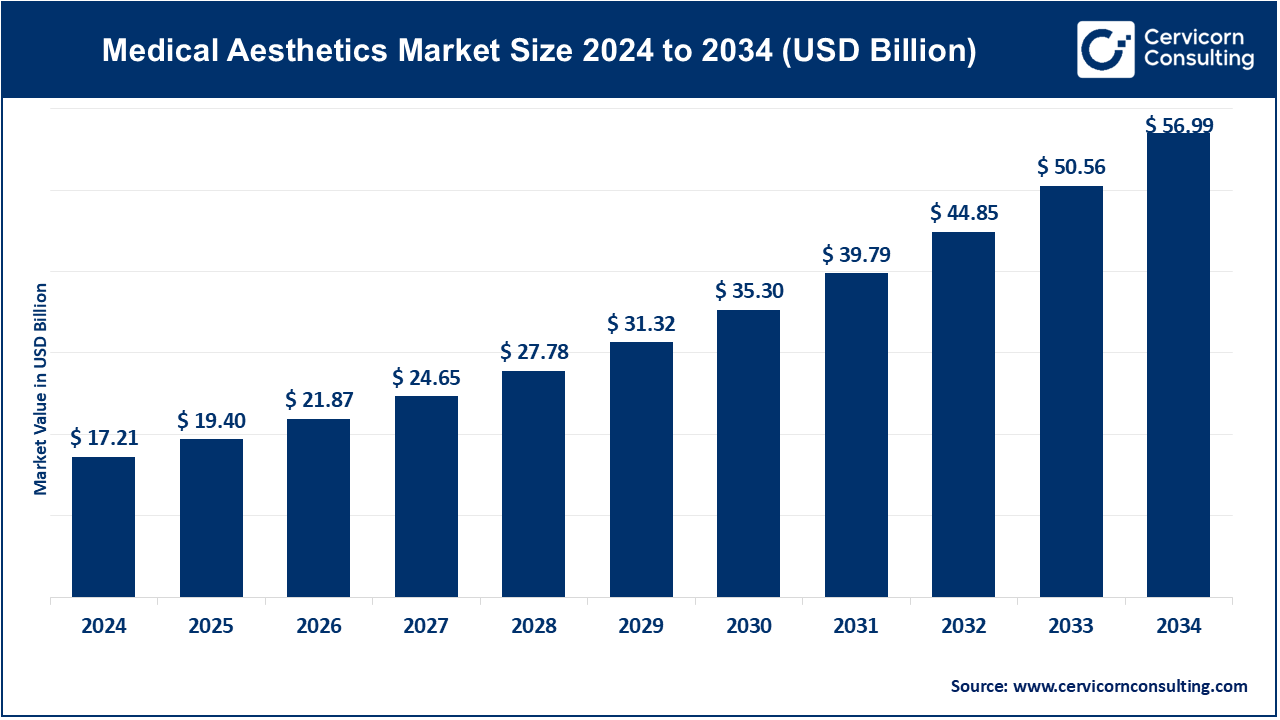

The global medical aesthetics market size was reached at USD 17.21 billion in 2024 and is estimated to exceed around USD 56.99 billion by 2034, growing at a compound annual growth rate (CAGR) of 12.72% during the forecast period 2025 to 2034. The medical aesthetics market is expected to grow due to rising demand for influence of social media along with celebrity endorsements, and technological advancements.

The growth of the medical aesthetics market is on a fast pace due to the consideration for minimally invasive cosmetic procedures, convergence of technologies, and incremental awareness about aesthetic domain treatment among consumers. This would cover all problematic overhauls, such as dermal fillers, Botox, laser treatments, body contouring, and some creams. Factors such as aging populations, increased purchasing power, and the glorification of cosmetic reconstruction in society all end up contributing to market outreach. With new developments in energy-based devices and combinations of undertakings, all treatment results are said to be enhanced, with patient satisfaction, expected in various ways. In addition, other development opportunities such as medical tourism, hypermarkets, and e-commerce platforms are nurturing the worldwide medical aesthetics market.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 19.40 Billion |

| Expected Market Size in 2034 | USD 56.99 Billion |

| Projected CAGR 2025 to 2034 | 12.72% |

| Dominant Region | North America |

| Fastes Growing Region | Asia-Pacific |

| Key Segments | Product, Procedure, Gender, Distribution Channel, End User, Region |

| Key Companies | ADSS, Zesay Beauty, Wontech, Skin Tech Pharma, Sincoheren, Sinclair Pharma, Shanghai Haohai Biological Technology, Sanhe Medical, Mentor, MedicalZone, Lutronic, Lumenis, IBSA, Guangzhou Itech Aesthetics, Galderma, Establishment Labs, Daeyang Medical, Cynosure, Croma Pharma, Classys, Candela Medical, BTL Aesthetics, Astiland, Beijing Kes Biological Technology, Allergan Aesthetics |

Male Aesthetic Market

AI and Personalization

Regulatory Hurdles

High Costs

Emerging Markets

Digital Integration

Side Effect Concerns

Skilled Workforce Shortage

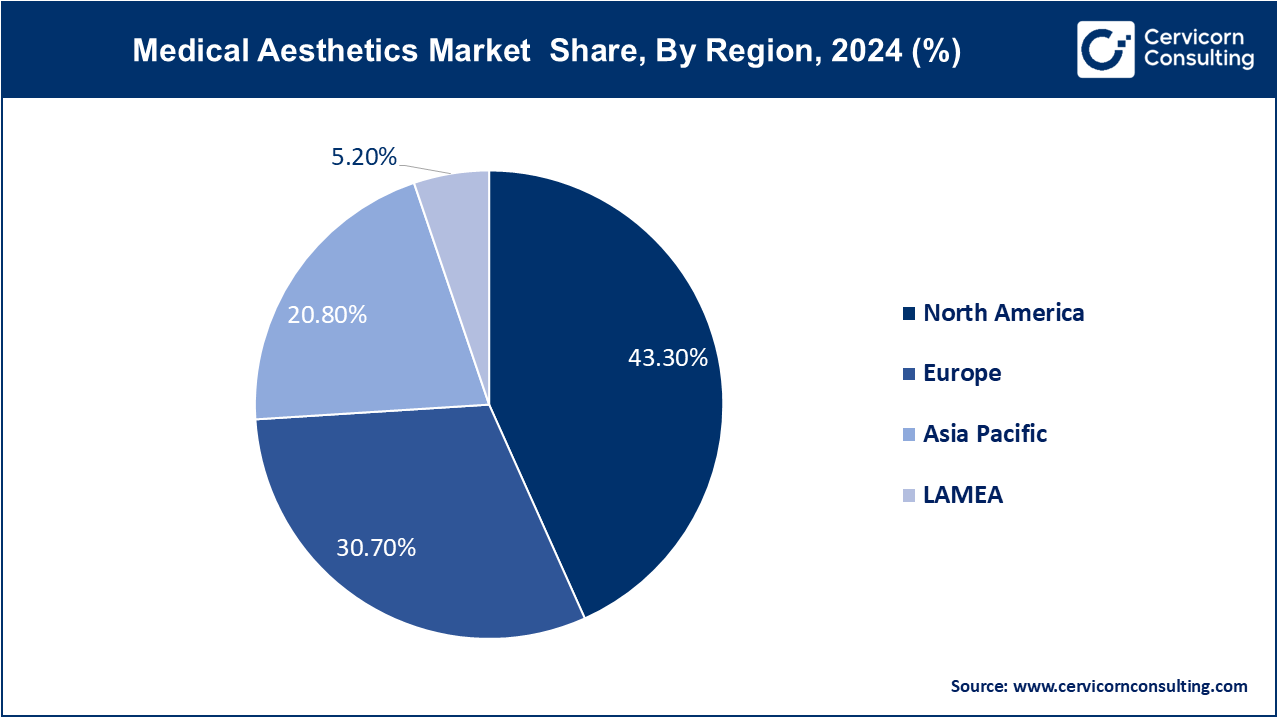

The medical aesthetics market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

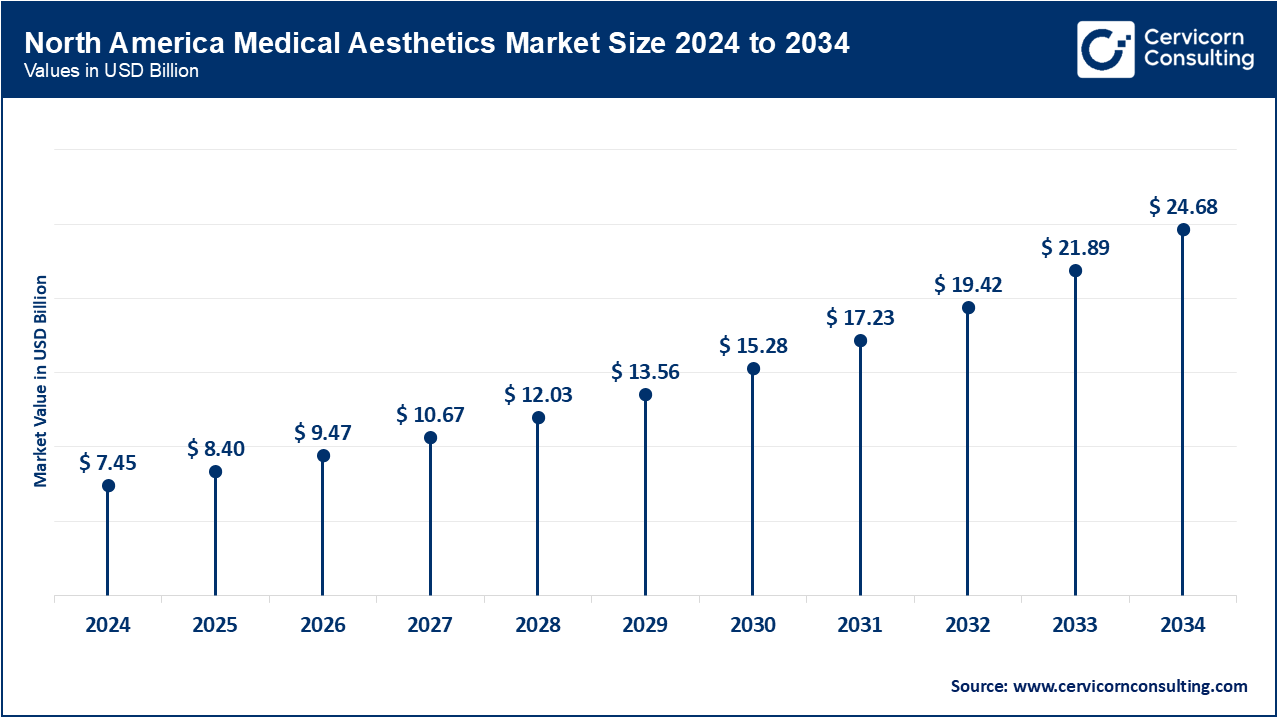

The North America medical aesthetics market size was reached at USD 7.45 billion in 2024 and is estimated to hit around USD 24.68 billion by 2034. North America peruses the market, owing to the high disposable income earned, advanced health care facilities, and a more appealing society for appearance. This region records a growing tendency for minimal invasive cosmetic procedures such as Botulinum Toxin injectables and dermal fillers mainly incited by beauty-oriented populations. Due to its pro-innovation aspect with a strong presence of R&D activities and the consequent integration of highly developed technologies like lasers and energy-based devices, the United States is what sets the tone.

The Europe medical aesthetics market size was valued at USD 5.28 billion in 2024 and is expected to reach around USD 17.50 billion by 2034. The Europe is one of the foremost players in the market with the higher demand for non-invasive procedures and a rising focus on natural results. Countries like Germany, France, and the United Kingdom are at the lead in this region and have cutting-edge technologies and skilled parties. The aesthetic-audience groups are very pro for treatments out of being proliferative in fear (associated with age) and then turning towards non-invasive treatments such as chemical peeling and laser resurfacing.

The Asia-Pacific medical aesthetics market size was estimated at USD 3.58 billion in 2024 and is projected to surpass around USD 11.85 billion by 2034. Asia-Pacific is one of the fastest-growing regions in the field of medical aesthetics. The trend has just been set by the growing number of middle-class and wealthy individuals who wish to have a fair amount of counter-consciousness treatments. Geographically, countries such as China, South Korea, and Japan lead the race with innovative technologies and advanced beauty industry. South Korea, in particular, is known for its world-class plastic surgery and skin treatment expertise.

The LAMEA medical aesthetics market size was accounted for USD 0.89 billion in 2024 and is anticipated to reach around USD 2.96 billion by 2034. The LAMEA region presents high growth opportunities, due to increasing urbanization, higher income levels, and great interest in aesthetic related procedures. Latin America thrives on plastic surgery and looks to have additional aesthetic treatment focuses within Brazil and Mexico. The Middle East is highly driven by countries such as the UAE and Saudi Arabia sees a rising demand for minimally invasive procedures among the beauty-conscious population.

The medical aesthetics market is segmented into product, procedure, gender, distribution channel, end user and region. Based on product, the market classified into botox, filler, peel, implant, liposuction, microneedling, hair removal, laser resurfacing, RF, phototherapy and others. Based on procedure, the market classified into surgical and non-surgical. Based on gender, the market classified into male and female. Based on distribution channel, the market classified into direct distribution and indirect distribution. Based on end user, the market classified into hospital, beauty clinic and spa.

Botox: Botox/botulinum toxin is a popular injectable treatment, which temporarily paralyzes facial muscles as a way to minimize wrinkles and fine lines. It is widely applied to domains such as forehead, crow's feet, and frown lines, resulting in a softer, more youthful look. The procedure is quick, minimally invasive, and has no downtime, making it a popular choice for both men and women.

Dermal Fillers: Dermal fillers are injections for the restoration of volume, wrinkle smoothing, and contouring the face. Fillers composed of hyaluronic acid, calcium hydroxylapatite, or poly-L-lactic acid tackle issues like hollow cheeks, under-eye bags and thin lips. They are also employed for nose job and jawline sculpting without surgery. The procedure is minimally invasive, with immediate results and minimal recovery time.

Chemical Peels: Chemical peels are skin resurfacing treatments that use chemical solutions, such as glycolic acid, salicylic acid, or trichloroacetic acid, to exfoliate the skin’s outer layers. They address concerns like acne, hyperpigmentation, uneven skin tone, and fine lines. Peels vary in intensity—light peels offer minimal downtime, while deeper peels may require longer recovery. Chemical peels also reveal brighter, smoother, and younger looking skin, resulting from stimulating cell renewing and collagen production.

Implants: Implants are surgical devices used to enhance or reconstruct areas of the body, such as the breasts, buttocks, or chin. Implants are made from silicone or saline, and the aim is to offer long-term outcomes and enhance physical contours. Breast implants, for instance, are frequently employed in the context of augmentation procedures, where they help to increase in size and shape and facial implants are used, e.g., contouring the chin or cheeks.

Liposuction: Liposuction is the surgical approach leading to the removal of adipose deposits from a certain area of the body e.g., the abdomen, the thighs, and the arms. It's very suited to anybody who has sets of stubborn fat that won't respond to diet and exercise. Fat is extracted by means of a thin tube (cannula) and creating small incisions. Developments in techniques, including tumescent and laser-assisted liposuction, have rendered the procedure safer and minimally invasive.

Microneedling: Microneedling is a minimally invasive treatment that uses fine needles to create tiny punctures in the skin, stimulating collagen and elastin production. With this procedure, the skin texture is enhanced, acne scar is improved, pores are minimized and the appearance of fine lines and wrinkles is improved. It is also useful for improving the penetration of topicals. Microneedling can be carried out on its own or in combination with platelet-rich plasma (PRP) to improve outcomes.

Hair Removal: Hair removal procedures utilize sophisticated technologies such as laser and intense pulsed light (IPL) to destroy hair follicles and offer lasting hair-reduction effect for unwanted hair. These therapies are successful in regions such as the face, limbs, arms, and bikini line. Laser hair removal is quite precise and effective, and can be used in several skin tones, whereas IPL covers a more extensive area. The procedure is virtually pain free, with the results becoming apparent after multiple sessions.

Laser Resurfacing: Laser resurfacing is a cosmetic treatment based on focused laser irradiation for improving skin facial texture and tone. It addresses issues that include wrinkles, acne scars, sun damage and pigmentation by peeling, removing damaged skin layers and promoting collagen genesis. Common methods are ablation lasers destroying the superficial layers of skin, and non-ablative lasers that penetrate deeper to produce fine results with little downtime. Laser treatment of the skin results in major improvements of skin appearance, and so it is a treatment of choice for patients wishing to be rejuvenated.

Radiofrequency (RF): Radiofrequency (RF) treatments apply energy to the skin's deeper structures causing heat that triggers collagen synthesis and contracts loose and/or sagging skin. RF has widespread clinical applications for facial rejuvenation, body contouring, and cellulite reshaping. Non-invasive, non-painful, RF-treatment improves skin elasticity and skin texture with little downtime. The technique can also be combined with any other modalities like microneedling or ultrasound to increase its performance.

Phototherapy: Phototherapy or light therapy for skin condition treatment incorporates wavelengths of light to correct acne, rosacea, and hyperpigmentation. Several common are blue light for acne-causing bacteria and red light for inflammation reduction and collagen stimulation. Phototherapy is non-invasive, painless and can be used for any skin type without downtime. It can be done in isolation or as part of a combination treatment for better outcome.

Surgical Procedures: Treatments in the medical aesthetics market are invasive such as liposuction, augmentation, facelift, and rhinoplasty. These procedures deliver long-lasting, dramatic results by addressing deeper structural concerns, such as excess fat, sagging skin, or asymmetrical features. While effective, surgical options require longer recovery times, involve higher costs, and carry risks associated with anaesthesia and complications. Developments in the use of technology, (i.e., minimising open surgery, robotics etc. have led to a better precision and a reduction of risks.

Non-Surgical Procedures: Non-invasive procedures such as Botox, dermal fillers, laser therapy and chemical peels play a leading role in the medical aesthetics market by virtue of their absence of downtime, low risk and affordability. In this treatment, they are aimed at surface level issues, such as wrinkling, fine-patterned lines, skin texture and volume decrease without invasive approaches.

Hospitals: Hospitals are an important part of the market, providing leading procedures such as surgical aesthetic procedures and niche dermatological services. Having modern equipment and trained medical personnel, the hospitals are well safe and dependable in providing invasive and non-invasive procedures to patients. They provide services for people interested in integrated complex solutions, which, often combining medical aesthetics and reconstructive surgical methods, aiming at both functional and cosmetic aspects.

Beauty Clinics: Beauty clinics are at the forefront of the medical aesthetic industry, however are moved toward non-invasive treatments such as Botox, dermal fillers, laser therapy, and chemical peels. The center is meant to offer customized care to middle - high-income customers interested in undergoing aesthetic transformations). With the support of trained personnel and advanced means, medical beauty clinics provide minimally invasive procedures according to the requirement of modern active lifestyle of people who want to get fast, efficient results with minimal disruption to the routine daily life.

Spas: Spas are offering a non-invasive treatment in a feel-good-like setting, i.e. Med spas, for instance, integrate traditional spa services with the techniques for advanced aesthetics such as microdermabrasion, microneedling, and phototherapy. These facilities focus on enhancing overall wellness while addressing cosmetic concerns, appealing to clients seeking both rejuvenation and relaxation.

Market Segmentation

By Product

By Procedure

By Gender

By Distribution Channel

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Medical Aesthetics

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Procedure Overview

2.2.3 By Gender Overview

2.2.4 By Distribution Channel Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Male Aesthetic Market

4.1.1.2 AI and Personalization

4.1.2 Market Restraints

4.1.2.1 Regulatory Hurdles

4.1.2.2 High Costs

4.1.3 Market Challenges

4.1.3.1 Side Effect Concerns

4.1.3.2 Skilled Workforce Shortage

4.1.4 Market Opportunities

4.1.4.1 Emerging Markets

4.1.4.2 Digital Integration

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Medical Aesthetics Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Medical Aesthetics Market, By Product

6.1 Global Medical Aesthetics Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Botox

6.1.1.2 Filler

6.1.1.3 Peel

6.1.1.4 Implant

6.1.1.5 Liposuction

6.1.1.6 Microneedling

6.1.1.7 Hair Removal

6.1.1.8 Laser Resurfacing

6.1.1.9 RF

6.1.1.10 Phototherapy

6.1.1.11 Others

Chapter 7. Medical Aesthetics Market, By Procedure

7.1 Global Medical Aesthetics Market Snapshot, By Procedure

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Surgical

7.1.1.2 Non-Surgical

Chapter 8. Medical Aesthetics Market, By Gender

8.1 Global Medical Aesthetics Market Snapshot, By Gender

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Male

8.1.1.2 Female

Chapter 9. Medical Aesthetics Market, By Distribution Channel

9.1 Global Medical Aesthetics Market Snapshot, By Distribution Channel

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Direct Distribution

9.1.1.2 Indirect Distribution

Chapter 10. Medical Aesthetics Market, By End-User

10.1 Global Medical Aesthetics Market Snapshot, By End-User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Hospital

10.1.1.2 Beauty Clinic

10.1.1.3 Spa

Chapter 11. Medical Aesthetics Market, By Region

11.1 Overview

11.2 Medical Aesthetics Market Revenue Share, By Region 2024 (%)

11.3 Global Medical Aesthetics Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Medical Aesthetics Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Medical Aesthetics Market, By Country

11.5.4 UK

11.5.4.1 UK Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Medical Aesthetics Market, By Country

11.6.4 China

11.6.4.1 China Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Medical Aesthetics Market, By Country

11.7.4 GCC

11.7.4.1 GCC Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Medical Aesthetics Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 ADSS

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Zesay Beauty

13.3 Wontech

13.4 Skin Tech Pharma

13.5 Sincoheren

13.6 Sinclair Pharma

13.7 Shanghai Haohai Biological Technology

13.8 Sanhe Medical

13.9 Mentor

13.10 MedicalZone

13.11 Lutronic

13.12 Lumenis

13.13 IBSA

13.14 Guangzhou Itech Aesthetics

13.15 Galderma