Injection Pen Market Size and Growth 2025 to 2034

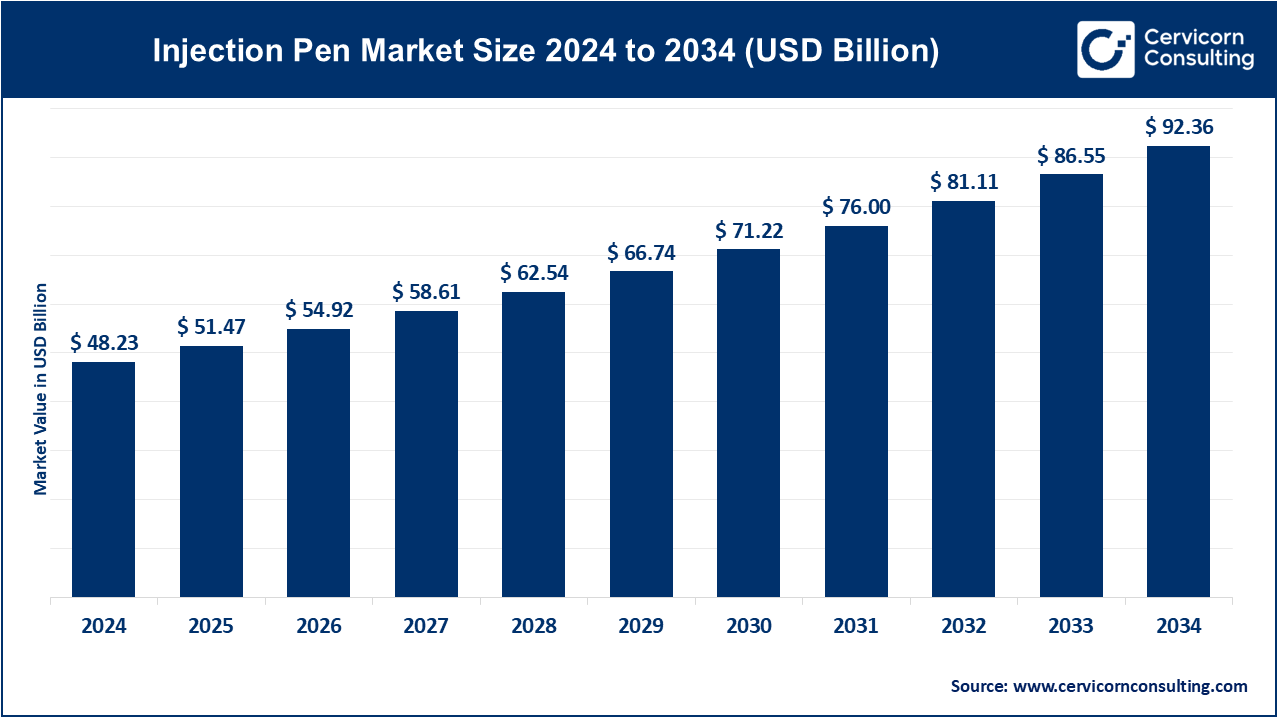

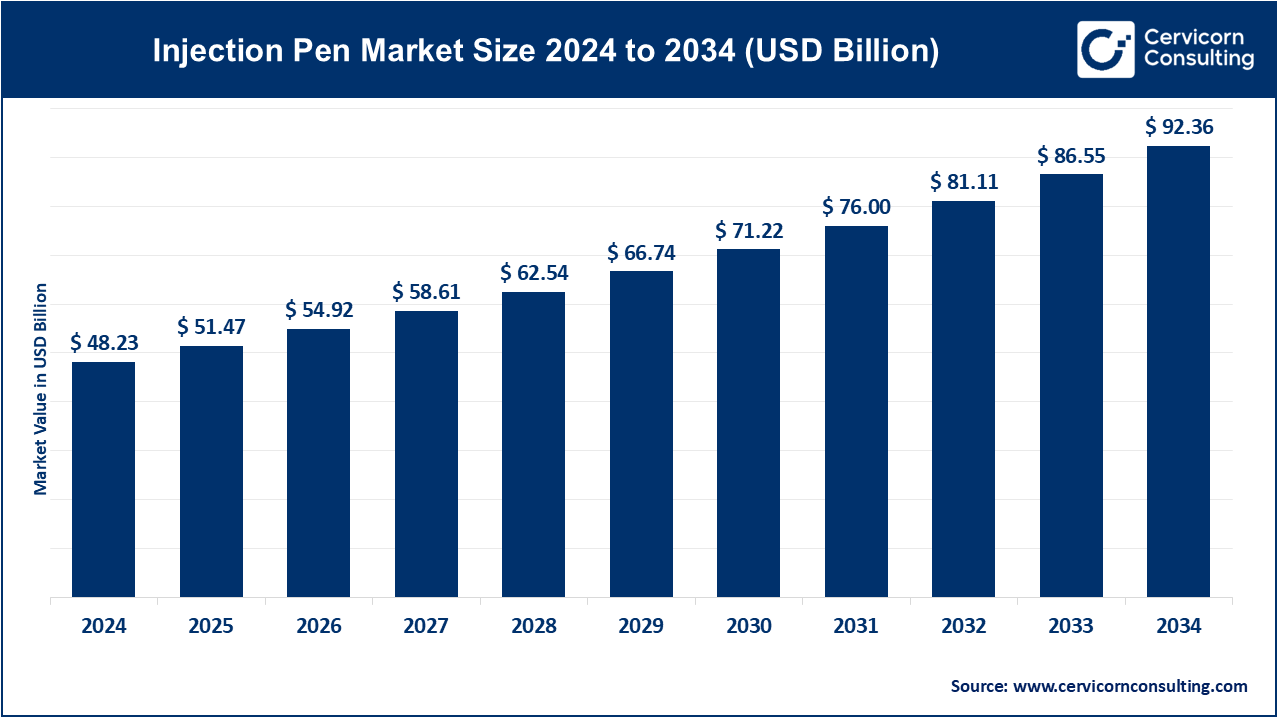

The global injection pen market size was reached at USD 48.23 billion in 2024 and is forecasted to exceed around USD 92.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.71% over the forecast period from 2025 to 2034. The injection pens market is fueled by a growing number of cases of chronic diseases like diabetes and rheumatoid arthritis, as well as the increasing need for self-care systems and home care.

Injection pens provide accurate, convenient, and low-pain delivery which, in turn, improves patient compliance. With the advent of technology, older injection pens are being updated to ‘smart’ pens with mobile applications, Bluetooth technology, dose tracking, and other features. Collaboration between pharma companies and medtech is helping advance innovation in connected devices. Support of digital health systems is also encouraging adoption. The advanced user-friendly interface and multifunctional purposes of smart injection pens enhancing their importance to personalized medicine. The need to improve patient outcomes while keeping healthcare costs down is expected to drive major growth in this market.

Report Highlights

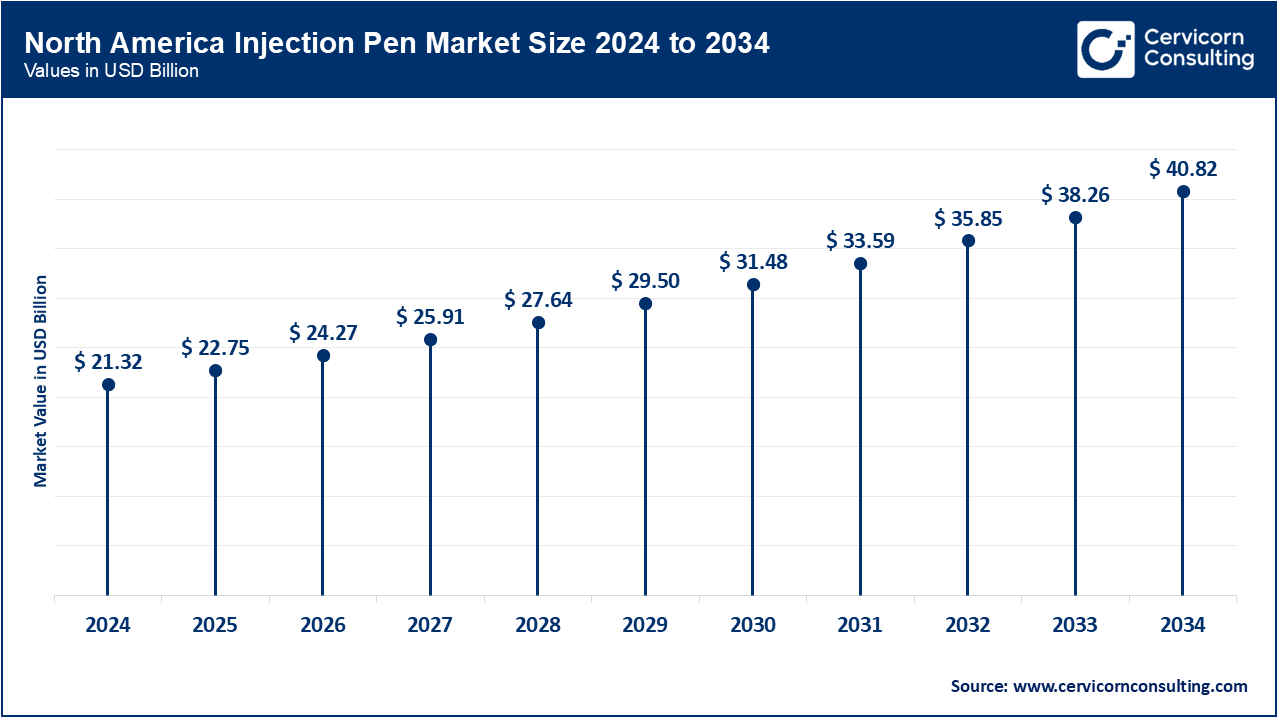

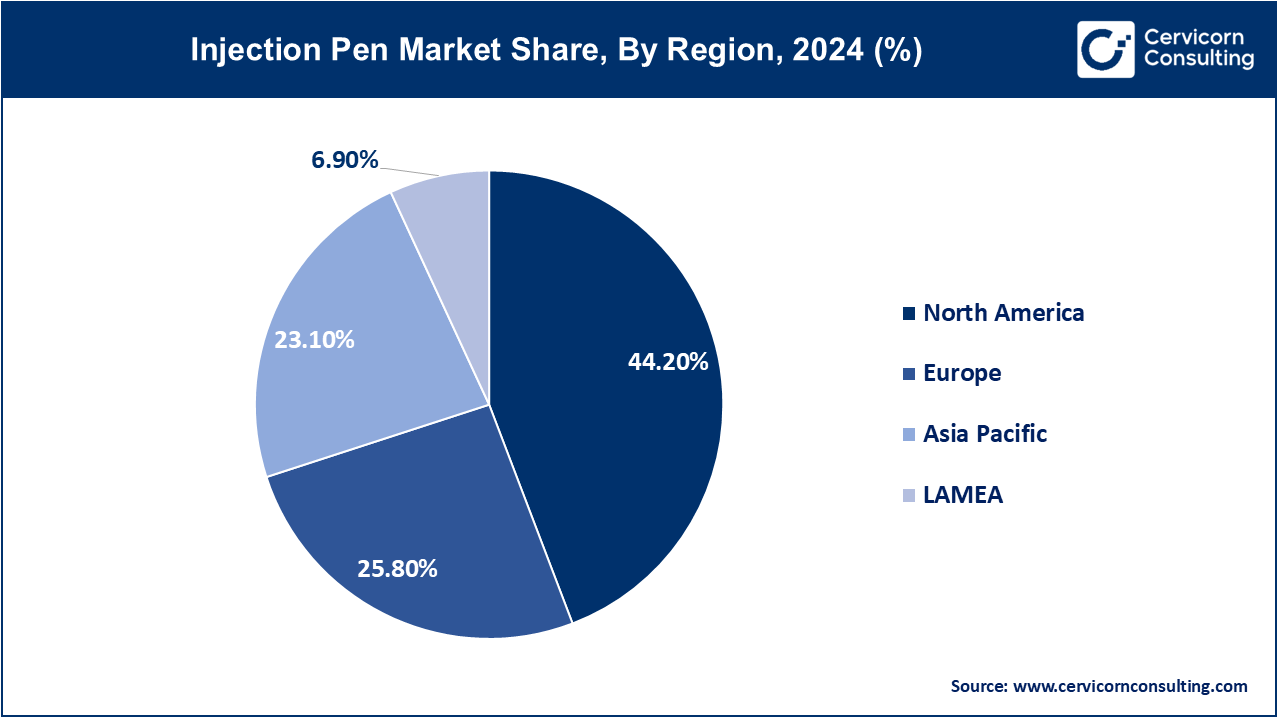

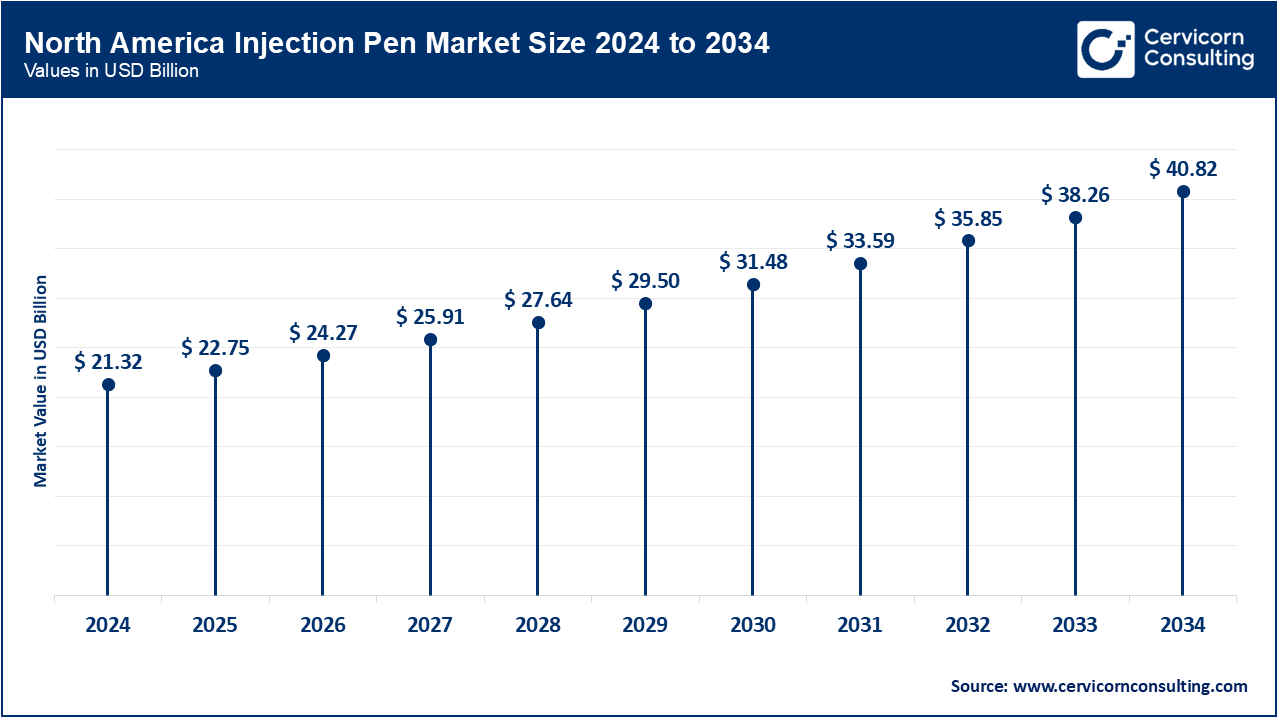

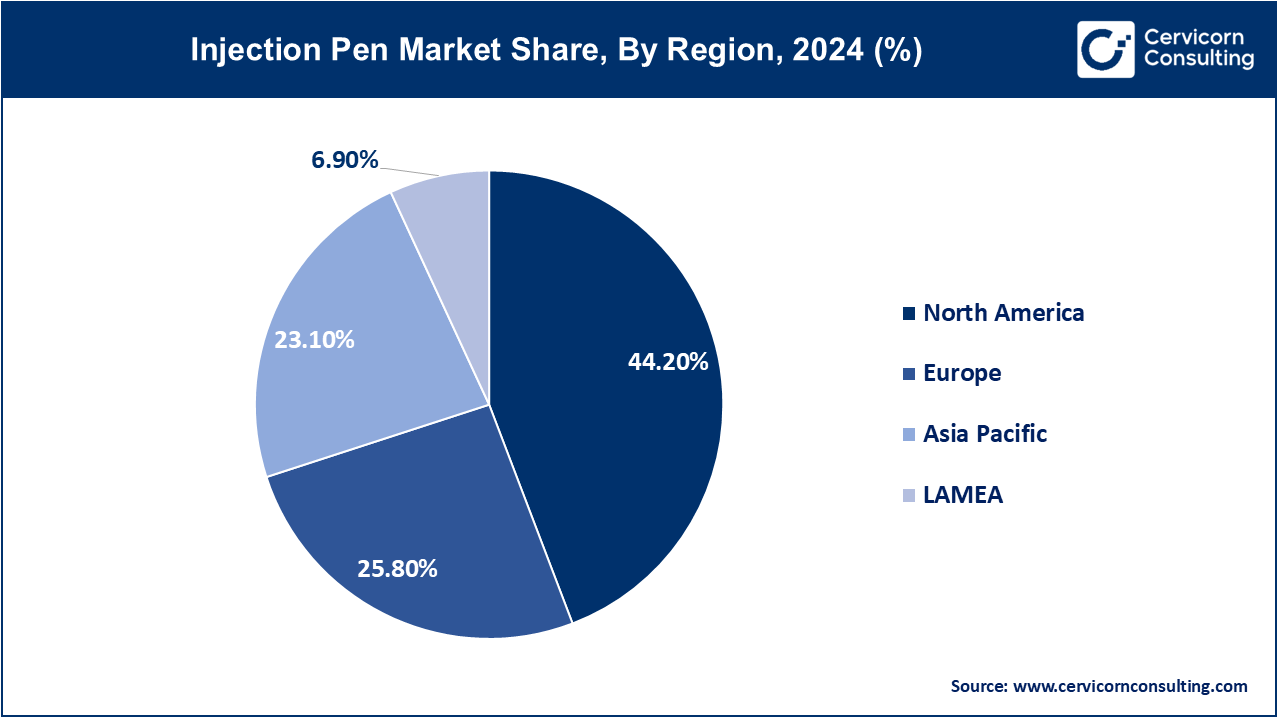

- North America accounted for a revenue share of 44.20% in 2024.

- Europe has captured revenue share of 25.80% in 2024.

- By product, the reusable segment has accounted for a revenue share of 71.20% in 2024.

- By application, the diabetes segment has garnered revenue share of 44.90% in 2024.

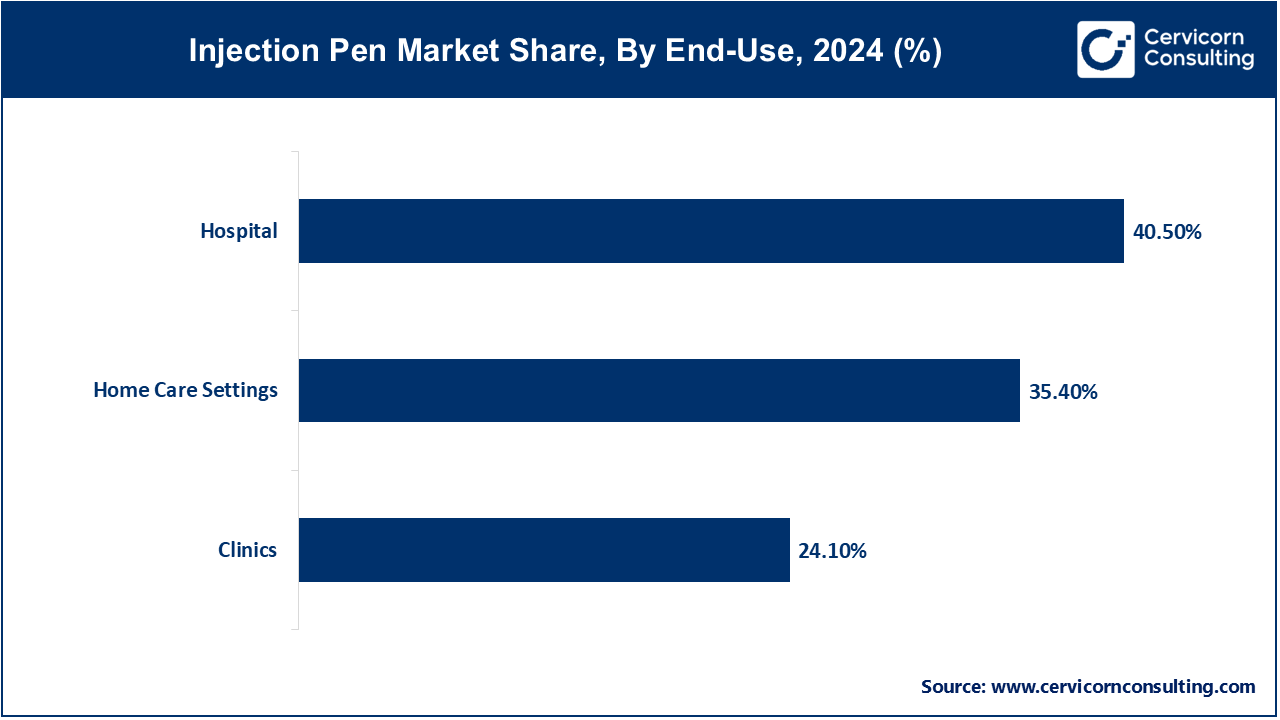

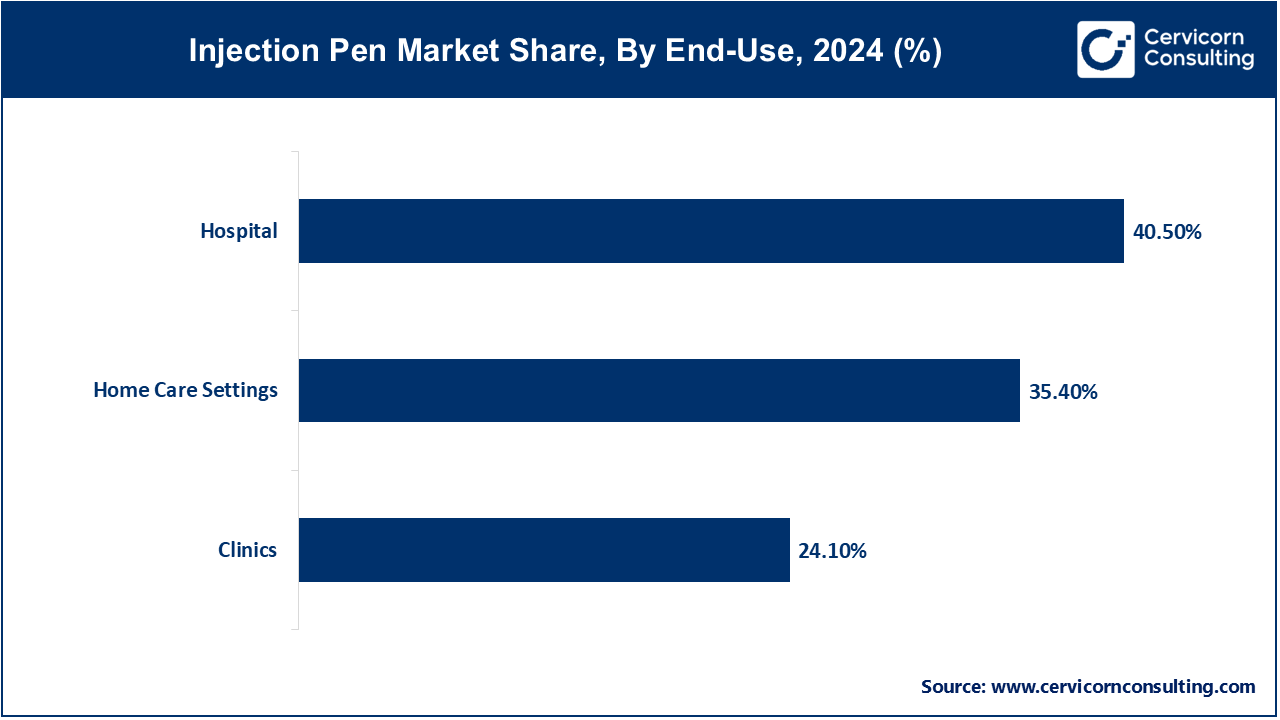

- By end-use, the hospital segment has generated revenue share of around 40.50% in 2024.

Market Growth Factors

- Rising prevalence of chronic diseases: Developing the healthcare system to provide better long-term care and improve technology for self-injection pens and your insulin biosimilars will ease the pain of managing chronic diseases such as diabetes. Chronic diseases like diabetes strongly increases the need for insulin injection pens. Approximately 70% of insulin-dependent individuals use injection pens which increases adherence to medication and decreases the need for healthcare visits and better access to healthcare. Merilog was approved for short-acting insulin biosimilars, now available in prefilled injection pens promoting ease of use and affordability. Such regulators are crucial in bridging chronic disease diffuse and the self-injection pen gap that focuses on presentation and ergonomic handling.

- Aging global population: The growth rate of this population segment swiftly exceeds all other age segments, as well as the average global population growth. Like all diabetes patients they are often categorized as chronic diseases. This condition in elderly makes traditional injection devices very difficult leading to the need productive and inexpensive alternatives. Older patients struggling with vision and dexterity require special devices, receiving greater precision and improving dosing accuracy. Devices like Biocorp’s solosmart cap provided improvement in the caregiver experience for older patients. Innovations simplify Syringes and boosts digital supervision showcasing the strength of a changing demographic in the injection pen development.

- Growing Need for Self-Administration Devices: The pandemic has accelerated the trend towards self-care, increasing the need for at-home injection devices. Qualification of Biocorp’s Mallya smart sensor, which attaches to disposable pens enabling Bluetooth dose tracking through smartphones, was granted by the FDA in December 2022. This device is used by patients on insulin or GLP-1 therapy who need to log their therapy records effortlessly and provides simplification and grace log without any formal training. In mid-2024 Biocorp announced collaboration with Novo Nordisk and Roche which, along with other industry participants, reinforces confidence in technologies that support pen-based, user-friendly, patient-controlled, home administration devices.

Market Trends

- Increased adoption of smart and connected injection pens: The adoption of technology with injection pens has noticeably progressed. FDA approval of SoloSmart's cap which logs dosages via Bluetooth and NFC was issued in January 2024. Medtronic also received clearance for its InPen with the CGM Simplera for dose alerting and real-time insulin guidance, issuing clearance November 2024. Such clearances demonstrate a willingness on the part of the regulators to accept components that are enhanced electronically, renewing trust regarding the shift from purely analog devices to smarter digitally focused ones centered on adherence and patient-centered care.

- Integration with mobile health applications and wearable devices: The connection between pens and their corresponding applications, as well as wearable devices, is advancing at an accelerating pace. Each component of Medtronic’s Smart MDI System the InPen and Simplera CGM works together to deliver advanced glucose-based meal and dosing guidance, giving tailored dosing guidance. Supplementary applications now issue reminders to log doses as well as communicate with EHR systems for clinician supervision. SoloSmart and similar devices interface with patient charts which promotes alignment within healthcare ecosystems allowing for efficient data-driven care and remote monitoring.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 51.47 Billion |

| Expected Market Size in 2033 |

USD 86.55 Billion |

| Projected Market CAGR 2025 to 2034 |

6.71% |

| Top-performing Region |

North America |

| Top Expanding Region |

Asia-Pacific |

| Key Segment |

Product, Application, End-Use, Region |

| Key Companies |

Novo Nordisk, Eli Lilly, Sanofi, Merck, Ypsomed, AstraZeneca, Hoffman-La Roche, Becton Dickinson and company, Owen Mumford, Novartis |

Market Dynamics

Market Drivers

- Insurance coverage and reimbursement policies: Policy reimbursement will now preferentially reimburse smart injection pens. In 2023, Bluetooth devices received reimbursement codes to be used under the Medicare and Medicaid reimbursement policy. By mid-2024, adoption had grown 25% among Medicare beneficiaries. Smart pens are now viewed as cost-effective because they have demonstrated real world proven data for reducing complications. These policies spearhead the removal of financial obstacles, thus, connected pens can be provided to a larger population and propelling market involvement.

- Demand for painless and minimally invasive solutions: The need for less painful and easy to use options drives innovations in pen design. Research shows that a pen equipped with a fine 4 mm needle introduces a 41% reduction in pain. In 2025, a CE marked pen which had the ability to change the speed of injection to further increase patient comfort was approved. Patients have noted a reduction in anxiety and increased ease compared to standard syringes. As comfort and ease of use become differentiating factors, these features accelerates the adoption of pen deliver systems.

- Increase in biologic drug approvals: There has been a consistent increase in the approvals of biologics and biosimilars for chronic illnesses, with five new subcutaneous biologics approved in 2023. Their contribution to global pharmaceutical sales as the drug class capturing roughly 30% shows their increasing role in clinical therapy. Injectables make home use easier which relieves the burden on Infusion Centers which reduces biologics infusion dependency. Pens have been scientifically justified as biologics delivery pen devices calibrated for use with complex therapies within the frameworks of accuracy, sterility, and stability of the biologic content.

Market Restraints

- High cost of smart and reusable injection pens: Challenges with Smart Reusable Injection Pens Technology: Non-connected pens range from $80-120, whilst smart devices are more costly and thus less economically viable for purchase. Infections of lower income strata face a 20-30% co-pay with Medicare which increases their out-of-pocket burden and disincentivizes care seeking. In resource constrained environments, these economic factors greatly hinder the adoption of smart injectors despite available reimbursement schemes. Even with available market demand, uptake is price sensitive due to advanced technologies for pen-sharp injections.

- Low awareness in rural and economically disadvantaged areas: Low awareness in rural and economically disadvantaged areas. Prior to self-injection pilot studies, WHO data indicated low adoption of self-injected contraception in rural Burkina Faso. According to a 2023 NGO survey, only 15% of primary care nurses in rural India were aware of connected pens. Mobile health outreach combined with localized education campaigns focused on the area can help resolve this gap. While initiatives, such as Bhutan’s WHO PEN package, aid in building awareness, robust programs are still needed to drive equitable adoption.

- Device breakdowns or mechanical issues: The complexity of injection pens entails occasional devices problems. Their compliance with ISO 11608 regulations is mandatory, however, real world problems arise, such as reports of spring fatigue and button failures in reusable and self-retracting pens in 2023-24. One smart pen brand was voluntarily recalled due to Bluetooth connection issues that may cause under dosing. Overall, all the events highlight the importance/context of thorough design validation, clean manufacturing standards, and casual post-market surveillance, in terms of continuously advancing confidence and safety standards in the smart pen market.

Market Opportunities

- Creating dual-drug or multi-dose pens: The development of a single or dual-drug delivery device is currently in progress. A dual-antibody pen for rheumatoid arthritis entered Phase II trials in Europe in 2024 and received FDA breakthrough designation in 2025. These combination pens have the benefit of simplifying complex treatment regimens by decreasing the per capita injection burden thereby improving adherence. TWHO has a pertinent objective of advancing injecting drug use safety, but it is not limiting safety in innovation for the sake of decreasing in needle exposure. These are alternative approaches that could improve patient and clinician convenience and at a minimum, these ideas may be reduce patient exposure to needles, and nudge better patient outcomes.

- Collaborating with telehealth providers for remote clinically relevant telemetry: Integration of telehealth platforms with connected pens enables remote real-time dosage supervision. Research shows that 46% of non-compliance is due to misunderstanding dosage instructions. Diabetes-related emergency admissions experienced a pilot 18% reduction in the UK with smart pen and telehealth integration in 2023. The FDA's 2024 interoperability requirement will necessitate these pens to facilitate secure exchange of electronic health record (EHR) and telehealth information. This kind of innovation increases proactive engagement from clinicians, which reduces safety, compliance, and remote care needs.

- Targeting autoimmune disorders and fertility treatment: Injection pens have taken on a new horizon that involves the treatment of autoimmune diseases, as well as fertility treatments. Burkina Faso's, self-injecting contraception pen programs saw risk increase, and by 2023, uptake doubled in rural communities with the assistance of WHO. In 2023, a fertility clinic advertised a pen-injector system for hCG which was touted for enhanced accuracy in dosing. As the pens are adopted for autoimmune and reproductive health applications, they provide easily scalable treatment solutions. The ability to digitally connect may also assist patients in these medically complex fields who require intricate, step-by-step treatment sequences.

Market Challenges

Limited physician familiarity with newer pen tech

- Despite the technological advances associated with digital injection pens, many providers are not familiar enough with how they operate or what they can offer as features. A 2024 report from the American Medical Association found that only 38% of primary care physicians, at least then when using connected devices, had any training or education, thus would not feel comfortable recommending them.

- In addition, clinicians lack both time, and the institutional support to adopt newer pen technologies and, in turn, to educate them. With these limitations, it is not uncommon for clinicians to continue to issue prescriptions for traditional pens, despite having recognized beneficial outcomes of utilizing smart pens to monitor their doses and adherence. The lack of familiarity by the vast majority of physicians has the potential to stop innovations from being accessible to their patients. Both physicians and other stakeholders in the healthcare system must recognize this gap, and you need to systematically include digital pen education into clinical guidelines, and continuing medical education programs (CME).

Risk of over-reliance on automated features

- Smart pens equipped with automated dose logging and dosing reminders can ultimately lead to over-reliance on these automation features which may lead the patient to disengage from their own duties to self monitor their chronic disease. The simplest example of the potential harm, is eliminated digital alerts due to no connectivity, may delay, or even stop, the patient from understanding that he/she missed doses, and/or that they had dosing errors.

- A 2023 FDA MedWatch report summarized multiple occurrences when patients, especially those with chronic disease, who relied solely on their automated dose logging, discovered their smart pen was not communicating with the application, leaving their dosing history blank. This is especially troubling news as patients living with more chronic illness (diabetes) often become dually reliant on automation technologies like smart pens. Automating clinical tools without user check systems can lead to compromised clinical outcomes. Design that achieves a balance with patient engagement and validation muscle memory is critical.

Patient related errors with digital assistance

- Visual and audible reminders do not eliminate the possibility of patients committing use errors with digital pens. A 2024 NHS audit revealed an alarming statistic that nearly one in five users did not correctly primer their pens or insert the cartridges leading to incomplete dosing. App-linked older users have difficulty navigating notification icons which adds layers of complexity enabling asymmetric cognitive overload. Failure to hear alarms may also cause patients to inadvertently skip or double doses, but with improper storage adding add more layers of complexity to the error equation.

- The issues presented here suggest digital enhancements do not eradicate human error completely. Many of these challenges can be addressed through provision of personalized onboarding and proactive, intuitive user interface designPatient related errors with digital assistance: Visual and audible reminders do not eliminate the possibility of patients committing use errors with digital pens. A 2024 NHS audit revealed an alarming statistic that nearly one in five users did not correctly primer their pens or insert the cartridges leading to incomplete dosing.

- App-linked older users have difficulty navigating notification icons which adds layers of complexity enabling asymmetric cognitive overload. Failure to hear alarms may also cause patients to inadvertently skip or double doses, but with improper storage adding add more layers of complexity to the error equation. The issues presented here suggest digital enhancements do not eradicate human error completely. Many of these challenges can be addressed through provision of personalized onboarding and proactive, intuitive user interface design.

Segmental Analysis

Product Analysis

Disposable: The most popular class of devices are single-use, prefilled disposable injection pens simply for safety and convenience. The literature reports that there is an improvement in patient adherence historically with pen injectors versus vial-and-syringe injectors that leads to improved treatment outcomes over time. Radius Health was given regulatory approval for the home-use abaloparatide terpenoids injectable pens for osteoporosis in early 2024. Their non-maintenance elements decreases the user training and potential infection control risks allowing for direct use. They are the preferred chose in market for cost-effectiveness, user-friendly interface, and for the easy to use method of administration at home-care. Their enduring expansion reflects unaddressed medical needs in conjunction with patient choice.

Injection Pen Market Revenue Share, By Product, 2024 (%)

| Product |

Revenue Share, 2024 (%) |

| Disposable |

28.80% |

| Reusable |

71.20% |

Reusable: The Reusable segment has dominated the market in 2024. Once considered wasteful, reusable pens become more economical over time because the cartridges can be replaced. In January 2024, Bluetooth dose tracking was added to Sanofi's SoloStar with the approval of a smart cap, SoloSmart, for use with these pens. Periodic maintenance and cartridge loading increases the demand for some user training. However, lowering the carbon footprint and plastic waste alongside connection features appeal to eco-conscious and tech-savvy users. The adoption of these pens demonstrates the balance between sustainable design and the integration of digital health technologies.

Application Analysis

Diabetes: Diabetes continues to lead the market in driving the use of injection pens, especially for insulin delivery. The literature suggests that a switch to pens greatly boosts treatment persistence and lowers the costs of healthcare services. With the advent of connected pens and continuous glucose monitoring systems, real-time dosing commands for achieving better control over the levels of glucose in the blood are possible. Regulatory authorities have accepted the proposals for integrating smart pens with glucose monitors that allow for adaptive dosing of insulin based on the actual level of glucose in the patient’s blood. Such approaches empower the patients and, at the same time, enhance clinicians’ capabilities to make timely treatment decisions during their interactions with the patients.

Anaphylaxis: The Anaphylaxis segment is expected to witness fastest CAGR over the forecast period. Self-injectable epinephrine auto-injectors represent the only available intervention for the treatment of life-threatening allergic reactions. Epinephrine pens are recommended at measures aimed for urgent and emergency readiness in schools or at public events. This year, regulators granted unprecedented access to a new epinephrine nasal spray that lacks a syringe, which may benefit some patients who fear needles. Several studies emphasize the supplied nasal version is functionally comparable to the injected pens in speed. These changes help broaden the range of potential users, especially those who are averse to needles, thereby bolstering community-level preparedness in emergency scenarios.

Osteoporosis: The majority of injectable therapies for osteoporosis, particularly anabolic agents, are administered through the use of pens. In the mid 2023, the use of a biosimilar to denosumab was approved for administration through a pen, improving accessibility to treatment. An abloperatide pen intended for daily use received regulatory approval for home-usage after showing remarkable results in reducing fracture risks. Injection pens guarantee precise and consistent doses which is important for compliance with chronic conditions. Their simplicity fosters self-administration and reduces the frequency of clinic appointments.

Growth Hormone Deficiency: Weekly pens for greater patient convenience have transformed the growth hormone therapy. In early 2023, regulators allowed the use of weekly pens in children and adults, so treatment protocols were simplified. These new devices lessens the mounted burden of injections and are easier to use than previous ones. Some of the design changes include improved ease of loading cartridges, setting the dose, and memory features already contained in the pen. Children and adults, including those needing long-term therapy, have better adherence to these pens. This is made possible by changes of this sort which increase access to treatments hitherto bound by restrictive policies.

Arthritis: The advent of biosimilar agents for rheumatoid arthritis and osteoporosis are being provided through pens. To date, more than fifty biosimilar agents for arthritis are available, many of which are in pen form. Self-administered pens lessen the need for infusion centers and aid in the management of chronic diseases from the patient's residence. Pens have been incorporated with digital attributes to monitor dose tracking and adherence. Improved documentation policies also allow the prescriber to exercise greater comfort with the use of pen devices. The reasons behind the use of these devices reflect a tendency toward more decentralized, patient-centered care in autoimmune disorders.

End Use Analysis

Hospitals: Hospitals continues to lead the market Inpatients and emergency cases at hospitals require the use of injection pens, such as epinephrine and insulin pens. Their portability and ease of use makes them ideal for code carts and critical care areas. Some hospital systems have piloted smart-cap equipped pens linked to the hospital EHR for dose tracking in real time. Regulatory provisions highlight the need for device traceability and read-back reconfirmations in medication delivery to mitigate errors. These devices facilitate the attainment of precision and efficiency in high-stakes clinical environments. Enhanced digital integration improves patient safety and elevates institutional oversight.

Clinics: Clinics use injection pens for initiating therapy and patient education sessions. Clinicians demonstrate the pen usage during visits. Clinics are now equipped with telehealth follow-up sessions that include smart–pen data analysis. Regalian changes permit the use of dose records for remote monitoring. Increased health literacy standards have led to heightened adoption among clinicians, and for patients, this has translated to fewer measures needed in-person visit—enhancing satisfaction.

Home Care Settings: The flexibility and control granted to patients makes it the most rapidly developing segment for injection pen applications. Research shows significant adherence and quality of life improvements with the use of pens in home settings. Remote monitoring of treatment progress is possible due to smart features like dosing reminders and digital logs. Regulatory guidance encourages interfacing with telehealth systems for clinician oversight. Connected pens provide real-time feedback to patients which lowers the need for frequent clinic visits. This evolution underscores a striking move toward home-centered, patient-driven care.

Regional Analysis

The injection pen market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

North America is leading the injection pen market

The North America injection pen market size was valued at USD 21.32 billion in 2024 and is expected to reach around USD 40.82 billion by 2034. In the U.S., the adoption of smart pens is accelerating: InPen’s integration with CGM was cleared by FDA in November 2024, enabled bolus alerts and dose tracking. Canada has also expanded access to insulin pens with Bluetooth in Nova Scotia and Ontario, which supports remote monitoring. Mexico, in coordination with WHO efforts to improve insulin access, shifted focus to cost in 2023 through prequalification and public-private procurement schemes. All three countries now focus, in the regional spirit, on diabetes management and equity in healthcare by addressing interoperability and connectivity standards for the devices at regulation level.

Europe Injection Pen Market Trends

The Europe injection pen market size was estimated at USD 12.44 billion in 2024 and is projected to hit around USD 23.83 billion by 2034. Regulators in Europe are working to establish principles for smart pens: Germany’s BfArM updated guiding principles IoT-enabled pen data in patient record base in 2023. UK’s NHS initiated pilot programs in late 2024 with the aim of reducing hospital attendances using connected insulin pens. France saw CE marking granted to a reusable Bluetooth-cap for standard pens in mid-2024 which supports dose recording via mobile applications. There is a notable change across Europe regarding digitizing chronic care, aligning regulations, and investing infrastructure to enhance adherence and chronic care management.

Asia-Pacific is expected to witness high growth

The Asia-Pacific injection pen market size was accounted for USD 11.14 billion in 2024 and is forecast to grow to USD 21.34 billion by 2034. Japan maintains the region's lead in home smart pen adoption: NovoPen 6 and Echo Plus pens were approved and set the stage for other APAC’s emulators in June 2021. In 2023, China's National Health Commission widened the scope of subsidized insulin pens to include rural provinces as a means to combat the issue of under-dosing. Through government telehealth initiatives, India rolled out RFID-enabled pens in 2024 aimed at bolstering remote diabetes care. In 2024, Australia piloted smart pen systems incorporated with PBS reimbursement in Tasmania. Under the 2023 revisions to e-health regulations, South Korea’s Ministry of Food and Drug Safety required audit logging for pens interfaced with CGMs.

LAMEA Injection Pen Market Trends

The LAMEA injection pen market size was valued at USD 3.33 billion in 2024 and is anticipated to reach around USD 6.37 billion by 2034. Brazil led Latin America by incorporating Mallya's resting smart sensor for tracking insulin and GLP-1 pens in urban clinics in 2023. In 2024, it began funding disposable pens nationally to improve access in rural regions. After confiscating counterfeit Ozempic pens in 2023, Anvisa tightened controls. In the Middle East and Africa, Saudi Arabia required Bluetooth enabled pens to interface with hospital systems starting late 2023. In 2024, the UAE commenced pilot projects of smart pens in clinics located in Dubai. South Africa enhances safe access by adding insulin pens to the Essential Medicines list in 2022, with procurement commencing in 2023.

Injection Pen Market Top Companies

Recent Developments

Recent partnerships in the injection open industry highlight advances in smart drug delivery and digital health integration. Novo Nordisk teamed up with Roche in 2024 to co-develop connected insulin pens with seamless CGM compatibility. Sanofi partnered with Biocorp to expand the reach of their SoloSmart smart cap, enhancing data capture for injection adherence. Eli Lilly collaborated with Apple to integrate pen usage data into HealthKit, improving patient monitoring. Ypsomed and Dexcom joined forces to combine reusable pens with continuous glucose monitoring for real-time dose adjustments. These collaborations focus on improving patient outcomes, streamlining data sharing, and accelerating the adoption of connected injection technologies worldwide. Together, they are driving innovation and greater patient empowerment in diabetes care and beyond.

- In April 2025, Novo Nordisk is phasing out its popular insulin pens, including Penfills and FlexPens, globally to consolidate its insulin portfolio and make room for increased production of other diabetes and obesity injectables, a move that is expected to disrupt the Indian market where these pens are widely used by patients for convenient insulin delivery. While the company will continue supplying insulin in vials, which require separate syringes and are less user-friendly, patients and advocates have raised concerns about the challenges of switching devices and brands, especially for those managing diabetes on tight budgets, even though alternative brands are available in the market.

- In April 2025, Owen Mumford launched UnifineOTC, a new line of over-the-counter pen needles designed to provide an affordable, cash-pay solution for people with diabetes facing high out-of-pocket costs or lacking adequate insurance coverage. Available in 4mm x 32G and 5mm x 31G sizes and in packs of 50 or 100, UnifineOTC pen needles maintain the trusted quality of the Unifine brand while eliminating the need for insurance billing, helping pharmacies streamline operations, and ensuring patients have easier access to essential diabetes care products.

- In September 2023, Sanofi, a global pharmaceutical company, is committed to integrating Environmental, Social, and Governance (ESG) principles into its business strategy to drive sustainable innovation and address global health challenges. The company regularly updates stakeholders on its ESG progress through quarterly reports and publishes a comprehensive CSRD (Corporate Sustainability Reporting Directive) report, detailing its sustainability strategy and achievements. Sanofi is also recognized as a leader in sustainable finance, having established sustainability-linked credit facilities and bonds, and provides transparent ESG disclosures through an ESG Index and key performance indicators.

Market Segmentation

By Product

By Application

- Diabetes

- Anaphylaxis

- Osteoporosis

- Growth Hormone Deficiency

- Arthritis

- Others

By End-Use

- Hospital

- Clinics

- Home Care Settings

By Region

- North America

- APAC

- Europe

- LAMEA