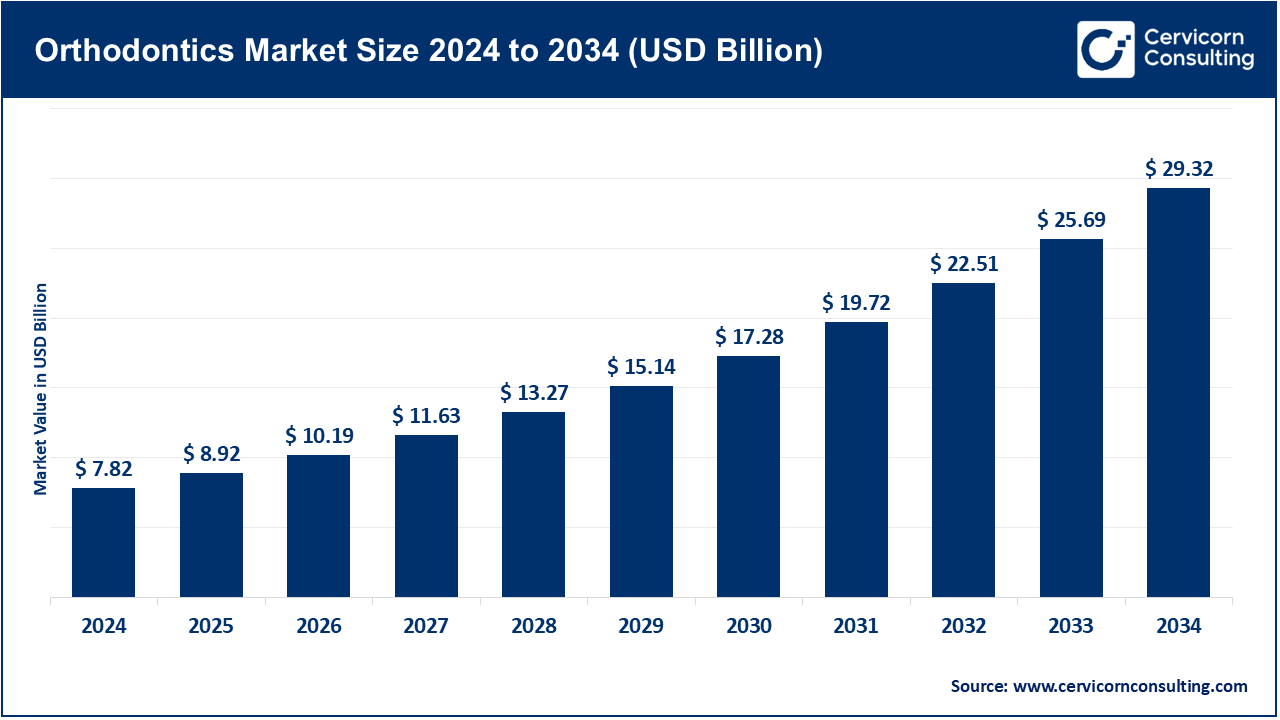

The global orthodontics market size was estimated at USD 7.82 billion in 2024 and is expected to surpass around USD 29.32 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.12% over the forecast period from 2025 to 2034. The global orthodontics market is expected to grow significantly owing to rising demand for aesthetic dental treatments, increasing prevalence of malocclusions, and technological advancements in clear aligners and 3D imaging. Growing awareness of oral health, rising disposable income, and expanding access to orthodontic care in emerging markets further support market expansion.

The orthodontics market is gaining traction owing to rising awareness of dental aesthetics, increasing disposable incomes, and growing demand for minimally invasive treatments. Clear aligners, lingual braces, and 3D-printed orthodontic devices offer enhanced comfort, precision, and visual appeal, making them popular among both teens and adults. Technological advancements in AI-driven treatment planning, digital impressions, and teledentistry are transforming patient care and accessibility. Supportive insurance coverage, increasing dental tourism, and professional training initiatives are accelerating adoption. The major players in the industry are investing in R&D, expanding global reach, and forming strategic collaborations. Consequently, Orthodontics is poised to redefine modern dentistry with innovative, patient-centric, and tech-driven solutions.

Health Benefits of Orthodontic Treatment

| Type | Share (%) |

| Boosted Mental Health | 15% |

| Enhanced Speech and Breathing | 10% |

| Lower Jaw Pain & TMJ Issues | 15% |

| Better Digestive Health | 15% |

| Reduced Risk of Gum Disease | 20% |

| Improved Oral Hygiene | 25% |

Instruments: The instruments segment holds leading position in market. For the placement, adjustment, and removal of appliances, probes, ligature cutters, wire benders, and even pliers are used by orthodontic practices. Due to the significant orthodontic instruments’ concern for accuracy, they are crafted from strong materials and dependable as well as tempered. Pliers that further reduction of hand strain came out in May 2024 and were lightweight and ergonomic, with over 300 clinics reporting benefits. Increased comfort during prolonged procedures has been noted alongside sharpened comfort. Instead of focusing on simple tasks that require instruments designed for repetitive use, clinics are now focusing on task demands that make use of autoclavable instruments. Progress in material and design is still persistence to driving innovation in this area.

Orthodontics Market Revenue Share, By Product, 2024 (%)

| Product | Revenue Share, 2024 (%) |

| Instruments | 60.40% |

| Supplies | 39.60% |

Supplies: Impression materials, brackets and arch wires, elastics, bonding agents and other items of similar nature fall under orthodontic supplies. They form the basis of daily operations and therefore, need to be stocked often. In November 2022, a leading European dental firm launched an eco-friendly line of self-ligating brackets using recyclable polymers, which received strong interest from sustainability-focused clinics. The development supports the rising demand for greener clinical operations. Supplies form a recurring revenue stream and contribute heavily to profit margins. Product innovation and sustainability are emerging focus areas.

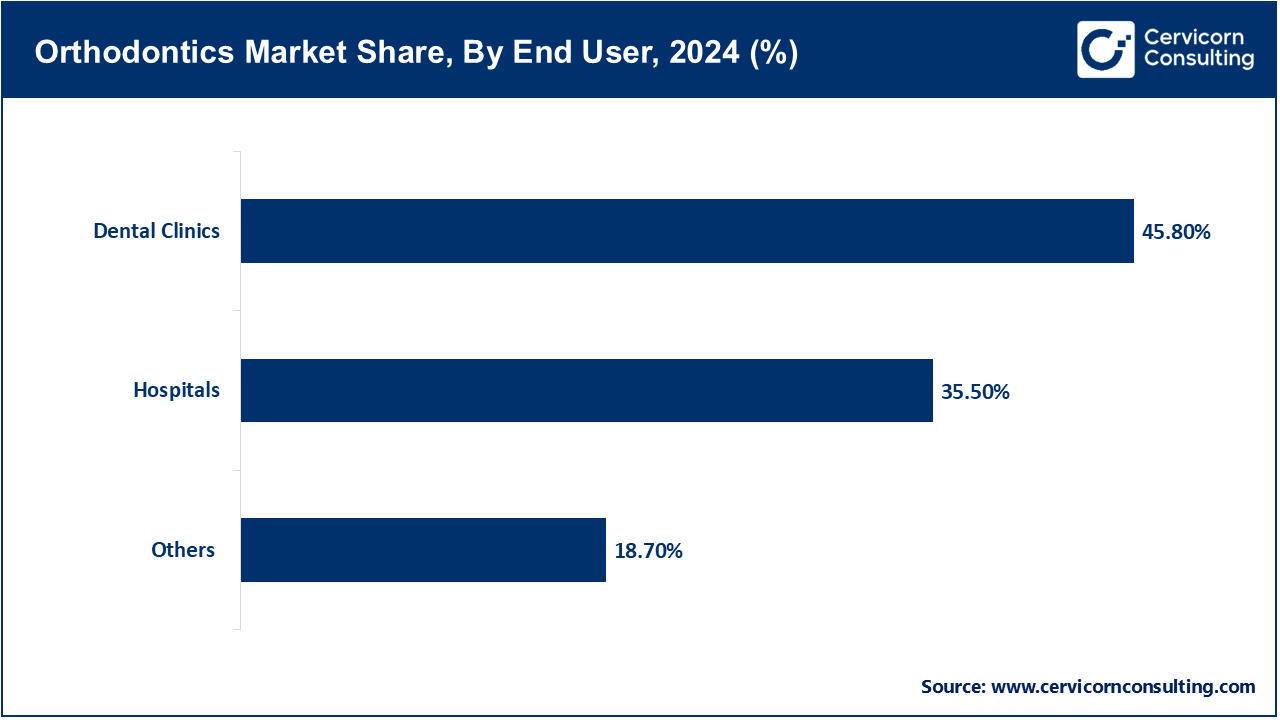

Hospitals: Hospitals provide orthodontic services within the scope of multidisciplinary dental, pediatric, or craniofacial units, usually dealing with advanced or surgical orthodontic procedures. These institutions cater to both insured and emergency patients. In March 2025, a regional healthcare network in the U.K. Initiated a distinct unit in orthodontics in the maxillofacial department for more efficient handling of congenital deformities. This created better pathways for patients needing coordinated orthodontic and surgical interventions. In the integrated comprehensive care models paradigm, hospitals are focusing on bolstering the auxiliary infrastructure for orthodontics. Investment in public health is subsidizing these initiatives.

Dental Clinics: The dental clinics segment has recorded highest revenue share. Dental Clinics are the first contact points of the patients with orthodontic problems, offering both traditional braces and modern aligners. Such facilities focus on the aesthetics of treatment, its ease, and patient-tailored services. An India clinic chain launched a fully digitized work process with intraoral scanners and aligner fittings done on the same day in January 2024. Patient volume grew by 30% within the subsequent 6 months due to this innovation. Clinics are keen to adopt digital advancements to improve patient satisfaction and health outcomes. Speed and affordability, paired with innovative approaches, define the competitive advantage in the orthodontics sector for these clinics.

Others: This Others category comprises dental labs manufacturing tailor-made orthodontic devices, academic institutions performing research, and specialty centers providing specialized services. These organizations facilitate innovation and education. In October 2023, a United States university collaborated with a 3D printing firm to establish a research facility for ramping up aligner prototyping with a goal to reduce the turnaround time by 50%. Such initiatives demonstrate the support provided by academia towards clinical innovation. These segments also shape curricular development and regulatory frameworks. Their strategic role is increasing internationally.

Adults: The adults segment has generated highest revenue share. Adults seek orthodontic treatments due to aesthetic or health concerns, preferring clear aligners and low-visibility brackets suitable for their careers. Their level of correction is usually mild to moderate. A leading aligner brand scheduled a financially incentivized promotional campaign aimed at adults with flexible consultation windows in June 2023. This resulted in a 25% increase in adult signups. This serves as evidence for the adult demographic’s sensitivity to cost, convenience, and vanity metrics. Adults have become a primary focus for lifestyle marketing on premium products.

Orthodontics Market Revenue Share, By Age Group, 2024 (%)

| Age Group | Revenue Share, 2024 (%) |

| Adult | 64.30% |

| Children | 35.70% |

Children: For children, early orthodontic intervention focuses on correcting problematic skeletal growth to mitigate the severity of future malocclusion. Compliance-focused, the pediatric appliances are lightweight. In September 2024, a group of child-centered clinics launched an app-based tracking and reward system which gamified retainer wear time. The targeted 8-12 age group exhibited a 40% increase in wear time resulting from this behavior reinforcement strategy. Parents and providers consequently have shifted their focus towards early, fun-oriented comprehensive orthodontic care. This segment is crucial for sustaining long-term case volume.

Fixed Braces: The fixed braces segment accounted maximum revenue share. Fixed braces employ bonding techniques to attach arch wires to the teeth which form a bracket system. They are used for sophisticated corrections and enable precise control of orthodontic force and tooth movement over extended periods. A certain dental supplier has released a new type of ceramic low friction braces which underwent clinical trials showing faster realignment and comfort. Adoption from clinics in Asia and Europe followed within three months. This illustrates the even well-established treatment types are still subject to innovation. Fixed braces still have their place due to reliability and versatility.

Orthodontics Market Revenue Share, By Treatment Type, 2024 (%)

| Treatment Type | Revenue Share, 2024 (%) |

| Fixed Braces | 58.10% |

| Removable Appliances | 41.90% |

Removable Appliances: Removable appliances encompass aligners, retainers, and functional appliances and are detachable by the patient, thus improving hygiene and comfort. These are sought for esthetics and mild-to-moderate disorders. A US aligner company launched a dual function aligner-retainer in November 2022 which was adopted by over 100 thousand users within a year. Post-treatment care became more effortless and the device gained recognition for convenience. There is still room for further innovation in compliance and timelines with the use of removable appliances.

Online: Online distribution includes e-commerce and direct-to-consumer channels for orthodontic devices and kits, enhancing access and decreasing overhead for practices. It also facilitates bulk ordering, order management, tracking, and home delivery. A global distributor integrated an AI-enhanced online ordering system with clinics as of July 2024. With urban delivery services streamlined for 24-hour accessibility, precision rests 30% higher than prior systems. Through digital integration expansion is rapidly occurring in all sectors. Evolving distribution channels illustrate growing transparency and ease.

Orthodontics Market Revenue Share, By Distribution Channel, 2024 (%)

| Distribution Channel | Revenue Share, 2024 (%) |

| Online | 28.40% |

| Offline | 71.60% |

Offline: The offline segment has reported dominance in market. This category of offline distribution comprises suppliers who are physical, representatives, and dental exhibitions where one can display and purchase products. These channels are still dominant in developing regions. They are essential for delivering guidance and practical sessions. A leading distributor opened five teaching hubs directly tied to their branches in April 2023. These centers were assigned the distribution of learning materials and were licensed to train specialist orthodontists on a new bracket system. Over 500 specialists have been endorsed in the last year. The importance of offline channels in product demonstration sustains the relevance of the offline model.

The orthodontics market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

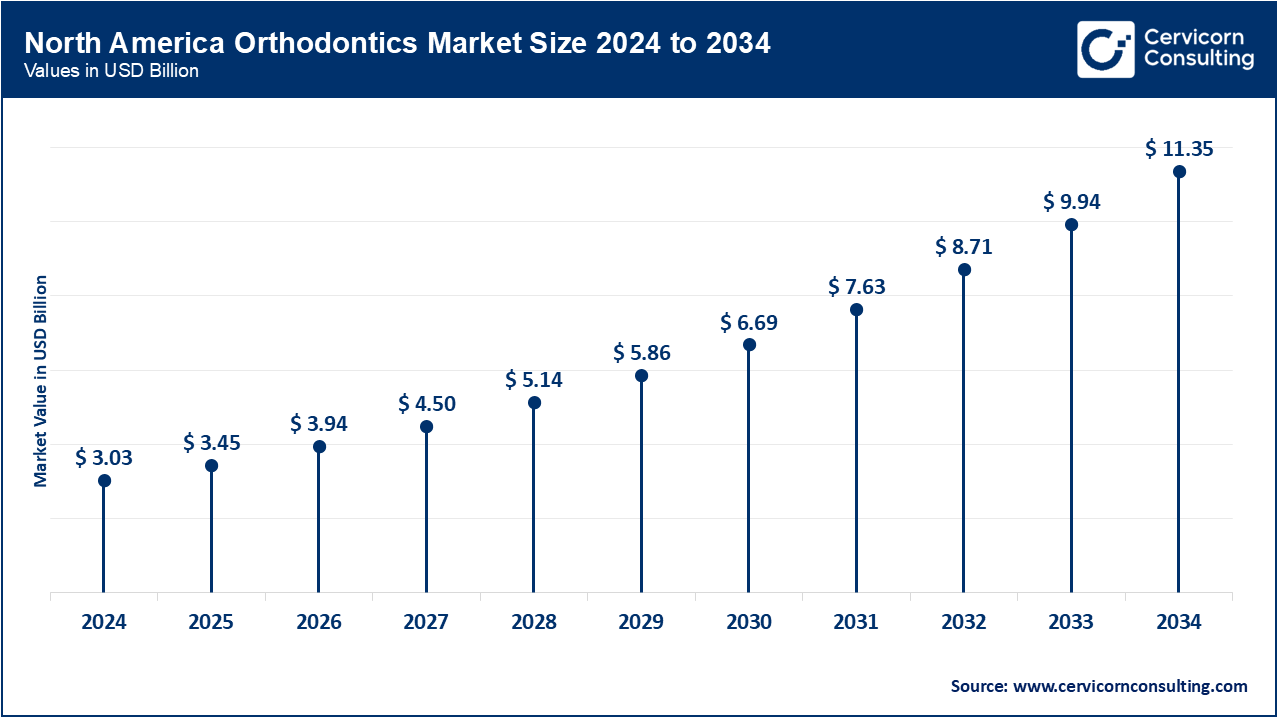

North America includes the US, Canada, Mexico, and surrounding countries. The region leads the world in orthodontics due to high income, advanced insurance frameworks, and significant orthodontic patronage. The United States remains the clear leader in innovation and consumption of clear aligners, whereas Canada and Mexico are transitioning towards digital workflows, teleorthodontics, and remote care delivery models. An American aligner company acquired a Canadian AI dental technology firm in April 2023 to integrate 3D diagnostics and predictive modeling into their treatment modalities. This acquisition improved access to care on the continent. It also strengthened collaboration between Canada and the US and encouraged more technology-oriented treatment paradigms in Mexican clinics, which continue to lead in primary aesthetic concerns of clinical innovation and the investment in research and development.

Europe, as a region which includes important markets such as Germany, the UK, France, Italy, Spain, Russia, and Netherlands is remarkadly noted for its stable regulatory environment, thorough dental coverage, and adoption of best practices in orthodontic innovation. Dominating the use of fixed and removable appliances are Germany and the UK, while there is a growing access in private sector in Southern and Eastern Europe. In October 2024, a teleorthodontics platform was launched across Germany, Italy, and the UK which motores underserved rural areas and underinsured populations. The initiative resulted in a 25% increase in digital consultations in six months, illustrating Europe's commitment to accessible orthodontic care and modern service delivery. European clinics are now striving for a balance between cost, attractiveness, and digitalization in care delivery.

The region includes developing countries such as China, India, Japan, South Korea, Australia, New Zealand, Taiwan, and others. Due to increasing incomes and widespread aesthetic awareness, there is a rapidly growing patient population in Orthodontics. While Japan and South Korea dominate in innovation and design, India and China distinguish themselves as leaders in volume. In February 2025, a segment of the Indian tech dental industry joined forces with a Chinese dental conglomerate to launch a digital orthodontic clinic on wheels aimed at semi-urban and rural markets. In the pilot phase, the project proved to be successful as it served over 5 thousand patients which highlights the impact of technology in underserved regions. The region is still urbanizing and digitizing at a fast rate which contributes to the Asia-Pacific region being a focal point for expansion in the orthodontic market and cross-border innovation.

Orthodontics Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 38.70% |

| Europe | 22.60% |

| Asia-Pacific | 32.50% |

| LAMEA | 6.20% |

This stands for “Brazil, The Middle East, and Africa” which regions are grouped together in a singular emerging Orthodontics market. This market is stimulated by an advancing middle-class population, increasing dental tourists, and a growing awareness in the field of oral aesthetics. As we know, Brazil has a private orthodontic sector that is quite advanced. The Middle Eastern countries center their focus on premium cosmetic orthodontic care, and Africa is working on establishing basic dental care infrastructure. In May 2024, the leading orthodontic clinic chain in Brazil opened its 50th clinic, which corresponds to a 35% increase in the volume of procedures since 2022 owing to better financing and outreach campaign opportunities. Gulf-based startups also launched virtual orthodontic supervision and monitoring services in two other countries in the region that allow for remote consultations enabling supervision beyond physical borders. There is a shift from traditional practice models to technology-driven, patient-centered systems.

Market Segmentation

By Product

By Age Group

By Treatment Type

By Distribution Channel

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Orthodontics

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Age Group Overview

2.2.3 By Treatment Type Overview

2.2.4 By Distribution Channel

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3.Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 The impact of social media and awareness of aesthetics

4.1.1.2 Preventive orthodontics for children and teenagers

4.1.1.3 Automated claim processing and enhanced interfaces with insurance providers

4.1.2 Market Restraints

4.1.2.1 Treatment-related discomfort, pain, and complications

4.1.2.2 Shortage of skilled orthodontists in rural/unserved areas

4.1.2.3 Competition from DIY and direct-to-consumer aligner kits

4.1.3 Market Challenges

4.1.3.1 Sustainability in materials and supply chains

4.1.3.2 Consumer trust uniformity is modified

4.1.4 Market Opportunities

4.1.4.1 Technologies for planning orthodontic treatment with AI and 3D imaging

4.1.4.2 Mini-sensor smart brackets enable real-time monitoring and feedback

4.1.4.3 Lines of sustainable and biodegradable products

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Orthodontics Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Orthodontics Market, By Product

6.1 Global Orthodontics Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Instruments

6.1.1.2 Supplies

Chapter 7. Orthodontics Market, By Age Group

7.1 Global Orthodontics Market Snapshot, By Age Group

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Adults

7.1.1.2 Children

Chapter 8. Orthodontics Market, By Treatment Type

8.1 Global Orthodontics Market Snapshot, By Treatment Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Fixed Braces

8.1.1.2 Removable Appliances

Chapter 9. Orthodontics Market, By Distribution Channel

9.1 Global Orthodontics Market Snapshot, By Distribution Channel

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Online

9.1.1.2 Offline

Chapter 10. Orthodontics Market, By End-User

10.1 Global Orthodontics Market Snapshot, By End-User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Hospitals

10.1.1.2 Dental Clinics

10.1.1.3 Others

Chapter 11. Orthodontics Market, By Region

11.1 Overview

11.2 Orthodontics Market Revenue Share, By Region 2024 (%)

11.3 Global Orthodontics Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Orthodontics Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Orthodontics Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Orthodontics Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Orthodontics Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Orthodontics Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Orthodontics Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Orthodontics Market, By Country

11.5.4 UK

11.5.4.1 UK Orthodontics Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Orthodontics Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Orthodontics Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Orthodontics Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Orthodontics Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Orthodontics Market, By Country

11.6.4 China

11.6.4.1 China Orthodontics Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Orthodontics Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Orthodontics Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Orthodontics Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Orthodontics Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Orthodontics Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Orthodontics Market, By Country

11.7.4 GCC

11.7.4.1 GCC Orthodontics Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Orthodontics Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Orthodontics Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Orthodontics Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 3M Company

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Align Technology, Inc.

13.3 American Orthodontics

13.4 Danaher Corporation

13.5 Dentaurum GmbH & Co. KG

13.6 DENTSPLY International, Inc.

13.7 G&H Orthodontics, Inc.

13.8 Henry Schein, Inc.

13.9 Rocky Mountain Orthodontics, Inc.

13.10 TP Orthodontics, Inc.