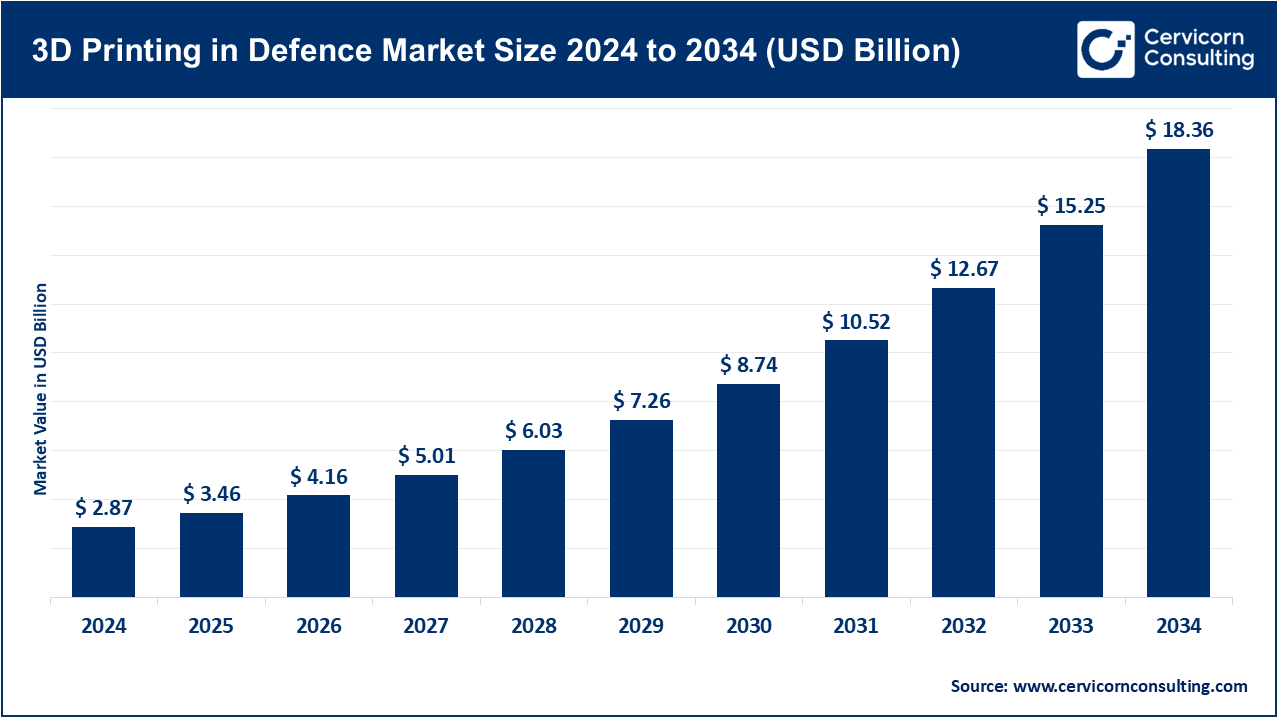

The global 3D printing in defence market size was valued at USD 2.87 billion in 2024 and is expected to hit around USD 18.36 billion by 2034, growing at a CAGR of 27.21% from 2025 to 2034. The global 3D printing in defense market is expected to grow significantly owing to rising demand for lightweight, customizable parts, faster prototyping, and reduced supply chain dependency. Defense agencies increasingly adopt additive manufacturing to enhance operational readiness, lower costs, and enable rapid production of mission-critical components in remote or combat zones.

Inauguration of 3D printing technology in the defense sector is a notable evolution in military production and logistics because it incorporates prototyping systems capable of producing urgent parts at any time, any place and accomplishing rapid repairs at the combat zone. Important innovations like metal sintering, use of composites, optimization of designs with artificial intelligence, and even 3D printers which are portable are empowering the defense forces to greatly minimize dependency on supply chains while maximizing adaptability and availability of gear. Uses include customized lightweight equipment for drones, personnel specific gear, hyper sonic weapon components, as well as replacement parts for older systems. These shifts are driven by increased modernization programs from the rising tensions of geopolitical conflict fueled by government spending aimed toward military innovation. This paradigm fosters operational efficiency and increases resilience which enhances decreased downtime centered around decentralized strategic autonomy geared towards agile maneuver warfare.

India’s Defence Revolution

| Year | Values in Crores |

| 2014-2015 | 1,941 |

| 2016-2017 | 1,522 |

| 2018-2019 | 1,0746 |

| 2020-2021 | 8,435 |

| 2022-2023 | 15,918 |

| 2023-2024 | 21,083 |

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 3.46 Billion |

| Expected Market Size in 2034 | USD 18.36 Billion |

| Projected CAGR 2025 to 2034 | 27.21% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Offering, Process, Application, Platform, Component, End User, Region |

| Key Companies | Lockheed Martin Corporation, 3D Systems Corporation, Desktop Metal, Inc., SLM Solutions Group AG, Stratasys Ltd., General Electric Company, Boeing Company, Dassault system SE, Materialise NV, HP Inc., ExOne Company, Proto Labs, Inc., Renishaw plc, Trumpf GmbH + Co. KG, Materialise NV, Optomec, Inc. |

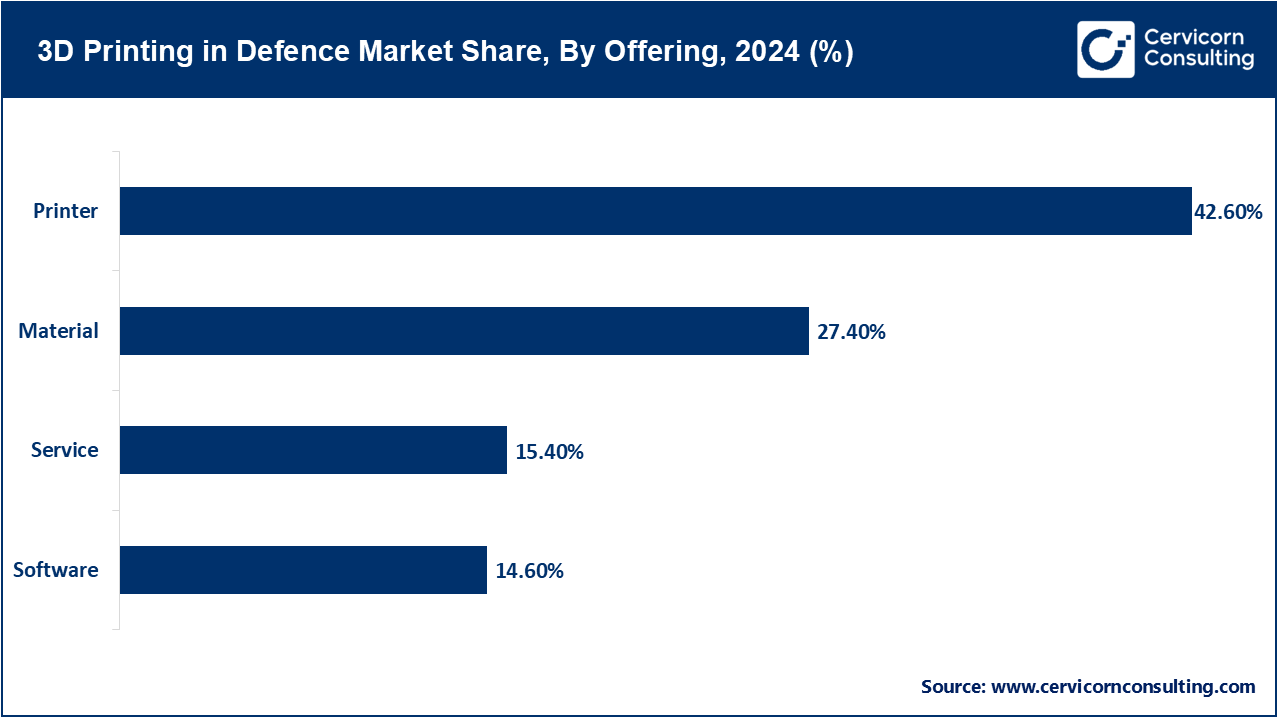

Printer: The printers segment dominated the market in 2024. 3D printers enable defence additive manufacturing when applied to making end-use components, prototypes, and mission essential tools at the point of need. From small field-deployable FDM systems that fit in a backpack to a large industrial-grade PBF machine or DED system that can yield tonnes of functional raw materials, defence agencies are utilizing a spectrum of hardware to allow them to fulfil operational requirements. These systems produce parts for vehicles, aircraft, and even field hospitals, significantly reducing logistics burdens. The strategic importance of having on-site, ruggedized printing capabilities—especially during prolonged missions—has made printers an essential investment across land, naval, and aerospace applications.

Material: Materials in the defence 3D printing domain range from high-strength metals like titanium and Inconel to composite polymers and fiber-reinforced resins. Each is selected based on mission-critical requirements like thermal stability, weight reduction, and mechanical resilience. For instance, aluminium alloys are favored for aircraft parts, while steel composites suit naval applications. The military's increasing focus on localized manufacturing requires secure, validated supply chains for certified material input. Software: Software serves as the digital foundation for defence additive workflows, converting CAD outputs into printable formats while maintaining acceptable military standards. Software platforms provide print path enhancement, structural simulation including performance, and topology optimization for weight reductions. The latest advancement leverages AI-powered functionality to offer predictive maintenance and build-failure prevention operating at machine, sequence and process levels, thus minimizing waste and maximizing uptime. Ability to build tighter integration into existing battlefield logistics systems will afford engineers working from their office desks a meaningful ability to collaborate with Teams in the field. Increasingly, defence software includes cybersecurity layers to prevent IP theft or sabotage—making it indispensable in secure, scalable manufacturing operations.

Services: Services provided in defence 3D printing vary and may include end-to-end production assistance, design consultation, materials testing, and post-processing for components used in an environment where there is a risk to the workspace. Providers, in-house or contracted, will have access to different workflows tailored for weapon components, airframe reinforcements, or surgical implants. Mobile AM Labs (often containerized) can support frontline units with repairs and custom part requests. With collaboration arrangements in place with the national labs and academic institutions, the possibilities of accelerating R&D development are enhanced. All of these services are intended to facilitate deployment readiness, decrease lead times, and ensure Armed Forces are in a position to produce and fabricate mission-specific tools or components, even in austere and high-threat locations.

Binder Jetting: Binder jetting is primarily used in the defence sector for prototyping, design validation, and low-density part fabrication. The process binds powdered material using a liquid agent, creating models quickly without high heat. Though not ideal for load-bearing parts, binder jetting supports educational tools, training devices, and low-strength functional components. With post-processing like sintering, some metal parts can gain enhanced strength. Defence designers use this technique for aerodynamic models, mock-up equipment, or pilot-testing new designs before transitioning to high-performance production methods like PBF or DED.

Direct Energy Deposition (DED): DED excels in producing large, durable parts or repairing worn-out components directly on existing structures—a major benefit for aircraft, vehicles, and naval systems. The method uses a laser or electron beam to melt wire or powder feedstock, allowing flexible geometry and gradient materials. Its high deposition rates are suited for rebuilding turbine blades or custom tools in limited-time missions. In defence healthcare, it’s even used to repair surgical instruments. The advantages of DED are restoring critical components instead of having to freeze the asset and purchase a whole new part, resulting in extended uptime and reduced waste across the supply chain.

Material Extrusion: Material extrusion (FDM) is a robust system that is cheap and flexible. In defence, it produced a great deal of rapid prototype which allowed realistic amounts of UAV shells to be developed, soldier systems, or electronics mounts on soldier equipment while still having rugged properties. If the parts are not war-critical, extruding using base or mobile facilities could yield great time savings and allows for ease of logistics since no specific technical requirements are required to use ABS, nylon, or fiber reinforced composites. Material extrusion will not yield the tolerances of PBF or SLA but is excellent for iterative development that created tactical tools quickly. Its ease of use makes it a preferred solution in field-deployed AM units.

Powder Bed Fusion (PBF): The powder bed fusion segment has dominated the market in 2024. PBF, including Selective Laser Sintering (SLS) and Direct Metal Laser Sintering (DMLS), is a key method for manufacturing high-strength, complex defence components. It allows production of lightweight, structurally sound parts like drone brackets, missile components, and aircraft joints. Materials like titanium and Inconel provide necessary thermal and fatigue resistance. PBF also supports lattice structures for shock absorption and stealth. Due to its precision and mechanical reliability, PBF is increasingly integrated into defence production lines, especially in air and space domains requiring tight tolerances.

Sheet Lamination: Sheet lamination is used for educational and planning models within the defence sector, building objects by bonding layers of material sheets. Though limited for structural parts, it excels in creating low-cost, low-waste training aids, tactical maps, and field mock-ups. Command centers use laminated models to simulate terrain or rehearse mission scenarios. Its fast output and minimal infrastructure make it suitable for pre-deployment exercises. In military healthcare, laminated anatomical models support surgical planning and personnel education, especially in resource-constrained environments.

Functional Part Manufacturing: The functional part manufacturing segment dominated the market in 2024. Functional part manufacturing within the defence function focuses on manufacturing fully deployable parts like missile cases, frames for vehicles, fuselage sections of unmanned aerial vehicles (UAVs) and turbine parts for aircraft. These mission-critical, end-use parts are printed using high-strength alloys through a number of advanced processes including Direct Metal Laser Sintering (DMLS) and Electron Beam Melting (EBM) to survive in operations. There is plenty of room for additive manufacturing to have a consequence in producing parts through a process called topology optimization and weight reduction while enhancing or maintaining performance. Additive manufacturing has the added benefit of reducing dependencies on supply chains during warfare or expeditionary force deployments, enabling on-time manufacturing, field maintenance, and spare part replacement in urgent scenarios.

3D Printing in Defence Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Functional Part Manufacturing | 54.20% |

| Tooling | 20.30% |

| Prototyping | 25.50% |

Tooling: Tooling in the 3D printing defence market is a large benefit for the production of jigs, gauges, molds and dies when dealing with high levels of dynamic precision to assemble, align, or repair complicated weapons systems and COMBAT platforms. Often custom-made to fit unique geometries such as tanks, aircraft, or missile systems, tooling processes through 3D printing allow designs that reduce tolerance errors and maximize efficiency in assembly work. 3D printing also has the potential to reduce tooling lead times from several weeks to a few hours, improving repair cycle capabilities and rotating staff at field depots. Common tooling materials withstand operational wear, rugged composites include carbon-fibre and heat-resistant polymers. Extra benefit is its ability to add modularity and scalability by fitments through the various complex geometries related to different operational profiles, increasing the responsiveness to missions and mission readiness.

Prototyping: Prototyping is one of the most important defence applications of 3D printing, allowing for quick turnaround on design iterations for new equipment like unmanned systems, advanced weapon systems, or soldier-worn equipment. CAD-based processes let designers and engineers make, test and change parts before investing time and money in final production. This reduces R&D costs and time-to-deployment. Prototypes are evaluated for aerodynamics, heat resistance, and weight using real-world simulations. Importantly, on-demand prototyping enables combatant commands to co-develop and test gear in theater, fostering a soldier-driven innovation model that aligns with defence modernization priorities.

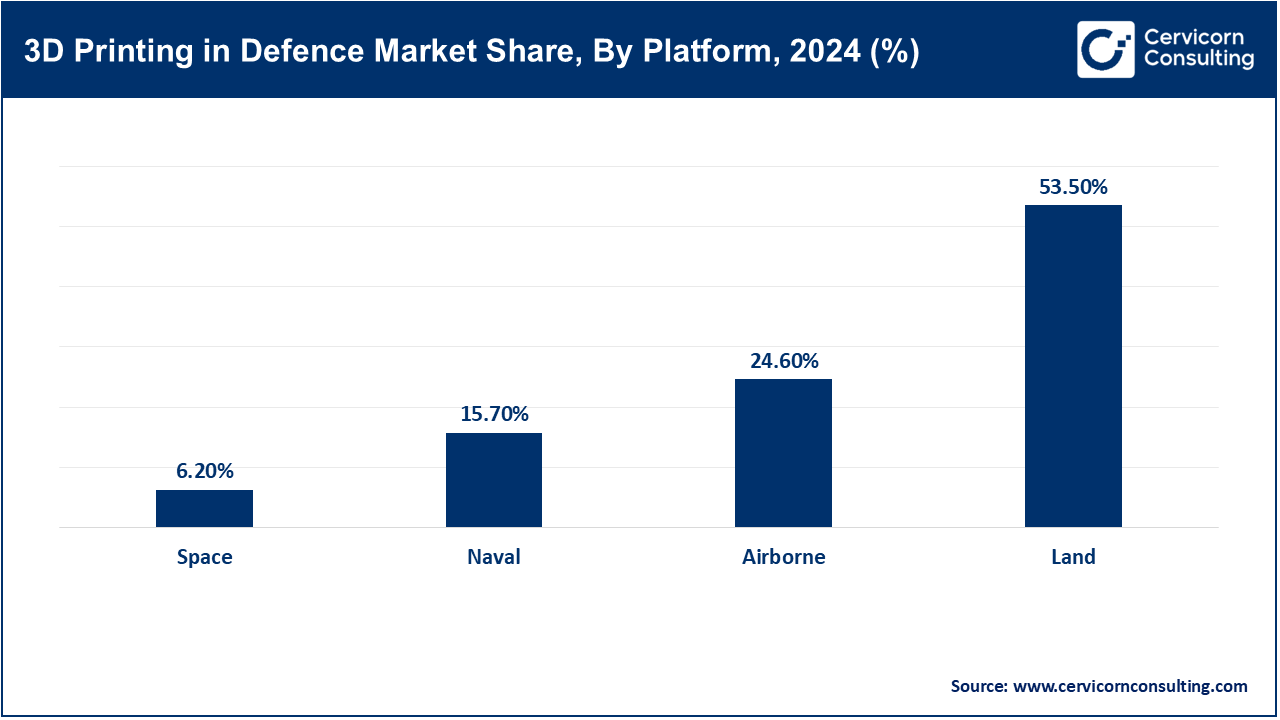

Airborne: 3D printing in airborne defence platforms supports the production of lightweight, structurally resilient parts for fighter jets, helicopters, and drones. Components such as avionics housings, ductwork, and radar mounts are printed using titanium or PEEK-based polymers for high strength-to-weight ratios. Additive manufacturing reduces lead times for mission-critical replacements, especially for legacy aircraft with obsolete components. Onboard diagnostics linked with AM allow predictive replacement of failing parts, improving flight-readiness. The U.S. Air Force and Boeing have both adopted 3D printing for rotorcraft parts and structural brackets, validating its importance in aerial defence logistics.

Land: The land segment has accounted highest revenue share in 2024. The land domain benefits from the use of additive manufacturing, through local production of vehicle armor, gun mounts, replacement gears and even drone parts intended for specific terrain. Army forward operating bases are now employing containerized AM labs, allowing them to locally fabricate the damaged and missing parts directly in combat zones. These systems are using durable materials–such as nylon composites or Inconel–to improve the durability of its supply chain during extended operations and contested environments. The additive solutions are also being used to support refurbishment of tanks, higher capability for engineering vehicles, and even repair of powertrains in armored carriers. Overall, additive manufacturing enables ground forces to remain operationally agile and keep continuity with limited logistic support.

Naval: 3D printing is being used to manage maintenance and sustainment of parts on-board warships, submarines and other maritime vessels/stations. For example, AM systems installed into naval vessels are used to fabricate replacement parts for valves, brackets and pump impellers as well as medical or cooking tools for the vessel. The systems must function reliably in very corrosive environments and extreme vibration. Notably, the focus on metal printing is growing in naval vessels for replacement parts like propeller blades and hydraulic components. The U.S. Navy has tested 3D-printed metal drain strainers aboard the USS Harry S. Truman, demonstrating readiness for permanent part replacement at sea. Additive printing reduces downtime and eliminates port-dependency for basic inventory.

Space: 3D printing for defence-related space applications supports satellite components, antenna arms, brackets, and shielding elements. Several defense agencies including the U.S. Space Force and NASA are collaborating with private aerospace companies to implement additive manufacturing on orbit-capable vehicles. The key benefits of using 3D-printed parts is the ability to consolidate designs and to optimize weight, both of which are critical issues on launch vehicles. Additionally, NASA and the Department of Defense are working on autonomous manufacturing and the potential of in-space manufacturing in orbit.

Technology: The technology segment has held dominant position in 2024. Within defence 3D printing, technology encompasses all aspects of the hardware (printers), software, monitoring systems, and integration platforms utilized to produce output suitable for mission. Typically, printers either tend to be smaller, lightweight ruggedized FDM printers which have been produced specifically for battlefield use, and, large-scale high-power laser sinters which are used to operate centralized production facilities. Defence-specific software handles STL editing, thermal analysis, and transfer of design files from a cybersecure stand point. Artificial intelligence algorithms also contribute to optimizing build orientation and materials where possible. As all of these technologies are enhancing their capabilities, Integrated sensors assures process traceability and repeatability. While functions of field-deployable (tech) is improving, the military is becoming more inclined toward plug-and-play type units requiring less training and work more successfully in an environment where temperatures and other environmental stressors are outside a 'friendly' range.

3D Printing in Defence Market Revenue Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Technology | 47.20% |

| Material | 34.20% |

| Services | 18.60% |

Material: Materials, along with the technology component, occupy critical positions in the defence 3D printing ecosystem, materials need to gain trust and rigour to comply with MIL-STD certifications and provide resilience in the form of thermal, mechanical, and environment standardization, titanium, aluminum alloys, inconel, and cobalt-chrome are materials that are commonly utilized, and can be used for aircraft and missile construction, as contrast, carbon fiber, polyetheretherketone (PEEK), and glass filled nylons can be selected for high-performance lightweight structures. They must support a high fatigue performance level and material engenders good results in performance strength and corrosion-resistant nature, along with some stealth features. As a research and development effort, there is a trial for producing materials for EM shielding, and radar absorption characteristics. The military is also developing materials that lend all the advantages of military-grade printables, and this is sending a strong signal that AM is now increasingly supplanting the traditional approaches to manufacturing in frontline production points.

Services: 3D printing services in defence cover pre-print design, material validation, post-processing, real-time diagnostics, and regulatory compliance support. Companies like Lockheed Martin and Stratasys offer on-site AM labs and digital platforms to field units, enabling fast production and repair services. Military bases benefit from support in scanning broken components, reverse engineering, and applying proper thermal or surface treatment post-print. Service providers also manage secure data handling, vital for defence IP protection. These services bridge the gap between frontline needs and centralized production capabilities, allowing flexibility across multiple theatres of operation.

Army: The army segment has leading the market in 2024. The United States Army employs 3D printing, or additive manufacturing (AM), to establish supply lines, manage logistics, expand repair options, and produce applicable components for the battlefield. AM is utilized to create parts for vehicles, the housing for weapons, and wearable armor. Mobile AM units operated from forward bases will improve operational effectiveness for losses that are less damaging than losses that require advantage at sea or by air. The Army's "Jointless Hull" project, which utilizes large-scale additive capacity systems to produce a full vehicle structure, demonstrates something that creates significant opportunities for new possibilities. The Army is also experimenting with 3D printing food utensils, medical equipment, and drone airframes on multi-material platforms. The Army indicates additive manufacturing represents offense for ground forces and phase II of its readiness and future fight system.

3D Printing in Defence Market Revenue Share, By End Use, 2024 (%)

| End Use | Revenue Share, 2024 (%) |

| Army | 39.70% |

| Navi | 34.50% |

| Airforce | 25.80% |

Navy: The Navy has embraced 3D printing, AM, to sustain maritime fleets of ships, submarines, and aircraft, even if they cannot always get a ship back to a nearby dock. Typical onboard shipboard systems will print pump parts, electrical enclosures, and surgical implements to support needs during long deployments. Navy engineers are exploring other consumables, such as heat exchangers, and entire replacement gearboxes comprised of 3D printed components. Central hubs have also been established at every naval base, with some bases acting as enterprise-sized machines to support post-part deployments production and training. The Navy emphasizes reliability, especially for parts being used in ships that may also be operating under the pressures of vibration, salt, and temperature changes. The integration of 3D scanning and additive systems aboard Navy ships (i.e., carriers) will ease life cycle maintenance while comfortably evolving workflows toward the navy of the future, characterized by modernization and autonomous and artificial intelligence-based support.

Airforce: The Air Force integrates 3D printing to produce lightweight airframe components, customized cockpit controls, and in-flight testing fixtures. With rapid turnaround required for airborne platforms, the service uses metal and composite AM to replace aging aircraft parts quickly. The USAF has even deployed AM systems in maintenance hangars for on-the-spot component recreation. Additive technologies are also used in simulator training, facial reconstruction for injured pilots, and G-force test devices. These advancements support the Air Force’s goals of agile logistics, predictive maintenance, and resilience in advanced aerospace operations.

The 3D printing in defence market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

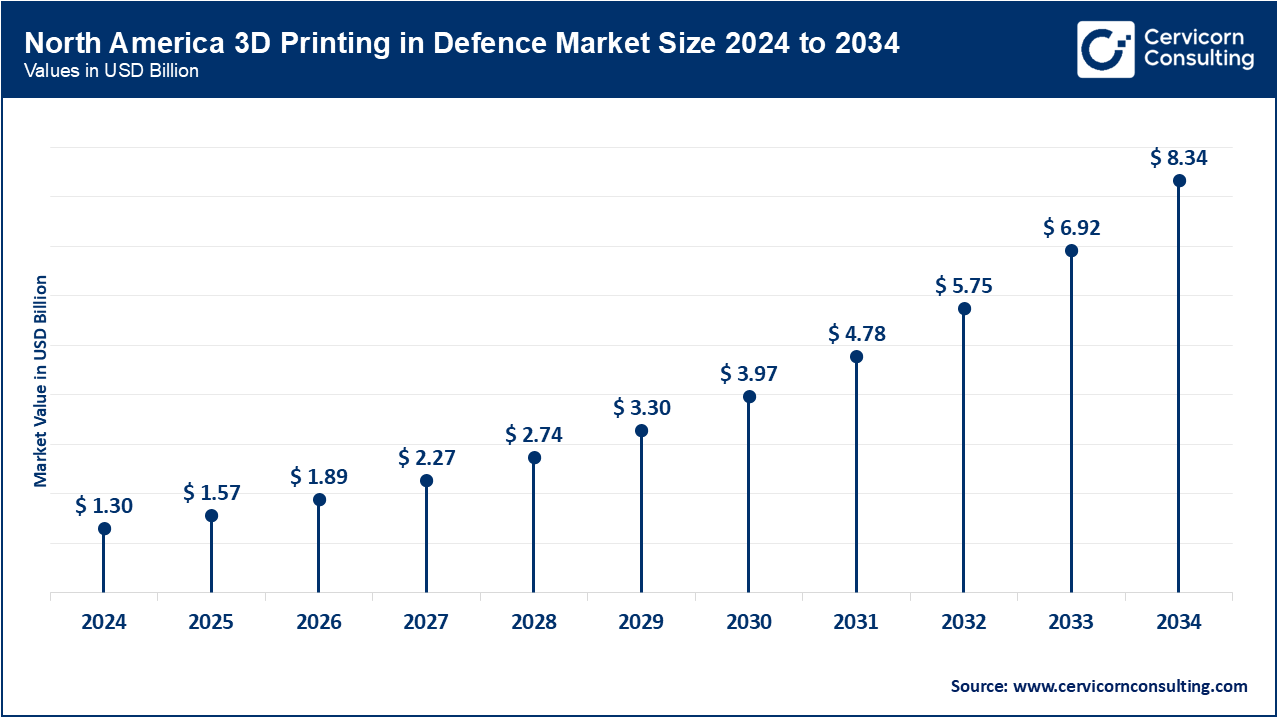

North America is the leader the market thanks to a strong defense health ecosystem, favorable FDA regulations, and early adoption to advanced manufacturing technologies. The U.S. Department of Defense continues to support the research of medical AM through DARPA, the VA system, and military research and development labs. Hospitals and military bases use AM for personalized implants, surgical guides, and tools for treating traumas. Canada also supports biofabrication through institutions like the NRC. The combination of strong investments, regulatory interpretations, and public-private approaches allowed North America to have a competitive edge in the 3D printing for defense-health.

Europe is demonstrating clear growth in market with nationalized healthcare systems, NATO led defense innovation, and regulatory standardization through EU regulation. Military medical innovation is occurring in Europe, specifically in Germany, UK, and France with 3D printing being integrated with field hospitals and rehabilitation facilities. The EU MDR provides clear guidelines for printed medical devices that can be utilized in a safe manner. The third convergence of defence-health can be seen in collaboration projects being funded by Horizon Europe and the EDA.

3D Printing in Defence Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 45.40% |

| Europe | 26.30% |

| Asia-Pacific | 18.90% |

| LAMEA | 9.40% |

Asia-Pacific is a region that developing quickly in market, supported by increased defense budgets, expanding healthcare infrastructure and technology initiatives to help develop within the countries. Nations like China, India, Japan, and South Korea have increased funding for military medical modernization, dividing their AM initiatives, such as deploying AM within military field hospitals and disaster settings. China has made enormous advances to develop bio-printed organ research, while India has had AM introduced within their armed forces medical colleges. Regulatory pathways have begun to open, and involved countries are building a framework and policy for biocompatible and trauma-response tools. The Asia Pacific region also has the added benefit of very low-cost production and vast volume scalability.

LAMEA indicates developing intent to explore 3D printing for the health sector, dedicated focus on in the humanitarian context and military field medicine. Within the Middle East, the UAE and Saudi Arabia are leading the way concerning investment in smart healthcare and military battlefield readiness, which includes mobile AM labs and surgical models. Now there is also pilot testing to develop low-cost 3D printed prosthetics and 3D printed anatomical training models with military hospitals in Latin America. Throughout Africa, examples of NGOs and UN missions are happening now in the forefront of using 3D printing for trauma and orthopedic training/care, support provided in remote conflict zones. As and example, charity bodies have limited infrastructure, and potential, but innovation hubs are rapidly growing, almost weekly.

Recent partnerships in the 3D printing in defence industry highlight innovation and deepening defense-tech convergence. Lockheed Martin has expanded its collaboration with Sintavia to develop 3D-printed aerospace components with enhanced thermal and structural performance. Stratasys has partnered with the U.S. Navy to deliver deployable 3D printing units for shipboard part manufacturing. 3D Systems works with the U.S. Army on metal AM for lightweight, durable combat vehicle parts. Desktop Metal collaborates with the Department of Defense to scale binder jetting for high-volume part replacement. SLM Solutions partners with Honeywell for aerospace certification of printed parts. These alliances are accelerating precision, autonomy, and supply chain resilience in defense production.

Market Segmentation

By Offering

By Process

By Application

By Platform

By Component

By End-Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of 3D Printing in Defence

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Offering Overview

2.2.2 By Process Overview

2.2.3 By Platform Overview

2.2.4 By Component Overview

2.2.5 By Application Overview

2.2.6 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Customization of Equipment

4.1.1.2 Operational Readiness

4.1.1.3 Government Incentives & Funding

4.1.1.4 Reduction in Waste Material

4.1.2 Market Restraints

4.1.2.1 Slow Print Speeds for Mass production

4.1.2.2 Regulatory & Compliance Barriers

4.1.2.3 Resistance from Traditional Defense Suppliers

4.1.3 Market Challenges

4.1.3.1 Printer Maintenance in Remote Environments

4.1.3.2 Environmental Impact of Some Materials

4.1.3.3 Dependence on Foreign Raw Material Supplies

4.1.4 Market Opportunities

4.1.4.1 Smart Munitions via AI + 3D Printing

4.1.4.2 Remote Defense Infrastructure via Large-Format Printing

4.1.4.3 Submarine and Naval Applications

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global 3D Printing in Defence Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. 3D Printing in Defence Market, By Offering

6.1 Global 3D Printing in Defence Market Snapshot, By Offering

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Printer

6.1.1.2 Material

6.1.1.3 Software

6.1.1.4 Service

Chapter 7. 3D Printing in Defence Market, By Process

7.1 Global 3D Printing in Defence Market Snapshot, By Process

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Binder Jetting

7.1.1.2 Direct Energy Deposition

7.1.1.3 Material Extrusion

7.1.1.4 Powder Bed Fusion

7.1.1.5 Sheet Lamination

Chapter 8. 3D Printing in Defence Market, By Platform

8.1 Global 3D Printing in Defence Market Snapshot, By Platform

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Airborne

8.1.1.2 Land

8.1.1.3 Naval

8.1.1.4 Space

Chapter 9. 3D Printing in Defence Market, By Component

9.1 Global 3D Printing in Defence Market Snapshot, By Component

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Technology

9.1.1.2 Material

9.1.1.3 Services

Chapter 10. 3D Printing in Defence Market, By Application

10.1 Global 3D Printing in Defence Market Snapshot, By Application

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Functional Part Manufacturing

10.1.1.2 Tooling

10.1.1.3 Prototyping

Chapter 11. 3D Printing in Defence Market, By End-User

11.1 Global 3D Printing in Defence Market Snapshot, By End-User

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Army

11.1.1.2 Navy

11.1.1.3 Airforce

Chapter 12. 3D Printing in Defence Market, By Region

12.1 Overview

12.2 3D Printing in Defence Market Revenue Share, By Region 2024 (%)

12.3 Global 3D Printing in Defence Market, By Region

12.3.1 Market Size and Forecast

12.4 North America

12.4.1 North America 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.4.2 Market Size and Forecast

12.4.3 North America 3D Printing in Defence Market, By Country

12.4.4 U.S.

12.4.4.1 U.S. 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.4.4.2 Market Size and Forecast

12.4.4.3 U.S. Market Segmental Analysis

12.4.5 Canada

12.4.5.1 Canada 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.4.5.2 Market Size and Forecast

12.4.5.3 Canada Market Segmental Analysis

12.4.6 Mexico

12.4.6.1 Mexico 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.4.6.2 Market Size and Forecast

12.4.6.3 Mexico Market Segmental Analysis

12.5 Europe

12.5.1 Europe 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.5.2 Market Size and Forecast

12.5.3 Europe 3D Printing in Defence Market, By Country

12.5.4 UK

12.5.4.1 UK 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.5.4.2 Market Size and Forecast

12.5.4.3 UKMarket Segmental Analysis

12.5.5 France

12.5.5.1 France 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.5.5.2 Market Size and Forecast

12.5.5.3 FranceMarket Segmental Analysis

12.5.6 Germany

12.5.6.1 Germany 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.5.6.2 Market Size and Forecast

12.5.6.3 GermanyMarket Segmental Analysis

12.5.7 Rest of Europe

12.5.7.1 Rest of Europe 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.5.7.2 Market Size and Forecast

12.5.7.3 Rest of EuropeMarket Segmental Analysis

12.6 Asia Pacific

12.6.1 Asia Pacific 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.6.2 Market Size and Forecast

12.6.3 Asia Pacific 3D Printing in Defence Market, By Country

12.6.4 China

12.6.4.1 China 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.6.4.2 Market Size and Forecast

12.6.4.3 ChinaMarket Segmental Analysis

12.6.5 Japan

12.6.5.1 Japan 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.6.5.2 Market Size and Forecast

12.6.5.3 JapanMarket Segmental Analysis

12.6.6 India

12.6.6.1 India 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.6.6.2 Market Size and Forecast

12.6.6.3 IndiaMarket Segmental Analysis

12.6.7 Australia

12.6.7.1 Australia 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.6.7.2 Market Size and Forecast

12.6.7.3 AustraliaMarket Segmental Analysis

12.6.8 Rest of Asia Pacific

12.6.8.1 Rest of Asia Pacific 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.6.8.2 Market Size and Forecast

12.6.8.3 Rest of Asia PacificMarket Segmental Analysis

12.7 LAMEA

12.7.1 LAMEA 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.7.2 Market Size and Forecast

12.7.3 LAMEA 3D Printing in Defence Market, By Country

12.7.4 GCC

12.7.4.1 GCC 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.7.4.2 Market Size and Forecast

12.7.4.3 GCCMarket Segmental Analysis

12.7.5 Africa

12.7.5.1 Africa 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.7.5.2 Market Size and Forecast

12.7.5.3 AfricaMarket Segmental Analysis

12.7.6 Brazil

12.7.6.1 Brazil 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.7.6.2 Market Size and Forecast

12.7.6.3 BrazilMarket Segmental Analysis

12.7.7 Rest of LAMEA

12.7.7.1 Rest of LAMEA 3D Printing in Defence Market Revenue, 2022-2034 ($Billion)

12.7.7.2 Market Size and Forecast

12.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 13. Competitive Landscape

13.1 Competitor Strategic Analysis

13.1.1 Top Player Positioning/Market Share Analysis

13.1.2 Top Winning Strategies, By Company, 2022-2024

13.1.3 Competitive Analysis By Revenue, 2022-2024

13.2 Recent Developments by the Market Contributors (2024)

Chapter 14. Company Profiles

14.1 Lockheed Martin Corporation

14.1.1 Company Snapshot

14.1.2 Company and Business Overview

14.1.3 Financial KPIs

14.1.4 Product/Service Portfolio

14.1.5 Strategic Growth

14.1.6 Global Footprints

14.1.7 Recent Development

14.1.8 SWOT Analysis

14.2 3D Systems Corporation

14.3 Desktop Metal, Inc.

14.4 SLM Solutions Group AG

14.5 Stratasys Ltd.

14.6 General Electric Company

14.7 Boeing Company

14.8 Dassault Systèmes SE

14.9 Materialise NV

14.10 HP Inc.

14.11 ExOne Company

14.12 Proto Labs, Inc.

14.13 Renishaw plc

14.14 Trumpf GmbH + Co. KG

14.15 Materialise NV

14.16 Optomec, Inc.