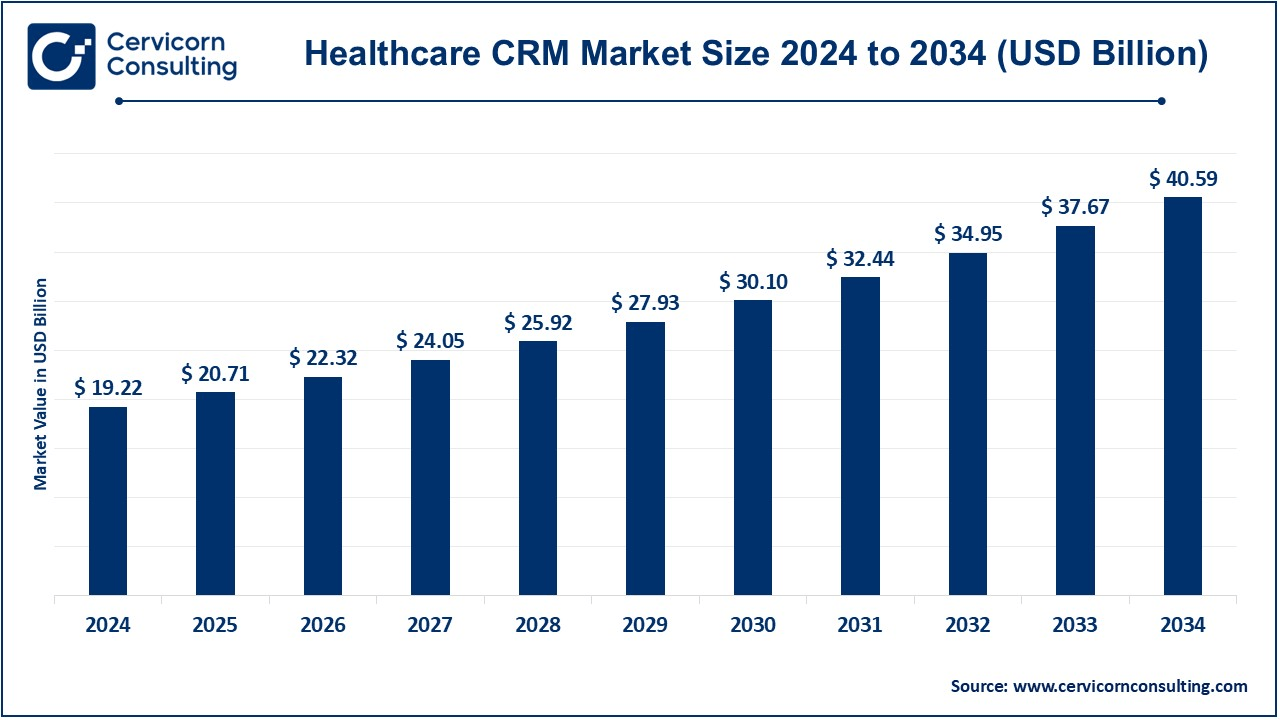

The global healthcare CRM market size was reached at USD 19.22 billion in 2024 and is estimated to surpass around USD 40.59 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.76% over the forecast period 2025 to 2034. The healthcare CRM market is experiencing robust growth driven by factors such as growing demand for the data that is structured and automation in healthcare organizations.

There has been a surge in the healthcare customer relationship management (CRM) owing to the rising demand for the demand for the patient-centric care along with advancements in the digital technologies and increasing adoption of the data-driven decision making in the healthcare sector. Innovations in digital technologies have been responsible for the growth of CRM software in terms of the utilization of patient data and increasing data-driven decision making in the healthcare sector. By consolidating data from various touch-points, apart from electronic health records (EHRs) as the most common types, these CRM's really simplify communication with patients and at the same time encourage patient engagement, operational efficiency, and data exchange among the healthcare facilities of the involved entities. Demand for personalized healthcare, as mentioned previously, has seen the adoption of CRM further driving healthcare organizations using patient data to understand and improve the delivery quality of health services and continue fostering the relationship. And now with telemedicine and mobile health applications strengthening, management of patient communication by CRM assumes a larger role. They continue with AI and ML in CRM becoming more significant in predicting patient needs and determining resource allocation. Implementation remains costly, but it is thought that better patient outcomes would justify these investments. More so, high-performing AI systems that optimize resource management set the pace for better healthcare CRM delivery.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 20.71 Billion |

| Expected Market Size in 2034 | USD 40.59 Billion |

| Projected CAGR 2025 to 2034 | 7.76% |

| Top-performing Region | North America |

| Rapidly Expanding Region | Asia-Pacific |

| Key Segments | Component, Deployment, Functionality, End-Use, Region |

| Key Companies | Accenture, Alvaria, Creatio, hc1, IBM, LeadSquared, Microsoft, NICE, Oracle (Cerner Corporation), Salesforce, SAP, Talisma, Veeva Systems, Verint Systems Inc., Zoho Corporation |

Demand for Real-Time Data Accessibility

Rising Competition Among Providers

High Implementation and Maintenance Costs

Data Privacy and Security Concerns

Expansion in Emerging Markets

Integration with Advanced Technologies

Resistance to Technological Adoption

Complex Integration Process

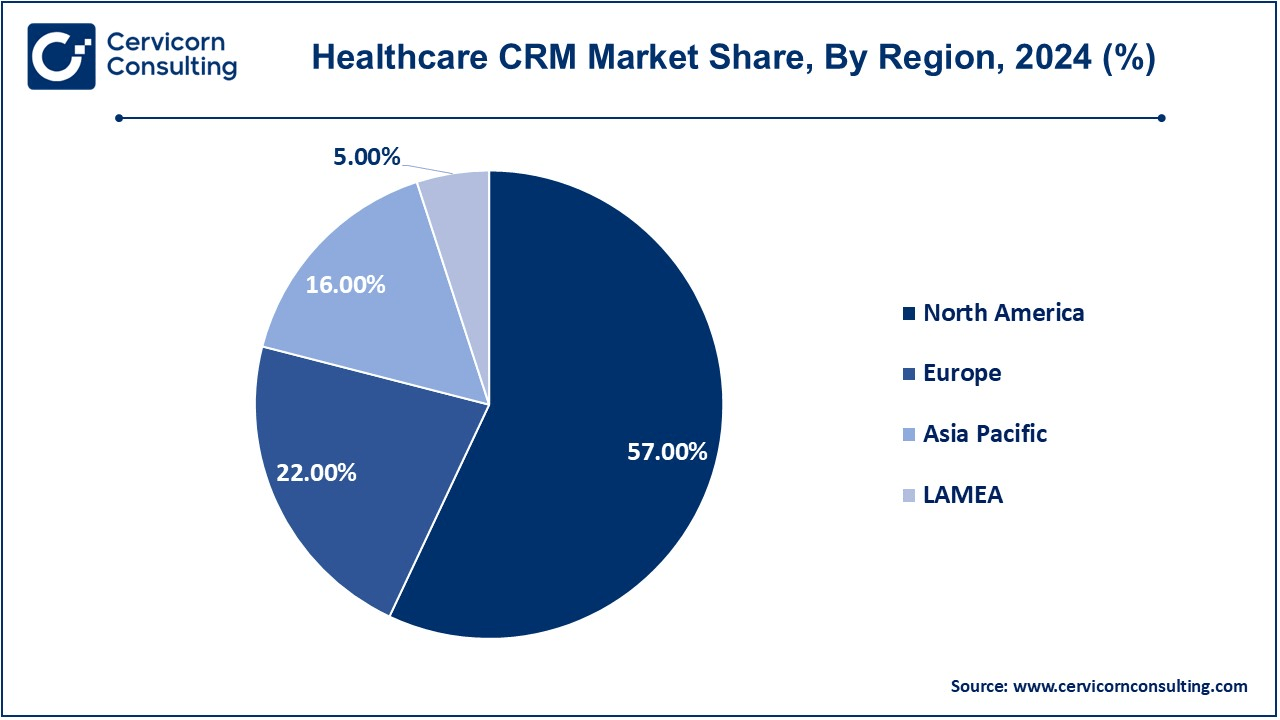

The healthcare CRM market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

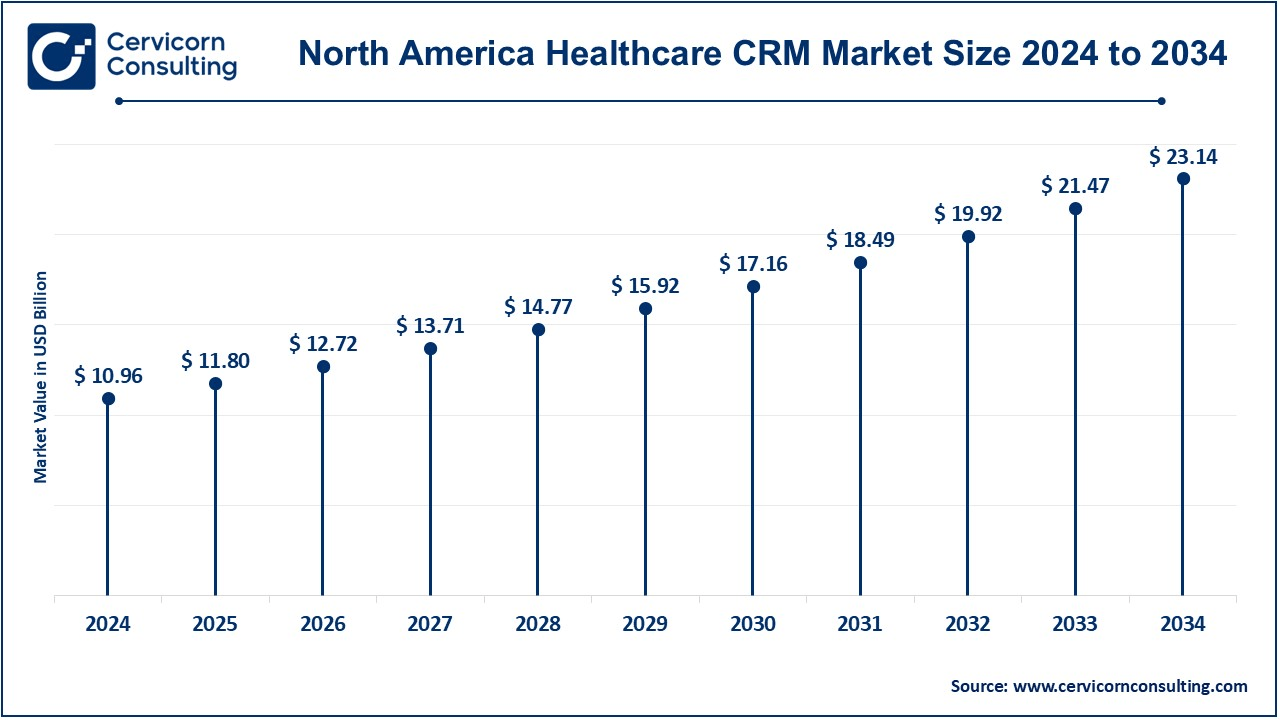

The North America healthcare CRM market size was reached at USD 19.22 billion in 2024 and is estimated to surpass around USD 40.59 billion by 2034. North America is a dominant market because there is a developed healthcare market, widespread adoption of digital health technology and a regulatory environment, which encourages the adoption of such technology. The United States and Canada have been pioneers in applying healthcare CRM systems, all of which are utilized to improve patient care, increase efficiency, and comply with HIPAA standards, etc. In the context of the above trends, the combined issue of declining health care cost and operations efficiency and the raised personalized care need is the reason that the health care CRM market in North America is expanding.

The Europe healthcare CRM market size was reached at USD 19.22 billion in 2024 and is estimated to surpass around USD 40.59 billion by 2034. Europe market is growing as healthcare facilities become, in an increasingly important way, to focus on patient engagement, workflow efficiency, and care delivery. Data privacy legislation in Europe (e.g., GDPR) has become focused on the safe custody of patient information and this leads to a strong integration of CRM applications, which are strong from a security perspective. It is being put into practice in the European territory in order to deal with the geriatric population and prevalence of comorbidities of chronic diseases, for instance, in Germany, the United Kingdom (UK) and France.

The Asia-Pacific healthcare CRM market size was reached at USD 19.22 billion in 2024 and is estimated to surpass around USD 40.59 billion by 2034. The Asia-pacific market is expanding very rapidly, driven by factors of rising healthcare expenditure, rising expectations of patients, and digitalization in the area. In China, India, and Japan, CRMs are being used to optimize patient care, streamline workflows, and extend service territory. The density and richness of the local population as well as the growing use of telemedicine and mobile apps provide significant opportunities for CRM providers.

The LAMEA healthcare CRM market size was reached at USD 19.22 billion in 2024 and is estimated to surpass around USD 40.59 billion by 2034. The LAMEA market is modest yet is expanding at a slow, deliberate rate, because healthcare providers and payers in the LAMEA markets are now recognizing the utility of digital change. Across Brazil, Mexico, UAE and South Africa and the adoption of CRM tools continues to rise to enhance the engagement of patients, streamline operations and to provide a proper handling of health information. The area is suffering from shortage of health care infrastructure and legislation, but the sociopolitical pressure exerted by the government in terms of health care access and affordability is the driving force behind the CRM system implementation.

Software: The software segment has dominated the market in 2024. Applications are the engine of a healthcare CRM which delivers features including, storage, management, and scheduling of patient information, appointment scheduling and management, and the ability to analyze. These methods enable focused consolidation of patient data, smoother information exchange among the members of the healthcare team and better delivery of care. Customizable and scalable software options cater to various organizational needs, from small clinics to large hospital networks. The integration of advanced technologies, through the use of Artificial Intelligence (AI) and Cloud Computing, is rapidly improving software performance, giving access to real-time data and predictive analytics.

Services: In the healthcare CRM market, services are key to software rollout, customization, and continuous support. These are (consultancy, training, system integration, technical support etc) with the potential of smooth assimilation and high performance. Managed services are used and benefit organisations in a variety of ways in order to address problems such as data confidentiality or compliance with legislation as well as training services to enhance the competency of users. Furthermore, the system has a robust support system in the form of systems providing uptime security and continuous operation which reduces the possibility of interruptions in the provision of patient care.

On-Premise Model: On-premise housing of healthcare CRMs is the housing of software and data on the internal servers of an organization and, consequently, enhanced control over patient health data is feasible. This model is for such companies that have good control on data security or such companies that are located in areas with particularly strong regulatory environment. Off-premise solutions have very good customization power, making it possible for the organization to personalize the system according to the unique requirements of the organization. However, it requires a hell of a lot of out of the box infrastructure investment, IT staff and support, etc.

Healthcare CRM Market Revenue Share, By Deployment, 2024 (%)

| Deployment | Revenue Share, 2024 (%) |

| Cloud/Web-based | 81.50% |

| On-premise | 18.50% |

Cloud/web-based: Cloud/web-based deployment model of healthcare CRMs is scalable and flexible, and economics, which is the most prevalent option for a large majority of organizations. These solutions are served on remote servers and accessed on the internet, so that providers can decrease infrastructure expenses and gain the advantage of automatic updates. Cloud-based CRMs enable real time data access and this allows for better sharing of information amongst stakeholders, as well as better patient engagement (for example). Most significantly, they are very useful, especially, for Small Medium Enterprises, due to their accessibility and easy installation.

Customer Service and Support: Customer service and support features in health care CRMs allow for greater patient engagement by effectively automating communication and handling inquiries. These applications are useful for medical staff working to answer patients' questions, make appointments, and follow up in a timely manner. The availability of features like chatbots, help desk, and ticketing systems 24/7 with multiple modalities and improving the patient safety. With the ability to store rich interaction histories, health organizations are able to provide individualized service, thereby building trust and loyalty. This functionality is critical for patient experience and building strong relationships in the long term, which leads to its penetration in the healthcare CRM market.

Digital Commerce: Digital commerce function within the health care customer relationship management (CRM) allows the vendor to accomplish online billing, payment processing and e-commerce for medical products and services. By combining secure payment gateways and inventory systems, CRMs offer a single solution for streamlining patient and provider interactions. Patients can use the website to pay bills, purchase drugs (pharmacies), or schedule appointments, which either increases the convenience and access. This functionality plays a role in allowing healthcare organizations to broaden their revenue streams and improve operational efficiency, and thereby is a key element in modern healthcare CRMs.

Marketing: Marketing features provided in healthcare CRMs allow a targeted marketing campaign, tracking, and monitoring of patient outreach and quantification of the degree of engagement. These tools make use of data analytics to cluster patients, so that they can be served with tailored marketing campaigns aimed at their specific needs and wants. Automation possibilities simplify operations such as email marketing, reminder for appointment and marketing promotion. Campaign performance analysis can help providers improve their approach and target focus, and hence maximize return on investment. If the marketing function is successful, health care organisations are able to benefit and sustain patients, generate customer loyalty, and increase patient engagement, which in turn makes it one of the power players in the CRM market.

Sales: The Sales segment has dominated the market in 2024. In a healthcare CRMs sales operation, clinicians are empowered to manage relationships with stakeholders including patients, payers and collaborators. These applications provide for lead tracking, contract management, and revenue streams direction all with the goal of productive operations and business growth. Pipelining management and analytics capabilities enable companies to discover opportunities, optimize their use of resources and achieve their revenue targets. By the merging with other functional capabilities CRMs can achieve a integrated representation of organizational performance for strategic decision making. This functionality is particularly relevant to health care organizations, who wish not only to expand market penetration but also to maximize revenue.

Cross-CRM Integration: Cross-CRM functionality provides a tight integration between more than one CRM and other healthcare IT applications, including electronic health records (EHRs) and telehealth services. This capability is also used by the providers to get (comp ill) patient data from different sources, so as to increase care coordination and operational efficiency. Integration of cross-CRM (connection of CRM) licenses better communication and decision making by allowing departmental data sharing across departments and organizations. It also improves the ease of communication for the patient through centralization of channels of communication and duplication reduction. This functionality is becoming increasingly relevant with the expansion of the complexity of health care systems, that is also resulting in demanding integration between CRMs.

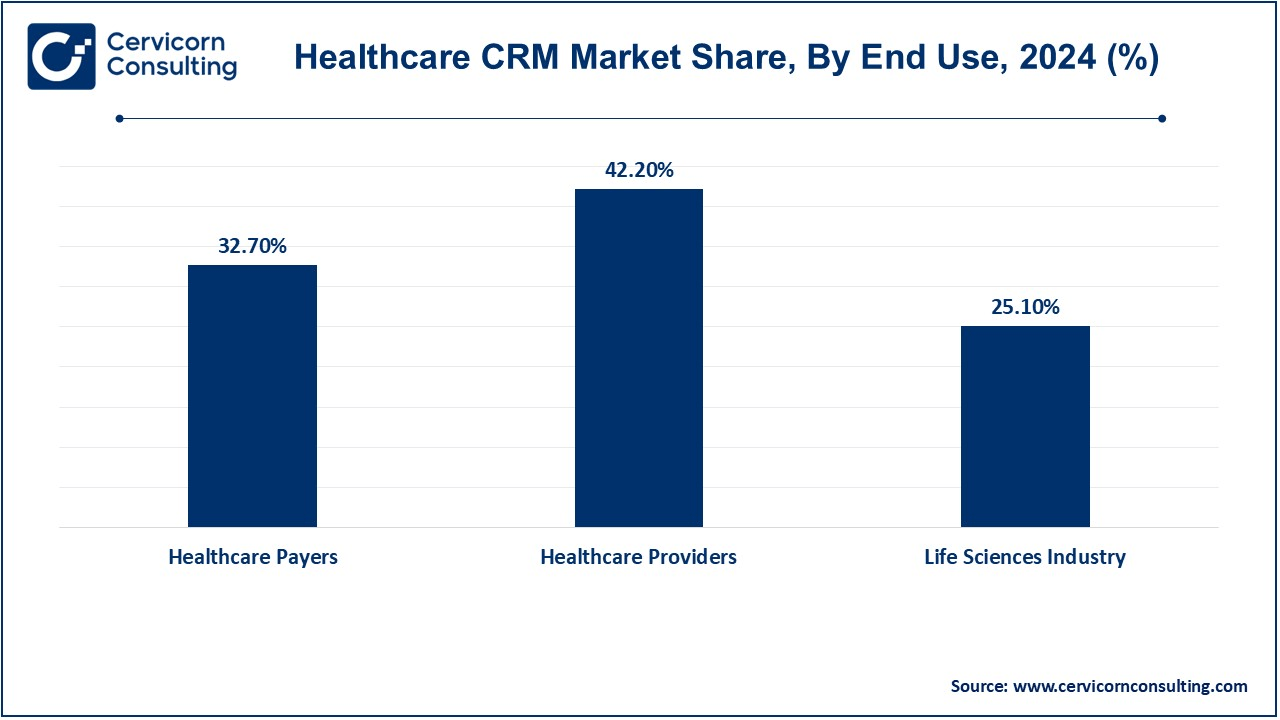

Healthcare Providers: The Healthcare Providers segment has dominated the market in 2024. CRM software for healthcare is special software, which is used by organizations that provide services in health facilities to engage patients in the lifetime valuation of their relationship with clients. Individual practitioners, hospitals, and clinics are the direct end users of healthcare CRM systems nowadays. They, too, need to use these systems for making their patient dealings organized, meaningful, and personal. The reason this industry uses CRM software is that controlled data on patients, visits tracked, quick retrieval of medical records, and service personalization go together. Scheduled patient visits can be entered into the system. The patient will be tracked when he or she will need to be scheduled next, in case of a follow-up. By simplifying administrative tasks, health providers can concentrate on improving patient outcomes, reducing operating expense, or assisting in patient satisfaction-the goal is to practice healthcare in the positive.

Healthcare Payers: Insurance companies and administrators of third parties are healthcare payers who introduce CRM solutions to them so that they can better deal with member engagement while they maintain the profiles of all policyholders, complete claims with such a creative service, as policy renewal and reminder, and much more. The insurers can review their risk, come up with open-ended tailor-made insurance packages, and satisfy the members even more through scale-developed member satisfaction improvements. It will help them recognize emerging health trends. They expect to reduce claims fallout time while at the same time reducing the overhead costs, which boosts CRM's worth within the insurance sector.

Life Science Industry: The industry is augmented by life sciences, pharmaceutical corporations, biotechnology, and the companies that produce medical devices. Their use in CRM integrates these providers with healthcare practitioners and provides patient alignment. In Congress, CRM technology is used by life science industries solely to establish options for this efficient communication with sales team and medical personnel in clinical trials. The CRM is an advantage for product selling, makes the marketing easier, and also justifies adherence to regulatory standards. CRM also permits marketing access strategy to get that harder recognition and enhancement of a market with a virtual environment.

Market Segmentation

By Component

By Deployment

By Functionality

By End-Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Healthcare CRM

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Component Overview

2.2.2 By Deployment Overview

2.2.3 By Functionality Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Demand for Real-Time Data Accessibility

4.1.1.2 Rising Competition Among Providers

4.1.2 Market Restraints

4.1.2.1 High Implementation and Maintenance Costs

4.1.2.2 Data Privacy and Security Concerns

4.1.3 Market Challenges

4.1.3.1 Resistance to Technological Adoption

4.1.3.2 Complex Integration Process

4.1.4 Market Opportunities

4.1.4.1 Expansion in Emerging Markets

4.1.4.2 Integration with Advanced Technologies

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Healthcare CRM Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Healthcare CRM Market, By Component

6.1 Global Healthcare CRM Market Snapshot, By Component

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Services

6.1.1.2 Software

Chapter 7. Healthcare CRM Market, By Deployment

7.1 Global Healthcare CRM Market Snapshot, By Deployment

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Cloud/Web-based Model

7.1.1.2 On-premise Model

Chapter 8. Healthcare CRM Market, By Functionality

8.1 Global Healthcare CRM Market Snapshot, By Functionality

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Customer Service and Support

8.1.1.2 Digital Commerce

8.1.1.3 Cross-CRM

8.1.1.4 Sales

8.1.1.5 Marketing

Chapter 9. Healthcare CRM Market, By End-Use

9.1 Global Healthcare CRM Market Snapshot, By End-Use

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Healthcare Payers

9.1.1.2 Healthcare Providers

9.1.1.3 Life Sciences Industry

Chapter 10. Healthcare CRM Market, By Region

10.1 Overview

10.2 Healthcare CRM Market Revenue Share, By Region 2024 (%)

10.3 Global Healthcare CRM Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Healthcare CRM Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Healthcare CRM Market, By Country

10.5.4 UK

10.5.4.1 UK Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Healthcare CRM Market, By Country

10.6.4 China

10.6.4.1 China Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Healthcare CRM Market, By Country

10.7.4 GCC

10.7.4.1 GCC Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Healthcare CRM Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Accenture

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Alvaria

12.3 Creatio

12.4 hc1

12.5 IBM

12.6 LeadSquared

12.7 Microsoft

12.8 NICE

12.9 Oracle (Cerner Corporation)

12.10 Salesforce

12.11 SAP

12.12 Talisma

12.13 Veeva Systems

12.14 Verint Systems Inc.

12.15 Zoho Corporation