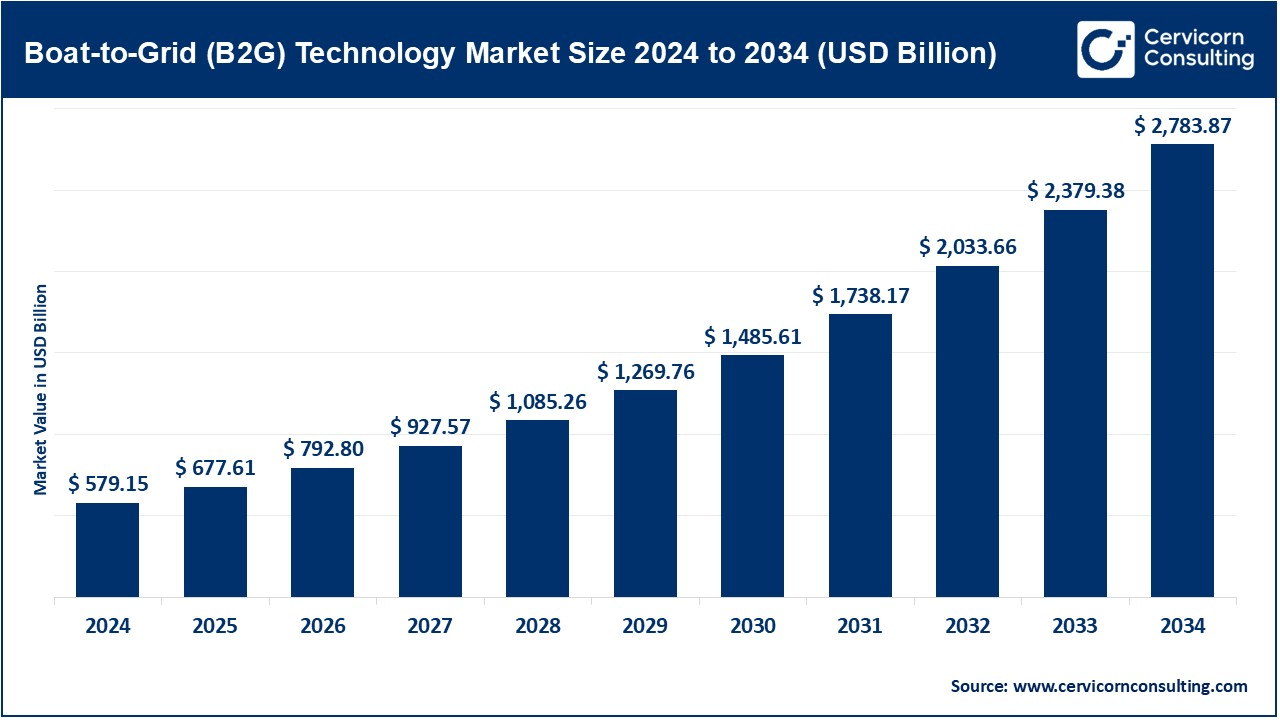

The global boat-to-grid (B2G) technology market size was valued at USD 579.15 billion in 2024 and is expected to reach around USD 2,783.87 billion by 2034, growing at a compound annual growth rate (CAGR) of 17% over the forecast period 2025 to 2034. The boat-to-grid technology market will witness substantial growth as it remains one of the key factors, that complements the wider shift towards the use of green energy and fuels the electrification of transportation, and the development of the storage systems of the future. Thus, a B2G market would ensure an energy storage distributed system by using boats as mobile energy batteries. Thus, this B2G technology serves as a parallel energy storage solution for the enhancement of grid stability. The main stimulants for B2G development are increasing demand for electric/hybrid marine vessels, the improvement in the grid and energy storage technologies, and new governmental laws related to better flexibility in a situation that involves a high need for decentralized energy storage solutions.

"Boat-to-grid" (B2G) may be a modern strategy of interfacing ships, particularly those utilized for oceanic exercises, to the electrical network arrange. It is basically vehicle-to-grid (V2G) innovation that has been adjusted for ships, which may be both vitality customers and providers. When batteries are utilized on board electric or cross breed ships, supply and ask may be balanced, particularly when startling renewable essentialness is conveyed. The boat-to-grid thought is still in its early stages, but it might contribute to the broader incline of green essentialness integration and versatile system organization, which would lead to more attempted and genuine and long-lasting control.

The boat-to-grid (B2G) technology market is primarily driven by the global push for decarbonization, the need for flexible grid management solutions to integrate renewable energy, advances in electric vessel technology, and the growing infrastructure supporting electric vessels. As these factors continue to evolve, B2G systems are expected to play an increasingly important role in both the maritime and energy sectors, offering new opportunities for energy storage, grid stability and sustainability.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 677.61 Billion |

| Expected Market Size in 2034 | USD 2783.87 Billion |

| Projected CAGR 2025 to 2034 | 17% |

| Key Segments | Technology, Vessel Type, Application, End User, Region |

| Key Companies | Siemens AG, ABB Ltd., Schneider Electric, General Electric (GE), Wärtsilä Corporation, Rolls-Royce Power Systems, Yanmar Co., Ltd., Tesla Inc., Nidec Corporation, Vestas Wind Systems, Man Energy Solutions, Norwegian Electric Systems (NES), PowerCell Sweden AB, Caterpillar Inc., DNV GL, Eelpower Ltd., Eidesvik Offshore, Vigo Marine, Soventix, Bollinger Shipyards |

Increasing Use of Electric and Hybrid Boats

Growing Regulatory Support and Government Incentives

Large Initial Investment and Costs

Regulatory and Legal Hurdles

Developments in Electric Boat and Battery Technology

Evolving Smart Grid Technologies

Problems with Battery Life and Durability

Operational Issues and the Use of Vessels

Energy Storage Systems: Energy storage systems are key in boat-to-grid applications, where electric vessels act as mobile storage units that store energy during off-peak hours and feed it back into the grid when demand is high. These include lithium-ion batteries, solid-state batteries and second-life batteries.

Electric Propulsion Devices: Innovations in electricity-converting technology have paved the way for mechanical movement in ships. A standout aspect of this technology is the B2G-compatible hybrid electric system, which improves efficiency by combining electric motors with standard engine systems.

Grid Connectivity and Power Electronics: VRF technology enables ships to supply electricity back into the grid using inverters, energy management systems, and bidirectional charging systems. The smart grid integration helps manage energy flow and ensures consistent communication between the vessels and the grid.

Systems for Control and Communication: To optimize the connection between electric vessels and the grid while monitoring energy consumption, they can communicate through cloud computing, IoT technology, and AI-based management solutions.

Passenger Vessels: These vessels, including electric ferries, water taxis and cruise ships, can be integrated into B2G systems by storing energy at berth and supplying energy to the grid during peak periods.

Cargo Vessels: These larger vessels can offer greater energy storage capacity and are potential participants in B2G systems, especially in areas with high energy demand. Various boats, such as cargo ships, electric container ships, and bulk carriers, are used by the maritime industry to transport commodities.

Recreational and Leisure Vessels: Motorboats, sailboats, and electric yachts provide unique opportunities for connecting with local energy networks in remote or off-grid areas, particularly along the coast or in recreational regions.

Fishing Vessels: Electric fishing boats are a type of fishing vessel. In areas where the maritime industry is implementing energy-efficient projects, smaller fishing boats might be involved in B2G activities.

Hybrid Vessels: Machines that mix classic fossil fuel engines with electric systems are great for B2G. They can run independently from the grid and join the electricity network when necessary.

Lattice Stability and Energy Storage: Excess energy produced by renewable sources (wind, solar) is stored in electrical containers and released when grid demand is high. Grid stabilisation is aided by this, particularly in regions where renewable energy is widely used.

Implementing Green Energy Sources: Boats can play a key role in integrating solar or wind energy into networks by intervening as energy storage devices.

Sea Traffic: Electrical ferries and leisure vessels can reduce emissions and integrate into grid systems and contribute to decarbonization efforts in maritime transport.

Port Operations: Electric boats are used in port operation and offer energy storage and network support. You can store excess energy that are generated from the port operation and deliver them to the network again.

Supply Company: Utilities can leverage B2G systems to manage grid balance and optimize energy distribution. They can use electric vessels as mobile energy storage units to stabilize local grids and help balance supply and demand.

Commercial Maritime Operators: The operators include shipping companies, cargo operators, and ferry services that integrate electric vessels into their fleets, either for environmental benefits or as part of green energy strategies.

Governments and Communities: Governments and municipalities can use B2G technologies to support sustainable transport solutions, reduce carbon emissions and to ensure more reliable energy in ports or coastal regions.

Energy Suppliers: Companies that offer renewable energies and develop microgrids or smart grid solutions can integrate electrical boats as part of their energy storage and distribution networks.

Private Users: Private users include owners of electric yachts, leisure boots and small fishing providers who can take part in local B2G systems, especially in remote or off-grid regions.

The boat-to-grid (B2G) technology market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

North America: The North American boat-to-grid technology industry is expected to grow significantly due to government support, maritime electrification advancements, and renewable energy integration, as both the US and Canada prioritize reducing carbon dioxide emissions in the maritime sector. The rise of electric and hybrid vessels is contributing to a more resilient electrical grid, especially within commercial shipping and ferry operations. Innovative zero-emission initiatives that facilitate boat-to-grid systems are currently being piloted in ports like Los Angeles and Vancouver. With additional investments, North America could emerge as a leader in the global boat-to-grid market.

Europe: Europe is making significant financial investments in environmentally friendly marine technologies as part of its commitment to reduce carbon emissions. The European Commission's "Fit for 55" mission aims to cut greenhouse gas emissions by 55% by 2030, focusing on energy production, renewable technologies, and marine electrification. The EU is spending money on smart grid infrastructure to make using electric boats more efficient. Scandinavian countries and the UK are leading in hybrid and electric ferries that can support local renewable energy grids, particularly in island nations like Denmark and Greece.

Asia-Pacific: As one of the worlds most dynamic maritime regions, with major maritime hubs like China, Japan, South Korea, and Australia, APAC is well-positioned to leverage Boat-to-Grid (B2G) systems to address its energy challenges, particularly the integration of renewable energy and improving grid stability. B2G technology helps stabilize the grid by storing extra renewable energy when production is high and returning it to the grid when production is low. The use of electric and hybrid vessels is increasing in the Asia Pacific, particularly in China, Japan, and South Korea, due to the need to lower emissions and meet strict environmental rules like the IMO standards. Governments in this region are providing incentives to support the development of electric vessels, assisting in covering the higher costs of electric boats and necessary infrastructure for B2G systems.

LAMEA: LAMEA countries like Brazil, South Africa, and the UAE are investing in renewable energy projects, especially solar and wind. Boat-to-grid (B2G) systems may help stabilize the grid by storing excess renewable energy in electric boats and releasing it when needed, balancing supply and demand for better energy security. Brazil and the UAE are using hybrid and electric vessels to cut emissions in maritime transport, which can work with B2G systems. Smart grid technologies are also being developed in these regions. With ongoing government support and collaboration, LAMEA can use boat-to-grid technology for energy resilience and economic growth.

Market Segmentation

By Technology

By Vessel Type

By Application

By End-User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Boat-to-Grid (B2G) Technology

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Vessel Type Overview

2.2.3 By Application Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Use of Electric and Hybrid Boats

4.1.1.2 Growing Regulatory Support and Government Incentives

4.1.2 Market Restraint

4.1.2.1 Large Initial Investment and Costs

4.1.2.2 Regulatory and Legal Hurdles

4.1.3 Market Challenges

4.1.3.1 Problems with Battery Life and Durability

4.1.3.2 Operational Issues and the Use of Vessels

4.1.4 Market Opportunity

4.1.4.1 Developments in Electric Boat and Battery Technology

4.1.4.2 Evolving Smart Grid Technologies

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Boat-to-Grid (B2G) Technology Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Boat-to-Grid (B2G) Technology Market, By Technology

6.1 Global Boat-to-Grid (B2G) Technology Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Energy Storage Systems

6.1.1.2 Electric Propulsion Systems

6.1.1.3 Grid Connection and Power Electronics

6.1.1.4 Communication and Control Systems

Chapter 7. Boat-to-Grid (B2G) Technology Market, By Vessel Type

7.1 Global Boat-to-Grid (B2G) Technology Market Snapshot, By Vessel Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Passenger Vessels

7.1.1.2 Cargo Vessels

7.1.1.3 Leisure and Recreational Boats

7.1.1.4 Fishing Vessels

7.1.1.5 Hybrid Vessels

Chapter 8. Boat-to-Grid (B2G) Technology Market, By Application

8.1 Global Boat-to-Grid (B2G) Technology Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Energy Storage and Grid Stabilization

8.1.1.2 Renewable Energy Integration

8.1.1.3 Maritime Transport

8.1.1.4 Port Operations

Chapter 9. Boat-to-Grid (B2G) Technology Market, By End-User

9.1 Global Boat-to-Grid (B2G) Technology Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Utility Companies

9.1.1.2 Commercial Maritime Operators

9.1.1.3 Governments and Municipalities

9.1.1.4 Energy Providers

9.1.1.5 Private Users

Chapter 10. Boat-to-Grid (B2G) Technology Market, By Region

10.1 Overview

10.2 Boat-to-Grid (B2G) Technology Market Revenue Share, By Region 2024 (%)

10.3 Global Boat-to-Grid (B2G) Technology Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Boat-to-Grid (B2G) Technology Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Boat-to-Grid (B2G) Technology Market, By Country

10.5.4 UK

10.5.4.1 UK Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Boat-to-Grid (B2G) Technology Market, By Country

10.6.4 China

10.6.4.1 China Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Boat-to-Grid (B2G) Technology Market, By Country

10.7.4 GCC

10.7.4.1 GCC Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Boat-to-Grid (B2G) Technology Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Siemens AG

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 ABB Ltd.

12.3 Schneider Electric

12.4 General Electric (GE)

12.5 Wärtsilä Corporation

12.6 Rolls-Royce Power Systems

12.7 Yanmar Co., Ltd.

12.8 Tesla Inc.

12.9 Nidec Corporation

12.10 Vestas Wind Systems

12.11 Man Energy Solutions

12.12 PowerCell Sweden AB

12.13 Caterpillar Inc.

12.14 DNV GL

12.15 Eelpower Ltd.

12.16 Eidesvik Offshore

12.17 Vigo Marine

12.18 Soventix

12.19 Bollinger Shipyards

12.20 Kongsberg Gruppen

12.21 Golden Gate Zero Emission Marine

12.22 Naval Group

12.23 Triton Submarines

12.24 Mitsubishi Heavy Industries

12.25 Lloyd's Register

12.26 Van der Velden

12.27 ZES (Zero Emission Services)

12.28 Corvus Energy

12.29 Navico

12.30 BMT Group

12.31 Ocean Infinity

12.32 Teledyne Marine