Water and Wastewater Treatment Market Size and Growth 2026 To 2035

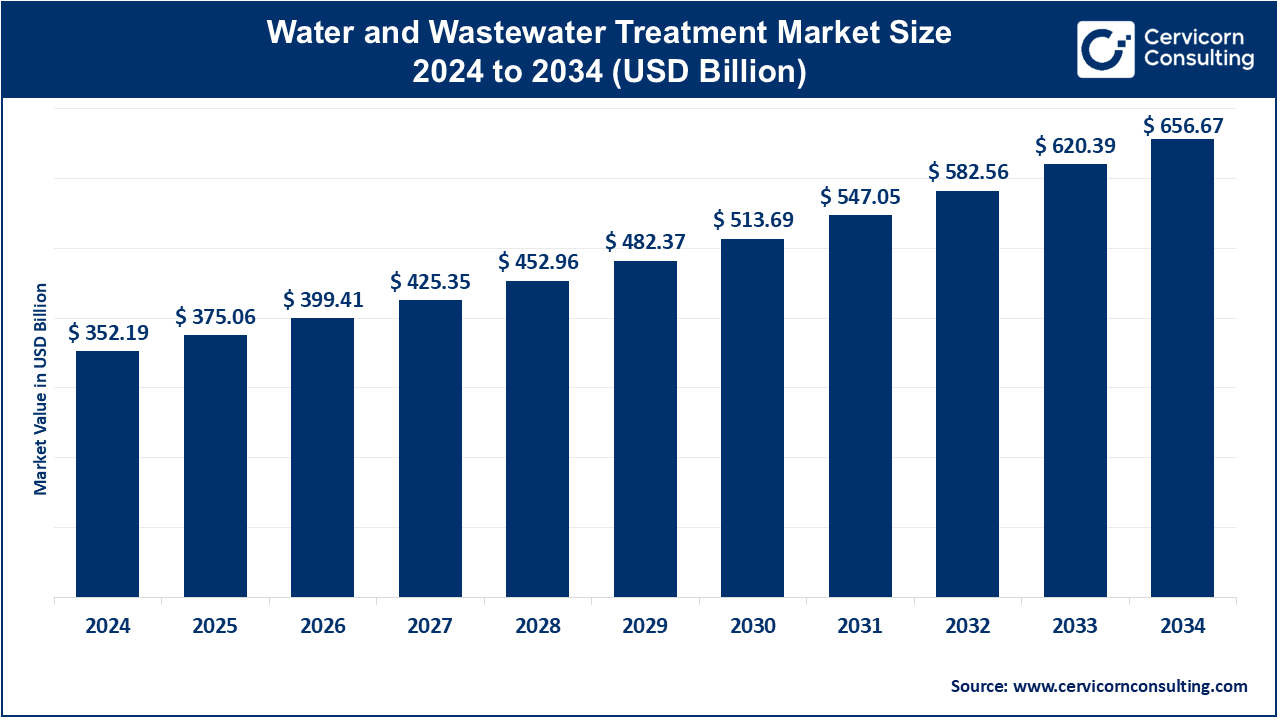

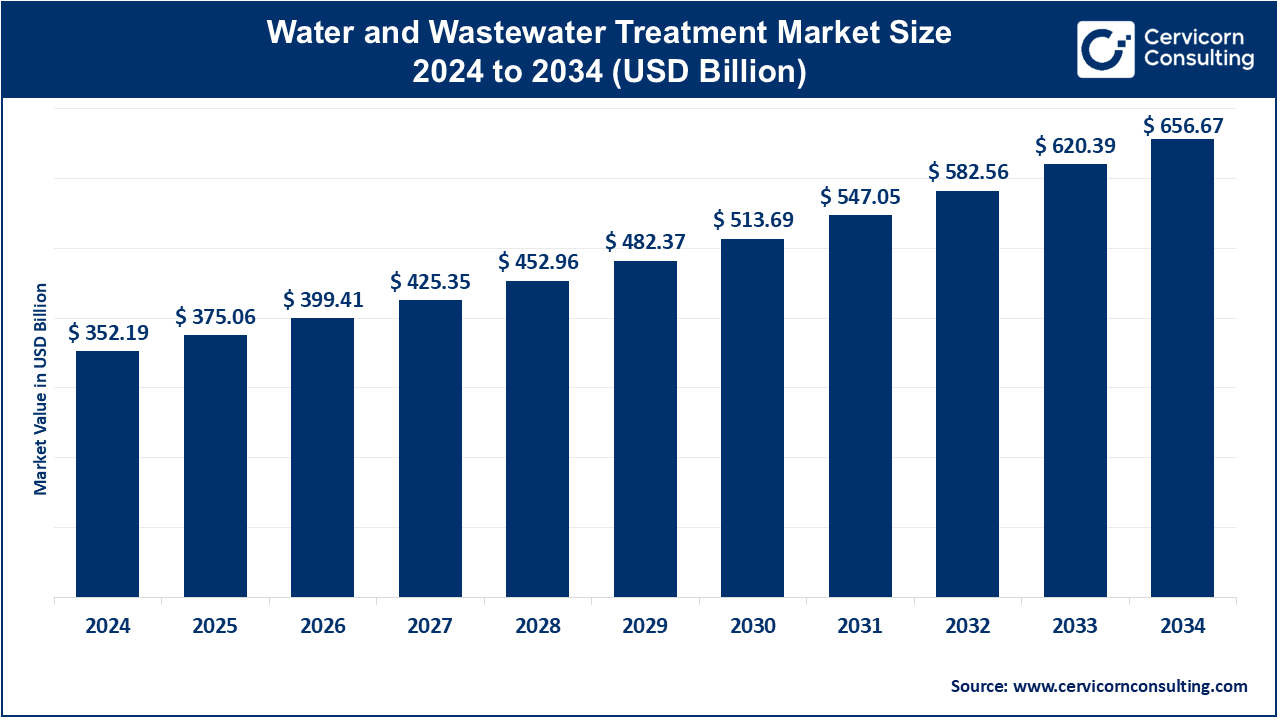

The global water and wastewater treatment market size was accounted for USD 375.06 billion in 2025 and is expected to hit around USD 693.99 billion by 2035, growing at a compound annual growth rate (CAGR) of 6.35% over the forecast period 2026 to 2035.

The water and wastewater treatment market is rapidly expanding due to growing concerns about water pollution, water scarcity, and the need for sustainable management of water resources. Increasing industrial activities and urbanization are placing immense pressure on water resources, making effective treatment technologies essential. As the global population grows, the demand for clean water and wastewater treatment solutions is intensifying. Industrial sectors such as manufacturing, power generation, and food processing contribute significantly to wastewater generation, driving the need for effective treatment systems. Municipalities are investing in infrastructure to meet the growing demand for potable water and improve wastewater discharge quality, further fueling the market.

- According to a Global Water Leaders Group survey, Industrial water demand fell by 27% in FY 2019-2020 per a Global Water Leaders Group survey. Emergency measures in many countries, like Brazil's tariff exemptions and bill deferrals, impacted municipal water revenues. The utility also donated water tanks to aid communities during the crisis.

- In July 2022, Pentair plc completed a $1.6 billion acquisition of Manitowoc Ice from Welbilt, Inc. This acquisition strengthens Pentair's Commercial Water Solutions business, enhancing its global presence in commercial ice makers and reinforcing its commitment to sustainable water management solutions.

What is water and wastewater treatment?

Water and wastewater treatment refers to the processes used to improve the quality of water for specific purposes, including drinking, industrial use, irrigation, or safe environmental discharge. The treatment involves removing impurities such as solids, bacteria, organic matter, and chemicals. Key processes include primary treatment (removal of large debris and sedimentation), secondary treatment (biological processes to remove organic matter), and tertiary treatment (advanced techniques like filtration, disinfection, or desalination). Types of water treatment include physical (filtration, sedimentation), chemical (chlorination, ozonation), and biological (activated sludge, biofilters). Wastewater treatment further involves specialized methods like anaerobic digestion, membrane filtration, and sludge management. These systems are essential for maintaining public health, protecting aquatic ecosystems, and supporting sustainable water use.

Water and Wastewater Treatment Market Report Highlights

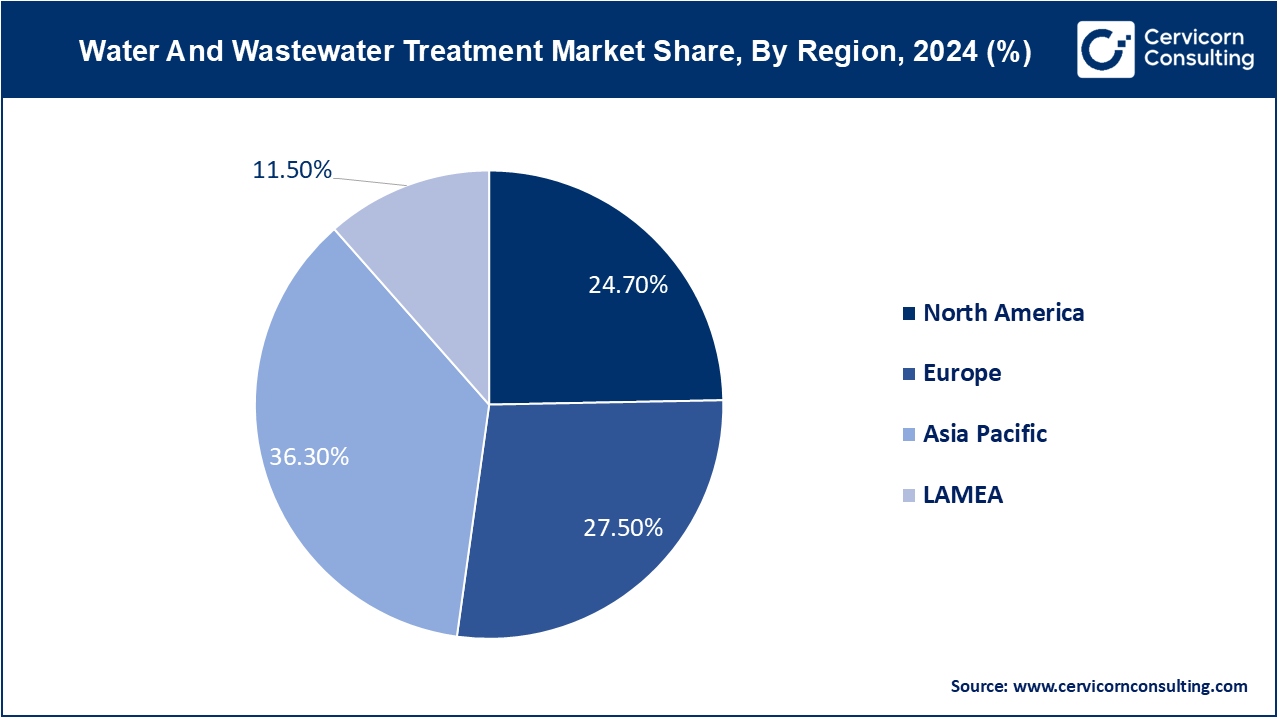

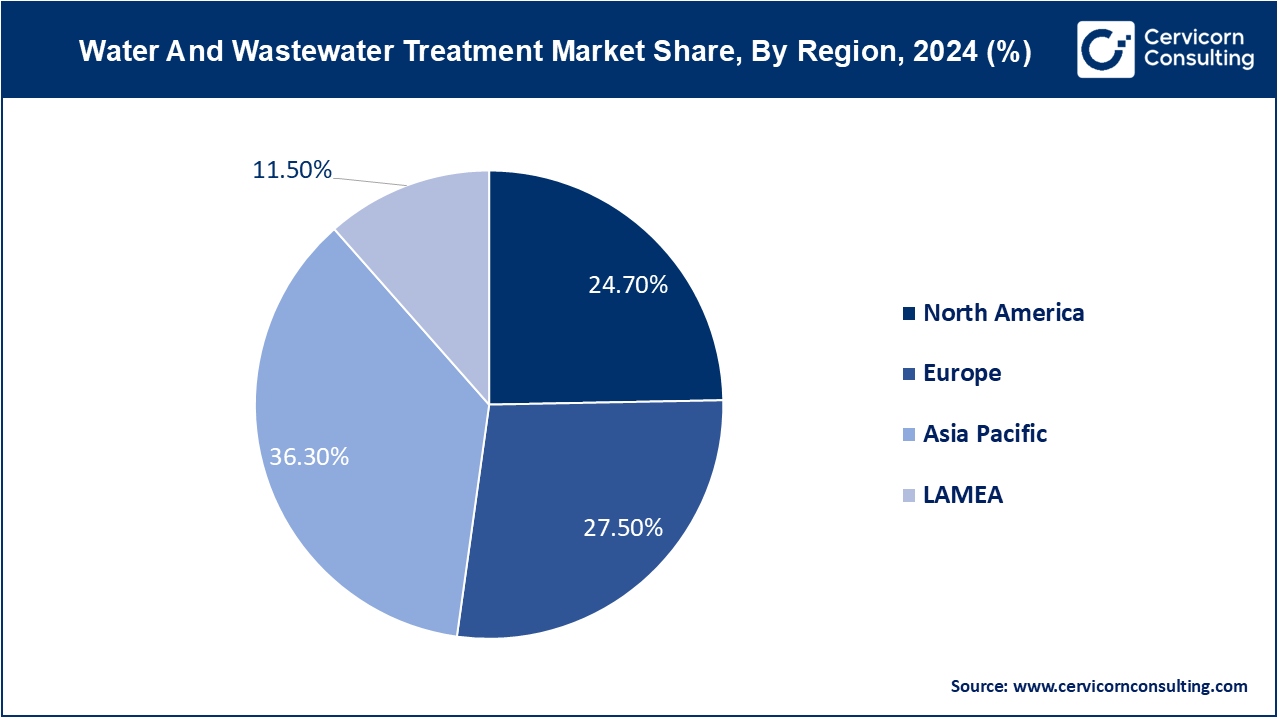

- Asia Pacific has registered highest revenue share of 36.3% in 2025.

- Europe has captured second highest revenue share of 27.5% in 2025.

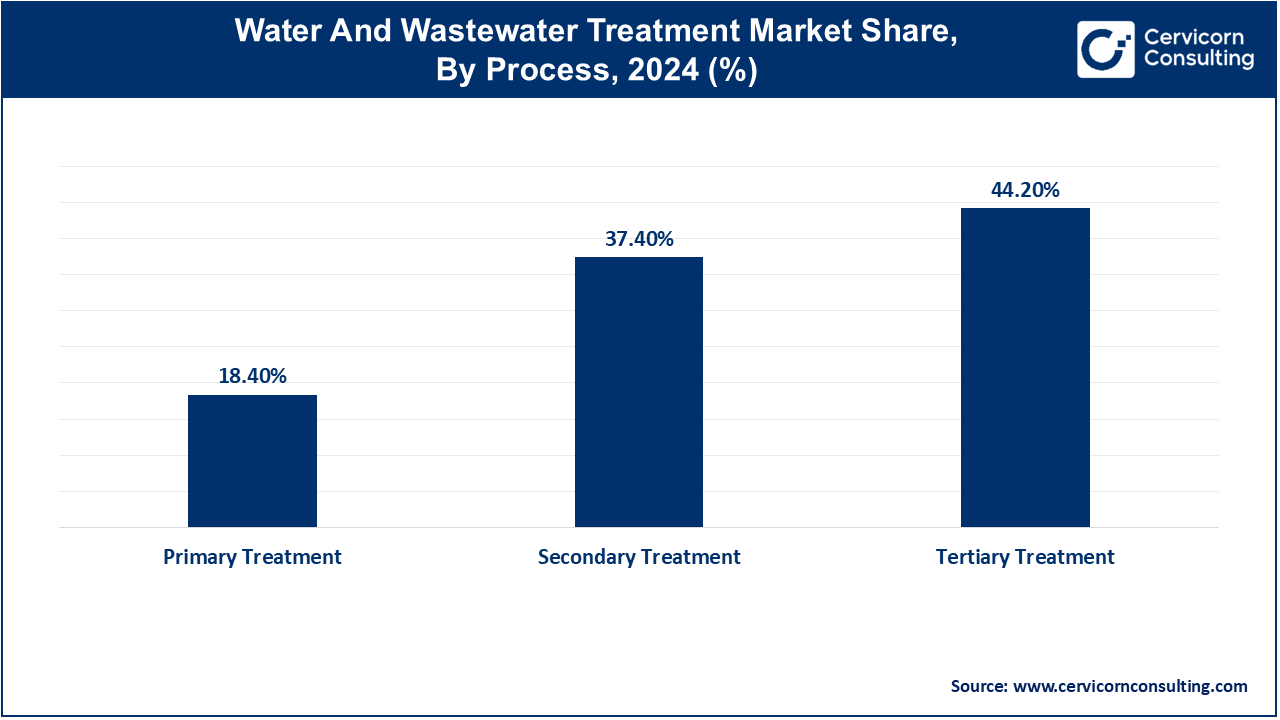

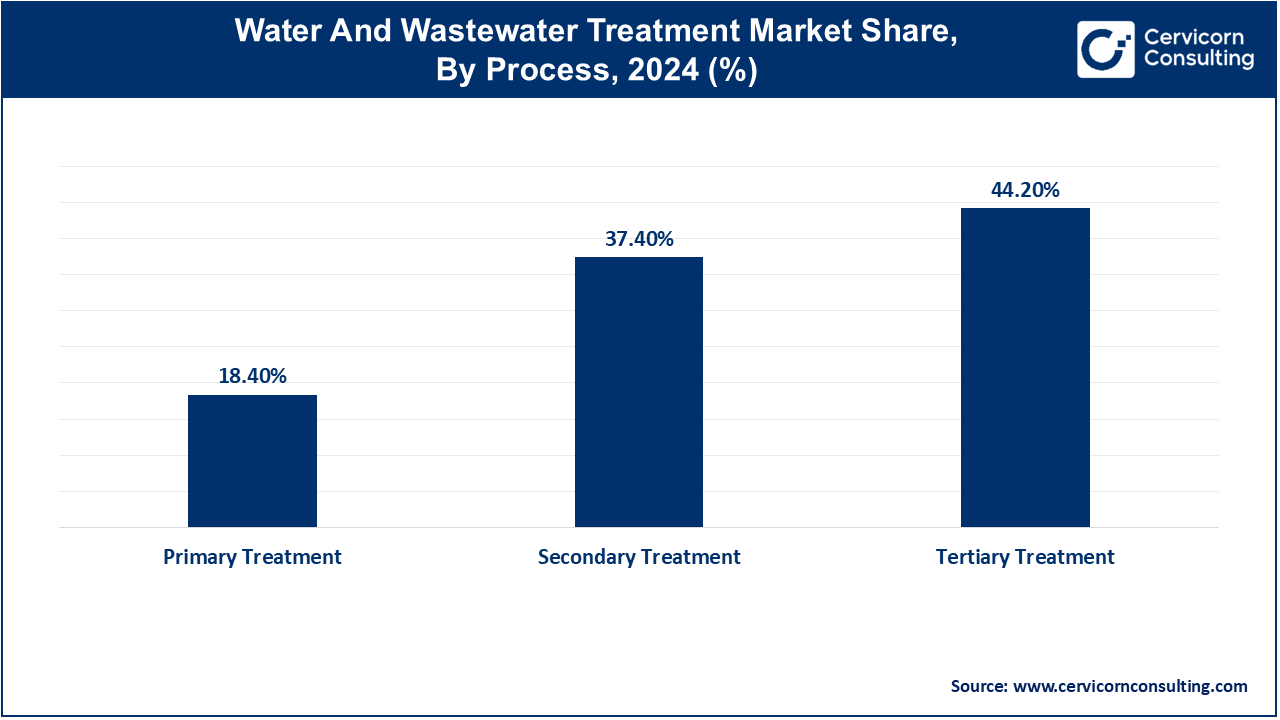

- By process, tertiary treatment segment has dominated market with the revenue share of 44.2%.

- By process, secondary treatment segment has generated revenue share of 37.4% in 2025.

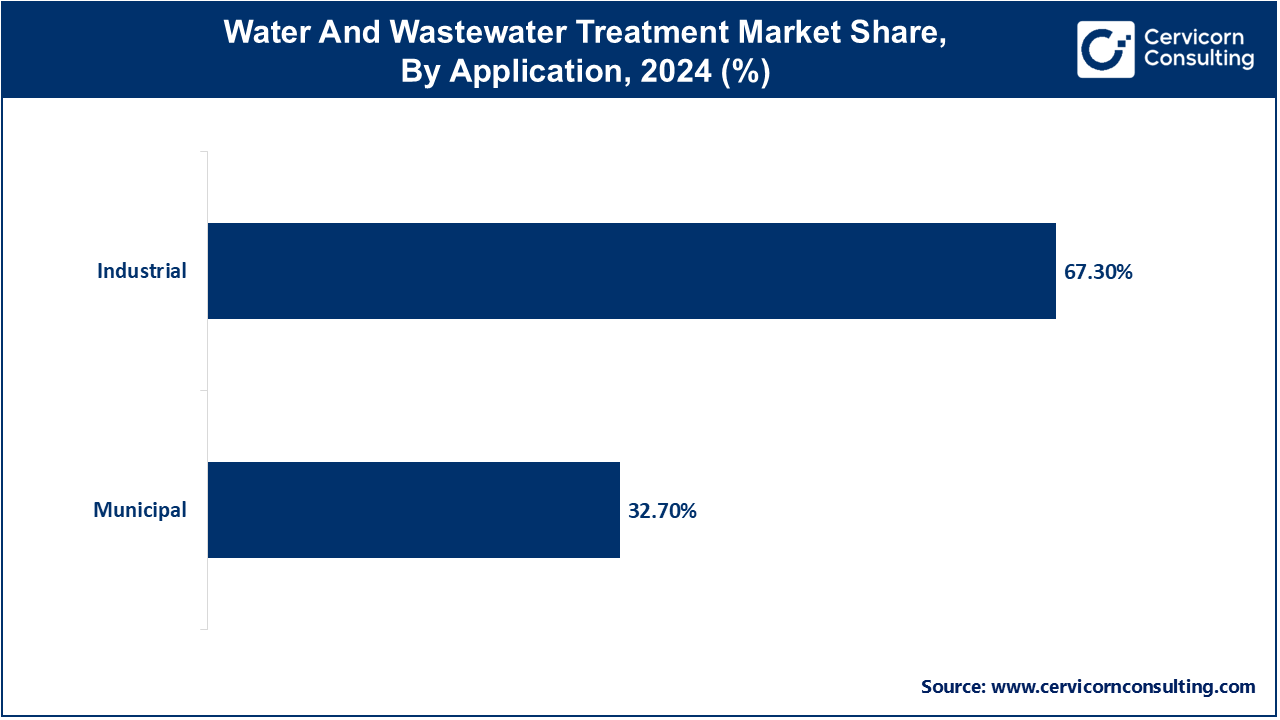

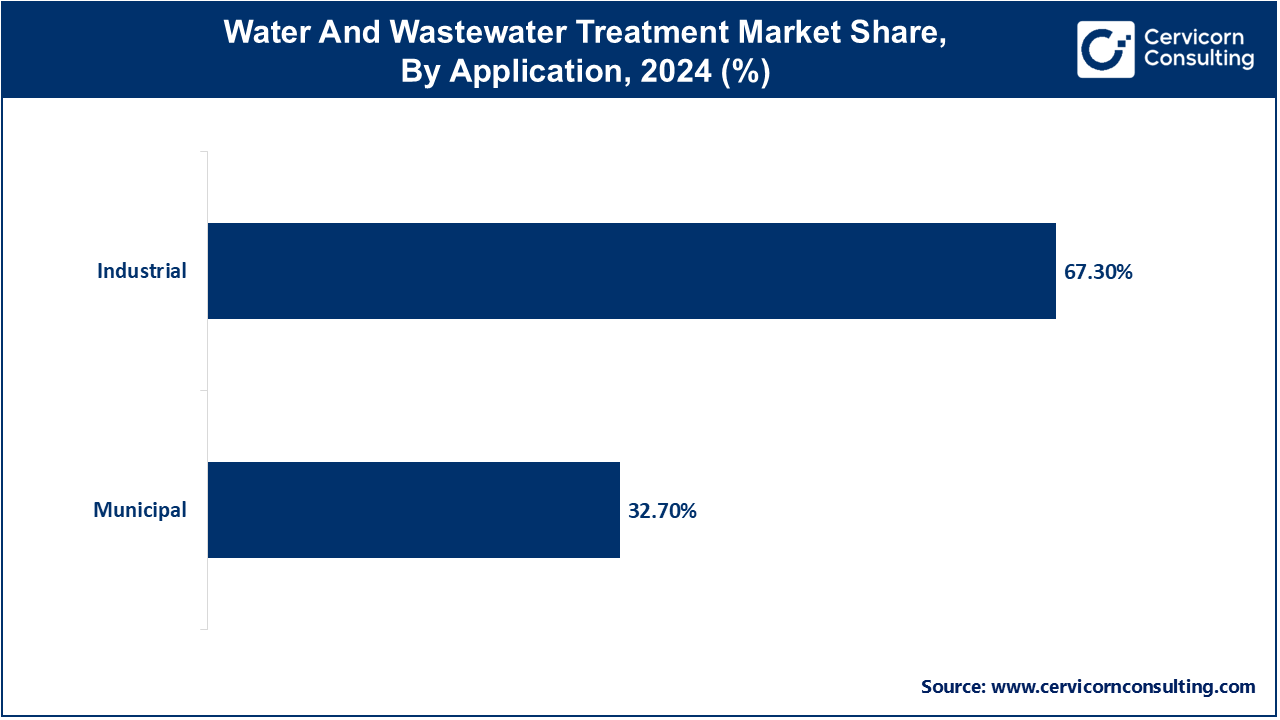

- By Application, industrial segment has achieved revenue share of 67.3% in 2025.

Water and Wastewater Treatment Market Growth Factors

- Population Growth and Urbanization: Rapid urban expansion increases demand for clean water, necessitating advanced treatment solutions to meet rising consumption needs.

- Stringent Environmental Regulations: Increasing regulatory standards globally drive the adoption of water treatment technologies to ensure compliance and mitigate environmental impact.

- Industrialization and Water Intensive Industries: Growth in industries such as manufacturing, food processing, and pharmaceuticals escalates demand for efficient water treatment solutions to manage wastewater discharge and recycling.

- Technological Advancements: Innovations in membrane filtration, UV disinfection, and advanced oxidation processes enhance treatment efficiency, driving market expansion.

- Water Scarcity and Sustainability Initiatives: Rising awareness of water scarcity prompts investments in sustainable water management practices and technologies, promoting the growth of the market for efficient water reuse and conservation solutions.

Water and Wastewater Treatment Market Trends

- Smart Water Management: Adoption of IoT, AI, and data analytics to optimize water treatment processes, improve efficiency, and reduce operational costs.

- Decentralized Water Treatment Systems: Growing preference for modular and decentralized systems to cater to remote and urban areas, providing flexibility and scalability.

- Water Reuse and Recycling: Increasing emphasis on sustainable practices drives demand for technologies that enable efficient water reuse and recycling, reducing freshwater consumption.

- Advanced Membrane Technologies: Rising deployment of membrane filtration technologies like reverse osmosis (RO) and nanofiltration for effective removal of contaminants and pollutants.

- Energy Efficiency: Integration of energy-efficient technologies and renewable energy sources to minimize carbon footprint in water treatment operations.

- Emerging Contaminant Removal: Focus on removing emerging contaminants such as pharmaceuticals, microplastics, and chemicals from wastewater to meet stringent regulatory standards.

- Resilience Planning: Heightened awareness of climate change impacts drives investment in resilient water infrastructure and disaster preparedness.

- Public-Private Partnerships (PPP): Increasing collaboration between governments, private sectors, and NGOs to finance and implement water treatment projects, particularly in developing regions.

Report Scope

| Area of Focus |

Details |

| Market size in 2026 |

USD 399.41 Billion |

| Market size in 2035 |

USD 693.99 Billion |

| Market Growth Rate |

CAGR of 6.35% from 2026 to 2035 |

| Largest Region |

Asia-Pacific |

| Fastest Growing Region |

North America |

| Segment Covered |

By Application, Process by Equipment, Regions |

Water and Wastewater Treatment Market Dynamics

Drivers

Public Health Concerns

- Increasing incidents of waterborne diseases and contamination outbreaks globally drive governments and communities to prioritize safe drinking water and effective wastewater treatment. Heightened awareness of the health impacts of poor water quality fuels demand for advanced treatment technologies and stringent regulatory standards, especially in regions prone to waterborne illnesses.

Urbanization and Infrastructure Development

- Rapid urban growth necessitates the expansion and modernization of water and wastewater infrastructure. Urbanization leads to higher water consumption rates and greater wastewater generation, requiring investments in efficient treatment systems to meet growing demand and ensure sustainable water management practices in urban areas.

Restraints

High Operational Costs

- Implementing and maintaining advanced water and wastewater treatment technologies can be costly, especially for municipalities and industries with limited budgets. Operational expenses include energy consumption, maintenance of equipment, and compliance with stringent regulatory standards. These costs may deter smaller organizations from investing in upgrading their treatment facilities, delaying necessary improvements to water quality and wastewater management.

Lack of Awareness and Education

- In some regions, there is a lack of awareness about the importance of effective water and wastewater treatment practices. This can lead to inadequate funding for infrastructure upgrades, insufficient adoption of advanced treatment technologies, and poor compliance with environmental regulations. Public education and awareness campaigns are crucial to garnering support for sustainable water management practices and encouraging investment in modernizing water treatment infrastructure.

Opportunities

Emerging Markets and Infrastructure Development

- Rapid urbanization in emerging markets presents significant opportunities for water and wastewater treatment infrastructure development. Governments and private sectors are increasingly investing in modernizing and expanding treatment facilities to meet growing demand and comply with environmental regulations. This growth potential extends to regions where industrialization and population growth drive the need for efficient water management solutions.

Technological Advancements

- Ongoing innovations in water treatment technologies, such as membrane filtration, advanced oxidation processes, and smart water management systems, create opportunities for enhanced efficiency, cost-effectiveness, and sustainability. Companies investing in research and development of these technologies can gain a competitive edge by offering solutions that improve water quality, reduce operational costs, and address emerging challenges like contaminants and water scarcity effectively.

Challenges

Complexity of Contaminants

- The presence of emerging contaminants such as pharmaceuticals, microplastics, and personal care products in wastewater poses a significant challenge. These substances often require specialized treatment methods that are not traditionally included in standard treatment processes. Developing effective technologies to detect and remove these contaminants is crucial but can be technically challenging and expensive, especially for smaller treatment facilities.

Climate Change Resilience

- Climate change-induced extreme weather events, such as floods and droughts, pose challenges to water treatment infrastructure. Floods can overwhelm treatment plants and lead to untreated sewage discharge, while droughts reduce water availability for treatment processes. Building resilience against these events requires investments in adaptive infrastructure, innovative technologies, and robust contingency planning to ensure continuity of water supply and wastewater treatment operations under changing environmental conditions.

Water and Wastewater Treatment Market Segmental Analysis

Application Analysis

Municipal: The municipal segment has covered market share of 32.7% in 2025. The municipal segment focuses on treating water for public consumption and managing wastewater from residential areas. Market trends include increasing urbanization driving demand for efficient water treatment solutions. Drivers include regulatory requirements for clean drinking water and wastewater discharge standards, prompting investments in advanced technologies like membrane filtration and UV disinfection to meet growing municipal water needs sustainably.

Industrial: The industrial segment has generated market share of 67.3% in 2025. This industrial segment addresses water treatment for various industrial processes and managing wastewater from manufacturing facilities. Market trends involve stricter environmental regulations pushing industries towards sustainable water management practices. Drivers include the need to comply with stringent discharge limits and reduce water consumption through recycling and reuse technologies. Innovations in industrial water treatment focus on tailored solutions for specific contaminants and optimizing resource efficiency amid increasing global industrialization.

Process Analysis

Primary Treatment: This Segement has accounted market share of 18.4% in 2025. Primary treatment in the Water and Wastewater Treatment market involves physical processes like screening and sedimentation to remove large particles and debris from wastewater. Market trends include advancements in screening technologies and automated sedimentation systems to improve efficiency. Drivers include the need for preliminary treatment to reduce organic load and protect downstream processes in wastewater treatment plants, ensuring effective overall treatment.

Secondary Treatment: The secondary treatment segment has calculated market share of 37.4% in 2025. Secondary treatment focuses on biological processes such as activated sludge and biological filtration to further remove dissolved organic matter and nutrients from wastewater. Market trends include the adoption of advanced biological reactors and membrane bioreactors for enhanced treatment efficiency. Drivers include regulatory requirements for nutrient removal and biological oxygen demand reduction, prompting investments in sustainable secondary treatment technologies to meet stringent discharge standards.

Tertiary Treatment: This segment has recorded market share of 44.2% in 2025. Tertiary treatment involves advanced processes like filtration, disinfection, and nutrient removal to achieve high-quality effluent suitable for reuse or environmentally sensitive discharge. Market trends include increasing demand for water reuse applications and advanced disinfection technologies like UV and ozone treatment. Drivers include the rising importance of water scarcity management and regulatory pressures to achieve near-zero discharge, driving innovations in tertiary treatment processes and equipment.

Water and Wastewater Treatment Market Regional Analysis

Why is Asia-Pacific leading the water and wastewater treatment market?

The Asia-Pacific water and wastewater treatment market size is accounted USD 135.40 in 2025 and is forecasted to gain USD 250.53 with a compound annual growth rate (CAGR) of 8.10% from 2026 to 2035. Countries such as China and India invest in expanding treatment capacities to address water pollution issues. The region also sees increasing adoption of smart water management solutions and investments in water infrastructure development.

Why North America region is experiencing rapid growth in the water and wastewater treatment market?

The North America water and wastewater treatment market size is calculated at USD 92.34 billion in 2025 and is expanding around USD 170.86 billion by 2035. North America market is characterized by stringent environmental regulations and advanced infrastructure. The United States and Canada lead in adopting advanced treatment technologies to meet strict water quality standards. Increasing investments in water reuse and recycling technologies are driven by concerns over water scarcity and sustainability.

Europe Water and Wastewater Treatment Market Trends

The Europe water and wastewater treatment market size is measured at USD 103.07 billion in 2025 and is estimated around USD 190.71 billion by 2035. Europe emphasizes sustainable water management practices with robust regulatory frameworks. Countries like Germany and the UK focus on upgrading aging infrastructure and implementing advanced treatment methods. Innovations in membrane technologies and decentralized treatment systems are prominent trends.

LAMEA's Water and Wastewater Treatment Market Trends

LAMEA's market is expanding due to urban development and industrial growth. Countries like Brazil, South Africa, and the UAE are focusing on improving water quality and managing wastewater effectively. Investments in desalination plants, wastewater treatment upgrades, and sustainable water reuse technologies are key trends in the region, driven by water scarcity concerns and regulatory requirements.

Global Water and Wastewater Treatment Market Top Companies

- Veolia Environnement S.A.

- Suez S.A.

- Ecolab Inc.

- Xylem Inc.

- Danaher Corporation

- Pentair plc

- Aquatech International LLC

- Evoqua Water Technologies LLC

- Kurita Water Industries Ltd.

- 3M Company

- Calgon Carbon Corporation

- IDEXX Laboratories, Inc.

- GE Water

- Pall Corporation

- Trojan Technologies

Dominating players in the Water and Wastewater Treatment Market, such as Veolia Environnement S.A. and Suez S.A., are at the leading with a strong emphasis on sustainability and technological advancements. They offer extensive water management solutions and cutting-edge purification technologies on a global scale. Players like Ecolab Inc., Xylem Inc., and Danaher Corporation specialize in industrial water sanitation, intelligent water resource management, and advanced water quality assessment, respectively. Along with that emerging players like AquaVenture Holdings Limited and DuPont Water Solutions focus on decentralized treatment approaches and innovative membrane technologies for desalination and water recycling. Through strategic collaborations with governmental bodies and private sectors, these market leaders drive innovations in smart infrastructure, digital monitoring tools, and decentralized treatment systems, promoting efficiency and sustainability in water treatment practices worldwide.

CEO Statements

- Antoine Frérot, CEO of Veolia Environnement S.A.: "At Veolia, we are committed to delivering sustainable solutions that address global water challenges. Our focus remains on innovation and operational excellence to ensure efficient water management and environmental stewardship."

- Bertrand Camus, CEO of Suez S.A.: "Suez is dedicated to providing essential water and waste management services worldwide. We continue to invest in cutting-edge technologies and partnerships to advance sustainable development and support the communities we serve."

- Douglas M. Baker Jr., CEO of Ecolab Inc.: "Ecolab remains steadfast in our mission to deliver clean water, safe food, and healthy environments. Our innovative solutions in water treatment and hygiene help industries worldwide operate efficiently and responsibly."

- Patrick K. Decker, CEO of Xylem Inc.: "Xylem is committed to solving water challenges through smart technology and collaboration. We leverage our expertise in water infrastructure and analytics to drive sustainability and resilience in communities around the globe."

- R. Lawrence Culp Jr., CEO of Danaher Corporation (formerly Thomas P. Joyce Jr.): "Danaher is focused on advancing water quality and safety through rigorous testing and monitoring solutions. We continue to innovate and invest in technologies that enhance environmental stewardship and regulatory compliance."

Recent Developments

- In April 2023, Veolia secured a contract for operating and maintaining Istanbul's inaugural waste-to-energy facility, recognized as Europe's largest.

- In January 2023, Xylem Inc. completed an all-stock acquisition of Evoqua, a prominent provider of water treatment solutions and services.

- In December 2022 saw Veolia finalize the sale of Suez Recycling and Recovery UK Group Holdings Ltd. to Suez, fulfilling antitrust obligations set by the UK Competition and Markets Authority (CMA).

- In October 2022, Xylem Water Solutions Singapore Pte Ltd. and Gross-Wen Technologies Inc. (GWT) entered a Memorandum of Understanding (MoU) for joint research and development (R&D) on sustainable wastewater treatment solutions.

- In August 2022, Veolia announced a merger agreement with Vigie SA (formerly Suez SA), aimed at streamlining the legal structure of the Veolia group.

Market Segmentation

By Application

By Process by Equipment

- Primary Treatment

- Secondary Treatment

- Tertiary Treatment

By Region

- North America

- APAC

- Europe

- LAMEA