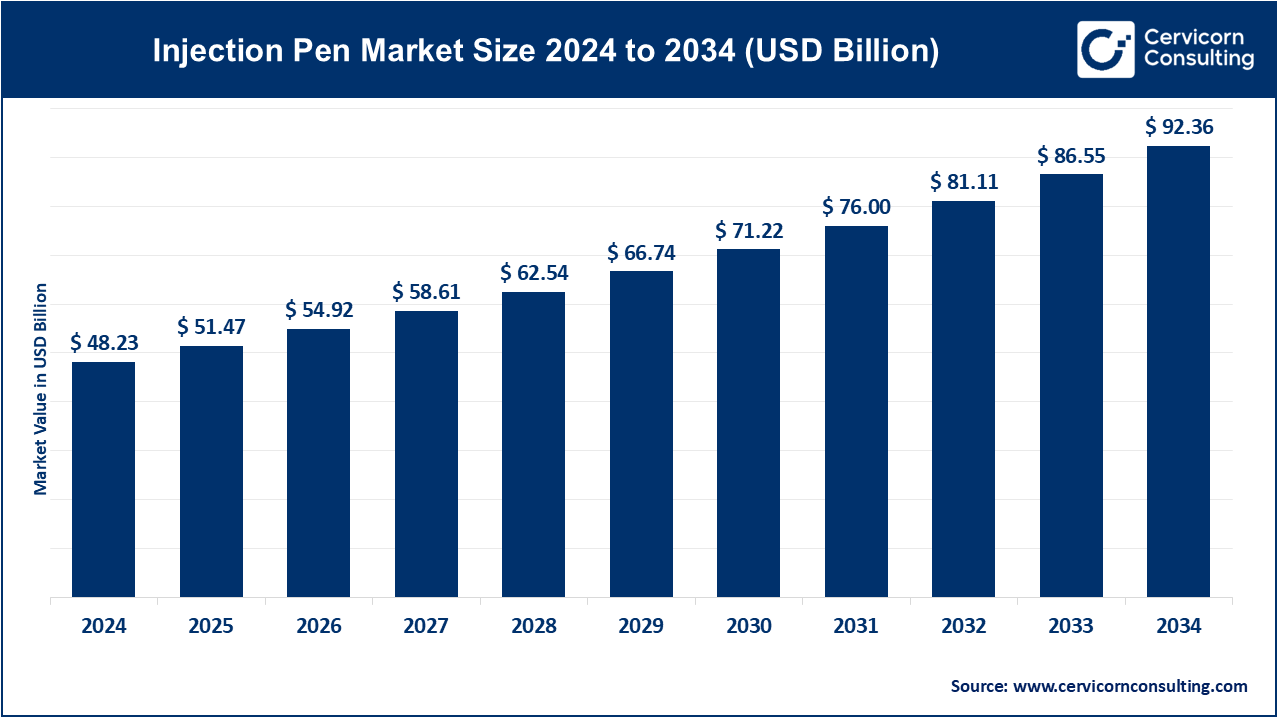

The global injection pen market size was reached at USD 48.23 billion in 2024 and is forecasted to exceed around USD 92.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.71% over the forecast period from 2025 to 2034. The injection pens market is fueled by a growing number of cases of chronic diseases like diabetes and rheumatoid arthritis, as well as the increasing need for self-care systems and home care.

Injection pens provide accurate, convenient, and low-pain delivery which, in turn, improves patient compliance. With the advent of technology, older injection pens are being updated to ‘smart’ pens with mobile applications, Bluetooth technology, dose tracking, and other features. Collaboration between pharma companies and medtech is helping advance innovation in connected devices. Support of digital health systems is also encouraging adoption. The advanced user-friendly interface and multifunctional purposes of smart injection pens enhancing their importance to personalized medicine. The need to improve patient outcomes while keeping healthcare costs down is expected to drive major growth in this market.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 51.47 Billion |

| Expected Market Size in 2033 | USD 86.55 Billion |

| Projected Market CAGR 2025 to 2034 | 6.71% |

| Top-performing Region | North America |

| Top Expanding Region | Asia-Pacific |

| Key Segment | Product, Application, End-Use, Region |

| Key Companies | Novo Nordisk, Eli Lilly, Sanofi, Merck, Ypsomed, AstraZeneca, Hoffman-La Roche, Becton Dickinson and company, Owen Mumford, Novartis |

Limited physician familiarity with newer pen tech

Risk of over-reliance on automated features

Patient related errors with digital assistance

Disposable: The most popular class of devices are single-use, prefilled disposable injection pens simply for safety and convenience. The literature reports that there is an improvement in patient adherence historically with pen injectors versus vial-and-syringe injectors that leads to improved treatment outcomes over time. Radius Health was given regulatory approval for the home-use abaloparatide terpenoids injectable pens for osteoporosis in early 2024. Their non-maintenance elements decreases the user training and potential infection control risks allowing for direct use. They are the preferred chose in market for cost-effectiveness, user-friendly interface, and for the easy to use method of administration at home-care. Their enduring expansion reflects unaddressed medical needs in conjunction with patient choice.

Injection Pen Market Revenue Share, By Product, 2024 (%)

| Product | Revenue Share, 2024 (%) |

| Disposable | 28.80% |

| Reusable | 71.20% |

Reusable: The Reusable segment has dominated the market in 2024. Once considered wasteful, reusable pens become more economical over time because the cartridges can be replaced. In January 2024, Bluetooth dose tracking was added to Sanofi's SoloStar with the approval of a smart cap, SoloSmart, for use with these pens. Periodic maintenance and cartridge loading increases the demand for some user training. However, lowering the carbon footprint and plastic waste alongside connection features appeal to eco-conscious and tech-savvy users. The adoption of these pens demonstrates the balance between sustainable design and the integration of digital health technologies.

Diabetes: Diabetes continues to lead the market in driving the use of injection pens, especially for insulin delivery. The literature suggests that a switch to pens greatly boosts treatment persistence and lowers the costs of healthcare services. With the advent of connected pens and continuous glucose monitoring systems, real-time dosing commands for achieving better control over the levels of glucose in the blood are possible. Regulatory authorities have accepted the proposals for integrating smart pens with glucose monitors that allow for adaptive dosing of insulin based on the actual level of glucose in the patient’s blood. Such approaches empower the patients and, at the same time, enhance clinicians’ capabilities to make timely treatment decisions during their interactions with the patients.

Anaphylaxis: The Anaphylaxis segment is expected to witness fastest CAGR over the forecast period. Self-injectable epinephrine auto-injectors represent the only available intervention for the treatment of life-threatening allergic reactions. Epinephrine pens are recommended at measures aimed for urgent and emergency readiness in schools or at public events. This year, regulators granted unprecedented access to a new epinephrine nasal spray that lacks a syringe, which may benefit some patients who fear needles. Several studies emphasize the supplied nasal version is functionally comparable to the injected pens in speed. These changes help broaden the range of potential users, especially those who are averse to needles, thereby bolstering community-level preparedness in emergency scenarios.

Osteoporosis: The majority of injectable therapies for osteoporosis, particularly anabolic agents, are administered through the use of pens. In the mid 2023, the use of a biosimilar to denosumab was approved for administration through a pen, improving accessibility to treatment. An abloperatide pen intended for daily use received regulatory approval for home-usage after showing remarkable results in reducing fracture risks. Injection pens guarantee precise and consistent doses which is important for compliance with chronic conditions. Their simplicity fosters self-administration and reduces the frequency of clinic appointments.

Growth Hormone Deficiency: Weekly pens for greater patient convenience have transformed the growth hormone therapy. In early 2023, regulators allowed the use of weekly pens in children and adults, so treatment protocols were simplified. These new devices lessens the mounted burden of injections and are easier to use than previous ones. Some of the design changes include improved ease of loading cartridges, setting the dose, and memory features already contained in the pen. Children and adults, including those needing long-term therapy, have better adherence to these pens. This is made possible by changes of this sort which increase access to treatments hitherto bound by restrictive policies.

Arthritis: The advent of biosimilar agents for rheumatoid arthritis and osteoporosis are being provided through pens. To date, more than fifty biosimilar agents for arthritis are available, many of which are in pen form. Self-administered pens lessen the need for infusion centers and aid in the management of chronic diseases from the patient's residence. Pens have been incorporated with digital attributes to monitor dose tracking and adherence. Improved documentation policies also allow the prescriber to exercise greater comfort with the use of pen devices. The reasons behind the use of these devices reflect a tendency toward more decentralized, patient-centered care in autoimmune disorders.

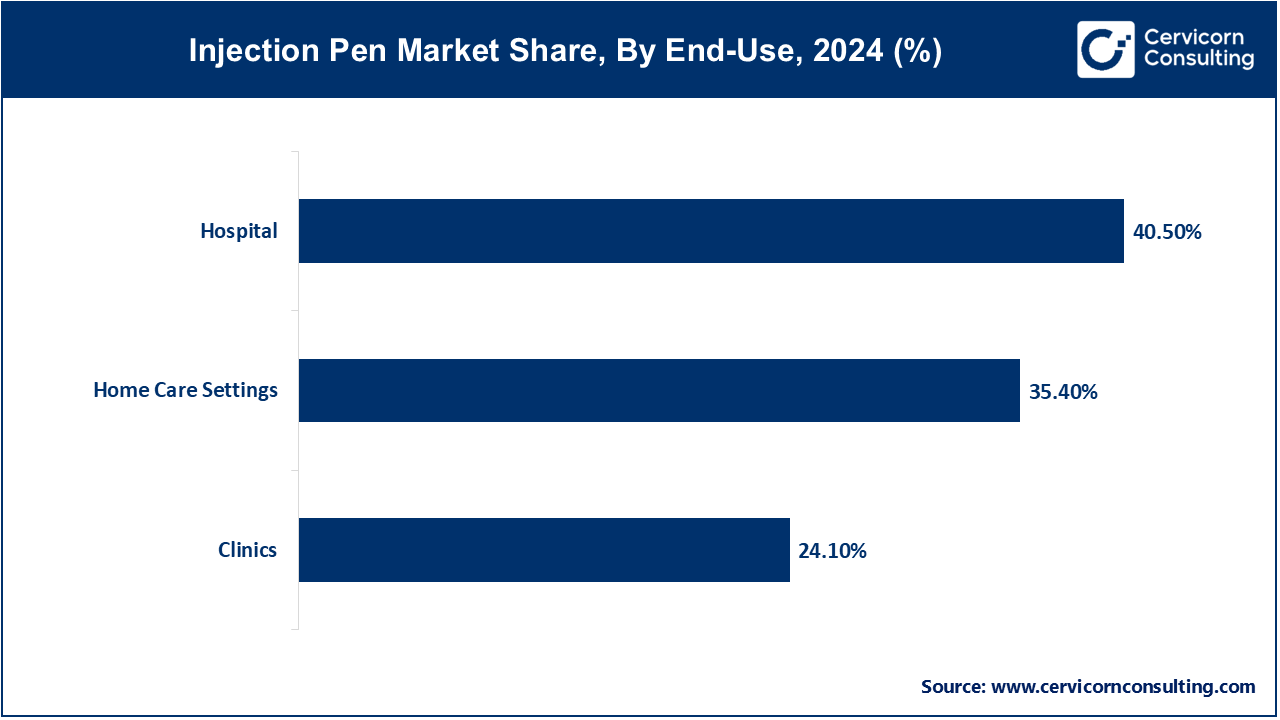

Hospitals: Hospitals continues to lead the market Inpatients and emergency cases at hospitals require the use of injection pens, such as epinephrine and insulin pens. Their portability and ease of use makes them ideal for code carts and critical care areas. Some hospital systems have piloted smart-cap equipped pens linked to the hospital EHR for dose tracking in real time. Regulatory provisions highlight the need for device traceability and read-back reconfirmations in medication delivery to mitigate errors. These devices facilitate the attainment of precision and efficiency in high-stakes clinical environments. Enhanced digital integration improves patient safety and elevates institutional oversight.

Clinics: Clinics use injection pens for initiating therapy and patient education sessions. Clinicians demonstrate the pen usage during visits. Clinics are now equipped with telehealth follow-up sessions that include smart–pen data analysis. Regalian changes permit the use of dose records for remote monitoring. Increased health literacy standards have led to heightened adoption among clinicians, and for patients, this has translated to fewer measures needed in-person visit—enhancing satisfaction.

Home Care Settings: The flexibility and control granted to patients makes it the most rapidly developing segment for injection pen applications. Research shows significant adherence and quality of life improvements with the use of pens in home settings. Remote monitoring of treatment progress is possible due to smart features like dosing reminders and digital logs. Regulatory guidance encourages interfacing with telehealth systems for clinician oversight. Connected pens provide real-time feedback to patients which lowers the need for frequent clinic visits. This evolution underscores a striking move toward home-centered, patient-driven care.

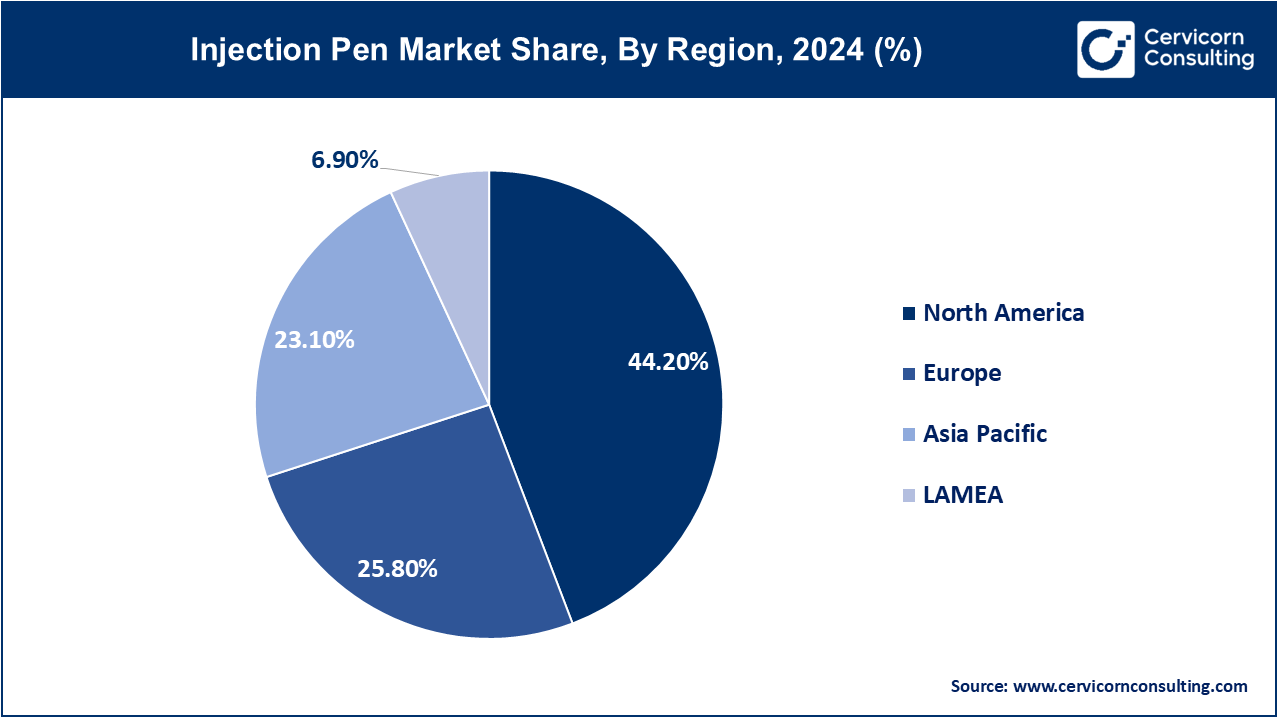

The injection pen market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

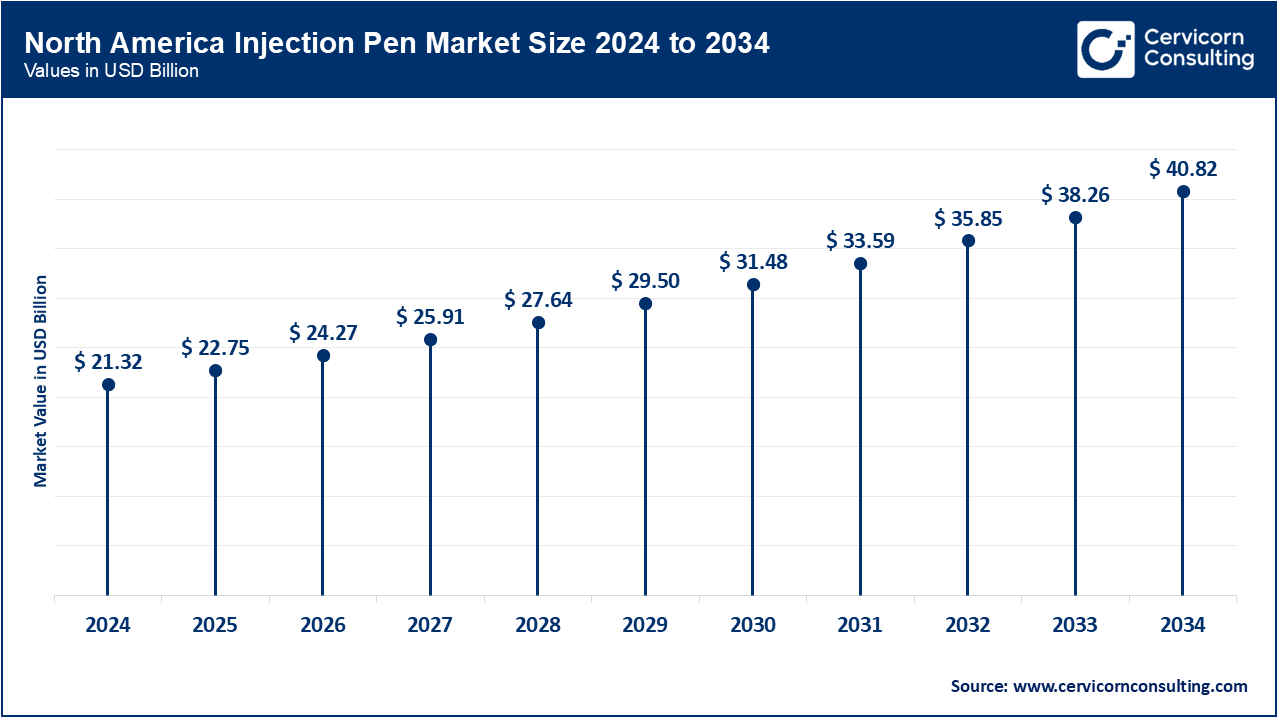

The North America injection pen market size was valued at USD 21.32 billion in 2024 and is expected to reach around USD 40.82 billion by 2034. In the U.S., the adoption of smart pens is accelerating: InPen’s integration with CGM was cleared by FDA in November 2024, enabled bolus alerts and dose tracking. Canada has also expanded access to insulin pens with Bluetooth in Nova Scotia and Ontario, which supports remote monitoring. Mexico, in coordination with WHO efforts to improve insulin access, shifted focus to cost in 2023 through prequalification and public-private procurement schemes. All three countries now focus, in the regional spirit, on diabetes management and equity in healthcare by addressing interoperability and connectivity standards for the devices at regulation level.

The Europe injection pen market size was estimated at USD 12.44 billion in 2024 and is projected to hit around USD 23.83 billion by 2034. Regulators in Europe are working to establish principles for smart pens: Germany’s BfArM updated guiding principles IoT-enabled pen data in patient record base in 2023. UK’s NHS initiated pilot programs in late 2024 with the aim of reducing hospital attendances using connected insulin pens. France saw CE marking granted to a reusable Bluetooth-cap for standard pens in mid-2024 which supports dose recording via mobile applications. There is a notable change across Europe regarding digitizing chronic care, aligning regulations, and investing infrastructure to enhance adherence and chronic care management.

The Asia-Pacific injection pen market size was accounted for USD 11.14 billion in 2024 and is forecast to grow to USD 21.34 billion by 2034. Japan maintains the region's lead in home smart pen adoption: NovoPen 6 and Echo Plus pens were approved and set the stage for other APAC’s emulators in June 2021. In 2023, China's National Health Commission widened the scope of subsidized insulin pens to include rural provinces as a means to combat the issue of under-dosing. Through government telehealth initiatives, India rolled out RFID-enabled pens in 2024 aimed at bolstering remote diabetes care. In 2024, Australia piloted smart pen systems incorporated with PBS reimbursement in Tasmania. Under the 2023 revisions to e-health regulations, South Korea’s Ministry of Food and Drug Safety required audit logging for pens interfaced with CGMs.

The LAMEA injection pen market size was valued at USD 3.33 billion in 2024 and is anticipated to reach around USD 6.37 billion by 2034. Brazil led Latin America by incorporating Mallya's resting smart sensor for tracking insulin and GLP-1 pens in urban clinics in 2023. In 2024, it began funding disposable pens nationally to improve access in rural regions. After confiscating counterfeit Ozempic pens in 2023, Anvisa tightened controls. In the Middle East and Africa, Saudi Arabia required Bluetooth enabled pens to interface with hospital systems starting late 2023. In 2024, the UAE commenced pilot projects of smart pens in clinics located in Dubai. South Africa enhances safe access by adding insulin pens to the Essential Medicines list in 2022, with procurement commencing in 2023.

Recent partnerships in the injection open industry highlight advances in smart drug delivery and digital health integration. Novo Nordisk teamed up with Roche in 2024 to co-develop connected insulin pens with seamless CGM compatibility. Sanofi partnered with Biocorp to expand the reach of their SoloSmart smart cap, enhancing data capture for injection adherence. Eli Lilly collaborated with Apple to integrate pen usage data into HealthKit, improving patient monitoring. Ypsomed and Dexcom joined forces to combine reusable pens with continuous glucose monitoring for real-time dose adjustments. These collaborations focus on improving patient outcomes, streamlining data sharing, and accelerating the adoption of connected injection technologies worldwide. Together, they are driving innovation and greater patient empowerment in diabetes care and beyond.

Market Segmentation

By Product

By Application

By End-Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Injection Pen

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Application Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Insurance coverage and reimbursement policies

4.1.1.2 Demand for painless and minimally invasive solutions

4.1.1.3 Increase in biologic drug approvals

4.1.2 Market Restraints

4.1.2.1 High cost of smart and reusable injection pens

4.1.2.2 Low awareness in rural and economically disadvantaged areas

4.1.2.3 Device breakdowns or mechanical issues

4.1.3 Market Challenges

4.1.3.1 Limited physician familiarity with newer pen tech

4.1.3.2 Risk of over-reliance on automated features

4.1.4 Market Opportunities

4.1.4.1 Creating dual-drug or multi-dose pens

4.1.4.2 Collaborating with telehealth providers for remote clinically relevant telemetry

4.1.4.3 Targeting autoimmune disorders and fertility treatment

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Injection Pen Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Injection Pen Market, By Product

6.1 Global Injection Pen Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Disposable

6.1.1.2 Reusable

Chapter 7. Injection Pen Market, By Application

7.1 Global Injection Pen Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Diabetes

7.1.1.2 Anaphylaxis

7.1.1.3 Osteoporosis

7.1.1.4 Growth Hormone Deficiency

7.1.1.5 Arthritis

7.1.1.6 Others

Chapter 8. Injection Pen Market, By End-User

8.1 Global Injection Pen Market Snapshot, By End-User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Hospital

8.1.1.2 Clinics

8.1.1.3 Home Care Settings

Chapter 9. Injection Pen Market, By Region

9.1 Overview

9.2 Injection Pen Market Revenue Share, By Region 2024 (%)

9.3 Global Injection Pen Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Injection Pen Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Injection Pen Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Injection Pen Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Injection Pen Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Injection Pen Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Injection Pen Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Injection Pen Market, By Country

9.5.4 UK

9.5.4.1 UK Injection Pen Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Injection Pen Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Injection Pen Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Injection Pen Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Injection Pen Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Injection Pen Market, By Country

9.6.4 China

9.6.4.1 China Injection Pen Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Injection Pen Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Injection Pen Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Injection Pen Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Injection Pen Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Injection Pen Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Injection Pen Market, By Country

9.7.4 GCC

9.7.4.1 GCC Injection Pen Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Injection Pen Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Injection Pen Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Injection Pen Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Eli Lilly

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Novo Nordisk

11.3 Sanofi

11.4 Merck

11.5 Ypsomed

11.6 AstraZeneca

11.7 Hoffman-La Roche

11.8 Becton Dickinson and company

11.9 Owen Mumford

11.10 Novartis