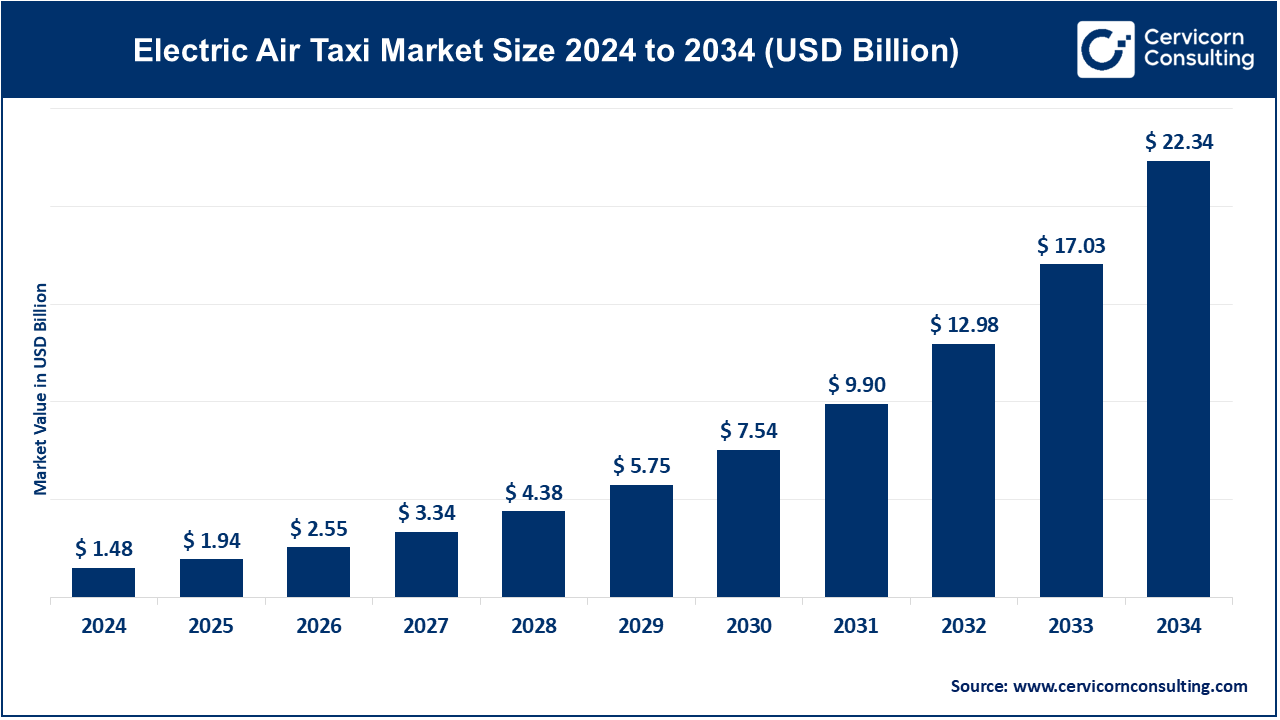

The global electric air taxi market size was valued at USD 1.48 billion in 2024 and is expected to be worth around USD 22.34 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 31.18% over the forecast period 2025 to 2034. The electric air taxi market is experiencing significant growth, driven by rapid advancements in battery technology have enhanced the range and payload capacity of electric vertical take-off and landing (eVTOL) aircraft, making them more versatile for both intra-city and inter-city travel. Technological progress in electric propulsion systems and autonomous flight capabilities has improved the efficiency and reliability of these aircraft, aligning with global sustainability goals. Additionally, the increasing need for urban air mobility solutions to alleviate traffic congestion and reduce carbon emissions has created a pressing demand for alternative transportation modes.

Electric air taxis are rapidly advancing as a transformative solution for urban air mobility (UAM). These aircraft promise to ease ground traffic congestion, lower carbon emissions, and provide ultra-fast point-to-point travel across metropolitan areas.

Supportive government initiatives and regulatory frameworks are also crucial to the market's expansion. Governments and aviation authorities worldwide are developing regulations and infrastructure to facilitate the integration of electric air taxis into existing transportation systems. Significant investments from major aerospace companies and venture capital firms are fueling research and development efforts, further propelling market growth.

What is an Electric Air Taxi?

An electric air taxi is a type of small, electric-powered aircraft often using vertical take-off and landing (eVTOL) technology, designed to transport passengers over short to medium distances, primarily within or between urban areas. These aircraft are typically quieter, more sustainable, and more cost-effective than traditional helicopters or airplanes, making them ideal for reducing traffic congestion and carbon emissions in cities. Electric air taxis come in various types, including piloted eVTOLs, remotely piloted vehicles, and fully autonomous aircraft. Their applications range from urban air mobility (UAM) services like airport shuttles and city-to-city commutes to emergency response, medical transport, tourism, and even cargo delivery. As infrastructure and regulations evolve, these air taxis are expected to revolutionize the future of transportation.

Key Global Adoption Trends & Drivers

Operational & Public Sentiment Metrics in the Electric Air Taxi Market

| Statistic | Value |

| Number of Active Air Taxi Projects Globally | Over 200 active eVTOL projects |

| eVTOL Concepts Under Development | Approximately 100 electric aircraft designs by 2022 and up to 700 sustainable aircraft concepts by 2023. |

| Public Willingness to Use (U.S.) | 98% of frequent flyers would consider using an electric air taxi |

| European Public Support for UAM | 83% positive attitude; 49% willing to try air taxis |

| Test Flights Completed (EHang EH216) | Over 10,000 safety test flights later expanded to more than 50,000 flights across 17 countries. |

| eVTOL Propulsion Share | Electric vehicles represent 38.8% of the flying taxi propulsion mix |

| Multicopter Design Adoption | Multicopters account for 47.1% of eVTOL aircraft by type |

Commercial Trials and Urban Flight Demonstrations

Electric air taxis are undergoing rapid real-world testing in major cities, with the goal of launching passenger services within the next few years. These trials demonstrate the feasibility of air mobility in urban environments, paving the way for regulatory approvals and public confidence.

Growing Investment and Strategic Partnerships

The electric air taxi sector is attracting significant investment from automotive, aerospace, and tech giants, fueling R&D and infrastructure development.

Expansion of Vertiport Infrastructure

As eVTOL services move closer to commercial launch, cities and private firms are investing in vertiport networks to support takeoffs and landings.

Increased Consumer Interest in Air Mobility

Public interest in electric air taxis is rising, fueled by the promise of faster, eco-friendly urban transport. Surveys indicate strong demand for short-distance air travel.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 1.94 Billion |

| Expected Market Size in 2034 | USD 22.34 Billion |

| Projected Market CAGR 2025 to 2034 | 31.18% |

| Dominant Area | North America |

| High-growth Area | Asia-Pacific |

| Key Segments | Propulsion Type, Mode of Operation, Application, End User, Region |

| Key Players | Joby Aviation, Archer Aviation, Lilium GmbH, Vertical Aerospace, Volocopter, EHang, Wisk Aero, Beta Technologies, Embraer’s Eve Air Mobility, Bell Textron, Supernal (Hyundai Motor Group), Urban Aeronautics |

Urban Traffic Congestion and Need for Faster Mobility

Advancements in eVTOL and Battery Technologies

Regulatory Uncertainty and Airspace Management Issues

High Development and Infrastructure Costs

Rising Demand for Eco-Friendly and Sustainable Mobility

Potential in Emerging Markets and Island Nations

Public Acceptance and Safety Concerns

Integration with Existing Air Traffic Systems

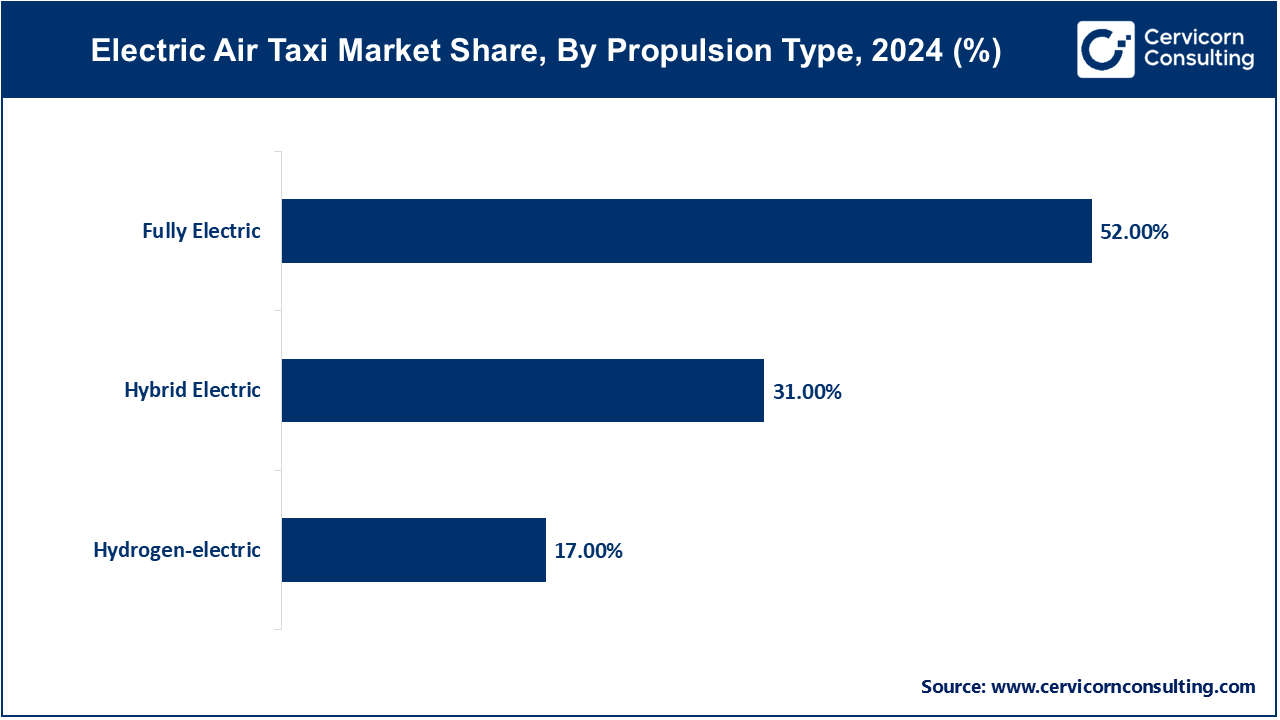

The electric air taxi market is segmented into propulsion type, mode of operation, application, end user, and region. Based on propulsion type, the market is classified into fully electric, hybrid electric, and hydrogen-electric. Based on the mode of operation, the market is classified into piloted, autonomous, and remotely operated. Based on application, the market is classified into passenger transportation, medical evacuation, search and rescue, cargo transportation, and others. Based on end user, the market is classified into Commercial and Government & military.

The fully electric segment is the dominant propulsion type in the electric air taxi market in 2024. Its popularity stems from zero-emission operations, low noise output, and reduced maintenance costs. Backed by increasing environmental regulations and rising investments in sustainable mobility, major players such as Joby Aviation, EHang, and Lilium are actively deploying fully electric air taxis for urban and intercity transport. Improvements in battery density and advancements in thermal management systems are further propelling the growth of this segment. With many regulatory bodies favoring battery-electric systems for initial certifications, the segment is expected to retain its market leadership in the short term.

The hydrogen-electric segment is the fastest-growing propulsion type, offering longer ranges and faster refueling capabilities than battery-powered models. Companies like ZeroAvia and Urban Aeronautics are investing in hydrogen-powered eVTOLs, aiming to overcome the limitations of battery range. While still in the early stages of development, the growing focus on green hydrogen infrastructure globally signals immense potential for this segment in the coming decade.

The piloted mode dominates the market in 2024, as most ongoing test flights and early-stage deployments rely on onboard human pilots. This approach eases regulatory approvals and builds trust among early adopters. Companies like Archer Aviation and Volocopter are launching piloted services in key cities like Los Angeles and Dubai, enhancing reliability and safety perception. Due to current aviation laws and safety concerns, the piloted segment continues to occupy the largest share.

Meanwhile, the autonomous segment is gaining momentum as the fastest-growing mode. Driven by technological advancements in AI, LiDAR, and 5G connectivity, autonomous air taxis are seen as a key to scalable urban air mobility. Wisk Aero and EHang have demonstrated fully autonomous test flights, and several cities are initiating smart airspace programs to prepare for autonomous traffic. Although regulatory hurdles remain, the push for cost-effective and pilotless operations is accelerating R&D in this segment.

The passenger transportation segment is the leading application in the electric air taxi market in 2024, fueled by the urgent need to decongest city traffic and reduce urban commute times. Startups and aerospace giants alike are focusing on air mobility for commuters, VIP transport, and short-distance travel. As cities prepare for launch programs (e.g., Paris for the 2024 Olympics), the passenger segment is expected to remain dominant in market share and revenue generation.

The medical evacuation segment is emerging as a high-growth area, particularly in regions with poor road infrastructure or dense urban traffic. Electric air taxis are increasingly being explored for life-saving missions such as organ transport, emergency rescue, and disaster response. With partnerships forming between health departments and aviation firms, this segment is witnessing early adoption and pilot programs in countries like the U.S., Germany, and Japan.

The commercial segment leads the market in terms of adoption and revenue, accounting for a majority share in 2024. This includes applications in ride-hailing services, tourism, corporate transport, and cargo logistics. With investments from Uber, Hyundai, and Archer, commercial electric air taxis are being actively integrated into future urban mobility solutions. The demand is particularly strong in metropolitan areas of the U.S., UAE, and South Korea.

The government & military segment, while smaller, is rapidly growing due to interest in defense mobility, surveillance, and emergency services. Governments are funding R&D, conducting pilot programs, and collaborating with aerospace startups to evaluate use cases for homeland security and battlefield logistics. As geopolitical tensions rise and technology matures, this segment is projected to expand steadily over the next decade.

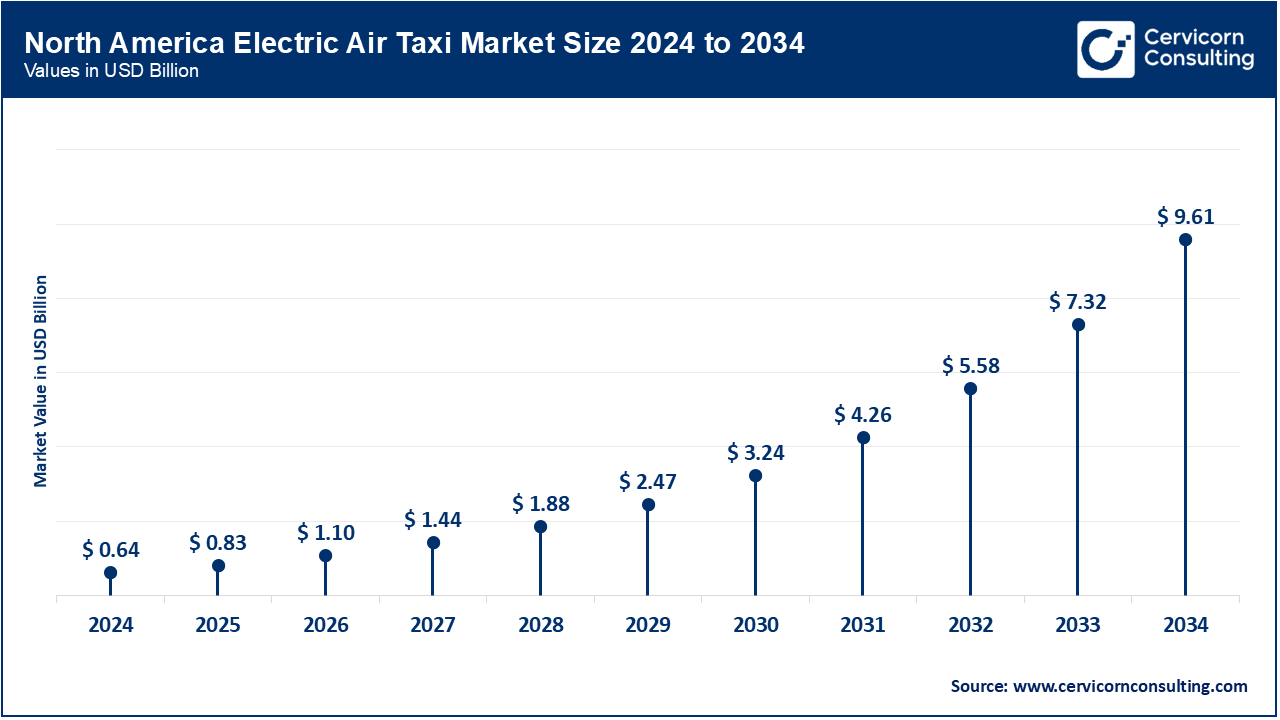

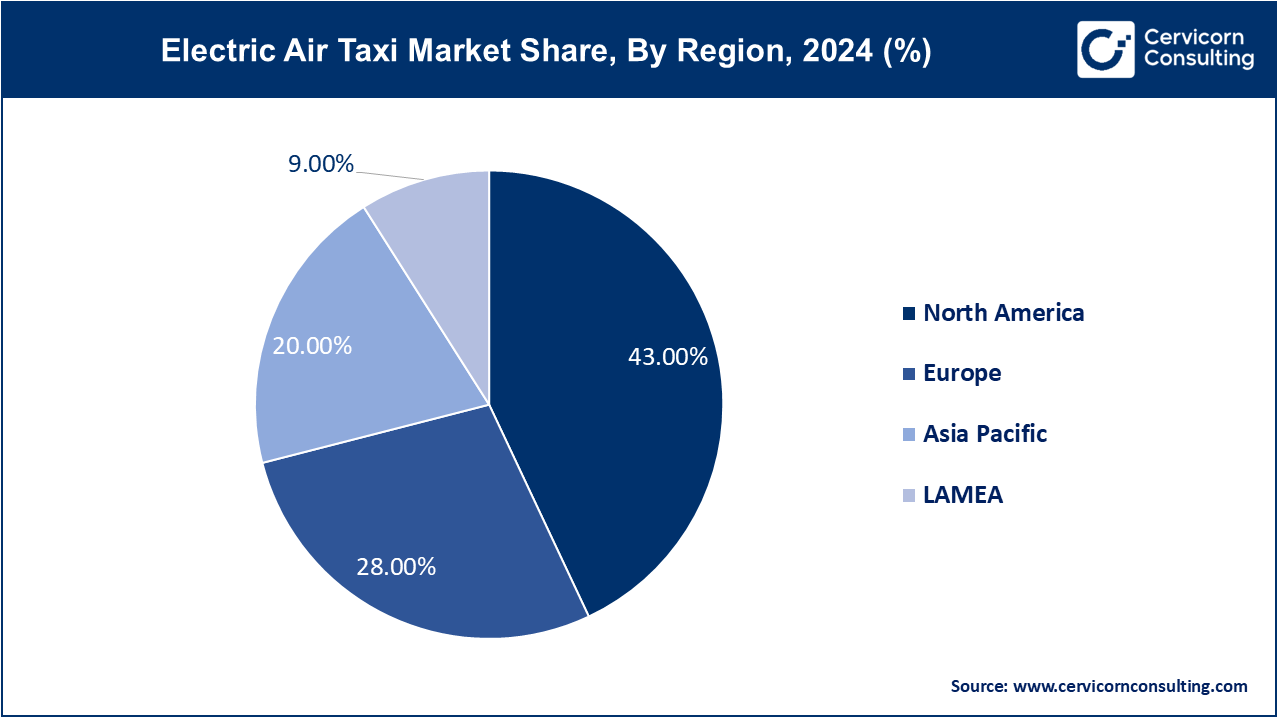

The electric air taxi market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA.

North America stands as the leading region in the electric air taxi market in 2024, driven by high investment in urban air mobility (UAM), supportive regulatory frameworks, and robust technological infrastructure. The U.S., in particular, is a hub for innovation, with companies like Joby Aviation, Archer Aviation, and Wisk Aero spearheading the development of electric vertical takeoff and landing (eVTOL) aircraft. NASA and the Federal Aviation Administration (FAA) are actively collaborating on airspace integration and safety certifications, accelerating market readiness. Cities like Los Angeles and New York are being explored as early adopters for commercial operations. The region benefits from a strong startup ecosystem and availability of venture capital funding, making it the most mature market globally.

Asia-Pacific is emerging as the fastest-growing market for electric air taxis, with countries like China, Japan, South Korea, and India making bold strides toward commercial deployment. China is leading the charge with EHang conducting autonomous test flights and public demonstrations. Japan is preparing for aerial taxi use at the Osaka Expo 2025, and South Korea has already launched UAM roadmaps involving Hyundai and government agencies. Rapid urbanization, high population density, and the need for traffic decongestion are major drivers. Governments across APAC are investing in smart cities and future transport infrastructure, creating fertile ground for eVTOL growth. The region’s emphasis on technological innovation and infrastructure modernization gives it significant long-term potential.

Europe is positioned as a key contributor to sustainable electric air taxi development, with strong policy support and a focus on green mobility. The European Union Aviation Safety Agency (EASA) has been proactive in setting certification pathways for eVTOLs. Countries like Germany, France, and the UK are hosting major players like Lilium, Volocopter, and Vertical Aerospace, which are developing air taxis for urban transit and tourism. Paris is notably preparing for electric air taxi launches in time for the 2024 Summer Olympics. Europe’s emphasis on carbon neutrality and its dense urban layouts make air taxis a promising solution for short-range travel. The continent’s strong regulatory alignment across nations is an advantage for scaling services.

The LAMEA region is an emerging player in the electric air taxi market, with the Middle East leading in early-stage adoption and investment. The UAE is aggressively advancing its smart mobility plans, with Dubai aiming to become one of the first cities globally to launch commercial air taxi services. Collaborations between the Dubai Roads and Transport Authority (RTA) and firms like Joby and Skyports highlight the region’s readiness. Latin America, especially Brazil, is also exploring eVTOLs for inter-city and tourism applications, leveraging its vast geography and high demand for agile transport. In Africa, while the market is still nascent, discussions around using electric air taxis for medical deliveries and access to remote areas have begun, indicating potential for humanitarian and infrastructure-based use cases in the future.

The electric air taxi industry is highly competitive, with numerous companies vying for leadership in the emerging urban air mobility (UAM) space. Joby Aviation, Archer Aviation, and Lilium GmbH are leading innovators, focusing on efficient, high-performance electric vertical takeoff and landing (eVTOL) aircraft. Vertical Aerospace and Volocopter are advancing with similar designs aimed at urban passenger transport. EHang and Wisk Aero are emphasizing autonomous flight technologies, while Beta Technologies and Embraer’s Eve Air Mobility focus on developing scalable, sustainable air mobility solutions. Bell Textron and Supernal (Hyundai Motor Group) bring strong aviation expertise and manufacturing capabilities to the market, while Urban Aeronautics is pioneering unique approaches to air mobility. With significant investments and partnerships across aerospace, automotive, and technology sectors, these players are shaping a competitive and dynamic landscape, striving to capitalize on the growing demand for urban air transportation.

Market Segmentation

By Propulsion Type

By Mode of Operation

By Application

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Electric Air Taxi

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Propulsion Type Overview

2.2.2 By Mode of Operation Overview

2.2.3 By Application Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Urban Traffic Congestion and Need for Faster Mobility

4.1.1.2 Advancements in eVTOL and Battery Technologies

4.1.2 Market Restraints

4.1.2.1 Regulatory Uncertainty and Airspace Management Issues

4.1.2.2 High Development and Infrastructure Costs

4.1.3 Market Challenges

4.1.3.1 Public Acceptance and Safety Concerns

4.1.3.2 Integration with Existing Air Traffic Systems

4.1.4 Market Opportunities

4.1.4.1 Rising Demand for Eco-Friendly and Sustainable Mobility

4.1.4.2 Potential in Emerging Markets and Island Nations

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Electric Air Taxi Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Electric Air Taxi Market, By Propulsion Type

6.1 Global Electric Air Taxi Market Snapshot, By Propulsion Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Fully Electric

6.1.1.2 Hybrid Electric

6.1.1.3 Hydrogen-electric

Chapter 7. Electric Air Taxi Market, By Mode of Operation

7.1 Global Electric Air Taxi Market Snapshot, By Mode of Operation

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Piloted

7.1.1.2 Autonomous

7.1.1.3 Remotely Operated

Chapter 8. Electric Air Taxi Market, By Application

8.1 Global Electric Air Taxi Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Passenger Transportation

8.1.1.2 Medical Evacuation

8.1.1.3 Search and Rescue

8.1.1.4 Cargo transportation

8.1.1.5 Others

Chapter 9. Electric Air Taxi Market, By End-User

9.1 Global Electric Air Taxi Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Commercial

9.1.1.2 Government & military

Chapter 10. Electric Air Taxi Market, By Region

10.1 Overview

10.2 Electric Air Taxi Market Revenue Share, By Region 2024 (%)

10.3 Global Electric Air Taxi Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Electric Air Taxi Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Electric Air Taxi Market, By Country

10.5.4 UK

10.5.4.1 UK Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Electric Air Taxi Market, By Country

10.6.4 China

10.6.4.1 China Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Electric Air Taxi Market, By Country

10.7.4 GCC

10.7.4.1 GCC Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Electric Air Taxi Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Joby Aviation

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Archer Aviation

12.3 Lilium GmbH

12.4 Vertical Aerospace

12.5 Volocopter

12.6 EHang

12.7 Wisk Aero

12.8 Beta Technologies

12.9 Embraer’s Eve Air Mobility

12.10 Bell Textron

12.11 Supernal (Hyundai Motor Group)

12.12 Urban Aeronautics