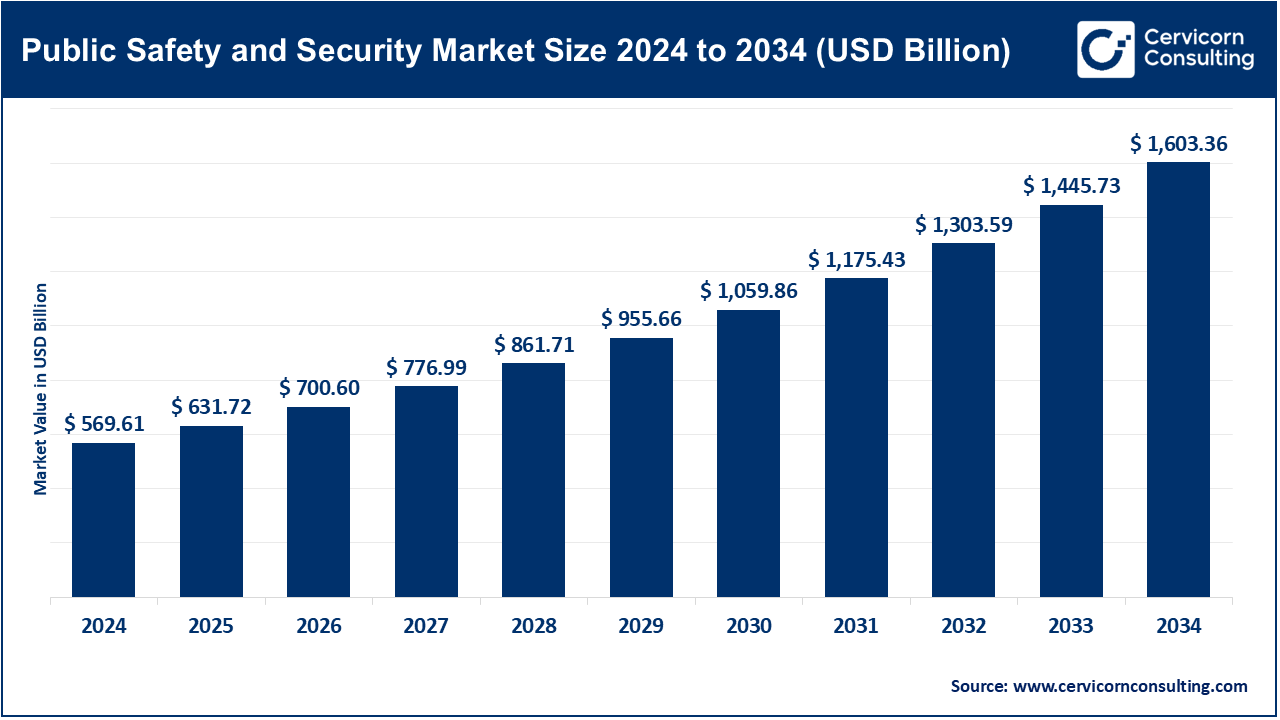

The global public safety and security market size was estimated at USD 569.61 billion in 2024 and is expected to hit around USD 1,603.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 11.32% over the forecast period from 2025 to 2034.†The public safety and security market is expected to grow at a significant rate owing to rising threats of terrorism, increasing cyberattacks, and the growing need for surveillance in urban and critical infrastructure environments. Governments worldwide are investing heavily in advanced technologies such as AI-powered surveillance, emergency communication systems, and predictive analytics. Additionally, smart city initiatives and stringent public safety regulations are accelerating the adoption of integrated security and emergency response systems.

The public safety and security market focuses on the integration of modern technologies such as artificial intelligence, the internet of things (IoT), big data, and cloud computing to improve responder efficiency, threat detection, and the safeguarding of essential infrastructure. The rapid evolution of threats, including terrorism, cyberattacks, natural disasters, and public health crises, requires integrated systems that offer real-time monitoring, smarter analytics, and automated decision-making capabilities. These systems are crucial for private and public entities implementing advanced surveillance systems with smart access control and communicative networks, fueled by urbanization and the growth of smart cities. This market is changing as a result of technological advancements, partnerships with security firms, the regulation of data rights, AI governance, and increasing reliance on digital infrastructure, which requires the integration of cyber and physical security.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 631.72 Billion† |

| Expected Market Size in 2034 | USD 1,603.36 Billion |

| Projected Market CAGR 2025 to 2034 | 11.32% |

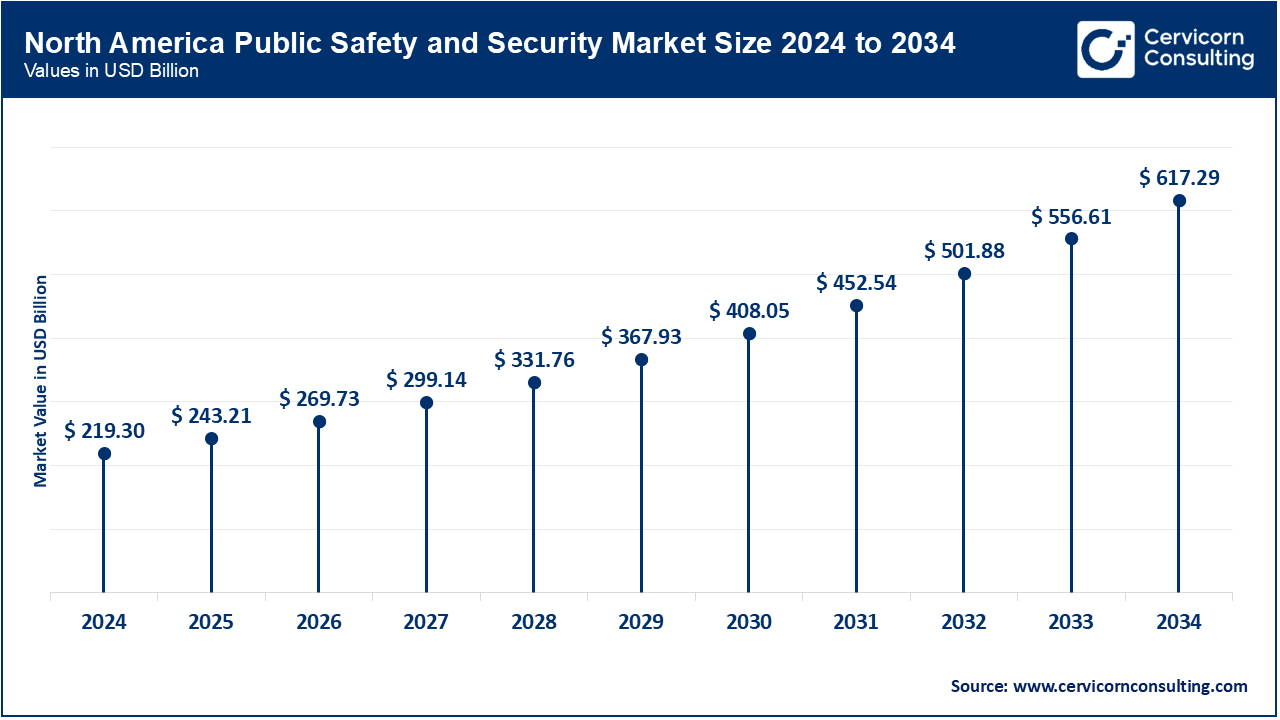

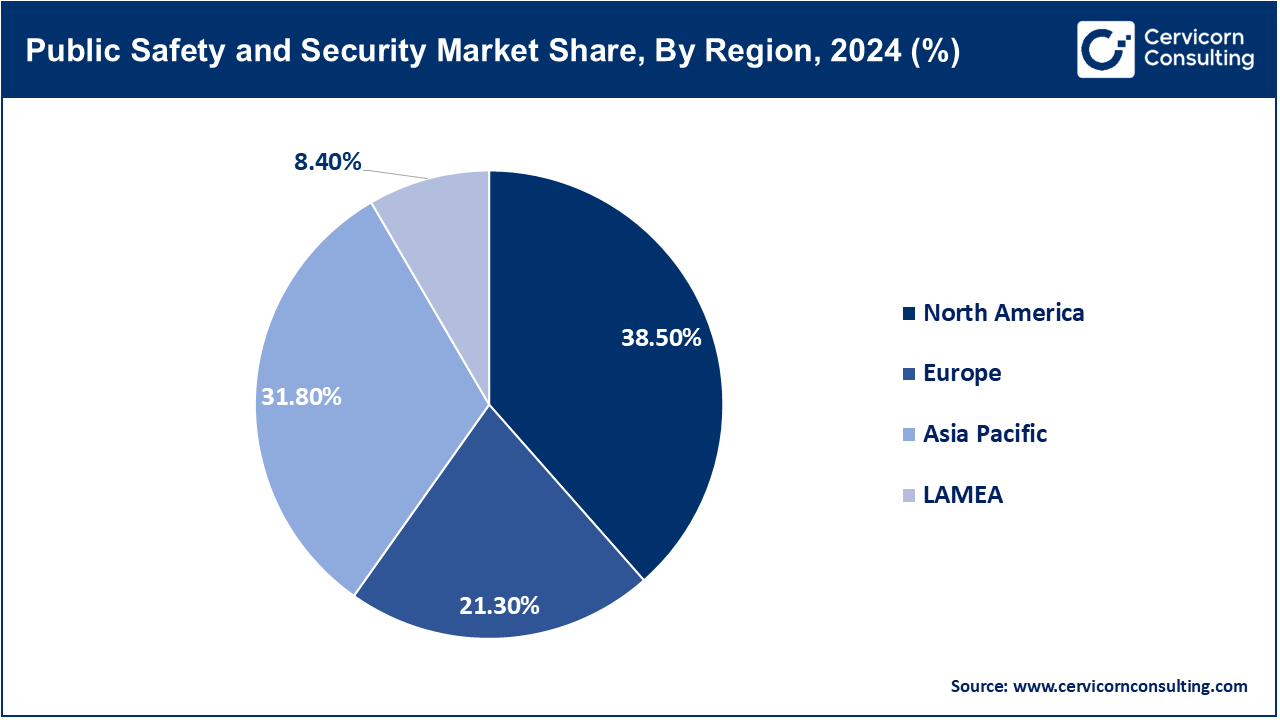

| Dominant Area | North America |

| Fastest Growing Area | Asia-Pacific |

| Key Segnments | Solution, Service, Deployment Mode, Software Type, Application, Region |

| Key Companies | Motorola Solutions, Inc., Cisco Systems, Inc., Honeywell International Inc., NEC Corporation, Thales, IBM, Huawei Technologies Co., Ltd., Tyco (Johnson Controls), General Dynamics Corporation, Siemens |

Biometric Security & Authentication System: As a form of authentication, biometrics employs the face, fingerprint, iris, or voice of an individual to authenticate identity for legal processes. Between September and November 2024, DHS‚ÄźOBIM posted RFIs for vendors to propose methods of migrating IDENT's over 260 million records to HARTís microservices architecture, emphasizing modern data management and cloud scalability. An August 2024 PIA lessened foreign data-sharing partnerships and enhanced opt-out and retention protocols. GAO audits suggest privacy-preserving system configuration and scheduling optimizations. These actions illustrate the modernization of biometics undertaken by the federal government with privacy and legal frameworks.

Critical Communication Network: The critical communication networks dominated the market. Critical communication networks provide encrypted, interoperative voice and data systems to first responders as per government specifications, such as P25. By late 2024, 83 countries had adopted Project 25 compliant radios under DHS/CISA and TIA guidance. In May 2024, NSPACsí pilot demonstrated mission-critical field team coordination via 5G, permitting real-time video streams to the field. Later that year, the BLM was awarded a $0.0027 billion contract from the federal government for the installation of satellite-backed radios for wildfire response. Government contracting and technical pilot projects reinforce the shift to legally mandated resilient critical communications.

C2/C4ISR System: The C2/C4ISR systems provide lawful centralized situational oversight by integrating command, control, communications, computers, intelligence, surveillance, and reconnaissance. In 2024, ISR pilots operating drones and radar systems funded by the DHS supported interagency cooperation under legal MOUs in both civilian and military spheres. Additionally, OMB authorized funding for secure information-sharing networks to be issued under CISA, which had previously been operationalized with respect to national security protocols. The fusion of real-time analytics with sensor data streamlining cross-agency fusion continues to enhance operational oversight while adhering to legal security requirements.

Surveillance System: Surveillance systems incorporate video apparatus and AI-driven analytic tools to watch over certain areas while remaining compliant with privacy and civil rights regulations. The DHS Biometric Technology Report of 2024 set forth mandates concerning accuracy parameters and oversight for facial-recognition technology in public spaces. Advocacy led by the ACLU from 2023 to 2024 resulted in a 30 percent increase to state-level audits of camera installations ensuring compliance with legal standards. ITAR regulations now require vendors to certify the AI systems employed for public surveillance. These changes highlight the increasing capabilities of AI surveillance technologies under stringent legal oversight.

Screening & Scanning System: As directed by the TSA and DHS, checkpoint screening biometrics and X-ray systems scan individuals and, where applicable, their belongings. DHS was scheduled to audit TSAís implementation of biometric ID and facial recognition systems at major airports in mid-2024 to assess legal compliance. By late 2024, TSA had awarded contracts for next-gen multimodal scanners meeting DHS and IEC data protection standards. These advancements are fortified within federally mandated frameworks and supervised constructions augment threat detection capabilities in transportation hubs.

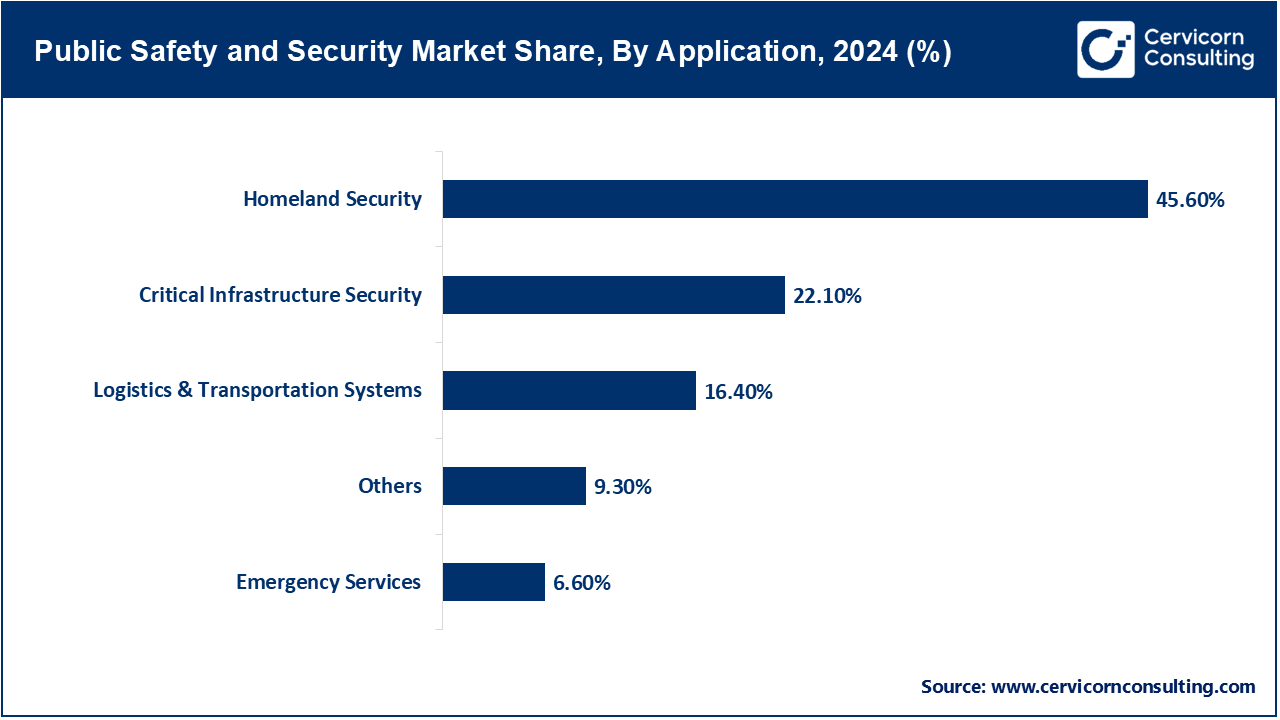

Emergency & Disaster Management: The emergency and disaster management segment is expected to experience the fastest CAGR during the forecast period. Under FEMA and DHS authorities, emergency and disaster management systems function within multi-agency coordination frameworks. In November 2023, DHS awarded a contract worth $0.0031 billion to the University of Illinois for ISO 17025 NG911 interoperability testing. In the latter part of 2024, the BLM received funds to deploy satellite-radio kits for cross-jurisdictional wildfire response improvement. These legally structured investments bolster systematized, transparent enhancements in crisis coordination and responsiveness.

Cybersecurity: Cybersecurity frameworks safeguard the digital public safety critical infrastructure as per CISA and NIST guidelines. With a focus on public sector employees, NIST sponsored $300 million in workforce development grants in cybersecurity in 2024. Organizational resilience policies were updated with NISTís Cybersecurity Framework 2.0, released in 2024. CISA published an AI-cybersecurity playbook for the protection of AI-enabled systems in 2025. These laws and regulations, combined with recent advancements, strengthen the cyber posture for public safety.

Public Address and General Alarm: Public address and general alarms transmit emergency messages in compliance with NFPA and OSHA legal requirements. Between 2023 and 2025, FEMAís Integrated Public Alert and Warning System CAP-based architecture was enhanced to enable NG911 and wireless alerts, which will be operational across all federal channels by April 2025. State audits confirm that the systems are legally required to alert residents within a ten-second window. These enhancements mandated by law will accelerate the responsiveness and interoperability of emergency alert systems.

Emergency Services: Emergency services (police, fire, EMS) operate within legal bounds when responding to crises. As of November 2023, DHS allocated $0.0031 billion for developing interoperability testbeds for NG911 at research labs. According to the FCCís NG911 regulations, PSAPs are mandated to receive image, video, and text communications as of March 2025. These funded and legal deadlines are fostering technological advancements in the coordination of emergencies within compliance of legal frameworks.

Homeland Security: The homeland security segment has dominated the market in 2024. Homeland Security operates under the authority of the DHS and protects the borders, critical infrastructure, and citizens. The Biometric Technology Report issued by DHS in 2024 implemented iris, fingerprint, and facial recognition technologies for high-risk scenarios, which ensured government supervision along with civil liberties considerations. Furthermore, OBIMís 2024 RFI to transfer more than 260 million biometric records into HART demonstrates modernization and lawful data-sharing policies. Initiatives like these demonstrate counsel on border identity security law.

Critical Infrastructure Security: Critical infrastructure security protects systems such as energy, water, and transportation using monitored surveillance, cyber defense, and controlled access solutions. A DHS report from January 2025 highlighted with AI technologies that 16 critical infrastructure sectors had received advanced protections. CISAís adoption of ďsecure-by-designĒ policies C2024 to Infrastructure Systems under Cybersecurity Framework 2.0 also demonstrated legal frameworks for the protection of infrastructure systems. These policies reinforce the application of protective technology on essential public infrastructures.

Logistics & Transportation Systems: Transportation and logistics security equips sensors, tracking systems, as well as biometric screening using TSA and DHS standards. In early 2024, DHS audited TSA on the application of biometric scanners and AI-based document verification at airports. TSAís multimodal scanner contracts after the audit met DHS/IEC requirements. These measures enhance threat detection regarding the movement of passengers and cargo within legally defined security frameworks.

Managed Services: Managed Services is offer solutions that enable governments and security organizations to streamline operations while providing real-time, continuous monitoring, threat evaluation, and immediate operational response for critical infrastructure. Moreover, managed services facilitate operational backup efficiency which aids in the mitigation of continuous active cyber and physical security risks through versatile outsourced security frameworks.

Managed Security Services: The managed security services segment has dominated the market in 2024. These services have been designed to address real-time surveillance, firewall administration, intrusion detection, and response management for important infrastructural facilities and law enforcement agencies. Given the increasing number of cyberspace attacks coupled with the complexity of guarding huge digital and physical domains, these services provide necessitated top-tier defense especially in situations when the internal security personnel do not have the required specialized skills.

Others: Consulting, training, and system integration are other services that assist in the strategic planning and implementation of managing agency-wide security initiatives. Advanced technologies aid in the threat assessment, emergency response, risk assessment, and the overall mitigation process. These services also enable adherence to regulatory compliance as well as the customization of public safety solutions.

Cloud: The cloud adoption is on the rise because of its ease of scaling, remote access, and cost effectiveness. Public safety agencies utilize cloud-based platforms for data storage, video surveillance, and analytics which aids in prompt reporting of incidents and collaboration in real-time while ensuring operational resilience with minimal infrastructure investment.

Public Safety and Security Market Share, By Deployment Mode, 2024 (%)

| Deployment Mode | Revenue Share, 2024 (%) |

| Cloud | 66.60% |

| On-Premises | 33.40% |

On-Premises: Institutions that handle sensitive, often classified material usually gravitate toward on-premises deployment. Housing the infrastructure locally allows them to exert tight control over every byte, meet exacting privacy standards, and satisfy complex statutory mandates. The model can be expensive and labor-intensive, yet it remains non-negotiable for public-safety functions and for regions where internet access is patchy or absent altogether.

Record Management Software: The record management software segment dominated the market in 2024. For law enforcement agencies, maintaining precise records regarding arrests, evidence, and incidents is crucial. Record Management Software (RMS) streamlines public safety operations while ensuring accuracy, legal compliance, consistency, and adherence to workflows across agencies. Moreover, it permits evidence-based decision-making and transparency in operations.

Investigation Management: Law enforcement agencies often struggle with coordinating casework due to disparate case files. With the use of Investigation Management Software, case files, leads, and investigative workflows can be automated and streamlined, enhancing inter-agency collaboration. This system also enhances the protection of evidence and expedites the resolution of both criminal and intelligence-related investigations.

Others: This category includes emergency dispatch, facial recognition, and surveillance analytic tools. These software solutions provide real-time threat prediction, detection, and response capabilities, thereby assisting authorities in proactively managing public safety and strengthening the security infrastructure.

The Public Safety and Security Market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Hereís an in-depth look at each region.

North Americaís public safety sector relies on federally mandated funding and cross-border regulatory alignment. In the U.S., DHS distributed nearly $1.98 billion in FY 2024 preparedness fundingóincluding $ 0.45 billion for NSGP and $0.27 billion for state/local cybersecurityóunder legally authorized programs targeting terrorism and cyber threats. Canada passed Bill C-26 and enacted the Countering Foreign Interference Act in May 2024, strengthening its cyber and public safety legal framework. In early 2023, Mexicoís SCT updated airport biometric screening and land-port identity systems per ICAO mandates, enhancing secure border flows. Taken together, these efforts reflect legally grounded investment and policy harmonization across North America.

Europe public-safety machinery is woven from GDPR privacy protections, EU Security Directives, and a forest of national modernization bills. In 2024 the United Kingdom unveiled a binding Surveillance Camera Code that governs the deployment of AI-enhanced CCTV in public spaces. Germany directed roughly $220 million toward BSI-certified cyber upgrades for its critical-infrastructure networks in 2023, all under strict domestic legal oversight. France enacted the 2024 Anti-Terrorism Reinforcement Act, funding biometric lanes at its borders and EU-aligned CBRN detection systems for cross-border transport. Collectively, these initiatives sketch a legally structured, privacy-conscious expansion of public safety capabilities across the continent.

The public-safety landscape has broadened dramatically, now featuring everything from helio-centrally controlled watch towers to city bylaws on digital privacy. In early 2024, Chinas National Development and Reform Commission connected biometric identification cards to subway and rail gates after overhauling its public-security code. About the same time, Indias Home Affairs Ministry financed Phase V of the National Integrated Emergency Command-and-Control System, requiring fifty municipalities to wire together new surveillance cameras under freshly drawn rules. Japan moved in parallel, tightening the 2023 Cybersecurity Basic Act so that local councils must secure full ISMS accreditation. Federal authorities in Australia followed suit, earmarking A$97 million in the 2024 Security Grants Rules to bolster cyber defenses. Further South Korea upgraded its CCTV networks with next-generation encryption in 2025 in order to comply with the Personal Information Protection Act. Across the region, these regulatory turns leave little doubt: the rulebook is driving the technology that underpins safety and security.

Latin America and the Middle East-Africa pair, occasionally grouped under the LAMEA label, are quietly overhauling their public-security frameworks through legislation rather than mere purchases. The 2014 Marco Civil da Internet and the 2018 LGPD now anchor Brazil digital compliance, and in 2023, the Justice Ministry set aside US$89 million for biometric upgrades in police precincts. Extensions drafted for 2024 permit AI-driven cameras to sift footage from Rios buses and metros. In the MEA corridor, Dubai Police introduced a Smart Surveillance Platform that harnesses machine learning and data piping, all sanctioned under the emirates Data Law. Saudi Arabia followed suit by standing up a National Cybersecurity Authority in early 2024, a move that lets authorities position defensive code during the Hajj in Mecca. Even Cape Towns airport now scans travelers against encrypted watch lists thanks to amendments the parliament slipped into the Cybercrimes Act midway through 2024. Taken together, these legal pivots signal a noteworthy pattern: governments are writing rules first and wiring cities second, betting that compliance will outpace any hardware rush.

Recent partnerships in the public safety and security industry underscore deep innovation and collaboration among major players like Motorola Solutions, Cisco Systems, Honeywell International, and NEC Corporation. Motorola Solutions has expanded its ecosystem by partnering with RapidSOS and AWS to enhance emergency response platforms with real-time caller location and video intelligence. Cisco Systems is working closely with government entities to implement secure, mission-critical networks in smart city and defense applications. Honeywell partnered with IDEMIA to integrate advanced biometric security in access control systems for critical infrastructure. NEC Corporation has teamed up with local governments and transit authorities across Asia to deploy facial recognition and AI-based surveillance for border and transportation security. These alliances reflect a broader trend of integrating AI, cloud,

Market Segmentation

By Solution

By Service

By Deployment Mode

By Software Type

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Public Safety and Security

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Solution Overview

2.2.2 By Service Overview

2.2.3 By Deployment Mode Overview

2.2.4 By Software Type Overview

2.2.5 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Information integration for swift decision-making

4.1.1.2 Grants and funding within the public sector regarding safety enhancements

4.1.1.3 Federal policy action taken to improve safety measures

4.1.2 Market Restraints

4.1.2.1 Disparate Regulatory Frameworks

4.1.2.2 Breached systems have exposed personally identifiable information (PII)

4.1.2.3 Cumbersome public procurement procedures

4.1.3 Market Challenges

4.1.3.1 DHS AI Corps and The Skills Gaps In AI and Cybersecurity

4.1.3.2 Public Acceptance of Self-Regulating Safety Systems

4.1.4 Market Opportunities

4.1.4.1 Safety and alert applications for mobile devices

4.1.4.2 Growth of PSaaS

4.1.4.3 Deployment of Digital Identity and Biometric Facial Recognition Technology at Borders

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Public Safety and Security Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Public Safety and Security Market, By Solution

6.1 Global Public Safety and Security Market Snapshot, By Solution

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Biometric Security & Authentication System

6.1.1.2 Backup & Recovery System

6.1.1.3 C2/C4isr System

6.1.1.4 Critical Communication Network

6.1.1.5 Cybersecurity

6.1.1.6 Emergency & Disaster Management

6.1.1.7 Public Address & General Alarm

6.1.1.8 Surveillance System

6.1.1.9 Screening & Scanning System

Chapter 7. Public Safety and Security Market, By Service

7.1 Global Public Safety and Security Market Snapshot, By Service

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Managed Services

7.1.1.2 Managed security services

7.1.1.3 Others

Chapter 8. Public Safety and Security Market, By Deployment Mode

8.1 Global Public Safety and Security Market Snapshot, By Deployment Mode

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Cloud

8.1.1.2 On-Premises

Chapter 9. Public Safety and Security Market, By Software Type

9.1 Global Public Safety and Security Market Snapshot, By Software Type

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Record Management Software

9.1.1.2 Investigation Management

9.1.1.3 Others

Chapter 10. Public Safety and Security Market, By Application

10.1 Global Public Safety and Security Market Snapshot, By Application

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Emergency Services

10.1.1.2 Critical Infrastructure Security

10.1.1.3 Homeland Security

10.1.1.4 Logistics & Transportation Systems

10.1.1.5 Others

Chapter 11. Public Safety and Security Market, By Region

11.1 Overview

11.2 Public Safety and Security Market Revenue Share, By Region 2024 (%)

11.3 Global Public Safety and Security Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Public Safety and Security Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Public Safety and Security Market, By Country

11.5.4 UK

11.5.4.1 UK Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Public Safety and Security Market, By Country

11.6.4 China

11.6.4.1 China Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Public Safety and Security Market, By Country

11.7.4 GCC

11.7.4.1 GCC Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Public Safety and Security Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Motorola Solutions, Inc.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Cisco Systems, Inc.

13.3 Honeywell International Inc.

13.4 NEC Corporation

13.5 Thales

13.6 IBM

13.7 Huawei Technologies Co., Ltd.

13.8 Tyco (Johnson Controls)

13.9 General Dynamics Corporation

13.10 Siemens