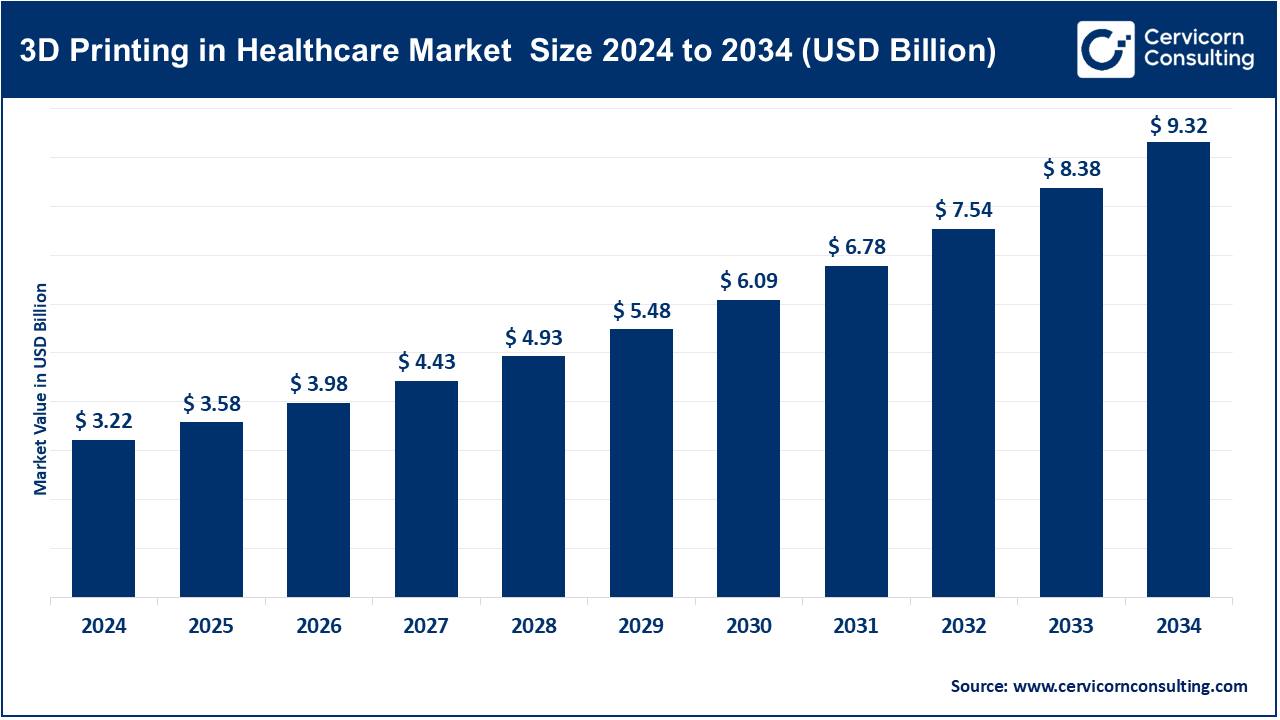

The global 3D printing in healthcare market size was accounted for USD 3.22 billion in 2024 and is expected to exceed around USD 9.32 billion by 2034, growing at a compound annual growth rate (CAGR) of 11.21% over the forecast period from 2025 to 2034.

The global 3D printing in healthcare market is expected to grow significantly owing to rising demand for personalized medical devices, increasing adoption of bioprinting for tissue engineering, and advancements in materials and printing technologies. Additionally, the need for cost-effective, patient-specific implants and surgical models, along with expanding applications in orthopedics, dental, and prosthetics, are driving growth. Regulatory support, ongoing R&D investments, and the expansion of digital healthcare infrastructure further accelerate market expansion globally.

The 3D printing in healthcare market is based on applying additive manufacturing processes to produce patient-specific medical devices, implantable medical devices, surgical instruments, prosthetics, and anatomical models. The technology allows for individualized patient treatment, enhanced surgical accuracy, and reduced lead times along with cost. Overall market developments can be influenced by an increase in access to biocompatible materials, the integration of imaging technologies (CT/MRI) into additive manufacturing, and increased demand for patient-specific health offerings. Increased collaboration among healthcare providers, academic and research institutions, and medical device manufacturers will continue to accelerate advancements with 3D printing technologies in the healthcare field, while the regulatory environment remains favorable, and hospital-based 3D printing labs continue to advance. Further automation, scalability and bioprinting of tissues will improve, whilst its continued rapid development and evolution could potentially create a new trajectory for the future of personalized medicine and surgical landscape.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 3.58 Billion |

| Expected Market Size in 2034 | USD 9.32 Billion |

| Projected CAGR 2025 to 2034 | 11.21% |

| Principal Region | North America |

| High-growth Region | Asia-Pacific |

| Key Segments | Product, Technology, Material, Application, End User, Region |

| Key Companies | Formlabs Inc., General Electric, 3D Systems Corporation, Exone Company, Materialise NV, Oxferd Performance Materials, Inc., SLM Solutions Group AG, Organovo Holdings, Inc., Proto Labs, Stratasys Ltd |

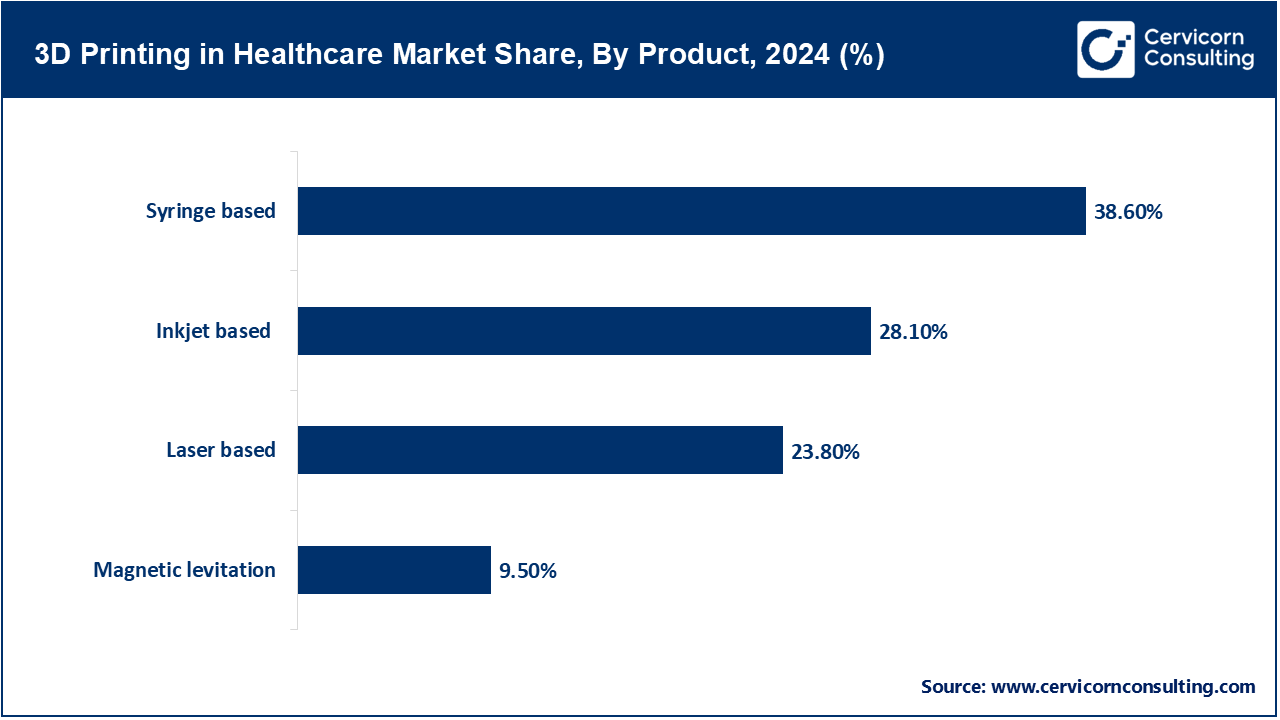

Syringe-based: Syringe - based 3D printing is often synonymous with bioprinting. Syringe-based printing extrudes material through a syringe, making for excellent reproducible control of bioink or polymer deposition. Syringe-based printing is suitable for fabricating scaffolds and tissue-like constructs with living cells and hydrogels because it offers extrusion that is gentle on living cells. As bioprinting is one of the most widely accepted biomanufacturing techniques for research or clinical applications, the syringe-based approach supports multi-material adds. Further, the technique allows for specific porosity, mechanical properties, and the capabilities of embedding living cells. Recent developments focus on aspects such as resolution, keeping cells alive while printing, and the ability to print complex vascular tissue constructs, this is the most mature bioprinting technique used to date in healthcare.

Inkjet-based: Inkjet -based 3D printing in healthcare uses the drop-on-demand method to jet droplets of either polymer or cell-laden inks into a substrate, which can support a relatively high resolution suitable for bioprinting drug arrays and biosensors, tissue models, and pharmaceutical formulations. Non-contact dispensing means the risk of contamination or carrying over unwanted materials is lessened. These attributes make inkjet bioprinting especially useful for sterile applications or where multi-copy formulations are desired. However, inkjet bioprinting has limited applications when inks exceed a certain viscosity and as bioinks, cell viability remains a critical issue. New bioink formulations that are suitable with these inks are currently being developed by academia, and inkjet bioprinting is being considered where in situ 3D bioprinting may apply. As a bioprinting technique, inkjet is still valuable for the high precision, array-based printing of healthcare products in R&D, and pharma applications.

Laser‑based: Laser-based 3D printing-including stereolithography (SLA) and selective laser sintering (SLS)-uses lasers to cure or sinter resin or powder layer by layer. In medical applications, SLA creates high-resolution surgical guides, anatomical models, and dental devices, while SLS produces durable polymer or metal implants with complex geometry. These methods enable detailed, patient-specific tooling and implants with high-dimensional accuracy and excellent surface finish. Ongoing developments focus on biocompatible resins and fine-tuning process parameters to meet regulatory standards, while continuously improving speed and scalability for clinical and industrial healthcare use.

Magnetic levitation: Magnetic levitation 3D printing uses magnetic fields to manipulate magnetized cells or particles in fluid media, enabling scaffold-free assembly of tissue-like structures. It supports precise spatial control without crosslinking materials, making it ideal for bio-engineered tissues and organoid models. This contactless, cell-friendly process allows for three-dimensional cell organization and vascularized constructs, promising applications in regenerative medicine and in vitro testing. Current research focuses on translating lab-scale magneto printing to scalable fabrication, improving structural stability, and integrating perfusable vascular networks for functional tissue constructs.

Fused Deposit Modelling (FDM): The Fused Deposit Modelling dominated the market in 2024. FDM builds parts using thermoplastics, layer by layer, manufacturing an affordable and readily available medium for prototyping anatomical models and producing inexpensive surgical instrumentation and simple orthotics. With medical-grade filaments including PLA, ABS, and PEEK, FDM can produce sterilizable functional parts. Though the resolution and surface finish are inferior to SLA or SLS, manufacturers are continuing to improve properties of materials, including blends and dual extrusion, in order to enhance functionality. FDM is an attractive production method for hospitals' printing labs and educational settings because of its low-cost printing capability and ease of use. Though FDM is an approved and regularly used method of production for professionals, consistent printing and regulatory issues are two connected points of consideration for clinical-grade equipment fabrication.

Selective Laser Sintering (SLS): SLS is an additive manufacturing procedure that employs the use of a laser to melt powdered polymers or metals together without the use of support structures creating an effective method of fabrication for complex functional medical parts such as prosthetics, implants and surgical planning tools. SLS enables the user to achieve complex internal structures and engineered mechanical performance. SLS products are an ideal range of products, particularly outsourced surgical fixtures and custom orthopedic implants when product weight must be less than current similar products. Common materials used in SLS are nylon, titanium, and PEEK. SLS is attractive because it uses a powder bed to produce long-lasting parts at scale. Using SLS would also require post- processing and factory quality hardware. SLS is largely utilized by medical device manufacturers for implant production, much of this production is approved certification for production, ongoing research and development in bioactive material composites and surface-enhanced materials development (like anchors and surface enhancement).

Stereolithography (SLA): SLA cures photosensitive resin layer by layer using light to create high-resolution, smooth, and accurate models. It is highly valued for producing surgical guides, dental models, prosthetic molds, and anatomical replicas. The exceptional detail and finish support clinical decision-making and patient-specific care. Healthcare-grade resins with biocompatibility and sterilization compatibility have emerged, expanding SLA’s applicability. Challenges include resin cost and post-processing, but workflow integration tools are improving. SLA remains a top-tier choice for precision printing in dental and surgical planning applications.

Other technologies: Other healthcare 3D printing technologies encompass powder bed binding, electron beam melting (EBM), binder jetting, and vat photopolymerization variants. EBM is particularly suited for titanium orthopedic and cranio-maxillofacial implants with excellent density and structural properties. Binder jetting enables multi-material and full-color bone models for surgical training and patient education. These emerging processes provide new pathways for functional, patient-specific devices and hybrid structures, with advances focusing on regulatory compliance, speed, biocompatible material development, and deployment in hospital environments or medical manufacturing services.

Medical: The medical application segment includes custom implants, prosthetics, surgical tools, anatomical models, and preoperative guides manufactured on industry or hospital-level printers. It encompasses orthopedics, cardiovascular, neurosurgery, and general surgery domains. Patient-specific tools improve accuracy, reduce complications, and shorten surgery times. In practice, clinicians utilize printed models for diagnosis, rehearsal, and even as training devices. There continues to be innovation, including metal and polymer composites for durable implants, sterilizable materials for surgical instruments, integration of highly integrated imaging, and regulatory changes that support point-of-care and in-hospital production.

3D Printing in Healthcare Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Medical | 50.80% |

| Dental | 38.70% |

| Biosensors | 10.50% |

Dental: Dental applications involve crowns, bridges, orthodontic models, aligners, surgical guides, and denture bases. 3D printing (mostly SLA and digital light processing, DLP) provides fast, accurate, and repeatable manufacturing with materials that are certified for long-term oral use. It supports dental labs and dental clinics with lean workflows and less downtime. Advances in the application of clear aligners and hybrid resins not only improve strength, but also aesthetics. Pairing clear aligners and intra-oral scanners allows custom devices to be made chair-side from the use of 3D printers. As a result, this sub-segment continues to grow as the regional dental professional base utilizes new digital manufacturing at various levels of their practice routine.

Biosensors: 3D printing enables customized microstructured biosensors and point-of-care diagnostic devices utilizing polymer, conductive and enzymatic materials. Layered fabrication provides integrated fluidic architecture, channels and electronics in compact, printable format. These include integrative applications like glucose monitors, tissue-based sensors, and environmental diagnostics. Rapid prototyping can accelerate development and promote patient-specific sensor setups. New conductive inks allow for more printable usage and there are increasingly more flexible substrates to work with. Quality control and regulation still weigh on the next transition for biosensors to level out from prototypes to clinical-grade tools whilst still ensuring we are looking at patients and the speed of technology evolving.

Polymers: Polymeric materials including PLA, ABS, PEEK, and photopolymer resins of various formulations dominate the healthcare space in 3D printing for models, tools and low-load implants. Polymers can be selected based on characteristics like sterilizability, biocompatibility, and ease of processing. While significant with respect to the benefits involved in using SLA and FDM workflows, progress in reinforced and/or composite filaments to approach or match strength or thermal properties is also occurring. Drug delivery systems and polymeric scaffolds continue to be explored. In addition, research on gradient structures and smart polymers continues to inform and expand potential future applications. Regulatory acceptance and assurance of material consistency and validation are still one of the primary areas of focus before polymers can be legally used for clinical applications.

3D Printing in Healthcare Market Revenue Share, By Material, 2024 (%)

| Material | Revenue Share, 2024 (%) |

| Polymers | 45.40% |

| Metals and Alloys | 28.20% |

| Biological Materials | 19.50% |

| Others | 6.90% |

Metals and alloys: Metals such as titanium, cobalt-chrome, stainless steel, as well as new biocompatible alloys are being developed for use as load-bearing implants and durable surgical devices. Processes such as SLS, EBM, and binder jetting allow the creation of tailored, porous, or lattice-like metal implants that strive to mimic natural bone. This creates several advantages for mechanical strength, osseointegration potential, and use over prolonged periods. At present, metals are being developed for orthopedic joints, patient-specific implants, and dental frameworks. Research continues to center around the printable alloy composition and surface treatment, as well as registration workflows that assure certification use. Metal AM has moved into the conventional regulatory pathway for class II/III devices.

Biological materials: Biomaterials include bioinks, hydrogels, decellularized matrices, and cell-laden formulations that are used for bioprinting tissues and organ-like constructs, these materials are able to support living cells, facilitate the regeneration tissue, and degrade into non-toxic by-products. Current areas of development are vascularized structures, tuned degradation profiles, and cell persistence. Research is at early phases examining applications to cartilage, skin, vascularized tissue, and organoids used for transplant and drug testing. Balancing printability, mechanical properties, and biological function has proven to be a core challenge in the field, even as regulatory bodies are recognizing biofabricated products are a realm in the biomedical space.

Medical & Surgical Centers: Hospitals, surgeries, and clinical centers deploy 3D printing for in-house anatomical modeling, surgical guide production, tools, and prosthetic planning. Point-of-care production speeds clinical workflows, reduces external service dependencies, and enables patient-specific treatment. Centers often integrate printers with imaging software and quality protocols under clinical governance. Adoption is highest with multidisciplinary teams at tertiary/teaching hospitals. Strategic positioning includes near-surgical-lab for faster turnaround. Education and integration into clinical practices are imperative for effective adoption into standard care pathways.

3D Printing in Healthcare Market Revenue Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Medical & Surgical Centers | 50.10% |

| Pharmaceutical & Biotechnology Companies | 32.40% |

| Academic Institutions | 17.50% |

Pharma & Biotech: Pharma and biotech organizations are exploring 3D printing for drug formulation, personalized dosages, organ- and tissue-model development for preclinical screening, as well as device prototyping. Technologies such as inkjet and syringe-based bioprinting enable formulation in complex drug-delivery systems and in vitro testing. Companies can quickly trial customizable tablets, microarrays, tissue chips which reduce the research and development cycle. Biotech companies utilize the use of printed scaffolds for development regarding regenerative medicine. Regulating practices, reproducibility in production, scalability in production, are also assessed by companies. Due to the increasing trends of collaboration and partnerships between pharma and print-spectrum organizations, new practical applications for developing a personalized therapy or advanced drug-testing platforms will continue expanding.

Academic Institution: Universities and other academic institutions, and research labs, are utilizing 3D printing technology, to innovate healthcare practices, for instructional purposes, and/or for proof-of-concept research studies. Academic investigations are broad-ranging from bioprinting and scaffold engineering through to implant design, drug screen models, and surgical simulation. Academic institutes have been experimenting with a variety of printer paradigms (especially in relation to syringe-based and inkjet bioprinter technologies) in order to evaluate healthcare usages at the early stages of innovation. Research outputs include novel bioinks, multiple-materials, and in vivo applications. Academic institutes also incorporate 3D education into engineering and life-science courses. Academic programs have continued to push the envelope and in looking at new possibilities that 3D printing technology may afford.

The 3D printing in healthcare market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

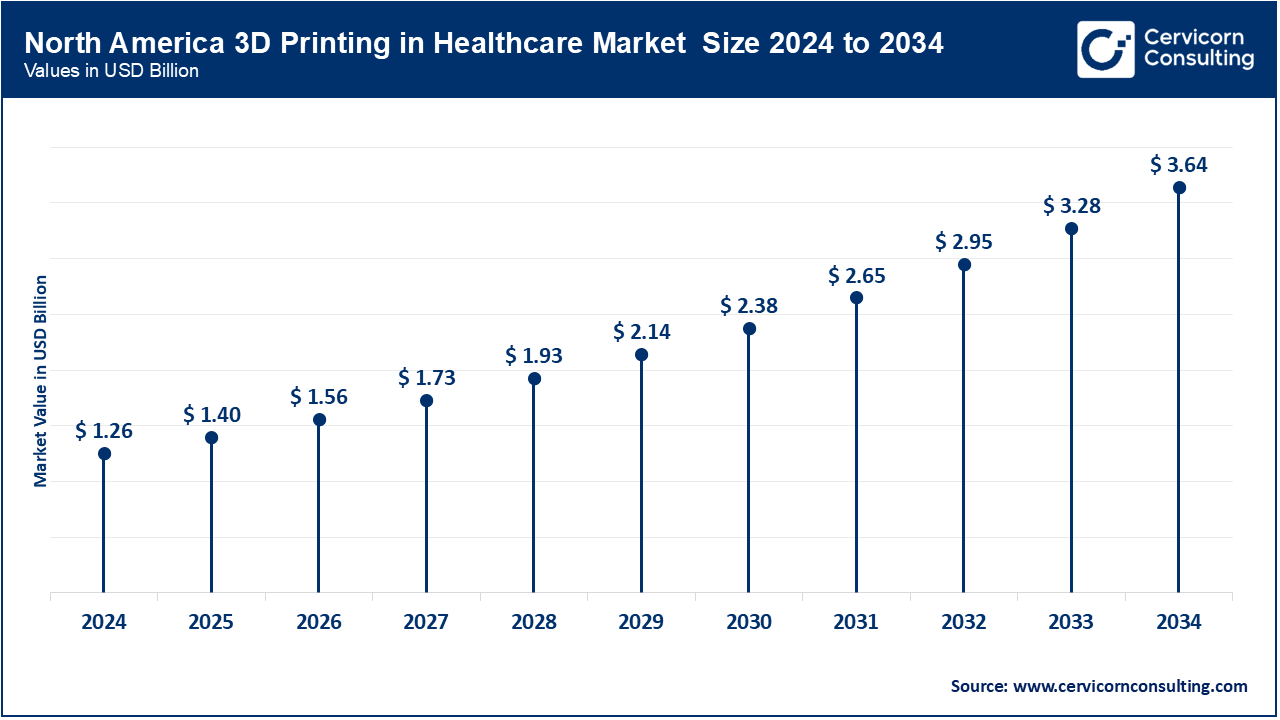

North America dominates the market due to advanced healthcare infrastructure, significant R&D investments, and strong regulatory frameworks supporting innovation. The U.S. leads with FDA-approved 3D-printed implants, surgical guides, and bioprinted models being integrated into mainstream clinical workflows. Academic hospitals are running point-of-care labs, while pharma companies explore drug personalization using additive manufacturing. Canada's supportive policies and research funding are also fostering bioprinting innovation. Collaborations between tech companies and medical institutions are further accelerating market adoption across North America.

Europe is a major hub for healthcare 3D printing, driven by strong academic research, favorable medical device regulations, and innovation from leading manufacturers. Countries like Germany, the UK, and the Netherlands are spearheading applications in dental, orthopedic, and prosthetic printing. The EU’s MDR (Medical Device Regulation) has shaped compliance-driven development, and hospitals are increasingly adopting point-of-care printing. European universities and biotech firms are advancing bioprinting technologies, particularly in regenerative medicine. Public-private partnerships and cross-border R&D projects are reinforcing Europe’s global leadership in the sector.

The Asia-Pacific region is witnessing rapid growth, due to rising healthcare expenditure, expanding medical tourism, and strong government support. Countries like China, Japan, South Korea, and India are investing in additive manufacturing hubs, R&D centers, and training programs. China leads in low-cost 3D printer production and implant trials, while Japan and South Korea focus on precision medicine and dental applications. India is expanding its hospital-based labs in tier-one cities. The region is poised for continued expansion as infrastructure and regulatory clarity improve.

3D Printing in Healthcare Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 39.10% |

| Europe | 29.30% |

| Asia-Pacific | 23.40% |

| LAMEA | 8.20% |

LAMEA is an emerging market, with potential driven by urban healthcare expansion, unmet surgical needs, and increasing medical imports. Brazil and Mexico are leading adoption in Latin America, mainly in dental and prosthetics. The Middle East, especially the UAE and Saudi Arabia, is investing in 3D-printed organ models and hospital infrastructure as part of their Vision 2030 healthcare reforms. In Africa, uptake is limited but growing in educational and pilot clinical settings. Regional challenges include cost, regulatory gaps, and limited skilled labor, but innovation hubs are beginning to form.

Recent partnerships in the 3D printing in healthcare industry emphasize innovation, precision manufacturing, and cross-sector integration. 3D Systems Corporation partnered with CollPlant to advance bioprinted regenerative breast implants, merging expertise in bioprinting and collagen-based bioinks. Formlabs Inc. collaborated with SmileDirectClub to scale personalized dental solutions using high-throughput desktop printers. Materialize NV joined forces with Siemens Healthineers to integrate 3D printing into diagnostic imaging workflows, enhancing surgical planning. GE Additive, a subsidiary of General Electric, worked with Stryker to develop metal-printed orthopedic implants. These alliances focus on regulatory compliance, patient-specific care, and accelerating 3D printing adoption across surgical, dental, and biotech domains—collectively driving healthcare's digital manufacturing transformation.

Market Segmentation

By Product

By Technology

By Application

By Material

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of 3D Printing in Healthcare

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Product Overview

2.2.3 By Product Overview

2.2.4 By Application Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growth in the integration of AI in medical model optimization

4.1.1.2 Growth in cosmetic and reconstructive surgeries

4.1.1.3 Appearance of telehealth and access to remote healthcare

4.1.2 Market Restraints

4.1.2.1 Large initial capital investment

4.1.2.2 Concerns regarding device accuracy and reliability

4.1.2.3 Data security and patient privacy issues

4.1.3 Market Challenges

4.1.3.1 Regulatory compliance and certification

4.1.3.2 Ability to educate medical 3D printing in additive manufacturing

4.1.3.3 Bioprinting research and trial costs

4.1.4 Market Opportunities

4.1.4.1 Real-time surgical planning with printed organ replicas

4.1.4.2 New advancements in printable, resorbable scaffolds

4.1.4.3 Custom prosthetics for pediatric and trauma care

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global 3D Printing in Healthcare Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. 3D Printing in Healthcare Market, By Technology

6.1 Global 3D Printing in Healthcare Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Droplet deposition

6.1.1.2 Photopolymerization

6.1.1.3 Laser beam melting

6.1.1.4 Electron beam melting (EBM)

6.1.1.5 Laminated object manufacturing (LOM)

6.1.1.6 Others

Chapter 7. 3D Printing in Healthcare Market, By Product

7.1 Global 3D Printing in Healthcare Market Snapshot, By Product

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Syringe based

7.1.1.2 Inkjet based

7.1.1.3 Laser based

7.1.1.4 Magnetic levitation

Chapter 8. 3D Printing in Healthcare Market, By Material

8.1 Global 3D Printing in Healthcare Market Snapshot, By Material

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Polymers

8.1.1.2 Metals and Alloys

8.1.1.3 Biological Materials

8.1.1.4 Others

Chapter 9. 3D Printing in Healthcare Market, By Application

9.1 Global 3D Printing in Healthcare Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Medical

9.1.1.2 Dental

9.1.1.3 Biosensors

Chapter 10. 3D Printing in Healthcare Market, By End-User

10.1 Global 3D Printing in Healthcare Market Snapshot, By End-User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Medical & Surgical Centers

10.1.1.2 Pharmaceutical & Biotechnology Companies

10.1.1.3 Academic Institutions

Chapter 11. 3D Printing in Healthcare Market, By Region

11.1 Overview

11.2 3D Printing in Healthcare Market Revenue Share, By Region 2024 (%)

11.3 Global 3D Printing in Healthcare Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America 3D Printing in Healthcare Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe 3D Printing in Healthcare Market, By Country

11.5.4 UK

11.5.4.1 UK 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific 3D Printing in Healthcare Market, By Country

11.6.4 China

11.6.4.1 China 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA 3D Printing in Healthcare Market, By Country

11.7.4 GCC

11.7.4.1 GCC 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA 3D Printing in Healthcare Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Formlabs Inc.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 General Electric

13.3 3D Systems Corporation

13.4 Exone Company

13.5 Materialise NV

13.6 Oxferd Performance Materials, Inc.

13.7 SLM Solutions Group AG

13.8 Organovo Holdings, Inc.

13.9 Proto Labs

13.10 Stratasys Ltd