Green Cement Market Size and Growth 2025 to 2034

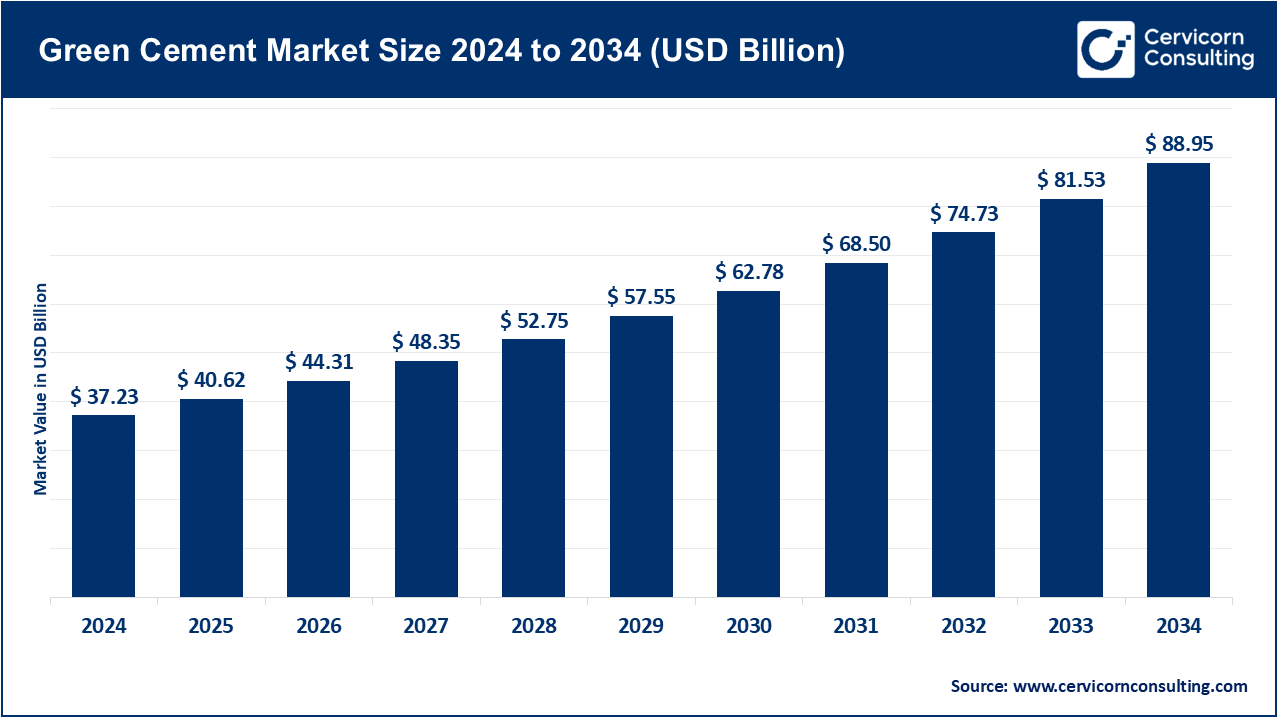

The global green cement market size was accounted for USD 37.23 billion in 2024 and is expected to hit around USD 88.95 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.1% over the forecast period from 2025 to 2034.

The global green cement market involves a profound metamorphosis of sorts in the construction industry toward sustainable and environmental-friendly alternatives to the traditional Portland cement. Green cement is produced by using industrial by-products like fly ash, slag, and recycled materials, which greatly minimize carbon emission and energy utilization during its setting and curing stages. It helps to lessen the overall carbon footprint of construction materials as per international sustainability standards and growing awareness of the environmental impact. Hence, it is an attractive alternative to conventional cement, comprising high compressive strength and durability, which champions anti-climate-change initiatives.

The green cement market is fuelled majorly by governments across the world setting stringent laws for carbon emission and growing environmental concern. Thus, more and more construction companies are resorting to green building materials in a bid to meet sustainability targets and regulatory requirements. Furthermore, the increasing demand for infrastructure developments, especially in the developing countries, is also pushing producers to think about greener alternatives. Improvements in production technologies have also increased the efficiency of green cement manufacturing, which further encourages its use in a wide range of construction applications. Moreover, as awareness about green buildings increases among developers and clients, the market has witnessed growth.

The market opportunities for green cement have been traditionally exploited as the industries and governments align to the goal of reducing carbon emissions while using sustainable building practices. Rapid urbanization and infrastructure development are setting the stage mainly in emerging economies, thus extending fertile grounds for the players to introduce green building materials.

Green Cement Producing Countries in North America

| Country |

Share, 2024 (%) |

| United States |

68% |

| Canada |

22% |

| Mexico |

7% |

| Others |

3% |

Innovation in product formulation and the use of alternative raw materials also provide the opportunity for manufacturers to differentiate and gain competitive advantages. Furthermore, it would also be a trigger toward the cement players forming strategic alliances with developers-eyed technologies and regulators on the R&D front to enhance product performance and the cost-efficiency of production.

Thus, projected economic and environmental benefits encourage more stakeholders to use green concrete in the construction of residential homes, apartments, and offices. Thus, with the building industry focusing on sustainable construction, these facets of green cement will offer further growth and investment opportunities, offering a path for innovation in the cement industry.

Green Cement Market Report Highlights

- By Region, North America has accounted highest revenue share of around 48.60% in 2024.

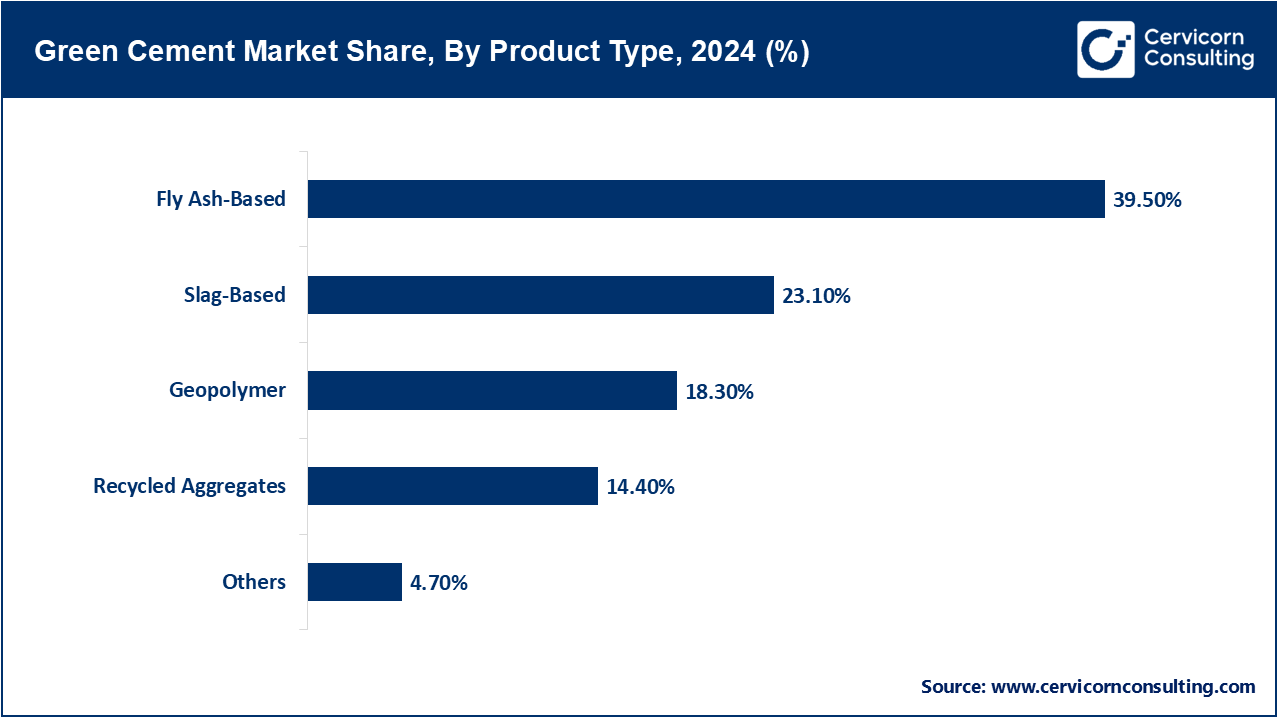

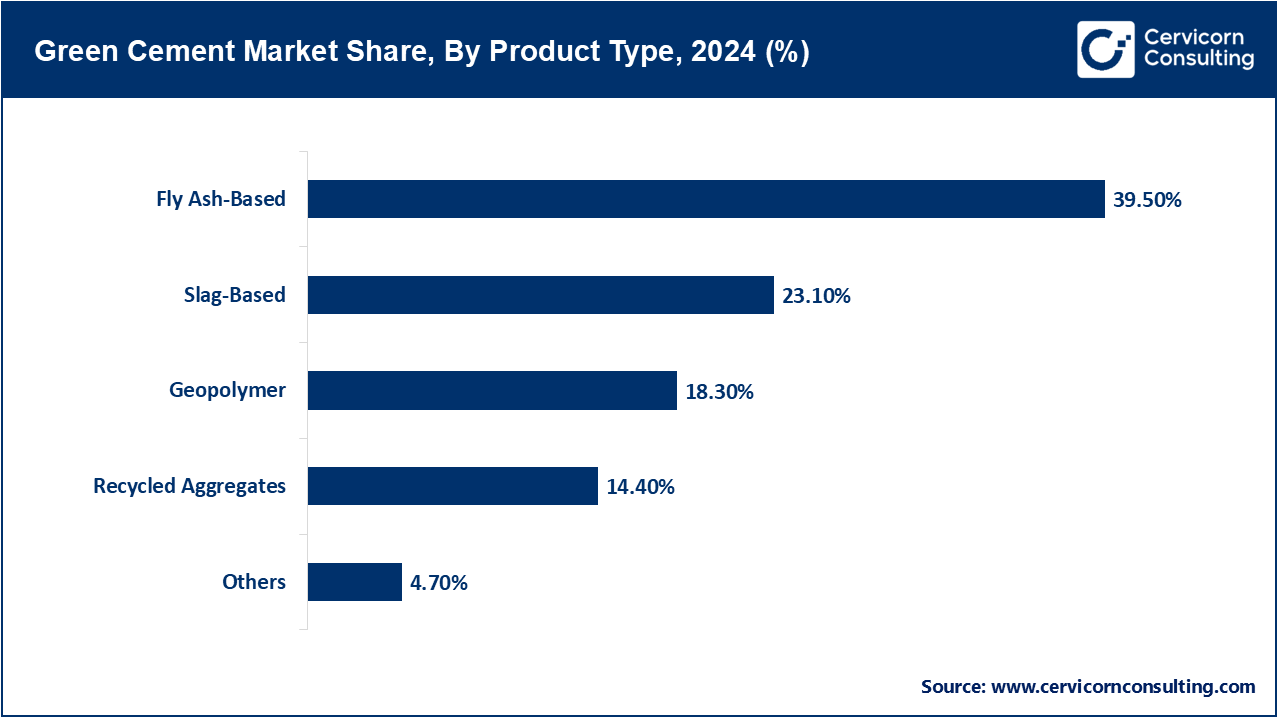

- By Product Type, the fly ash-based segment accounted for a revenue share of approximately 39.50% in 2024. This can be attributed to the wide availability of fly ash from coal-fired power plants, casting it as a cheap and green alternative to the conventional Portland cement. From an engineering perspective, fly ash augments the durability, workability, and strength of cement, making it very much favourable to infrastructure and residential construction. It duly marks up its status with a smaller carbon footprint and thereby conforms with environmental regulations and green building standards. With industries and governments all out to implement reductions in emissions connected with construction, the green cement based on fly ash has thus found a high level of acceptance and managed to remain atop.

- By Application, in 2024, the sector of residential construction with renewable energy saw a revenue share of around 42.50%. This is mainly because areas experiencing rapid urbanization and population growth have witnessed a direct increase in demand for sustainable housing, especially among developing economies, such as China, India, and Brazil. Furthermore, increases in awareness of population groups comprising prospective homebuyers about environmental impact are some factors that greatly accelerated the use of green cement in residential construction. Apart from that, the residential sector normally involves a greater number of construction projects than all the other segments, which include individual houses or multi-storey apartment buildings. And now, more of these buildings require sustainable building materials that align with green certification schemes such as LEED or BREEAM. Additional concerns for indoor air quality and energy efficiency among developers and homebuyers are further pushing the adoption of low-carbon options like green cement. Hence, the segment continues to dominate the market, presenting a greater growth outlook for developing and developed regions alike.

- By End-Use Industry, in 2024, construction & real estate registered a revenue share of 33.20%. Construction & Real Estate, among the end-user industries, dominates in the global green cement market. This dominance can be largely attributed to the construction industry's very urgent need to curb carbon emissions with an extremely adverse environmental impact. Traditional cement production is the biggest polluter of CO2; it is responsible for the production of some 8% of global CO2 emissions-wherewith-green cement comes forth as a potential green alternative with a smaller carbon footprint. Rapid urbanization is opening gates to the ever-increasing demand for sustainable construction materials in residential, commercial, and infrastructural areas-many of the volumes now lying in emerging economies. Governments and regulatory organizations promote green building codes and certifications like LEED to further promote its acceptance. Further, green cement is increasingly used by real estate developers to meet sustainability goals and lure the green buyers. Green cement is also preferred for its enhanced durability and thermal insulation, providing long-term construction savings. Therefore, Construction & Real Estate is also a leading sector in terms of both consumption volume and revenue generation.

Green Cement Market Growth Factors

- Urbanization and Smart City Initiatives: As urban populations across the world grow, more housing and infrastructure are required. Governments are diligently pursuing smart city initiatives to ensure that urban growth fits within the framework for sustainability. Issues revolving around energy conservation and waste management put the priority on a range of construction issues pertaining to the choices of construction materials. With lightweight carbon emission and utilization of industrial by-products, green cement fits into the broader scheme of sustainable urban development. Nowadays, the green cement is becoming a popular option in smart city infrastructure that includes road development, transit systems, energy-efficient buildings, and utilities. Use of green cement in these projects serves the cause of environmental conservation, along with structural considerations. The increasing demand for green building certifications by urban planners and contractors has also propelled the use of green cement in urban infrastructure. As many countries launch their own smart city movement, green cement shall witness increased application on a variety of construction sites.

- Corporate Sustainability Commitments: Under increasing pressure from stakeholders and investors, sustainability and carbon neutrality commitments are being made by many global corporations, especially those in construction and real estate. Such Environmental, Social, and Governance (ESG) goals bring about changes in procurement and in the running of an enterprise largely including those related to green building materials. With its characteristics of being low emission and using recycled materials, green cement aligns well with circular economy practices and thus plays a significant role in such strategies. By putting green cement in their supply chains, multinational companies are not only aiming at compliance with legislation but also at building their brand and limiting their long-term environmental liabilities. This demand for greener alternatives is shifting the nature of the markets and encouraging manufacturers to upscale production of green cement and engage in further innovation. As ESG compliance becomes a basic requirement for doing business, corporate sustainability commitments would stay one of the driving forces behind the rapid growth of the global green cement market.

- Growing Consumer Awareness of Eco-Friendly Materials: Consumers are now more aware of the environmental impact of materials used for construction and infrastructure development. Increasingly, it is a shift that is most pronounced in residential and commercial real estate as buyers have begun to ask questions about sustainability, energy efficiency, and eco-labels. Cement being a central product in construction, construction companies responded to the demand by adopting green cement into their building techniques. Technically speaking, green cement entails carbon emission reduction, better thermal insulation ability, and utilization of recycled contents, thus fulfilling customer preference in areas of environmentally responsible living spaces. Green certification of a building is viewed as a long-term contractor of savings on energy bills and thus attractive to buyers’ conscious of cost and conscious of the environment. This latest trend is, of course, not something that is just in developed nations, and in fact, so much so that emerging markets too have had a rise in consumer-driven green building adoption. As it will continue and grow in the coming times, the demand for sustainable construction input materials like green cement will grow significantly worldwide.

- Circular Economy and Industrial Waste Utilization: The global emphasis on operating the circular economy sustains industrial procedures, resource efficiency, and waste reduction. Green cement takes its stand in the cement industry to that extent, permitting the use of industrial wastes such as fly ash generated in coal plants, blast furnace slags from steel production, and silica fumes from silicon production. These wastes are recycled as key components of green cement instead of going to waste: a much-needed facility because the wastes otherwise cause serious environmental problems. This also helps minimize the needs for conventional materials used for cement-making, such as limestone and clay, involving intense mining and processing. Besides, often, green cement consumes less power than its traditional counterpart, giving it yet another point in Favor of sustainability. Governments and environmental agencies are offering preferential schemes and grants supporting these measures. With the growing acceptance of circular practices, green cement will witness extensive growth as a sustainable option to recycle waste materials.

Green Cement Market Trends

- Growing Demand from Emerging Economies: The rapidly urbanizing economies of India, China, Brazil, South Africa, and Indonesia are getting fast infrastructures. Governments in these regions are increasingly setting the green standards in public projects to resist growing pollution levels apart from adherence to global levels of climate change agreements. With the rise of smart cities, highways, affordable housing schemes, and transport corridors, there is an increasing need for green materials for construction, which includes green cement. Besides, national policies for carbon emission reduction and environmental performance improvement are leading both local and international companies to set up green cement plants. Considering labour costs are typically cheap in these countries, alongside heavy government support for green practices, a further establishment of green cement can be expected. This is a double win in the sense that it fosters economic development alongside sustainability, thus putting emerging economies on the map as important contributors to the world's green cement industry.

- Increased Investment in R&D and Circular Economy Integration: To address environmental concerns and about sustainable resource use, the green cement industry has been pushing for innovative technologies and circular economy solutions. Both somewhat established cement producers and fledgling units are constantly in the process of R&D to produce alternatives to binders and clinker from industrial wastes such as fly ash, slag, silica fume, and recycled aggregates, etc. Technologies that provide to produce low-carbon cements from alkali-activated materials, carbon-mineralization, and electrified kilns, offering equal or better performance characteristics, are hence being explored. Accordingly, the circular economy approach to convert demolished concrete into aggregate and wastage material from other industries goes a long way in lessening its carbon footprint and reducing material cost. This integration tries to minimize the usage of natural limestone and facilitates waste-usage for climate mitigation goals. There are a few avenues that act as nodes to tie together an interactive network system scaled between innovation and commitment to environment, whereupon R&D initiatives are very much grown based on government grants and sustainability-driven investors.

- Strategic Collaborations and Green Certifications: With sustainability becoming an integral part of construction practices, partnerships between cement manufacturers, construction companies, architects, urban planners, and environmental agencies have gained importance. Such alliances strive to build a common understanding of accounting for green cement applications and enhancing certification procedures for these products. More projects, both public and private, are making such certifications essentially mandatory-Certifications such as LEED (Leadership in Energy and Environmental Design), BREEAM (Building Research Establishment Environmental Assessment Method), and regional labels such as GreenPro (India). To achieve certification targets, manufacturers adjust their processes and raw materials to align accordingly, thus improving transparency in products and their acceptance by the marketplace. Development research signing with universities, technology transfer with international players, and policy advocacy groups form part of strategic alliances. This creates a climate where innovation is encouraged while entry barriers within the regulated construction environment are minimized. And the heightened emphasis on traceability, life-cycle analyses, and environmental product declarations (EPDs) only strengthens certification's role in pushing green cement into mainstream markets worldwide.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 40.62 Billion |

| Expected Market Size in 2034 |

USD 88.95 Billion |

| Projected Market CAGR 2025 to 2034 |

9.1% |

| Key Region |

North America |

| High-growth Region |

Asia-Pacific |

| Key Segments |

Product Type, Application, End Use, Region |

| Key Companies |

Holcim Ltd., ACC Limited, JSW Cement, Green Cement Inc., UltraTech Cement Limited, Anhui Conch Cement, CEMEX S.A.B. de C.V., CarbonCure Technologies Inc., Heidelberg Cement, Others |

Green Cement Market Dynamics

Market Drivers

- Stringent Environmental Regulations on Carbon Emissions: One of the key drivers for the green cement market worldwide is the environmental regulations. It is said that traditional Portland cement manufacture-a highly dirty and carbon-intensive manufacturing process-consumes about from 7 to 8% of global CO2 emissions. New stringent environmental regulations and climate action plans have been implemented around the world to combat climate change by limiting the quantity of greenhouse gas emissions. The plans include carbon taxes, trade of carbon credits, compulsory environmental impact assessment, among others. These policies indirectly coerce cement manufacturers to avail themselves of less carbon-intensive alternatives such as green cement, which comprises industrial by-products (fly ash, slags, etc.) and advanced production technologies with low CO2 emissions. Regulatory framework in the European Union, North America, and certain regions of Asia are the most important contributors. Further, international agreements such as the Paris Climate Accord are also pressing for sustainable industrial operations, which additionally translate speedy adoption of green cement solutions both in public infrastructure and private construction.

- Growing Demand for Sustainable Construction Materials: Sustainability is the tectonic shift in the construction industry because of environmental issues and awareness, as well as buyer demands for green structures. Lower carbon emissions, energy efficiency, and less waste during cement production-all are proponents that can place green cement as a main solution. It generally makes use of recycled materials such as fly ash, slag, and silica fumes that would have otherwise been disposed of in landfills. In addition, green buildings are trending because of the myriad long-term advantages such as energy savers, good indoor air quality, and higher asset value. Certification systems like LEED and BREEAM incentivize builders and developers to embrace sustainable materials, making green cement a preferred option in certified projects. Urban planners, governments, and real estate developers are ever intent on seeking greener choices that bear on the larger global climate agenda and green building framework aspirations. The green cement market indeed stands to gain from a strong growth agenda, propelled by ever-growing demand for eco-friendly construction materials.

- Rising Urbanization and Infrastructure Development: Rapid industrialization is creating massive demand for all kinds of infrastructures in developing regions, especially in Asia Pacific, Africa, and Latin America, from roads and bridges to housing and commercial buildings. Environmentally conscientious governments employ time, resources, and energy on sustainable infrastructure to promote lifestyle formation of urban population while also bearing climate and environmental objectives. These green cements are the building transition for a better environment with its low adverse impact on the environment and potential long-term savings. It reduces emission, preserves nature and resources, and utilizes industrial waste. Thus, in both conscious public and private construction, it fits perfectly well. Additionally, green building mandates and sustainable procurement policies are being increasingly applied to many large infrastructure projects that are often government-funded. Smart city initiatives worldwide also emphasize sustainable construction materials. While development continues at a frantic pace in these regions, green cement integration into urban planning and infrastructure projects is gaining momentum, thereby emerging as a major growth driver.

Market Restraints

- Inadequate Infrastructure for Green Cement Manufacturing: The most advanced technology is the production of green cement, which involves sophisticated, often customized making of kilns and systems for alternative fuel and raw material use. Many places-with developing countries perhaps at a greater disadvantage-can be referred to as infrastructurally dearth-ridden for such requirements. Hence, they lack recycling or industrial aftermarket machinery that uses less energy, and even the logistical support required for sourcing industrial wastes or by-products. Due to this, cement producers find it difficult to scale up the manufacturing of green cement. Retrofitting existing plants is also technically possible in some cases but carries a huge capital expenditure and cost that may not seem justified to smaller players wishing to switch production. There is very little access to renewable energy, and carbon capture schemes also end up contributing to the prevailing challenge. Without a well-developed ecosystem governing their production, manufacturers find it tough to sustain efficiency and uniformity in green cement production. This infrastructure lag, gradually turning to become a bottleneck, becomes particularly severe in technically associate constrained high urbanization rank countries that promote widespread adoption and limit the growth potential for green cement on a global scale.

- Regulatory and Standardization Challenges: Green cement is one of the newest entries in the construction materials industry, and it lacks universally accepted regulatory frameworks or performance standards that would govern its manufacture and use. Different countries and regions hold different takes on what should be labelled "green," thereby causing confusion at the manufacture, builder, and bloke levels. Such disparities in certification, quality benchmarks, and carbon labelling do not allow green cement to grab hold domestically for large-scale acceptance. Besides, the slow approval from the various building code bodies and industry bodies awaiting an absolute validation of the long-term performance and durability of alternative cement formulations hinders the launch of green cement in major infrastructure projects. Also, the absence of direct incentives, support, or mandates further throttles investment and innovation in the sector. Until unifying global or regional policies take shape, regulatory uncertainty will continue to hold back green cement.

- Longer Setting Time and Performance Uncertainty: Green cement usually has the addition of industrial wastes such as fly ash, slag, and other pozzolanic materials, which sometimes may retard the setting time and impart early strength to the cement to some extent differently from conventional Portland cement. So much is said about time in the field of construction-as time is money. Any delay instigated due to long curing or inconsistency in performance poses as a risk to the schedule and budget of the projects. This uncertainty in performance remains to deter the contractors and engineers from making use of green cement in the critical works of building construction for high-rise buildings, bridges, or roads. Other than being concerned about durability, capacity of load, and compatibility with other needed materials, variability of compositions and formulations from supplier to supplier makes it much more difficult for someone to predict the behaviour of green cement under varying environmental conditions. More importantly pan and field-level data on long-term structural integrity are lacking. The performance aspects of uncertainty will continue to check any market growth until green cement technologies mature to a point where they can guarantee performance to the same level as traditional cement.

Market Opportunities

- Expansion in Emerging Economies: Emerging economies such as India, Brazil, Vietnam, and Indonesia are undergoing fast-paced urbanization, population growth, and development of infrastructures. These factors serve to bolster cement consumption thus providing a fertile ground for green cement. With increasing awareness of climate change and the heavy weight placed on minimizing carbon footprints, these countries are thus slowly adopting sustainable construction practices. Green cement offers an attractive option-cutting CO2 emissions and thus lessening energy consumption. With the assembly of smart cities ahead in developing countries, eco-housing, and infrastructure upgrades, the demand for green cement is poised for growth. Further demand can be created through investments coming into these countries from abroad and through public-private partnerships in the realm of infrastructure. The companies that will penetrate these markets ahead of others and create strategic collaborations with local players would gain a positional advantage as they propagate the adoption of sustainable construction.

- Government Support and Green Building Regulations: Government regulations enforcing sustainable construction materials and low-carbon building options are creating new windows of opportunity for green cement. A few countries bring into force green building codes, carbon taxation, and subsidies for carbon-friendlier construction. Such policies hasten the conversion from Portland cement to alternative binders, with alternative binders emitting less CO2 during production. Increasingly, public infrastructure tenders require environmental certification such as LEED, BREEAM, or IGBC, which aids the use of green cement. In addition, with international climate commitments such as Paris Agreement compelling nations to support low-carbon materials, should green cement manufacturers align with these situations, they stand eligible for grants, tax credits, and public sector contracts. Moreover, government-backed R&D activities and pilot projects in green construction technologies may enable cement manufacturers to innovate and industrially scale sustainable cement alternatives.

- Technological Innovations in Carbon-Neutral Cement Production: Such continued advancements in technology are opening new avenues for making cement carbon-neutral or carbon-negative. CCS, geopolymer cements, and the application of alternative raw materials like industrial by-products (fly ash, slag) are shores in the transformation of the cement industry. These technologies lower CO2 emissions and improve cement's mechanical and durability qualities. Companies investing in R&D to design proprietary green cement formulas can also share IP advantages and carve out new revenue streams. The cement environment combines AI, automation, process optimization, making production more efficient and sustainable. Also, joint ventures with startups, universities, and environmental research organizations nurture some disruptive innovations. With industries and governments setting lofty net-zero targets, low-carbon cement technologies will provide huge openings for innovators in the green cement industry.

Market Challenges

- Limited Awareness and Acceptance among End-Users: While green cement is environmentally friendly, its acceptance among contractors, architects, and developers is limited. Many in the construction field are not aware of the performance capabilities and long-term benefits associated with green cement. In fact, the suggestion is often thrown around that some green materials will come to lose their structural strength or durability. This scepticism, however, is not supported by widespread educational campaigns or incentives to advance the cause of sustainable construction materials. Also, for a host of reasons, mostly in emerging markets, decision-makers seem keener on short-term savings in the cost of construction, to the detriment of environment-friendly considerations. There must be well-planned awareness campaigning and case studies showing the use of green cement; otherwise, it might stand a very slim or no chance at all to substitute the normal cement. Such resistance can be overcome by encouraging industry demonstrations, pilot projects, and training, all showing working green cement. Another option to fast-track the introduction into the market would be working with policymakers to provide an incentive for green materials to be considered in building codes.

- Raw Material Availability and Supply Chain Constraints: The production of green cement depends on alternative raw materials, such as fly ash, slag, rice husk ash, and other industrial by-products and residues. The availability and steady supply of these materials vary considerably from one region to another, largely depending on local industrial activity. However, with the global trend to curb carbon emissions, coal-fired power plants are few and far between, with fly ash as one of the key inputs now becoming scarcer. Difficulty in sourcing and transporting these materials sends the procurement costs higher, especially in regions without local sources. Local unreliability of supply undermines green cement production at an industrial scale and simultaneously drives the cost of production upwards. Moreover, many developing regions lack adequate recycling and waste management infrastructure, thus hindering the process of collecting necessary alternative materials. Reliable and sustainable systems are established for the green cement input supplies; huge investments in infrastructure are needed, including storage facilities, with a strong need for inter-industrial coordination. Should this go unaddressed, restrictions limiting the scale-up opportunities and wider uptake into broad markets would be imposed.

- Longer Setting Time and Performance Uncertainty in Certain Conditions: Compared to traditional Portland cement, the setting time of green cement is comparatively longer. This delay could thus interrupt construction schedules since speed becomes the most important factor in fast-track infrastructure projects. Lastly, various green cement formulations sometimes react differently to extreme weather conditions, or they could differ when used in certain structural applications, such as in high-load-bearing bridges or marine environments. This uncertainty in performance discourages engineers and contractors who would otherwise value reliability and code-compliant work. Without standards and rigorous field-testing, many types of green cement keep regulators and end-users at bay. Inconsistent results from various projects can tend to compound their apprehension, undermining any confidence that can be afforded to this material in the long term. To solve this problem, manufacturers must improve product performance through R&D and develop formulations tailored for different environments and use conditions. Furthermore, certification and third-party verification will be helpful to build confidence and gain acceptance in the market.

Green Cement Market Segmental Analysis

Product Type Analysis

Fly Ash-Based: The fly ash-based segment has dominated the market. Fly ash-based green cement is prepared using fly ash, a thermal power plant waste generated from coal combustion. It acts as a partial replacement for ordinary Portland cement and helps in greatly reducing carbon emissions. This type of green cement gives easy workability, less heat of hydration, and even greater strength in the long run. The pozzolanic reaction of fly ash with calcium hydroxide to generate the cementitious compounds that further aid in durability. The green cement is much more utilized in countries with heavy thermal power generation like India and China. It is widely used in roadways, bridges, and tall structures due to its resistance to chemical attacks and lower permeability. Its demand is driven by the availability and regulatory framework supporting waste reutilization. However, the varying quality and consistency of fly ashes during implementation gave rise to quality control concerns.

Slag-Based: Green cement is slag- or blast-furnace-slag-based, and it uses ground granulated blast furnace slag (GGBFS) as one of the setting agents. This class of cement lowers clinker content greatly, with a resultant lesser carbon dioxide emission. The slag imparts properties like durability, resistance to aggressive chemicals, and resistance to sulphates, and therefore, it is well suited for marine construction, sewage treatment plants, and coastal infrastructure works. Another feature of slag-based green cement is that it increases workability and long-term strength while reducing curing heat evolution. Regions with a strong steel manufacturing region adopt them. Environmental regulations favouring industrial waste reuse and sustainable building materials drive the segment. Logistics challenges could hamper increased adoption due to transportation costs and supply chain dependence on the steel industry.

Recycled Aggregates: Green cement with recycled aggregates involves using crushed concrete or other C&D wastes as a substitute for virgin aggregates. This ensures lesser environmental load through mining of natural resources on the one hand and helps in keeping the landfill space free on the other. It thus follows the circular economy principle in the construction sector by closing the material loop. The recycled aggregates fare best in the production of low-grade concretes used for pavements, driveways, and non-structural elements. The advantages are reduction in material cost and further reduction in carbon footprint. Increasing use of these is being rewarded with incentives and green building certifications by governments and environmental agencies. Yet, poor quality control and hazards of asbestos contamination, coupled with limitations in structural applications from somewhat lower compressive strength than regular aggregates, hold back widespread acceptance in major infrastructure projects.

Geopolymer: This emerging green alternative comprised alumina-silicate materials such as fly ash, slag, or kaolin activated by alkaline solutions is sold under the term Geopolymer Cement. It obtains very few carbon emissions when compared to traditional cement: instead of limestone and high-temperature process, mere use of alumina-silicate precursors and alkaline solutions is made. Some other exciting properties of geopolymer cement include mechanical strength, thermal stability, fire resistance, and ant corrosivity, which would suit it very well for industrial flooring, precast structures, and refractory applications. This segment is further gaining momentum due to its eco-efficiency and technical performance. Geopolymer cement production supports waste valorisation by utilizing different industrial by-products. The research and pilot studies are rapidly advancing in Australia, Europe, and India. Its widespread commercialization is otherwise hampered by scale-up issues, absence of standardized codes, and pricing of alkali activators on the higher side.

Others: Other areas include alternative green cement formulations such as magnesium-based cement, limestone calcined clay cement (LC3), and other innovative formulas with environmental impact reduction as a goal. Usually, these variants act to reduce the clinker factor, embodied carbon, or work with low-carbon binders. As a good example, LC3 mixes calcined clay, limestone, and low clinker to give a low carbon yet high-performance cement. Magnesium-based cements have also been subjected to interest as carbon absorbers. Innovative green cement mixtures usually have academic research and pilot construction projects supporting them. Market demand for high-performing, sustainable materials is expected to grow, thus implying the huge potential for this market segment to grow in the future. On the contrary, being new and not yet fully industrially produced puts them in a position to be challenged concerning regulation, supply chains, and market acceptance.

Application Analysis

Residential Construction: The residential construction segment has captured highest revenue share. Residential construction uses green cement to make housings that sustain and reduce environmental impact while enhancing energy efficiency. Growing demand for green housing in metro cities is pushing green cement into apartments, villas, and multi-family-based housing blocks. The segment benefits as consumer awareness goes up on carbon footprints, the government provides incentives for green buildings, and sustainable urbanization is under way. Green cement is favoured for its benefits in ways of lesser CO2 emission, greater thermal insulation, and better durability, thus making it an excellent choice for homeowners and developers. This, in fact, increases opportunities, especially in places where there are strict green building codes and greater housing shortages. Moreover, green cement serves well with contemporary construction methods such as prefabrication and 3D printing, adding to the value of green cement for residential applications. Real estate developments and sustainable housing policy integration around the world are going to stabilize the segment growth with time.

Non-Residential Construction: Non-residential construction includes commercial buildings such as offices, retail centres, educational establishments, and healthcare facilities. In the segment, demand for green cement is increasing to attain sustainability objectives, acquire green building certifications such as LEED or BREEAM, and align with ESG standards. Governments and organizations now pay considerable importance to the use of environmentally friendly materials for the development of any infrastructure, public or private, so as to curb the operation cost and to maintain high environmental performance. Green cement is appreciated mainly because it emits low carbon dioxide, offers superior durability and energy savings that ensure operational effectiveness on a longer basis for huge buildings. Corporate sustainability commitments and regulations promoting low-carbon construction materials act as further drivers for demand. On the other hand, public investment in green schools, hospitals, and administrative buildings is another wave favouring the growth of this segment. Thus, as companies increasingly seek to enhance their environmental profile, it is set for a sharp rise in the utilization of green cement in non-residential construction across established market economies as well as emerging ones.

Green Cement Market Revenue Share, By Application, 2024 (%)

| Application |

Revenue Share, 2024 (%) |

| Residential Construction |

42.50% |

| Non-Residential Construction |

29.70% |

| Infrastructure |

19.20% |

| Industrial Construction |

8.60% |

Infrastructure: Giving further scope for the construction of infrastructure are roads, bridges, tunnels, dams, railways, and airports in this application portfolio. It is used for national sustainability agendas by governments and private contractors to minimize lifecycle costs while increasing resilience in critical infrastructure. Low environmental emissions, high compressive strength, and resistance to extreme environments go in favour of large-scale public works for green cement. Even else, this segment is fostered by the initiative for carbon-neutral transport systems and green urban development. Also, funding for sustainable infrastructure, which is generally backed by climate-focused lending institutions, would lower using eco-friendly materials like green cement. The climate-proof and resilient infrastructure of developing countries is the subject of investment to facilitate speedy urbanization and to keep climate threats at bay. This is further supplemented by stringent environmental regulations and procurement standards that require the use of green alternatives in government-funded projects. Given that a larger share of investment is being attracted by sustainable infrastructure, this application segment is poised to take the lead about volume.

Industrial Construction: Industrial construction includes factories, warehouses, power plants, and manufacturing establishments. Such projects require materials that can withstand heavy loads, chemicals, and temperature variations. Green cement fits in well here. Industrial emissions are increasingly being controlled under various environmental laws, thereby making it mandatory for industries to choose green materials all along the supply chain, including plant construction. Green cement can cut down carbon emissions during production and insulation and durability improve in industrial setups, better energy efficiency, and greater longevity of structures. On the other hand, industrial companies are now considering sustainability issues within their corporate policies and, hence, also resort to green-building practices. Green cement aids in meeting regulatory requirements applicable for high-emission sectors, such as mining, energy, and heavy manufacturing, and helps in ESG reporting. Greenfield projects in emerging economies and retrofit projects in advanced economies further supplement the growth of this segment. Given such advancement of greener footprints and intelligent industries, the industrial construction segment is in store as a pocket for green cement.

End-Use Industry Analysis

Construction & Real Estate: The construction and real estate segment constitutes the first end-user across the globe. With respect to the growing need for sustainable infrastructure, urbanization, and green building norms, usage of green cement by the segment nears residential, commercial, and institutional projects. Developers prefer green cement along with other eco-friendly materials for the purpose of obtaining green certifications such as LEED. The incentives by the governments to promote energy-efficient buildings and as one of the means to be considered as low carbon footprint building, further boost the demand for green cement. Green cement, in comparison with traditional cement, has good thermal insulation, more durability, and is a low carbon footprint product. With this, the segment is expected to hold the highest share in the coming years, especially in emerging economies that are leaning toward investments in smart cities and eco-housing developments.

Oil & Gas: In the upstream area of the oil and gas sector, green cement is sold for White Cement applications such as well cementing and infrastructure of refineries and pipelines. Being the segment that includes sustainability mandates and environmental regulations promotes the use of green materials from this perspective. Green cement will help reduce the carbon footprint for massive construction in very hostile environments of an offshore platform and drilling sites. It acts fast and offers strong mechanical strength along with chemical resistance, a necessity in oilfield applications. In the determination to improve ESG (Environmental, Social, and Governance) concerns, there is an uptake of green cement in operations for companies to perform regulatory compliance and win attraction from socially responsible investors.

Green Cement Market Revenue Share, By End Use, 2024 (%)

| End Use |

Revenue Share, 2024 (%) |

| Construction & Real Estate |

33.20% |

| Oil & Gas |

22.60% |

| Transportation |

15.10% |

| Energy and Power |

18.40% |

| Others |

10.70% |

Transportation: The transportation category comprises roads, highways, railways, airports, and ports, all requiring high-performance construction materials. Green cement is increasingly being favoured in the transportation segment for its comparatively low emissions during production and increased durability. As governments across the globe are pouring money into sustainable infrastructure, this segment is anticipated to witness growth in adoption rates. Being affected by massive wear and tear, transportation infrastructure practices use green cement due to increased resistance to environmental factors. Furthermore, the existence of public-private partnerships and green funds promotes the usage of environmentally safe construction materials. The high scope of this sector is emphatically realized due to the large-scale development projects being achieved in both developed and developing countries.

Energy & Power: The energy and power sector, especially renewable energy infrastructure, relies on sustainable construction materials for land development and for substations or foundations of wind turbines. Green cement finds its use for solar farm construction and hydroelectric power dams due to its durability and eco-friendliness. Thus, the global transition to clean energy is pushing cement demand in the sector. Green cement itself reduces carbon emissions and meets the environmental goals of energy companies. Further, the long life and structural strength of green cement allow for cuts in maintenance and lifecycle costs that make it an attractive constituent for energy-related construction.

Others: This segment includes industrial manufacturing, water treatment plants, public infrastructure, and institutional projects (like schools and hospitals). Green cement is being adopted for the sake of sustainability and the amenity of being cheaper over time. Public infrastructure projects are a key area of emphasis for governments and NGOs promoting environmentally friendly alternatives to conventional construction materials. The "Others" category thus reflects a very diverse and growing market opportunity as sustainability becomes a concern to absolutely every industry. Such applications may never have been considered major players in any individual segment but collectively take up a substantial share of the market, especially where policy-based demands for green construction exist.

Green Cement Market Regional Analysis

The green cement market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

What makes North America the leading region in the green cement market?

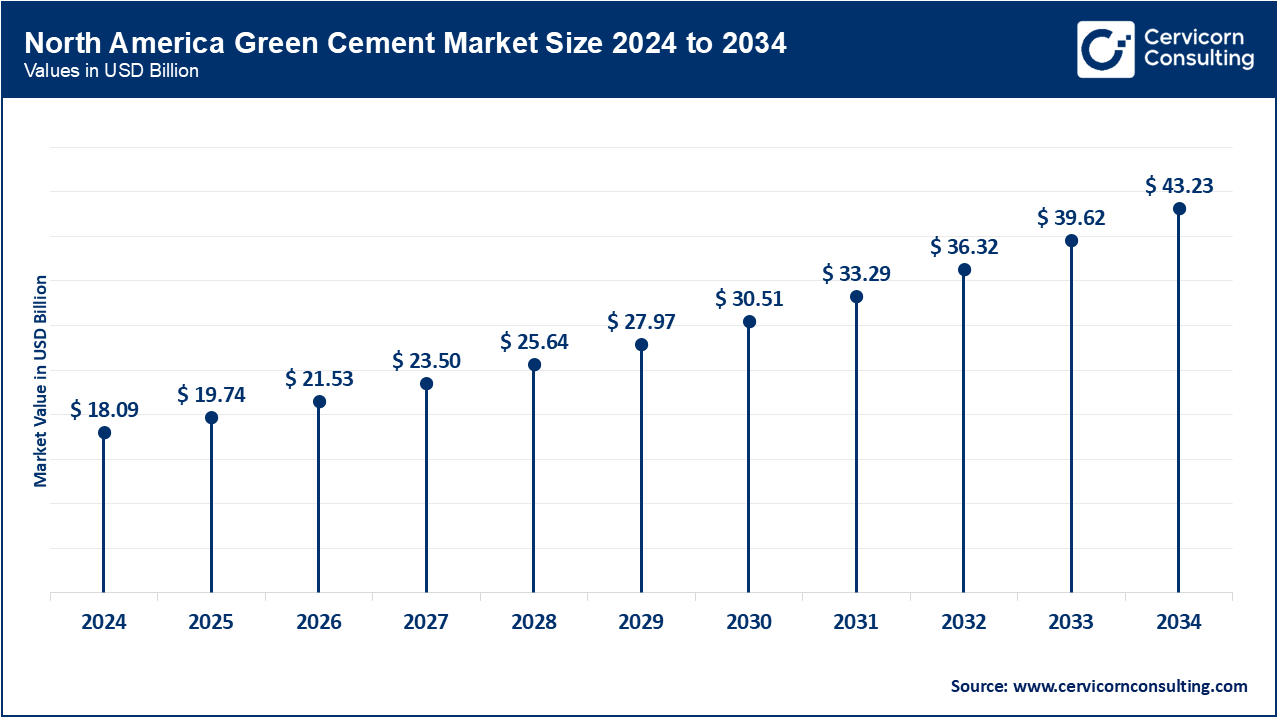

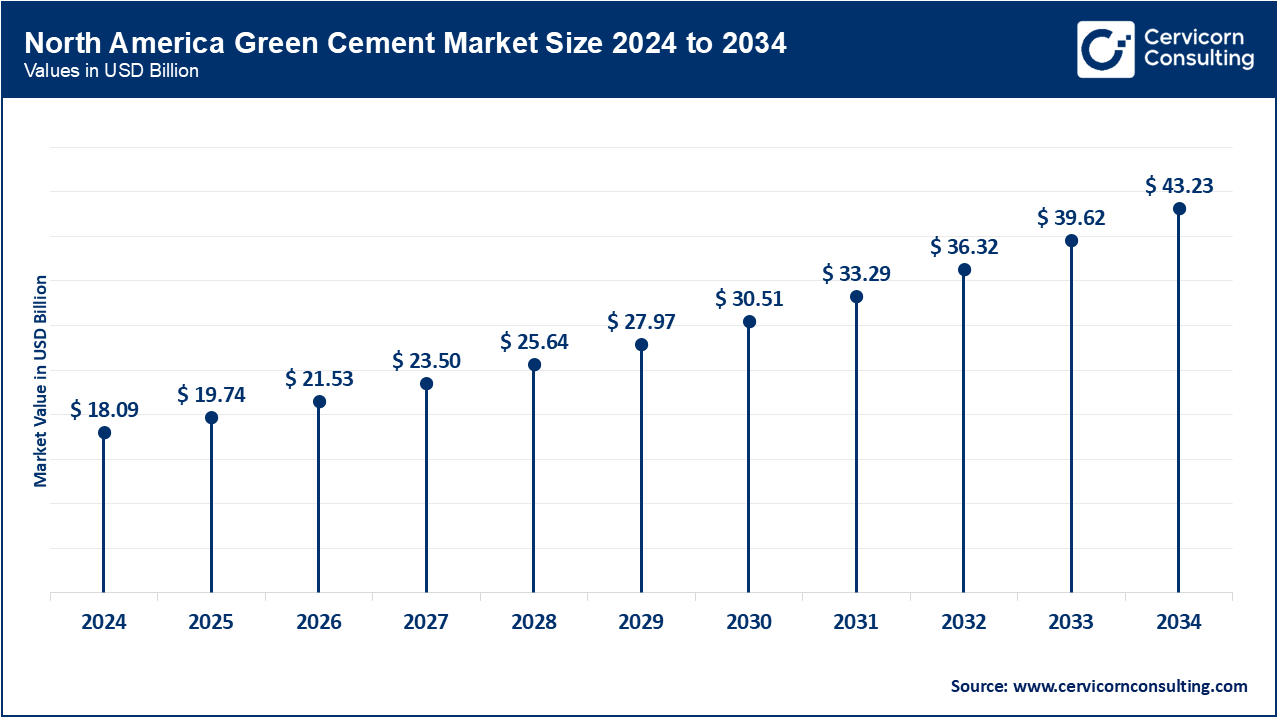

- The North America green cement market size was valued at USD 18.09 billion in 2024 and is expected to surpass around USD 43.23 billion by 2034.

North America is the biggest region in the market due to many environmental protection-related laws and a high demand for sustainable construction, along with governmental incentives supporting green building practices. The market is witnessing strong demand for energy-efficient, low-carbon cement from the U.S. and Canada, especially within commercial and residential real estate sectors. The presence of key market players in the regions and early adoption of newer technologies such as geopolymer and fly ash-based cement are even supporting the growth with increasing environmental awareness. Furthermore, specifications for green cement are increasingly being promoted for use in infrastructure projects of LEED-certified buildings. There is also an ongoing renovation of old infrastructures using eco-friendly materials, which thereby propels market growth.

Why has the European region experienced significant growth in the green cement market?

- The Europe green cement market size was estimated at USD 9.01 billion in 2024 and is projected to hit around USD 21.53 billion by 2034.

Europe stands to secure a larger share, given its ambitious climate goals associated with the European Green Deal. Other nations such as Germany, France, and the United Kingdom have heavily invested in decarbonizing the construction industry. Circular economy-related policies and carbon-neutral construction materials boost alternative binders like slag and recycled aggregates. Europe also leads on carbon capture and storage technologies in cement manufacturing. The presence of mature green cement producers alongside a strong collaboration framework for sustainable infrastructure initiatives involving governments and private parties bolster the growth of the industry in the region.

Why is Asia Pacific an emerging and fast-growing region for green cement market?

- The Asia-Pacific green cement market size was valued at USD 7.19 billion in 2024 and is expected to reach around USD 17.17 billion by 2034.

Asia Pacific is an emerging and fast-growing region. Demand for sustainable building materials is mainly generated due to high urbanization rate, heavy infrastructure projects, and environmental concerns in countries such as China, India, and Japan. Government policies toward carbon reduction in construction and FDI in eco-friendly development further assist in the market growth. There remains a lot of scope for traditional cement to be used in development works, but people are becoming more aware, and investors have been turning to greener options; however, much of the R&D is still green. Due to the construction boom in developing economies, green cement technology has a huge opportunity for market penetration in the region.

Green Cement Market Revenue Share, By Region, 2024 (%)

| Region |

Revenue Share, 2024 (%) |

| North America |

48.60% |

| Europe |

24.20% |

| Asia-Pacific |

19.30% |

| LAMEA |

7.90% |

Why is the LAMEA region still in the developing stage in the green cement market?

- The LAMEA green cement market size was reached at USD 2.94 billion in 2024 and is expected to hit around USD 7.03 billion by 2034.

LAMEA is thus a promising developing market for green cement usage mostly in urban development and public works. Latin American countries are adopting green practices, albeit slowly, while Middle East countries such as the UAE and Saudi Arabia are embedding green practices within their national vision. Africa is fuelled by international development aid projects with green infrastructure emphasis. However, low awareness, high cost, and poorly developed green building codes pose the challenge. With increasing urbanization and strengthening government initiatives toward reducing construction emissions, the green cement market potentially will witness moderate but steady growth in the LAMEA region.

Green Cement Market Top Companies

Recent Developments

- In October 2022, JSW Cement declared an investment of USD 390 million for the integrated green cement manufacturing facility in Madhya Pradesh and a split grinding unit in Uttar Pradesh. The investment includes clinker capacity of about 2.5 MTPA, grinding capacity of about 2.5 MTPA, and the installation of a 15 MW WHR system. The facility at Madhya Pradesh shall be an integrated facility, while the unit in Uttar Pradesh shall be a split grinding unit. This capacity expansion is a strategic move by JSW Cement to enhance its cement capacity.

- In July 2022, Hallett Group launched the $125 million green cement project aiming to offset 300,000 tons of CO2 emissions per year. Sprawling and lunar, this multi-site project covers Port Adelaide, Port Augusta, Port Pirie, and Whyalla in South Australia. This is part of a larger movement toward sustainable construction and carbon reduction in the cement industry.

- In July 2021, Holcim launched ECOPlanet, a global range of green cement with a minimum 30% less carbon footprint and meeting equal to better performance. The product is already available in Germany, Romania, Canada, Switzerland, Spain, France, and Italy, with plans for distribution across 15 more countries by 2021 to enlarge market presence twofold by the end of 2022, thus enabling scale-up construction considerations for low carbon.

- In January 2023, ACC introduced 'ACC ECOMaxX', a green concrete sector product range. These products, made by means of Unique Green Ready Mix Technology, to maximize the green impact by minimizing CO2 emissions by as much as 100%.

Market Segmentation

By Product Type

- Fly Ash-Based

- Slag-Based

- Recycled Aggregates

- Geopolymer

- Others

By Application

- Residential Construction

- Non-Residential Construction

- Infrastructure

- Industrial Construction

By End-Use Industry

- Construction & Real Estate

- Oil & Gas

- Transportation

- Energy & Power

- Others

By Region

- North America

- APAC

- Europe

- LAMEA

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Green Cement

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Type Overview

2.2.2 By Application Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Stringent Environmental Regulations on Carbon Emissions

4.1.1.2 Growing Demand for Sustainable Construction Materials

4.1.1.3 Rising Urbanization and Infrastructure Development

4.1.2 Market Restraints

4.1.2.1 Inadequate Infrastructure for Green Cement Manufacturing

4.1.2.2 Regulatory and Standardization Challenges

4.1.2.3 Longer Setting Time and Performance Uncertainty

4.1.3 Market Challenges

4.1.3.1 Limited Awareness and Acceptance among End-Users

4.1.3.2 Raw Material Availability and Supply Chain Constraints

4.1.3.3 Longer Setting Time and Performance Uncertainty in Certain Conditions

4.1.4 Market Opportunities

4.1.4.1 Expansion in Emerging Economies

4.1.4.2 Government Support and Green Building Regulations

4.1.4.3 Technological Innovations in Carbon-Neutral Cement Production

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Green Cement Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Green Cement Market, By Product Type

6.1 Global Green Cement Market Snapshot, By Product Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Fly Ash-Based

6.1.1.2 Slag-Based

6.1.1.3 Recycled Aggregates

6.1.1.4 Geopolymer

6.1.1.5 Others

Chapter 7. Green Cement Market, By Application

7.1 Global Green Cement Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Residential Construction

7.1.1.2 Non-Residential Construction

7.1.1.3 Infrastructure

7.1.1.4 Industrial Construction

Chapter 8. Green Cement Market, By End-User

8.1 Global Green Cement Market Snapshot, By End-User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Construction & Real Estate

8.1.1.2 Oil & Gas

8.1.1.3 Transportation

8.1.1.4 Energy & Power

8.1.1.5 Others

Chapter 9. Green Cement Market, By Region

9.1 Overview

9.2 Green Cement Market Revenue Share, By Region 2024 (%)

9.3 Global Green Cement Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Green Cement Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Green Cement Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Green Cement Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Green Cement Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Green Cement Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Green Cement Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Green Cement Market, By Country

9.5.4 UK

9.5.4.1 UK Green Cement Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Green Cement Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Green Cement Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Green Cement Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Green Cement Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Green Cement Market, By Country

9.6.4 China

9.6.4.1 China Green Cement Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Green Cement Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Green Cement Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Green Cement Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Green Cement Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Green Cement Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Green Cement Market, By Country

9.7.4 GCC

9.7.4.1 GCC Green Cement Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Green Cement Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Green Cement Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Green Cement Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Holcim Ltd.

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 ACC Limited

11.3 JSW Cement

11.4 Green Cement Inc.

11.5 Anhui Conch Cement

11.6 UltraTech Cement Limited

11.7 CEMEX S.A.B. de C.V.

11.8 CarbonCure Technologies Inc.

11.9 Heidelberg Cement

...