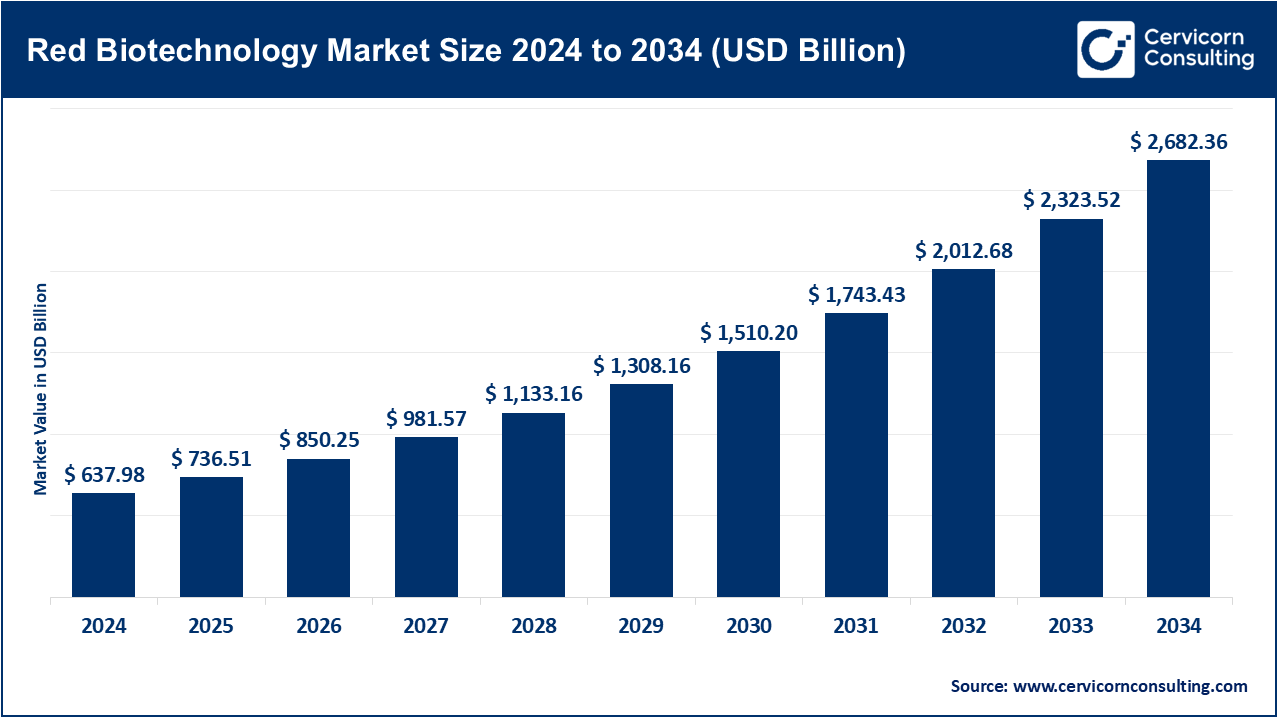

The global red biotechnology market size was reached at USD 637.98 billion in 2024 and is projected to be worth around USD 2,682.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 15.44% over the forecast period from 2025 to 2034. The red biotechnology market is expected to grow significantly owing to rising demand for personalized medicine, breakthroughs in gene and cell therapy, and the increasing global burden of chronic diseases like cancer and autoimmune disorders. Supportive government initiatives, expanding biopharmaceutical R&D, and advancements in antibody-based technologies are further accelerating market expansion.

The red biotechnology market includes medical and pharmaceutical innovations including gene therapy, biopharmaceuticals, and regenerative medicine. Demand for specialized treatment options is rising along with advanced diagnostics and targeted drug delivery systems which are propelling growth within this area. Innovation is being driven by breakthroughs in gene editing using CRISPR as well as the emergence of monoclonal antibodies and new cell therapies. Chronic diseases and rare genetic disorders are becoming a focus of R&D spending from both governmental bodies and private institutions. Biotech companies, research institutes, and healthcare providers are entering into strategic partnerships to fast-track clinical adoption. This type of red biotechnology is transforming health care throughout the world as it becomes possible to provide more precise, efficient, and sustainable solutions with better therapeutics.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 736.51 Billion |

| Expected Market Size in 2034 | USD 2,682.36 Billion |

| Projected CAGR from 2025 to 2034 | 15.44% |

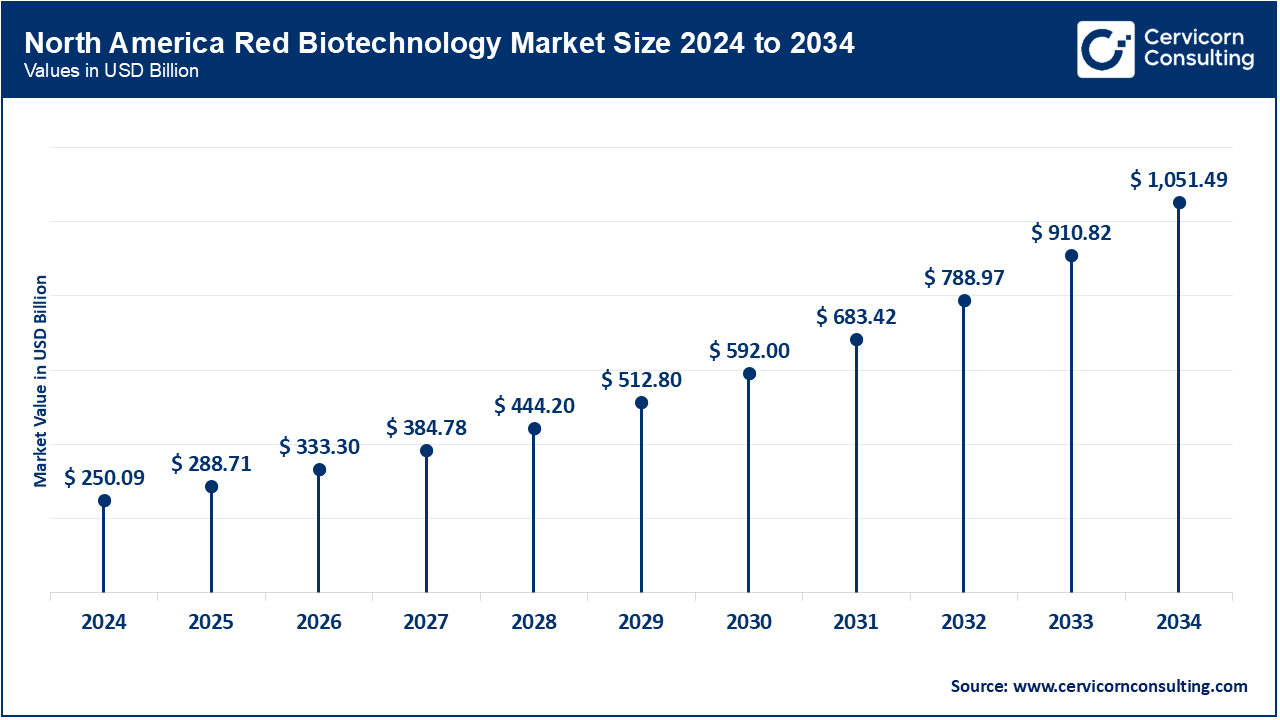

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Product Type, Technology, Therapeutic Area, Application, End User, Region |

| Key Companies | Amgen Inc., Gilead Sciences, Inc., Biogen, Pfizer Inc., Novartis AG, Hoffmann-La Roche, Johnson & Johnson Services, Inc., Sanofi, Merck & Co. Inc., AbbVie Inc., GSK plc., AstraZeneca, Eli Lilly and Company, Novo Nordisk A/S, Bayer AG, Bristol-Myers Squibb Company, Teva Pharmaceutical Industries Ltd., Takeda Pharmaceutical Company Limited, Boehringer Ingelheim International GmbH, Astellas Pharma Inc. |

CRISPR and Gene Editing Technologies: The introduction of CRISPR technology and gene editing has made it possible to change genetic material in order to correct mutations causing some diseases. These technologies are important for treating rare disorders and inherited conditions in the future. As of December 2023, FDA approved Casgevy, the first-ever CRISPR-based therapy for sickle cell disease. Bahrain became the first country in the world to issue a global release in February 2025, reflecting quick regulatory adoption. The clinical efficacy of CRISPR is now accepted around the world. In addition, precision applications continue to be offered by further advances of base editing and prime editing.

Recombinant DNA Technology: Devising new proteins and biologics such as hormones or vaccines requires us to merge numerous genes which is the goal of recombinant DNA technology. This foundational technique powers many biopharmaceuticals on the market today. Moderna broadened its mRNA vaccine platform by incorporating rDNA technology for flu and RSV vaccines in July 2022. The swift modularity of rDNA systems makes responding to emergent infections remarkably faster than ever before, aiding in the swift creation of gene therapy vectors as well. There is a worldwide scaling of rDNA capacity led by biomanufacturing firms using red biotech platforms retaining these technologies as their workhorse.

PCR and Real-Time PCR: Amplifying as well as quantifying DNA is vital for disease detection, genetic screening, and monitoring therapy. PCR and real-time PCR are critical in diagnostics and companion testing. In March 2023, Roche introduced the LightCycler PRO system which improves the sensitivity and speed of multiplex PCR amplification in oncological and infectious disease diagnostic laboratories. The system offers high sensitivity as well as AI powered integration. PCR supports the continued growth of personalized medicine, remaining vital to quality control relative to R&D in red biotech. Expanding the applications of real-time technologies drives global market growth.

Stem Cell Technology: Undifferentiated cells can be applied through stem cell technology to fix damaged tissues and organs, making it possible to treat these degenerative or inflammatory diseases. Both stem cells posses invaluable application within medicine since they serve as undifferentiated tissues capable of turning into any cell type. Remestemcel-L from Mesoblast got FDA approval treatment for pediatric graft-versus-host disease in October 2024 which marked an important step toward proving efficacy after surviving high-risk treatments. This enables additional development of stem cells for immune-related disorders which allows greater focus on neurodegenerative or cardiac disorders.

Cell Culture Technology: The cultivation of cells is a prerequisite for producing vaccines, biologics, and gene therapies. Cell culture technology provides a systematic method through which cells can be cultivated systematically with efficiency, it serves as an infrastructural backbone to most red biotech manufacturing processes. In April 2023, Thermo Fisher launched the Gibco CTS DynaCellect system which allows automated T-cell culture on a scalable level. This advancement allows enhanced production in gene therapy through closed-loop processing which reduces the risk of contamination. Such systems enhance clinical compliance while providing improved consistency making them indispensable despite the advances achieved in bioprocessing automation on a global scale.

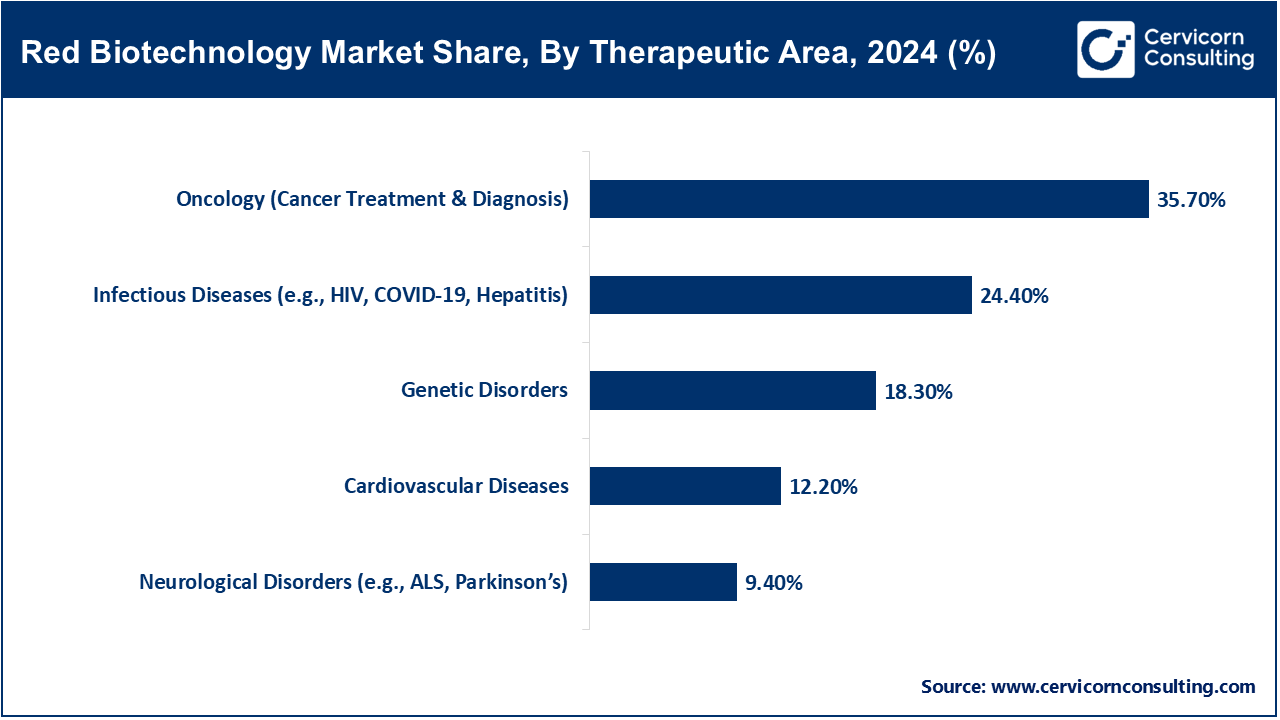

Oncology (Cancer Treatment & Diagnosis): The oncology segment is leading the market. Developments involving biologics, immunotherapy, and gene therapy within red biotechnology oncology seek to treat the cancer with utmost precision. It is also the most funded and fiercly competitive area of therapeutics. The FDA granted approval for Imdelltra by Amgen in November 2023 which is a bispecific T-cell engager aimed at small cell lung cancer. The drug acts by commanding immune cells to destroy only the cancerous cells while sparing healthy tissues. Cell therapies and companion diagnostics have become standard inclusion into oncology pipelines. Also, revolutionary AI tools are changing biomarker discovery. Red biotech still leads in innovations regarding cancer care.

Genetic Disorders: Treated through gene therapy, gene editing, or enzyme replacement, red biotechnology seeks to modify perturbed genes responsible for genetic disorders.The adptoms of such treatments can be curative and approve are being more readily approved. In December 2023, Casgevy and Lyfgenia’s landmark therapies were approved as the first gene therapy approved for sickle cell disease two years prior ushered in significant clinical milestones driven by CRISPR and lentiviral delivery systems. With Bahrain administering Casgevy becoming one of the first sites outside the US reached further regulatory credibility infastructure confidence along with promise transforming genetic biotech into therapeutic futurists dream.Enter your text here.

Infectious Diseases (e.g. HIV, COVID-19, Hepatitis): Increased outbreaks of certain infections pose a challenge in dealing with chronic infection control. The use of red biotech methods to design biologics, mRNA vaccines, and antivirals aids this segment’s biological response efforts for both routine and alternative medicine. For example, in January 2023 Moderna began Phase 3 trials for RSV mRNA vaccine boosting off its COVID-19 platform. Likewise, Sanofi is set to advance its hepatitis B treatment using synthetic DNA technologies in August 2024. These examples showcase the rapid innovation made possible by red biotechnology on therapeutic and vaccine development. Additionally, the sector is essential as a backbone of international health infrastructure and uninterrupted expansion on innovation pipelines can be anticipated.

Cardiovascular Diseases: Within lipid disorders or heart failure related ailments, regenerative therapies alongside biologic entities are actively shaping new avenues through gene editing resulting from red biotech developments alongside growing rates of chronic diseases. In June 2026 Verve Therapeutics commenced an in vivo gene therapy trial for familial hypercholesterolemia utilizing base-editing techniques which marked a first milestone with human heart disease treatment via base editing. Successful results have potential to drastically change the paradigm regarding long term cholesterol control without daily medication as well as inherited cardiac conditions making cardiovascular biotech gain clinical momentum post this breakthrough.

Neurological Disorders (e.g., ALS, Parkinson’s): Frameworks of red biotechnology aim to manage neurological disorders through gene therapy, antisense RNA, and stem cell therapies which seek to slow down or reverse the progression of these disorders. Due to their complex nature, these conditions are often poorly managed through traditional medicine. In October 2022, Ionis Pharmaceuticals completed Phase 3 trials of tofersen for SOD1-linked ALS showing a deceleration in motor decline. Concurrently, gene therapies for Parkinson's are moving into early-stage human tests. These shifts have the potential to close long-standing therapeutic gaps. The field is still immensely challenging and rewarding from a biotech standpoint. In neurodegenerative ailments, red biotechnology is emerging as a carrier of hope.

Biopharmaceuticals: Monoclonal antibodies, growth factors, and fusion proteins are examples of biopharmaceuticals which are complex drugs produced through living organisms. In modern therapeutics, they play an important role in the treatment of oncology as well as autoimmune and infectious diseases. Biogen and Samsung Bioepis partnered to launch Byooviz, a biosimilar to Lucentis, for age-related macular degeneration in April 2024 which illustrates scale in biologic production. Partnerships are being formed all over the world to enhance access. Enhanced efficiency in processes is a good development as products become cheaper and more readily available. The red biotech sector persists to be the leading scope of biopharmaceutical innovation.

Biosimilars: Comparable to branded biological medicine whose patents have lapsed, biosimilars are its follow-on versions that claim similar effectiveness but are cheaper in price. This helps widen healthcare availability while also containing global healthcare spending. March 2023 saw Semglee gaining FDA approval from Pfizer making it the first interchangeable Insulin Glargine biosimilar which allows pharmacy level substitution. This is a very positive development as it marks borderless competition resulting into lower prices. Restrictions on interchanging medical products are improving as frameworks developing on them mature. The rest of the world is quickly advancing in filling gaps considering biosimilar products lack free competition thus boosting availability of red biotech therapies within developed states and emerging economies alike.

Gene Therapy: Gene therapy is the process of rectifying patient’s genes by functional denoting with either viral or non-viral vectors. This method changes the approach of treatment for genetic disorders. The FDA approved Casgevy and Lyfgenia for sickle cell disease approving both CRISPR and lentiviral delivery systems in December 2023. These approvals refer to different types of gene therapy demonstrating varying strategies using vectors. The global rollout started in February 2025 which broadened access internationally, while Innovative CMO partnerships are expanding manufacturing capabilities. The use of gene therapy has become the primary choice for treating genetic diseases.

Tissue Engineering: Tissue engineering integrates cells with scaffolds and bioactive molecules to create living tissues and organs for repair or replacement purposes. It serves as a backbone for regenerative medicine on multiple organ systems. Organovo made a first advancement to phase one preclinical testing of their bio-printed liver tissue model marking the progression towards 3D printed organ constructs in September 2024. It has shown marked progress concerning its usefulness in drug testing as well as modeling diseases. There is growth observed from pharmaceutical companies too, that will be working together under specific regulatory frameworks which are yet to be published concerning tissue-engineered products. Overall, this domain is gaining attention whether clinical or R & D based.

Cell Therapy: Living cells, whether autologous or allogeneic, can be employed to combat diseases such as cancer as well as autoimmune conditions and tissue damage. CAR‑T and MSC therapies are examples of such techniques. In March 2023, Legend Biotech received FDA approval for cilta-cel, a CAR-T therapy aimed at treating multiple myeloma. This was preceded by approval in China. The therapy has demonstrated profound and lasting remissions. Expanded manufacturing capacity was supported by new global production hubs. Innovation in cell therapy continues, especially within oncology and rare disorders. It remains one of the fastest growing segments of red biotechnology.

Drug Discovery & Development: In the early stages of research and development (R&D), biotech tools are used in drug discovery to screen and validate new candidates. Biotech platforms aid in the clinical-testing and regulatory approval processes within the scope of drug development. Recursion Pharmaceuticals partnered with Takeda to aid in rare disease drug discovery via AI-driven phenotypic screening. This collaboration allowed for accelerated target validation alongside candidate progression, combining both AI and wet-lab strengths. The red biotechnology branch is actively shortening these drawn-out processes, helping wit the creation of precise therapies.

Animal Biotechnology: Animal biotechnology focuses on applying genetic as well as cellular technologies to improve animals regarding their health, agriculture production, or even models concerning humans. Animal biotechnology involves vaccines, breeding tools, diagnostics among others. Using red biotechnological platforms derived from human medicine, Zoetis in January 2024 marketed an mRNA vaccine for swine influenza virus which reduced infection rates during field trials thus improving livestock health. The adoption of veterinary biotechnologies has enhanced the animal models that are used for human therapeutics. Furthermore, the emerging biologics veterinarian pathways create these pipeline innovation opportunities flexible developments foster broad criteria deep multidisciplinary explorations.

Red Biotechnology Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Drug Discovery & Development | 23% |

| Animal Biotechnology | 10% |

| Environmental Biotechnology | 6% |

| Medical Biotechnology | 42% |

| Industrial Biotechnology | 7% |

| Agricultural Biotechnology | 9% |

| Others | 3% |

Environmental Biotechnology: This branch focuses on using microorganisms and other biological agents to clean up pollution, manage waste, and promote environmental sustainability. Other uses include bioremediation and bioenergy. In May 2022, LanzaTech was authorized to use its microbial fermentation technology for industrial carbon emission capture with subsequent conversion to sustainable ethanol production. This marks an important step towards embedding durability into microbial biotechnology’s environmental sectors portfolio. There is increasing investment in waste-to-value technologies which are vital innovations in climate strategy. With these developments, red biotech broadened its scope into Earth-friendly solutions.

Medical Biotechnology: The main focus of this field is on the use of biotech tools for diagnosing, preventing and treating human diseases with vaccines, biologics and diagnostics as some examples. It overlaps heavily with pharmaceutical R&D. In October 2022 Illumina launched its NovaSeq X Plus sequencer that enables ultra-high throughput genome sequencing which can be utilized diagnostically.

Industrial Biotechnology: Industrial biotechnology develops enzymes and microbes, as well as cellular systems to create biofuels, chemicals, and materials more sustainably. It is one step closer towards reducing reliance on petrochemicals. Novozymes opened a new enzyme manufacturing plant in India in March 2024 to support the bio-based feed and detergent industries. This investment not only improved regional access but also increased capacity. Increased public and private funding targeting industrial eco-friendly biotech initiatives is driving growth in the Asia-Pacific region.

Agricultural Biotechnology: Agricultural biotech involves modern techniques such as genetic engineering and cell culture in plant and animal breeding to increase disease resistance and yield of crops and livestock. It promotes sustainable agriculture while addressing food security challenges. A new variety of soybean resistant to diseases was developed with CRISPR and released by Corteva Agriscience in August 2023 for use in Latin America. The crop underperformed fungicide expectations during field trials, raising hopes of lower fungicide usage regions. Acceptance towards the regulation of gene-edited crops is growing all over the world aiding climate-resilient agriculture. Agricultural biotech continues to take center stage as an investment magnet.

Others: This comprises the biotechnology section of cosmetics such as peptide-based skin treatments, marine biotech with bioactive compounds, and food biotech like cultured meat. These all utilize cellular or genetic techniques. In November 2024, Upside Foods became the first U.S. company to receive FDA approval for lab-grown chicken after previously receiving regulatory greenlight for cultured chicken. This breakthrough permits greater application of food biotechnology in the country. Cosmetic biotech also expands further with growth-factor serums. These new segments are enhancing market penetration of Red Biotech’s key offerings.

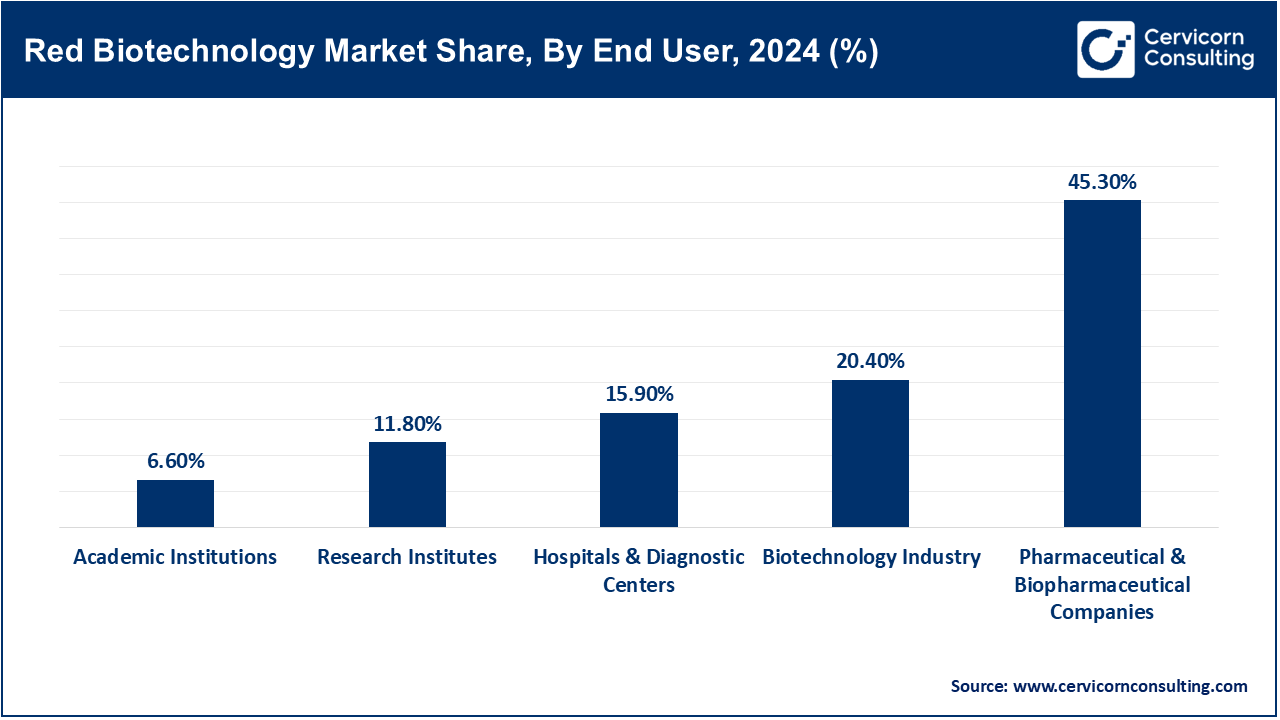

Pharmaceutical and Biopharmaceutical Companies: The pharmaceutical and biotechnology companies segment witness highest revenue share. These companies utilize red biotechnology together with their biotechnological partners to develop therapeutics and biologics, including advanced therapies such as gene and cellular therapies. For example, in June 2023 Pfizer acquired ReViral Therapeutics, adding to their antiviral therapeutics pipeline. This acquisition enhanced Pfizer’s capabilities to produce red biotech drugs. It illustrates substantial consolidation of pharmaceuticals into biotechnological firms. Currently, pharmaceutical companies are insourcing biotechnology more actively than before. They foster innovation at the clinical and scale-up stages. This end-user segment still remains the primary market engine.

Research Institutes: Governmental and academic research institutes work on foundational scientific studies, novel therapeutic targets, and early-stage biotechnology platforms advancing them further. These breakthroughs often serve as the impetus for new startup companies. For example, in January 2024, Harvard's Wyss Institute proclaimed the formation of AI-designed synthetic gene circuitry capable of complex multi-pathogen detection alongside rapid diagnostics (which can return results in mere hours), thus bacterial cell-based clinic application acceleration (Prokaryotic systems). These types of academic innovations propel next-gen biotech inventions. Research institutes have begun implementing commercialization strategies along with industry collaboration which is central to red biotech innovation ecosystems.

Biotechnology Sector: This sector includes biotech firms, start-up companies, and Contract Manufacturing Organizations (CMOs) that focus on the development and production of red biotech products and enabling technologies as well as providing ancillary services. Their operations fall between research and pharma. Catalent's acquisition of MaSTherCell in May 2024 to increase cell and gene therapy manufacturing capacity is a good example. The acquisition enabled complete CGT production service integration, demonstrating clear industry demand for specialized biotechnology infrastructure. These firms enhance compliance with scaling requirements as well as regulatory frameworks. The industry is responding to the demand for redbiotech.

Hospitals & Diagnostic Centers: In this segment, hospitals and diagnostic labs are the end users of red biotechnology implementing it for personalized healthcare protocols such as genetic testing, companion diagnostics, and cell-mediated therapies. They provide therapeutic interventions to patients. For instance, Mayo Clinic commenced onsite CAR-T therapy production in October 2023 post FDA approval which reduces waiting time for leukemia patients further decentralizing these advanced therapies to hospitals. Next generation sequencers are being added by diagnostic centers too expanding the role of hospitals from therapy providers to production sites. This user segment is expediting the clinical adoption of red biotechnology.

Academic Institutions: Universities do education, research, and basic informal IP development in red biotechnology. And, from their spin-offs may make a contribution to commercializing technologies. For example, in March 2023 MIT announced a new Synthetic Biology Centre focused on the integration of CRISPR with AI for gene therapy use. The center will educate learners as well as commercialize prototypes. It exemplifies expanding academic-tertiary partnerships. Colleges and universities are intensifying their interactions with business for translational research. They are emerging as hubs of innovation in biotechnology. The progression from academic institutions to startups is accelerating worldwide advancements in red biotech.

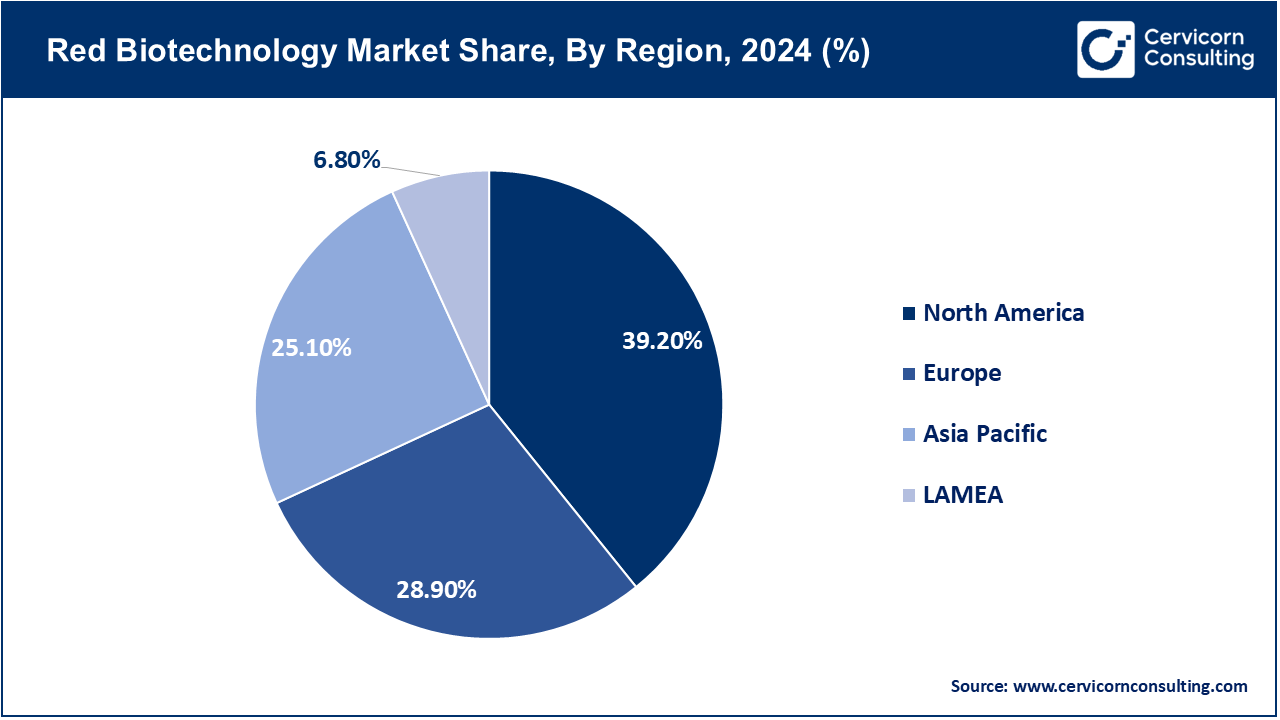

The red biotechnology market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America dominates the market, driven by clinical trial infrastructure and regulations in the US biopharma sector. Canada's and Mexico's contributions stem from innovation centers and expanding manufacturing growth. The region continues to benefit from outsized NIH funding, fast FDA approvals, and cross-border research collaborations. In April 2024, the U.S. FDA approved one of the most significant gene therapy launches worldwide—Pfizer’s hemophilia B gene therapy Beqvez. This approval indicated that the gene editing and red biotech infrastructure in North America is fully developed. Canada aligned with the approval by December 2023, furthering regional alignment. Mexico has been focused on scaling biotech trials since mid-2023. Together, the region still leads global red biotechnology advances.

Due to its integrated regulatory system, Europe remains a focus area for red biotechnology innovation leadership in R&D, bio-manufacturing, and precision medicine. France, Germany, and the U.K. are leaders in investment for CRISPR, biologics, and cell therapies whereas Southern and Eastern Europe are emerging players in diagnostic and therapeutic biotech. Strategic consolidation among European red biotech firms signaling mergers is highlighted by BioNTech’s acquisition of CureVac mRNA platforms in 2024. The deal increased mRNA R&D capability and reinforced German leadership in biotech innovation. The UK saw strong venture capital investments at the end of 2023 while Spain and Italy are improving their clinical trial infrastructures. Red biotechnologies serving various therapy areas continue to prosper under Europe's robust regulatory framework.

The demographic size along with the rising biotechnology missions in Japan, Korea, India, Australia and China is rapidly accelerating R&D investment making them one of the fastest growing region. Regenerative medicine as well as biosimilars and precision biologics are the main focal areas of attention for the countries in this region. Recently, December 2023 marked a notable shift in domestic gene editing practices as China approved its first CRISPR-based gene therapy clinical trial for hemophilia A. There are advancements throughout the entire region, India announced several CGT production facilities. Japan began accelerated cell therapy trials and Korea is a leading innovator for biosimilars while Australia and Taiwan pursue diagnostic advancement. The Asia-Pacific ecosystem is becoming an international powerhouse of red biotechnology.

The LAMEA region is a developing market, with Brazil spearheading vaccine development in Latin America and the Middle East making substantial investments in genomic medicine as well as therapeutic biotechnologies. There is now increasing public investment and infrastructure development across the region. On February 2025, Bahrain became the first country in the region to clinically deploy gene-editing therapy by administering Casgevy, the first CRISPR-based treatment for sickle cell disease. Brazil has also made advancements by building pilot facilities for gene therapy to treat rare diseases starting mid-2024. In 2023 Saudi Arabia also started a biotech innovation fund, South Africa expanded its vaccine R&D hubs in 2022, fueling the growth of red biotech. The region is becoming critically important for adoption and localization of red biotech.

Recent partnerships in the red biotechnology industry are fast-tracking advancements in gene therapy, personalized medicine, and regenerative health. In 2023, Biogen extended its alliance with Ionis Pharmaceuticals to develop antisense RNA therapies for neurological conditions. Pfizer partnered with Beam Therapeutics in January 2024 to explore base-editing tools for rare blood disorders. Novartis joined Oxford Biomedica in late 2022 to expand viral vector production for CAR-T therapies. In 2025, Gilead teamed up with Sangamo Therapeutics to co-develop zinc finger protein-based genomic medicines. Amgen’s March 2024 collaboration with Generate Biomedicines harnesses generative AI for targeted protein design. These strategic alliances are reshaping the future of precision therapeutics in red biotechnology.

Market Segmentation

By Product Type

By Application

By End User

By Technology

By Therapeutic Area

By Region