The global fleet electrification market size was reached at USD 93.25 billion in 2024 and is expected to be worth around USD 224.51 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.20% over the forecast period from 2025 to 2034.

The integration of electric vehicles (EVs) into fleets is likely to grow due to sustainability initiatives, carbon reduction policies, and the changing total cost of ownership (TCO) benefits associated with EVs. Public transport as well as logistics and corporate fleets are now receiving government subsidies and tax breaks alongside infrastructure development for the transition from internal combustion engine (ICE) buses and vans to electric counterparts. The economic and operational efficiency of EV fleets is improving alongside advancements in battery technology, vehicle range capabilities, and charging stations. Moreover, meeting ESG (Environmental, Social, and Governance) criteria and decarbonization pressures are prompting major corporations and logistics companies to embrace electric vehicles, thereby deepening market penetration and strengthening sustained growth momentum.

Due to the increase in sustainability goals, cost-efficiency, and lower carbon emissions, companies are adopting electric vehicles (EVs) which is driving the growth of the fleet electrification market. The market includes the purchase of electric vehicles, charging infrastructure, and fleet management systems. Further advancements are being propelled by cross-industry collaboration between automotive, technology, and energy companies. The logistics, transit, and corporate sectors that used to rely on gasoline-powered fleets are now able to leverage EV technologies. Increased government subsidies, reduced battery costs, stricter environmental policies, and added regulations further support the motivation to invest in this market. The transformational paradigm shift involved in replacing business fleets is poised to disrupt the entire industry while aiding in the world’s net-zero emission goals.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 101.81 Billion |

| Expected Market Size in 2034 | USD 224.51 Billion |

| Projected Market CAGR in 2025-2034 | 9.20% |

| Leading Region | North America |

| Growing region | Asia-Pacific |

| Key Segments | Product, Hybridization, Vehicle Type, Charging Infrastructure, Component, Region |

| Key Companies | Robert Bosch GmbH, Continental AG, DENSO CORPORATION, Aptiv, Johnson Electric Holdings Limited, Mitsubishi Electric Corporation, BorgWarner Inc., Magna International Inc., AISIN CORPORATION, Johnson Controls, ZF Friedrichshafen AG, Valeo SA, JTEKT Corporation, Hitachi Astemo, Ltd., Wabco Holdings Inc. |

Start/Stop System: The most recent technical evaluations conducted in 2023 prove that the application of start/stop systems yield fuel savings of up to 7% during city driving and more than 26% during urban closed course testing. In addition, the EPA projects that these systems will lower COâ‚‚ emissions by almost 10 million tons cumulatively by 2025. These systems are used in 65% of new vehicles to gain emissions credits, although there are concerns about their impact on vehicle longevity. There are proposals as of mid 2025 from EPA leadership to change fuel-credit policies which would alter incentives for automakers regarding installation. Regardless of mixed driver feedback, the systems are still regarded as a cost-efficient emissions control mechanism in light of the current federal vehicle standards. Legal frameworks support instrument deployment and continued research.

Electric Power Steering: Electric Power Steering (EPS) systems are widespread as a result of NHTSA research, considering over 125 safety criteria EPS must meet. Between 2023 and 2024 EPS was a concern in two major recalls: Hyundai’s safety recall due to a motor circuit board defect in July 2024 and Ford Mustang’s software update to fix torque sensor calibration. EPS now falls under broader ADAS regulatory oversight and NHTSA’s functional safety evaluations (ISO 26262 framework) EPS is included. Furthermore, EPS systems with AI capabilities demonstrated lane-centering and adaptive torque in late 2024. These developments guarantee EPS’s continued prominence in considerations of safety and performance compliance in steering technology.

Liquid Heater PTC: In electric vehicles (EVs), Positive Temperature Coefficient (PTC) liquid heaters serve as cabin heaters and battery thermal management units. As per the 2023 EPA mandate, effective defrosting systems that comply with FMVSS103 regulations for Battery Electric Vehicles (BEVs) is mandatory. In 2024, manufacturers started using PTC thermal systems to enhance cold weather operations independent of conventional engine byproducts. Meeting federal legal obligations for defrosting and demisting makes PTC heaters essential for safety compliance. Moreover, designed advanced control modules implemented in 2025 and integrated into upgraded systems demonstrated enhanced energy efficiency while improving regulated parameters including passenger sight lines, battery longevity, and compliance margins.

Electric Air Conditioner Compressor: Regarding compliance with FMVSS 141, the NHTSA's Final Rule on minimum sound requirements for compressors has an indirect effect on electric air conditioning compressors as of 2023. To comply with Noise and performance benchmarks, several OEMs had implemented electric AC compressors by 2024, decoupling the operation of engines from cabin cooling. The air conditioning systems are integrated to fulfill temperature control mandates within the cabins of for-hire and transit vehicles as regulated by The National Clean Vehicle. Test fleets noted a 20% improvement in cabin comfort during hot climate idle periods by early 2025, while adherence to rigorous HVAC energy efficiency and safety standards continued.

Electric Water Pump: Effective windshield defrost and demist functions require heating proportional to coolant flow, as stated by federal motor vehicle safety standard FMVSS 103. For EVs, these requirements have driven the change from water pumps driven mechanically to electric variants for off-engine thermal management. Audits performed in 2025 within regulatory frameworks confirmed designed pumps met durability benchmarks for long-standby idle periods, reinforcing their regulatory importance for EV certification.

Integrated Starter Generators: An Integrated Starter Generator (ISG) serves the dual purpose of an alternator and a starter motor. These systems are present in mild-hybrids which have torque assists from 5 up to 20 kW. In addition, it can enable start/stop functions as well as braking energy recuperation without full hybridization. In 2023, mild-hybrids became more popular in the U.S. due to emissions regulations. OEMs reported COâ‚‚ reductions from ISG vehicles during federal test cycles to the EPA. Commercial fleet adoption began in 2024-25 to meet the clean fleet mandate. Within the existing legal structures, the EPA and DOE classify ISGs as efficiency devices which encourages their utilization in mild-hybrids prior to stricter GHG emissions regulations.

Actuators: ITT controls electric actuators for throttles, valves, and HVAC dampers which have all come under increased scrutiny as NHTSA automates systems oversight. Critical to ADAS and safety compliance, FMVSS updates have classified these as essential since 2023. Safety analyses conducted by government entities confirm that functional actuators are required elements of both steering and braking automation. Guidance issued in 2024 stressed redundancy and fail-safe behaviors under connected vehicle frameworks. New government-sponsored research by SAE is focused on extreme scenario actuator failure. These actions strengthen the position of actuators as essential components for safety and vehicle automation type certification.

ICE & Micro-hybrid Vehicle: Automobiles that employ internal combustion engines (ICE) equipped with start/stop micro-hybrid systems are still eligible to receive EPA off-cycle fuel creditsbased on their emission performance. As of 2023-2024, approximately two-thirds of new light-duty vehicles incorporated this technology to take advantage of the credits under the Clean Air Act. Legal oversight by the EPA validates the certification test results which shows 4-10% fuel saving margin which helps reach the emissions reduction targets. To comply with the forthcoming Federal GHG micro-hybrid rules, OEM manufacturers are continuing to implement micro-hybrid solutions. In early 2025, automakers incorporated enhanced battery systems with micro-hybrid packages to improve performance under revised credit policy changes, thus strengthening compliance.

HEV: Hermetic hybrid electric vehicles (HEVs) that incorporate an ICE with electric traction motors have met federal GHG and CAFE standards by utilizing off-cycle crediting under EPA protocols. Between 2023 and 2025, HEVs are the subject of regulatory attention as the EPA has characterized them as stopgap measures aimed at fleet electrification compliance. OEM introductions in 2024 included HEVs with improved regenerative braking systems that were approved during EPA bench and on-road testing. At the state level, California's ZEV mandates recognize HEVs for compliance reporting within the fleet. DOE funding in 2024 was directed to HEV drivetrain efficiency initiatives, highlighting the vehicles' perceived contributions under U.S. law regarding emissions and fuel economy.

PHEV: The evolution of plug-in hybrids allows for electric driving alongside an internal combustion engine backup, qualifying for tax rebates, including those from the ZEV program since the Inflation Reduction Act of 2022. Recent legal documents indicate that PHEVs now satisfy the zero-emission miles requirements, thus awarding fleet compliance credits at the federal level. New disclosure laws by the FTC required disclosure of fuel use and electric range, PHEV sales until 2025 further strengthen State Clean Fleet requirements. OEMs released EV variants of extended-range PHEVs for transit fleets, meeting both federal and local clean air standards. Legal clarity regarding utility actions under PHEV charging rules bolsters regulated procurements for these vehicles.

BEV: Fully comprising with federal zero-emission vehicle standards as well as accruing state ZEV credits for fleets, battery electric vehicles are projected to capture the majority of new zero-emission registrations by 2024 per DOE and EPA vehicle fleet reports. The legal landscape now mandates BEVs compliance with FMVSS 141 pertaining to minimum sound and FMVSS 103 on HVAC performance. In 2023–2025, fleet-grade BEV vans and trucks were expected from OEMs while meeting EPA and NHTSA certification criteria. Major states with zero-emission mandates for regulated fleets leave no alternative besides BEVs. Legal support is guaranteed due to government stimulus programs covering the installation of chargers.

Passenger Vehicle: Compliance with FMVSS concerning steering, defrost/heating, noise, and pedestrian protection is required for passenger EVs and micro-hybrid start/stop vehicles. According to recent EPA reports, there are nearly 4 million registered passenger EVs in the U.S., which triggers wider regulatory concerns regarding safety and emissions requirements. Cold and urban tests for compliance with FMVSS 141 and 103 were met in 2024 test fleets. As of 2025, NHTSA has incorporated advanced pedestrian protection frameworks (FMVSS/AEB) expanding its use for EV-specific sensors integrated within passenger vehicles. Focus of regulation now shifts to EPS and actuator reliability concerning automation support for passenger EVs.

Fleet Electrification Market Revenue Share, By Vehicle Type, 2024 (%)

| Vehicle Type | Revenue Share, 2024 (%) |

| Passenger vehicle | 71.60% |

| Commercial vehicle | 28.40% |

Commercial Vehicle: The intersection of commercial fleet electrification integrates with FMCSA and NHTSA regulations pertaining to heavy trucks and vans. PHEVs and BEVs operating in a commercial capacity are now subject to FMVSS safety standards. Several pilot programs funded by DOT in mid-2024 implemented electric buses that complied with both EPA and FMVSS cleanliness requirements as well as clean-fleet reporting. Electric commercial vehicles are also included in GHG Phase 3 compliance under EPA and earn credits pertaining to operation in a zero-emissions state. Electric torque steering and commercial transit HVAC performance are added safety tests legal in 2025 along with expanded legal frameworks to ensure fleet-grade design meets federal requirements.

Depot Charging: This is the use of Level 2 or DC fast chargers situated at fleet hubs for overnight or shift-based EV charging. Smart charging, compliant with OCPP regulations for optimized load balancing, is commonly integrated into these systems. They enhance self-sufficiency and vehicle throughput while minimizing external infrastructure dependency. Standard practices and benchmark documents from the U.S. DOE's Alternative Fuels Data Center are available. Deposited in December 2023, the DOE allocated funding under the IIA for Electrifying federal and state fleet locations, enabling several pilot programs for equipping municipal fleets with fast charging networks. These actions promote increased utilization of business electric vehicles.

Opportunity Charging: It is the use of high-powered charging stations during set intra-shift breaks or at designated shift change times to recharge fleet electric vehicles (EVs). This practice is also an efficiency booster since it optimally serves to replenish onboard battery charge, vehicle weight, and capital cost. This is beneficial for intensive operational fleets like buses and delivery vans. U.S. DOE case studies validate the effectiveness, BYD bus fleets are empirically confirming fiscal optimizations in battery pack size, achieving a fifty percent reduction which translates into savings of approximately fifty-five thousand dollars per vehicle. These savings are achieved from strategically placed DC fast chargers in what are termed Depot Zone Networks. Public-private partnerships funded by federal grants strategically placed the chargers at transit depots which enabled faster subsidized goal achievement. This model is increasingly recognized for enhancing the cost efficiency of fleet operations.

Public Charging Stations: Public charging stations include Level 3 DC fast charge stations which are strategically placed along major transport corridors as well as in urban centers to service electric fleets and passenger EVs. They function as additional range and flexibility extensions to depot systems which service electric fleets and passenger EVs. As of December 2024, 61.9% of U.S. highway corridors have fast charger coverage within 50 miles, a result of DOE investments from the Infrastructure Investment and Jobs Act. In January 2025, the DOE allocated $68 million under the SuperTruck Charge program which aims to construct high-capacity charging hubs at key logistics areas such as ports and freight corridors. These chargers are commercially built to spec for medium and heavy duty fleet vehicles and their deployment ensures multi-district fleet operations. This approach promotes the use of smaller battery packs while reducing maintenance costs associated with charge port contacts. Research and pilot projects funded by the U.S. Department of Energy and Federal Highway Administration have tested “graze charging” on specific transit routes. As of late 2023, Electreon and other companies conducted extensive trials in Detroit and other cities, operating bus fleets. These pilots demonstrated improved battery cycle efficiency and vehicle uptime by as much as 20%. Federal agencies are still determining cost and energy benchmarks, but progress like this suggests transit authorities are more willing to modernize infrastructure.

Wireless/Inductive Charging: Wireless or inductive charging systems integrate coils into roads and stationary pads to wirelessly transmit energy during low-speed movement or at a stop. This method allows for smaller battery packs to be used and decreases maintenance costs associated with charge port contacts. Pilot research projects have been funded by the U.S. Department of Energy and Federal Highway Administration to test “graze charging” on specific transit routes. Federal agencies continue to monitor the cost and energy performance to establish standards. This advancement signals growing interest from transit authorities for next-gen infrastructure.

Battery Swapping Stations: The ability to rapidly exchange used battery packs for charged ones at battery swapping stations is useful to fleet vehicles. This is especially important for two and three wheeled electric vehicles, as well as taxi and delivery fleets which operate on stringent time schedules. India’s government issued formal guidelines for battery swapping under the “Electric Drive Revolution” initiative set for January 2025, which aims to control and foster standardization. In December 2023, IOC and HPCL-Gogoro's joint venture inaugurated swap stations in Kolkata. They plan to set up over 25,000 charging stations across the country by the end of 2024. These swap stations not only offer prompt service but also have modern payment systems as well as sophisticated fleet management systems. Given the safety regulations and legal interoperability frameworks in place, India now holds a competitive edge as one of the top providers of scalable swapping system solutions.

Battery Pack: In relation to the EV fleets, a battery pack is an assembly of several lithium-ion cells contained in modules for energy storage. It also includes thermal management and mechanical protections as well as the construction fit to fleet duty cycles. Energy density and cost-per-kWh have lowered batteries costs by 10% between 2023 and 2025 per DOE milestones. Other federal efforts like the Energy Storage Grand Challenge sponsored Innovative Battery Manufacturing grants in 2024. Standardized deployment of battery packs is facilitated by the existence of over 400,000 charging stations for EVs globally. Sustainability is still a focal point for federal research with second life reuse and recycling. UL and UN have recently set new regulations on the safety of battery packs for crashes and their transport which protects fleet batteries along with reliability and circularity.

Battery Management System (BMS): A BMS manages and monitors the complete health of the pack by charging each cell in the configuration, managing temperatures, and estimating the state of charge (SOC) for safety and performance for electric vehicle (EV) fleets. It also enables smart charging during optimal grid conditions and preplanned schedules to relieve peak load pressure. From the DOE documents, we note that a fully functional battery management system improves pack life and operational uptime as well. Integrated BMS with real-time data exchange capability with depot energy systems for demand charge optimization were demonstrated by Federal pilots late 2023. Cybersecurity BMS requirements were established in the 2024 NHTSA EV safety regulations. Open-source BMS firmware was awarded funding under The DOE’s 2025 Energy Storage Challenge, which aimed to promote innovation by eliminating proprietary restrictions. These projects position the responsive BMS as crucial to fleet operations.

Electric Motor: An electric motor is an electric device designed to convert electrical energy into mechanical torque for driving fleet EVs with high torque and efficiency across a broad speed range. Modern permanent magnet and induction motors exceed 95% peak efficiency which is critical for the operating economics of a commercial fleet. The Department of Energy SuperTruck program, funding announced in early 2025, is sponsoring new motor design development for heavy-duty trucks with a goal of up to 75% reduction of controlled emissions. In 2024, new motor manufacturing partnerships were announced funded the U.S. Motor domestic production boost through the Inflation Reduction Act. Fleet 2024 compliance motors are now NHTSA 2024 The durability compliance deadline. There is also a goal for development of high efficiency motors for larger vehicle classes.

Inverter: The inverters convert the DC power from the battery to AC power for the electric motor, managing power and frequency for precise motor command. Range-extending, high-efficiency inverters reduce conversion losses. As of 2021, U.S. ENERY STAR revisions have charging system inverter efficiency benchmarks. Under the 2024 Infrastructure Act, the DOE is sponsoring modern inverter manufacturing plants in several states to bolster domestic production capacity. New compliance regulations set for 2024 require inverters installed on heavy-duty EVs to meet electromagnetic compatibility standards and minimum efficiency thresholds. By 2025, these research programs aim to explore silicon carbide and gallium nitride semiconductors to enhance energy efficiency and lower operational costs for the fleet.

Onboard chargers: convert AC power from the grid into DC power for vehicle batteries charging. The onboard chargers with EVs enable more flexibility with various types of chargers. Smart and scheduled charging reduces impact on the grid while enhancing battery health. For depot charging installations, the DOE AFDC recommends one charger per vehicle to assist with load control. Starting in 2024, DOE grants will support V2G and peak grid charging with digital control capabilities added to the chargers. Changes in laws now require onboard chargers to be compliant with UL safety standards and OCPP interoperability by 2025. Incident reporting shows failure rates below 0.5% which aligns with NHTSA thresholds. These modifications strengthen fleet charging infrastructure adaptability.

Power Electronics Controller: Power electronics controllers regulate the flow of electrical energy between the battery, motor, and other systems onboard, thus maximizing efficiency and safeguarding against electrical damage. They work together with energy management systems and even allow for regenerative braking. The Infrastructure Investment and Jobs Act (2023) included funding for domestic controller manufacturing to decrease dependence on foreign products. In 2024, DOE-funded projects developed grid-responsive controllers that manage load to balance depot power consumption. Legal requirements began in 2025 mandating controllers to observe cybersecurity standards for vehicle-to-grid communications. Performance benchmarks indicate current fleet-grade controllers maintain energy losses below 2%. This enables the electrified fleets to maintain optimally dependable and responsive energy management.

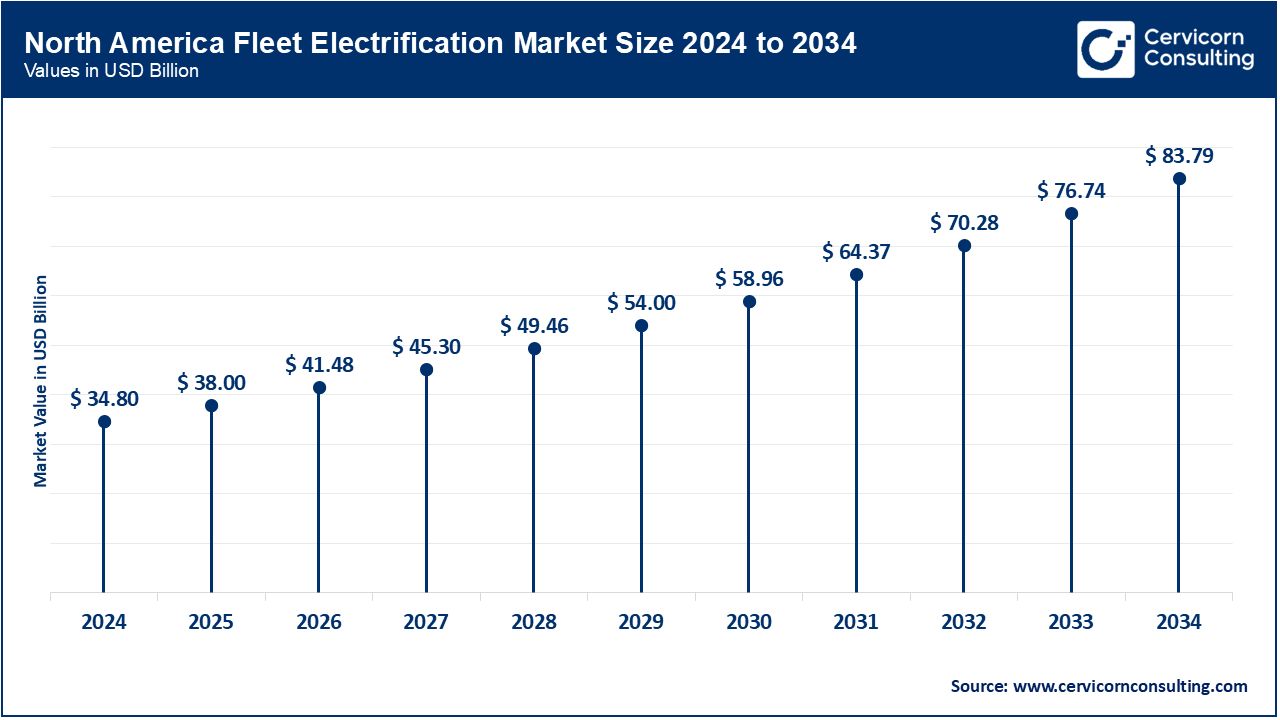

The fleet electrification market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

As of 2024, the united states has more than 4 million registered electric vehicles (EVs), with continued infrastructure expansion spurred by stimulus funding and the Inflation Reduction Act. The adoption rate of zero-emission vehicles (ZEVs) by Canada reached approximately 19% in late 2024, as a result of charging initiatives at both federal and provincial levels. Mexico introduced new EV policy revisions in 2023 aimed at reducing import tariffs and standardized EV safety regulations. Under continental clean transport initiatives, all three countries are also working on public-private EV charging corridors along major highways. Electrification of cross-border freight is on the rise, especially along California–Mexico trade routes. Recent legal changes include tighter emissions standards and harmonized charging interoperability rules across NAFTA neighbors. These developments help promote electrification among private fleets and public transit systems.

By the year 2023, EV adoption reached an impressive 22.7% in the EU, with 2.4 million electric cars registered and increased adoption of electric vans. In the UK, new registrations of EVs reached ~21% by May 2025, with drivers adopting ZE fleets along with increased protective measures regarding lithium-ion battery fires. Germany and France together accounted for more than 50% of the BEV adoption in 2023 due to their stringent carbon policies. The European Commission enforced sound safety and performance criteria on the operating systems of EVs in 2024. Public transport systems in these countries are accelerating the cessation of diesel buses under legal framework incentives related to clean air zones for municipalities. Recent infrastructure grants made in Germany and France have expanded the number of high-power charging stations along the autobahns and autoroutes. All these developments work towards the legally binding targets set by the EU for COâ‚‚ reductions by 2030 and the zero-emissions by 2035 goal.

As of 2023, China continues to be the global NEV leader with over 30% market share in plug-in vehicle sales, having sold nearly 9 million NEVs. This is attributed to tax incentives which are projected to reach RMB 520 billion by 2025. India added another 1.5 million EVs in 2023, reaching an estimated market penetration of 6.3%. It is expected to roll out a national subsidy program in 2024 accompanied by reduced import tariffs to attract foreign OEMs in 2025. Japan is also expanding charging infrastructure as METI continues to roll out pilot BEV bus fleets in Tokyo and Osaka. With the fast-charger rollouts, Australia improved to an approx. 9.5% EV market share in 2024, still trailing global leaders. Both South Korea and Japan incentivize EV manufacture under local industrial policy and grant charging station construction subsidies. Other types of collaboration across the region include convergence of charging interface, emission, grid readiness, fleet-wide electrification and localization targets.

Latin America and the Middle East and Africa (LAMEA) regions are experiencing rapid fleet electrification on account of local policies and regulatory frameworks bespoke to regional contexts. In 2023, EV sales in Brazil soared by 178%, reaching approximately 52,000 units, spurred by the MOVER program and renewed focus on domestic EV manufacturing following reintroduction of import tariffs. The pilot electric bus projects funded by the federal government in the metropolitan regions of Rio and São Paulo initiated the decarbonization of urban transit in early 2025. As an example, The National EV Policy in United Arab Emirates is seeking a 50% EV adoption rate by 2050 and, as of the end of 2023, has over 25,900 EVs. Progress was also made in Saudi Arabia with the opening of a Tesla showroom in Riyadh in 2025, as part of the Ceer EV brand (2022-2024) and Vision 2030. These changes are accompanied by new restrictive import regulations for South Africa, marking the beginning of the South African public EV fleet pilot program scheduled for 2024-2025. The primary focus of regulatory policy in these countries targets cross-sector collaboration, public-private partnerships, and electric vehicle infrastructure to facilitate their adoption.

Recent partnerships in the fleet electrification industry emphasize sustainability, technology integration, and large-scale mobility transformation. Ford has partnered with Sunrun to support home charging and energy management for its electric trucks. GM collaborates with EV go to expand nationwide fast-charging infrastructure for fleet users. Volvo Group and Aurora are jointly developing autonomous electric trucks for freight operations. Amazon continues to scale its partnership with Rivian, deploying thousands of electric delivery vans across the U.S. Meanwhile, BYD and Shell are teaming up to build EV charging hubs in key global markets. These alliances focus on boosting EV adoption, improving charging accessibility, and enabling intelligent fleet management through data-driven ecosystems. Together, they are redefining commercial mobility and fleet electrification on a global scale.

Market Segmentation

By Product

By Hybridization

By Vehicle Type

By Charging Infrastructure

By Component

By Region