing every bit of data generated in real-time unleashes businesses to not freeze time with decisions made on marketing strategies, hence being considered an indispensable entity in the evolution of modern advertising.

Customer Support and Experience: The systems of customer service and customer experience are altered because AI ensures the availability of services round the clock, fast-track query resolutions, and render personal experiences to clientele. An AI chatbot or assistant with natural language understanding could respond to many kinds of customer questions without needing any intervention from human beings, thus increasing response time and customer satisfaction. Past interactions analysed by machine learning models might lead to the recommendation of solutions, automation of ticket routing, and provision of predictive insights regarding customer behaviour. Companies can also leverage AI to forecast the requirements of customers, identify churn risks, and communicate accordingly. Sentiment analysis tracks emotional responses while a brand sharpens its support strategies. Since AI in an AI-enabled CRM provides a consistent experience aware of context along channels, customer demands, and more use AI to proactively support with scalability and cost-effectiveness. On AI's behalf, Loyalty, retention, and satisfaction have all been increased by gratifying the seamless, customized journeys that cater to the ever-changing consumer needs.

Human Resource and Recruitment: By automating resume screening, candidate matching, and interview scheduling, AI immensely facilitates the world of recruitment and HR. Other applications will review the job descriptions and talent profiles against each other to establish the best fit, minimizing time-to-hire. These AI applications feature Natural Language Processing to parse unstructured data from resumes and social media, and few others use machine learning models that predict a candidate's success from past hiring data. AI chatbots can resolve candidate queries and keep candidates engaged during the recruitment process. Further, AI works toward retention by considering performance data, engagement survey data, and attrition patterns for workforce planning insights. In right scenarios, reduction of bias through AI can encourage diversity and inclusion in hiring decisions. AI in talent management works in skill gap analysis, personalized training recommendations, and performance evaluations. As companies are facing an uphill task about attracting and retaining top talent, AI therefore becomes essential in helping HR become more data-driven, efficient, and focused on strategic priorities.

Business Intelligence and Analytics: In the intersection of artificial intelligence and business intelligence, data can now be processed in real-time, predictive modelling can take place, and insights can be automated. AI is thus employed by businesses to discern patterns, trends, and anomalies in vast pools of data-so as to foster faster and better decision-making. AI-driven BI is a hybrid of various machine-learning algorithms that can predict business performances of interest, identify market opportunities, and aid in strategy formulation. Through a user-friendly application of language, Natural Language Processing allows users to probe into data from across departments, thereby offering democratized access to insights. Today, the focus is on being data-centric, so organizations use AI to monitor their KPIs, customer behaviour, and operational efficiency. Automatic generation of dashboards and reports exhibits agility and late dependency on manual set methods of analysis. AI-powered analytical tools provide the armed bases for innovation and competitive differentiation-from sales, finance, supply chain to product development. Transforming intricate and complicated data into easy-to-understand, actionable intelligence is posed to be among the most important enterprise AI applications today.

Process Automation: An AI remaining this robotic process automation system, intelligent automation, which automates repetitive and rule-based tasks using smart self-learning systems. These AI-ready bots function very fast and accurate in invoice processing, data entry, and compliance-checking activities in finance, HR, customer service, and supply chain operations. However, unlike traditional robotic process automation, these AI-enabled systems can analyse unstructured data, recognize patterns, and draw contextual conclusions. The workflow with these ML models improves as time passes, helping enrich efficiency while reducing operational expenditure. It duly acts as a key enabler putting together different enterprise systems in an even well-coordinated mode of operations. On the other hand, in manufacturing, logistics, and supply chain management industries, AI undertakes assignments for predictive maintenance, inventory control, and quality assurance. Process automation of AI helps make the operation more efficient and agile in scaling without a proportional increase in labour force or costs. This switch allows resources to be diverted to other high-value, strategic functions, while AI takes care of routine operations.

Large Enterprises: The large enterprises segment has captured highest revenue share. Enterprises having the financial backing and diverse geographical presence have gained a lead over other competitors in global artificial intelligence enterprise markets. These immense corporations are investing heavily in cutting-edge technologies. These technologies include natural language processing, predictive analytics, and machine learning, to name a few fields. The technology is used for helping the customer experience, supply chain optimization, fraud detection, and automation of business processes. With a wider customer base and hugely greater data sets, large enterprises stand to gain far from AI-enabled insights and automation. The enterprises have in-house technical expertise with an R&D department to ideally smooth the deployment of AI with existing systems and processes to improve operational efficiency and gain a competitive edge. Large corporations are the trendsetters in use and innovations. Strategic partnerships with AI vendors and collaborative research with research institutes and continuous efforts in digital transformation only serve to further enhance and consolidate the large corporations' market position.

Enterprise AI Market Revenue Share, By Organization Size, 2024 (%)

| Organization Size | Revenue Share, 2024 (%) |

| Large Enterprises | 60.30% |

| Small & Medium Enterprises (SMEs) | 39.70% |

Small & Medium Enterprises (SMEs): SMEs are still a smaller chunk in the enterprise AI market, though their rate of adoption is speeding up. AI helps such small businesses to automate tasks, interact with customers, and make decisions based on data without requiring large numbers of workers. SMEs are therefore now using the cloud-based solutions provided at a low cost, which in turn offers scalability and very little upfront investment. Among some of the bigger names in the private sector, artificial intelligence is getting into them through limited budgets, businesses use chatbots for customer service, recommendation engines, AI-based marketing, and intelligent CRMs. Roughly talking, third-party platforms and democratized AI are easing the adoption challenge for SMEs that are strapped for cash and lack technical expertise. The more competition, the more this SME-side view of AI as a strategic enabler to improve productivity, reduce operational costs, and gain technological advantage over other competitors. Governments, industry bodies, and other organizations are supporting SMEs seeking digital adoption through funding and training initiatives. Hence, despite lagging large enterprises in market share, SMEs growing interest in AI-driven innovation is expected to significantly enhance market growth in the years to come.

IT & Telecommunications: The IT & telecommunications industry is the biggest consumer of enterprise AI, due to the nature of its infrastructure and need for automation. AI sees extensive application in network management, fault prediction, bandwidth optimization, and virtual assistants for customer support. Telecom operators utilize ML to foresee service disruptions, tailor offerings, and detect fraudulent activities. In the 5G networks' epoch, AI will be a heavy hitter in resource allocation and service quality maintenance, meanwhile cloud AI platforms allow telecom providers to scale efficiently. Coupled with edge computing and IoT, AI paves a further way for real-time decision processes, placing the sector as one of the most continuous innovators in AI applications. Apart from this, the high requirement for fast data processing, analytics, and cybersecurity solutions in the sector also sustains continuous investments in AI. Voice-based AI systems, chatbots, and natural language processing systems also enhance customer experience, keeping human intervention to the bare minimum. Going digital on the one hand and intelligent on the other make IT & telecom a dominant player in enterprise AI adoption.

Banking, Financial Services, and Insurance (BFSI): These sectors ensure that operational efficiency and risk management do exist due to AI. AI deals in fraud detection, credit scoring, algorithmic trading, robot-advisory services, as well as customer-service-based chatbots. Machine learning models are implemented to flag suspicious transactions about a more enhanced fraud detection mechanism and yet allowing a minimal number of false positives. In insurance, AI automates claims processing, underwriting, and risk evaluation. Financial institutions are applying AI-powered predictive analytics for investment decisions and customer segmentation. Scheduling compliance management and regulation reporting are another area in which AI works by analysing large volumes of data real time. AI is changing the face of personalized banking services based on insights from user behaviour. AI adoption becomes a key enabler for reduction in operational costs and improved turnaround time of services. With cybersecurity as one of the frontrunners, the sector also leverages AI to pinpoint potential threats and shield sensitive financial information. Increasing digitization and the growing demand for personalized, real-time financial solutions make BFSI one of the biggest contributors to enterprise AI deployment.

Healthcare and Life Sciences: Whenever AI intervenes in the healthcare sector, it stands liable to improving areas such as diagnosis, care, drug discovery, and operational efficiency. For diagnosis, AI algorithms help interpret medical images such as X-rays and MRIs with near-perfect accuracy, thus accelerating disease detection at an early stage. AI treatments create treatment plans tailored to an individual by analysing genetic data and patient history, thus leading to better outcomes in treatment. AI in drug discovery helps in the fast-tracking of the discovery of drugs by identifying potential compounds and predicting the efficacy thereof, hence saving huge amounts of money and time in R&D. In enhancing patient engagement, virtual assistants and chatbots provide support all day long. Hospitals also use AI for administrative tasks machining the duties of scheduling patients, billing, and managing electronic health records. Predictive analytics is used in anticipating patient admissions and allocation of resources. AI, combined with wearable devices, helps monitor chronic ailments in real time. Its continuation, thus, remains imperative as the industry turns more to precision medicine and care at a distance.

Retail and E-commerce: AI is the technology behind the revolution in retail and e-Commerce, giving a whole new meaning to the analysis of customer behaviour, inventory control, and customization of shopping experiences. An AI can do dynamic pricing, recommendation engine marketing based on browsing and purchasing history. Retailers check customer sentiment via reviews and social media using AI so they can adjust their offerings while working on customer brands. The chatbot and the virtual assistant based on AI are an excellent option to provide superior customer services with real-time support. In inventory and supply chain management, AI anticipates demand, reduces stock-outs, and enhances logistics. Technologies such as image recognition and natural language processing make online search easier. Also, fraud detection during online transactions would be an AI application to make these more secure. Visual AI provides the possibility of virtual try-on and augmented reality shopping. With rising customer expectations and online competition, AI is critical for enabling retailers to provide fast, convenient, and personalized services.

Automotive and Transportation: The AI in the automotive and transport sector acts toward vehicle safety, autonomy, and operation. In automotive, the advanced driver-assistance systems (ADAS), such as lane detection, collision avoidance, and adaptive cruise control, are powered by AI. It is majorly involved in autonomous vehicles developing and allows them to make decisions in real time based on data from their sensors, cameras, and LiDAR systems. Predictive maintenance is the use of AI to evaluate vehicle health for the prevention of being broken down. On the transport and logistics side, it concerns route planning, fuel usage, and delivery scheduling for fleet management purposes with a goal to reduce operational costs. Enhancing traffic prediction and MaaS platforms for ideal urban transport efficiency stands as the driver of AI. Automakers use AI for defect identification and the automatic assembly process in their smart manufacturing. AI is used for personalizing in-car experiences through voice assistants and driver behaviour analysis. With the rise of demand for connected vehicles, EVs, and smart mobility solutions, AI will most certainly remain at the very core of innovation in this industry in matters relating to safety, performance, and user convenience.

Others: Generally, this sector includes various industries such as education, energy, manufacturing, and media, with the common understanding being AI applications tackling specific problems in an industry. In education, AI enables adaptive learning, automatic grading, and the provision of content to an individual student according to his needs to help educational performance. In the energy sector, AI is employed for predictive maintenance, smart grid control, and load management optimization. In manufacturing, AI promotes Industry 4.0 by supporting robotics, quality control, and predictive analysis to engineer less downtime. Media and entertainment use AI for content recommendation, editing automation, and audience engagement analyses. City planners use AI to allocate resources, plan cities, and model policy. Agriculture, also an emerging area, is provided icing by AI for crop monitoring, pest control, and precision farming. This collection of different uses establishes AI as one of the most versatile transformation technologies possible across verticals. While the respective industries undergo digital transformation, the adoption of AI in these "other" sectors is steadily increasing, thereby also emerging as considerable contributors toward the growth of enterprise artificial intelligence.

The enterprise AI market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

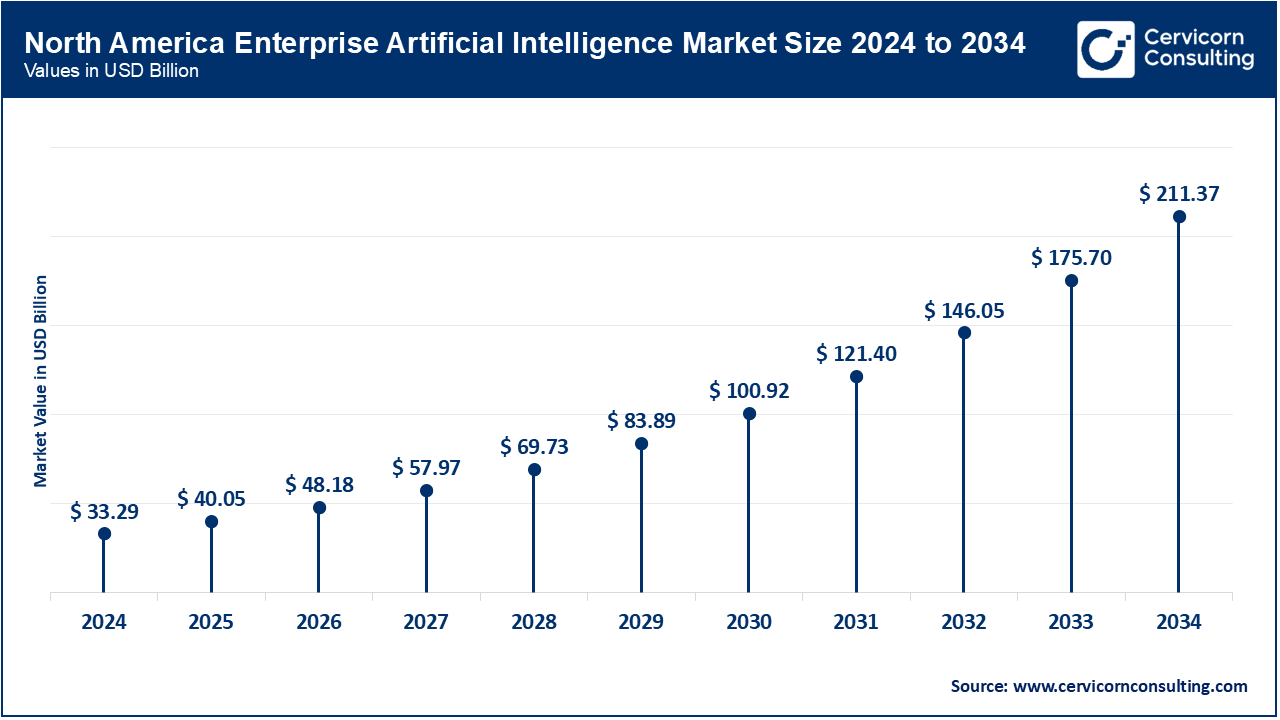

North America dominates the global market because of its mature technology infrastructure, a very strong cloud ecosystem, and high levels of AI adoption across all industries. In the region, the AI giants Google, Microsoft, IBM, and Amazon actively carry out R&D, product development, and enterprise solution development. Enterprises in the U.S. adopt AI for automation, predictive analytics, customer relations, and cybersecurity. Governmental support for AI development programs, very heavy flows of venture capital, and academic synergy keep the system churning. In other words, the greatest adoption of cloud-based AI deployment has led to rapid scaling. Healthcare, BFSI, retail, and manufacturing are some of the key sectors in high adoption. The availability of skilled workforce and early adopters of emerging technologies is further placed for their governance. While the other regions are catching up rapidly, continuous investment with policy support will maintain North America's lead.

Europe holds a significant share in the market, induced by regulatory backing, digital transformation of industrial sectors, and investment in ethical AI development. Countries such as Germany, United Kingdom, and France are at the forefront concentrating on industrial automation, smart manufacturing, and digitization for the public sector. Responsible and transparent AI is at the core of the AI strategy of the European Commission, requiring the implementation of AI tools by companies in harmony with data privacy legislations such as GDPR. Finally, the adoption of AI is gaining traction as an efficiency tool for its ability to make decisions in automotive, finance, and health applications. It may not have the tech giants North America boasts, but European AI holds strong through innovation hubs, academic research institutions, and cross-border collaborations. Cloud AI deployment remains an ever-growing force, while data sovereignty concerns let on-prem solutions also shine. Europe sees slow but steady growth, carefully cultivating its reputational standing, wherein regulations promote ethical usage of AI.

Being propelled by rapid digital transformation, wide-scale internet access, and increasing amounts of investments in AI, the Asia-Pacific market is considered one of the fastest-growing enterprise AI markets. AI activities span across countries such as China, India, Japan, and South Korea and domains such as manufacturing, retail, telecom, and finance. China is the biggest player in investing in AI infrastructure and innovation through a government-led plan along with top-tier private companies: Alibaba, Baidu, and Tencent. India is fast becoming a hotspot for AI because of its large IT workforce and strong SaaS ecosystem. Enterprises in the region consider AI adoption for customer experience enhancement, operational optimization, and establishing data-driven strategies. Cloud adoption is on the rise as well, supported by local cloud providers and global cloud service providers. While Asia-Pacific still does an inch less in terms of overall market share when compared to North America, considering its high growth rate and government backing, it surely can pose serious competition within the coming years.

Enterprise AI Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 36.90% |

| Europe | 24.40% |

| Asia-Pacific | 26.10% |

| LAMEA | 12.60% |

LAMEA is a smaller and emerging segment of the global marketplace. Being young in adoption, the growth is due to government modernization initiatives, increased penetration of smartphones, and slow development of cloud infrastructure. In Latin America, Brazil and Mexico are exploring AI in banking, public administration, and retail. The Middle East, the UAE in particular, and Saudi Arabia, are busily engaged in the development and implementation of national AI strategies to diversify their economies and to improve their public services. Africa is slowly maturing into the acceptance of AI in agriculture, health, and education sectors. Lack of infrastructure, skills, and finances act as an impediment to rapid adoption of technologies. Partnerships with international tech companies and investments in digital skills are closing the divide. The region currently stands as the least contributing to global AI revenues with LAMEA potentials remaining untapped, while increasing attention on smart governance and digital economy initiatives present long-term development possibilities.

Market Segmentation

By Deployment Mode

By Technology

By Organization Size

By Application

By Industry Vertical

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Enterprise Artificial Intelligence

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Deployment Mode Overview

2.2.2 By Technology Overview

2.2.3 By Organization Size Overview

2.2.4 By Application Overview

2.2.5 By Industry Vertical Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Integration of AI with Internet of Things (IoT) and Edge Computing

4.1.1.2 Advancements in NLP and Computer Vision Technologies

4.1.2 Market Restraints

4.1.2.1 High Implementation and Operational Costs

4.1.2.2 Data Privacy and Security Concerns

4.1.2.3 Shortage of Skilled AI Professionals

4.1.3 Market Challenges

4.1.3.1 Integration Complexities with Legacy Systems

4.1.3.2 Lack of Standardization and Interoperability

4.1.3.3 Ethical and Regulatory Uncertainty

4.1.4 Market Opportunities

4.1.4.1 Expansion of AI-as-a-Service (AIaaS) for SMEs

4.1.4.2 Integration of AI with IoT and Edge Computing in Industrial Applications

4.1.4.3 Rising Demand for Personalized Customer Experiences through AI-driven Insights

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Enterprise Artificial Intelligence Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Enterprise Artificial Intelligence Market, By Deployment Mode

6.1 Global Enterprise Artificial Intelligence Market Snapshot, By Deployment Mode

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Cloud-Based

6.1.1.2 On-Premises

Chapter 7. Enterprise Artificial Intelligence Market, By Technology

7.1 Global Enterprise Artificial Intelligence Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Machine Learning & Deep Learning

7.1.1.2 Natural Language Processing (NLP)

7.1.1.3 Computer Vision

7.1.1.4 Speech Recognition

7.1.1.5 Others

Chapter 8. Enterprise Artificial Intelligence Market, By Organization Size

8.1 Global Enterprise Artificial Intelligence Market Snapshot, By Organization Size

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Large Enterprises

8.1.1.2 Small & Medium Enterprises (SMEs)

Chapter 9. Enterprise Artificial Intelligence Market, By Application

9.1 Global Enterprise Artificial Intelligence Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Security and Risk Management

9.1.1.2 Marketing and Advertising Management

9.1.1.3 Customer Support and Experience

9.1.1.4 Human Resource and Recruitment

9.1.1.5 Business Intelligence and Analytics

9.1.1.6 Process Automation

Chapter 10. Enterprise Artificial Intelligence Market, By Industry Vertical

10.1 Global Enterprise Artificial Intelligence Market Snapshot, By Industry Vertical

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 IT & Telecommunications

10.1.1.2 BFSI

10.1.1.3 Healthcare and Life Sciences

10.1.1.4 Retail and E-commerce

10.1.1.5 Automotive and Transportation

10.1.1.6 Media & Advertising

10.1.1.7 Others

Chapter 11. Enterprise Artificial Intelligence Market, By Region

11.1 Overview

11.2 Enterprise Artificial Intelligence Market Revenue Share, By Region 2024 (%)

11.3 Global Enterprise Artificial Intelligence Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Enterprise Artificial Intelligence Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Enterprise Artificial Intelligence Market, By Country

11.5.4 UK

11.5.4.1 UK Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Enterprise Artificial Intelligence Market, By Country

11.6.4 China

11.6.4.1 China Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Enterprise Artificial Intelligence Market, By Country

11.7.4 GCC

11.7.4.1 GCC Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Enterprise Artificial Intelligence Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Alphabet Inc.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Amazon Web Services, Inc.

13.3 C3.ai, Inc.

13.4 DataRobot, Inc.

13.5 Hewlett Packard Enterprise Development LP

13.6 IBM Corporation

13.7 Intel Corporation

13.8 Microsoft Corporation

13.9 NVIDIA Corporation

13.10 Oracle Corporation

13.11 SAP SE

13.12 Wipro Limited