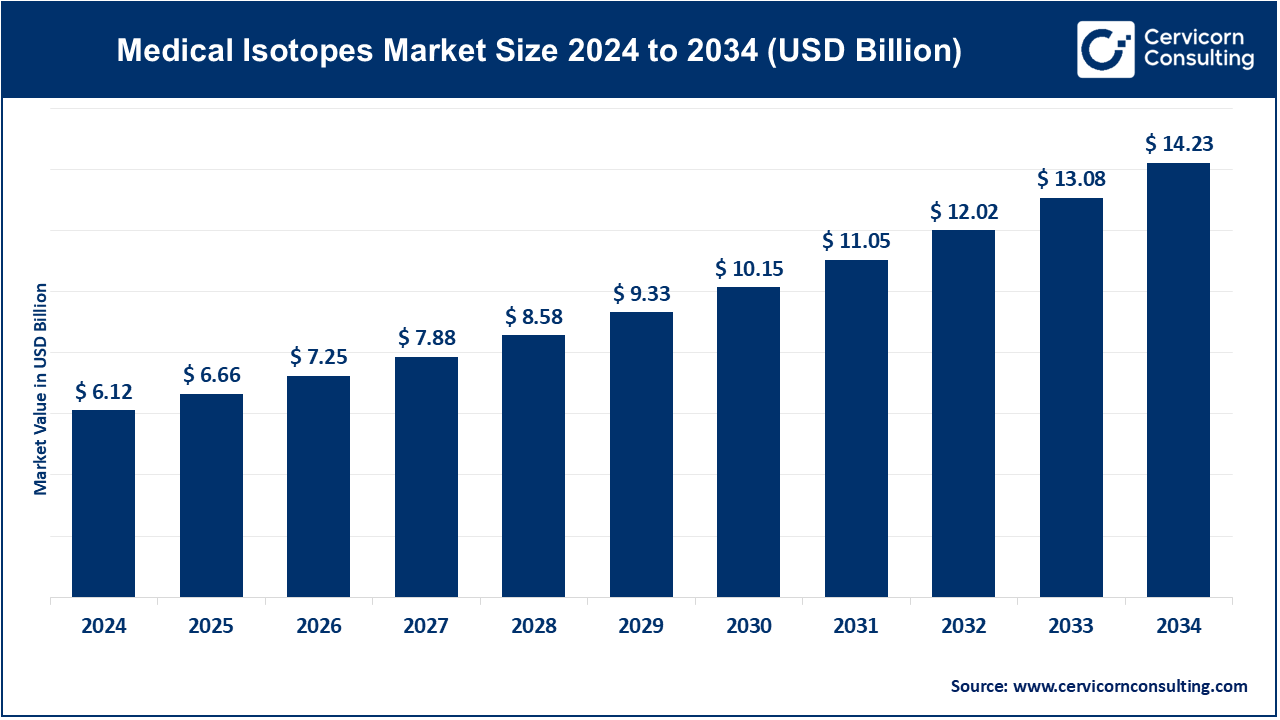

The global medical isotopes market size was reached at USD 6.12 billion in 2024 and is expected to be worth around USD 14.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.80% over the forecast period from 2025 to 2034. The medical isotopes market is expected to grow significantly due to increasing cancer and cardiovascular cases, rising demand for diagnostic imaging, expanding nuclear medicine applications, and technological advancements in isotope production. Medical isotopes are crucial in advancing healthcare due to their effectiveness and safety, enabling precise radiologic interventions and enhancing a patient’s outcome across numerous medical conditions.

Isotopes can be used in nuclear medicine for the diagnosis, treatment, and research of various diseases while simultaneously providing therapeutic techniques. Medical isotopes can emit radiation which is useful for imaging or signal capturing devices, and can be employed in therapy focused on malignancies in order to eradicate unhealthy cells. Fluorine-18 in PET scans, Technetium-99m for imaging organs, and Iodine-131 for thyroid treatment are some commonly used isotopes. Medical isotopes enable early disease detection, monitoring of treatment response, and the delivering of targeted radiotherapy. They are obtained from nuclear reactors or cyclotrons. They facilitate modern healthcare which relies on personalized medicine and minimally invasive procedures.

Leading companies based on medical device revenue in 2023, (in billion U.S. dollars)

| Company | Revenue in 2023 (USD Billion) |

| Medtronic | 32.31 |

| Johnson & Johnson | 30.4 |

| Siemens Healthineers | 24.04 |

| Danaher | 23.89 |

| Fresenius Medical Care | 21.47 |

| Stryker Corporation | 20.49 |

| GE Healthcare | 19.55 |

| Becton-Dickinson and Company | 19.49 |

| Abbott Laboratories | 16.88 |

| Philips Healthcare | 15.4 |

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 6.66 Billion |

| Expected Market Size in 2033 | USD 14.23 Billion |

| Projected CAGR from 2025 to 2034 | 8.8% |

| Top-performing Region | North America |

| Rapidly Expanding Region | Asia-Pacific |

| Key Segments | Type, Application, End User, Region |

| Key Companies | Isotopen Technologien München, Mallinckrodt Pharmaceuticals, Eczacibasi-Monrol Nuclear Products, Canadian Nuclear Laboratories, Curium, Nordion Inc., Northstar medical radioisotopes, LLC, GE Healthcare, IBA Radiopharma Solutions, Jubilant Radiopharma |

Stable Isotopes: Stable isotopes refer to the non-radioactive members of a category that are mostly applied in the applied research and development of drugs. They are present in studies of biochemistry and metabolism, in tracer techniques, and various other non-invasive diagnostic procedures. Considering their safety, stable isotopes are gaining popularity in research related to food, medicine, nutrition, drug metabolism as well as in calibrating imaging devices for medicine. There is an increasing need in clinical research and pharmaceutical R&D in developed countries which is why the stable isotope market is growing steadily, even though it is still much smaller than that of radioisotopes.

Medical Isotopes Market Revenue Share, By Type, 2024 (%)

| Type | Revenue Share, 2024 (%) |

| Stable Isotopes | 31.80% |

| Radioisotopes | 68.20% |

Radioisotopes: Radioisotopes are methods utilized in nuclear medicine for both diagnostic and therapeutic purposes. Important ones are Technetium-99m for imaging and Iodine-131 for the treatment of thyroid cancer. Their short half-life is a benefit for dynamic imaging and focused radiotherapy. Their increasing utilization in SPECT and PET scans and the higher incidence of cancer will increase the demand for these isotopes. The major drawback is that their production is greatly dependent on nuclear reactors, while the distribution is regulated by strict safety and transport policies.

Diagnostic: The medical isotope market is largely driven by the demand for diagnostic applications which include PET and SPECT imaging for cancer, cardiovascular, and other neurological disorders. Various radioisotopes such as Technetium-99m and Fluorine-18 are utilized for performing functional imaging and for some structures, detecting abnormalities at the earliest possible stage. There is a considerable shift towards non-invasive and accurate diagnostics which, along with developing diagnostic imaging infrastructure, is sustaining growth in these segments. Enhanced and AI powered imaging also improves the precision of diagnostics and songs diagnostics and isotope employment throughout.

Medical Isotopes Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Diagnostic | 81% |

| Nuclear Therapy | 19% |

Nuclear Therapy: The therapeutic applications of nuclear medicine involve the treatment of cancers and others with various therapeutic radioisotopes such as Iodine-131, Lutetium-177 and Yttrium-90 which are utilized for thyroid, prostate, and liver cancers respectively and they deliver radioactive energy to a target diseased tissue. Radiotherapies cures perpetuate ideal tissue preservation and enhanced recovery for the patients. The increasing popularity of personalized medicine and theragnostic is driving the use of isotopes in therapies faster. Nuclear therapy is emerging as a key area of development in isotope applications owing to the rising incidence of cancer and favorable regulatory policies.

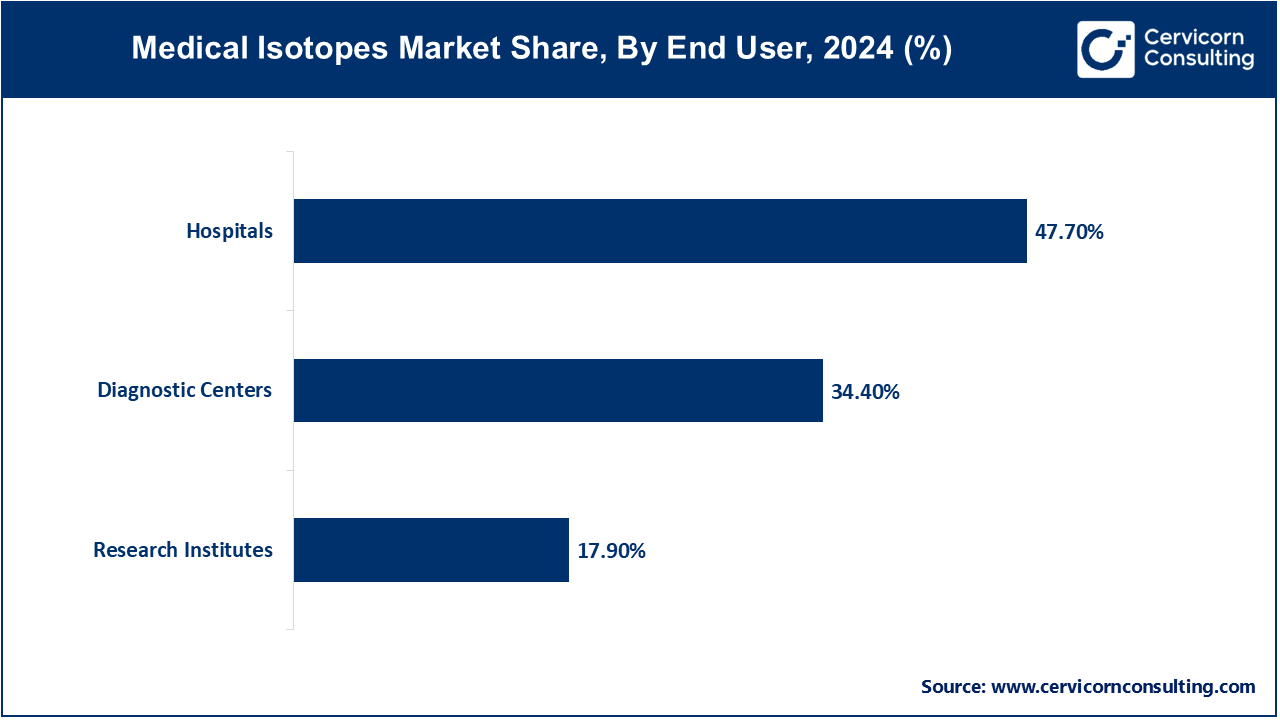

Hospitals: The largest segment of medical isotope end users remains hospitals which integrate these isotopes into their medical imaging, cancer therapy and surgical planning. The nuclear medicine departments of hospitals make use of these isotopes for PET/CT scans and also perform targeted radiotherapy, which is common across oncology, cardiology, and neurology. The increased value of healthcare spending in developing economies coupled with the expansion of hospital-based nuclear medicine units is increasing isotope market growth. Research hospitals as well as other hospitals have direct supply contracts with isotope providers and tend to work with various research institutions to develop new radiopharmaceuticals, which helps in advancing medicine.

Diagnostic Centers: Diagnostic imaging centers use isotopes primarily for non-invasive procedures such as SPECT and PET scans. These centers focus on outpatient diagnostics for early detection of diseases, especially cancers and cardiac conditions. Due to growing healthcare awareness and the shift toward preventive diagnostics, independent diagnostic centers are expanding rapidly in urban areas. The decentralization of imaging services from hospitals to specialized centers supports higher isotope consumption, particularly of Technetium-99m and Fluorine-18 for real-time metabolic imaging.

Research Institutes: Within experimental and clinical studies, drug development, tracer experimentations, and radiobiology, the use of isotopes in research institutes is essential. Stable isotopes are commonly used in biomarker work and analysis of metabolic pathways while, radioisotopes are vital in preclinical imaging and therapeutic research. These institutes make joint R&D programs with academic institutions and pharmaceutical companies. The increasing investment in the innovations of nuclear medicine and more spending by the government on developing medical science research are the factors using isotopes in foremost research and academic institutions around the world.

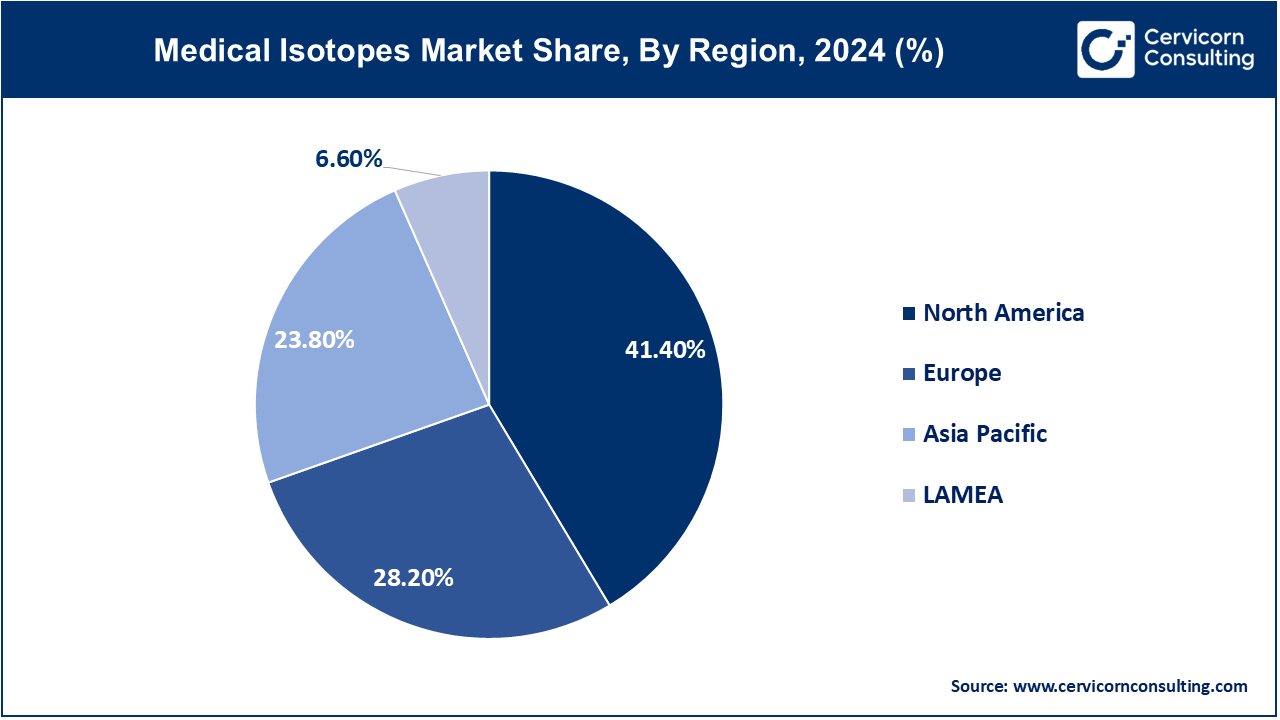

The medical isotopes market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

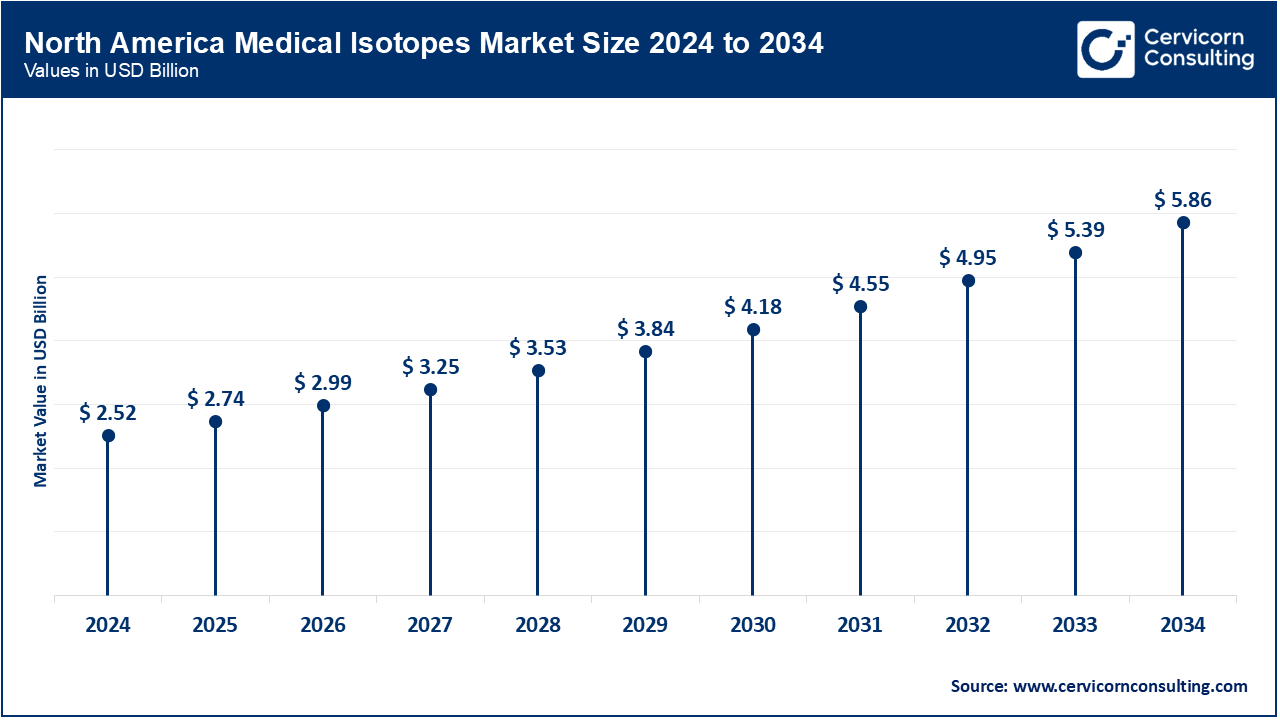

The region dominates the market of medical isotopes due to its sophisticated healthcare infrastructure, significant government investments, and adoption of nuclear medicine. The United States greatly contributes the market as it includes major players such as Cardinal Health and Lantheus. The region also maintains a robust demand for isotopes due to the widespread usage of PET/SPECT imaging and the strong presence of research institutions. Ongoing investment in the innovation of radiopharmaceuticals, favorable reimbursement policies, and a high burden of chronic illnesses continue to increase the regional growth and advance the technology in nuclear medicine.

Due to the public healthcare systems, developed diagnostic facilities, and strong regulations, Europe also has a significant share in the market. Germany, France and the UK are the frontrunners in nuclear medicine application. The region benefits from active joint scouting and research carried out by IBA and Curium that produce isotopes. Government funding for cancer screening programs along with the expanding scopes of radiopharmaceutical therapies are increasing the demand. Moreover, the European initiatives to develop new alternative methods for production aid in mitigating the dependence on aging reactors which helps to ensure long-term resilience in the supply of isotopes.

The region with the most rapidly evolving medical isotopes market is the Asia-Pacific region owing to the increased access to healthcare, growing cancer rates, and spending associated with the development of the nuclear medicine infrastructure. China, India, Japan, and South Korea are advanced in their diagnostic and therapeutic capabilities. Japan leads in the use of isotopes, while India and China are concentrating on the domestic production of isotopes and public-private healthcare collaborations. The advanced imaging techniques and their increasing usage alongside other supportive factors make this region an important area of obligation.

Although growth is currently constrained by the underdeveloped nuclear medicine infrastructure of the region, LAMEA still offers new prospects for medical isotopes. In terms of investment on diagnostic and cancer care using isotopes, Brazil, South Africa and the UAE are the continental leaders. An increasing number of governments are working together with foreign agencies to establish local production plants and improve accessing healthcare in the region. The sparsely available technical expertise, expensive equipment, rising healthcare awareness, urbanization, and medical tourism prospects in the UAE are slower but stronger than expected market development drivers.

The medical isotopes market is driven by key players such as Cardinal Health, Curium, GE Healthcare, Lantheus Holdings, and Siemens Healthineers, who are focusing on innovation in radiopharmaceuticals, advanced imaging agents, and alternative production technologies. These companies are investing heavily in R&D to develop next-generation isotopes with improved safety and targeting precision, including theranostic agents. Strategic partnerships, facility expansions, and vertical integration are strengthening global supply chains. Moreover, their emphasis on sustainable isotope production and localized distribution is enhancing availability, supporting growing clinical demand across oncology and precision medicine applications worldwide.

Recent collaborations in the medical isotopes market highlight a strategic focus on advancing nuclear medicine technologies, supply chain sustainability, and global healthcare accessibility. Leading players like Curium, NorthStar Medical Radioisotopes, BWXT Medical, and Telix Pharmaceuticals are partnering with research institutions, cyclotron developers, and AI healthtech firms to enhance isotope precision, automate imaging workflows, and enable real-time diagnostics. These alliances aim to improve treatment outcomes, especially in oncology and cardiology, while accelerating global regulatory approvals and clinical trial pipelines. Joint efforts are also targeting localized isotope production, reducing reliance on aging reactors and enhancing regional resilience in supply chains. Some notable examples of key developments in the Medical Isotopes Market include:

Market Segmentation

By Type

By Application

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Medical Isotopes

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Application Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growth in Chronic Illnesses

4.1.1.2 Advancements in Imaging Technologies

4.1.1.3 Growing Adoption of Personalized Medicine

4.1.2 Market Restraints

4.1.2.1 High Production Costs

4.1.2.2 Regulatory Challenges

4.1.2.3 Supply Chain Disruptions

4.1.3 Market Challenges

4.1.3.1 Aging Reactor Infrastructure

4.1.3.2 Transportation and Logistics Issues

4.1.4 Market Opportunities

4.1.4.1 Development of Alternative Production Methods

4.1.4.2 Integration with Telemedicine

4.1.4.3 Innovations in the Development of Radiopharmaceuticals

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Medical Isotopes Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Medical Isotopes Market, By Type

6.1 Global Medical Isotopes Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Stable Isotopes

6.1.1.2 Radioisotopes

Chapter 7. Medical Isotopes Market, By Application

7.1 Global Medical Isotopes Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Diagnostic

7.1.1.2 Nuclear Therapy

Chapter 8. Medical Isotopes Market, By End-User

8.1 Global Medical Isotopes Market Snapshot, By End-User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Hospitals

8.1.1.2 Diagnostic Centres

8.1.1.3 Research Institutes

Chapter 9. Medical Isotopes Market, By Region

9.1 Overview

9.2 Medical Isotopes Market Revenue Share, By Region 2024 (%)

9.3 Global Medical Isotopes Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Medical Isotopes Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Medical Isotopes Market, By Country

9.5.4 UK

9.5.4.1 UK Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Medical Isotopes Market, By Country

9.6.4 China

9.6.4.1 China Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Medical Isotopes Market, By Country

9.7.4 GCC

9.7.4.1 GCC Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Medical Isotopes Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Isotopen Technologien München

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Mallinckrodt Pharmaceuticals

11.3 Eczacibasi-Monrol Nuclear Products

11.4 Canadian Nuclear Laboratories

11.5 Curium

11.6 Nordion Inc.

11.7 Northstar medical radioisotopes, LLC

11.8 GE Healthcare

11.9 IBA Radiopharma Solutions

11.10 Jubilant Radiopharma