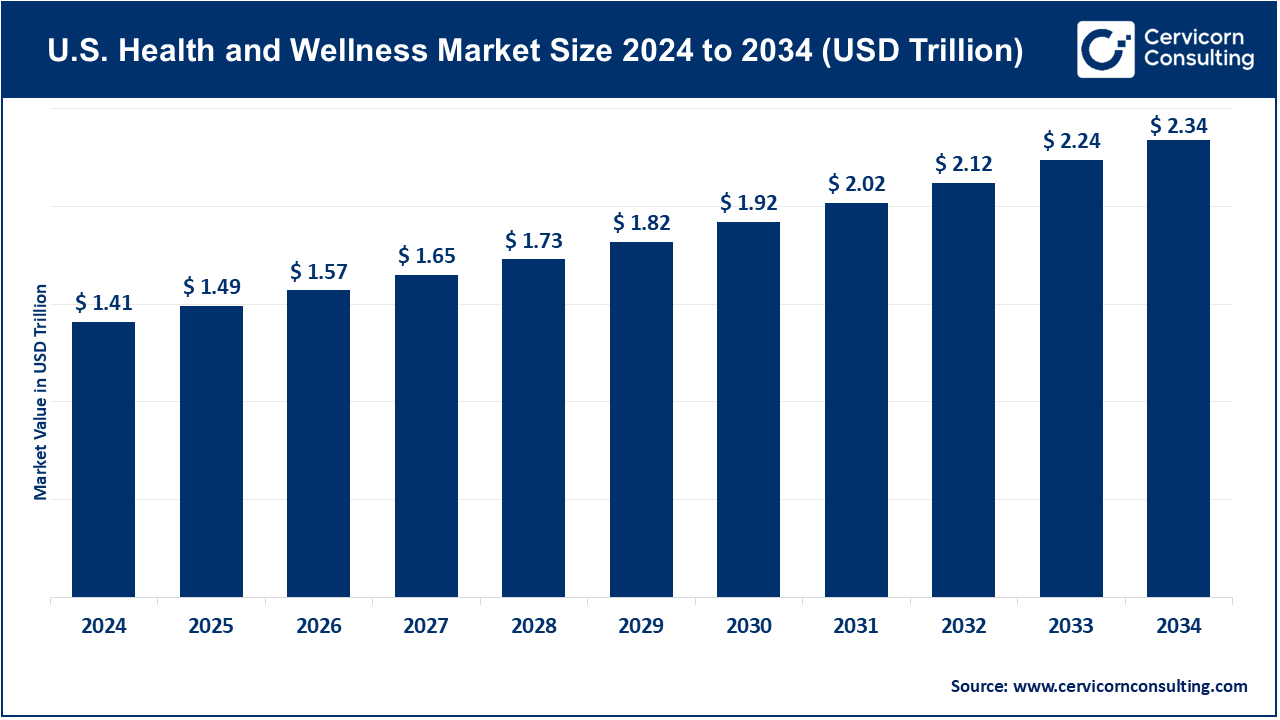

The U.S. health and wellness market size was reached at USD 1.41 trillion in 2024 and is expected to be worth around USD 2.34 trillion by 2034, exhibiting at a compound annual growth rate (CAGR) of 5.19% over the forecast period 2025 to 2034.

The U.S. health and wellness market is experiencing significant growth, driven by an increasing consumer focus on preventive healthcare and overall well-being. Rising awareness of the importance of healthy lifestyles, fueled by a growing understanding of nutrition, physical activity, and mental health, has led to higher demand for wellness products and services. This has resulted in a boom in fitness memberships, wellness tourism, and the popularity of nutrition and weight loss programs. The growing adoption of health-tracking technology, such as wearable devices and fitness apps, is also a major driver, allowing individuals to monitor and optimize their well-being in real time. Furthermore, the rising prevalence of chronic diseases, coupled with a shift toward personalized medicine and preventive care, has amplified the need for health services tailored to individual needs.

Another key driver of market growth is the evolving wellness economy, which is expanding beyond traditional health services to include sectors like spa treatments, beauty, anti-aging products, and mental wellness services. Consumers are increasingly prioritizing self-care and holistic health, leading to a surge in demand for spa and relaxation experiences, mental health apps, and skincare products. Additionally, the COVID-19 pandemic has accelerated interest in personal health and hygiene, contributing to the market’s growth. As more people seek balance in their physical, emotional, and mental health, the market is likely to continue expanding, driven by innovations in health services, products, and technology that meet the evolving needs of modern consumers.

What is Health and Wellness?

Health and wellness represent a lifestyle that focuses on maintaining and improving overall well-being through various practices and habits. It's not just about being free from illness but actively taking steps to enhance your body, mind, and spirit. This includes exercising regularly, eating nutritious food, taking care of mental health, and practicing self-care. People are increasingly interested in health and wellness as they realize the long-term benefits of staying healthy and preventing diseases. With more focus on holistic approaches like mindfulness, fitness activities, and personal care, the wellness movement is empowering people to live healthier, happier lives while balancing both physical and emotional well-being.

Growth of Mental Health and Wellness Services

Mental health services are seeing increasing demand, with more individuals prioritizing their mental well-being alongside physical health. The use of mental health apps has surged, and therapy platforms are gaining traction as people seek convenience and accessibility.

Shift Toward Plant-Based and Sustainable Products

Consumers are more mindful about their environmental footprint, pushing the growth of plant-based, organic, and sustainably sourced products in the health and wellness sectors. From food to skincare, people are increasingly turning to eco-friendly and cruelty-free alternatives.

Table: Adoption of Plant-based Substitutes in the U.S.

| Plant-based Substitutes | Adoption Rate in 2024 |

| Plant-based Milk | 82% |

| Dairy Product Substitutes | 40% |

| Plant-based Meat Alternative | 62% |

| Egg Substitutes and/or Vegan Egg | 22% |

| Plant-based Condiments | 18% |

| Other Products | 4% |

Integration of Wearable Technology in Health Monitoring

Wearable devices are becoming a vital part of health management, helping people track their physical activity, heart rate, sleep patterns, and more. These devices offer real-time data that enables individuals to monitor their wellness consistently.

Rise of Wellness Tourism

Wellness tourism is gaining popularity as people seek vacations that focus on health, relaxation, and rejuvenation. This trend includes wellness resorts, yoga retreats, and spas, where people disconnect to improve their physical and mental well-being.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 1.49 Trillion |

| Expected Market Size in 2034 | USD 2.34 Trillion |

| Projected Market CAGR 2025 to 2034 | 5.19% |

| Key Segments | Application, Distribution Channel, Age Group |

| Key Companies | Procter & Gamble (P&G), Herbalife Nutrition Ltd., Peloton Interactive, Inc., Hilton Worldwide Holdings Inc., Humana Inc., WW International, Inc. (Weight Watchers), Lululemon Athletica Inc., Johnson & Johnson, The Estée Lauder Companies Inc. |

The US health and wellness market is segmented into applications. Based on applications, the market is classified into personal care & beauty & anti-aging, nutrition & weight loss, physical activity, wellness tourism, preventive & personalized medicine, spa economy, and others. Based on distribution channel, the market is classified into online and offline. Based on age group, the market is classified into adults, children, elderly, athletes & fitness enthusiasts and corporate & workplace wellness participants.

Personal Care, Beauty & Anti-Aging: The personal care, beauty, and anti-aging segment holds a significant share due to the growing consumer interest in skincare, cosmetics, and anti-aging treatments. The increasing desire for youth preservation and personal grooming is driving the growth in this segment. Recent trends show a rise in demand for organic, natural, and cruelty-free beauty products, alongside advancements in anti-aging skincare like wrinkle creams and Botox.

Nutrition & Weight Loss: The nutrition & weight loss segment continues to grow as more individuals focus on maintaining a healthy diet and weight management. The rising rates of obesity and the growing trend of fitness-conscious consumers contribute to the growth of this segment. The demand for plant-based proteins, low-carb options, and tailored dietary supplements are shaping the market.

Physical Activity: The physical activity segment has seen a rise due to the growing focus on fitness and overall well-being. The increasing adoption of fitness routines, especially virtual fitness classes, and wearable fitness devices is fueling the market's growth. The pandemic accelerated the shift towards home workout equipment and digital fitness solutions, with more people prioritizing physical activity for mental and physical health.

Wellness Tourism: The wellness tourism segment is gaining momentum with consumers seeking health-focused travel experiences like wellness resorts and spa retreats. The rise in disposable income and an increased focus on stress management are driving growth. Post-pandemic, wellness tourism has become more popular, with travelers seeking relaxation and mental rejuvenation through health retreats, yoga vacations, and medical tourism.

Preventive & Personalized Medicine: The preventive & personalized medicine segment is expanding rapidly due to the growing interest in proactive healthcare. Consumers are increasingly seeking customized wellness plans, including genetic testing and tailored nutrition. Advancements in precision medicine and the rising awareness about preventive care are driving this segment's growth.

Spa Economy: The spa economy segment continues to thrive with an increasing interest in relaxation and self-care treatments. Rising stress levels and increased disposable income are key factors driving growth in this market. The growing trend of integrating wellness practices like meditation and yoga into traditional spa services is enhancing consumer experiences.

Others: The others segment includes various niche applications like mental wellness and environmental wellness, contributing to the overall health and wellness market growth. The increasing focus on mental health and the demand for eco-friendly wellness products are driving this segment. Companies are also integrating wellness programs into workplace environments to address mental and physical well-being.

The competitive landscape of the U.S. Health and Wellness Market is highly dynamic, featuring a mix of established global companies and niche players offering diverse products and services. Major companies such as Procter & Gamble (P&G), Herbalife Nutrition Ltd., and Johnson & Johnson dominate the personal care, nutrition, and wellness sectors, leveraging their strong brand recognition and wide product portfolios. Fitness-focused brands like Peloton Interactive, Inc. and Lululemon Athletica Inc. capitalize on the growing trend of physical activity and wellness, while health insurance providers such as Humana Inc. and weight loss leaders like WW International, Inc. (Weight Watchers) focus on holistic health solutions. The Estée Lauder Companies Inc. strengthens its position in the personal care and beauty segment, while hospitality giants like Hilton Worldwide Holdings Inc. contribute to the wellness tourism market. The competition is driven by innovation, consumer demand for personalized services, and the increasing emphasis on preventive health, with companies constantly adapting to changing consumer preferences.

Market Segmentation

By Application

By Distribution Channel

By Age Group

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of U.S. health and wellness

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Application Overview

2.2.2 By Distribution Channel Overview

2.2.3 By Age Group Overview

2.3 Competitive Overview

Chapter 3 Impact Analysis

3.1 Russia-Ukraine Conflict: Market Implications

3.2 Regulatory and Policy Changes Impacting Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Health Consciousness

4.1.1.2 Technological Advancements

4.1.2 Market Restraints

4.1.2.1 High Cost of Health and Wellness Products

4.1.2.2 Lack of Regulation

4.1.3 Market Challenges

4.1.3.1 Market Saturation

4.1.3.2 Consumer Skepticism

4.1.4 Market Opportunities

4.1.4.1 Growth of Plant-Based and Sustainable Products

4.1.4.2 Rise of Wellness Tourism

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 U.S. health and wellness Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 U.S. health and wellness Market, By Application

6.1 U.S. health and wellness Market Snapshot, By Application

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Personal Care & Beauty & Anti-Aging

6.1.1.2 Nutrition & Weight Loss

6.1.1.3 Physical Activity

6.1.1.4 Wellness Tourism

6.1.1.5 Mental Wellness

6.1.1.6 Alternative & Traditional Therapies

6.1.1.7 Preventive & Personalized Medicine

6.1.1.8 Healthy Eating, Nutrition, & Organic Food

6.1.1.9 Spa Economy

6.1.1.10 Others

Chapter 7 U.S. health and wellness Market, By Distribution Channel

7.1 U.S. health and wellness Market Snapshot, By Distribution Channel

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Online

7.1.1.2 Offline

Chapter 8 U.S. health and wellness Market, By Age Group

8.1 U.S. health and wellness Market Snapshot, By Age Group

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Adults

8.1.1.2 Children

8.1.1.3 Elderly

8.1.1.4 Athletes & Fitness Enthusiasts

8.1.1.5 Corporate & Workplace Wellness Participants

Chapter 9 U.S. health and wellness Market, By Region

9.1 Overview

9.2 U.S. health and wellness Market Revenue Share, By Region 2024 (%)

9.3 Market Size and Forecast

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11 Company Profiles

11.1 Procter & Gamble (P&G)

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Herbalife Nutrition Ltd.

11.3 Peloton Interactive, Inc.

11.4 Hilton Worldwide Holdings Inc.

11.5 Humana Inc.

11.6 WW International, Inc. (Weight Watchers)

11.7 Lululemon Athletica Inc.

11.8 Johnson & Johnson

11.9 The Estée Lauder Companies Inc.