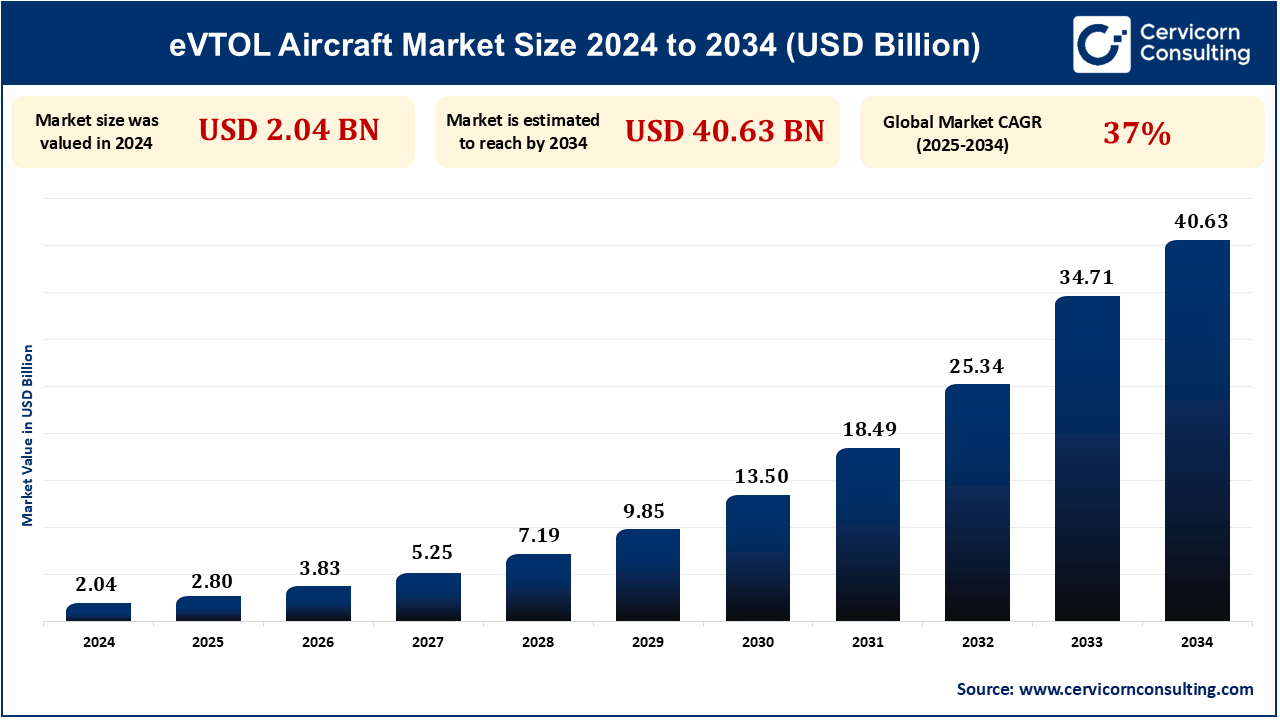

As of 2024, the global eVTOL aircraft market was valued at approximately USD 2.04 billion. It is projected to reach USD 40.63 billion by 2034, reflecting a compound annual growth rate (CAGR) of 37%.

eVTOL (electric vertical takeoff and landing) aircraft are part of a completely new kind of spacecraft. They can hover, take off, and land vertically like helicopters. However, turning the propeller is not dependent on traditional fuels, which makes it a very important part of an emerging industry called urban air mobility or UAM. eVTOLs could significantly change how we travel, offering greener, efficient, and less expensive options for short-haul flights-during heavy congestion in urban cities, at least. However, these eVTOLs are still very much under construction in terms of rules and standards. They have to be put to full use by aviation authorities. In America, this is taken care of by the Federal Aviation Administration (FAA), whereas in Europe, by the European Union Aviation Safety Agency (EASA). The process of getting this approval is not simple and may take several years to delay the first entry for regular, commercial flights.

The eVTOL aircraft market has rapidly grown with the advancement of better electric motors and battery technology. Aspects of UAM and eco-friendly air travel have also contributed to the soaring growth of this market. eVTOL is going to shine in the future for very crucial activities like air taxis, cargo delivery, confirming emergency aid, and operations for the military. With improved technology and more organizations entering, this market is going to witness very high augmentations in the coming years. The market will probably reach multi-billion dollars by 2030. Commercially adopted eVTOL may take years to thrive, but testing and limited-scale projects will continue. Urban air mobility could soon become an essential part of our transportation. Great investments are still made by the prime movers despite the obstacles posed by regulations, battery limitations, and infrastructural requirements.

A key element in the eVTOL aircraft domain is the need for urban air mobility (UAM). UAM is defined as the use of eVTOL aircraft in cities for flights of short distances, such as air taxis, commuter aircraft, or other cargo delivery mechanisms. The UAM market is expected to reach US$41.87 billion in revenue by 2033, growing at a CAGR of around 24.71%. Urban congestion is becoming quite a popular discussion topic in many of the larger cities across the globe. eVTOLs are a much quicker and more direct alternative, as they entirely avoid any traffic on the ground and therefore have drastically reduced commute times.

The forecasted deliveries for eVTOL aircraft will sharply rise with projections of up to 1,000 deliveries by 2030, due to the increasing urban demand. By taking flight paths instead of functionally exhausted roadways, eVTOL aircraft present a mode of transportation that is faster and saves time, and helps to cater to efficient urban transportation. Vertiports, or dedicated landing and takeoff points for eVTOL aircraft, are being developed in many cities worldwide, further driving the growth of UAM. Companies such as Skyports and Urban Future Lab are working to create vertiports. These are special areas designed for aircraft to land and take off easily in busy city environments. The development of these vertiports will contribute to making Urban Air Mobility (UAM) systems safer, more accessible, and more efficient in the future. UAM systems represent the future of urban aircraft movement, aiming to reduce traffic congestion and make transportation more convenient for everyone. In November 2024, Japan Airlines and Sumitomo Corporation teamed up to create a business venture called Soracle. They intended to buy electric aircraft from Archer Aviation at a total value of around US$ 500 million. This purchase indicates that more and more people are putting money into this new and innovative way of air travel. This contributes to Archer's total indicative order book value exceeding US$6 billion. Bolstered by government support, infrastructure development, and sustained investments, the eVTOL aircraft market is ready to witness a huge boom, which might change the urban transport landscape radically and provide modern cities with some sustainable solutions to their growing challenges.

The Urban Air Mobility (UAM) market is drawing a lot of financial support from both private companies and governments. In 2023, funding from venture capitalists surpassed US$ 5 billion. A company named Joby Aviation secured over US$800 million alone that year. UAM, along with eVTOLs, is set to be a key factor in the logistics industry. The market for eVTOLs, specifically for cargo and delivery, is predicted to expand rapidly, potentially generating US$1.5 billion in revenue by 2030.

One significant restraint to the advancement of the market for eVTOL aircraft is the comprehensive rules and approvals process to certify the aircraft for commercial use. eVTOL aircrafts require a completely new set of regulations as they differ in many aspects from other conventional planes in features such as vertical take-off and landing, electric propulsion, and autonomous operations. Traditional planes usually take years to get clearance, and eVTOLs might take just as long because eVTOLs work on different technology and require real-world testing to ascertain safety and reliability. In 2024, more than 70 models of eVTOLs were undergoing feasibility checks for use globally by safety authorities. Joby Aviation, a leading company in the eVTOL industry, is likely to obtain FAA certification by 2024 to 2025 after many test flights and compliance with strict safety requirements. Lilium and Archer Aviation also work towards certification, with commercial operations expected to start after that, around 2025-2027.

Establishing new safety standards, integrating into existing air traffic systems, and gaining public trust are some of the challenges that will need to be addressed along the way if the industry is to eventually realize its full potential. By 2025, most eVTOL aircraft are expected to meet noise levels of 60-70 dB at ground level, which is about the same noise level as an average conversation or city traffic. As of February 2025, India's Directorate General of Civil Aviation (DGCA) is developing a regulatory framework for eVTOL operations. This includes guidance on vertiport design, airworthiness certification, and integration of Unmanned Aircraft Traffic Management (UTM) systems with existing Air Traffic Management (ATM). In getting past these regulatory hurdles, collaboration between regulators, manufacturers, and urban planners, along with years of testing and validation, would be essential.

The market for eVTOL aircraft has a big opportunity in regional air mobility (RAM). By 2025, the RAM market could see significant growth, reaching US$ 7.55 billion. RAM connects smaller towns and regions to larger urban centers, promising a travel mode that allows improving the transport sector, among other things, and reduces travel time. It has been reported that at the beginning of 2025, the RAM market has completed the finalization of approximately 12,000 orders, including 711 new orders since October 2024. The order books of the leading firms, Eve Air Mobility and Vertical Aerospace, account for 2,950 and 1,552 orders respectively. Improved air connection would strengthen and stimulate local economies and make it easier for people to reach markets, services, and jobs. This further aims to reduce economic gaps between urban and rural areas. BETA Technologies is in the process of outlining its next iteration of an aircraft called the Alia-250 eVTOL. This will be a very flexible aircraft in that it can carry both passengers and cargo with capabilities up to 350 kilometers. To help ensure access to air travel between local distribution points, BETA has partnership deals with UPS and others to provide air routes for ground-based cargo and package delivery. Joby Aviation signed an agreement contract with the US Air Force in March 2025 towards the provision of eVTOL aircraft, which will be a significant milestone towards using this kind of aircraft for transport and military purposes. The increasing RAM not only hits the existing travel problem but is also likely to change the traveling methods. eVTOL technology can help in revolutionizing regional connectivity and positively impact economic growth.

| Attribute | Details |

| By Lift Technology |

|

| By Propulsion Type |

|

| By System |

|

| By Mode of Operations |

|

| By Range |

|

| By Maximum Take-off Weight (MTOW) |

|

| By Application |

|

| By Region |

|

| Key Players |

|

North America is expected to emerge as the fastest-growing market for eVTOL aircraft in the coming years. With rapid technological changes, investments from key players, and regulatory backing, this market is slated for rapid growth. The eVTOL industry is home to several primary players in North America: Joby Aviation, Archer Aviation, and BETA Technologies. They have gained access to vast amounts of funding, with partnerships along the lines of established aerospace firms such as Boeing, Toyota, and Uber. Joby has completed more than 1,000 test flights as of early 2024. The company aims to start its commercial services by 2025 in select North American cities. eVTOL market growth in the US is critically supported by the FAA (Federal Aviation Administration) through initiatives, such as Part 23 Certification, while the FAA also develops a safety regulatory framework with eVTOL manufacturers.

The US is likely to develop the world's first commercial eVTOL services since many major cities have been preparing their localities for air taxi services and regional air mobility solutions. Further, Canada is also a big contributor to the North American eVTOL market as firms like Horizon Aircraft and Lilium also advance eVTOL projects oriented toward sustainable aviation solutions. In October 2024, Toyota Motors invested an additional US$ 500 million in Joby Aviation, totaling nearly US$ 900 million in investments. This funding supports the certification and commercial production of eVTOL aircraft. Strong support from the private and government sectors will thus greatly cater to the quick commercialization of eVTOLs in the region.

The Asia-Pacific region is set to become very important for the growth of eVTOL aircraft. Several factors contribute to its potential leadership in the global eVTOL market. Governments throughout Asia-Pacific are actively supporting the development and commercialization of urban air mobility, particularly eVTOL aircraft. For instance, the Chinese government is investing heavily in aviation innovation, particularly eVTOL-related R&D, with the Civil Aviation Administration of China (CAAC) intensively preparing regulations to allow eVTOL aircraft and facilitate rapid uptake. The Japanese Government is also investing US$ 1 billion to support testing programs and build eVTOL infrastructure, with a goal of integrating air taxi operations safely into urban airspace by 2025. Further, the South Korean government is also investing US$ 5 billion to create an air taxi service in major cities like Seoul to be established by 2026.

The APAC region has certain leading technology companies in the world in electric propulsion, battery technology, and autonomous systems. As technology quickly improves, eVTOL aircraft are getting better in performance, more efficient to operate, and safer to use. Developing vertiport infrastructure is very important for helping the eVTOL market grow in the Asia-Pacific region. AeroMobil, which is a big player in this market, has received US$ 50 million to work on and test its flying car prototype in the countries of Japan and South Korea. Countries such as Singapore and Japan are putting in place the necessary infrastructure, including vertiports and charging stations for eVTOL operations. Various eVTOL manufacturers, mainly in China and Japan, have already entered into pilot testing and demonstration flights of their aircraft. For instance, EHang (China) has autonomously flown the EHang 216 eVTOL with autonomous capabilities in urban areas. Consequently, as the region addresses urban congestion, sustainability objectives, and air pollution, the Asia-Pacific eVTOL market is rapidly anticipated to grow.

In 2024, the lift and cruise segment takes the largest share of the market. It contributes about 18% to 22% of the total earnings in the eVTOL market. This segment is considered the best because it blends simplicity, efficiency, and the ability to expand. It is easy to use, works well, and can grow as needed, making it stand out. In such a design, the aircraft uses separate systems for vertical lift with rotors, and horizontal cruise with a conventional wing or, in some cases, other systems. Lift and cruise eVTOLs are scalable for a variety of passenger configurations, from small air taxis to larger urban mobility solutions. Their adaptable design can carry 1-5 passengers, making them ideal for short-range urban air mobility.

Several companies are focusing on a design called lift and cruise. The trials have been done, and these firms are now working towards obtaining certification for flying these aircraft commercially. One such company is Joby Aviation, and they currently have one of the top designs. Hence, the lift and cruise design becomes the market leader as it is considered to be the best design to easily develop quick air transportation solutions. Alaka’i Technologies secured US$ 50 million in funding for the Skai eVTOL (Hydrogen-powered lift and cruise), contributing to increased interest in sustainable aviation solutions.

The short-range (0-200 km) segment dominated the eVTOL aircraft market in 2024. Designed for urban air mobility (UAM), eVTOLs are used for air taxis between cities or very close cities or districts and can meet customers' demand for fast, effective, and economical transportation in related major cities. Benefits of short-range eVTOLs include low overall weight, compactness, and lower energy consumption, which are more efficient for shorter trips.

Other companies include Joby Aviation, Archer Aviation, and Lilium, which have released prototypes in the category and tested them under short-range operations. Thus, the short-range (0-200 km) segment is the leading segment in the eVTOL aircraft market due to its strong focus on urban air mobility, operational efficiency, and increasing demand for intra-city transport. This range fits the current market's needs for quick, efficient travel in urban areas and is expected to dominate the market as eVTOL technology matures.

The passenger transport segment dominates the global eVTOL aircraft market as a result of increasing urban air mobility demand, possibilities for air taxi services, and large investments from aviation conglomerates. UAM is going to be the largest application of eVTOLs, aimed at enabling quick, efficient travel within and between cities. Urban congestion and traffic problems continue worldwide, and eVTOLs can provide a quick, new, and different means of getting to an end. Above all, there is a unique offering in value: eVTOL transport, time-saving, and convenience. For example, as cities get more congested, people are looking for options to bypass drive-through ground traffic. Most eVTOL manufacturers look towards the passenger transport segment as the main revenue model. The main investments go from countries planning to develop such air taxi systems as contributions by United Airlines and Daimler, to companies such as Archer Aviation and Volocopter. Moreover, short-distance city-to-city journeys of air taxis are likely to be the main market-driving force in the years to come, establishing the eVTOL segment-demarcated market sector as the one most commercially viable and promising.

The low payload (up to 500 kg) segment dominates the global eVTOL aircraft market, particularly because it aligns with the primary applications of eVTOL aircraft, such as passenger transport and light cargo delivery. Most of the eVTOLs developed under the umbrella of urban air mobility (UAM) carry 1-4 passengers, approximately 300-500 kg payloads. These vehicles are optimized for short trips inside or between urban corridors, where lightweight designs allow for fast take-off, fuel efficiency, and great manoeuvrability.

eVTOLs in the low-payload category are generally cheaper to develop and operate. They require less power and smaller battery systems and are typically cheaper in terms of production and maintenance. Hence, this class of aircraft represents the best commercial options, the largest market potential, and is a focus of companies operating in air taxi services and last-mile delivery.

The global market for eVTOL aircraft has favorable conditions for the electric propulsion segment, owing to both sustainability and efficiency concerns, as well as the increased interest in environmental technologies. The existing eVTOLs use electric propulsion systems, which can claim to have much more environmental advantages than traditional internal combustion engines: they have zero direct emissions, making these aircraft greener for urban air mobility. eVTOLs, based on electric power, operate at lower costs than aircraft powered by combustion engines because electric propulsion systems have fewer moving parts, require less maintenance, and are cheaper to operate.

Electric propulsion is indeed the technology that got the most attention from the regulatory authorities like the FAA and EASA regarding the new frameworks being created for the certification of electric aircraft. With companies focusing on improving battery technology and designs of electric motors, this is going to be the technology of choice for next generations of urban air mobility and air taxi services. Moreover, electric propulsion identifies more growing demand in sustainable aviation and a cut in carbon emissions, which are progressively solidifying this technology as the leading technology in eVTOL.

The urban air mobility (UAM) segment is the strongest contender for the global eVTOL aircraft market by end-use industry. The main reason for this is the increasing demand for air taxis, which help people travel within cities and connect them for the final stretch of their journey. eVTOL is manufactured to cater to air taxi operations in the urban environment. This allows people to move from one place to another fast and efficiently in congested urban environments. The larger cities get, and the more normal traffic jams become, the greater demand for quicker and efficient ways of moving from Point A to Point B arises.

The FAA and EASA have started focusing on UAM and are developing the safety criteria and airspace management system, and certification for urban air mobility. With their regulations, the aim has been to facilitate the safe integration of eVTOLs into the urban landscape, which is imperative for air-taxi and similar services to be commercialized. It is expected that, with investments in infrastructure, regulatory advances, and the growing customer appetite for fast and efficient travel within the city, UAM will be taking the eVTOL market in the coming years.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2376

Ask here for more details@ sales@cervicornconsulting.com