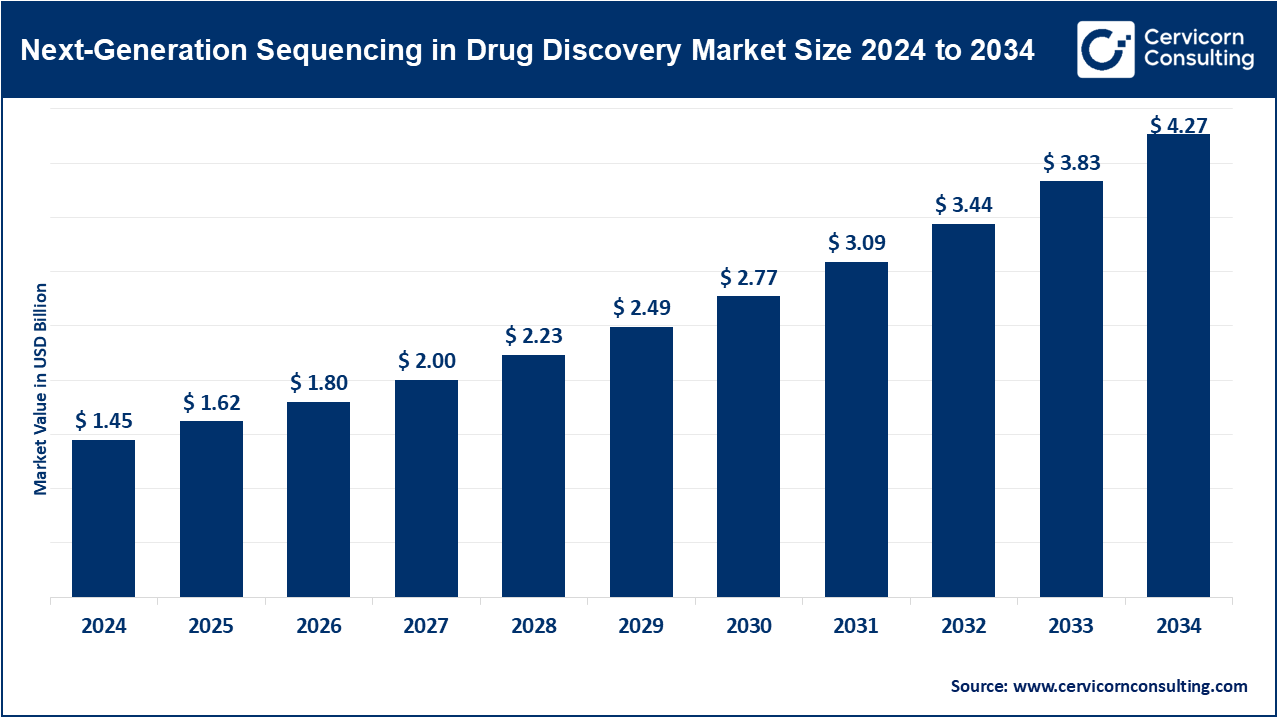

The global next-generation sequencing (NGS) in drug discovery market size was valued at USD 1.45 billion in 2024 and is expected to hit around USD 4.27 billion by 2034, growing at a compound annual growth rate (CAGR) of 18.3% over the forecast period from 2025 to 2034. The next-generation sequencing (NGS) in drug discovery market is expected to grow significantly owing to its ability to deliver high-throughput genomic data, accelerating target identification, biomarker discovery, and personalized medicine development. Rising prevalence of complex diseases like cancer, increasing R&D investment by pharmaceutical companies, and integration of AI-driven analytics for precision drug design further support its growth. NGS enhances speed, accuracy, and cost-efficiency across early-stage drug discovery pipelines.

The next-generation sequencing (NGS) in drug discovery sector is fundamentally changing pharmaceutical research and development by providing high-throughput genomic sequencing analysis and allowing for quicker and more accurate identification of drug targets and biomarkers. NGS improves the drug development process by providing: characterizing potential drug targets and biomarkers, de-risking targets in the preclinical stage, using predictive modeling, machine learning and artificial intelligence tools for variant interpretation, and using biospecimens sampled by traditional medical methods and processing them with a variety of sequencing options. The success of the NGS drug discovery market can be attributed to higher demand for personalized medicines from pharmaceutical companies, an increase R&D spending by pharmaceutical firms, and the need to integrate predictive modeling, machine learning, and artificial intelligence for modeling. Pharmaceutical firms and sequencing platform firms are beginning to collaborate with each other and with research institutions, increasing the potential for innovation in how drugs are discovered. As the cost to perform NGS increasingly decreases and the access improves, it is becoming a disruptive technology that will lead to more precise, rapid, and effective therapeutics being developed for medicines that are more patient-specific than previous versions.

Devices: NGS devices are high-throughput sequencing technology machines that automate all the sequencing of DNA or RNA samples. NGS devices play a key role in implementing sequencing workflows at scale as part of research and drug discovery. In 2023, the U.S. Food and Drug Administration (FDA) rolled out a pilot pre-certification program for next-generation sequencing (NGS)-based oncology devices, specifically for Illumina’s NovaSeq X platforms. Thermo Fisher released new versions of the Ion Torrent devices with increased throughput for rare disease gene panels. The National Institutes of Health's (NIH) All of Us program has announced that it will put $70M towards expanding sequencing infrastructure funding in 2024. Oxford Nanopore launched a vastly smaller sequencer that could be sent to the field for genomic surveillance. All of these developments have improved the overall capture of clinical trial data and the integration of decentralized sequencing.

Consumables: The consumables segment has accounted for highest revenue share in 2024. Consumables consist of reagents, flow cells, and sample prep kits that are needed for sequencing and sample prep processes. Each consumable is single-use with a single run, and it is critical for accuracy of results. In 2024, the Centers for Disease Control and Prevention (CDC) funded a project to help stimulate and localize U.S. manufacturing of next generation sequencing (NGS) consumables due to increased geopolitical threats to the supply chain. The World Health Organization (WHO) also has prequalified rapid DNA extraction kits for infectious disease genomics. Companies like QIAGEN also rolled out additional enzymatic prep kits that are designed and optimized for high-efficient low-input samples. There was also a strong need for sustainable, single-use plastic product options.

NGS in Drug Discovery Market Revenue Share, By Product Type, 2024 (%)

| Product Type | Revenue Share, 2024 (%) |

| Instruments | 37.90% |

| Consumables | 48.50% |

| Software & Services | 13.60% |

Software & Services: Software and services include bioinformatics tools, cloud-based storage, and analytics software utilized to process, interpret, and store the sequencing data. These services also include sequencing-as-a-service products. The U.S. Office of the National Coordinator for Health IT published genomic interoperability standards in the U.S. in 2023. Cloud-based AI tools began to contribute to clinical trial stratification, notably Google's DeepVariant and NVIDIA’s Clara Parabricks. The FDA updated the guidance for SaMD (Software as a Medical Device) in 2024 to require improved traceability of sequencing algorithms. EPIC and Cerner began implementing sequencing data modules into their EHRs to support oncology clinical workflows. Software is becoming increasingly influential in clinical decision-making and ensuring compliance with regulations.

Whole Genome Sequencing (WGS): WGS decodes the entire DNA sequence of an organism’s genome, allowing researchers to uncover structural variations, rare mutations, and genetic disorders. The NIH’s 2023 Genomic Data Commons reported a 20% increase in whole-genome datasets submitted for rare disease studies. Illumina’s NovaSeq X was adopted in major cancer genome projects. In 2024, the UK Biobank released over 500,000 WGS datasets, leading to novel drug target findings. WGS was incorporated in FDA-approved companion diagnostics for several tumor types. Lower per-genome costs due to high-throughput platforms are accelerating its use in mainstream drug discovery.

Whole Exome Sequencing (WES): WES focuses only on sequencing protein-coding regions (exons) of genes, which represent about 1–2% of the genome but contain most disease-related variants. In 2023, a CDC-backed pediatric study using WES identified new neurodevelopmental disorder biomarkers. Academic hospitals began using WES panels in undiagnosed diseases as part of NIH’s Rare Disease Clinical Research Network. Illumina and Thermo Fisher launched updated exome kits with faster hybrid capture. WES is now standard in early-phase oncology trials due to its balance between cost and actionable insights. Bioinformatic pipelines optimized for WES gained regulatory traction for clinical research.

Targeted Sequencing: The targeted sequencing segment has generated highest revenue share in 2024. This technique concentrates on sequencing specific genes or genomic regions of interest which also provides high depth and is less costly and has a faster turnaround time than either WGS or WES. In 2024, Tempus and Foundation Medicine received FDA clearance for new gene panels covering common oncogenic mutations. Targeted sequencing is now widely used in both companion diagnostics and pharmacogenomics panels. CMS also introduced new billing codes associated with reimbursement for specific cancer genomic panel-based diagnostics. COVID-19 surveillance pivoted to targeted amplicon sequencing to evaluate specific spike protein key regions. Researchers are using frequently to either evaluate therapeutic gene targets within rare diseases.

ChIP-Sequencing (ChIP-Seq): ChIP-Seq integrates chromatin immunoprecipitation with sequencing to analyze the association of protein and DNA to study protein-DNA interactions, allowing scientists to gain insights into transcriptional regulation as it relates to mechanisms of drug action. The ENCODE Project at the NIH expanded the funding for ChIP-Seq experiments from 2022 to 2023 to be used as a research tool in studies for at least 150 epigenetic targets. A number of academic drug discovery centers for drug makers employed ChIP-Seq studies to characterize the enhancer domains of immune-oncology genes. A 2024 study from Stanford utilizes ChIP-Seq to validate the regulatory elements for the CAR-T resistance mechanism. Some new antibodies and protocols for ChIP-Seq technologies focused on single-cell studies were developed this year. There are numerous advancements in ChIP-Seq that show this technology is an important tool for validating epigenetic targets.

De Novo Sequencing: De novo sequencing is clearly defined as a sampling approach to reconstruct the genome while not using a reference, and it can be important for studying organisms that have not been sequenced yet, as well as studying divergent genomes. De novo sequencing work was done by the CDC in 2023 to decode new bacterial strains involved in outbreak research of unknown commitment to hospital outbreak investigation. In 2024, the agricultural biotech sector used de novo sequencing to generate information to develop new plant biosynthetic pathways to make drugs and study plant derived drugs. There are very few systems using Nanopore sequencing, but the technology gained momentum with the good home disposition of long-read systems that Nanopore has demonstrated capabilities. The African Pathogen Genomics Initiative is establishing de novo sequencing systems to trace outbreaks in foreign locations. The de novo sequencing approach is also now used in increasing numbers of discoveries of drug targets for the microbiome.

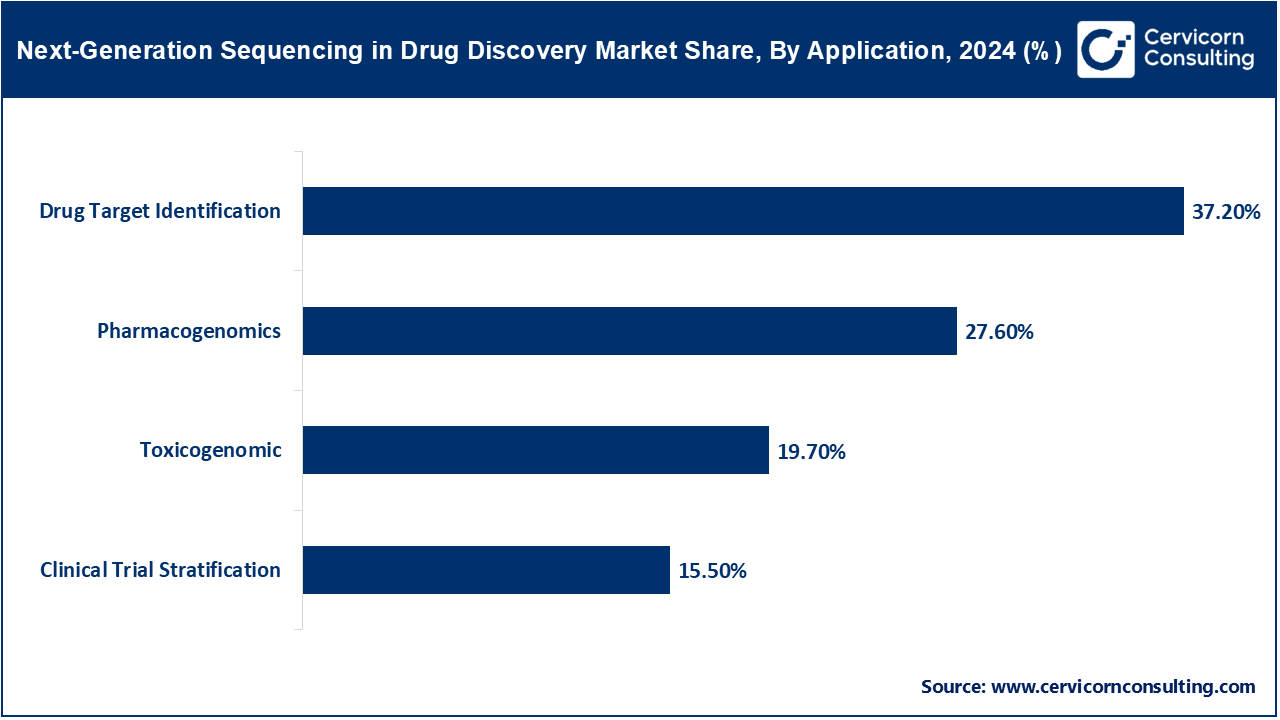

Drug Target Identification: This involves identifying specific genes or proteins that drugs can interact with to alter disease progression. NGS helps uncover these targets through large-scale gene expression and variant analysis. In 2024, the NIH Accelerating Medicines Partnership (AMP) expanded sequencing-based screening for autoimmune drug targets. Researchers at the Broad Institute used CRISPR-NGS integration to validate oncogene inhibition pathways. The FDA supported NGS-aided target identification under its Emerging Technology Program. Roche applied NGS to profile new targets in its inflammation drug pipeline. Advances in single-cell RNA sequencing have made target identification more precise across heterogeneous tumors.

Pharmacogenomics: Pharmacogenomics uses NGS to understand how genetic variations affect individual drug responses, enabling personalized therapies. It is critical in avoiding adverse drug reactions. In 2023, the U.S. Veterans Affairs program launched a major pharmacogenomic initiative using NGS to guide prescriptions. The expected use of NGS in screening patients in clinical trials. Publications are beginning to accumulate that describe improvements in clinical trial designs using genomics, which approach allowing trials to better determine variable cohort selections by process of elimination, and obtaining "real-world" data that would not have been possible using traditional trial designs. The FDA's Project Optimus will thoughtfully identify the "right" dose range for therapeutic agents, based on trial design approach based on genomic insights, a total departure from traditional trial designs without any genetic analysis.

Toxicogenomics: Toxicogenomics applies NGS to study gene expression changes after chemical exposure, helping identify potential drug toxicities early. In 2023, the Environmental Protection Agency’s ToxCast program was using RNA-Seq as part of its toxicogenomics program to find genomic markers of toxicity from high-throughput drug studies. The predictive toxicology roadmap of the United States Food and Drug Administration (FDA) placed next-generation sequencing (NGS) toxicogenomics in one of its top 5 tools. NGS methods were also employed to validate organoid responses to substances in liver toxicity modeling. The National Institutes of Health (NIH) employed funding derived from the American Rescue Plan Act (ARPA) mandates in 2024 to conduct transcriptome-based toxicological profiling (and screening) of immunotherapeutics. These developments signal the urgency to mitigate late COVID-19 drug studies which caused far too many drug candidate delays and substantial costs to advance drug programs that may have had unforeseen toxic effects.

Clinical Trial Patient Stratification: In clinical trials NGS has been employed for patient stratification and management by identifying actionable genetic biomarkers to predict individual patient treatment responses or disease progression. In 2023, FDA initiated Project Optimus which encouraged the incorporation of genomics for the redesign of trial dose response curves in oncology patients. Genentech began employing NGS-guided patient stratification in several exploratory and phase III clinical trials related to neurodegenerative disease trials. The Centers for Medicare and Medicaid Services (CMS) provided expanded coverage for NGS-based eligibility testing in rare cancer clinical trials for patients. Additionally, even adaptive clinical trials began to operationalize the real-time patient stratification NGS input. Collectively, the participation of NGS for clinical trial stratification and management is increasing both trial efficiency and associated patient response rates, improved regulatory approvals timelines, and overall increased trial approvals.

Pharmaceutical & Biotechnology Companies: The pharmaceutical & biotechnology companies segment has recorded highest revenue share in 2024. These companies use NGS for early discovery, target validation, biomarker discovery, and trial optimization. Pfizer, Merck, and Moderna expanded in-house sequencing infrastructure in 2024 to enhance personalized drug pipelines. The FDA fast-tracked NGS-driven biologic submissions under its Real-Time Oncology Review pilot. Amgen used NGS to identify new biosimilar markers in 2023. Biotech startups received NIH SBIR grants for NGS-based drug development tools. These entities are investing heavily in sequencing to shorten time-to-market and improve therapeutic precision.

Academic & Research Institutes: Universities and institutes use NGS to explore basic biology, disease mechanisms, and early-phase therapeutic research. In 2023, Stanford, MIT, and UCSF expanded NGS core labs with NIH funding under the Genome Technology Program. Harvard researchers used single-cell sequencing to identify rare neurodegenerative biomarkers. New York Genome Center launched a consortium in 2024 for pathogen sequencing in drug resistance. Many universities now offer NGS-based drug discovery programs. Their foundational research continues to power innovation across disease areas.

NGS in Drug Discovery Revenue Market Share, By End-User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Pharmaceutical & Biotechnology Companies | 46.20% |

| Academic & Research Institutes | 25.80% |

| Contract Research Organizations (CROs) | 17.50% |

| Hospitals & Clinics | 10.50% |

Contract Research Organizations (CROs): CROs conduct sequencing-based drug discovery, preclinical studies, and trial support on behalf of pharmaceutical clients. In 2024, Labcorp and ICON plc integrated long-read NGS in preclinical biomarker screening. CROs in India and Europe scaled up sequencing labs to meet outsourcing demand from U.S. and Japanese pharma. IQVIA expanded its genomics analytics wing in response to NGS demand. CROs increasingly offer full-stack sequencing—from sample prep to regulatory-ready data analysis. Their role is crucial in expanding affordable and rapid sequencing access.

Hospitals & Clinics: These end-users apply NGS to support clinical trials, companion diagnostics, and personalized medicine implementation. Mayo Clinic and Cleveland Clinic incorporated NGS into clinical drug-matching workflows in 2023. The CMS reimbursement for diagnostic NGS panels broadened, encouraging hospital-based pharmacogenomics programs. Children's hospitals began using NGS for stratifying rare disease patients in therapeutic trials. Academic medical centers use NGS data in IRB-approved drug validation trials. Hospitals are becoming key nodes in decentralized, patient-centric drug research networks.

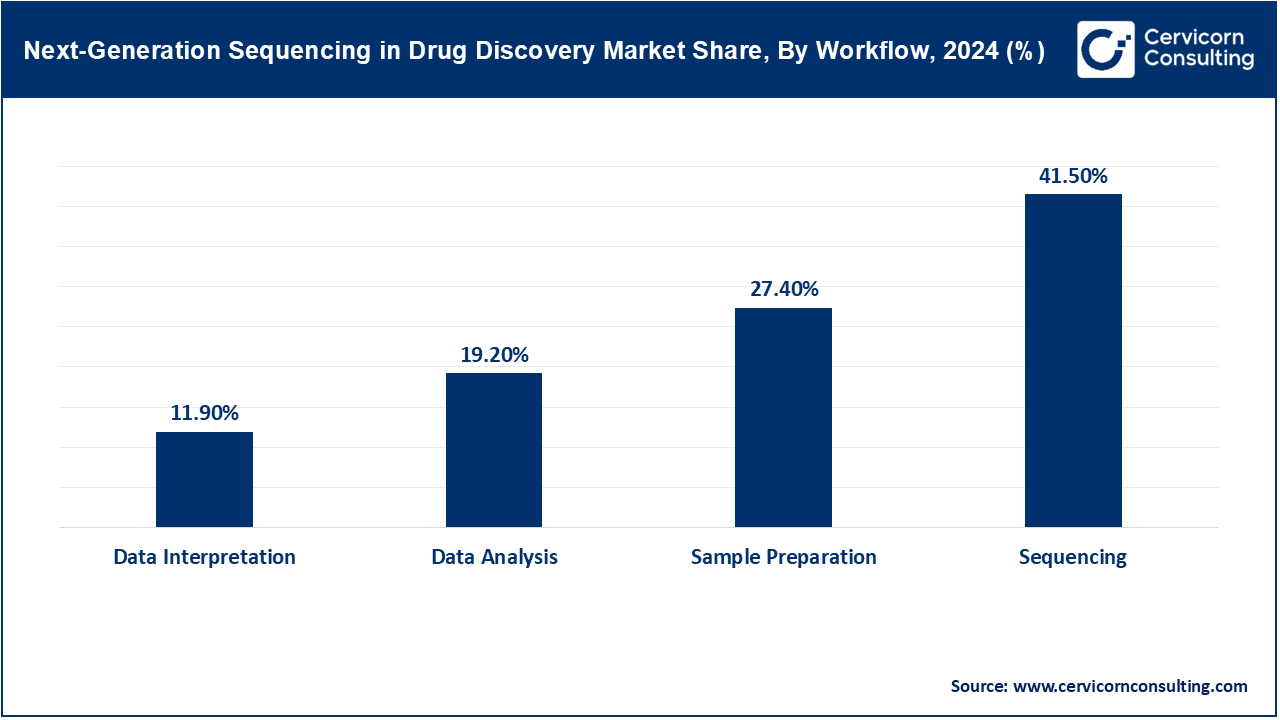

Sample Preparation: This includes DNA/RNA extraction, library prep, and enrichment processes to ready samples for sequencing. The FDA’s 2023 LDT rule impacted clinical labs by tightening oversight of sample prep protocols. QIAGEN and Roche introduced rapid prep kits with automation capabilities that reduce time by 30%. NIH labs began using magnetic bead-based kits in multicenter clinical research networks. Single-cell sample prep tools saw wider adoption for rare cell type analysis. Reliable prep ensures data accuracy, which is critical in regulatory drug discovery pipelines.

Sequencing: The sequencing segment dominates the market. This is the core step where genetic material is read, generating millions of short or long DNA/RNA fragments for analysis. In 2024, nanopore-based sequencing grew in adoption due to real-time analytics and long-read accuracy improvements. Illumina’s NovaSeq X platform achieved new clinical certifications in Europe. Clinical trial sponsors began integrating portable sequencers for decentralized study arms. WGS and WES adoption soared in adaptive trial designs. Sequencing accuracy and speed now directly impact trial endpoints and regulatory filings.

Data Analysis: This involves alignment, variant calling, and interpretation of raw sequencing reads to extract meaningful biological information. AI-powered platforms like NVIDIA’s Clara and DeepVariant gained traction in pharma for real-time variant interpretation. FDA guidance on traceability of genomic pipelines affected software design. The National Cancer Institute funded analytics research to handle terabyte-scale multi-omic integration. Open-source tools like GATK remained standard but now operate in FDA-partnered environments. Scalable, accurate analytics are critical for drug mechanism modeling.

Data Interpretation: This step translates genomic data into actionable insights for drug development, including target validation and biomarker discovery. In 2023, EPIC and Cerner EHR systems added genomic decision support tools to clinical modules. Pharma firms use interpretation software to stratify clinical trial populations more precisely. FDA’s SaMD guidance now requires audit trails for interpretation software. Genomic interpretation teams are now common in R&D units. This final step closes the loop between sequencing and therapeutic application

The NGS in drug discovery market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

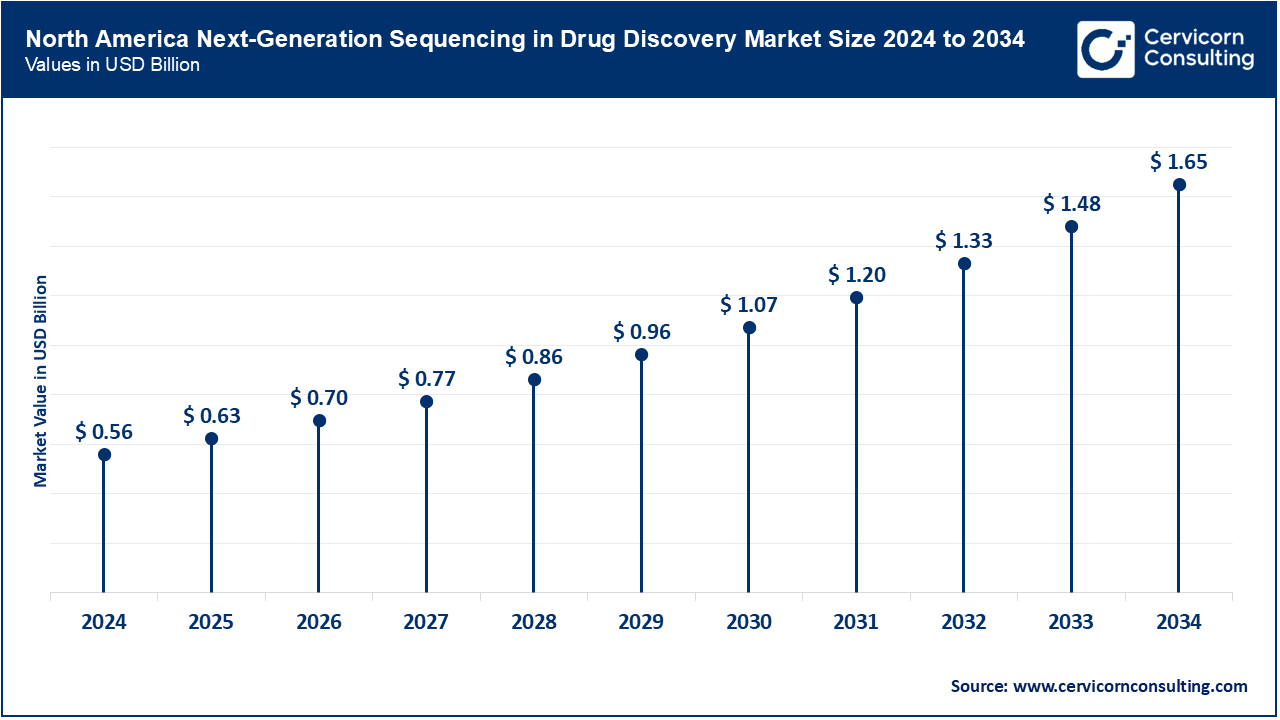

North America, comprising the U.S., Canada, and Mexico, dominates the NGS in drug discovery market due to advanced R&D infrastructure, regulatory clarity, and significant federal investment. The U.S. NIH allocated over $47.6 billion in 2023 toward biomedical research, with NGS playing a central role in target identification and pharmacogenomics. The FDA approved over 100 gene-related therapy INDs in 2024, many based on NGS data. Canada invested $0.2 billion in 2024 for genomics research under its Genomics Action Plan, supporting clinical-grade sequencing for personalized medicine. Mexico’s COFEPRIS approved several NGS platforms in 2023 for early drug toxicity screening. Academic centers in all three countries have integrated sequencing into clinical trial stratification. Government-led initiatives are aligning regional efforts for cross-border genomic data harmonization.

Europe is seeing robust growth in NGS-based drug discovery, led by the UK, Germany, and France, with heavy emphasis on regulatory support and digital health integration. The UK’s Genomics England program launched a drug discovery arm in 2023, sequencing 100,000+ genomes linked to clinical drug response. Germany passed legislation in 2024 to integrate genomic data into national EHR systems, enabling faster biomarker-based drug validation. France expanded its Plan France Médecine Génomique in 2023 with new sequencing centers in Paris and Lyon. European Medicines Agency endorsed a harmonized NGS validation framework in 2024. Public-private partnerships across the EU aim to enhance AI-enabled data analysis in drug trials. These countries are aligning their sequencing regulations under the EU Health Data Space framework. Clinical genomics for rare and cancer-related drug development is gaining traction.

Asia-Pacific is emerging as a major growth engine for NGS in drug discovery, supported by favorable regulations and large patient pools. China’s National Health Commission issued guidelines in 2023 promoting NGS adoption in clinical pharmacogenomics and drug resistance profiling. India’s Genome India Project reached its target of sequencing over 10,000 genomes by late 2024, enhancing drug trial design for genetic subgroups. Japan expanded its AMED funding in 2024, with NGS now embedded in government-sponsored oncology drug studies. Australia’s Genomics Health Futures Mission approved $0.08 billion in 2023 for using sequencing in rare disease drug development. South Korea’s MOHW funded national biobank sequencing for precision drug targets in 2024. Regional efforts are increasingly integrating NGS with AI for trial stratification. Cross-border collaborations are underway to standardize protocols across Asia-Pacific nations.

NGS in Drug Discovery Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 38.70% |

| Europe | 28.80% |

| Asia-Pacific | 23.30% |

| LAMEA | 9.20% |

LAMEA, including Brazil, UAE, Saudi Arabia, and South Africa, is expanding its capabilities in NGS-led drug discovery through national genome projects and international collaboration. Brazil’s Ministry of Health launched a Rare Genomes Project in 2023, aiding new drug target validation using exome sequencing. Saudi Arabia’s Vision 2030 plan included a 2024 directive to use NGS in drug development pipelines for hereditary diseases. The UAE’s National Genome Strategy accelerated in 2024 with a clinical genomics lab for personalized medicine R&D. South Africa’s National Genomics Program integrated sequencing into public hospital cancer registries in 2023. Brazil’s Fiocruz began NGS-based drug screening for infectious diseases in 2024. These countries are working to bridge sequencing gaps through public-private partnerships. Investment in local sequencing infrastructure is increasing to reduce reliance on foreign platforms.

Recent partnerships in the NGS in drug discovery industry highlight innovation and collaboration across biotech, pharma, and tech sectors. Illumina has partnered with Janssen and Deerfield to speed up drug target discovery using whole genome data. Thermo Fisher Scientific teamed up with Moderna to support mRNA drug development through high-throughput sequencing. Roche joined forces with PathAI to integrate AI with NGS for more precise cancer drug discovery. QIAGEN and AstraZeneca expanded their collaboration to use NGS in companion diagnostics. These alliances focus on improving accuracy, reducing development time, and personalizing treatments. Together, they are shaping the future of precision medicine through advanced sequencing technologies.

Market Segmentation

By Product Type

By Technology

By Application

By End-User

By Workflow

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Next-Generation Sequencing in Drug Discovery

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Type Overview

2.2.2 By Technology Overview

2.2.3 By Application Overview

2.2.4 By End User Overview

2.2.5 By Workflow Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Use of Electric and Hybrid Boats

4.1.1.2 Increase of Investment in Biopharmaceutical R&D

4.1.1.3 Academic and Research Institution Collaborations

4.1.1.4 Increasing Role in Rare Disease Research

4.1.2 Market Restraints

4.1.2.1 Problems with interpreting complex data

4.1.2.2 Problems with regulatory and ethical mechanisms

4.1.2.3 Limited Access in Low-Resource Settings

4.1.3 Market Challenges

4.1.3.1 Lack of Skilled Bioinformaticians

4.1.3.2 Analysis Pipelines and Standardization

4.1.4 Market Opportunities

4.1.4.1 Expansion in Personalized Oncology

4.1.4.2 Microbiome-Driven Drug Discovery

4.1.4.3 Integration with Digital Health Platforms

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Next-Generation Sequencing in Drug Discovery Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Next-Generation Sequencing in Drug Discovery Market, By Product Type

6.1 Global Next-Generation Sequencing in Drug Discovery Market Snapshot, By Product Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Instruments

6.1.1.2 Consumables

6.1.1.3 Software & Services

Chapter 7 Next-Generation Sequencing in Drug Discovery Market, By Technology

7.1 Global Next-Generation Sequencing in Drug Discovery Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Whole Genome Sequencing (WGS)

7.1.1.2 Whole Exome Sequencing (WES)

7.1.1.3 Targeted Sequencing

7.1.1.4 Chip-Sequencing (ChIP-Seq)

7.1.1.5 De Novo Sequencing

Chapter 8 Next-Generation Sequencing in Drug Discovery Market, By Application

8.1 Global Next-Generation Sequencing in Drug Discovery Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Drug Target Identification

8.1.1.2 Pharmacogenomics

8.1.1.3 Toxicogenomic

8.1.1.4 Clinical Trial Stratification

Chapter 9 Next-Generation Sequencing in Drug Discovery Market, By End-User

9.1 Global Next-Generation Sequencing in Drug Discovery Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Pharmaceutical & Biotechnology Companies

9.1.1.2 Academic & Research Institutes

9.1.1.3 Contract Research Organizations (CROs)

9.1.1.4 Hospitals & Clinics

Chapter 10 Next-Generation Sequencing in Drug Discovery Market, By Workflow

10.1 Global Next-Generation Sequencing in Drug Discovery Market Snapshot, By Workflow

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Sample Preparation

10.1.1.2 Sequencing

10.1.1.3 Data Analysis

10.1.1.4 Data Interpretation

Chapter 11 Next-Generation Sequencing in Drug Discovery Market, By Region

11.1 Overview

11.2 Next-Generation Sequencing in Drug Discovery Market Revenue Share, By Region 2024 (%)

11.3 Global Next-Generation Sequencing in Drug Discovery Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Next-Generation Sequencing in Drug Discovery Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Next-Generation Sequencing in Drug Discovery Market, By Country

11.5.4 UK

11.5.4.1 UK Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UK Market Segmental Analysis

11.5.5 France

11.5.5.1 France Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 France Market Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 Germany Market Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of Europe Market Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Next-Generation Sequencing in Drug Discovery Market, By Country

11.6.4 China

11.6.4.1 China Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 China Market Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 Japan Market Segmental Analysis

11.6.6 India

11.6.6.1 India Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 India Market Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 Australia Market Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia Pacific Market Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Next-Generation Sequencing in Drug Discovery Market, By Country

11.7.4 GCC

11.7.4.1 GCC Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCC Market Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 Africa Market Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 Brazil Market Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Next-Generation Sequencing in Drug Discovery Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 12 Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13 Company Profiles

13.1 Illumina, Inc.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Thermo Fisher Scientific Inc.

13.3 Agilent Technologies, Inc.

13.4 F. Hoffmann-La Roche Ltd. (Roche)

13.5 QIAGEN N.V

13.6 BGI Genomics Co., Ltd.

13.7 Bio-Rad Laboratories, Inc.

13.8 Oxford Nanopore Technologies plc

13.9 Pacific Biosciences of California, Inc. (PacBio)

13.10 PerkinElmer, Inc.