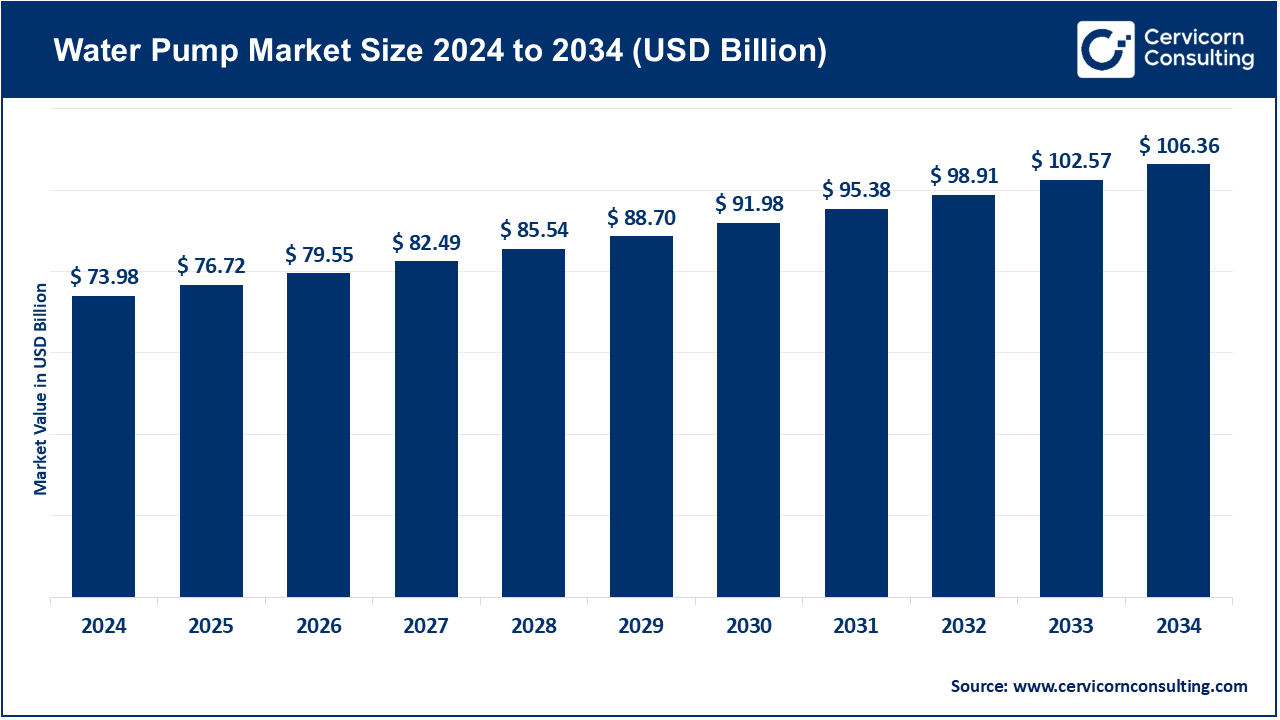

The global water pump market size was valued at USD 73.98 billion in 2024 and is expected to hit around USD 106.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.13% over the forecast period from 2025 to 2034.

The water pump market is expected to grow significantly owing to increasing global demand for efficient water management solutions in agriculture, municipal infrastructure, and industrial processes. Urbanization and population growth are driving the need for reliable water supply and wastewater treatment systems. Simultaneously, government initiatives focusing on irrigation development, flood control, and clean water access in emerging economies are accelerating pump adoption. Technological advancements such as smart pumps and energy-efficient models are further fueling market expansion, especially in regions facing water scarcity and rising energy costs. Additionally, the rise of industrial automation and the expansion of manufacturing sectors in Asia-Pacific and Latin America are reinforcing long-term demand for high-performance pumping systems across end-use sectors.

The water pump market is witnessing robust growth driven by rising global water demand across residential, agricultural, and industrial sectors. Increasing urbanization, climate-related water stress, and infrastructure upgrades are prompting investments in efficient pumping systems. Governments are promoting sustainable water use, encouraging the adoption of energy-efficient and solar-powered pumps. Smart water pumps with IoT integration are also gaining traction for real-time monitoring and predictive maintenance. Major players are focusing on innovations in materials, variable-speed drives, and automation to improve reliability and energy savings. This evolution supports broader goals of water conservation, operational efficiency, and access to clean water in emerging economies.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 76.72 Billion |

| Expected Market Size in 2034 | USD 106.36 Billion |

| Projected CAGR 2025 to 2034 | 4.13% |

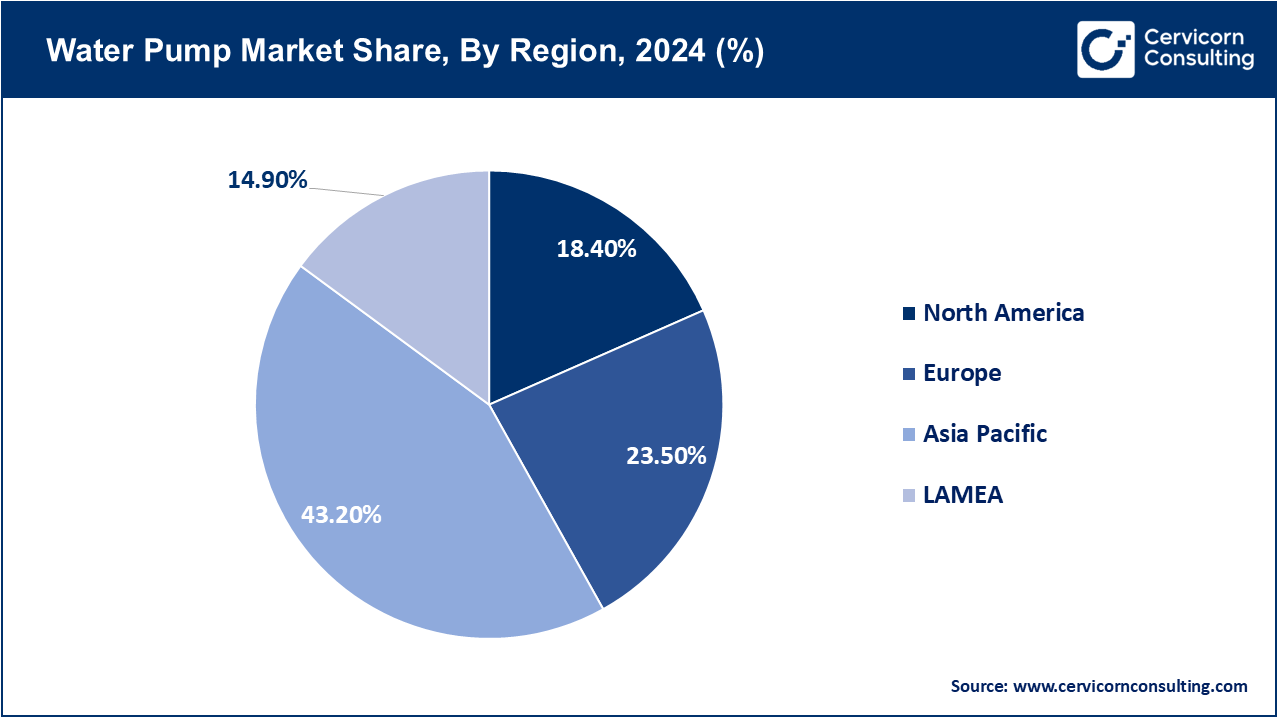

| Dominant Region | Asia-Pacific |

| Key Segments | Type, Business, Distribution Channel, Driving Force, End Use, Region |

| Key Companies | KSB SE & Co. KGaA, Flowserve, TT Inc., Gorman-Rupp, Pentair, Xylem, WILO SE, Grundfos, EBARA CORPORATION, ANDRITZ AG |

Centrifugal Pumps: As the workhorse of the market, centrifugal pumps employ impellers to transform rotational energy into fluid velocity and pressure. They perform well for high-flow, low-viscosity applications such as municipal water systems and irrigation, HVACs, and fire-fighting. Their basic structure provides cost-efficient operation, minimal maintenance, easy scaling across industries, and adaptability. However, their effectiveness is limited when pumping viscous liquids. There continues to be strong market demand for these pumps due to their affordability which drives innovation towards material improvements, efficiency enhancements to reduce cavitation, and expand hydraulic performance range.

Water Pump Market Revenue Share, By Type, 2024 (%)

| Type | Revenue Share, 2024 (%) |

| Centrifugal Pumps | 64.70% |

| Positive Displacement Pumps | 35.30% |

Positive Displacement Pumps: Positive displacement pumps capture specific fluid volumes and shift them through a fixed discharge aperture at the same rate resulting in steady flow regardless of consequences on downstream pressure. This makes them suitable for high viscosity fluids like oils, slurries, and pastes. These pumps also serve the precision dosing needs of chemical, food production, and mining industries. Other examples include gear; screw; diaphragm; plunger; and peristaltic pumps. While they experience higher costs due to mechanical complexity for both upfront costs as well as regular maintenance visits, these devices are invaluable where movement of dense/slurry liquid or abrasive substances is essential sludge removal, chemical metering, oil transport because critical industrial end-users.

OEM: Original Equipment Manufacturer (OEM) pumps are sold directly to OEMs for integration into new infrastructure, vehicles, and machines. These are often high-spec precision units customized to exact design tolerances, materials, and performance criteria. OEM relationships yield steady, long-term supply contracts, driving pump usage in sectors like automotive, OEM water circuits, irrigation systems, and industrial equipment. While margin per unit may be lower, the volume and repeat contract cycle make OEM business essential for pump producers.

Water Pump Market Revenue Share, By Business, 2024 (%)

| BUsiness | Revenue Share, 2024 (%) |

| OEM | 60.20% |

| Aftermarket | 39.80% |

Aftermarket: The aftermarket segment focuses on pump repair, replacement parts, retrofits, upgrades, and extended warranties. As centrifugal and displacement pumps age or sustain wear, demand grows for spare components, service kits, and performance upgrades. Furthermore, as a result of increased installed base globally, aftermarket revenue benefits from keeping the planned service cycles, environmental regulations shifting, and service bundling. This division often has higher margins than OEM sales, and is a benefit for pump manufacturers because it allows for repeat revenue and customer loyalty.

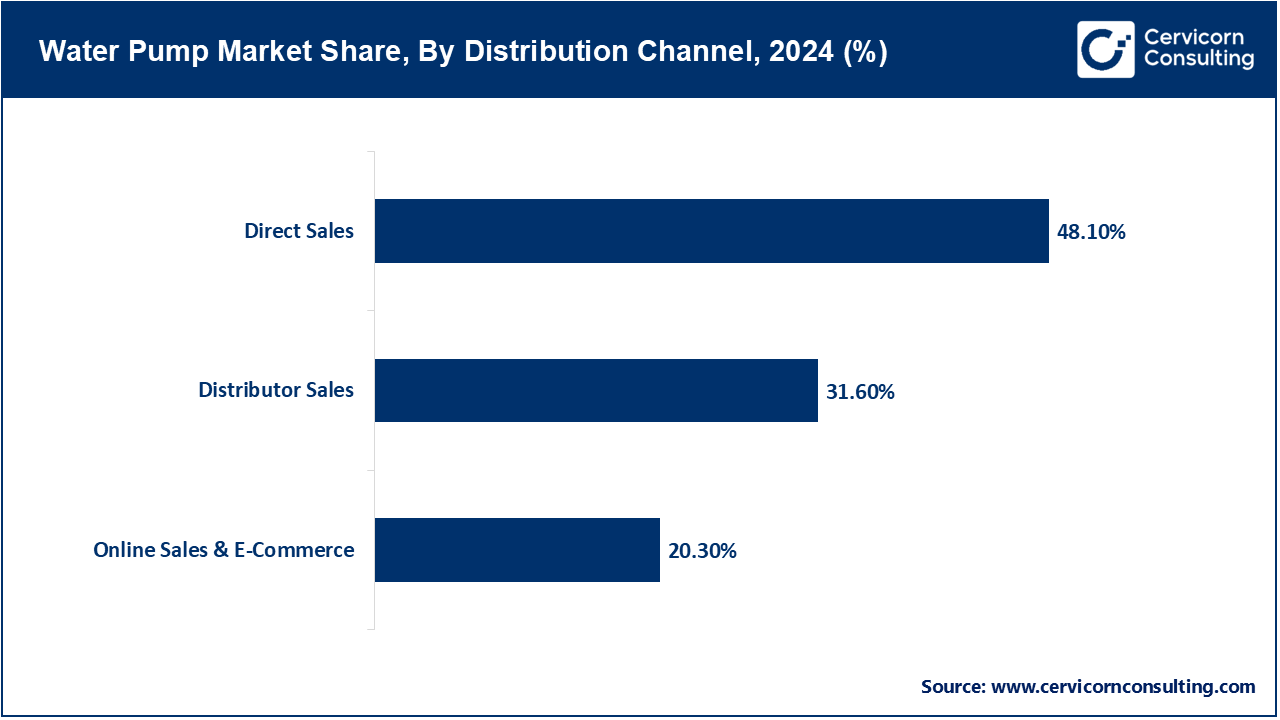

Direct Sales: This involves direct engagement of pump end-users, industrial clients, and contractors by manufacturers. This ensures bespoke design, rapid technical assistance, and robust integration needed for large-scale or specialized projects in municipal water systems, rigorous industries, or sophisticated consolidated pump arrangements. Retention of technical competencies staves off in-house burdens preserves agility to intricate specification demands to difficult compliance requirements. Though there is a need for additional field sales personnel and infrastructure, direct selling channels strengthen brand visibility and command over technical standards and quality augments brand reputation.

Distributor Sales: The stocking of pumps of different types and makes constitutes great value addition for distributors which they carry out under their own label. SMEs and construction firms as well as agricultural and municipal companies from a particular region are served by local distributors who also possess the required knowledge and skills. Additionally, authorized distributors improve logistics efficiency as well as speed of delivery; they have better information about the market in their vicinity compared to pump manufacturers. With specialized distributors coping with these factors improves access to markets without full-scale global infrastructure being set up by the pump manufacturers themselves. Most often these distributors determine performance based on the cycles of the economy in that area which is fundamentally important for competing OEMs.

Online Sales & E-Commerce: E-commerce is transforming the pump sector by allowing SMEs and DIY consumers to source pumps and parts from anywhere in the world. Emerging markets are benefitting from product comparison, pricing transparency, and technical documentation that online platforms offer. Although high-end or customized industrial pumps require hands-on interaction, standard centrifugal pumps, spare parts, and submersible units are easily ordered online. The use of digital channels reduces distribution costs while expanding market reach for smaller manufacturers. This trend accelerates adoption and contributes to aftermarket growth.

Municipal: Water management systems are integral to the pump market. For municipal water supply, pressure boosting, sewage pumps, and treatment plants centrifugal pumps are indispensable. Upgrades for infrastructure in developing countries continue parallel to existing investments due to scarce tap water and demand for large-capacity pumps with high energy efficiency. Tenders and prescribed adherence to strict standards often characterize municipal projects creating continuous demand. Urbanization trends still accelerate which together with sprucing up sanitation targets guarantees investments in low-maintenance robust pumps designed for public utilities.

Construction: Pumps are necessary at construction sites for dewatering, pressurization of HVAC systems as well as provision of temporary water supply. High-capacity portable centrifugal pumps are commonly used by contractors and hire firms. There is an increase in uptake of rugged pull-and-tow submersibles powered by electricity or solar. These, along with the ongoing construction boom in Asia-Pacific and LAMEA regions spurred through urbanization, shall meet the growing demand easily. Construction site pumps have a vital role during floods and need fast deployment during foundation work and site control over water issues due to their reliability.

Water Pump Market Revenue Share, By End Use, 2024 (%)

| End Use | Revenue Share, 2024 (%) |

| Municipal | 27.5% |

| Construction | 12.90% |

| Agriculture | 24.40% |

| Mining | 9.10% |

| Oil & Gas | 7.60% |

| Industrial | 18.50% |

Agriculture: The irrigation and water management sectors are among the highest consumers of pumps. The industry requires cost-effective, durable solutions ranging from submersible borehole units to centrifugal and diesel-driven surface pumps. Government subsidies for irrigation coupled with mechanization in India, China, and Brazil is driving pump proliferation. Used for lifting water effluents scrubbed of sedimentation, irrigation pumps require materials with corrosion resistance as well as generous hydraulic ranges. Prompting OEMs to offer IoT-enabled pumps geared towards remote efficiency monitoring is the digitalization of irrigation systems.

Mining: Water management in mining operations entails dewatering, slurry transfer and chemical dosing which occurs simultaneously in a confined space due to harsh environmental conditions. Within solid-laden liquid or high-pressure contexts, positive displacement pumps like diaphragm and screw types are favored; centrifugal units may support groundwater extraction or flushing duties. Rugged, maintainable abrasive resistant service-grade solutions are essential at remote mining sites along with spill-proof design due to stringent environmental regulations. Demand for specialized mining-duty models remains strong as mineral extraction expands across Latin America, Africa, and Australia.

Oil & Gas: In the oil and gas industry, pumps are important for upstream extraction and downstream refining as well as for transporting petrochemical feedstocks. Positive displacement pumps are used for high-viscosity crude and injection chemicals, while centrifugal types support water injection, cooling, and leak recovery. The industry’s rigorous standards for pumps include explosion-proof design remote monitoring systems API compliance. There is a continual or growing global demand for energy and offshore expansion, thus sophisticated pumping systems are still in such high demand. There is also an emerging need for hydrogen-ready pumps and low-emission systems.

Industrial: Industrial users include manufacturing companies, chemical industries, food and drink industries, pharmaceutical sectors, and power generation plants. Their fluid handling services range from clean water to corrosive solvents/slurries, lubricants as well as precise dosing requirements. Both centrifugal and positive displacement pumps are critical to these industries; their hygiene requirements during food processing, accuracy in pharmaceuticals or service longevity in chemicals sets them apart from the competition. There is ever increasing global automation which escalates the need of intelligent trustworthy performance propelled by Industry 4.0 designed IoT condition monitoring systems into pump design.

The water pump market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

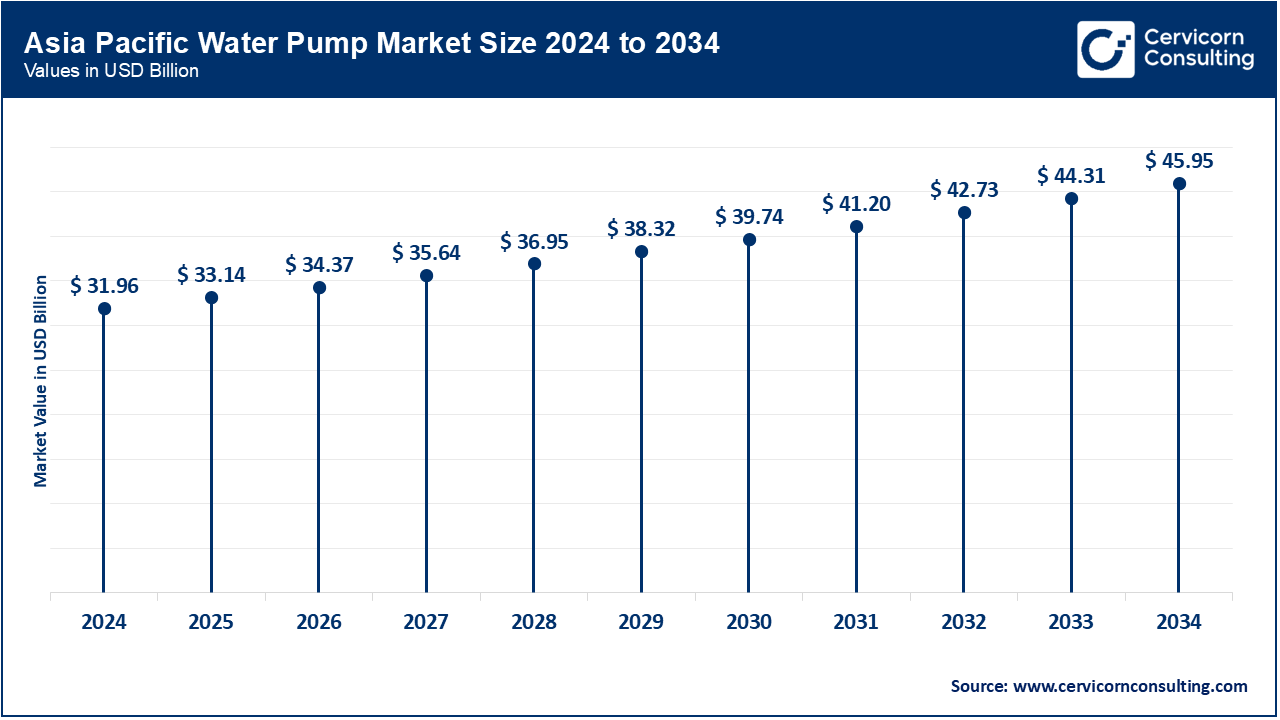

The Asia-Pacific consists of the most advanced market, due to industrialization trends, construction megaprojects and mechanized agriculture. China and India are key demand centers, with significant usage for irrigation, construction and municipal water supply activities. Adoption is enhanced by expansion projects in smart cities as well as renewable energy powered water systems. Increased understanding of water conservation alongside stressed local resources fosters innovation on efficient pumping technologies. Local companies are increasing production capacities while international companies are accessing regional growth through collaborations. Government-supported initiatives for irrigation and sanitation also boost sustained demand in the region.

In North America, there is a significant increase in the market due to the need of modernizing outdated water systems in both urban and rural areas. Regulatory policies relating to sustainable water preservation focus on the implementation of energy-efficient and smart pump technologies. This region also serves other industries such as oil & gas, agriculture, and construction which require constant water access. Furthermore, manufacturers from this region are equipping themselves with advanced technological capabilities that position them at the forefront of smart municipal and industrial pumps markets, which fuels competition in those sectors. Other driving factors include climate change mitigation strategies coupled with a need for reliable water infrastructures.

The Europe is driven by international framework agreements like environmental boundaries regions as well as water availability policies from European Union institutions together with urban renewal programs. Germany, France, and The Netherlands are adopting smart water widtech in wastewater treatment and clean water supply services. They also prioritize energy efficiency while lowering carbon emissions; thus increasing demand for automation sensors in pumps. Coupled with these motivations, the upper-tier manufacturing counties eco-design marks quality attributes for self-and faster rate servicing tough competition to cope up with increasing concern about aging infrastructure across municipalities-elevated needing wide modernization investment its counterparts

In LAMEA Region, urban growth alongside scarcity of water resources coupled with investment in agriculture as well as mining and oil & gas sector drives demand for water pumps within the region. Middle East region especially with GCC countries has large scale desalination and reuse projects which serves as a critical driver from further growth. Countries such as Africa and Latin America have greater adoption of pumps for rural based farming activities along with community access powered by solar energy. These markets are greatly influenced by political stability, investment in infrastructure development along with military spending public private partnerships funded by the government Augmented funnel structure is structurally much simpler than conventional centrifugal versions The mobile pump market system create portable energy independent systems designed for remote regions rely heavily on locally tailored conditions.

The global water pump industry is driven by major industrial players such as Grundfos, Xylem, KSB SE & Co. KGaA, WILO SE, and EBARA Corporation, who are leading innovation in smart pumping systems, energy-efficient technologies, and sustainable water management. These companies are actively investing in digitized pump solutions integrated with IoT, predictive maintenance capabilities, and cloud-based monitoring, targeting industries such as municipal water supply, agriculture, mining, and construction.

Xylem is expanding its smart water infrastructure to enable real-time data monitoring, while Grundfos continues to pioneer energy-saving circulator pumps for domestic and industrial use. WILO SE is focusing on decarbonization by launching high-efficiency pumps for heating, cooling, and water distribution. Meanwhile, Flowserve and Pentair are diversifying their portfolios with robust pumping systems for wastewater and desalination plants.

These companies are leveraging R&D, sustainability frameworks, and regional expansion to capture growing demand amid rising urbanization, water scarcity, and regulatory compliance. Their collective push toward low-carbon, AI-integrated, and modular water pump solutions positions them as enablers of future-ready infrastructure.

Market Segmentation

By Type

By Business

By Distribution Channel

By Driving Force

By End Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Water Pump

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Business Overview

2.2.3 By Distribution Channel Overview

2.2.4 By Driving Force Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Energy Efficiency Mandates

4.1.1.2 Digitalization & Predictive Maintenance

4.1.1.3 Government Funding for Water Projects

4.1.2 Market Restraints

4.1.2.1 High Upfront Cost of Advanced Pump Systems

4.1.2.2 Infrastructure Deficit in Developing Regions

4.1.2.3 Fluctuating Prices of Raw Materials

4.1.3 Market Challenges

4.1.3.1 Smart Systems and Legacy Integration

4.1.3.2 Cybersecurity Challenges Posed by SCADA Networks

4.1.4 Market Opportunities

4.1.4.1 Retrofitting with Variable Speed Drives (VSDs)

4.1.4.2 Pump-as-a-Service (PaaS) Models

4.1.4.3 Digital Twin & Real-Time Optimization

4.1.4.4 Heat-Recovery & Waste-Energy Pumping

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Water Pump Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Water Pump Market, By Type

6.1 Global Water Pump Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Centrifugal Pumps

6.1.1.2 Positive Displacement Pumps

Chapter 7. Water Pump Market, By Business

7.1 Global Water Pump Market Snapshot, By Business

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 OEM

7.1.1.2 Aftermarket

Chapter 8. Water Pump Market, By Distribution Channel

8.1 Global Water Pump Market Snapshot, By Distribution Channel

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Direct Sales

8.1.1.2 Distributor Sales

8.1.1.3 Online Sales & E-Commerce

Chapter 9. Water Pump Market, By Driving Force

9.1 Global Water Pump Market Snapshot, By Driving Force

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Electric Driven

9.1.1.2 Engine Driven

Chapter 10. Water Pump Market, By End-User

10.1 Global Water Pump Market Snapshot, By End-User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Municipal

10.1.1.2 Construction

10.1.1.3 Agriculture

10.1.1.4 Mining

10.1.1.5 Oil & Gas

10.1.1.6 Industrial

Chapter 11. Water Pump Market, By Region

11.1 Overview

11.2 Water Pump Market Revenue Share, By Region 2024 (%)

11.3 Global Water Pump Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Water Pump Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Water Pump Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Water Pump Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Water Pump Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Water Pump Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Water Pump Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Water Pump Market, By Country

11.5.4 UK

11.5.4.1 UK Water Pump Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Water Pump Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Water Pump Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Water Pump Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Water Pump Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Water Pump Market, By Country

11.6.4 China

11.6.4.1 China Water Pump Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Water Pump Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Water Pump Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Water Pump Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Water Pump Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Water Pump Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Water Pump Market, By Country

11.7.4 GCC

11.7.4.1 GCC Water Pump Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Water Pump Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Water Pump Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Water Pump Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 KSB SE & Co. KGaA

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Flowserve

13.3 TT Inc.

13.4 Gorman-Rupp

13.5 Pentair

13.6 Xylem

13.7 WILO SE

13.8 Grundfos

13.9 EBARA CORPORATION

13.10 ANDRITZ AG