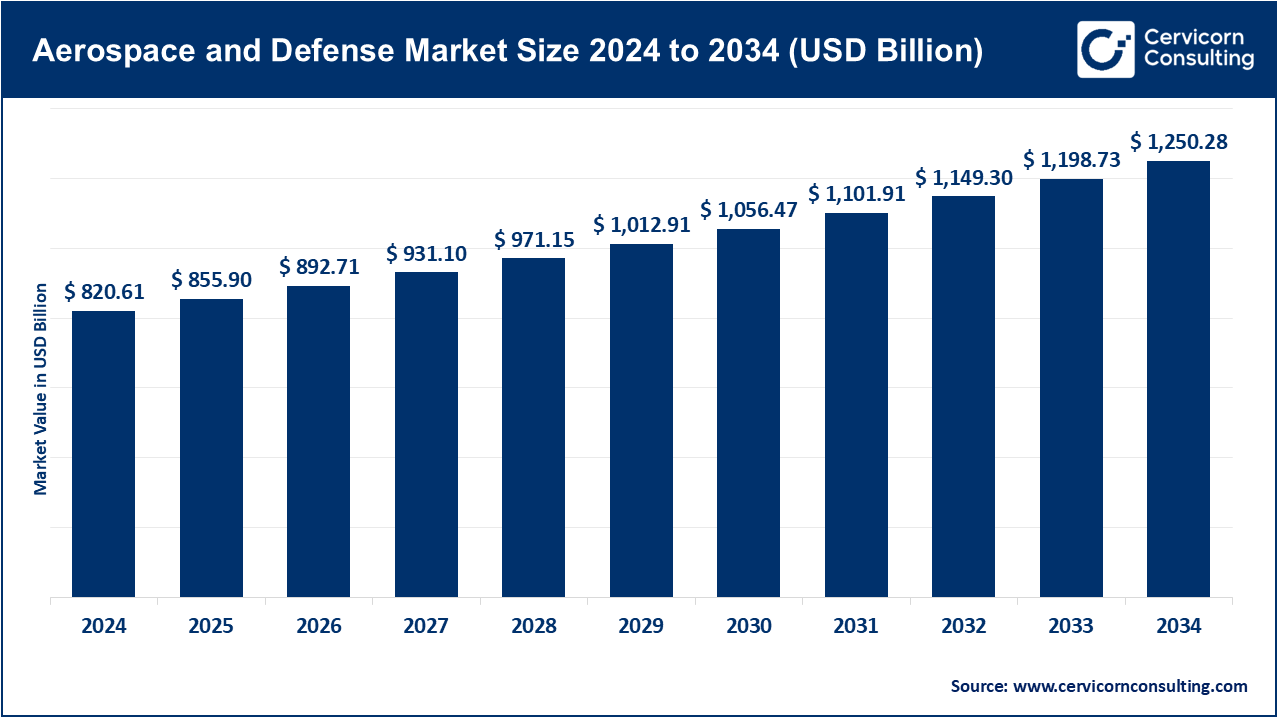

The global aerospace and defense market size was valued at USD 820.61 billion in 2024 and is expected to hit around USD 1,250.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.5% over the forecast period from 2025 to 2034.

The aerospace and defense market are expected to grow significantly owing to rising geopolitical tensions, increasing defense budgets, and rapid advancements in aerospace technologies. Demand for next-generation military systems, unmanned aerial vehicles (UAVs), and space exploration initiatives are driving investment. Additionally, the modernization of commercial aircraft fleets and strong air travel recovery post-pandemic are fuelling growth. Government partnerships and private sector innovation further support long-term expansion across global markets.

Artificial intelligence, autonomous platforms, cybersecurity tools, and new space capabilities are reshaping the aerospace and defense sector at a remarkable speed. Rising national security spending and surging private capital in space projects are injecting fresh energy into military planes, drones, missile systems, and satellites alike. Three striking trends stand out: hypersonic weapons, AI-assisted mission design, and an urgent drive for cleaner, greener flight. Partnerships among defense contractors, software firms, and leading cloud providers are speeding the march toward fully digital operations. At the same time, governments are crafting rules on ethical AI and the militarization of outer space. The result is a defense domain that is smarter, more automated, and deeply interconnected. Such a system underpins national security and fuels progress in next-generation technology.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 855.90 Billion |

| Expected Market Size in 2034 | USD 1,250.28 Billion |

| Projected CAGR 2025 to 2034 | 6.5% |

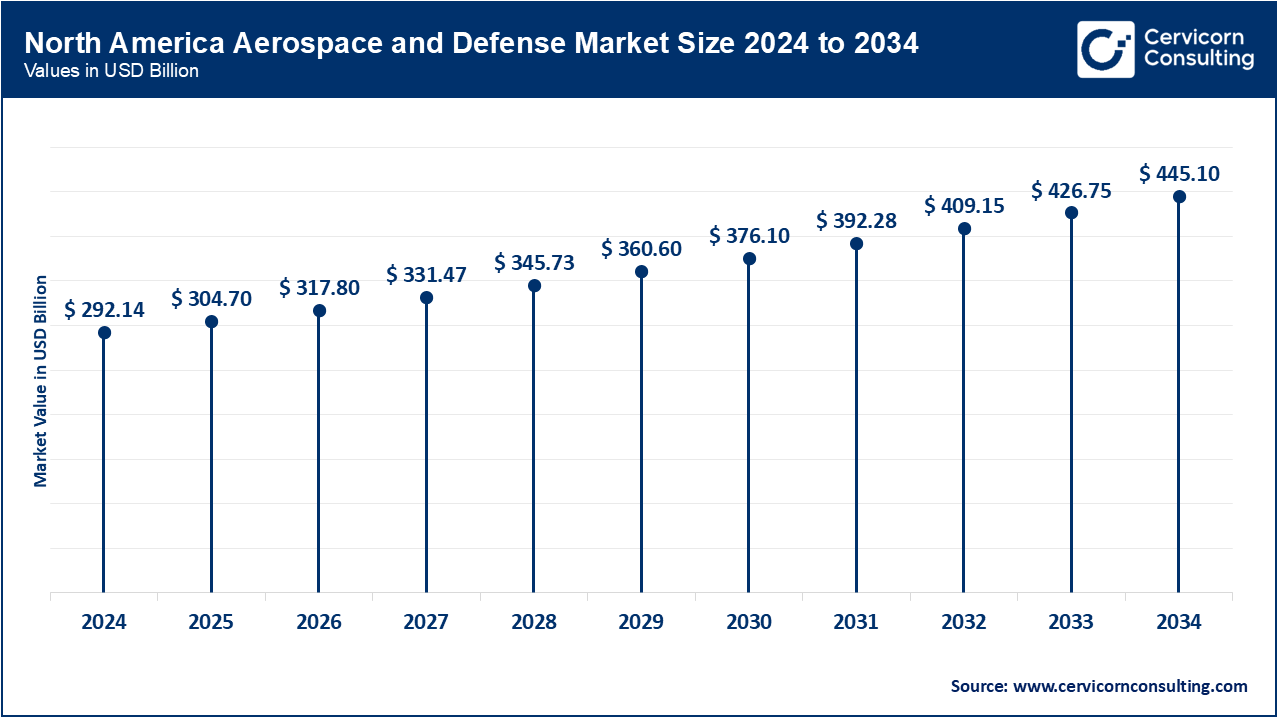

| High-impact Region | North America |

| High-growth Region | Asia-Pacific |

| Key Segments | Type, Operation, Component, Region |

| Key Companies | Northrop Grumman Corp, General Dynamics, Raytheon Technologies Corporation, Airbus Group SE, The Boeing Company, Lockheed Martin Corporation, Raytheon Co, Bae Systems plc, General Electric Company, Safran SA |

Aerospace: The aerospace segment has generated highest revenue share in the market. According to the Department of Transportation, U.S. civil aviation contributed $1.8 trillion to GDP and accounted for 9.4 million jobs in 2022. The FAA's NextGen modernization program will ultimately deliver over $12.3 billion in operational benefits by 2024, primarily through reduced fuel use and emissions. Moreover, NASA and the FAA co-sponsored the reporting of over 3.7 million hours of flights of UAVs in 2023 through the pilot integration programs. In early 2025, the DOT announced new expanded digital twins to better manage airspace with more optimal air traffic optimization. All these examples, especially those led by government initiatives, illustrate how aerospace systems are integrating autonomous tools into digital ecosystems under regulatory oversight to improve the overall safety and efficiency of their operations.

Aerospace and Defense Market Revenue Share, By Type, 2024 (%)

| Type | Revenue Share, 2024 (%) |

| Aerospace | 55.65% |

| Defense | 44.35% |

Defense: The U.S. Department of Defense released its first Defense Industrial Strategy in January 2024 to modernize the defense sector and to ensure greater resiliency and responsiveness in the supply chain. With the commit of funding for FY 2024-25 and the investments of over $5 billion for the development of hypersonic missiles, as well as, over $0.5 billion for orbital ISR (intelligence, surveillance, and reconnaissance) capabilities, the U.S. Department of Defense (DoD) established the Replicator program in August 2023 with the vision to have thousands of attritable autonomous systems, drones, UUVs, in operational fielding by mid-2025. This effort marked a departure from single or remote autonomous action to mass autonomous operations. These developments are important because they highlight legally supported strategic actions to strengthen national defense through advancing use of autonomous and artificial-intelligence-enabled capabilities.

Autonomous: In 2023 the DoD updated Directive 3000.09 to expand on review and approval requirements for autonomy in lethal systems to ensure human judgment remains at the forefront of the decision making. Contracts totaling $1 billion were awarded by Navy in 2024 for contracts utilizing unmanned surface vehicle autonomy systems, and subsystems (while compliance frameworks are heavily regulated). Process-oriented acquisitions that utilize autonomy were in production, like the Ghost Fleet Overlord project (USV fleet) that deployed multiple vessels completely untouched by a human by January of 2024. These government programs highlight both comprehension of autonomy across multiple defense environments, but also levels of oversight that are required, to allow advancements in capability development while preserving oversight, of autonomy and of use of force, in the air, land, or uncharted surface is still relevant in defense.

Aerospace and Defense Market Revenue Share, By Operation, 2024 (%)

| Operation | Revenue Share, 2024 (%) |

| Autonomous | 36.25% |

| Manual | 63.75% |

Manual: The manual segment has held leading position in the market. While autonomy tends to be trending towards high levels of autonomy, human-manned or operated platforms will continue to play a significant role. In its report the FAA noted that the 2022 civil aviation supported 9.4 million jobs, which highlights the undeniable relevance of human flight in the industry within the U.S. The funding allocated to the defense sector on the 2024 Defense Industrial Strategy continues to consider supporting crewed aircraft programs previously (and now) like F-35, B-21, or even nuclear-powered submarines and have to meet the highest requirements and standards under defense policy (DoD). The DoD modernization effort to software (in 2024) was only to include hybrid-human in the loop systems allowing for human oversight over commands and control which returned to, must be part manual. This has remained a back-end conforming requirement and is enforced under safety, certification, or legal regime across the defence (or aviation) and aerospace sectors.

Weapon System: The weapon system segment has dominated the market. In 2024, the AIM-260 JATM entered initial production as the priority for air-to-air weapon constructions by the U.S. military at the DoD's classified procedures for developing capabilities that include Mach 5 speed and long-range engagements. In 2025, Kratos received a 1.45 billion dollar contract to create hypersonic testbeds for subscale and full-scale hypersonic weapon platforms under DoD and MDA testing. The Replicator contracts in May 2024 included the purposeful use of autonomous offensive watercraft and loitering munitions like the Switchblade 600 as assessed against doctrine-based rules of engagement and compliant fielding requirements where the fielding of the systems involved the utilization of legally reviewed attorney vetting tools with comprehensive oversight frameworks.

Fire Control System: In 2024 and funded by DARPA, AI fire control capability platforms achieved 30% more precision using machine learned targeting and tracking algorithms as reported in defense briefing statements. As part of the US Navy SBIR Topic N242-078 in 2024, solicitations were issued to procure legally recognized autonomy agents to protect against adversarial threats that defend against legally recognized cyber risks to assure fire-control actions. The results of the Autonomous Multi-Domain Launcher air and ground launch trials (Project Convergence 2025) indirectly launched fired capabilities and fired with embedded autonomy within a DoD compliant constructive testing layout. Collectively, combined with the results in 2024, government agencies are enhancing the testing urgency surrounding fire-control systems enrolled in legally recognized procurement methods.

Command and Control System: In 2024, the DoD’s CIO led the merging of DevSecOps pipelines (C2SF and Vulcan) to modernize enterprise command-and-control software under legally mandated cybersecurity standards. NTIA-backed 5G/IoT pilot projects in 2024 introduced real-time encrypted sensor integration into tactical C2 nodes, meeting cybersecurity and latency compliance. DARPA’s 2025 roadmap emphasized explainable AI for command systems to ensure legal accountability and transparent decision logs. These developments highlight that next-gen C2 systems are being built atop secure, AI-integrated architectures governed by real-time auditing and policy-compliant frameworks.

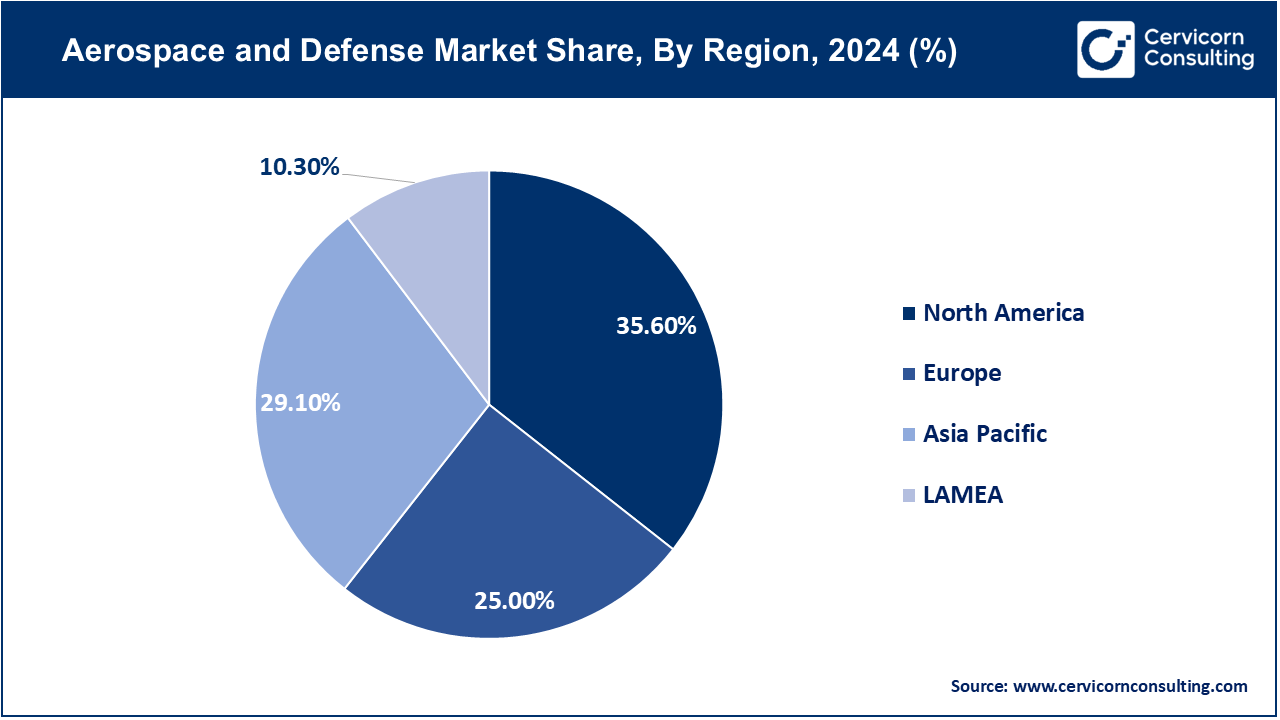

The aerospace and defense market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region:

The US Congress approved a budget for $145 billion on RDT&E in the FY 2024 National Defense Authorization Act, of which $1.8 billion was allocated for AI and $1.4 billion towards JADC2 - translating into considerable federal investment decisions within a defence modernization program across aerospace and defense. The government of Canada additionally updated its procurement budget for defence procurement to announce a commitment to CAD 13 billion in 2024 for modernised fighter jets and naval vessels within legally regulated procurement budgets. In 2025, SEDENA, Mexico's Secretaria de la Defensa Nacional, also acquired remote-sensing UAV platforms using a federally prescribed procurement regime to enhance border surveillance capabilities along land and maritime borders. Thus, these North American ASW nations are investing in aerospace and defense modernization activities within regulated procurement policies while undertaking a strategic alignment.

The UK reported a 49% increase in its defense export orders from 2022, at £14.5 billion in 2023. The defense order figure, especially in the aerospace sector, reported a record of 56% output controlled by legally regulated governance of government-mandated controls on exports. The UK government, in March 2025, announced the idea of a defense innovation program to establish a Defence Innovation Organisation to fast-track military technology into frontline support within its mission to support 430,000 defence jobs. Germany has committed significantly to agile systems and unmanned capability in an increase of 4% for its 2024 defense budget that was approved by the Bundestag. France, as part of the Direction Générale de l'Armement, announced its accelerated procurement of CAESAR artillery systems and tactical combat UAVs for 2024, to specifically deploy in Sahel aligned with the EU regulatory framework. Collectively, these countries demonstrate.

China’s Ministry of National Defense increased UAV and hypersonic program funding in early 2024, supported by new space-launch infrastructure under legally mandated five-year plans. India’s 2025 defense budget reached RS 6.81 lakh crore (~US$78.6 billion), with capital R&D up 13% and 75% of procurement reserved for indigenous platforms, notable projects include the Akashteer air-defense system and approval of 52 surveillance satellites. Japan’s Defense Ministry awarded 240 next-generation jet engines in late 2024 under its five-year plan for upgraded fighter fleets. Australia’s 2023 naval shipbuilding plan gained legal approval of AUD 270 billion to localize combat vessel and submarine production. South Korea enhanced its defense exports in 2023 by exporting missile defense systems under government–industry agreements. The region is advancing self-reliant, technology-driven military capabilities with legal backing.

In Latin America and the Middle East & Africa, countries are building indigenous defense capabilities through formal mechanisms. In 2024, Brazil increased its aerospace R&D budget by 12% from the previous year. The focus was on the continued upgrades of the Embraer KC-390 and in modernizing submarines. Recently, Brazil entered into R&D agreements with its Latin American neighbors, Argentina and Chile, regarding UAVs. In 2024, the UAE Air Force purchased AED 2 billion of AI-enabled radar and UAV systems to support its border security under import regulations. Saudi Arabia announced a SAR 10 billion commitment to manufactured domestic missiles and air-defense systems in 2023, aligned with Vision 2030. In 2024, South Africa's Armscor procured USD 0.025 billion for upgrades to command-and-control systems and make upgrades to Rooivalk helicopters. All these nations have developed AI, UAV, and naval systems with state-backed programs. The emphasis remains on defense autonomy, regional cooperation, and compliance with national procurement regulation.

Recent partnerships in the aerospace and defense industry focus on accelerating AI integration, automation, and multi-domain capabilities. Boeing and Shield AI teamed up in 2024 to co-develop autonomous drones using Hivemind AI software. Airbus partnered with Helsing to advance AI mission systems for European combat aircraft. Northrop Grumman collaborated with the U.S. Air Force on AI-driven missile warning systems. Lockheed Martin joined NVIDIA to apply digital twin technology for hypersonic testing and simulation. Raytheon expanded work with DARPA to enhance AI-based electronic warfare. These cross-industry alliances are transforming defense strategies through scalable, secure, and real-time AI applications.

Market Segmentation

By Type

By Operation

By Component

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Aerospace and Defense

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Operation Overview

2.2.3 By Component Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Technological convergence

4.1.1.2 Increase in cross-border cyber activities and digital warfare

4.1.1.3 Growing exports of defense equipment from developed nations

4.1.2 Market Restraints

4.1.2.1 Stringent regulatory and export control frameworks (ITAR, EAR)

4.1.2.2 Talent shortage in aerospace engineering and AI integration

4.1.3 Market Challenges

4.1.3.1 Balancing innovation speed with safety and compliance

4.1.3.2 Interoperability between legacy and modern systems

4.1.3.3 Potential backlash over AI-driven lethal autonomous weapons

4.1.4 Market Opportunities

4.1.4.1 Use of AR/VR in military training and combat simulations

4.1.4.2 Incorporation of quantum computing in secure communications

4.1.4.3 Sophisticated space-based surveillance and early warning systems

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Aerospace and Defense Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Aerospace and Defense Market, By Type

6.1 Global Aerospace and Defense Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Aerospace

6.1.1.2 Defense

Chapter 7 Aerospace and Defense Market, By Operation

7.1 Global Aerospace and Defense Market Snapshot, By Operation

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Autonomous

7.1.1.2 Manual

Chapter 8 Aerospace and Defense Market, By Component

8.1 Global Aerospace and Defense Market Snapshot, By Component

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Weapon System

8.1.1.2 Fire Control System

8.1.1.3 Command and Control System

8.1.1.4 Others

Chapter 9 Aerospace and Defense Market, By Region

9.1 Overview

9.2 Aerospace and Defense Market Revenue Share, By Region 2024 (%)

9.3 Global Aerospace and Defense Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Aerospace and Defense Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Aerospace and Defense Market, By Country

9.5.4 UK

9.5.4.1 UK Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Aerospace and Defense Market, By Country

9.6.4 China

9.6.4.1 China Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Aerospace and Defense Market, By Country

9.7.4 GCC

9.7.4.1 GCC Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Aerospace and Defense Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11 Company Profiles

11.1 Northrop Grumman Corp

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 General Dynamics

11.3 Raytheon Technologies Corporation

11.4 Airbus Group SE

11.5 The Boeing Company

11.6 Lockheed Martin Corporation

11.7 Raytheon Co

11.8 Bae Systems plc

11.9 General Electric Company

11.10 Safran SA