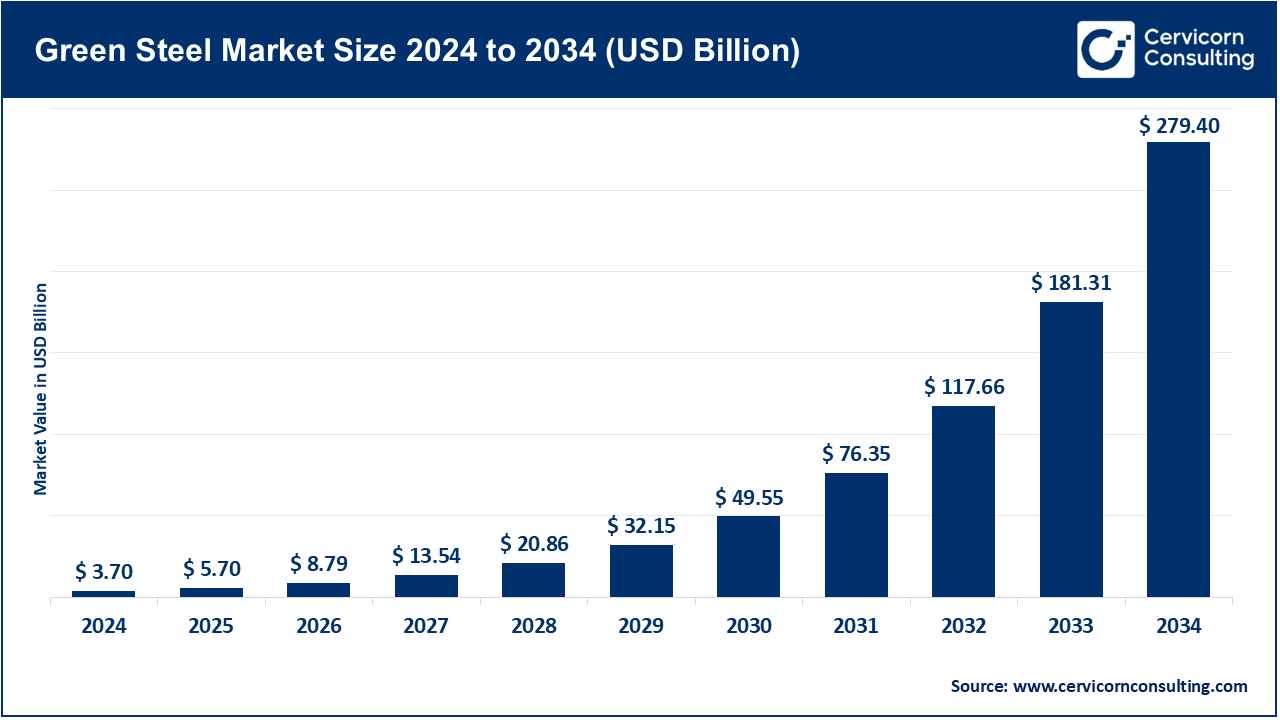

The global green steel market size was estimated at USD 3.70 billion in 2024 and is expected to surpass around USD 279.40 billion by 2034, growing at a compound annual growth rate (CAGR) of 54.10% over the forecast period from 2025 to 2034.

The global green steel market represents a steelmaking segment that produces steel in a manner that is environmentally friendly-large scale carbon emissions from conventional steelmaking are either drastically curtailed or almost eliminated. Green steel is relatively in the limelight because of alternative processes based mostly on low carbon measures whereby hydrogen-based direct reduction, electric arc furnaces running on renewable energy, and carbon capture technologies feature prominently. The need to decarbonize heavy industries and hence fulfil climate test dictates has acted as the chief impetus for this transformation. Green steel, thus, replaces a coal-based method with a cleaner alternative, thereby making steel production clean, which is among those that have the heaviest environmental footprint from the industrial side.

Regulatory and environmental restraints to announce the industrial emissions reduction-remained among the primary factors imposing on the growth of the green steel market. Producers have also been pushed by investors and consumers to shift towards green product types. These industries are preferring low-carbon steel green steel more and more in their measures to build brand recognition and improve their sustainability goals. Through the intervention of green hydrogen production technology and the integration of renewable energy, production along green lines has become more technical and financially viable, thus giving a new pace to the growth of the market. The push for circular economy principles also helps in increasing the usage of scrap-based electric arc furnaces by way of approved material reuse while bringing down the emission load.

A multitude of prospects exists in the market for green steel. There is much room for industrial collaborations, especially among steel producers, energy suppliers, and production technology companies working toward zero-emission solutions. Government incentives, such as tax breaks and funding for green infrastructure, open new doors for project developments and expansion of pilot technologies. Furthermore, the growing number of net-zero commitments from the corporate world within and across industries creates a demand for green steel, a sustainable material. Green steel is also looked upon as a strategic investment avenue by countries and companies that wish to carve a name for themselves as leaders in green technologies. As innovation takes its course and scaling of production follows, green steel will move onto a larger market share: long-term growth in green steel is for the established manufacturers as well as new entrants focused on clean production technology.

Top Countries in Green Steel Production

| Countries | Share (%) |

| China | 54% |

| India | 6.30% |

| Japan | 5.10% |

| USA | 4.60% |

| Russia | 4% |

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 5.70 Billion |

| Expected Market Size in 2025 | USD 279.40 Billion |

| Projected CAGR 2025 to 2034 | 54.10% |

| Dominant Region | North America |

| Region with the Strongest Growth | Asia-Pacific |

| Key Segments | Product Type, Production Technology, End-Use Industry, Region |

| Key Players | SSAB, Emirates Steel Arkan Group, Outokumpu Oyj, Swiss Steel Group, ArcelorMittal, China Baowu Group, Salzgitter AG, H2 Green Steel, Nippon Steel Corporation, Nucor Corporation |

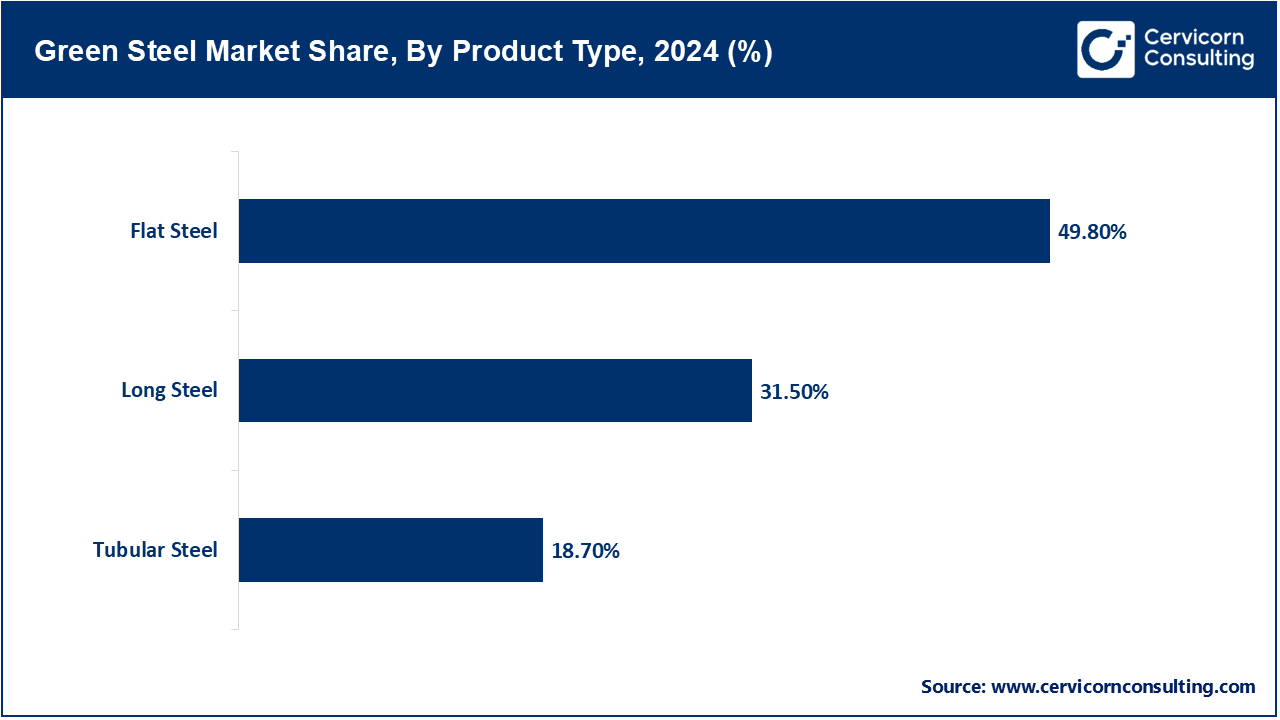

Flat Steel: The flat steel segment has held leading position. Flat steel is a generic term for steel products rolled into flat shapes like sheets, strips, and plates. Because it is versatile and strong and can be easily fabricated, in the green steel market, flat steel finds applications in transport (automotive), home appliances, civil constructions, and shipbuilding industries. With the increasing demand for sustainability, manufacturers are adopting green steel in flat form to offset big carbon footprints in large applications. Flat steel is among those industries that gain enormously from green production methods such as electric arc furnaces operated by electricity from renewable sources. It is still a major ingredient in green infrastructures and in low-emission vehicles. Commercial procurement of low-return carbon flat steel is, however, rapidly skyrocketing with OEMs and government-infrastructural projects that strongly focus on ESG objectives. Flat steel, given its diverse industrial applications and plethora of environmental regulatory compendia, all dictates into the greener steel world and embodies its leading front in the cross-industry thrust for a decarbonized material.

Long Steel: Long steel products include bars, rods, rails, and structural sections used chiefly in construction and engineering projects. Being used in the production of sustainable buildings, bridges, rebar for concrete structure, and heavy industries, long steel products are important for green steel. With nations all over the world promoting green buildings coupled with net-zero construction targets, the demand for low-carbon long steel is on the rise. These products are more environmentally friendly if produced through recycling routes such as scrap-fed electric arc furnaces instead of being produced in blast furnaces. Long steel proves useful for renewable energy by providing supports for wind turbine towers and solar panels. As the construction industry turns toward lowering the embodied carbon within materials, this segment grows. Being sturdy and recyclable, long steel is one of the very few materials deemed suitable for green construction; hence, long steel sits right in the middle of the transition of the construction sector toward sustainability.

Tubular Steel: Tubular steel encompasses steel pipes and tubes used for fluid and gas transportation as well as structural applications. In the green steel market, tubular products are movers in the energy (especially hydrogen and renewables), construction, and automotive sectors. With the initiation of clean energy on the global front, tubular green steel is gaining importance in the erection of hydrogen infrastructure, wind energy, and sustainable water distribution. Green steel pipelines fabricated with truly low carbon processes will curb the environmental footprint of symbolically important large-scale infrastructure and industrial projects. The segments attract recycled steel as well as low-emission production processes, thereby conforming to corporate and regulatory targets to cut down carbon emissions. Tubular products are being increasingly used in transport systems designed for sustainability, including components for electric vehicles and infrastructure for public transit. In line with rising demand for environmentally responsible pipelines and structural supports, tubular steel illustrates a growing and innovative application area within the green steel ecosystem.

Hydrogen-Based Direct Reduced Iron (H-DRI): The H-DRI represents an avant-garde green steel technology aimed at substituting fossil fuels with hydrogen as the reducing agent to strip oxygen from iron ore. The process emits no carbon dioxide and produces only water vapour. H-DRI is followed by sponge iron melting usually in an electric arc furnace, which is operated on green electricity, thus constituting a low-emission way to make steel. This technology is increasingly gaining recognition with the global urgency in decarbonization and the large regional investments in green hydrogen infrastructure. The high cost and scarcity of hydrogen pose constraints, but as hydrogen becomes cheap, we should be looking at H-DRI becoming the favourite process in green steelmaking.

Molten Oxide Electrolysis (MOE): In essence, MOE when given the status of emerging green steel technology, specifies the electrolysis procedure by which iron ore is directly converted into molten iron without having to use any type of carbon reductants. This wonderful system passes electric currents through molten oxides, thereby breaking the iron-oxygen bonds and releasing oxygen as one of the by-products instead of carbon dioxide. The high-purity steel and the absence of coke or coal are advantages given by MOE. Yet, as with many technologies in the developmental phase, it faces problems of energy consumption rates, material durability under proceeds of extreme heat, and imbalance concepts regarding its scale of production. Given the accessibility of renewable electricity, MOE holds the possibility of bringing a big transformation in sustainable steelmaking.

Carbon Capture, Utilization, and Storage (CCUS): CCUS technology focuses on sequestering carbon dioxide emissions arising from conventional steel production, through a blast furnace, for either underground storage or for conversion to chemical products. Thus, unlike direct zero-emission steelmaking, the CCUS technology can reduce substantially the carbon footprint of traditional steelmaking processes. It is considered a transitional measure, permitting existing plants to comply with climate regulations without being refitted completely. The feasibility of CCUS will thus depend upon capture efficiency, storage safety, and cost-effectiveness. As governments increasingly offered incentives and set targets for emission reduction, CCUS is being increasingly considered within hybrid green steel strategies compared to scenarios emphasizing sustainability more than operational continuity.

Electric Arc Furnace (EAF) with Renewable Energy: In the production of steel, the EAF method finds widespread acceptance. Here, scrap steel or direct reduced iron is melted by means of electric arcs. When renewable electricity (wind, solar) is used for running electric arc furnaces, however, it becomes a low-emission process, suitable for green steel production. Its main advantages are in its flexibility, energy efficiency, and recycling of scrap materials. Several developed markets have seen commercial enterprises operating on EAF with renewable energy. This method follows circular economy principles and works best in urban places, where scrap steel collection systems have matured. Its application, however, depends upon the availability of scrap and the integration of renewable grid, both of which vary from region to region.

Biomass-Based Reduction: Reduction based on biomass substitutes coal or coke for carbon sources derived from biomass (such as charcoal) in the reduction of iron ore. It becomes carbon-neutral, considering if the biomass is sourced in a sustainable manner and is regrown to absorb the CO2 released. This should be especially appealing in regions where biomass resources are in abundance. Though this approach may lower life cycle emissions, issues encountered are supply chain logistics, land-use conflicts, and lower calorific value when compared to coal. Biomass reduction can act as the bridge technology for decarbonizing existing blast furnace operations, and a complementary one for other green steel routes. Improvement in technology and sustainability certification are key to scaling the solution.

Automotive: The automotive segment has accounted highest revenue share. Automotive is the foremost consumer of green steel establishment toward the goal of sustainability and regulatory mandates for carbon reduction. Electric vehicle manufacturers and traditional automakers have started integrating green steel into the manufacturing lines to make sure to lower the carbon footprint on their vehicles of the chassis, body panel, and structural components, which essentially have the same application as conventional steel but are far less in emissions during their production. The increasing consumer awareness and ESG commitments amongst producers is leading to cooperation between automakers and steel producers for setting up long-term supply chains for green steel. This sector is expected to have a strong growth track because of the global movement towards clean vehicle transit and life cycle emission reductions in vehicle manufacturing.

Construction: Green steel has momentum in the construction setup, especially for commercial and infrastructural projects looking for LEED certification or net zero goals-building frame, rebar, beam, and cladding materials. Governments and private developers alike are promoting sustainable construction, thereby applying higher demand for eco-friendly construction materials such as green steel. Green steel is compatible with green building codes and supports lifecycle sustainability, helping to reduce emissions associated with urban development. In keeping with commitments on climate change and the circular economy, new high-rises, bridges, and public infrastructure increasingly specify green steel. Construction demand will go up due to regulations, investor pressure, and long-term cost benefits associated with sustainable materials.

Green Steel Market Revenue Share, By End-Use, 2024 (%)

| End-Use | Revenue Share, 2024 (%) |

| Automotive | 40.40% |

| Construction | 28.10% |

| Energy & Power | 10.20% |

| Manufacturing | 15.30% |

| Others | 6% |

Energy & Power: The global energy and power sector sees high-strength steel used as a construction material in such renewables as wind and solar: wind turbine towers, solar mounting structures, and transmission towers. With a global tilt toward renewable energy and decarbonizing the power grid, green steel stands out as the most appropriate environmentally conscious material that meets low-carbon goals. Energy majors have started sourcing green steel into their supply chains to meet ESG commitments and regulatory expectations. On a much larger scale, hydrogen and green ammonia projects will demand eco-friendly steel in huge volumes for storage tanks, pipelines, and platforms. Thus, a strong long-term demand for the green steel in this sector is being created through the energy transition.

Manufacturing: One steel is for manufacturing industries to build up machinery, tools, components, and infrastructure for plants. Across manufacturing, green steel is being taken up in an ever-accelerating way, as companies of all sectors-from consumer goods to heavy machinery-are seeking to reduce Scope 3 emissions. Manufacturers are now looking to integrate green steel into product design to substantiate their sustainability claims and add value to their brands. Companies in sectors such as electronics, appliances, and industrial machinery are increasingly sourcing materials with low emissions to satisfy customer and regulatory demand. This segment is also influenced by carbon pricing, with companies seeking to reduce the embedded emissions in the goods they export. More green steel usage will thus spread across different manufacturing verticals as sustainability reporting grows toward standardization.

Others: This "Others" segment consists of applications such as consumer goods, shipbuilding, agricultural equipment, and defence. With a lower tonnage as compared to the other segments, these industries still foster the demand for green steel in a big way. An example in this context is consumer electronics and white goods, where the use of green steel in casing or structural components is gaining traction to cut down on lifecycle emissions. Green steel is being felt as an alternate with a lesser carbon footprint for maritime transportation in shipbuilding. Through government sustainability initiatives, the defence and aerospace sectors are beginning to adapt green materials for bases, equipment, and vehicles. Agricultural machinery and tools are also being conditioned towards more environmentally friendly materials. This diversity of applications reveals the cross-sectoral capacity of green steel and the immense sustainability awareness across the whole industrial spectrum. As global carbon accountability spreads, even those users of steel that traditionally were relegated to very low tonnage are seeing some value in the switch to green alternatives, gradually paving the way for comparatively small-scale dispersal.

The green steel market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

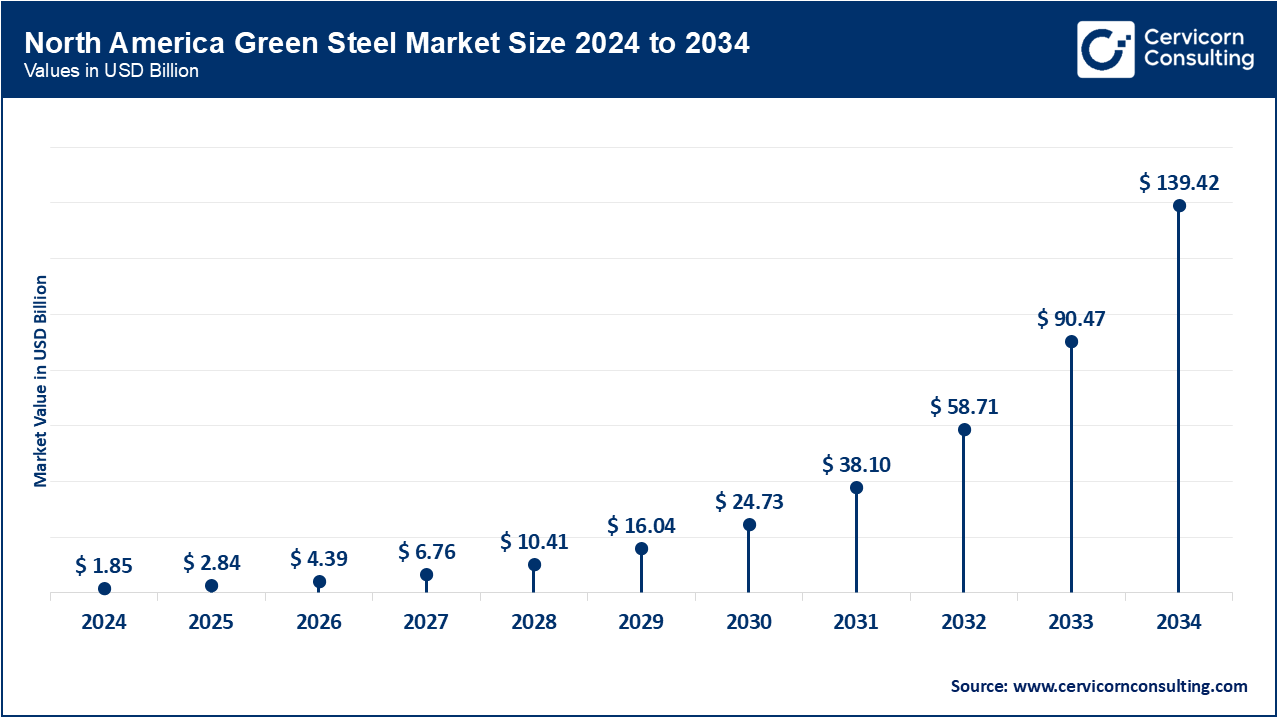

The North America region has therefore been charging ahead in green steel, with regulatory pressure on carbon emissions gaining pace, followed closely by the manufacturers and automotive sectors flying the sustainability flag. There are upward trends for green hydrogen production and electric arc furnace (EAF) technologies in the U.S. and Canada, both considered significant actors in the green steel ambience. Steel-making units in the country seem to be propagandized under influence of tax regimes, clean energy policies, and so on towards greener alternatives. Automotive OEMs and construction companies, however, need the greener steel to support their ESG objectives and meet requirements given by the consumers. The partnerships between the big steel houses and renewable energy providers are coming up and getting stronger. But on the downside, high upfront costs, coupled with some level of reliance on the traditional steel-making process, remain stumbling blocks. The region, with the ever-rising awareness and policy support across decarbonization goals, is expected to swell to a very large green steel demand contributor.

Europe maintains supremacy over the global market due to rigorous environmental regulations, high carbon prices under the EU ETS, and strong political will towards net-zero emissions by 2050. Germany, Sweden, and the Netherlands are leading countries where companies such as SSAB, ArcelorMittal, and Salzgitter AG are taking the first steps in hydrogen-based DRI and other low-carbon technologies. The Green Deal of the European Union and the coming into being of the Carbon Border Adjustment Mechanism (CBAM) have fast-tracked the move towards sustainable steel production. In addition to this, both private and public sectors promote green metallurgy innovations with investments. The demand from industries downstream is robust, especially from automotive, construction, and infrastructure, which are put under pressure to decarbonize their supply chains. In contrast to other geographies with lower production costs, the European green steel market gets an advantage from the policy-driven structure to act as a catalyst for global green steel adoption.

Owing to rapid industrialization, immense infrastructure development, and enhanced environmental consciousness, the Asia-Pacific is the fastest-growing region. Countries such as China, Japan, South Korea, and India are increasingly focusing on the decarbonization of their steel sector-the one with the highest carbon emissions. Being the largest steel producer in the world, China has set targets for peak carbon emissions and is also investing in hydrogen-based steelmaking technologies. Japan and South Korea are pursuing research in carbon capture and green hydrogen integration. India, with its growing population and steel demand, is now moving towards green steel pilot projects where the government-backed foreign collaborations are aiding. The exports are further driving the growth in the region as in demand territories for green steel. Against the attempts to transit to a greener route for steel production stand the high upfront investment costs coupled with traditional coal-based blast furnaces. With these factors, strong economic momentum and supportive policies are well poised to imbibe Asia-Pacific with transformative intent in the green steel landscape.

Green Steel Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 49.90% |

| Europe | 24.80% |

| Asia-Pacific | 20.20% |

| LAMEA | 5.10% |

LAMEA is slowly but surely emerging market. In Latin America, countries such as Brazil and Chile are pursuing green hydrogen projects to facilitate green steel production. Brazil would boast a fine renewable energy backdrop, thus befitting biomass and hydrogen-based DRI technologies. The Middle East is tapping its solar-energy potential into hydrogen production, with countries such as Saudi Arabia and the UAE launching green industrial projects so that their economic diversification strategies are complemented. Green steel in Africa is still in its infancy but is promising with increased foreign investment and regional partnerships. LAMEA faces constraints, such as lack of infrastructure, an obsolete knowledge-base when it comes to technology, and fractured policy environments. Having said that, the region does hold long-term potential to arise when global steel importers begin to demand low-carbon production options.

Market Segmentation

By Product Type

By Production Technology

By End-Use Industry

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Green Steel

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Type Overview

2.2.2 By Production Technology Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Corporate Net-Zero Commitments

4.1.1.2 Government Incentives and Funding Programs

4.1.1.3 Growing Investor Pressure and ESG Focus

4.1.2 Market Restraints

4.1.2.1 Limited Availability of Green Hydrogen

4.1.2.2 Long Payback Period for Investments

4.1.2.3 Logistical and Storage Limitations

4.1.3 Market Challenges

4.1.3.1 Technological Readiness and Scalability Issues

4.1.3.2 Supply Chain and Raw Material Constraints

4.1.3.3 Customer Willingness to Pay Premium Prices

4.1.4 Market Opportunities

4.1.4.1 Scaling Hydrogen-Based Steel (Green Hydrogen DRI)

4.1.4.2 Expanding Electric Arc Furnace (EAF) & Scrap-Based Circular Production

4.1.4.3 Tapping into High-Growth End-User Sectors

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Green Steel Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Green Steel Market, By Product Type

6.1 Global Green Steel Market Snapshot, By Product Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Flat Steel

6.1.1.2 Long Steel

6.1.1.3 Tubular Steel

Chapter 7. Green Steel Market, By Production Technology

7.1 Global Green Steel Market Snapshot, By Production Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Hydrogen-Based Direct Reduced Iron (H-DRI)

7.1.1.2 Molten Oxide Electrolysis (MOE)

7.1.1.3 Carbon Capture, Utilization, and Storage (CCUS)

7.1.1.4 Electric Arc Furnace (EAF) with Renewable Energy

7.1.1.5 Biomass-Based Reduction

Chapter 8. Green Steel Market, By End-User

8.1 Global Green Steel Market Snapshot, By End-User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Automotive

8.1.1.2 Construction

8.1.1.3 Energy & Power

8.1.1.4 Manufacturing

8.1.1.5 Others

Chapter 9. Green Steel Market, By Region

9.1 Overview

9.2 Green Steel Market Revenue Share, By Region 2024 (%)

9.3 Global Green Steel Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Green Steel Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Green Steel Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Green Steel Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Green Steel Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Green Steel Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Green Steel Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Green Steel Market, By Country

9.5.4 UK

9.5.4.1 UK Green Steel Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Green Steel Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Green Steel Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Green Steel Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Green Steel Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Green Steel Market, By Country

9.6.4 China

9.6.4.1 China Green Steel Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Green Steel Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Green Steel Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Green Steel Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Green Steel Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Green Steel Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Green Steel Market, By Country

9.7.4 GCC

9.7.4.1 GCC Green Steel Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Green Steel Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Green Steel Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Green Steel Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 SSAB

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Emirates Steel Arkan Group

11.3 Outokumpu Oyj

11.4 Swiss Steel Group

11.5 ArcelorMittal

11.6 China Baowu Group

11.7 Salzgitter AG

11.8 H2 Green Steel

11.9 Nippon Steel Corporation

11.10 Nucor Corporation