Orthodontics Market Size and Growth 2025 to 2034

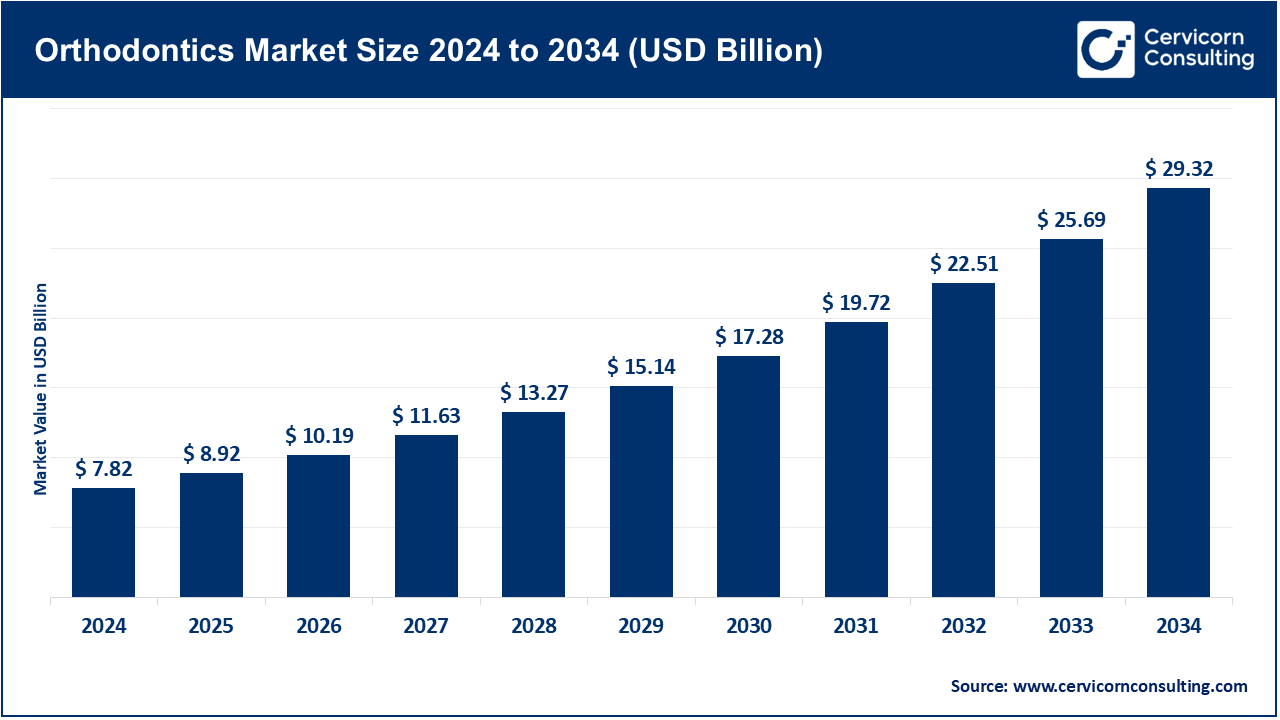

The global orthodontics market size was estimated at USD 7.82 billion in 2024 and is expected to surpass around USD 29.32 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.12% over the forecast period from 2025 to 2034. The global orthodontics market is expected to grow significantly owing to rising demand for aesthetic dental treatments, increasing prevalence of malocclusions, and technological advancements in clear aligners and 3D imaging. Growing awareness of oral health, rising disposable income, and expanding access to orthodontic care in emerging markets further support market expansion.

The orthodontics market is gaining traction owing to rising awareness of dental aesthetics, increasing disposable incomes, and growing demand for minimally invasive treatments. Clear aligners, lingual braces, and 3D-printed orthodontic devices offer enhanced comfort, precision, and visual appeal, making them popular among both teens and adults. Technological advancements in AI-driven treatment planning, digital impressions, and teledentistry are transforming patient care and accessibility. Supportive insurance coverage, increasing dental tourism, and professional training initiatives are accelerating adoption. The major players in the industry are investing in R&D, expanding global reach, and forming strategic collaborations. Consequently, Orthodontics is poised to redefine modern dentistry with innovative, patient-centric, and tech-driven solutions.

Health Benefits of Orthodontic Treatment

| Type |

Share (%) |

| Boosted Mental Health |

15% |

| Enhanced Speech and Breathing |

10% |

| Lower Jaw Pain & TMJ Issues |

15% |

| Better Digestive Health |

15% |

| Reduced Risk of Gum Disease |

20% |

| Improved Oral Hygiene |

25% |

Orthodontics Market Report Highlights

- By Region, North America has accounted highest revenue share of around 38.7% in 2024.

- By Product, the instruments segment has recorded a revenue share of around 60.4% in 2024. Instruments dominate due to repeated use in procedures and the growing adoption of advanced diagnostic tools.

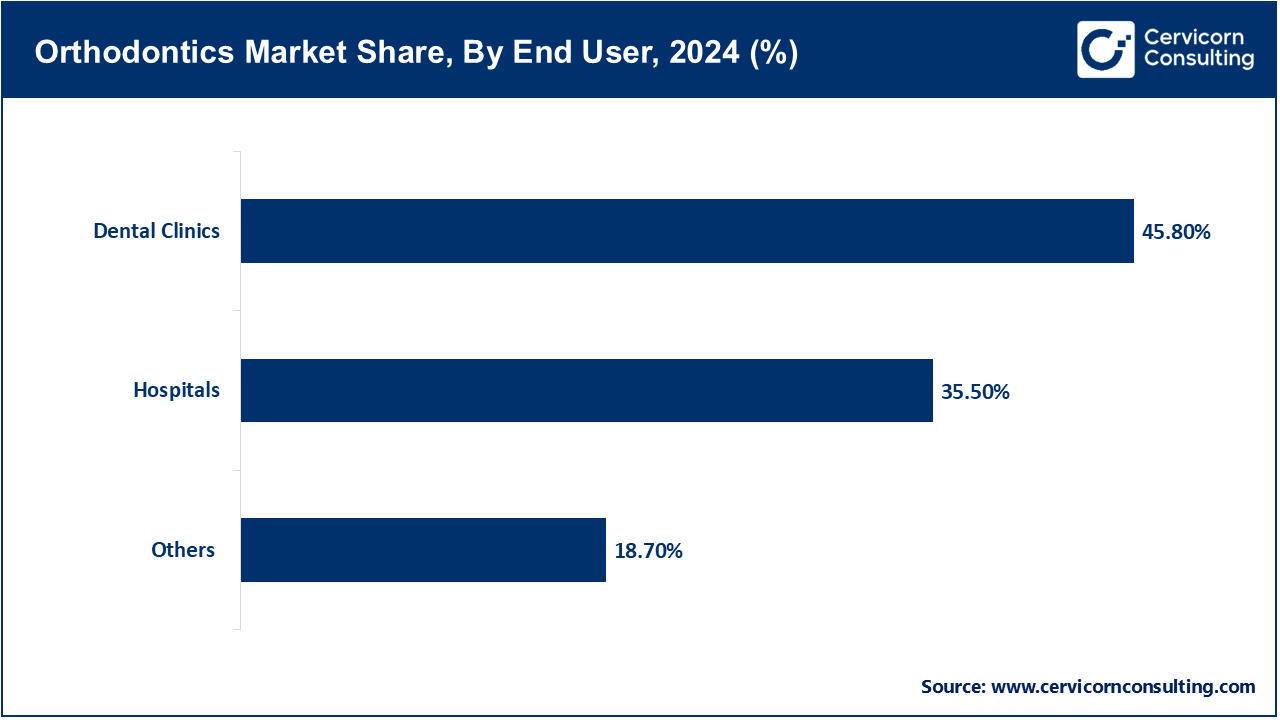

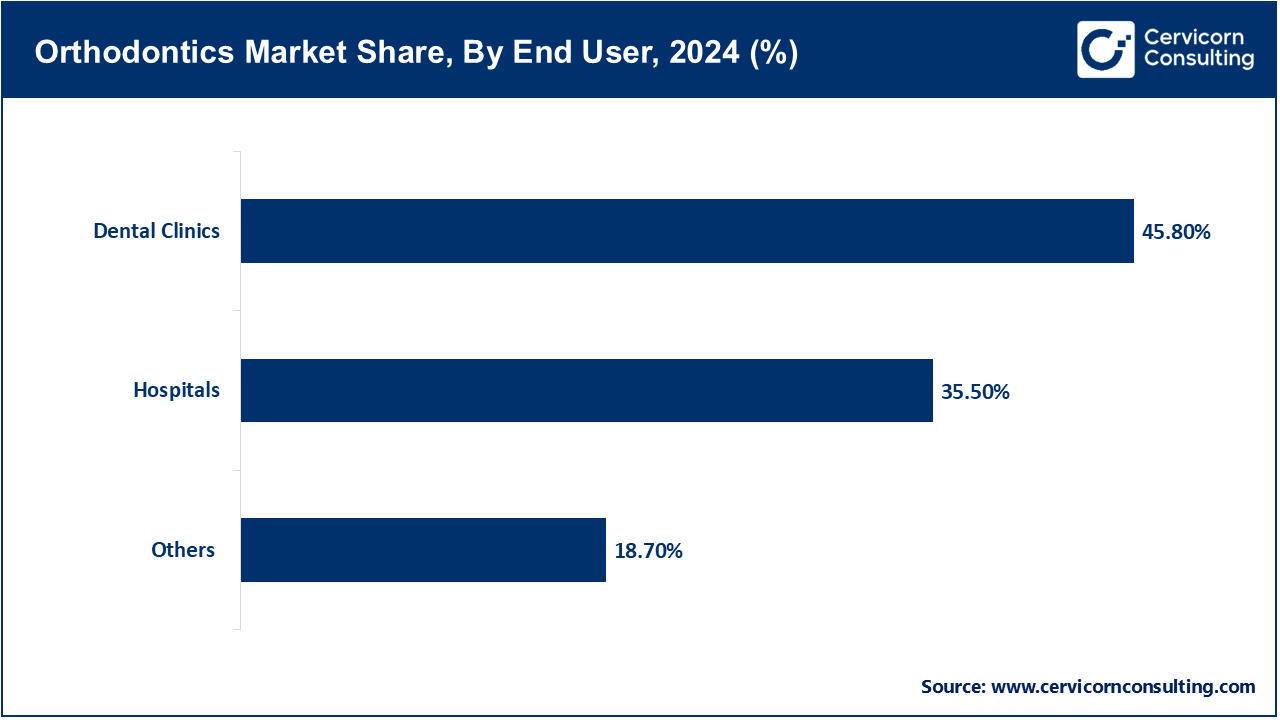

- By End User, the dental clinics segment has recorded a revenue share of around 45.8% in 2024. Dental clinics lead due to high patient footfall, personalized care, and faster adoption of aligner technology.

- By Age Group, the adults segment has recorded a revenue share of around 64.3% in 2024. Adults dominate the segment owing to the rising demand for aesthetic corrections and aligner-based solutions.

- By Treatment Type, the fixed braces segment has recorded revenue share of around 58.1% in 2024. Fixed braces hold a larger share as they are preferred for complex cases and long-term controlled tooth movement.

- By Distribution Channel, the offline segment has recorded a revenue share of around 71.6% in 2024. Offline distribution dominates due to strong distributor networks, hands-on product support, and clinical training needs.

Orthodontics Market Growth Factors

- Rising prevalence of malocclusion and dental disorders: Increased rates of malocclusion among children and teenagers are fueling global demand for orthodontic intervention. Clinics are expanding preventive screening programs, and manufacturers are developing more effective, kid-friendly appliances. Awareness campaigns are emphasizing early diagnosis and treatment benefits. In January 2023, a leading U.S. orthodontic group reported a 45 % rise in school-based referrals and launched a nationwide screening initiative. This initiative marked a clear pivot toward proactive care. Industry players are adjusting product lines to be more accessible and appealing to younger demographics. Malocclusion prevalence continues to be a key catalyst for market expansion.

- Alignment of functional and aesthetic needs for an older adult demographic: Orthodontic procedures are being sought by older adults to improve aesthetic concerns and functional attributes of the oral cavity. This demographic is benefiting from the advent of force-reduced aligners and treatments devised keeping adaptation to age in mind. Practitioners are modifying their approaches to utilize therapies that slow down the pace of bone remodeling for better comfort for the patient. European dental provider “Silver Aligner” programs after seeing a 60% surging in patient population aged over 60 years. Their specialized gentler treatments improve accessibility to financing tailored for this age group. Clinical benchmarks and technology used to create orthodontic appliances are shifting considerably due to older patients’ expectations. Redefined market segments have come about due to the aging population.

- Emerging Market Trends: The orthodontics industry is witnessing its increased growth potential within Emerging Asian and Latin American markets. This growth has directly been linked to the rising standards of living in these countries. The expanding middle class now perceives smile enhancement as an essential part of personal health as well as social standing. This has shifted the demand for orthodontic care. Moreover, clinics are increasingly sophisticated, strategically targeting secondary and tertiary cities as well as offering payment plans enabling broader access to their services. A prime example is the Brazilian dental chain that opened its 50th clinic in May 2025 after seeing a 35% rise in orthodontic treatments since 2022. The expansion of this network exemplifies how economic growth in Brazil is fueling orthodontic treatment adoption. The focus of these strategies formulated to target emerging markets have shifted towards lower pricing and high local availability. The sustained double-digit growth from these markets is now expected for the long term.

Orthodontics Market Trends

- Shift from traditional braces to clear aligners: The popularity of clear aligners is increasing because they are more comfortable and aesthetic than traditional braces. Their removability makes clear aligners easier for patients to incorporate into daily life, especially for older teens and adults. This trend is prompting clinics to revise their treatment strategies. Newer technologies aimed at muscle accommodation and aesthetic materials are being worked on steadily. One a leading aligner manufacturers launched an enhanced transparent tray with better force calibration in March of 2025. The tray was equipped with new features like improved force calibration with quicker treatment phases. Through 400 clinics, the product gained rapid adoption during its first quarter. This release clearly demonstrates how consumers actively seek more discreet treatment options. The transition to using aligners is arguably one of the most transformative shifts we’ve seen in orthodontics.

- Teleorthodontics and remote monitoring: Teleorthodontics is marked by virtual consultations and synchronous remote monitoring which revolutionizes continuous care. These approaches enable access to providers in rural and underserved areas. There is streamlining of follow-up sessions and a decrease in the need for face-to-face appointments. In May of 2025, one of the leading providers for tele dentistry announced a surge in orthodontic users based in rural India. They recorded over ten thousand virtual consultations in a span of six months. Remote platforms are now integral to treatment workflows and many clinics have begun replacing physical inspections with virtual scans followed by secure video check-ins. This is fundamentally changing service delivery models, along with shifting the frameworks regarding service accessibility.

- Mechanics of Precision: The development and use of heat activated NiTi wires and self-ligating brackets showcase how modern material science improves patient comfort during treatment. These technologies reduce friction and time spent on treatment. Providers report an increase in proactive adjustment visits and a decrease in reactive visits with more predictable movements. A global manufacturer released a cross-linked heat-activated NiTi wire blend in April 2024 that was celebrated for reducing discomfort and improving alignment. Clinics in North America and Europe adopted the technology almost universally. This underscores the fact that enhancements made to mechanical devices fundamentally drive clinical progress. Orthodontic laboratories are concentrating on systems for brackets and materials that respond to temperature changes.

Orthodontics Market Dynamics

Market Drivers

- The impact of social media and awareness of aesthetics: Interest in cosmetic orthodontics is growing, particularly among Millennials and Gen Z, due to social media and marketing campaigns. Influencer treatment journeys and before-after showcase transformations foster greater acceptance. Clinics are adopting digital and interactive content. A major American company confirmed the shifts in consumer behavior brought by social media and reported a 30 percent spike in requests for aesthetic aligners two months ago after a celebrity smile Instagram post. Providers now carefully structured staff engagement to educate digitally as patients become more and more immersed in technology. Social networks are useful only when the topic of discussion is of visual nature.

- Preventive orthodontics for children and teenagers: Early detection along with proactive remedying methods is becoming more prevalent. Proactive strategies such as palate expanders are alleviating challenges much earlier which reduces the need for complex procedures down the line. A more systematic educative routine screening drives in schools have recently emerged. An orthodontic association started an interceptive orthodontics pilot program in schools in October 2024, claiming a reduction of severe malocclusion by 20% in two years. The pilot program funded partnerships between public pediatric dental clinics and private orthodontic dental clinics. This showcases the incredible effectiveness prevention models can offer in numerous areas including time, expense, and discomfort. There is a noticeable shift towards the need to redefine clinical and educational frameworks.

- Automated claim processing and enhanced interfaces with insurance providers: Automated claim processing and enhanced interfaces with insurers removes financial hurdles to accessing orthodontic care. Administrative burdens from integrated digital systems with insurers are greatly reduced, increasing appointment availability. Clinics utilizing automated systems report quicker reimbursement, increased acceptance of cases, and improved reimbursement rates. In July 2024, a health-tech startup released an insurance integration tool that reduced claim processing time by half and increased treatment commencement by 25%. Currently, this tool is in use by over three hundred practices. Such innovations lower the threshold patients have to cross to access care. Modern clinic workflows place great emphasis on efficient insurance processing.

Market Restraints

- Treatment-related discomfort, pain, and complications: Orthodontic treatment often leads to discomfort and biological complications such as root resorption which may discourage some patients. Optimizing the patient experience remains a clinical concern. Instructional modifications and low-force systems are gaining interest. A national orthodontic council released new clinical recommendations reducing force usage in orthodontic therapy. These guidelines aim to encourage root resorption incident reduction and more patient-centered treatment. Compliance with force controls and imaging, alongside safety prerogatives, is pushing for gentler methodologies.

- Shortage of skilled orthodontists in rural/unserved areas: Regions lacking access to orthodontic specialists face increased inequalities and prolonged wait times. Often, primary care doctors do not have the requisite skills for intricate cases. Tele-mentoring and mobile clinics are new emerging models addressing these gaps. A national dental authority launched late last year with aims to retrain 200 rural general practitioners within two years through a virtual orthodontics certification program. This model can enable rural areas to build their healthcare capacity without relocating to cities. Rural areas gained network provider status recently, but the lack of reliable coverage continues to be the primary barrier to consistent care.

- Competition from DIY and direct-to-consumer aligner kits: Marked competitive pressure on established practices is stemming from consumer parcel orthodontics. Aligner brands that serve customers directly through the mail offer lower prices than traditional orthodontic practices. Still, these products face scrutiny due to a lack of professional supervision regarding safety and efficacy. There has been an increase in regulatory scrutiny. After a peer-reviewed study published in April 2023, alerting regulators to complications associated with increased usage of DIY aligners, stricter regulations began being considered. Clinics began issuing advisories to patients warning them about the risks associated with such treatments. This orthopedic backlash has shown how important it is to have proper medical supervision. The DIY phenomenon is transforming the orthodontic field’s regulatory framework as well as its pedagogy.

Market Opportunities

- Technologies for planning orthodontic treatment with AI and 3D imaging: The merging of AI programs with 3D imaging technology is improving the accuracy and forecastability of treatment planning. Simulated results bolster both acceptance and productivity metrics. Received by the market in October 2024, an industry-leading aligner manufacturer incorporated an AI-based planner which cut prep time by 40% leading to over 200 clinics adopting the technology within a month. Post-implementation, patient satisfaction and retention rates significantly improved. Transformative advancements are redefining competitive dynamics in innovation and strategic shifts. The rapid increase in precision customization is distinct in advanced orthodontics.

- Mini-sensor smart brackets enable real-time monitoring and feedback: Constant monitoring smart brackets with mini-sensors provide with tooth movement enables real-time updates to force application and responsive treatment changes. These improvements may increase accuracy while decreasing the length of treatment time. Controlled clinical data released by one manufacturer in February 2025 documented a 25% reduction of treatment time with the smart-bracket system in 20 clinics. This data is turning the heads of clinic networks and investors. The shift from trial to mainstream use is underway. We are witnessing the dawn of a new era in orthodontics with the introduction of real-time smart technologies.

- Lines of sustainable and biodegradable products: The increasing volume of orthodontic procedures is driving the use of eco-friendly materials such as aligners and brackets manufactured from recycled plastics. This development is a response to market and regulatory demand. A leading producer of aligners started testing the use of biodegradable polymer trays in select markets in March 2025, with full implementation planned by 2027. This represents a significant advance in the direction of environmental dentistry. Other competing firms are beginning to undertake comparable sustainable initiatives. Such portfolios are becoming market differentiators and are expected to take over as the primary attribute of the brand.

Market Challenges

- Sustainability in materials and supply chains: The orthodontics industry now encounters a completely different range of sustainability and waste reduction challenges across the supply chain. Sustainably "green" practices span from innovations in R&D to earning "green" certificates. A competing aligner firm was set to earn major industry recognition for being the first to release a pilot biodegradable aligner in March of 2025, further intensifying competition. Such practices increase complexity and cost in material sourcing. Stricter regulations are being implemented concerning dental plastics and their disposal. Sustainability ineco is now vital to brand strategy and influence product design.

- Value-added services: Whitening, airways, and holistic dental care: To differentiate themselves in a saturated market, separate orthodontic clinics are looking to diversify with integrated whitening, airway-centered care, and holistic services. These service suites require additional clinical and operational investments. An “Ortho-plus” package offered by A multi-specialty practice group includes erweiters and additional services like teeth whitening and sleep apnea screening, resulting in improved patient satisfaction as well as revenue per patient increase of 20%. Adoption of these bundled care models is surging among high-end practitioners. The newer holistic paradigms are now viewed as the most essential for competitive differentiation.

- Consumer trust uniformity is modified: The disparate industry suffers from pronounced discrepancies in quality between providers, geographies and their locations, making trust uniformity nearly impossible as far as consumer perception goes. While some accrediting bodies are trying to formulate them, there is little active progress. An international orthodontic society implemented a new clinic accreditation system in November 2024, in which 150 clinics had enrolled by early 2025. The framework establishes minimum requirements for adequate equipment, techniques, and patient care. Early adopters benefit from increased marketing opportunities. Widespread participation remains elusive, but acceptance of orthodontic standards is improving. Long-term credibility in the market hinges on robust quality assurance frameworks.

Orthodontics Market Segmental Analysis

Product Analysis

Instruments: The instruments segment holds leading position in market. For the placement, adjustment, and removal of appliances, probes, ligature cutters, wire benders, and even pliers are used by orthodontic practices. Due to the significant orthodontic instruments’ concern for accuracy, they are crafted from strong materials and dependable as well as tempered. Pliers that further reduction of hand strain came out in May 2024 and were lightweight and ergonomic, with over 300 clinics reporting benefits. Increased comfort during prolonged procedures has been noted alongside sharpened comfort. Instead of focusing on simple tasks that require instruments designed for repetitive use, clinics are now focusing on task demands that make use of autoclavable instruments. Progress in material and design is still persistence to driving innovation in this area.

Orthodontics Market Revenue Share, By Product, 2024 (%)

| Product |

Revenue Share, 2024 (%) |

| Instruments |

60.40% |

| Supplies |

39.60% |

Supplies: Impression materials, brackets and arch wires, elastics, bonding agents and other items of similar nature fall under orthodontic supplies. They form the basis of daily operations and therefore, need to be stocked often. In November 2022, a leading European dental firm launched an eco-friendly line of self-ligating brackets using recyclable polymers, which received strong interest from sustainability-focused clinics. The development supports the rising demand for greener clinical operations. Supplies form a recurring revenue stream and contribute heavily to profit margins. Product innovation and sustainability are emerging focus areas.

End User Analysis

Hospitals: Hospitals provide orthodontic services within the scope of multidisciplinary dental, pediatric, or craniofacial units, usually dealing with advanced or surgical orthodontic procedures. These institutions cater to both insured and emergency patients. In March 2025, a regional healthcare network in the U.K. Initiated a distinct unit in orthodontics in the maxillofacial department for more efficient handling of congenital deformities. This created better pathways for patients needing coordinated orthodontic and surgical interventions. In the integrated comprehensive care models paradigm, hospitals are focusing on bolstering the auxiliary infrastructure for orthodontics. Investment in public health is subsidizing these initiatives.

Dental Clinics: The dental clinics segment has recorded highest revenue share. Dental Clinics are the first contact points of the patients with orthodontic problems, offering both traditional braces and modern aligners. Such facilities focus on the aesthetics of treatment, its ease, and patient-tailored services. An India clinic chain launched a fully digitized work process with intraoral scanners and aligner fittings done on the same day in January 2024. Patient volume grew by 30% within the subsequent 6 months due to this innovation. Clinics are keen to adopt digital advancements to improve patient satisfaction and health outcomes. Speed and affordability, paired with innovative approaches, define the competitive advantage in the orthodontics sector for these clinics.

Others: This Others category comprises dental labs manufacturing tailor-made orthodontic devices, academic institutions performing research, and specialty centers providing specialized services. These organizations facilitate innovation and education. In October 2023, a United States university collaborated with a 3D printing firm to establish a research facility for ramping up aligner prototyping with a goal to reduce the turnaround time by 50%. Such initiatives demonstrate the support provided by academia towards clinical innovation. These segments also shape curricular development and regulatory frameworks. Their strategic role is increasing internationally.

Age Group Analysis

Adults: The adults segment has generated highest revenue share. Adults seek orthodontic treatments due to aesthetic or health concerns, preferring clear aligners and low-visibility brackets suitable for their careers. Their level of correction is usually mild to moderate. A leading aligner brand scheduled a financially incentivized promotional campaign aimed at adults with flexible consultation windows in June 2023. This resulted in a 25% increase in adult signups. This serves as evidence for the adult demographic’s sensitivity to cost, convenience, and vanity metrics. Adults have become a primary focus for lifestyle marketing on premium products.

Orthodontics Market Revenue Share, By Age Group, 2024 (%)

| Age Group |

Revenue Share, 2024 (%) |

| Adult |

64.30% |

| Children |

35.70% |

Children: For children, early orthodontic intervention focuses on correcting problematic skeletal growth to mitigate the severity of future malocclusion. Compliance-focused, the pediatric appliances are lightweight. In September 2024, a group of child-centered clinics launched an app-based tracking and reward system which gamified retainer wear time. The targeted 8-12 age group exhibited a 40% increase in wear time resulting from this behavior reinforcement strategy. Parents and providers consequently have shifted their focus towards early, fun-oriented comprehensive orthodontic care. This segment is crucial for sustaining long-term case volume.

Treatment Type Analysis

Fixed Braces: The fixed braces segment accounted maximum revenue share. Fixed braces employ bonding techniques to attach arch wires to the teeth which form a bracket system. They are used for sophisticated corrections and enable precise control of orthodontic force and tooth movement over extended periods. A certain dental supplier has released a new type of ceramic low friction braces which underwent clinical trials showing faster realignment and comfort. Adoption from clinics in Asia and Europe followed within three months. This illustrates the even well-established treatment types are still subject to innovation. Fixed braces still have their place due to reliability and versatility.

Orthodontics Market Revenue Share, By Treatment Type, 2024 (%)

| Treatment Type |

Revenue Share, 2024 (%) |

| Fixed Braces |

58.10% |

| Removable Appliances |

41.90% |

Removable Appliances: Removable appliances encompass aligners, retainers, and functional appliances and are detachable by the patient, thus improving hygiene and comfort. These are sought for esthetics and mild-to-moderate disorders. A US aligner company launched a dual function aligner-retainer in November 2022 which was adopted by over 100 thousand users within a year. Post-treatment care became more effortless and the device gained recognition for convenience. There is still room for further innovation in compliance and timelines with the use of removable appliances.

Distribution Channel Analysis

Online: Online distribution includes e-commerce and direct-to-consumer channels for orthodontic devices and kits, enhancing access and decreasing overhead for practices. It also facilitates bulk ordering, order management, tracking, and home delivery. A global distributor integrated an AI-enhanced online ordering system with clinics as of July 2024. With urban delivery services streamlined for 24-hour accessibility, precision rests 30% higher than prior systems. Through digital integration expansion is rapidly occurring in all sectors. Evolving distribution channels illustrate growing transparency and ease.

Orthodontics Market Revenue Share, By Distribution Channel, 2024 (%)

| Distribution Channel |

Revenue Share, 2024 (%) |

| Online |

28.40% |

| Offline |

71.60% |

Offline: The offline segment has reported dominance in market. This category of offline distribution comprises suppliers who are physical, representatives, and dental exhibitions where one can display and purchase products. These channels are still dominant in developing regions. They are essential for delivering guidance and practical sessions. A leading distributor opened five teaching hubs directly tied to their branches in April 2023. These centers were assigned the distribution of learning materials and were licensed to train specialist orthodontists on a new bracket system. Over 500 specialists have been endorsed in the last year. The importance of offline channels in product demonstration sustains the relevance of the offline model.

Orthodontics Market Regional Analysis

The orthodontics market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

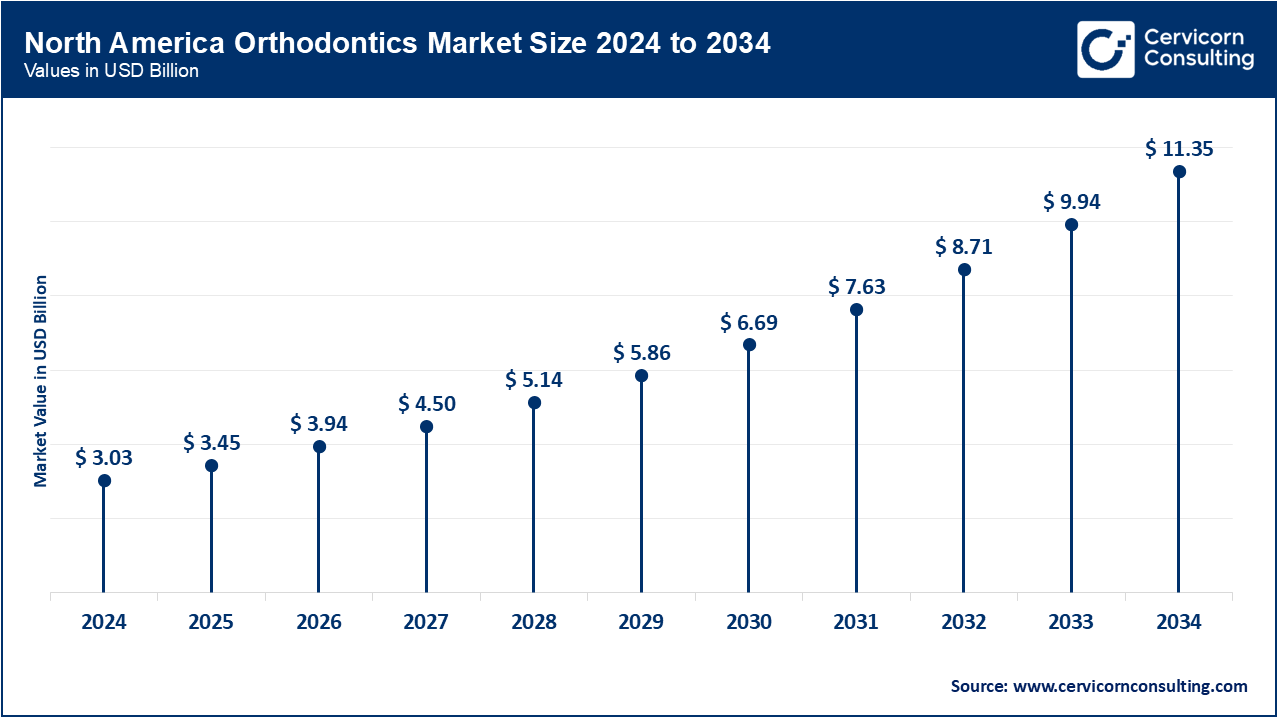

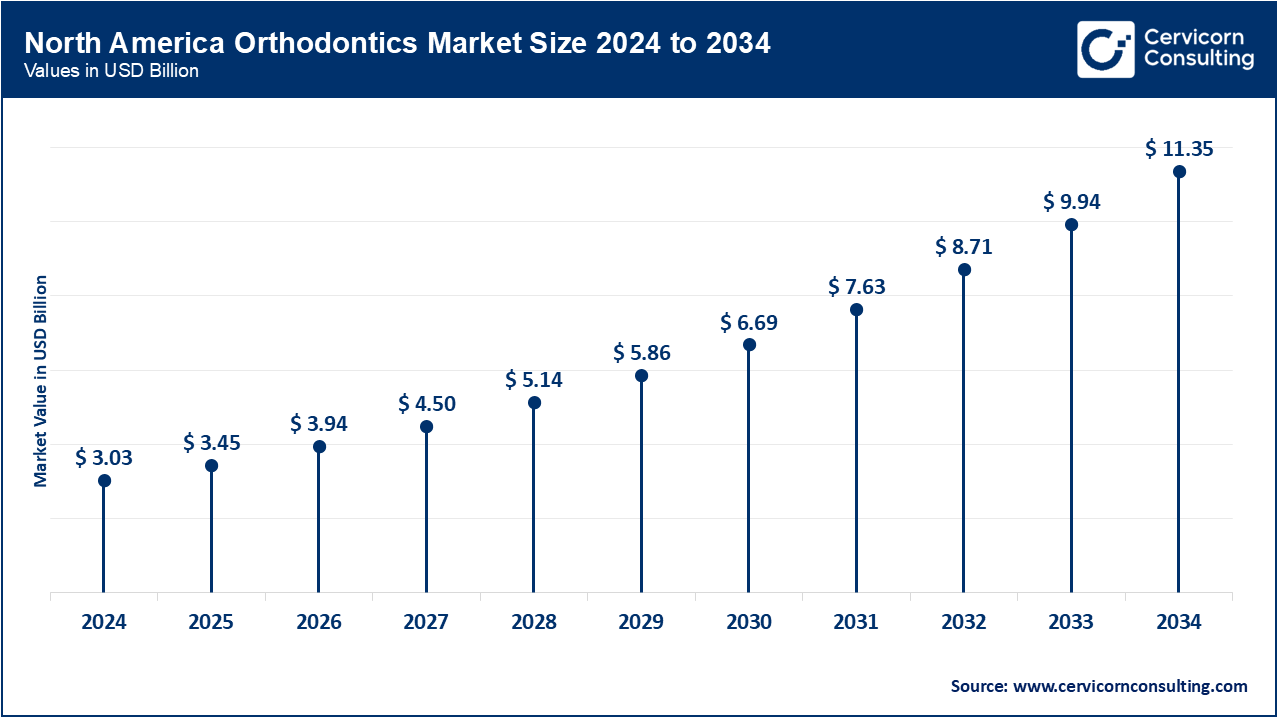

Why does North America dominate the orthodontics market?

- The North America orthodontics market size was valued at USD 3.03 billion in 2024 and is expected to reach around USD 11.35 billion by 2034.

North America includes the US, Canada, Mexico, and surrounding countries. The region leads the world in orthodontics due to high income, advanced insurance frameworks, and significant orthodontic patronage. The United States remains the clear leader in innovation and consumption of clear aligners, whereas Canada and Mexico are transitioning towards digital workflows, teleorthodontics, and remote care delivery models. An American aligner company acquired a Canadian AI dental technology firm in April 2023 to integrate 3D diagnostics and predictive modeling into their treatment modalities. This acquisition improved access to care on the continent. It also strengthened collaboration between Canada and the US and encouraged more technology-oriented treatment paradigms in Mexican clinics, which continue to lead in primary aesthetic concerns of clinical innovation and the investment in research and development.

What are the key drivers of the orthodontics market in Europe?

- The Europe orthodontics market size was estimated at USD 1.77 billion in 2024 and is expected to hit around USD 6.63 billion by 2034.

Europe, as a region which includes important markets such as Germany, the UK, France, Italy, Spain, Russia, and Netherlands is remarkadly noted for its stable regulatory environment, thorough dental coverage, and adoption of best practices in orthodontic innovation. Dominating the use of fixed and removable appliances are Germany and the UK, while there is a growing access in private sector in Southern and Eastern Europe. In October 2024, a teleorthodontics platform was launched across Germany, Italy, and the UK which motores underserved rural areas and underinsured populations. The initiative resulted in a 25% increase in digital consultations in six months, illustrating Europe's commitment to accessible orthodontic care and modern service delivery. European clinics are now striving for a balance between cost, attractiveness, and digitalization in care delivery.

Why is Asia-Pacific a rapidly growing region in the orthodontics market?

- The Asia-Pacific orthodontics market size is set to reach from USD 2.54 billion in 2024 to USD 9.53 billion by 2034.

The region includes developing countries such as China, India, Japan, South Korea, Australia, New Zealand, Taiwan, and others. Due to increasing incomes and widespread aesthetic awareness, there is a rapidly growing patient population in Orthodontics. While Japan and South Korea dominate in innovation and design, India and China distinguish themselves as leaders in volume. In February 2025, a segment of the Indian tech dental industry joined forces with a Chinese dental conglomerate to launch a digital orthodontic clinic on wheels aimed at semi-urban and rural markets. In the pilot phase, the project proved to be successful as it served over 5 thousand patients which highlights the impact of technology in underserved regions. The region is still urbanizing and digitizing at a fast rate which contributes to the Asia-Pacific region being a focal point for expansion in the orthodontic market and cross-border innovation.

Orthodontics Market Revenue Share, By Region, 2024 (%)

| Region |

Revenue Share, 2024 (%) |

| North America |

38.70% |

| Europe |

22.60% |

| Asia-Pacific |

32.50% |

| LAMEA |

6.20% |

What trends are driving the orthodontics market in LAMEA?

- The LAMEA orthodontics market size was valued at USD 0.48 billion in 2024 and is anticipated to record USD 1.82 billion by 2034.

This stands for “Brazil, The Middle East, and Africa” which regions are grouped together in a singular emerging Orthodontics market. This market is stimulated by an advancing middle-class population, increasing dental tourists, and a growing awareness in the field of oral aesthetics. As we know, Brazil has a private orthodontic sector that is quite advanced. The Middle Eastern countries center their focus on premium cosmetic orthodontic care, and Africa is working on establishing basic dental care infrastructure. In May 2024, the leading orthodontic clinic chain in Brazil opened its 50th clinic, which corresponds to a 35% increase in the volume of procedures since 2022 owing to better financing and outreach campaign opportunities. Gulf-based startups also launched virtual orthodontic supervision and monitoring services in two other countries in the region that allow for remote consultations enabling supervision beyond physical borders. There is a shift from traditional practice models to technology-driven, patient-centered systems.

Orthodontics Market Top Companies

Recent Developments

- In January 2024, Align Technology launched its enhanced ClinCheck Pro with AI-based treatment simulation. 3M introduced new translucent low-friction brackets in March 2023, and American Orthodontics expanded its distribution in Southeast Asia in June 2022. Danaher boosted chairside scanning capabilities through its subsidiaries, while Dentaurum unveiled recyclable orthodontic products in October 2024. Together, they are redefining the future of precise, patient-friendly orthodontic care.

- In May 2025, Align Technology has launched a new professional marketing initiative across EMEA and North America, highlighting doctors at the forefront of digital orthodontics and their impact in transforming over 20 million smiles with Invisalign aligners. The campaign features real stories from doctors, celebrating their achievements and the positive changes they bring to patients’ lives, with a focus on authentic, emotionally compelling short-form videos shared across multiple platforms. This initiative aims to recognize and honor the expertise, dedication, and innovation of orthodontists and dental professionals who use Align’s digital tools to improve oral health and build patient confidence.

Market Segmentation

By Product

- Instruments

- Supplies

- Fixed

- By Product

- Brackets

- Bands & Buccal Tubes

- Archwires

- Others

- By Type

- Removable

- Aligners

- Retainers

- Others

By Age Group

By Treatment Type

- Fixed Braces

- Removable Appliances

By Distribution Channel

By End User

- Hospitals

- Dental Clinics

- Others

By Region

- North America

- APAC

- Europe

- LAMEA